Professional Documents

Culture Documents

Michigan SFA Explanation of Legacy Costs

Uploaded by

Justin HinkleyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Michigan SFA Explanation of Legacy Costs

Uploaded by

Justin HinkleyCopyright:

Available Formats

State Notes

TOPICS OF LEGISLATIVE INTEREST

Summer 2013

Explaining "Stranded" and "Legacy" Costs in Retirement Systems

By Kathryn Summers, Associate Director

Over the past decade or so, interest in privatization, at both the State and local levels, has grown

steadily. Part of the appeal of privatization stems from the option that private providers have of

offering different and often scaled-back, or nonexistent, retirement options for the contracted

employees, relative to the retirement plans offered by State and local government. When there are no

"legacy" costs for the public employees, a comparison between the costs of public versus contracted

or private employees is much simpler. However, at times like the present when significant legacy

costs do exist, the analysis is somewhat more complicated. This article will explain "stranded" and

"legacy" costs associated with the State Employees' Retirement System (SERS) and the Michigan

Public School Employees' Retirement System (MPSERS), examine what privatization means when

bids are analyzed, and explain the impact of stranded costs on the State budget.

What Are Stranded and Legacy Costs?

The costs of each year's benefits are fully paid in that year. This is the normal cost. Legacy costs (or

unfunded actuarial liability, UAL) result from market crashes, recessions, population loss/ privatization,

unfunded benefit giveaways (e.g., early outs at the local or statewide level), and other factors that

throw the actuarial assumptions off.

When assumptions are off, it is not always to the bad. Sometimes there is negative UAL (i.e., the plan

is overfunded, which has happened before). More recently, there has been positive UAL, meaning the

plan is currently underfunded. Therefore, legacy costs refer to the costs of providing benefits that

were promised and earned, for which there presently is a shortfall of assets available to pay.

In somewhat simplistic terms, this can be most easily equated with the amount of unfunded accrued

liability there is in a retirement system, and the shortfall must be funded regardless of whether

employees remain directly hired by State or local government, or privatization occurs.

Stranded costs refer to the phenomenon that occurs when an employer deliberately reduces the

number of employees covered by the retirement system (through privatization or downsizing, for

example) for the purpose of not having to pay retirement contributions, and the legacy costs that were

being partly paid for as a charge against that covered payroll are instead transferred to the remaining

payroll of employees covered by the retirement system. In other words, the responsibility of the

employer to pay its fair share of the legacy costs is stranded to the extent of the privatization or

downsizing, and, since the same dollar amount must be generated in order to pay down the shortfall

(like paying off a mortgage), the remaining employers or covered payroll must pick up the stranded

cost.

With the State being one single employer managing employees in SERS, the analysis is somewhat

more direct when reviewing the impact of legacy and stranded costs. However, when looking at

hundreds of school district employers that are all part of one retirement system, the analysis is

somewhat more complex. The next section of the article provides examples illustrating what happens

to the legacy costs if they are stranded by an employer.

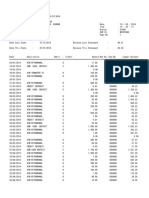

First, however, Table 1 shows how much funding must be collected as a percentage of payroll for

fiscal year (FY) 2013-14 in order to make the annual payment toward the legacy costs, in both SERS

and MPSERS. The legacy costs, or the unfunded accrued liability, are on a 25-year payoff plan, such

that, if sufficient payments continue to be made on a scheduled basis and actuarial assumptions (e.g.,

market returns or mortality tables) are met, the legacy costs will be paid off by 2038.

Ellen Jeffries, Director Lansing, Michigan (517) 373-2768

www.senate.michigan.gov/sfa

State Notes

TOPICS OF LEGISLATIVE INTEREST

Summer 2013

Table 1

Employer Normal Costs and Legacy (UAL) Costs for FY 2013-14, as Percent of Payroll

SERS MPSERS

SERS Defined Basic/Member

Defined Contribution Investment MPSERS

Benefit (DB) (DC) Plan (MIP) Hybrid

Normal

Pension Normal....................................... 3.30% 7.00% 2.90% 2.67%

Health Normal ......................................... 4.18% 4.18% 0.93% 0.93%

Total Normal .......................................... 7.48% 11.18% 3.83% 3.60%

Legacy (UAL)

Pension UAL ........................................... 17.54% 17.54% 15.44% 15.44%

Health UAL .............................................. 20.01% 20.01% 5.52% 5.52%

Total UAL ............................................... 37.55% 37.55% 20.96% 20.96%

Health UAL Paid by State through

the School Aid Fund ............................. n/a n/a 4.56% 4.56%

1)

Total Rate ............................................. 45.03% 48.77% 29.35% 29.12%

1)

Total rate excludes FICA, reconciliation, and MPSERS Hybrid DC employer contributions

Note: SERS DB does not include Corrections or Conservation Officers; their rates are slightly higher.

MPSERS Basic/MIP and Hybrid were chosen as they represent the largest numbers of

employees.

Legacy costs can be thought of as similar to a mortgage: regardless of the changes or makeup of

household income, the mortgage payment must be made in order for the principal and interest to be

paid by its scheduled payoff date. Unlike a personal mortgage, however, where a house could be sold

if household income fell below a level necessary to pay for the mortgage, the State Constitution

protects pension benefits earned; therefore, the legacy costs associated with accrued pension service

cannot be avoided. Legacy costs associated with earned health care benefits may be subject to

change, but the courts would have to decide to what extent changes would be acceptable. Table 1

shows that for FY 2013-14, in SERS, more than 37% applied to payroll must be remitted to make the

annual payment toward legacy or UAL costs. For MPSERS, nearly 21% of payroll must be levied to

make the annual payment.

Table 1 also illustrates the "normal" retirement costs, which represent the cost today of providing an

additional year of pension and/or health benefits accrued for the future. Looking at the table for

SERS, for example, the "normal" cost to provide one more year of pension and health care benefits for

a State defined benefit (DB) worker is 7.48% of pay. (Defined benefit now is a closed system: since

March 31, 1997, no new employees have been eligible.) For MPSERS workers in the Basic or

Member Investment Plan (also closed with no new eligible participants), the normal cost is 3.83% of

pay, and for members in the Hybrid plan (for members hired on or after July 1, 2010), the normal cost

is 3.60% of pay.

As of the FY 2011-12 valuation for the State Employees' Retirement System, the unfunded accrued

pension liability was $6.2 billion and the unfunded accrued health liability was $8.4 billion. The sum of

these two can be considered the legacy costs, to be paid off over 25 years, and the yearly "mortgage

payment" in dollar terms must be made regardless of the size of the direct State payroll, or how many

employees are laid off or privatized. In a given year, the "legacy" (UAL) cost is a fixed dollar amount

Ellen Jeffries, Director Lansing, Michigan (517) 373-2768

Page 2 of 5 www.senate.michigan.gov/sfa

State Notes

TOPICS OF LEGISLATIVE INTEREST

Summer 2013

where the method of raising the dollars necessary to make the "mortgage payment" is to collect the

dollars as a percentage of current covered payroll (again, 37.55% for SERS DB members in FY 2013-

14), and the legacy costs reflect the shortfall of assets to pay for previously accrued benefits.

Turning to the Michigan Public School Employees' Retirement System, the FY 2011-12 valuation

indicated an unfunded accrued pension liability of $24.3 billion and an unfunded accrued health

liability of $21.8 billion. However, it should be noted that the accrued liabilities found in the FY 2011-

12 valuation for MPSERS do not reflect the reduction in health care liability that will occur beginning in

FY 2012-13 due to prefunding (rather than paying on a cash basis) other post-employment benefits

(OPEB), and other changes enacted in 2012. At the time of the change to prefunding (part of Public

Act 300 of 2012), it was estimated that OPEB liabilities would be reduced by roughly $14.0 billion

beginning in FY 2012-13.

State Employees' Retirement System

The State of Michigan is a single employer in the State Employees' Retirement System. Therefore,

the normal and legacy costs within SERS are paid entirely by the State via appropriations to all of the

State departments, which then remit the required amounts to the pension system. Total State payroll is

roughly $3.1 billion; applying the total UAL of roughly 37.6% to $3.1 billion payroll equates to a yearly

payment toward legacy costs of about $1.2 billion.

What often is misunderstood is that simply shrinking State payroll (such as by privatizing services)

does not reduce the legacy costs. The $1.2 billion annual payment actually is derived first, calculated

by the independent actuaries contracted by the State to oversee the financing of the pension systems.

The actuaries determine the monetary amount necessary to "make the mortgage payment" on the

unfunded accrued liabilities, such that the "mortgage" will be paid off within a specified period of time,

in this case, 25 years. Then, the State Budget Office, with the Office of Retirement Services and the

actuaries, determines the percentage that must be collected on payroll in order to generate the

necessary dollar contribution in any given year. In this case, $1.2 billion is the amount necessary to

be raised, and it represents 37.6% of State payroll. If one-quarter of State payroll were to be

privatized, bringing total State payroll down to $2.3 billion, then the percentage of payroll necessary to

generate $1.2 billion in the required contribution would increase from 37.6% to 52.1%. Therefore,

regardless of privatization or other methods of reducing active State payroll, the legacy costs still would

have to be paid; they would just be spread out among a smaller payroll base (meaning a higher

percentage applied to payroll).

For the reasons stated above, when examining bids for privatizing services it is necessary to make a

comparison that accounts for the fact that legacy costs associated with the past must be paid

regardless of whether employees are State employees or private employees. Table 2 illustrates a

comparison between a hypothetical State department and two bids from private companies. In the

table, the cost to use State employees in the example totals $14.7 million, of which $10.9 million would

be payroll and "normal" costs and another $3.8 million would be "legacy" costs. When comparing this

to private bids, the "legacy" costs must be added to the bid price, since they have to be paid

regardless of whether the employer is the State or a private company. In the first bid, wages are 10%

lower than the State's and the company offers no retirement benefits, for total costs of $12.8 million, or

savings of $1.9 million (13.2%). In the second bid, wages and benefits at the private company are

20% lower than the total State cost of $14.7 million, which, at first glance would seem to produce

savings. However, when the legacy costs are added in, the total cost of the second bid exceeds the

cost of retaining the employees at the State level, making privatization more costly.

Ellen Jeffries, Director Lansing, Michigan (517) 373-2768

Page 3 of 5 www.senate.michigan.gov/sfa

State Notes

TOPICS OF LEGISLATIVE INTEREST

Summer 2013

Table 2

Current Situation

Payroll paid to State employees ......................................................... $10,000,000

Normal pension/health costs (avg. 9.33%) ......................................... $933,000

Subtotal of non-legacy costs ............................................................... $10,933,000

Legacy costs +

UAL costs (37.59%) ............................................................................ $3,759,000

Total Appropriation to Cover Compensation ....................................... $14,692,000

New Bid 1 - 10% Lower Wages and No Retirement Benefits Offered

Payroll plus private retirement contributions (if any) ........................... $9,000,000

Plus +

Legacy costs ....................................................................................... $3,759,000

True total privatization cost ................................................................. $12,759,000

Net Cost (Savings) Compared to Current Situation ...................... ($1,933,000)

New Bid 2 - 20% Less than Total State Cost, but Legacy Costs Added

Payroll plus private retirement contributions (if any) ........................... $11,753,600

Plus +

Legacy Costs ...................................................................................... $3,759,000

True total privatization cost ................................................................. $15,512,600

Net Cost Compared to Current Situation ....................................... $820,600

Michigan Public School Employees' Retirement System (MPSERS)

Legacy and stranded costs are present in the Michigan Public School Employees' Retirement System,

as in SERS. The difference between MPSERS and SERS, though, is that there are hundreds of local

employers within MPSERS compared with the sole employer (State of Michigan) in SERS. Before

Public Act (PA) 300 of 2012 capped the unfunded accrued liability percentage paid by local employers

at 20.96% of payroll, when an employer in MPSERS (school district, intermediate school district,

community college, or participating library or charter) reduced its covered payroll (such as by

downsizing, privatizing, or converting to a charter school), the employer would immediately shift that

portion of its legacy costs to the payroll remaining in the system statewide, thereby resulting in

"stranded costs" that were spread to other employers.

However, due to the MPSERS rate cap on unfunded liabilities that was enacted as part of PA 300 of

2012, any reduction in covered MPSERS payroll now will result in a cost to the School Aid Fund, until

such a time when the rate contributed by local employers toward the UAL falls below 20.96%. The

reason is that, again, in any given year, the money that must be raised to pay down the legacy costs is

a fixed dollar amount, like a mortgage. Whether that dollar amount is spread among a larger payroll

(generating a smaller percentage rate) or among a smaller payroll (generating a larger percentage

rate), the same dollar amount must be raised. Since the enactment of PA 300, if the MPSERS payroll

declines and the percentage that must be collected against payroll rises to generate the fixed UAL

payment, the School Aid Fund will have to pay for any percentage of payroll in excess of 20.96%.

Ellen Jeffries, Director Lansing, Michigan (517) 373-2768

Page 4 of 5 www.senate.michigan.gov/sfa

State Notes

TOPICS OF LEGISLATIVE INTEREST

Summer 2013

Once the "mortgage" is paid off, scheduled in 25 years, then the stranding of costs again could occur

among employers in the event of shifting of payroll, if unfunded liabilities accrue in the future.

Continued expansion in the number of nonparticipating charter schools, the conversion of school

districts to charter schools, and the introduction and expansion of the Education Achievement

Authority schools all draw covered payroll away from providing financial structure for the system. In

addition, the recent enactment of House Bills 4813 and 4815 (Public Acts 96 and 97 of 2013) provides

for an expansion in the dissolution of schools, and the extent to which the dissolution of schools

results in a reduction in MPSERS payroll, it also will result in "stranded" costs and an increased cost to

the School Aid Fund. If the covered payroll does not grow at the actuarially assumed 3.5% per year

for any of these reasons, or any other reasons, there will be additional yearly costs to the School Aid

Fund to meet the required payment toward legacy costs.

As shown in Table 1, the normal cost to the employer for an employee accruing a year of service in

MPSERS is less than 4% of payroll, and the amount the employer must contribute to pay down the

"mortgage" of the historical legacy costs is just under 21% of payroll (statutorily capped by PA 300 of

2012). The legacy costs actually are higher than 21% of payroll, and Table 1 shows that the additional

State support toward the employer contribution rate for FY 2013-14 is 4.56% of payroll, which equates

to roughly $403.6 million in the School Aid budget and another $31.4 million in the Community

Colleges budget. The estimated cost in FY 2014-15 to the School Aid Fund to pay for the MPSERS

rate cap is more than $650.0 million. An expansion in covered payroll (such as bringing all K-12

alternatives into the retirement system) could substantially reduce the costs paid directly by the School

Aid Fund in the future.

Conclusion

Several items of note should be considered when reviewing retirement issues. First, legacy costs are

historical costs that are tied to benefits that have already been earned and that must be paid, but for

which there is currently a shortfall in system assets due to factors that have thrown actuarial

assumptions off. Closing a system will not eliminate legacy costs related to pensions, and courts

would have to rule on whether closing out health care benefits would be allowable. Second, in order

to compare privatization to State employment, or competitive bidding, the costs attributed to legacy

costs must be included in the analysis in order to compare "apples to apples". Again, this is because

legacy costs from the previous system will have to be paid regardless of whether employment remains

at the State level or is privatized. Third, with the enactment of PA 300 of 2012, any reduction in

covered payroll in MPSERS will mean an increase in State costs to the School Aid Fund due to the

employer rate cap of 20.96% of payroll, at least until the rate levied to pay off the unfunded accrued

liabilities falls below that level.

Ellen Jeffries, Director Lansing, Michigan (517) 373-2768

Page 5 of 5 www.senate.michigan.gov/sfa

You might also like

- Joseph Spry Court of Appeals OpinionDocument3 pagesJoseph Spry Court of Appeals OpinionJustin HinkleyNo ratings yet

- Safety ResultsDocument1 pageSafety ResultsJustin HinkleyNo ratings yet

- Meds Cafe LLC AUR000141 AUR000200 Consent Order and Stipulation and Formal ComplaintDocument7 pagesMeds Cafe LLC AUR000141 AUR000200 Consent Order and Stipulation and Formal ComplaintJustin HinkleyNo ratings yet

- HUNT 2022 Annual ReportDocument20 pagesHUNT 2022 Annual ReportJustin HinkleyNo ratings yet

- Swoffer-Sauls COA OpinionDocument6 pagesSwoffer-Sauls COA OpinionJustin HinkleyNo ratings yet

- Rappaport: The Economic Impact of Restricting Housing SupplyDocument12 pagesRappaport: The Economic Impact of Restricting Housing SupplyJustin HinkleyNo ratings yet

- Rappaport: The Economic Impact of Restricting Housing SupplyDocument12 pagesRappaport: The Economic Impact of Restricting Housing SupplyJustin HinkleyNo ratings yet

- FOIA Text MessagesDocument24 pagesFOIA Text MessagesJustin HinkleyNo ratings yet

- Letter From Doctors To APSDocument2 pagesLetter From Doctors To APSJustin HinkleyNo ratings yet

- District Health Department No. 4: Dhd4 Covid-19 Vaccination FaqsDocument3 pagesDistrict Health Department No. 4: Dhd4 Covid-19 Vaccination FaqsJustin HinkleyNo ratings yet

- Proposed Alpena-Alpena Township Fire Department ContractDocument8 pagesProposed Alpena-Alpena Township Fire Department ContractJustin HinkleyNo ratings yet

- Alpena Recipients of PPP LoansDocument2 pagesAlpena Recipients of PPP LoansJustin HinkleyNo ratings yet

- Rural Prosperity ReportDocument47 pagesRural Prosperity ReportJustin HinkleyNo ratings yet

- Northeast Michigan Kids County ProfilesDocument8 pagesNortheast Michigan Kids County ProfilesJustin HinkleyNo ratings yet

- Gov. Whitmer's Stay-At-Home OrderDocument8 pagesGov. Whitmer's Stay-At-Home OrderMLive.com100% (8)

- Neiman's Statement On Pharmacy ClosureDocument1 pageNeiman's Statement On Pharmacy ClosureJustin HinkleyNo ratings yet

- Terry King Lawsuit Against SheriffDocument9 pagesTerry King Lawsuit Against SheriffJustin HinkleyNo ratings yet

- Former Alpena County Undersheriff Terry King's Letter Addressing AllegationsDocument3 pagesFormer Alpena County Undersheriff Terry King's Letter Addressing AllegationsJustin HinkleyNo ratings yet

- David Lall 2017 Administrative ComplaintDocument31 pagesDavid Lall 2017 Administrative ComplaintJustin HinkleyNo ratings yet

- Christopher Lombardo License Probation DocumentsDocument10 pagesChristopher Lombardo License Probation DocumentsJustin HinkleyNo ratings yet

- House Letter To MSUDocument2 pagesHouse Letter To MSUJustin HinkleyNo ratings yet

- Bills From Greater Lansing LawmakersDocument2 pagesBills From Greater Lansing LawmakersJustin HinkleyNo ratings yet

- Terry King's StatementDocument1 pageTerry King's StatementJustin HinkleyNo ratings yet

- Redacted Letter From Alpena County Sheriff Steve Kieliszewski To Undersheriff Terry KingDocument4 pagesRedacted Letter From Alpena County Sheriff Steve Kieliszewski To Undersheriff Terry KingJustin HinkleyNo ratings yet

- Michigan Department of Health & Human Services Work RulesDocument14 pagesMichigan Department of Health & Human Services Work RulesJustin HinkleyNo ratings yet

- Superintendent David Hornak Letter On Larry NassarDocument2 pagesSuperintendent David Hornak Letter On Larry NassarJustin HinkleyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Sales Manager Latin AmericaDocument3 pagesSales Manager Latin Americaapi-76934736No ratings yet

- Pro Tools ShortcutsDocument5 pagesPro Tools ShortcutsSteveJones100% (1)

- Lemon AidDocument17 pagesLemon AidJade Anne Mercado BalmesNo ratings yet

- The "Solid Mount": Installation InstructionsDocument1 pageThe "Solid Mount": Installation InstructionsCraig MathenyNo ratings yet

- Engagement Letter TrustDocument4 pagesEngagement Letter Trustxetay24207No ratings yet

- CH 2 Nature of ConflictDocument45 pagesCH 2 Nature of ConflictAbdullahAlNoman100% (2)

- Electrical Estimate Template PDFDocument1 pageElectrical Estimate Template PDFMEGAWATT CONTRACTING AND ELECTRICITY COMPANYNo ratings yet

- Agoura Hills DIVISION - 6. - NOISE - REGULATIONSDocument4 pagesAgoura Hills DIVISION - 6. - NOISE - REGULATIONSKyle KimNo ratings yet

- IOSA Information BrochureDocument14 pagesIOSA Information BrochureHavva SahınNo ratings yet

- Product Guide TrioDocument32 pagesProduct Guide Triomarcosandia1974No ratings yet

- Powerpoint Presentation R.A 7877 - Anti Sexual Harassment ActDocument14 pagesPowerpoint Presentation R.A 7877 - Anti Sexual Harassment ActApple100% (1)

- C Sharp Logical TestDocument6 pagesC Sharp Logical TestBogor0251No ratings yet

- (ENG) Visual Logic Robot ProgrammingDocument261 pages(ENG) Visual Logic Robot ProgrammingAbel Chaiña Gonzales100% (1)

- Department of Labor: 2nd Injury FundDocument140 pagesDepartment of Labor: 2nd Injury FundUSA_DepartmentOfLabor100% (1)

- Active Directory FactsDocument171 pagesActive Directory FactsVincent HiltonNo ratings yet

- (ACYFAR2) Toribio Critique Paper K36.editedDocument12 pages(ACYFAR2) Toribio Critique Paper K36.editedHannah Jane ToribioNo ratings yet

- Project Management: Chapter-2Document26 pagesProject Management: Chapter-2Juned BhavayaNo ratings yet

- Hitt PPT 12e ch08-SMDocument32 pagesHitt PPT 12e ch08-SMHananie NanieNo ratings yet

- Soneri Bank Compensation PolicyDocument20 pagesSoneri Bank Compensation PolicySapii Mandhan100% (1)

- Service ManualDocument30 pagesService ManualYoni CativaNo ratings yet

- Ssasaaaxaaa11111......... Desingconstructionof33kv11kvlines 150329033645 Conversion Gate01Document167 pagesSsasaaaxaaa11111......... Desingconstructionof33kv11kvlines 150329033645 Conversion Gate01Sunil Singh100% (1)

- Hierarchy of The Inchoate Crimes: Conspiracy Substantive CrimeDocument18 pagesHierarchy of The Inchoate Crimes: Conspiracy Substantive CrimeEmely AlmonteNo ratings yet

- Customer Satisfaction-ICICI Bank-Priyanka DhamijaDocument85 pagesCustomer Satisfaction-ICICI Bank-Priyanka DhamijaVarun GuptaNo ratings yet

- CNG Fabrication Certificate16217Document1 pageCNG Fabrication Certificate16217pune2019officeNo ratings yet

- Bank Statement SampleDocument6 pagesBank Statement SampleRovern Keith Oro CuencaNo ratings yet

- MEMORANDUMDocument8 pagesMEMORANDUMAdee JocsonNo ratings yet

- NX CAD CAM AutomationDocument12 pagesNX CAD CAM AutomationfalexgcNo ratings yet

- Alternator: From Wikipedia, The Free EncyclopediaDocument8 pagesAlternator: From Wikipedia, The Free EncyclopediaAsif Al FaisalNo ratings yet

- PHP IntroductionDocument113 pagesPHP Introductionds0909@gmailNo ratings yet

- Braga - 2016 - On Standing's A Precariat Charter - Confronting The Precaritisation of Labour in Brazil and PortugalDocument12 pagesBraga - 2016 - On Standing's A Precariat Charter - Confronting The Precaritisation of Labour in Brazil and PortugalLiam MurciaNo ratings yet