Professional Documents

Culture Documents

Of Contracting The Obligation

Uploaded by

Aaron ViloriaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Of Contracting The Obligation

Uploaded by

Aaron ViloriaCopyright:

Available Formats

ESTAFA

Elements

in

General:

1. The accused defrauded another by

abuse of confidence of by means of

deceit; and

2. That damage or prejudice capable

of pecuniary estimation is caused to

the offended party or third persons

ESTAFA BY MEANS OF DECEIT (Article

315,

No.

2

RPC)

Elements:

1. There must be false pretense,

fraudulent act or fraudulent means;

2. Such false pretense, act or

fraudulent means must be made or

executed prior to or simultaneously

with the commission of the fraud;

3. The offended party must have relied

on the false pretense, fraudulent act

or fraudulent means, that is, he was

induced to part with his money or

property

because

of

the

false

pretense; and

4. That as result thereof, the offended

party suffered damage.

ARTICLE 315 NO. 2

(d) By post-dating a check, or

issuing a check in payment of an

obligation when the offender

therein were not sufficient to

cover the amount of the check.

The failure of the drawer of the

check to deposit the amount

necessary to cover his check

within three (3) days from receipt

of notice from the bank and/or the

payee or holder that said check

has been dishonored for lack of

insufficiency of funds shall be

prima facie evidence of deceit

constituting false pretense or

fraudulent act. (As amended by

R.A. 4885, approved June 17,

1967.)

Canonizado (Estafa vs. BP22)

ELEMENTS:

1. That the offender postdated a

check, OR issued a check in payment

of an obligation; and

2. That such postdating or

issuing a check was done when the

offender had no funds in the bank, or

his funds deposited therein were not

sufficient to cover the amount of the

check

The issuance by the offender of

the check (whether postdated if bit),

prior to or simultaneous with the

transaction, must be for the purpose

of

contracting

the

obligation,

otherwise if the check is issued in

payment of a preexisting obligation,

no estafa is committed, only a civil

liability.

- If the check was issued by the

debtor only for security of the creditor,

as in the nature of promissory notes

but not to be encashed, no estafa will

be

involved.

- Good faith is a defense in a charge of

estafa by postdating or issuing a

check (People vs Villapando, 56 Phil

31)

- Estafa by issuing a bad check is a

continuing offense

- There is prima facie evidence

of deceit when the drawer fails to pay

or make arrangement for payment

three (3) days after receiving notice of

dishonor.

- The payee or person receiving

the check must be damaged or

prejudiced

BOUNCING

B.P. Blg. 22

Offenses

Page 1

CHECKS

Punished

under

LAW

BP22:

A. Making or Drawing and issuing

a check knowing at the time of issue

that he does not have sufficient funds

Elements:

1. That a person makes or draws and

issues any check to apply on account

or for value;

2. That the person knows that

at the time of issue he does not have

sufficient funds or credit with the

drawee bank for the payment of such

check upon its presentment; and

3.

That

the

check

is

subsequently dishonored

by the

drawee bank for insufficiency of funds

or credit, or would have been

dishonored for the same reason had

not the drawer, without any valid

reason, ordered the bank to stop

payment

Requisites for Criminal Liability

under

BP

22

1. A person makes, draws or issues a

check as payment for account or for

value;

2.

That

the

check

was

dishonored by the bank due to a lack

of funds, insufficiency of funds or

account already closed;

3. The payee or holder of such

check gives written notice of dishonor

and demand for payment; and

4. That the maker, drawer or

issuer, after receiving such notice and

demand, refuses or fails to pay the

value of the check within FIVE

BANKING DAYS

It is not the making, drawing, or

issuance nor the dishonor of the check

which gives rise to a violation of BP

22, but rather the failure to make

good the check within FIVE BANKING

DAYS from receipt of the Notice of

Dishonor and Demand for Payment

While the written notice of dishonor

and demand is not an element in the

violation of BP 22, the failure to give

Canonizado (Estafa vs. BP22)

such notice to the maker, drawer or

issuer of the bouncing check is FATAL

to an action to hold the latter

criminally liable.

The full payment of the amount

appearing in the check within five

banking days from notice of dishonor

is a complete defense against BP 22.

The absence of a notice of dishonor

necessarily deprives an accused an

opportunity to preclude criminal

prosecution. Accordingly, procedural

due process clearly enjoins that a

notice of dishonor be actually served

on the maker, drawer or issuer of the

check. He has a right to demand that

the notice of dishonor be actually sent

to and received by him to afford him

the opportunity to avert prosecution

under BP 22. (Lina Lim Lao vs People

GR No. 117178 June 20, 1997)

B. Failing to keep sufficient funds

to cover the full amount of the

check

Elements:

1. That a person has sufficient funds

with the drawee bank when he makes

or draws and issues a check;

2. That he fails to keep sufficient funds

or to maintain a credit to cover the full

amount if presented within a period of

90 days from the date of appearing

thereon; and

3. That the check is dishonored by the

drawee bank.

The 90- day period stated is NOT an

element of the violation of BP 22 by

failing to keep sufficient funds. As

such, the maker, drawer or issuer of

the check is not discharged from his

duty to maintain a sufficient balance

on his account for a reasonable time

even BEYOND the 90-day period. A

reasonable time according to current

banking practice is 6 months or 180

days, after which the check becomes

stale.

Page 2

Thus, where a check is presented

beyond the 90-day period but within

180 days from the date of failure to

maintain a sufficient balance, the

maker, drawer or issuer shall still be

liable for violation of BP 22 (Wong vs

C.A. GR No. 117857, February 2,

2001)

Gravamen of BP 22 is the issuance of

a worthless or bum check

Evidence

of

Knowledge

Insufficient Funds

of

- Refusal of drawee bank to pay

the check due to insufficiency of funds

when presented within 90 days from

the date of the check shall be prima

facie knowledge of insufficiency of

funds, unless the drawer or maker

pays the holder the amount due

thereon or makes arrangements for

the payment thereof by the drawee

within five (5) banking days after

receipt of notice that the check was

dishonored.

Canonizado (Estafa vs. BP22)

Page 3

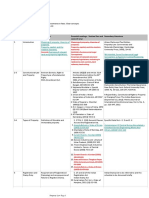

BP 22

ESTAFA (RPC)

The maker or

drawer and

issuer knows at

the time of issue

that he does not

have sufficient

fund in or credit

with the drawee

bank for the

payment of the

check in full

Not necessary

that the drawer

should know at

the time that he

issued the check

that the funds

deposited in the

bank were not

sufficient to

cover the

amount of the

check

Mere issuance of

a check that is

dishonored

gives rise to the

presumption of

knowledge of

insufficiency of

funds

No presumption

of knowledge

arises

You might also like

- Batas Pambansa BLG 22Document19 pagesBatas Pambansa BLG 22Samn Pistola CadleyNo ratings yet

- Quiz 1Document2 pagesQuiz 1Richelle ManocayNo ratings yet

- Lecture 2 - Income Taxation (Individual)Document8 pagesLecture 2 - Income Taxation (Individual)Lovenia Magpatoc100% (1)

- Tax Management SyllabusDocument2 pagesTax Management Syllabusbs_sharathNo ratings yet

- Financial ManagementDocument6 pagesFinancial ManagementDaniel HunksNo ratings yet

- Transfer TaxesDocument101 pagesTransfer TaxesAngelo IvanNo ratings yet

- Estate and Donors Tax in Re TRAIN LAWDocument8 pagesEstate and Donors Tax in Re TRAIN LAWRona RososNo ratings yet

- Salient Features of Philippine Deposit Insurance Corporation (PDIC) - Republic Act 3591Document6 pagesSalient Features of Philippine Deposit Insurance Corporation (PDIC) - Republic Act 3591Mycah AliahNo ratings yet

- Multiple Choice 6Document3 pagesMultiple Choice 6Mj CabangananNo ratings yet

- BIR RR 13 - 18 MatrixDocument2 pagesBIR RR 13 - 18 MatrixErmawooNo ratings yet

- Estate Tax Amnesty ActDocument10 pagesEstate Tax Amnesty ActJocelyn MendozaNo ratings yet

- File 4061506199676160319Document5 pagesFile 4061506199676160319Arah OpalecNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument76 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledFrancis Coronel Jr.No ratings yet

- Watered StockDocument4 pagesWatered StockAnugrah EdoNo ratings yet

- Ease of Doing Business and FRIADocument39 pagesEase of Doing Business and FRIAmenNo ratings yet

- Lesson 05B. Inter-Company Transactions - A.TDocument8 pagesLesson 05B. Inter-Company Transactions - A.THayes HareNo ratings yet

- Estate Tax: Bantolo, Javier, MusniDocument31 pagesEstate Tax: Bantolo, Javier, MusniPatricia RodriguezNo ratings yet

- Sales Part 10: Coverage of Discussion: Assignment of Credit and Other Incorporeal RightsDocument15 pagesSales Part 10: Coverage of Discussion: Assignment of Credit and Other Incorporeal RightsAmie Jane MirandaNo ratings yet

- Insurance Syllabus With Laws RA 10607Document7 pagesInsurance Syllabus With Laws RA 10607Pring SumNo ratings yet

- Atty. S. C. Madrona, JR.: Juris Doctor College of Law University of The Philippines Diliman, Quezon CityDocument17 pagesAtty. S. C. Madrona, JR.: Juris Doctor College of Law University of The Philippines Diliman, Quezon Citydarren chenNo ratings yet

- Basic Concepts of TaxationDocument5 pagesBasic Concepts of TaxationRhea Javed100% (1)

- 048 Ang Vs CADocument12 pages048 Ang Vs CACeslhee AngelesNo ratings yet

- DocxDocument4 pagesDocxKimmy Shawwy0% (1)

- Jhen Powerpoint Law 1Document95 pagesJhen Powerpoint Law 1Farah Tolentino NamiNo ratings yet

- Coworking Agreement - The Professional PointDocument12 pagesCoworking Agreement - The Professional PointDeba Pratim SinhaNo ratings yet

- Chapter 7 Law On Sales 2020Document22 pagesChapter 7 Law On Sales 2020ESTELA AGNONo ratings yet

- Reo Cpa Review Management Services Pre-Week - May 2023 BatchDocument23 pagesReo Cpa Review Management Services Pre-Week - May 2023 BatchAliah Punguinagina MagintaoNo ratings yet

- Multiple Choice Questions in Obligations and Contracts by MilesDocument6 pagesMultiple Choice Questions in Obligations and Contracts by MilesmercxNo ratings yet

- Sales Part 8: Coverage of Discussion: Obligations of The VendeeDocument7 pagesSales Part 8: Coverage of Discussion: Obligations of The VendeeAmie Jane MirandaNo ratings yet

- RFBT MidtermDocument27 pagesRFBT MidtermShane CabinganNo ratings yet

- RFBT Law On Private CorporationsDocument39 pagesRFBT Law On Private CorporationsEunice Lyafe PanilagNo ratings yet

- Interim Rules of Procedure On Corporate RehabilitationDocument11 pagesInterim Rules of Procedure On Corporate RehabilitationChrissy SabellaNo ratings yet

- Law PDFDocument5 pagesLaw PDFAbdul ShadulNo ratings yet

- Sales Agreement: Page 1 of 3Document3 pagesSales Agreement: Page 1 of 3Virgy PutriNo ratings yet

- AffidavitDocument3 pagesAffidavitAdv Dhaval VyasNo ratings yet

- Audit EngagementDocument3 pagesAudit EngagementTyra Lim Ah KenNo ratings yet

- Midterm Exam DWCLDocument12 pagesMidterm Exam DWCLHakdog HatdogNo ratings yet

- (Final) Quiz Statement of Changes in Equity and Cash Flows Word FileDocument3 pages(Final) Quiz Statement of Changes in Equity and Cash Flows Word FileAyanna CameroNo ratings yet

- RFBTDocument34 pagesRFBTpanicNo ratings yet

- This Study Resource Was: Intermediate Accounting 3 (Interim)Document2 pagesThis Study Resource Was: Intermediate Accounting 3 (Interim)Nah HamzaNo ratings yet

- 3.4.1 Answer Key - Assignment - General Principles of Income TaxDocument5 pages3.4.1 Answer Key - Assignment - General Principles of Income Taxsam imperialNo ratings yet

- SCENARIO 3: Voluntary Dissolution Shortening Corporate Term (Sec 136)Document1 pageSCENARIO 3: Voluntary Dissolution Shortening Corporate Term (Sec 136)Summer FreniereNo ratings yet

- EwtDocument5 pagesEwtKobe BullmastiffNo ratings yet

- Tax 1 Comprehensive Problem For Bir FormsDocument7 pagesTax 1 Comprehensive Problem For Bir FormsMelissa BaileyNo ratings yet

- Chapter 19Document9 pagesChapter 19Marc Siblag IIINo ratings yet

- Estate Tax - BIR - ProceduresDocument2 pagesEstate Tax - BIR - ProceduresDan FactoranNo ratings yet

- Module 1 Law On SalesDocument52 pagesModule 1 Law On SalesSandra DoriaNo ratings yet

- Affidavit of Cancellation of Business NameDocument1 pageAffidavit of Cancellation of Business NamemarvieNo ratings yet

- Sales Part 6: Coverage of DiscussionDocument21 pagesSales Part 6: Coverage of DiscussionAmie Jane MirandaNo ratings yet

- Summary of Obligation An D ContractsDocument35 pagesSummary of Obligation An D ContractsJoy Camaclang0% (1)

- DRAFT AMLA QandADocument24 pagesDRAFT AMLA QandAMamabetNo ratings yet

- Income Tax ReviewerDocument24 pagesIncome Tax ReviewerFRITZ JANN CERANo ratings yet

- Revenue Memorandum Circular No. 35-06: June 21, 2006Document17 pagesRevenue Memorandum Circular No. 35-06: June 21, 2006Kitty ReyesNo ratings yet

- Qualifying Exam Reviewer - ObliconDocument10 pagesQualifying Exam Reviewer - ObliconFeeNo ratings yet

- OG-07-016 USB Amended Guidelines On 2nd-End. Chks 10.31.06Document6 pagesOG-07-016 USB Amended Guidelines On 2nd-End. Chks 10.31.06romeldevera100% (2)

- Sales.1505-1506 in Relation To Article 559 Cases.2016Document27 pagesSales.1505-1506 in Relation To Article 559 Cases.2016Joven CamusNo ratings yet

- ReviewerDocument7 pagesReviewerangel maeNo ratings yet

- Requirements Merger-ConsolidationDocument1 pageRequirements Merger-ConsolidationmarjNo ratings yet

- Withholding Tax: Taxation LawDocument21 pagesWithholding Tax: Taxation LawB-an JavelosaNo ratings yet

- Bouncing Checks Law NOTESDocument2 pagesBouncing Checks Law NOTESMoniva Aiza JaneNo ratings yet

- CONTRACTSDocument37 pagesCONTRACTSAaron ViloriaNo ratings yet

- Locsin vs. Nissan Car LeaseDocument13 pagesLocsin vs. Nissan Car LeaseAaron ViloriaNo ratings yet

- Roldan vs. Sps. BarriosDocument3 pagesRoldan vs. Sps. BarriosAaron Viloria100% (1)

- Digitel Vs SorianoDocument48 pagesDigitel Vs SorianoAaron ViloriaNo ratings yet

- Diversified Security vs. BautistaDocument6 pagesDiversified Security vs. BautistaAaron ViloriaNo ratings yet

- Ombudsman Vs MedranoDocument12 pagesOmbudsman Vs MedranoAaron ViloriaNo ratings yet

- Luna vs. Allado ConstructionDocument13 pagesLuna vs. Allado ConstructionAaron ViloriaNo ratings yet

- Affidavit of DenialDocument1 pageAffidavit of DenialAaron ViloriaNo ratings yet

- Affidavit of Exhumation and TransferDocument1 pageAffidavit of Exhumation and TransferAaron Viloria50% (2)

- Talam vs. NLRCDocument12 pagesTalam vs. NLRCAaron ViloriaNo ratings yet

- Motion To Avail Post Judgment RemedyDocument1 pageMotion To Avail Post Judgment RemedyAaron ViloriaNo ratings yet

- Boac vs. CadapanDocument4 pagesBoac vs. CadapanAaron ViloriaNo ratings yet

- The Little Prince and Private Language Argument:: Thesis StatementDocument6 pagesThe Little Prince and Private Language Argument:: Thesis StatementAaron ViloriaNo ratings yet

- Insurance Recit Questions (Atty. Bathan)Document6 pagesInsurance Recit Questions (Atty. Bathan)Aaron ViloriaNo ratings yet

- Philippine International Trading Corporation, Petitioner, - Versus - Commission On Audit, Respondent. G.R. No. 183517Document12 pagesPhilippine International Trading Corporation, Petitioner, - Versus - Commission On Audit, Respondent. G.R. No. 183517Aaron Viloria100% (1)

- Frias Vs San Diego-Sison DigestDocument2 pagesFrias Vs San Diego-Sison DigestAaron Viloria100% (3)

- Sobejana-Condon VS ComelecDocument2 pagesSobejana-Condon VS ComelecAaron ViloriaNo ratings yet

- Labor Cases Full Text (E-SCRA)Document25 pagesLabor Cases Full Text (E-SCRA)Aaron ViloriaNo ratings yet

- Criminal Law 2, Table of FeloniesDocument99 pagesCriminal Law 2, Table of FeloniesAaron Viloria67% (3)

- Why Don't You Know? Why Can't You Understand? How Come You Don't Remember?Document9 pagesWhy Don't You Know? Why Can't You Understand? How Come You Don't Remember?Aaron ViloriaNo ratings yet

- Annotated BibliographyDocument5 pagesAnnotated Bibliographytarin15No ratings yet

- Castillo Vs CruzDocument2 pagesCastillo Vs CruzDarren Joseph del PradoNo ratings yet

- Planteras, Jr. vs. People DigestDocument2 pagesPlanteras, Jr. vs. People DigestEmir MendozaNo ratings yet

- Letter To Navajo Elections Administration From Department of Diné EducationDocument2 pagesLetter To Navajo Elections Administration From Department of Diné EducationDaily TimesNo ratings yet

- Justice ® Dr. Munir Ahmad MughalDocument140 pagesJustice ® Dr. Munir Ahmad MughalNoor Ul Huda ChaddharNo ratings yet

- Durable Power of Attorney FormDocument6 pagesDurable Power of Attorney Formpowerofattorney100% (5)

- ch18 PDFDocument14 pagesch18 PDFRodrigo S QuirinoNo ratings yet

- NIRC Rem NotesDocument15 pagesNIRC Rem NotesSherwin LingatingNo ratings yet

- K-29444 Roof Protector Data SheetDocument2 pagesK-29444 Roof Protector Data SheetJoséNo ratings yet

- Rosaldes v. People, G.R. No. 173988, October 8, 2014Document6 pagesRosaldes v. People, G.R. No. 173988, October 8, 2014Glenn caraigNo ratings yet

- For Friday ThesisDocument20 pagesFor Friday ThesisBradley Rome Viloria BaltazarNo ratings yet

- EP Referral AgreementDocument3 pagesEP Referral AgreementJohnNo ratings yet

- SampleDocument4 pagesSampleCarlMarkInopiaNo ratings yet

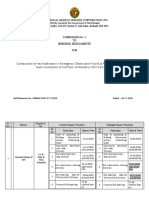

- West Bengal Medical Services Corporation Ltd. Swasthya Sathi, GN-29, Sector-V, Salt Lake, Kolkata-700 091Document2 pagesWest Bengal Medical Services Corporation Ltd. Swasthya Sathi, GN-29, Sector-V, Salt Lake, Kolkata-700 091kuntal dasNo ratings yet

- Lecture OutlinesDocument39 pagesLecture OutlinesPhilipp KoergeNo ratings yet

- Digests Set 2 PledgeDocument4 pagesDigests Set 2 PledgeTrem GallenteNo ratings yet

- STRS Class Action ComplaintDocument16 pagesSTRS Class Action ComplaintFinney Law Firm, LLCNo ratings yet

- Kida v. Senate of The PhilippinesDocument7 pagesKida v. Senate of The PhilippinesNoreenesse SantosNo ratings yet

- Prop Case DigestsDocument142 pagesProp Case DigestsKim Jan Navata BatecanNo ratings yet

- National SymbolsDocument14 pagesNational SymbolsМастер и МаргаритаNo ratings yet

- Lea 1 2023 Post TestDocument6 pagesLea 1 2023 Post TestHan WinNo ratings yet

- Hudson Valley Property Association. V City of KingstonDocument46 pagesHudson Valley Property Association. V City of KingstonDaily FreemanNo ratings yet

- Notice To All Law EnforcementDocument6 pagesNotice To All Law EnforcementMin Hotep Tzaddik Bey100% (18)

- Seth JudgmentDocument8 pagesSeth Judgmentshilpasingh1297No ratings yet

- TVA V HILL Case BriefDocument5 pagesTVA V HILL Case Briefsamantha koferNo ratings yet

- White Gold Marine Services Vs Pioneer (GR 154514)Document1 pageWhite Gold Marine Services Vs Pioneer (GR 154514)Marge OstanNo ratings yet

- Course Manual: Week Broad Topic Particulars Essential Readings - Section Nos and Cases (If Any) Secondary LiteratureDocument44 pagesCourse Manual: Week Broad Topic Particulars Essential Readings - Section Nos and Cases (If Any) Secondary LiteratureYasharth ShuklaNo ratings yet

- 25 Cir v. Bicolandia Drug CorpDocument11 pages25 Cir v. Bicolandia Drug CorpMabelle ArellanoNo ratings yet

- Other Privileged Class Deviance SDocument21 pagesOther Privileged Class Deviance SDEBJIT SAHANI100% (1)

- Chapter 2 - Taxes, Tax Laws and AdministrationDocument3 pagesChapter 2 - Taxes, Tax Laws and AdministrationAEONGHAE RYNo ratings yet