Professional Documents

Culture Documents

Sav 0106

Uploaded by

MichaelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sav 0106

Uploaded by

MichaelCopyright:

Available Formats

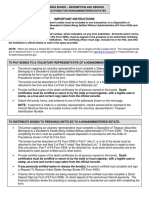

FS Publication 0106

Department of the Treasury Trust Transactions

Bureau of the Fiscal Service

(Revised July 2015) United States Savings Bonds & Notes

To conduct a transaction involving a trust and savings bonds or savings notes, complete the appropriate

form(s) identified below. If required, sign the form(s) in the presence of an authorized certifying officer

(available at a bank, trust company, or credit union).

Definitions

Trust Real or personal property held by one person for the benefit of another person (or

oneself). Trusts have a specific purpose, a designated beneficiary, and specific duties for the trustee(s) as

specified by the grantor. Every trust has a:

Grantor or Donor Person who creates the trust.

Trustee(s) The party or entity, named in the trust by the grantor, to care for and manage the

property.

Beneficiary The party for whose benefit the trust was created and who receives the income

from the trust.

Trust Agreement / Trust Instrument The actual document that sets out in writing the

authority, duties, and rights of everyone involved. It can be called a declaration of trust, deed of trust, trust

indenture, or agreement of trust.

Types of Trusts

Private Trust Estates

Personal Trusts Created by an individual to benefit himself or others. Personal trusts can be

revocable or irrevocable, and may be known as:

o Declaration of Trust (U/D/T) The grantor and trustee are the same person;

o Trust Under Agreement (U/A) The grantor and trustee are not the same; or

o Testamentary Trust (U/W) Created under a will; it doesnt take effect until the grantors

death.

Public or Quasi-Public Trusts Funds for which public bodies or officers act as trustees under express

authority of law.

Trust Registrations

Security registrations must include the name(s) of the trustee(s), name(s) of the grantor(s) unless the trust

is known by the trust name, such as Smith Family Trust and the date the trust was created. Also, the

trustee(s) must sign for transaction requests for accounts registered in trust form.

Forms

FS Form 1455 To distribute securities to an entitled person, such as when a trust

is terminated

FS Form 1522 To request payment of savings bonds or savings notes

FS Form 1851 To reissue savings bonds to a personal trust

FS Form 4000 To reissue savings bonds

FS Form 5396 To request the direct deposit of Series HH or Series H bond

interest payments or a savings bond redemption payment

These forms are available for download at www.treasurydirect.gov.

NOTE: When we reissue a Series EE or Series I savings bond, we no longer provide a paper bond. The

reissued bond is in electronic form, in our online system TreasuryDirect.

Additional Requirements

If bonds are registered in the name of a trust and a change in the registration is being requested:

Personal Trust Provide a copy of the entire trust agreement with any amendments or pertinent

pages and any amendments certified to be a true and correct copy of the original. The following

pages must be included:

o The page showing the name and date of the trust;

o The page(s) identifying the successor trustee(s) (if more than one successor trustee is

named, also provide the portion of the trust that states if they may act independently);

o The page with the grantors certified signature;

o Any amendments to the trust that may alter the information on the pages submitted or limit

the authority of the trustee(s) to request the transaction.

Testamentary Trust Provide a certified copy of the will, under court seal. (The will must be

probated in order for a testamentary trust to be effective.)

In the event the trustee named in the registration of the bond(s) is no longer acting, also provide:

A certified copy of the trustees death certificate; or

A letter of resignation.

If the trust instrument or will does not name a successor trustee, a certified copy of the court order or other

evidence is required.

NOTE: Additional forms or documentation may be required depending on the transaction requested.

Send To

Send the completed form(s), bonds, and trust instrument (if applicable) to:

Treasury Retail Securities Site

PO Box 214

Minneapolis, MN 55480-0214

For further information, visit us on the web at www.treasurydirect.gov or call 844-284-2676 (toll free).

You might also like

- Sav PDP 0064Document2 pagesSav PDP 0064Michael100% (1)

- Sec 5235Document5 pagesSec 5235MichaelNo ratings yet

- Sav 3782Document1 pageSav 3782MichaelNo ratings yet

- Sav3062 4Document6 pagesSav3062 4MichaelNo ratings yet

- Sec 1014Document2 pagesSec 1014Michael100% (1)

- Sav 1048Document7 pagesSav 1048Michael100% (2)

- Sav 5446Document21 pagesSav 5446Michael100% (2)

- United States Retirement Plan Bonds: Tables of Redemption Values For Twelve Month PeriodDocument6 pagesUnited States Retirement Plan Bonds: Tables of Redemption Values For Twelve Month PeriodMichaelNo ratings yet

- Sav PDP 0051Document6 pagesSav PDP 0051MichaelNo ratings yet

- Sav 5257Document2 pagesSav 5257MichaelNo ratings yet

- Sec 1010Document4 pagesSec 1010MichaelNo ratings yet

- Sav 4652Document3 pagesSav 4652MichaelNo ratings yet

- Direct Deposit Sign-Up Form AttachmentDocument1 pageDirect Deposit Sign-Up Form AttachmentMichaelNo ratings yet

- Sav 5396Document1 pageSav 5396MichaelNo ratings yet

- Sav 2243Document5 pagesSav 2243MichaelNo ratings yet

- Sav 2517Document2 pagesSav 2517MichaelNo ratings yet

- Sav 5336Document9 pagesSav 5336Michael100% (1)

- Questions and Answers About Paper Series I Savings Bonds: AnswerDocument3 pagesQuestions and Answers About Paper Series I Savings Bonds: AnswerMichaelNo ratings yet

- Values For U.S. Savings Bonds: $50 Series I/EE/E Bonds and $50 Savings NotesDocument17 pagesValues For U.S. Savings Bonds: $50 Series I/EE/E Bonds and $50 Savings NotesMichaelNo ratings yet

- Sav 1851Document5 pagesSav 1851MichaelNo ratings yet

- Sav 1980Document2 pagesSav 1980Michael100% (1)

- Sav PDP 0065Document2 pagesSav PDP 0065MichaelNo ratings yet

- Savings Securities Maturity Chart: Series E and Ee, Savings Notes, Series I, Series H and HHDocument1 pageSavings Securities Maturity Chart: Series E and Ee, Savings Notes, Series I, Series H and HHMichaelNo ratings yet

- Sav 5456Document1 pageSav 5456MichaelNo ratings yet

- Sav PDP 0049Document4 pagesSav PDP 0049MichaelNo ratings yet

- Sav 2490Document2 pagesSav 2490MichaelNo ratings yet

- Sav 5188Document3 pagesSav 5188Michael100% (1)

- Sav PDP 0026Document1 pageSav PDP 0026MichaelNo ratings yet

- Sav 4239Document3 pagesSav 4239MichaelNo ratings yet

- Sav 3500Document1 pageSav 3500MichaelNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lesson Plan 2021Document68 pagesLesson Plan 2021ULYSIS B. RELLOSNo ratings yet

- 19 Preposition of PersonalityDocument47 pages19 Preposition of Personalityshoaibmirza1No ratings yet

- LP DLL Entrep W1Q1 2022 AujeroDocument5 pagesLP DLL Entrep W1Q1 2022 AujeroDENNIS AUJERO100% (1)

- Expedite Unclaimed Cargo AuctionsDocument4 pagesExpedite Unclaimed Cargo AuctionsDinesh ChakravartyNo ratings yet

- Foucault Truth and Power InterviewDocument7 pagesFoucault Truth and Power IntervieweastbayseiNo ratings yet

- HCB 0207 Insurance Ad Risk ManagementDocument2 pagesHCB 0207 Insurance Ad Risk Managementcollostero6No ratings yet

- Sarva Shiksha Abhiyan, GOI, 2013-14: HighlightsDocument10 pagesSarva Shiksha Abhiyan, GOI, 2013-14: Highlightsprakash messiNo ratings yet

- Blades of Illusion - Crown Service, Book 2 First Five ChaptersDocument44 pagesBlades of Illusion - Crown Service, Book 2 First Five ChaptersTerah Edun50% (2)

- Symphonological Bioethical Theory: Gladys L. Husted and James H. HustedDocument13 pagesSymphonological Bioethical Theory: Gladys L. Husted and James H. HustedYuvi Rociandel Luardo100% (1)

- The Marcos DynastyDocument19 pagesThe Marcos DynastyRyan AntipordaNo ratings yet

- Plum FacialDocument1 pagePlum FacialhhfddnNo ratings yet

- Recruitment On The InternetDocument8 pagesRecruitment On The InternetbgbhattacharyaNo ratings yet

- What's New: Activity 1.2 ModelDocument3 pagesWhat's New: Activity 1.2 ModelJonrheym RemegiaNo ratings yet

- TRANSGENDER ISSUES AT UiTM SHAH ALAMDocument15 pagesTRANSGENDER ISSUES AT UiTM SHAH ALAMJuliano Mer-KhamisNo ratings yet

- Poetry and PoliticsDocument21 pagesPoetry and Politicshotrdp5483No ratings yet

- PW Show Daily at Frankfurt Day 1Document68 pagesPW Show Daily at Frankfurt Day 1Publishers WeeklyNo ratings yet

- Powerpoint of Verbal Communication: The Way People SpeakDocument15 pagesPowerpoint of Verbal Communication: The Way People SpeakRisa Astuti100% (1)

- ASAP Current Approved Therapists MDocument10 pagesASAP Current Approved Therapists MdelygomNo ratings yet

- Advacc 2 Chapter 1 ProblemsDocument5 pagesAdvacc 2 Chapter 1 ProblemsClint-Daniel Abenoja100% (1)

- English FinalDocument6 pagesEnglish FinalAPRIL LYN D. GETI-AYONNo ratings yet

- G. Rappaport: Grammatical Role of Animacy in A Formal Model of Slavic MorphologyDocument28 pagesG. Rappaport: Grammatical Role of Animacy in A Formal Model of Slavic Morphologyanon_315959073No ratings yet

- Immediate Flood Report Final Hurricane Harvey 2017Document32 pagesImmediate Flood Report Final Hurricane Harvey 2017KHOU100% (1)

- Criminal Investigation 11th Edition Swanson Test BankDocument11 pagesCriminal Investigation 11th Edition Swanson Test BankChristopherWaltonnbqyf100% (14)

- 978191228177Document18 pages978191228177Juan Mario JaramilloNo ratings yet

- 3M Case StudyDocument14 pages3M Case StudyYasir AlamNo ratings yet

- Accord Textiles LimitedDocument41 pagesAccord Textiles LimitedSyed Ilyas Raza Shah100% (1)

- Understanding Your Family LegacyDocument81 pagesUnderstanding Your Family LegacyKimberly Verendia100% (2)

- InvoiceDocument1 pageInvoiceDp PandeyNo ratings yet

- Canons of ST Basil The GreatDocument67 pagesCanons of ST Basil The Greatparintelemaxim100% (1)

- Wagner Group Rebellion - CaseStudyDocument41 pagesWagner Group Rebellion - CaseStudyTp RayNo ratings yet