Professional Documents

Culture Documents

Fiscal Impact of Question 9: Potential State Revenue Implications

Uploaded by

MPP0 ratings0% found this document useful (0 votes)

786 views11 pagesFiscal Impact of Question 9: Potential State Revenue Implications

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFiscal Impact of Question 9: Potential State Revenue Implications

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

786 views11 pagesFiscal Impact of Question 9: Potential State Revenue Implications

Uploaded by

MPPFiscal Impact of Question 9: Potential State Revenue Implications

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 11

2

Fiscal Impact of Question 9:

Potential State-Revenue

Implications

Prepared by

R. Keith Schwer, Ph.D.

Mary Riddel, Ph.D.

Jason Henderson, Graduste Assistant

October 16, 2002

he Center for Business and Economic Research

University of Nevada, Las Vegas

isrze

Fiscal Impact of Question 9: Potential State-Revenue Implications

atisfaction with che iliegal status of marijuana has resulted in its legalization

(Europe), recommendations for legalization (Canade), and referendums for legalization

(Nevada). For any community of concemed citizens faced with similar decisions, such as

Nevada, issues surround proposals to legalize small amounts of marijuana, for example,

referendum #9 on the November 2002 ballot

One issue, namely the potentia! cax revenues, may de especially imponiant °0 Nevadans

Nevada has recenily faced sharp revenue shortfalls, a tepidly depleting rainy-day fund, and a

fomure of structural-budger deficits, Therefore, in order te accomplish the task of uncovering the

Potential fiseal impacts on our community due tc the legalization of marijuana, the nature of the

inquiry undertaken must strietly be an economic one.

‘While the multitude of discussions on merijuana-drug control has focused on usage

rates, potential health effects, criminel justice, impacts of usage by youth as a gareway to

incrzased smoking, problem drinking, and other illicit drug behavior, the vast array of potential

social costs and benefits lies outside our scope. Though these are important issues for voters 10

understand, this policy brief focuses more nerrowly on potential revenue issues for the siate of

Nevada. To our knowledge, estimates of chis pocential revenue source aze not currently

available for Nevada

The literature on the potemtiai value of a legalized market for marijuane has,

however, been addressed at the national level. Caputo and Ostrurr, (1994) estimated she

potential tax revenue of a regulated marijuana market to range from 2.55 to 9.09 billion dellers

at 1991 price levels. These estimates rest on survey findings suggesting that 10 million

Americans regularly use marijuana and 20 million occasionally use it (Caputo and Ostrum,

94), Of course, findings of black-market activities present difficulties fr researchers since

tthe demand

survey partiéipants may want to obscure their behavior. Still, attempting to g

for marijuana in a regulated market is a firsc step, and, as such, curcent activities provide a base

line on which some reasonable estimates can be built.

Estimating Nevada’s Demand for Marijuana

In estimating the demand for marijuana in the state of Nevada and the subsequent tax

This has been

implication, we have chosen conservative numbers for every step of this process.

done with the intention of producing a tax-revenue dollar value that is a minimum given the

information available to us, The first step in this process is to provide a demographic base line

from which to work. In order to accomplish this task the 2000 U.S. Census number for total

population 21 years and over for the state of Nevada was used, The Nevada population for this

age category is 1,411,378 as of April 2000. Moreover, because of the large amount of tourism

in the state the population base line above received a boost of 10 percent.

The 10 percent boost is conservative and defensible. Firs:, the majority of the tourists

that visit the stave of Nevada do so for gaming reasons. As such, iris reasonable to estimate the

bulk of visitors as 21 years of age and over. Additionally, we use the number of rooms and the

subsequent occupancy rates for Nevada as the rationale for the 10 percent number. This ensures

a conservative, bot:om-line type of estimate, The Nevada Tourism Commission and the Las

‘Vegas Visitors and Convention Authority estimate the current total room inventory for Nevada

at 174,235. Current total occupancy rates are approximately 80 percent, which suggests at least

139,388 toutists are visiting Nevada daily given one person per room. This conservative

estimate is soughly 10 percent of the resident population of 1.4 million. Thus, our demographic

2

for potential marijuana users, both resident and visiters, is approximately 1.5 million people

The next step in the demand-side estimation of Nevada’s potentigl marijuana market 1s

to identify and define the potential users of the commodity. Utilizing the criteria similar in she

Ceputo and Ostcum piece, this brief follows the National Insciture of Drug Abuse Research in

the assumption that “essentially all individuals who kave used marijuana in the last month are

regular users.” (1994) Individuals who “use irregulariy” are those who have “used marijuana in

tne past year, but not the past month.” (1994) Thus, we base usage rates on those who use

regularly and exclude those who use occasionally in our estimates.

We have based tax-revenue estimates from the passage of referendum #9 on the

estimated population of regular users. Although frequency-of-use estimates are available for

them, occasional users have been left out cf this analysis due to the difficul:ies in estimating the

amounts they would use over time. Tt is worth noting that over the last 20 years occasional

users have doubled nationally (Caputo and Ost-urn, 1994) and, thus, would stil add

substantially to che tax revenues, However, the dollar amounts they would contribute would be

subject to vaciations from year to year that would be difficult 10 estimate given the nature of

legalizing a formerly il!egal market.

Moreover, legalization may increase the demand for marijuana. Of the limited amour

of credible literature available on this subject, it appears that there would be an increase in

emand due te legalization. Saffer and Chaloupka conducted a study in which “marijuana

ecriminalization was found co increase the probability of marijuana participation by about 3

percent.” (1999) The same team conducted another study (The Demand for Dicit Drugs, 1999)

in which they found the demand effects of marijuana decriminalization to be increased usege by

8.4 percent for regular users and 7.6 percent for occasional users, Although these types of

increases are no: accounied for in our approach, they are worth noting as available evidence that

suggests higher-revenue possibilities. ;

For our purposes, however, the marijuana market is defined as regular users of the drug.

nce the 1970s, marijuana

Although the number of reguler users has fallen si

age has remained

Zairly consistent (SAMHSA; National Household Survey on Drug Abuse). Regular users are

consistent consumers of the commodity and, thus, are the core contributors to potential tax

revenues. That is, the amounts that they purchase are consistent and continuous and, as such,

form the solid tax base for the marijuana market. We used the most recent data on this group

of consumers as the foundation for our estimate

In estumating the total number of regular users 21 and older, we use a 5 percent usa;

rate based on the data from National Househoid Survey on Drug Abuse and che literawure

review we conducted. The 5 percent estimate is in line with the estimated number of regular

users in our region of the country and similar to che national average: and by looking at Tabie 1

from the National Household Survey on Drug Abuse, we find thet toral past-menth users

represent

5.6 percent of the relevant age categories of Nevada's total population. Therefore, altheugh 5

percent is an estimate, it is clearly the best number we have zt this time.

‘We estimate the total number of regular users in, the state by muluiplying the 5 percen:

usage rate by 1.5 million people, yielding an estimate of approximately 75,C00 regular

marijuana in Nevada.

From the estimate of 75,000 regular users in the state we can derive an estimate of the

total usage of marijuana for the month using aational-frequency-of-use percentages for 2000

provided by the National Household Survey on Drug Abuse. We have taken the population of

4

regular users and multiplied it by the mean rate of use for each category cf regular users

weighted by the percentage of consumers in each category. Tais yields an estimate of

approximately 870.712 uses per month, Following the lead of Caputo and Ostrom, the amount

of marijuana that equates 10 one vse is, on average, equivalent to one gran: of marijuana

according to the National Commission on Marijuana and Drug Abuse (1994). Thus, the

‘monthly usage of marijuana in the state of Nevada is estimated at 870,712 grams per month

The data and formula used (0 arrive at this estimate appears in Table 2

State Revenue Implications of Nevada’s Marijuana Demand

The conversion of regular marijuana usage from grams to ounces is the next step in

estimating the revenue available for taxation. We have done this because the current retail

pricing of marijuana is availabie in ounces. By reviewing sources on the prising of marijuana

(Caputo and Ostrom, 1994 / Gieringer. 1994) we were able co decide on a conservative estimate

of $100 - S506 an ounce by excluding very nigh and Jow marijuana prices. This cange of retail

valve is attributable to the quality of the marijuana being sold. Because “the price of marijuana

tends to be proportional to potency” {Gieringer, 1994) and, thus, the amounts needed for

consumption will vary with quality. we took the average of this range and used it as a consistent

measure of retail value per ounce. Therefore, our estimate is based on an average price of $250

per ounce

Converting grams to ounces yields a monthly usage rate of 30,713.5 ounces. At an

average cost of $250 per ounce, the retait market for marijuana produces a revenue stream of

approximately $7.68 million per moxth. Annually chis results in a total revenue of around

$92.2 million from the retail sale of marijuana, and assuming a 20 percent markup at retail

yields an estimate of the wholesale value of roughly $73.7 million. By basing the taxation of

5

‘marijuana sales on the structure used For other tobacco products a two-part tax-revenue stream

becomes avaiiable (0 the state of Nevada through the sale

smarijvang,

Levying an excise tax of marijuana of 30 percent at wholesale yields an annual tax-

revenue stream of about $22.1 miilion per year. Sales-tax collections on setai: sales would

yield revenues of about $6.5 million per year assuming 2n average of 7 percent sales-cax rate

across Nevada counties, Taken cogether, legalizing marijuana yields a total tax-revenue stream

of approx:mately $28.6 million annually.

Additional Revenue Implications: Licencing Fees

‘The taxation of sales at retail and wholesale, estimated to conservatively yield at least

$28.6 million, is only part of the sources of possible future revenue. Though these are expected

to be mejor revenue sources, the state could also levy license fees on private producers or

establish a state-run operation. In either case, addivional revenues would be generatec.

Jegulation issues such as these would have (0 be worked out in the state legislarsre; and, as a

result, we have not included

¢ possible revenues. [cis clear, nowever, that the potential for

further state revenue exists. All in all, the expected revenues of $28.6 compares with $18.8

million for liquor-related revenues and $61.1 million for tobacco the fiscal year 2000-2001

Conclusion

We) atively estimate that the legelization of marijuana would create state

ae

roel thier $28.6 million per year. This estimate is based on sales taxes at retail and

wholesa ible revenue sources are not considered. Furthermore, we used

of usage rates and price. Our estimates would place revenue collections

on che Boi of marijuana between the current revenue collections for tobacco and liquo:

Table 1. Estimates from the National Survey on Drug Abuse Relating to Selected Suostance

Use, Perceptions of Great Risk, and average Annual Rates of Fust Marijuana Use ia the Past

24 Momtns in Nevada, by Age Group ?

z os T

Drug Characteristic Total | Age12-17 | Age28-25 | Age 26

Population Estimates (In Percentages)

ILLICIT DRUG USE

Past month marijuana 58 6 7 4

Average rate of 18 use 17 8 33 02

PERCEPTIONS OF GREAT RISK

Smoking manjuanaonce amonth 34.8 298 266 366

Population Estimates (In Thousands)

ILLICIT DRUG USE

Past month marijuane 83 7 20 46

Average annual # of initietes 1s 9 5 1

PERCEPTIONS OF GREAT RISK

Smoking marijuana once a month 518 43 46 429

Note: Estimates are based on a suivey-weighted hierarchical Beyes estimation approech,

Average Annual Rate=(First Use of Marijuana in Past 24 Monthsy(First Use of Marijuana in

Past 24 Months *0.5)+Never Used Marijuana)/2. Both of the cemputetion components, first use

of marijuana in past 24 months and never used marijuana, are based on a survey-weighted

hierarchical Bayes estimation approach,

Source: SAMFISA, Office of Applied Studies, National Household Survey or Drug Abuse,

1999, CAL

Table 2; Use of Marijuana Among Past-Ycar and Pas:-Month Users, Findings from tne 1999

2000 National Survey on Drug abuse

,

Frequency of Use L 1399 2006

Number of days used in past year among past-year users

100 11 uses 36.1 34.1

1210 49 uses 217 204

| 50 t0 99 uses | 10.6 10.8

i 100 10 299 uses 214 23

[300 oF more uses 102° ul?

Number of days used in past month among past-monta users

Lto 2 uses 28.9 273

L 3 t0 5 uses 199 20

Sto 19 uses 215 22.4

20 or more uses 29.6 30.4

*Low precision; no estimate reported.

{ Difference between estimate anc 2000 estimate is statistzcally significant at the 05 level.

® Difference beiween estimate ané 2000 estimate is statistically significant at the 1 level

Source: SAM-ISA, Office cf Applied Studies, National Household Survey on Dig Abuse,

1999 and 2000,

References

Caputo, Michael R. and Ostrom, Brian J., "Potential Tax Revenue from y Regulated

Marijuana Market: A Meaningful Revenue Source,” American Journal of Economics

and Sociology, 53(4), 1994, 475-90.

Gierinrger, Dale, “Economics of Cannabis Legalization,”

hup:/www ngrmlorgindex.cfm?Group_ID=442 |, hutp:!/www.norml.org, June, 1994,

10/1/2902.

“Nevada Bring lt On,” btip.siwww traveinevada.convindex_early.asp, in News, Nevada

Commision on Tourism, Discover the facts

‘Nevada Department of Taxation,” http://tax.state.nv.as/taxnew/pubs.htm, 10/3 / 2002

Saffer, Henry and Chaloupka, Frank, “The Demand for Dlict Drugs,” Economic In

37(3), 1999, 401.

Saffer, Henry and Chaloupka, Frank, "State Drug Control Spending ang Hlicit Drug

Participation,” hp://www.nber.crg/papers/w71 14, NBER Working Paper Series

Working Paper 71 14(JEL No.1), 1999, pg. 4, 9/3 / 2002.

“SAMSRA: Substance Abuse and Mental Health Services Administratio

hup:i/www.drugabusestatistics.semhsa, govi, in Data on Alcohe ‘bacco, and Illicit

Drugs, National Household Survey on Drug Abuse, U.S. Department of Health and

Homan Services.

"US. Census Bureau,” hupy/ifactfinder census gov, in Profile of General Demographic

Characteristics, Census 2000 Summary File | (SF 1) 100-Percent Data, Nevada.

Home —

Initiative —

News —

Releases —

[Search

Nevadans for Responsible Law Enforcement

Marijuana tax worth $28.6 million, study says ie

» Chiat Goda”

Wednesday, October 16, 2002 ‘

Copyright © Las Vegas Review-Journal > Greadsast Mattia

By Ed Vogel

Review Journal Bureau

CARSON CITY -- A UNLV study released today said Nevada would receive $28.6 million a year in additional

‘revenue if voters approved Question 9 and the state taxed marijuana,

The study by the Center for Business & Economic Research based its conclusions on 75,000 people, 5 percent

‘of the adult population, using an average of 12 grams, less than a hall-ounce, of marijuana per month.

Question 9, if approved by voters Nov. 5 and again in 2004, would allow people age 21 and older to possess up

to 3 ounces of the drug. Driving under the influence of the drug, use in public and use by those younger than 21

‘would be prohibited,

R. Keith Schwer of the Center of Business and Economic Research said the study did not take into

consideration that marijuana is an illegal substance banned under federal law

Law enforcement authorities have said that because of the federal law, Nevada could not sell or tax the sale of

marijuana,

‘Schwer said the study was done at the request of Nevadans for Responsible Law Enforcement, the organization

that gathered signatures from 110,000 residents to put Question 9 on the general election ballot. The

organization paid $5,000 for the study.

“This had nothing to do with the center's view on marijuana,” Schwer said, “People who vote on this issue

should know what we found.”

Billy Rogers, leader of Nevadans for Responsible Law Enforcement, had estimated 150,000 regular marijuana

Users were in the state. Rogers said Tuesday that the earlier estimate of 110,000 to 150,000 regular users

included juveniles. He said Schwer is being conservative in his estimate of users

| thought they were extremely careful in their study,” Rogers said, "Twenty-eight milion dollars would buy a lot

of textbooks for children, and it certainly would help fund education.

Question 9 calls for the state Legislature to devise regulations "for the cultivation, taxation, sale and distribution”

(of marijuana to adults. Marijuana would be bought from state licensed stores

The tax rate, set inthe ballot initiative, would be the same as the tax for tobacco products. The UNLV center

based the average retail price for manjuana at $250 per ounce. At that rate, the state would reap annual

marijuana taxes of $22.1 milion and $6.5 milion in additional sales taxes, according to the report

‘A marijuana tax could not be levied before 2005, when the Legislature would meet to vote on regulations,

Legistative Counsel Brenda Erdoes said the state has a marijuana tax of $250 per gram that allows the state to

cash in when large amounts of manjuana are confiscated from drug dealers. The tax brings in less than $2,000 a

year

“The constitution does not prohibit the state from doing something like that (enacting a new marijuana tax),”

Erdoes said. "But the enforcement of federal law might be a problem.

| coming up with 75,000 manjuana users, Schwer counted tourists as 10 percent of the users.

Language in the ballot question does not deny marijuana to visitors. It says only that persons older than 21 can

Possess the drug without fear of arrest. But another section in the question prohibits people from transporting

‘marijuana in or out of Nevada

You might also like

- Petition Urging Governors To Protect Medical Cannabis AccessDocument70 pagesPetition Urging Governors To Protect Medical Cannabis AccessMPPNo ratings yet

- 2020 Vermont Poll ResultsDocument7 pages2020 Vermont Poll ResultsMPPNo ratings yet

- MPP Policy Paper - Regulating Cannabis Oil VaporizersDocument7 pagesMPP Policy Paper - Regulating Cannabis Oil VaporizersMPPNo ratings yet

- Medical Cannabis Provides An Alternative To OpiatesDocument1 pageMedical Cannabis Provides An Alternative To OpiatesMPPNo ratings yet

- 2017 SIU Paul Simon Public Policy Institute Legalization PollDocument7 pages2017 SIU Paul Simon Public Policy Institute Legalization PollMPPNo ratings yet

- Medical Cannabis Implementation TimelinesDocument10 pagesMedical Cannabis Implementation TimelinesMPPNo ratings yet

- Marijuana Policy Map May 2020Document1 pageMarijuana Policy Map May 2020MPPNo ratings yet

- GQR Connecticut Poll January 2020Document1 pageGQR Connecticut Poll January 2020MPPNo ratings yet

- Marijuana Policy Progress Report 2019 Legislative UpdateDocument28 pagesMarijuana Policy Progress Report 2019 Legislative UpdateMPP100% (3)

- Decriminalization and Expungement in NY: An Overview of A0840 / S06579Document1 pageDecriminalization and Expungement in NY: An Overview of A0840 / S06579MPPNo ratings yet

- Prescribing Versus Recommending Medical CannabisDocument2 pagesPrescribing Versus Recommending Medical CannabisMPPNo ratings yet

- 2018 SIU Paul Simon Public Policy Institute Legalization PollDocument4 pages2018 SIU Paul Simon Public Policy Institute Legalization PollMPPNo ratings yet

- Simon Poll March 2019Document14 pagesSimon Poll March 2019MPPNo ratings yet

- Medical Marijuana MapDocument1 pageMedical Marijuana MapMPPNo ratings yet

- Severe Pain and Medical CannabisDocument1 pageSevere Pain and Medical CannabisMPPNo ratings yet

- U.S. Attorneys' Comments Post Cole Memo RecissionDocument8 pagesU.S. Attorneys' Comments Post Cole Memo RecissionMPPNo ratings yet

- Progress Report New York Medical Marijuana ProgramDocument2 pagesProgress Report New York Medical Marijuana ProgramMPPNo ratings yet

- Potential Revenue From Regulating Marijuana in ConnecticutDocument2 pagesPotential Revenue From Regulating Marijuana in ConnecticutMPPNo ratings yet

- What Does Former AG Sessions' Marijuana Enforcement Memo Mean in Practice?Document2 pagesWhat Does Former AG Sessions' Marijuana Enforcement Memo Mean in Practice?MPPNo ratings yet

- Medical Marijuana by The NumbersDocument2 pagesMedical Marijuana by The NumbersMPPNo ratings yet

- D.C.'s Medical Marijuana ProgramDocument2 pagesD.C.'s Medical Marijuana ProgramMPPNo ratings yet

- New Jersey Progress ReportDocument2 pagesNew Jersey Progress ReportMPPNo ratings yet

- Expungement: Removing The Life-Long Stigma Caused by Marijuana ProhibitionDocument1 pageExpungement: Removing The Life-Long Stigma Caused by Marijuana ProhibitionMPPNo ratings yet

- Maryland Progress ReportDocument2 pagesMaryland Progress ReportMPPNo ratings yet

- Sessions Asks Congress To Undo Medical Marijuana ProtectionsDocument3 pagesSessions Asks Congress To Undo Medical Marijuana ProtectionsMPPNo ratings yet

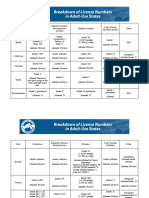

- Breakdown of License Numbers in Adult-Use StatesDocument2 pagesBreakdown of License Numbers in Adult-Use StatesMPPNo ratings yet

- Breakdown of Fees in Adult-Use StatesDocument6 pagesBreakdown of Fees in Adult-Use StatesMPPNo ratings yet

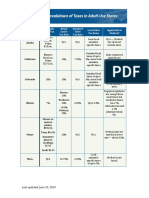

- Breakdown of Taxes in Adult-Use StatesDocument2 pagesBreakdown of Taxes in Adult-Use StatesMPPNo ratings yet

- Revenue From Adult Use StatesDocument5 pagesRevenue From Adult Use StatesMPPNo ratings yet

- Safe, Legal Access To Marijuana Can Help Fight The Opioid EpidemicDocument1 pageSafe, Legal Access To Marijuana Can Help Fight The Opioid EpidemicMPPNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)