Professional Documents

Culture Documents

Process Costing - Loss Units

Uploaded by

Akira Marantal ValdezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Process Costing - Loss Units

Uploaded by

Akira Marantal ValdezCopyright:

Available Formats

Pani Manufacturing Company has its products processed in two consecutive departments, Mixing and Finishing.

Conversion costs are evenly applied throughout the processes while materials are added at the start of the process

and at the middle of the process for Mixing and Finishing respectively. Cost and production data for August are as

follows:

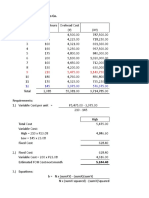

Cost data: Mixing Finishing

August factory cost

Materials 62,500.00 34,425.00

Labor 80,031.25 52,591.50

Overhead 65,256.25 40,455.00

Cost from Mixing ?

In Process August 1

Materials 14,400.00 -

Labor 6,450.00 840.00

Overhead 5,350.00 640.00

Cost from Mixing 19,920.00

Production data: Mixing Finishing

In Process, August 1 6,000 1/3 done 2,400 1/6 done

Placed in process in August 25,000 26,000

In Process, August 31 ? 1/8 done 2,000 1/4 undone

Loss units 1,000 1,400

Required: Prepare the cost of production report under a) FIFO and b) Average assuming loss units:

5) Are normal discovered at QCI of 90% for Mixing and at 50% completion for Finishing before

adding the materials

6) Base on #5 and assuming loss units are expected at 2% and 3% of the units completed for

Mixing and Finishing respectively.

Lost Units - Normal and Abnormal

Pani Manufacturing Company has its products processed in two consecutive departments, Mixing and Finishing.

Conversion costs are evenly applied throughout the processes while materials are added at the start of the process

and at the middle of the process for Mixing and Finishing respectively. Cost and production data for August are as

follows:

Cost data: Mixing Finishing

August factory cost

Materials 62,500.00 34,425.00

Labor 80,031.25 52,591.00

Overhead 65,256.25 40,455.00

Cost from Mixing ?

In Process August 1

Materials 14,400.00 -

Labor 6,450.00 840.00

Overhead 5,350.00 640.00

Cost from Mixing 19,920.00

Production data: Mixing Finishing

In Process, August 1 6,000 1/3 done 2,400 1/6 done

Placed in process in August 25,000 26,000

In Process, August 31 ? 1/8 done 2,000 1/4 undone

Loss units 1,000 1,400

Required: Prepare the cost of production report under a) FIFO and b) Average assuming loss units:

1) Normal discovered at the beginning or during

2) Normal discovered at the end

3) Abnormal discovered at the beginning

4) Abnormal discovered at the end

5) Are expected at 2% of the unit completed and discovered at the end

6) Are normal discovered at QCI of 90% for Mixing and at 50% completion for Finishing before adding the materials

7) Base on #6 and assuming loss units are expected at 2% and 3% of the units completed for Mixing and Finishing

respectively

terials

shing

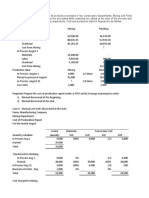

MIXING FINISHING

Qty Actual Materials Labor and OH Actual Material Labor and OH

Schedule Units WD EUP WD EUP Units WD EUP WD EUP

In Process April 1 6,000 100% 6,000 1/3 2,000 2,400 0% - 1/6 400

Started/Received 25,000 26,000

Total 31,000 28,400

Transferred to Finished Goods

In Process April 1 6,000 0% - 2/3 4,000 2,400 100% 2,400 5/6 2,000

Started/Received 20,000 100% 20,000 100% 20,000 22,600 100% 22,600 100% 22,600

In Process April 30 4,000 100% 4,000 1/8 500 2,000 100% 2,000 3/4 1,500

Normal loss - Beginning 1,000 0% - 0% - 1,400 0% - 0% -

Total 31,000 24,000 24,500 28,400 27,000 26,100

Cost Charged to Department A Total In Process Current Unit Total In Process Current Unit

EUP EUP

Cost Beg Cost Cost Cost Beg Cost Cost

In Process April 1

Cost from Department A 240,525.78 19,920.00 220,605.78 26,000 8.484838

Cost Added

Materials 76,900.00 14,400.00 62,500.00 24,000 2.604167 34,425.00 - 34,425.00 27,000 1.275000

Labor 86,481.25 6,450.00 80,031.25 24,500 3.266582 53,431.50 840.00 52,591.50 26,100 2.015000

Overhead 70,606.25 5,350.00 65,256.25 24,500 2.663520 41,095.00 640.00 40,455.00 26,100 1.550000

Total 233,987.50 26,200.00 207,787.50 8.534269 128,951.50 1,480.00 127,471.50 4.840000

Adjustment for lost units - 0.482877

Total Cost to be accounted 233,987.50 26,200.00 207,787.50 8.534269 369,477.28 21,400.00 348,077.28 13.807715

Cost Accounted as follows:

Transferred to Department B

In Process April 1

Cost Last Month 26,200.00 21,400

Cost to complete

Materials - X 2.604167 - 2,400 X 1.275000 3,060.00

Labor 4,000 X 3.266582 13,066.33 2,000 X 2.015000 4,030.00

Overhead 4,000 X 2.663520 10,654.08 49,920.41 2,000 X 1.550000 3,100.00

Adj. for lost units 6,000 X - - 49,920.41 0 X 0.482877 - 31,590.00

Started/Received and Completed 20,000 X 8.53427 170,685.37 22,600 X 13.807715 312,054.35

Total Cost Transferred 220,605.78 343,644.35

In Process April 30

Cost from Department A 2,000 X 8.484838 16,969.68

Materials 4,000 X 2.604167 10,416.67 2,000 X 1.275000 2,550.00

Labor 500 X 3.266582 1,633.29 1,500 X 2.015000 3,022.50

Overhead 500 X 2.663520 1,331.76 1,500 X 1.550000 2,325.00

Adj. for lost units 4,000 X - - 13,381.72 2,000 X 0.482877 965.75 25,832.93

Total costs as accounted for 233,987.50 369,477.28

Material Labor Overhead Total Mixing Material Labor Overhead Total

Cost of Normal loss - - - - 11,878.77 - - - 11,878.77

Units identified with lost units (Started/Received and Completed + IP end) 24,000 (Received and Completed + IP end) 24,600

Adjustment for lost units - 0.482877

-

MIXING FINISHING

Qty Actual Materials Labor and OH Actual Material Labor and OH

Schedule Units WD EUP WD EUP Units WD EUP WD EUP

In Process April 1 6,000 100% 6,000 1/3 2,000 2,400 0% - 1/6 400

Started/Received 25,000 26,000

Total 31,000 28,400

Transferred to Finished Goods

In Process April 1 6,000 0% - 2/3 4,000 2,400 100% 2,400 5/6 2,000

Started/Received 20,000 100% 20,000 100% 20,000 22,600 100% 22,600 100% 22,600

In Process April 30 4,000 100% 4,000 1/8 500 2,000 100% 2,000 3/4 1,500

Normal loss - Beginning 1,000 100% 1,000 100% 1,000 1,400 100% 1,400 100% 1,400

Total 31,000 25,000 25,500 28,400 28,400 27,500

Cost Charged to Department A Total In Process Current Unit Total In Process Current Unit

EUP EUP

Cost Beg Cost Cost Cost Beg Cost Cost

In Process April 1

Cost from Department A 241,058.73 19,920.00 221,138.73 26,000 8.505336

Cost Added

Materials 76,900.00 14,400.00 62,500.00 25,000 2.500000 34,425.00 - 34,425.00 28,400 1.212148

Labor 86,481.25 6,450.00 80,031.25 25,500 3.138480 53,431.50 840.00 52,591.50 27,500 1.912418

Overhead 70,606.25 5,350.00 65,256.25 25,500 2.559069 41,095.00 640.00 40,455.00 27,500 1.471091

Total 233,987.50 26,200.00 207,787.50 8.197549 128,951.50 1,480.00 127,471.50 4.595657

Total Cost to be accounted 233,987.50 26,200.00 207,787.50 8.197549 370,010.23 21,400.00 348,610.23 13.100993

Cost Accounted as follows:

Transferred to Department B

In Process April 1

Cost Last Month 26,200.00 21,400

Cost to complete

Materials - X 2.500000 - 2,400 X 1.212148 2,909.15

Labor 4,000 X 3.138480 12,553.92 2,000 X 1.912418 3,824.84

Overhead 4,000 X 2.559069 10,236.27 48,990.20 2,000 X 1.471091 2,942.18 31,076.17

Started/Received and Completed 20,000 X 8.19755 163,950.98 22,600 X 13.100993 296,082.43

Cost of normal loss 1,000 X 8.19755 8,197.55 1,400 X 13.100993 18,341.39 6,550.50

Total Cost Transferred 221,138.73 345,499.99

In Process April 30

Cost from Department A 2,000 X 8.505336 17,010.67

Materials 4,000 X 2.500000 10,000.00 2,000 X 1.212148 2,424.30

Labor 500 X 3.138480 1,569.24 1,500 X 1.912418 2,868.63

Overhead 500 X 2.559069 1,279.53 12,848.77 1,500 X 1.471091 2,206.64 24,510.23

Total costs as accounted for 233,987.50 370,010.23

MIXING FINISHING

Qty Actual Materials Labor and OH Actual Material Labor and OH

Schedule Units WD EUP WD EUP Units WD EUP WD EUP

In Process August 1 6,000 100% 6,000 1/3 2,000 2,400 0% - 1/6 400

Started/Received 25,000 26,000

Total 31,000 28,400

Transferred to Finished Goods

In Process August 1 6,000 0% - 2/3 4,000 2,400 100% 2,400 5/6 2,000

Started/Received 20,000 100% 20,000 100% 20,000 22,600 100% 22,600 100% 22,600

In Process August 31 4,000 100% 4,000 1/8 500 2,000 100% 2,000 3/4 1,500

Abnormal loss - End 1,000 100% 1,000 100% 1,000 1,400 100% 1,400 100% 1,400

Total 31,000 25,000 25,500 28,400 28,400 27,500

Cost Charged to Mixing Total In Process Current Unit Total In Process Current Unit

EUP EUP

Cost Beg Cost Cost Cost Beg Cost Cost

In Process August 1

Cost from Mixing 232,861.18 19,920.00 212,941.18 26,000 8.190045

Cost Added

Materials 76,900.00 14,400.00 62,500.00 25,000 2.500000 34,425.00 - 34,425.00 28,400 1.212148

Labor 86,481.25 6,450.00 80,031.25 25,500 3.138480 53,431.50 840.00 52,591.50 27,500 1.912418

Overhead 70,606.25 5,350.00 65,256.25 25,500 2.559069 41,095.00 640.00 40,455.00 27,500 1.471091

Total 233,987.50 26,200.00 207,787.50 8.197549 128,951.50 1,480.00 127,471.50 4.595657

Total Cost to be accounted 233,987.50 26,200.00 207,787.50 8.197549 361,812.68 21,400.00 340,412.68 12.785702

Cost Accounted as follows:

Transferred to Finishing

In Process August 1

Cost Last Month 26,200.00 21,400

Cost to complete

Materials - X 2.500000 - 2,400 X 1.212148 2,909.15

Labor 4,000 X 3.138480 12,553.92 2,000 X 1.912418 3,824.84

Overhead 4,000 X 2.559069 10,236.27 48,990.20 2,000 X 1.471091 2,942.18 31,076.17

Started/Received and Completed 20,000 X 8.19755 163,950.98 22,600 X 12.785702 288,956.87

Total Cost Transferred 212,941.18 320,033.04

In Process August 31

Cost from Mixing 2,000 X 8.190045 16,380.09

Materials 4,000 X 2.500000 10,000.00 2,000 X 1.212148 2,424.30

Labor 500 X 3.138480 1,569.24 1,500 X 1.912418 2,868.63

Overhead 500 X 2.559069 1,279.53 12,848.77 1,500 X 1.471091 2,206.64 23,879.65

Factory overhead control 1,000 X 8.19755 8,197.55 1,400 X 12.785702 17,899.98

Total costs as accounted for 233,987.50 361,812.68

MIXING FINISHING

Qty Actual Materials Labor and OH Actual Material Labor and OH

Schedule Units WD EUP WD EUP Units WD EUP WD EUP

In Process August 1 6,000 100% 6,000 1/3 2,000 2,400 0% - 1/6 400

Started/Received 25,000 26,000

Total 31,000 28,400

Transferred to Finished Goods

In Process August 1 6,000 0% - 2/3 4,000 2,400 100% 2,400 5/6 2,000

Started/Received 20,000 100% 20,000 100% 20,000 22,600 100% 22,600 100% 22,600

In Process August 31 4,000 100% 4,000 1/8 500 2,000 100% 2,000 3/4 1,500

Normal Loss - End 520 100% 520 100% 520 500 100% 500 100% 500

Abnormal loss - End 480 100% 480 100% 480 900 100% 900 100% 900

Total 31,000 25,000 25,500 28,400 28,400 27,500

Cost Charged to Mixing Total In Process Current Unit Total In Process Current Unit

EUP EUP

Cost Beg Cost Cost Cost Beg Cost Cost

In Process August 1

Cost from Mixing 237,123.90 19,920.00 217,203.90 26,000 8.353996

Cost Added

Materials 76,900.00 14,400.00 62,500.00 25,000 2.500000 34,425.00 - 34,425.00 28,400 1.212148

Labor 86,481.25 6,450.00 80,031.25 25,500 3.138480 53,431.50 840.00 52,591.50 27,500 1.912418

Overhead 70,606.25 5,350.00 65,256.25 25,500 2.559069 41,095.00 640.00 40,455.00 27,500 1.471091

Total 233,987.50 26,200.00 207,787.50 8.197549 128,951.50 1,480.00 127,471.50 4.595657

Total Cost to be accounted 233,987.50 26,200.00 207,787.50 8.197549 366,075.40 21,400.00 344,675.40 12.949653

Cost Accounted as follows:

Transferred to Finishing

In Process August 1

Cost Last Month 26,200.00 21,400

Cost to complete

Materials - X 2.500000 - 2,400 X 1.212148 2,909.15

Labor 4,000 X 3.138480 12,553.92 2,000 X 1.912418 3,824.84

Overhead 4,000 X 2.559069 10,236.27 48,990.20 2,000 X 1.471091 2,942.18 31,076.17

Started/Received and Completed 20,000 X 8.19755 163,950.98 22,600 X 12.949653 292,662.16

Cost of normal loss 520 X 8.19755 4,262.73 500 X 12.949653 6,474.83

Total Cost Transferred 217,203.90 330,213.16

In Process August 31

Cost from Mixing 2,000 X 8.353996 16,707.99

Materials 4,000 X 2.500000 10,000.00 2,000 X 1.212148 2,424.30

Labor 500 X 3.138480 1,569.24 1,500 X 1.912418 2,868.63

Overhead 500 X 2.559069 1,279.53 12,848.77 1,500 X 1.471091 2,206.64 24,207.55

Factory overhead control 480 X 8.19755 3,934.82 900 X 12.949653 11,654.69

Total costs as accounted for 233,987.50 366,075.40

MIXING FINISHING

Qty Actual Materials Labor and OH Actual Material Labor and OH

Schedule Units WD EUP WD EUP Units WD EUP WD EUP

In Process August 1 6,000 100% 6,000 1/3 2,000 2,400 0% - 1/6 400

Started/Received 25,000 26,000

Total 31,000 28,400

Transferred to Finished Goods

In Process August 1 6,000 0% - 2/3 4,000 2,400 100% 2,400 5/6 2,000

Started/Received 20,000 100% 20,000 100% 20,000 22,600 100% 22,600 100% 22,600

In Process August 31 4,000 100% 4,000 1/8 500 2,000 100% 2,000 3/4 1,500

Normal loss - 90%/50% 1,000 100% 1,000 90% 900 1,400 0% - 50% 700

Total 31,000 25,000 25,400 28,400 27,000 26,800

Cost Charged to Mixing Total In Process Current Unit Total In Process Current Unit

EUP EUP

Cost Beg Cost Cost Cost Beg Cost Cost

In Process August 1

Cost from Mixing 241,047.51 19,920.00 221,127.51 26,000 8.504904

Cost Added

Materials 76,900.00 14,400.00 62,500.00 25,000 2.500000 34,425.00 - 34,425.00 27,000 1.275000

Labor 86,481.25 6,450.00 80,031.25 25,400 3.150837 53,431.50 840.00 52,591.50 26,800 1.962369

Overhead 70,606.25 5,350.00 65,256.25 25,400 2.569144 41,095.00 640.00 40,455.00 26,800 1.509515

Total 233,987.50 26,200.00 207,787.50 8.219980 128,951.50 1,480.00 127,471.50 4.746884

0.531007

Total Cost to be accounted 233,987.50 26,200.00 207,787.50 8.219980 369,999.01 21,400.00 348,599.01 13.782795

Cost Accounted as follows:

Transferred to Finishing

In Process August 1

Cost Last Month 26,200.00 21,400

Cost to complete

Materials - X 2.500000 - 2,400 X 1.275000 3,060.00

Labor 4,000 X 3.150837 12,603.35 2,000 X 1.962369 3,924.74

Overhead 4,000 X 2.569144 10,276.57 49,079.92 2,000 X 1.509515 3,019.03

Adjustment for loss units 2,400 X 0.531007 1,274.42 32,678.19

Started/Received and Completed 20,000 X 8.21998 164,399.61 22,600 X 13.782795 311,491.18

Cost of normal loss 7,647.98 -

Total Cost Transferred 221,127.51 344,169.36

In Process August 31

Cost from Mixing 2,000 X 8.504904 17,009.81

Materials 4,000 X 2.500000 10,000.00 2,000 X 1.275000 2,550.00

Labor 500 X 3.150837 1,575.42 1,500 X 1.962369 2,943.55

Overhead 500 X 2.569144 1,284.57 12,859.99 1,500 X 1.509515 2,264.27

Adjustment for loss units 2,000 X 0.531007 1,062.01 25,829.65

Total costs as accounted for 233,987.50 369,999.01

Cost of normal loss

Cost from Mixing 1,400 X 8.504904 11,906.87

Materials 1,000 X 2.500000 2,500.00 - X 1.275000 -

Labor 900 X 3.150837 2,835.75 700 X 1.962369 1,373.66

Overhead 900 X 2.569144 2,312.23 700 X 1.509515 1,056.66

Total 7,647.98 14,337.18

Divide by units that will absorbed the normal loss 27000

Adjustment for loss units 0.5310068

MIXING FINISHING

Qty Actual Materials Labor and OH Actual Material Labor and OH

Schedule Units WD EUP WD EUP Units WD EUP WD EUP

In Process August 1 6,000 100% 6,000 1/3 2,000 2,400 0% - 1/6 400

Started/Received 25,000 26,000

Total 31,000 28,400

Transferred to Finished Goods

In Process August 1 6,000 0% - 2/3 4,000 2,400 100% 2,400 5/6 2,000

Started/Received 20,000 100% 20,000 100% 20,000 22,600 100% 22,600 100% 22,600

In Process August 31 4,000 100% 4,000 1/8 500 2,000 100% 2,000 3/4 1,500

Normal loss - 90%/50% 520 100% 520 90% 468 1,400 0% - 50% 700

Abnormal loss - 90%/50% 480 100% 480 90% 432

Total 31,000 25,000 25,400 28,400 27,000 26,800

Cost Charged to Mixing Total In Process Current Unit Total In Process Current Unit

EUP EUP

Cost Beg Cost Cost Cost Beg Cost Cost

In Process August 1

Cost from Mixing 237,376.48 19,920.00 217,456.48 26,000 8.363711

Cost Added

Materials 76,900.00 14,400.00 62,500.00 25,000 2.500000 34,425.00 - 34,425.00 27,000 1.275000

Labor 86,481.25 6,450.00 80,031.25 25,400 3.150837 53,431.50 840.00 52,591.50 26,800 1.962369

Overhead 70,606.25 5,350.00 65,256.25 25,400 2.569144 41,095.00 640.00 40,455.00 26,800 1.509515

Total 233,987.50 26,200.00 207,787.50 8.219980 128,951.50 1,480.00 127,471.50 4.746884

0.523686

Total Cost to be accounted 233,987.50 26,200.00 207,787.50 8.219980 366,327.98 21,400.00 344,927.98 13.634281

Cost Accounted as follows:

Transferred to Finishing

In Process August 1

Cost Last Month 26,200.00 21,400

Cost to complete

Materials - X 2.500000 - 2,400 X 1.275000 3,060.00

Labor 4,000 X 3.150837 12,603.35 2,000 X 1.962369 3,924.74

Overhead 4,000 X 2.569144 10,276.57 49,079.92 2,000 X 1.509515 3,019.03

Adjustment for loss units 2,400 X 0.523686 1,256.85 32,660.61

Started/Received and Completed 20,000 X 8.21998 164,399.61 22,600 X 13.634281 308,134.74

Cost of normal loss 3,976.95 -

Total Cost Transferred 217,456.48 340,795.36

In Process August 31

Cost from Mixing 2,000 X 8.363711 16,727.42

Materials 4,000 X 2.500000 10,000.00 2,000 X 1.275000 2,550.00

Labor 500 X 3.150837 1,575.42 1,500 X 1.962369 2,943.55

Overhead 500 X 2.569144 1,284.57 12,859.99 1,500 X 1.509515 2,264.27

Adjustment for loss units 2,000 X 0.523686 1,047.37 25,532.62

Factory Overhead Control 3,671.03

Total costs as accounted for 233,987.50 366,327.98

Cost of normal loss

Cost from Mixing 1,400 X 8.363711 11,709.19

Materials 520 X 2.500000 1,300.00 - X 1.275000 -

Labor 468 X 3.150837 1,474.59 700 X 1.962369 1,373.66

Overhead 468 X 2.569144 1,202.36 700 X 1.509515 1,056.66

Total 3,976.95 14,139.51

Divide by units that will absorbed the normal loss 27000

Adjustment for loss units 0.5236857

Cost of Abnormal loss

Cost from Mixing

Materials 480 X 2.500000 1,200.00

Labor 432 X 3.150837 1,361.16

Overhead 432 X 2.569144 1,109.87

Total 3,671.03

You might also like

- PPP Mfg. Co. Unit Cost Data REVIEWDocument58 pagesPPP Mfg. Co. Unit Cost Data REVIEWNikki GarciaNo ratings yet

- D. Depends On The Significance of The Amount.: Cost Accounting Comprehensive Examination 1Document14 pagesD. Depends On The Significance of The Amount.: Cost Accounting Comprehensive Examination 1Ferb CruzadaNo ratings yet

- COGS statement and journal entries for SYM CompanyDocument3 pagesCOGS statement and journal entries for SYM CompanyClarisse Angela PostreNo ratings yet

- Cost Acctg. - HO#9Document5 pagesCost Acctg. - HO#9JOSE COTONER0% (1)

- P2 09Document8 pagesP2 09Mark Levi CorpuzNo ratings yet

- Cost Quiz 3Document5 pagesCost Quiz 3Jerric CristobalNo ratings yet

- Finished Goods Inventory: Exercise 1-1 (True or False)Document16 pagesFinished Goods Inventory: Exercise 1-1 (True or False)Isaiah BatucanNo ratings yet

- Exercise 5-25 Activity Levels and Cost Drivers: RequiredDocument20 pagesExercise 5-25 Activity Levels and Cost Drivers: RequiredDilsa JainNo ratings yet

- Budgeted Actual: in ShortDocument21 pagesBudgeted Actual: in Shortcole sprouseNo ratings yet

- Multiple Choice - JOCDocument14 pagesMultiple Choice - JOCMuriel MahanludNo ratings yet

- Final Term Quiz 3 On Cost of Production Report - FIFO CostingDocument4 pagesFinal Term Quiz 3 On Cost of Production Report - FIFO CostingYhenuel Josh LucasNo ratings yet

- Cost AccountingDocument291 pagesCost AccountingIrish Mae0% (1)

- Investment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Document6 pagesInvestment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Jessie Dela CruzNo ratings yet

- Cost Accounting Chapter 10Document66 pagesCost Accounting Chapter 10Reshyl HicaleNo ratings yet

- Guerrero Answer KeyDocument32 pagesGuerrero Answer KeyJaira ClavoNo ratings yet

- The Graphical MethodDocument4 pagesThe Graphical MethodJelay Quilatan100% (1)

- AFAR - Standard and PRocess AssessmentDocument7 pagesAFAR - Standard and PRocess AssessmentMary Grace NaragNo ratings yet

- QUIZ3Document6 pagesQUIZ3Jillian Mae Sobrino BelegorioNo ratings yet

- Job Order Costing System ExplainedDocument47 pagesJob Order Costing System Explainedslow dancerNo ratings yet

- Ch9 Raiborn SMDocument34 pagesCh9 Raiborn SMMendelle Murry100% (1)

- Basic Concepts and Job Order Cost CycleDocument15 pagesBasic Concepts and Job Order Cost CycleGlaiza Lipana Pingol100% (2)

- Quiz No. 1 Part 3 Multiple Choice Problems Attempt ReviewDocument1 pageQuiz No. 1 Part 3 Multiple Choice Problems Attempt ReviewEly RiveraNo ratings yet

- Stand CostingDocument38 pagesStand CostingaydhaNo ratings yet

- Process Costing SWDocument2 pagesProcess Costing SWChristine AltamarinoNo ratings yet

- Process1 Process2 Process3Document2 pagesProcess1 Process2 Process3Darwin Competente LagranNo ratings yet

- Assignment 3: Spoilage in Weighted Average and FIFO Cost Flow MethodDocument3 pagesAssignment 3: Spoilage in Weighted Average and FIFO Cost Flow MethodKelvin CulajaráNo ratings yet

- POP QUIZ OVERHEAD CALCULATIONSDocument10 pagesPOP QUIZ OVERHEAD CALCULATIONSXyne FernandezNo ratings yet

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- Pre-Test 5Document3 pagesPre-Test 5BLACKPINKLisaRoseJisooJennieNo ratings yet

- Afar Job Order CostingDocument20 pagesAfar Job Order CostingBridget Zoe Lopez Batoon100% (1)

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaJoyce Anne DugayNo ratings yet

- Variable Costing Statements for Production & Sales ChangesDocument13 pagesVariable Costing Statements for Production & Sales ChangesimjiyaNo ratings yet

- Cost AccountingDocument47 pagesCost AccountingCarlos John Talania 1923No ratings yet

- Manage Direct Labor CostsDocument26 pagesManage Direct Labor Costshae1234No ratings yet

- Solutions To ProblemsDocument42 pagesSolutions To ProblemsJane TuazonNo ratings yet

- Costs Concepts and ClassificationDocument14 pagesCosts Concepts and Classificationsheng100% (1)

- Chapter 10 Process CostingDocument69 pagesChapter 10 Process CostingMyriam ElaounNo ratings yet

- Activity No. 5 Comprehensive ProblemsDocument1 pageActivity No. 5 Comprehensive ProblemsZenCamandang100% (1)

- Cherry's accounting error affects net incomeDocument1 pageCherry's accounting error affects net incomeRikki Mae TeofistoNo ratings yet

- Dissolution of Partnership Firm Accounting ProblemsDocument5 pagesDissolution of Partnership Firm Accounting ProblemsPrageeth Roshan WeerathungaNo ratings yet

- Process Costing ProblemsDocument9 pagesProcess Costing ProblemsmilleranNo ratings yet

- CosthuliDocument7 pagesCosthulikmarisseeNo ratings yet

- CVP Relationships and Break-Even AnalysisDocument3 pagesCVP Relationships and Break-Even AnalysisExequiel AdradaNo ratings yet

- Chapter 2 Cost AcctngDocument10 pagesChapter 2 Cost AcctngJustine Reine CornicoNo ratings yet

- CHAPTER 5 Product and Service Costing: A Process Systems ApproachDocument30 pagesCHAPTER 5 Product and Service Costing: A Process Systems ApproachMudassar HassanNo ratings yet

- xACC 213Document10 pagesxACC 213CharlesNo ratings yet

- Intermediate Accounting 1 Receivables DIY ProblemsDocument11 pagesIntermediate Accounting 1 Receivables DIY ProblemsMay Ramos100% (1)

- Fifo Method of Process CostingDocument17 pagesFifo Method of Process CostingPrateek DubeyNo ratings yet

- CHAPTER 4 Assignment Answer KeyDocument30 pagesCHAPTER 4 Assignment Answer KeyCatherine OrdoNo ratings yet

- Exercises For Accounting For Merchandise StoresDocument4 pagesExercises For Accounting For Merchandise StoresAnne Dorene ChuaNo ratings yet

- Answer Key Chapter 3Document5 pagesAnswer Key Chapter 3Donna Zandueta-TumalaNo ratings yet

- Sanchez, Mark Laurence S. BSA 2106 Cost Accounting Exercises: Multiple ChoiceDocument4 pagesSanchez, Mark Laurence S. BSA 2106 Cost Accounting Exercises: Multiple ChoiceMark Laurence SanchezNo ratings yet

- Process Costing - Loss UnitsDocument7 pagesProcess Costing - Loss UnitsNikki GarciaNo ratings yet

- Accounting For Lost Units - Part 1Document17 pagesAccounting For Lost Units - Part 1Unnamed homosapienNo ratings yet

- Chapter 9.2 Process Costing - Average and FIFODocument14 pagesChapter 9.2 Process Costing - Average and FIFOdoomageddonsplinterlandNo ratings yet

- Dente Q2Document3 pagesDente Q2hanna fhaye denteNo ratings yet

- De Guzman, Kyla (Act. Cost)Document4 pagesDe Guzman, Kyla (Act. Cost)kyla deguzmanNo ratings yet

- LEC 2 Additions, Spoilage, Rework, and ScrapDocument37 pagesLEC 2 Additions, Spoilage, Rework, and ScrapKelvin CulajaráNo ratings yet

- Chapter 9.1 Process CostingDocument9 pagesChapter 9.1 Process CostingdoomageddonsplinterlandNo ratings yet

- Actual Materials Labor and OH Qty Schedule Units WD EUP WDDocument15 pagesActual Materials Labor and OH Qty Schedule Units WD EUP WDNikki GarciaNo ratings yet

- Module 2 Ver 3.1Document81 pagesModule 2 Ver 3.1Akira Marantal Valdez100% (1)

- Stratma External AGTANG 123Document1 pageStratma External AGTANG 123Akira Marantal ValdezNo ratings yet

- Stratma External AGTANGDocument8 pagesStratma External AGTANGAkira Marantal ValdezNo ratings yet

- Analysis Reviewer BusfinDocument2 pagesAnalysis Reviewer BusfinAkira Marantal ValdezNo ratings yet

- Quiz 3 - Normal and AbnormalDocument1 pageQuiz 3 - Normal and AbnormalAkira Marantal ValdezNo ratings yet

- Niat 2017 PDFDocument1 pageNiat 2017 PDFEnnavy YongkolNo ratings yet

- Upcoming CAT Review and Exam SchedulesDocument1 pageUpcoming CAT Review and Exam SchedulesAkira Marantal ValdezNo ratings yet

- Installment Sales ReviewerDocument3 pagesInstallment Sales ReviewerErika78% (9)

- Partnership essentials under 40 charsDocument26 pagesPartnership essentials under 40 charskat perezNo ratings yet

- Process Costing - Max CorporationDocument9 pagesProcess Costing - Max CorporationAkira Marantal ValdezNo ratings yet

- Chapter 18 Int. AccountingDocument50 pagesChapter 18 Int. AccountingVaniamarie VasquezNo ratings yet

- Advac AssignmentDocument5 pagesAdvac AssignmentAkira Marantal ValdezNo ratings yet

- Cost Accounting ReportDocument22 pagesCost Accounting ReportAkira Marantal ValdezNo ratings yet

- Analysis On AdcomaDocument6 pagesAnalysis On AdcomaAkira Marantal ValdezNo ratings yet

- Process Costing - Loss UnitsDocument10 pagesProcess Costing - Loss UnitsAkira Marantal ValdezNo ratings yet

- SummaryDocument30 pagesSummaryAkira Marantal Valdez0% (1)

- Class activity chapter 6 memory and learningDocument3 pagesClass activity chapter 6 memory and learningAkira Marantal ValdezNo ratings yet

- Cfs 2millions 2017Document9 pagesCfs 2millions 2017Akira Marantal ValdezNo ratings yet

- Advanced Accounting - PART 1Document6 pagesAdvanced Accounting - PART 1Akira Marantal ValdezNo ratings yet

- Advanced Accounting - Estimating Recovery for CreditorsDocument6 pagesAdvanced Accounting - Estimating Recovery for CreditorsAkira Marantal ValdezNo ratings yet

- 2013 Year End Assessment Market ActivitiesDocument9 pages2013 Year End Assessment Market ActivitiesAkira Marantal ValdezNo ratings yet

- Multiple Choice Problems 2Document14 pagesMultiple Choice Problems 2Akira Marantal ValdezNo ratings yet

- Take Home Quiz 1Document9 pagesTake Home Quiz 1Akira Marantal Valdez100% (1)

- Thesis AppendicesDocument3 pagesThesis AppendicesAkira Marantal ValdezNo ratings yet

- Partnership Liquidation InstallmentDocument1 pagePartnership Liquidation InstallmentAkira Marantal ValdezNo ratings yet

- Advanced AccountingDocument14 pagesAdvanced AccountingAries Bautista100% (2)

- Actual Materials Qty Schedule Units WDDocument8 pagesActual Materials Qty Schedule Units WDAkira Marantal ValdezNo ratings yet

- Class activity chapter 6 memory and learningDocument3 pagesClass activity chapter 6 memory and learningAkira Marantal ValdezNo ratings yet

- Qty Schedule - 1-10-17Document14 pagesQty Schedule - 1-10-17Akira Marantal ValdezNo ratings yet

- ResumeChaturyaKommala PDFDocument2 pagesResumeChaturyaKommala PDFbharathi yenneNo ratings yet

- Revision Banking QDocument15 pagesRevision Banking QThảo Hương PhạmNo ratings yet

- MP Assistant ProfessorDocument3 pagesMP Assistant ProfessorSwapnil NeerajNo ratings yet

- How To Think Like A Marketing Genius - Table of ContentsDocument10 pagesHow To Think Like A Marketing Genius - Table of Contentsbuymenow2005No ratings yet

- Background - Venture Capital and Stages of Financing (Ross - 7th Edition) Venture CapitalDocument8 pagesBackground - Venture Capital and Stages of Financing (Ross - 7th Edition) Venture CapitalDaniel GaoNo ratings yet

- SampleFullPaperforaBusinessPlanProposalLOKAL LOCADocument279 pagesSampleFullPaperforaBusinessPlanProposalLOKAL LOCANicole SorianoNo ratings yet

- UF Marketing QuizDocument8 pagesUF Marketing QuizkatelynleeNo ratings yet

- BecelDocument10 pagesBecelCorina MarinicăNo ratings yet

- Channel System: Presented byDocument78 pagesChannel System: Presented bygrace22mba22No ratings yet

- OpenText Vendor Invoice Management For SAP Solutions 7.5 - Scenario Guide English (VIM070500-CCS-En-1)Document96 pagesOpenText Vendor Invoice Management For SAP Solutions 7.5 - Scenario Guide English (VIM070500-CCS-En-1)HarshaNo ratings yet

- Contract LetterDocument5 pagesContract LetterprashantNo ratings yet

- Fifo & LifoDocument9 pagesFifo & LifoTeodoraNo ratings yet

- HBR White Paper - Future-Proofing B2B SalesDocument11 pagesHBR White Paper - Future-Proofing B2B SalesMahesh PatilNo ratings yet

- Bhakti Chavan CV For HR ProfileDocument3 pagesBhakti Chavan CV For HR ProfileADAT TestNo ratings yet

- Republic Act No. 10667Document5 pagesRepublic Act No. 10667orionsrulerNo ratings yet

- Hallahan Et Al. 2011, "Defining Strategic Communication" in International Journal of Strategic CommunicationDocument34 pagesHallahan Et Al. 2011, "Defining Strategic Communication" in International Journal of Strategic Communicationlivros_bihNo ratings yet

- Nafdac Nigeria GMP 2021Document116 pagesNafdac Nigeria GMP 2021Dilawar BakhtNo ratings yet

- Siebel Systems Case Analysis SummaryDocument6 pagesSiebel Systems Case Analysis SummaryAyush MittalNo ratings yet

- HCL ProposalDocument2 pagesHCL Proposalrishabh21No ratings yet

- FPC ManualDocument8 pagesFPC ManualAdnan KaraahmetovicNo ratings yet

- TSWIFT Consumer Protection Act (HB 1648)Document8 pagesTSWIFT Consumer Protection Act (HB 1648)Hannah KnowlesNo ratings yet

- Perancangan Enterprise Architecture Pada PT Vitapharm Menggunakan Framework TogafDocument13 pagesPerancangan Enterprise Architecture Pada PT Vitapharm Menggunakan Framework TogafJulianto SaputroNo ratings yet

- Procurement Workshop Invite 8th April 2013 PDFDocument2 pagesProcurement Workshop Invite 8th April 2013 PDFDurban Chamber of Commerce and IndustryNo ratings yet

- Case InstructionsDocument4 pagesCase InstructionsHw SolutionNo ratings yet

- ANILAO BANK (RURAL BANK OF ANILAO (ILOILO) INC - HTMDocument2 pagesANILAO BANK (RURAL BANK OF ANILAO (ILOILO) INC - HTMJim De VegaNo ratings yet

- DevelopmentThatPays Scrumban CheatSheet 3 - 0Document1 pageDevelopmentThatPays Scrumban CheatSheet 3 - 0Hamed KamelNo ratings yet

- Solutions Manual: Introducing Corporate Finance 2eDocument9 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- Bracket and Cover OrderDocument11 pagesBracket and Cover OrderVaithialingam ArunachalamNo ratings yet

- Strategic Analysis of United Bank Limited. MS WordDocument39 pagesStrategic Analysis of United Bank Limited. MS Wordshahid_pak1_26114364100% (2)

- Eatest Financial AssetDocument216 pagesEatest Financial AssetsssNo ratings yet