Professional Documents

Culture Documents

FinAcc Questions

Uploaded by

DanielleOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FinAcc Questions

Uploaded by

DanielleCopyright:

Available Formats

Danielle Louise F.

Gaza

3A1//Financial Accounting

QUESTIONS

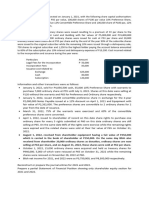

1. On January 1, 2017, DeokSeon Company began its operations. The following

information pertains to the December 31, 2017 portfolio of equity securities:

TRADING NON-TRADING

Aggregate cost 5,000,000 2,800,000

Aggregate market value 8,900,000 6,000,000

Aggregate lower of cost 4,500,000 5,300,000

or market value applied

to each security

The market declines are judged to be other than temporary. The non-

trading securities are designated at fair value through profit or loss. What

amount should be reported as total gain or loss on these securities in the

income statement for 2017?

2. On June 30, 2017, Taek Company acquired 300,000 ordinary shares of

JungHwan Company for P13,500,000. At the time of acquisition, JungHwan

Company had outstanding 800,000 shares with a carrying value of

P36,000,000. The following events took place during the year:

JungHwan Company reported net income of P5,000,000 for the year

2017.

Taek Company received from JungHwan Company a dividend of P0.50

per ordinary share.

SunWoo Company acquired 10,000 preference shares (par P150) from

JungHwan Company at acquisition price of P200.

The market value of JungHwan Company share had temporarily

declined to P30.

Taek Company has elected irrevocably to measure the investment at

fair value through other comprehensive income.

What is the carrying amount of the investment on December 31, 2017?

3. Jessica Company held the following financial assets as trading investments

on December 31, 2016:

COST MARKET VALUE

100,000 shares of 8,500,000 7,500,000

TaeYeon Company

nonredeemable

preference share

capital, par value P80

7,000 shares of Sunny 1,500,000 2,000,000

Company preference

share capital, par value

P150, subject to

mandatory redemption

by theissuer at par on

December 31, 2017

10,000,000 9,500,000

On December 31, 2016 how much is the total carrying value of the

investments?

4. On March 30, 2017, BokJoo Company acquired 300,000 ordinary shares of

JooHyuk Company for P9,000,000. At the time of acquisition, JooHyuk

Company had outstanding 800,000 shares with a carrying value of

P36,000,000. The following events took place during the year:

JooHyuk Company reported net income of P5,000,000 for the year

2017.

BokJoo Company received from JooHyuk Company a dividend of P0.50

per ordinary share.

JaeRim Company acquired 10,000 6% cumulative preference shares

(par P150) from JooHyuk Company at acquisition price of P200.

The market value of JooHyuk Company share had temporarily declined

to P30.

What is the carrying amount of the investment on December 31, 2017?

5. Jun Company provided the following portfolio of equity investments

measured at fair value through other comprehensive income:

Aggregate cost- December 31, Net realized gain during 2015

2014 1,700,000

Unrealized gain- December 31, 40,000

2014 260,000

Unrealized loss- December 31, 300,000

2014

On January 1, 2016, the entity reported an unrealized loss of P15,000 as a

component of other comprehensive income. In the statement of changes in

equity, what cumulative amount should be reported as unrealized loss on the

securities?

6. During 2017, SeungKwan Company bought the ordinary shares of Vernon

Company as follows:

June 1 20,000 shares @ 30,000 shares @

December 1 P100 P120

2,000,000 3,600,000

The following transactions happened in 2018:

January 1, Vernon Company has 250,000 outstanding ordinary shares

and 50,000 preference shares.

January 10, SeungKwan Company received cash dividend of P10 per

ordinary share

February 15, SeungKwan received 20% stock dividend

March 1, Vernon Company issued additional 150,000 ordinary shares

and SeungKwan Company did not exercise his right and sold these

rights for P5 each.

April 13, SeungKwan Company sold half of his ordinary shares at P150

per share.

October 9, Vernon Company declared 4 for 1 share split for its ordinary

shares.

December 31, the fair market value of ordinary shares and preference

shares are P90 and P100 per share respectively.

How much is the balance of the equity investment through other

comprehensive income at year-end?

7. On July 1, 2017, Infinite Company paid P1,000,000 plus a transaction cost of

P50,000 for 100,000 outstanding shares which represent 40% of Seventeen

Company. At that date, the net assets of Seventeen totalled P2,000,000. All

assets are equal to their fair value, except for an equipment with P400,000

excess of fair value over carrying value. The equipment has a remaining

useful life of 4 years.

Seventeen reported net income of P800,000 for 2017, of which

P500,000 was for the 2nd half of the year. Seventeen also paid cash dividends

of P300,000 on September 30,2017.

On January 1, 2018, Infinite Company acquired an additional 5% shares

for P15 per share. The excess of fair value over the carrying value of this

date is attributable to inventories amounting to P190000 which is already

sold. At year-end, Seventeen Company reported net income of P2,000,000

and no dividends was declared at that year. How much is the carrying value

of the investment at December 31, 2018?

8. On March 31, 2016, Dana Company purchased 20% of the outstanding

ordinary shares of Louise Company for P5,000,000 of which 25% was paid in

cash and the rest is payable with 10% annual interest due on March 31,

2017. Louise Companys net assets as of that date was P19,000,000.

Dana also paid P1,000,000 to a business broker who helped to find a

suitable business and negotiated the purchase.

At the time of acquisition, the fair values of Louise Companys

identifiable assets and liabilities were equal to their carrying amount except

for inventories which had a fair value in excess of carrying amount of

P5,000,000. Half of these inventories are sold on the first half of the year

while the 50% of the remaining inventories are sold on the second half of the

year. During 2016, the associate reported net income of P6,000,000 and paid

dividend of P1,000,000.

a. How much should be the share in income of Dana Company at year

2016?

b. How much is the carrying amount of the investment at year-end?

c. How much goodwill arises from the investment?

9. On January 1, 2015, Solar Company purchased 40% of the ordinary shares of

Wheein Company for P3,500,000 when the net assets of Wheein Company

amounted to P7,000,000.

At acquisition date, the carrying amounts of the identifiable assets and

liabilities of Wheein Company were equal to their fair values, except for a

machinery for which the fair value was P1,500,000 greater than carrying

amount and inventory whose fair value was P500,000 greater that cost. The

equipment has a remaining life of 5 years and the inventory was all sold

during 2015.

Wheein Company reported net income of P4,000,000 for 2015 and paid

no dividends during 2015. How much is the maximum amount of the equity

in earnings of the investee?

10. On September 30, 2016, Noah Company purchased 200,000 of the

outstanding ordinary shares of Rozen Company for P5,000,000 of which 25%

was paid in cash and the rest is payable with 10% annual interest due on

March 31, 2017. Rozen Companys net assets as of that date was

P19,000,000. Rozen Company also had 1,000,000 outstanding ordinary

shares (P15 par value) as of that year.

Noah also paid P1,000,000 to a business broker who helped to find a

suitable business and negotiated the purchase.

At the time of acquisition, the fair values of Louise Companys

identifiable assets and liabilities were equal to their carrying amount except

for inventories which had a fair value in excess of carrying amount of

P5,000,000. Half of these inventories are sold on the first half of the year

while the 50% of the remaining inventories are sold on the second half of the

year. During 2016, the associate reported net income of P6,000,000 and paid

dividend of P1,000,000. Next year, the following chronological events

happened:

Jan 1: Rozen Company issued additional 250,000 ordinary shares.

Jan 1: Noah received one right for every ordinary share held. The

rights entitle their holders to buy one ordinary share at P10 for

every 2 rights submitted.

Feb 1: Noah didnt exercise his right and sold all his rights for P5

each.

Feb 1: At this date, Noah loses his significant influence from the

company and made an irrevocable choice of designating his

investment at fair value through profit or loss

Dec 31: Fair value of each share is P25

a. How much is the gain/loss from dilution?

b. How much is the equity investment at year-end

c. How much is the unrealized gain or loss P/L?

11. On March 31, 2014, WonWoo Company purchased 20% of MinGyu

Companys outstanding ordinary shares and no goodwill resulted from the

purchase.

WonWoo Company appropriately carried this investment at equity and

the balance in Wonwoos account was P3,900,000 on December 31, 2014.

MinGyu Company reported net income of P5,000,000 for the year ended

December 31, 2014 and paid cash dividend totalling P700,000 on December

31, 2015. How much did WonWoo pay for the 25% interest in MinGyu?

12. Dino Company owned 10% of Hoshi Companys preference share

capital and 15% of the ordinary share capital on December 31, 2013. The

investee reported net income P500,000 for the year end.

6% cumulative preference share 2,000,000

Ordinary share 8,000,000

13. How much is the equity in earnings of the investee for 2013?

14. SungGyu Company acquired 40% interest in an associate, MyungSoo

Company, for P5,000,000 on January 1, 2012. At the acquisition date, there

were no differences between fair value and carrying amount of identifiable

assets and liabilities. MyungSoo Company reported the following net income

and dividend for 2012 and 2013 respectively:

15. Net 16. Dividend 19. 3,000,000

income 17. 2,000,000 20. 1,000,000

18. 800,000

21. The following transactions happened between the two entities:

April 1, 2012, MyungSoo Company sold a machinery costing P500,000

to SungGyu Company for P800,000. SungGyu Company applied 10%

straight line depreciation.

On July 1, 2013 MyungSoo Company sold an equipment for P900,000

to SungGyu Company. The carrying amount of the equipment is

P500,000 with a remaining life of 5 years from the time of sale.

On December 31, 2013, MyungSoo Company sold an inventory to

SungGyu Company for P2,800,000. The inventory had a cost of

P2,000,000 and still on hand at that date.

a. How much is the investors share in profit of the associate for 2012?

b. How much is the investors share in profit of the associate for 2013?

c. How much is the carrying amount of the investment in associate on

December 31, 2012?

d. How much is the carrying amount of the investment in associate on

December 31, 2013?

22. The following chronological transactions were completed by Popi

Company:

Bought 1,000 ordinary shares of Tolits Company for P50,000 to be

measured at fair value through other comprehensive income.

Bought 500 shares 5% P150 par preference of the same company at

P200 per share plus brokers fee of P5,000. The shares are classified

as at fair value through other comprehensive income.

350 ordinary shares were sold for P20,000 and an expense was

incurred amounting to P750

Received one right from Tolits Company for every ordinary share

held. The rights entitle their holders to buy one ordinary share at

P40 for every five shares held.

Popi exercised 70% of the rights received form Tolits when each

ordinary share of Tolits sells at P70. The remaining shares were sold

at P5 each.

Popi received 4 for 1 share split.

Market value of the securities at year-end are: ordinary share P55,

preference share P120

a. How much is the cost of ordinary and preference shares per unit after

the share split?

b. How much is the unrealized gain or loss on the investment?

23. Krystal Companys portfolio of trading securities includes the following

on December 31, 2016:

24. 25. COST 26. FAIR VALUE

27. 25,000 ordinary 28. 500,000 29. 425,000

shares of Amber Co.

30. 50,000 ordinary 31. 550,000 32. 675,000

shares of Luna Co.

33. 34. 1,050,000 35. 1,100,000

36. All of the above securities have been purchased in 2016.

KrystalCo. Completed the following transactions:

37. March 1- Sold 15,000 shares of Amber Co. ordinary shares

at P40, less brokerage commission of P3,500.

38. June 30- Bought 2,800 ordinary shares of Victoria, Inc. at

P55 plus commission, taxes and other transactions of P3,500.

39. September 30- Received one for four share spilt from

Victoria, Inc.

40. Krystal Company portfolio of trading securities appeared as

follows on December 31, 2016:

41.

42. 43. 44. FAIR VALUE

COST

45. ? 46. 47. 580,000 (net of P6,000

ordinary 546,00 estimated transaction costs that

shares of 0 would be incurred on the sale of

Luna Co. securities)

48. ? 49. 50. 75,000 (net of P5,000

ordinary 82,650 estimated transaction costs that

shares of would be incurred on the sale of

Victoria, Inc. securities)

51. 52. 53. 655,000

628,65

0

a. How much is the cost per unit of the ordinary shares held at year-end?

b. How much is the unrealized gain/loss on these securities should be

reported in the 2016 income statement?

c. What is the gain/loss on the sale of Amber Co. ordinary shares?

d. How much is the total amount of trading securities at year-end?

54. On January 1, 2016, Twice Company acquired 15% interest in

Mamamoo Company by paying P8,000,000 for 100,000 ordinary shares. On

this date, the net assets of Mamamoo Company totalled P40,000,000. The

fair values of Mamamoos identifiable assets and liabilities were equal to

their book values. Twice received dividends of P1.50 per share from

Mamamoo on October 1, 2016. Mamamoo reported net income of P5,00,000

for the year 2016. Twice classified the investment as at fair value through

other comprehensive income. Market price for each shares was P90 at

December 31, 2016.

55. Twice paid P30,000,000 on January 1, 2017, for 300,000

additional ordinary shares, which represents 25% interest in Mamamoo

Company. The fair value of Mamamoos identifiable assets, net of

liabilities was equal to their books values of P92,00,000. Twice received

a dividend of P2.50 per share on September 1, 2017 and Mamamoo

reported net income of P6,000,000 for the year 2017. Market value at

year-ended 2017 is P120.

a. How much is the carrying amount of the investment at year-

ended 2017?

b. How much is the gain on re-measurement to equity should be

reported in 2017 income statement?

c. How much is the goodwill arises from the year 2017?

56. On January 1, 2016, Twice Company acquired 15% interest in

Mamamoo Company by paying P8,000,000 for 100,000 ordinary shares. On

this date, the net assets of Mamamoo Company totalled P40,000,000. The

fair values of Mamamoos identifiable assets and liabilities were equal to

their book values. On June 30, 2016, Twice sold the 25% of his ordinary

shares at P95 per share.

57. Twice received dividends of P1.50 per share from Mamamoo on

October 1, 2016. Mamamoo reported net income of P5,00,000 for the year

2016. Twice classified the investment at fair value through other

comprehensive income. Market price for each shares was P90 at December

31, 2016.

58. Twice paid P30,000,000 on January 1, 2017, for 300,000

additional ordinary shares, which represents 25% interest in Mamamoo

Company. The fair value of Mamamoos identifiable assets, net of

liabilities was equal to their books values of P92,00,000. Twice received

a dividend of P2.50 per share on September 1, 2017 and Mamamoo

reported net income of P6,000,000 for the year 2017. Market value at

year-ended 2017 is P120.

a. How much is the amount that was transferred from investment in

equity through OCI to Investment in Associate?

b. How much is the gain on sale from the year 2016?

59. Sian Company owns 5% interest in Rohee Company, which declared a

cash dividend of P3,720,000 on November 31, 2016, to shareholders of

record on December 25, 2016, payable on January 25, 2017. In addition, on

September 30, 2016, Sian Company received a liquidating dividend of

P100,000 from Sarang Company. Sian Company owns 7% of Sarang

Company. What amount of dividend income should be recorded at year-end

2016 at Sians income statement?

60. Lisa Company purchased 40% of Jennie Companys outstanding

ordinary shares on April 1, 2015, for P270million. The book value of Jennie

Companys net assets at the acquisition date totalled P450million. Book

values and fair values are same for all assets and liabilities except for

inventory and office building, for which fair values exceeded book values by

P12.5million and P112.5million, respectively. 25% of the inventories were

sold at first half of the year, while the remaining were sold at the second half

of the year. The office building has a remaining useful life of 15 years.

61. Jennie Company reported net income of P110million for the year

ended December 31, 2015 and paid cash dividends of P40million. The fair

value of Lisas investment in associate was P300million at year-end.

a. How much is attributable to goodwill?

b. How much is the balance of the investment at year-end?

c. How much is the investment income in 2016?

62. Lisa Company purchased 20% of Jennie Companys outstanding

ordinary shares on July 1, 2015, for P500,000. The book value of Jennie

Companys net assets at the acquisition date totalled P3,000,000. Book

values and fair values are same for all assets and liabilities except for

inventory. The excess of carrying value over fair value of the inventory was

P300,000. 25% of the inventories were sold at first half of the year, while the

remaining was sold at the second half of the year.

63. Jennie Company reported net income of P270,000 for the year

ended December 31, 2015 and declared and paid cash dividends of

P170,000 on August 1, 2016. The fair value of Lisas investment in associate

was P400,000 at year-end. How much is the impairment for the year 2016?

You might also like

- Equity InvestmentsDocument2 pagesEquity InvestmentsNhajNo ratings yet

- Investment in AssociateDocument2 pagesInvestment in AssociateChiChi0% (1)

- 162 019Document4 pages162 019Angelli LamiqueNo ratings yet

- Investment in Equity Securities 2Document2 pagesInvestment in Equity Securities 2miss independentNo ratings yet

- Investment in Associate 2Document2 pagesInvestment in Associate 2miss independent100% (1)

- Long Quiz For InvestmentDocument2 pagesLong Quiz For InvestmentBarbie BleuNo ratings yet

- Quiz On Retained EarningsDocument2 pagesQuiz On Retained EarningsCamila AlduezaNo ratings yet

- Quiz Shareholders Equity TH With Questions PDFDocument4 pagesQuiz Shareholders Equity TH With Questions PDFMichael Angelo FangonNo ratings yet

- SheDocument4 pagesShecedrick abalosNo ratings yet

- Shareholders' EquityDocument49 pagesShareholders' EquityPeter Banjao50% (2)

- Part IIDocument11 pagesPart IINCTNo ratings yet

- Retained EarningsDocument9 pagesRetained EarningsCamille GarciaNo ratings yet

- Midterm Exam Intermediate Accounting 2Document10 pagesMidterm Exam Intermediate Accounting 2Juan Dela cruzNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- Problem 1Document7 pagesProblem 1Maketh.ManNo ratings yet

- Acc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - CainDocument2 pagesAcc 124 - Week 13-14 - Ulob - Investment in Equity Securities - Assignment - Cainslow dancerNo ratings yet

- 3rd ActivityDocument2 pages3rd Activitydar •No ratings yet

- Quiz On L2 and L3: 60,000 Loss Not GAIN 1,500,000Document2 pagesQuiz On L2 and L3: 60,000 Loss Not GAIN 1,500,000Unknown WandererNo ratings yet

- pRACTICE SET INVESTMENTDocument4 pagespRACTICE SET INVESTMENTAlayka A AnuddinNo ratings yet

- Finacc 1 Reviewer - Finacc1 G. Ong: ProblemDocument1 pageFinacc 1 Reviewer - Finacc1 G. Ong: ProblemForkensteinNo ratings yet

- Equity and Debt Investment On Securities ProblemsDocument5 pagesEquity and Debt Investment On Securities ProblemsPepperNo ratings yet

- 162 020Document5 pages162 020Angelli LamiqueNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacNo ratings yet

- University of Luzon College of Accountancy Acc 412 - Equity Part 2Document5 pagesUniversity of Luzon College of Accountancy Acc 412 - Equity Part 2fghhnnnjmlNo ratings yet

- ACCOUNTING 4 Retained EarningsDocument2 pagesACCOUNTING 4 Retained EarningsJoy ConsigeneNo ratings yet

- Seatwork - Module 1Document5 pagesSeatwork - Module 1Alyanna Alcantara100% (1)

- Intermediate Accounting I Investment in Associate Part 2Document3 pagesIntermediate Accounting I Investment in Associate Part 2Fery AnnNo ratings yet

- SheDocument2 pagesSheRhozeiah LeiahNo ratings yet

- ACTREV 4 Business CombinationDocument4 pagesACTREV 4 Business CombinationchosNo ratings yet

- Shareholdersx27 Equity Prac 1 PDF FreeDocument10 pagesShareholdersx27 Equity Prac 1 PDF FreeIllion IllionNo ratings yet

- Chapter 12Document7 pagesChapter 12RBNo ratings yet

- Shareholders' EquityDocument16 pagesShareholders' Equitymaria evangelistaNo ratings yet

- Prelim Exam Aud AnswersDocument5 pagesPrelim Exam Aud Answerslois martinNo ratings yet

- Earning Per ShareDocument6 pagesEarning Per ShareArianne LlorenteNo ratings yet

- Audit of Investments PDFDocument2 pagesAudit of Investments PDFandreamrieNo ratings yet

- Finals Q1 - Investment in Equity PDFDocument4 pagesFinals Q1 - Investment in Equity PDFCzerielle QueensNo ratings yet

- Bcacctg2 - Accounting For Partnership and Corporation: Exercise 4 Shareholders' EquityDocument4 pagesBcacctg2 - Accounting For Partnership and Corporation: Exercise 4 Shareholders' EquityNimfa SantiagoNo ratings yet

- Fin 1Document3 pagesFin 1Jeric IsraelNo ratings yet

- Problem 11 AFARDocument4 pagesProblem 11 AFARNorman Delirio0% (1)

- Question 1. Grizzlies Inc. Was Organized On January 2, 2021, With Authorized Capital Stock of 50,000Document5 pagesQuestion 1. Grizzlies Inc. Was Organized On January 2, 2021, With Authorized Capital Stock of 50,000lois martinNo ratings yet

- Ap8501, Ap8502, Ap8503 Audit of ShareholdersDocument21 pagesAp8501, Ap8502, Ap8503 Audit of ShareholdersRits Monte100% (1)

- The Shareholders' Equity Section of Dawson Corporation's Statement of Financial Position As of December 31, 2019, Is As FollowsDocument4 pagesThe Shareholders' Equity Section of Dawson Corporation's Statement of Financial Position As of December 31, 2019, Is As FollowsAnn louNo ratings yet

- ActDocument1 pageActCyrra BalignasayNo ratings yet

- Exercises 122BDocument3 pagesExercises 122BAthena Fatmah AmpuanNo ratings yet

- Unit 6. Audit of Investments, Hedging Instruments - Handout - Final - t31516Document8 pagesUnit 6. Audit of Investments, Hedging Instruments - Handout - Final - t31516mimi96No ratings yet

- ASSIGNMENT (3points Each)Document5 pagesASSIGNMENT (3points Each)sammie helsonNo ratings yet

- Acctg 100C 06 PDFDocument2 pagesAcctg 100C 06 PDFQuid DamityNo ratings yet

- Acctg 100G 02Document4 pagesAcctg 100G 02lov3m3100% (1)

- Investment Questionnaire FinalDocument4 pagesInvestment Questionnaire FinalKy DulzNo ratings yet

- Shareholders' EquityDocument9 pagesShareholders' EquityLeah Hope CedroNo ratings yet

- SHE Comprehensive ProblemDocument4 pagesSHE Comprehensive Problemliezelkatemesina82No ratings yet

- p1 ReportDocument3 pagesp1 Reportlinette causingNo ratings yet

- Practice Problems - Audit of InvestmentsDocument10 pagesPractice Problems - Audit of InvestmentsAnthoni BacaniNo ratings yet

- Quiz InvestmentsDocument2 pagesQuiz InvestmentsstillwinmsNo ratings yet

- 162.materials 1.SHE 001Document2 pages162.materials 1.SHE 001jpbluejnNo ratings yet

- Investment PDFDocument15 pagesInvestment PDFLenrey Cobacha100% (1)

- Solutions (Quiz1 &2)Document8 pagesSolutions (Quiz1 &2)Aaron Arellano50% (2)

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- 03 Certain Doctrines in TaxationDocument8 pages03 Certain Doctrines in TaxationDanielleNo ratings yet

- Baggayao WACC PDFDocument7 pagesBaggayao WACC PDFMark John Ortile BrusasNo ratings yet

- Chap 009Document69 pagesChap 009Brey Callao0% (1)

- 2016 Vol 2 CH 2 AnswersDocument18 pages2016 Vol 2 CH 2 AnswersHohohoNo ratings yet

- 03 Certain Doctrines in Taxation PDFDocument5 pages03 Certain Doctrines in Taxation PDFDanielleNo ratings yet

- Solution To Average and Difficult QuestionsDocument7 pagesSolution To Average and Difficult QuestionsDanielleNo ratings yet

- Answer Key 2016 Edition Income TaxDocument5 pagesAnswer Key 2016 Edition Income TaxYsa Limsico75% (4)

- Evaluation Method: Exact Match Exact Match Exact Match Exact MatchDocument3 pagesEvaluation Method: Exact Match Exact Match Exact Match Exact MatchDanielleNo ratings yet

- 2016 Vol 3 CH 1 AnsDocument2 pages2016 Vol 3 CH 1 AnsDanielleNo ratings yet

- Profit Planning, Activity-Based Budgeting, and E-Budgeting: Answers To Review QuestionsDocument69 pagesProfit Planning, Activity-Based Budgeting, and E-Budgeting: Answers To Review QuestionsDanielleNo ratings yet

- Correct Answer: False: 1 Out of 1 PointsDocument3 pagesCorrect Answer: False: 1 Out of 1 PointsDanielleNo ratings yet

- Relevant Costing Introduction For ClassDocument32 pagesRelevant Costing Introduction For ClassDanielleNo ratings yet

- Reviewer in Technical WritingDocument16 pagesReviewer in Technical WritingDanielleNo ratings yet

- Make or Buy - Theory and Illustrative ProblemDocument3 pagesMake or Buy - Theory and Illustrative ProblemDanielleNo ratings yet

- Assignment in FinAcc2Document1 pageAssignment in FinAcc2DanielleNo ratings yet

- Danielle Louise F. Gaza: ObjectiveDocument2 pagesDanielle Louise F. Gaza: ObjectiveDanielleNo ratings yet

- Danielle Louise F. Gaza: Internship ObjectiveDocument1 pageDanielle Louise F. Gaza: Internship ObjectiveDanielleNo ratings yet

- SolutionDocument1 pageSolutionDanielleNo ratings yet

- Stock Market IndexDocument27 pagesStock Market Indexjubaida khanamNo ratings yet

- Financial Ratio AnalysisDocument10 pagesFinancial Ratio AnalysisSehat TanNo ratings yet

- A Comparative Study On Organised Security Market (Document12 pagesA Comparative Study On Organised Security Market (DeepakNo ratings yet

- Dcomprehensiveexam DDocument12 pagesDcomprehensiveexam DDominic SociaNo ratings yet

- Brief Introduction: Market Refers To Open Market Operations in Highly Marketable Short-Term Debt InstrumentsDocument12 pagesBrief Introduction: Market Refers To Open Market Operations in Highly Marketable Short-Term Debt InstrumentsvaeshnavikanukuntlaNo ratings yet

- 7 Powerful Secrets To Trade CFDs SuccessfullyDocument67 pages7 Powerful Secrets To Trade CFDs SuccessfullyDima Sobolev100% (1)

- Audit of Shareholders EquityDocument5 pagesAudit of Shareholders EquityAldwin LlevaNo ratings yet

- Final ProjectDocument60 pagesFinal ProjectAntaryami SamalNo ratings yet

- Investments in Equity Securities and Debt Securities Problems 7-1 (Dusit, Inc.) Classified As Available For Sale SecuritiesDocument15 pagesInvestments in Equity Securities and Debt Securities Problems 7-1 (Dusit, Inc.) Classified As Available For Sale SecuritiesExequielCamisaCrusperoNo ratings yet

- FSB - 01 - Idcl (1) 2Document3 pagesFSB - 01 - Idcl (1) 2Siri VallabhaneniNo ratings yet

- Impact of Placement With Qip Vs Public OfferDocument44 pagesImpact of Placement With Qip Vs Public OfferRomit Rakesh0% (1)

- About GVKDocument14 pagesAbout GVKmiddha_ankurmbaNo ratings yet

- Value Creation Bridge 1704547119Document5 pagesValue Creation Bridge 1704547119mblue.mkNo ratings yet

- Exquisite Jewellery Limited Reported The Following Summarized Balance Sheet atDocument2 pagesExquisite Jewellery Limited Reported The Following Summarized Balance Sheet atMuhammad ShahidNo ratings yet

- Solution:: Answer: The Cost of The Preferred Stock Is 12.24%Document1 pageSolution:: Answer: The Cost of The Preferred Stock Is 12.24%Unknowingly AnonymousNo ratings yet

- Investment AccountDocument11 pagesInvestment Accountanila rathodaNo ratings yet

- C.E. Info Systems Limited: Promoters of Our Company: Rakesh Kumar Verma and Rashmi VermaDocument329 pagesC.E. Info Systems Limited: Promoters of Our Company: Rakesh Kumar Verma and Rashmi VermadavidNo ratings yet

- Islamic Preference SharesDocument3 pagesIslamic Preference Shares0026547100% (1)

- Customer Survey Report On Demat Account: Submitted ToDocument15 pagesCustomer Survey Report On Demat Account: Submitted ToSoumik ParuaNo ratings yet

- CF 10e Chapter 09 Excel Master StudentDocument27 pagesCF 10e Chapter 09 Excel Master StudentWalter CostaNo ratings yet

- ADR and GDRDocument22 pagesADR and GDRsaini_randeep2No ratings yet

- Facebook Inc.: The Initial Public Offerings (A) : Ruskin Lisa Crystal WeiDocument32 pagesFacebook Inc.: The Initial Public Offerings (A) : Ruskin Lisa Crystal WeiThái Hoàng NguyênNo ratings yet

- BoltDocument205 pagesBoltAri SintyaNo ratings yet

- Dividend King Beginners Guide To Dividend Investing-1Document16 pagesDividend King Beginners Guide To Dividend Investing-1Michael WoodrowNo ratings yet

- IB Australia Pty LTD CFD Product Disclosure StatementDocument35 pagesIB Australia Pty LTD CFD Product Disclosure StatementSim TerannNo ratings yet

- Fundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. HoustonDocument32 pagesFundamentals of Financial Management Concise 8E: Eugene F. Brigham & Joel F. HoustonixisusjhsNo ratings yet

- Assignment 5 - SolutionsDocument2 pagesAssignment 5 - SolutionsEsther LiuNo ratings yet

- Private PlacementDocument50 pagesPrivate PlacementRajesh ChavanNo ratings yet

- Lecture 07Document27 pagesLecture 07simraNo ratings yet

- Harshad Mehta ScamDocument12 pagesHarshad Mehta Scamsudhir100% (1)