Professional Documents

Culture Documents

2551Q

Uploaded by

chelissamaerojas0 ratings0% found this document useful (0 votes)

421 views1 pageThis document provides guidelines and instructions for filing Quarterly Percentage Tax Returns. It specifies who must file, the basis of tax, penalties for non-compliance, and attachments required. Franchise grantees and proprietors of amusement businesses like cockpits and nightclubs must file quarterly returns within 20 days of the quarter's end. The return is based on gross receipts and filed with an Authorized Agent Bank, with payment due upon filing. Penalties include surcharges for late or false filing, interest on unpaid taxes, and compromise penalties.

Original Description:

bir form 2551Q

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides guidelines and instructions for filing Quarterly Percentage Tax Returns. It specifies who must file, the basis of tax, penalties for non-compliance, and attachments required. Franchise grantees and proprietors of amusement businesses like cockpits and nightclubs must file quarterly returns within 20 days of the quarter's end. The return is based on gross receipts and filed with an Authorized Agent Bank, with payment due upon filing. Penalties include surcharges for late or false filing, interest on unpaid taxes, and compromise penalties.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

421 views1 page2551Q

Uploaded by

chelissamaerojasThis document provides guidelines and instructions for filing Quarterly Percentage Tax Returns. It specifies who must file, the basis of tax, penalties for non-compliance, and attachments required. Franchise grantees and proprietors of amusement businesses like cockpits and nightclubs must file quarterly returns within 20 days of the quarter's end. The return is based on gross receipts and filed with an Authorized Agent Bank, with payment due upon filing. Penalties include surcharges for late or false filing, interest on unpaid taxes, and compromise penalties.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

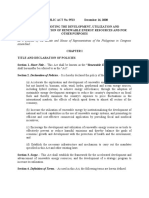

BIR FORM NO.

2551Q - QUARTERLY PERCENTAGE TAX RETURN

Guidelines and Instructions

Who Shall File Basis of Tax

This return shall be filed in triplicate by the following: For the purpose of the amusement tax, the term gross receipts embraces

1. Franchise grantees sending overseas dispatch, messages all the receipts of the proprietor, lessee or operator of the amusement place. Said

or conversations from the Philippines, except on services involving the gross receipts also include income from television, radio and motion picture

following: rights, if any.

a) Government of the Philippines - for messages transmitted by the

Government of the Republic of the Philippines or any of its political Penalties

subdivisions and instrumentalities; There shall be imposed and collected as part of the tax:

b) Diplomatic services - for messages transmitted by any embassy and 1. A surcharge of twenty five percent (25%) for each of the following

consular offices of a foreign government; violations:

c) International organizations - for messages transmitted by a public a. Failure to file any return and pay the amount of tax or installment

international organization or any of its agencies based in the due on or before the due date;

Philippines enjoying privileges and immunities pursuant to an b. Unless otherwise authorized by the Commissioner, filing a return

international agreement; and with a person or office other than those with whom it is required to be

d) News Services - for messages from any newspaper, press filed;

association, radio or television newspaper, broadcasting agency, or c. Failure to pay the full or part of the amount of tax shown on the

newsticker services to any other newspaper, press association, radio return, or the full amount of tax due for which no return is required

or television newspaper broadcasting agency or newsticker services to be filed on or before the due date;

or to bonafide correspondents, which messages deal exclusively with d. Failure to pay the deficiency tax within the time prescribed for its

the collection of news items for, or the dissemination of news items payment in the notice of assessment.

through, public press, radio or television broadcasting or a newsticker 2. A surcharge of fifty percent (50%) of the tax or of the deficiency tax, in

service furnishing a general news service similar to that of the public case any payment has been made on the basis of such return before the

press. discovery of the falsity or fraud, for each of the following violations:

2. Proprietors, lessees or operators of cockpits, cabarets, night or day a. Willful neglect to file the return within the period prescribed by the

clubs, boxing exhibitions, professional basketball games, jai-alai and Code or by rules and regulations; or

racetracks. b. In case a false or fraudulent return is willfully made.

Provided that cooperatives shall be exempt from the three percent (3%) 3. Interest at the rate of twenty percent (20%) per annum, or such higher rate

gross receipts tax. as may be prescribed by rules and regulations, on any unpaid amount of

tax from the date prescribed for the payment until the amount is fully

When and Where to File paid.

The return shall be filed within twenty (20) days after the end of each 4. Compromise penalty.

quarter, provided, however, that with respect to taxpayers enrolled with the

Electronic Filing and Payment System (EFPS), the deadline for e-filing and e- Attachments Required

paying the tax due thereon shall be five (5) days later than the deadline set above. 1. Certificate of Creditable Tax Withheld at Source, if applicable;

Any person retiring from a business subject to percentage taxes shall notify the 2. Duly approved Tax Debit Memo, if applicable;

nearest Revenue District Office, file his return and pay the tax due thereon within 3. Copy of Certificate of Registration issued by Cooperative Development

twenty (20) days after closing his business. Authority for cooperatives and from the National Electrification

The return shall be filed with any Authorized Agent Bank (AAB) within Administration for electric cooperatives;

the territorial jurisdiction of the Revenue District Office where the taxpayer is 4. For amended return, proof of the payment and the return previously filed.

required to register/conducting business. In places where there are no AABs,

the return shall be filed with the Revenue Collection Officer or duly Authorized Note: All background information must be properly filled up.

City or Municipal Treasurer within the Revenue District Office where the All returns filed by an accredited tax representative on behalf of a

taxpayer is required to register/conducting business. taxpayer shall bear the following information:

A taxpayer may, at his option, file a separate return for the head office and A. For CPAs and others (individual practitioners and members of

for each branch or place of business or a consolidated return for the head office GPPs);

and all the branches or place of business except in the case of large taxpayers a.1 Taxpayer Identification Number (TIN); and

where only one consolidated return is required. a.2 Certificate of Accreditation Number, Date of Issuance,

and Date of Expiry.

When and Where to Pay

Upon filing this return, the total amount payable shall be paid to the B. For members of the Philippine Bar (individual practitioners,

Authorized Agent Bank (AAB) where the return is filed. In places where there members of GPPs):

are no AABs, payment shall be made directly to the Revenue Collection Officer b.1 Taxpayer Identification Number (TIN); and

or duly Authorized City or Municipal Treasurer who shall b.2 Attorneys Roll Number or Accreditation Number, if

issue a Revenue Official Receipt (BIR Form No. 2524) therefor. any.

Nos. 1, 2 and 3 of this form refer to transaction period and not the

Where the return is filed with an AAB, the lower portion of the return must date of filing this return.

be properly machine-validated and stamped by the Authorized Agent Bank to The last 3 digits of the 12-digit TIN refers to the branch code.

serve as the receipt of payment. The machine validation shall reflect the date of TIN = Taxpayer Identification Number

payment, amount paid and transaction code, and the stamped ENCS

mark shall show the name of the bank, branch code, teller's code and teller's

initial. The AAB shall also issue an official receipt or bank debit advice or credit

document, whichever is applicable, as additional proof of payment.

You might also like

- BIR FORM 2551Q InstructionsDocument2 pagesBIR FORM 2551Q InstructionskehlaniNo ratings yet

- Guidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnDocument1 pageGuidelines and Instruction For BIR Form No. 2551Q: Quarterly Percentage Tax ReturnRieland CuevasNo ratings yet

- Bir Form 2551qDocument6 pagesBir Form 2551qmaeshach100% (2)

- 2551QDocument3 pages2551QJerry Bantilan JrNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- BIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsDocument1 pageBIR FORM NO. 2550Q - Quarterly Value-Added Tax Return Guidelines and InstructionsdreaNo ratings yet

- PenaltiesDocument2 pagesPenaltiesfatmaaleahNo ratings yet

- BIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsDocument2 pagesBIR Form No. 2551M Percentage Tax Return Guidelines and InstructionsseanjharodNo ratings yet

- 2550Q InstructionsDocument1 page2550Q InstructionsMay RamosNo ratings yet

- 2550Q Guidelines 2023 - FinalDocument1 page2550Q Guidelines 2023 - Finallorenzo ejeNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- BIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsDocument1 pageBIR Form 2550M - Monthly Value-Added Tax Declaration Guidelines and InstructionsdreaNo ratings yet

- 2551QDocument3 pages2551QnelsonNo ratings yet

- Percentage TaxDocument7 pagesPercentage TaxArielle CabritoNo ratings yet

- Percentage Tax Requirements and ProceduresDocument8 pagesPercentage Tax Requirements and ProceduresDura LexNo ratings yet

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzNo ratings yet

- Percentage Tax ReviewerDocument5 pagesPercentage Tax ReviewerJerico ManaloNo ratings yet

- What Is Percentage Tax?Document3 pagesWhat Is Percentage Tax?Lucas JuanchoNo ratings yet

- BIR Form 2551Q: Under Sections 116 To 126 of The Tax Code, As AmendedDocument9 pagesBIR Form 2551Q: Under Sections 116 To 126 of The Tax Code, As AmendedJAYAR MENDZNo ratings yet

- RMC No. 12-2020 Annex A - 2552 GuidelinesDocument1 pageRMC No. 12-2020 Annex A - 2552 GuidelinesDarla EnriquezNo ratings yet

- Closely-Held Corporation IAET Return RequirementsDocument1 pageClosely-Held Corporation IAET Return RequirementsRizza Mae RodriguezNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezNo ratings yet

- Accounting Technician Level 3 - Module 3 Part 2Document4 pagesAccounting Technician Level 3 - Module 3 Part 2Rona Amor MundaNo ratings yet

- 2000 June 2006 (Back)Document1 page2000 June 2006 (Back)Rica Santos-vallesteroNo ratings yet

- January 14, 2011: DescriptionDocument11 pagesJanuary 14, 2011: DescriptionRosselle GuevarraNo ratings yet

- Percentage TaxDocument5 pagesPercentage TaxGIGI BODONo ratings yet

- RMC No. 84-2023 GuidelinesDocument1 pageRMC No. 84-2023 GuidelinessandraNo ratings yet

- Mid-Term-Day 1-Other Percentage Taxes (Opt)Document52 pagesMid-Term-Day 1-Other Percentage Taxes (Opt)Christine Joyce MagoteNo ratings yet

- 1601-EQ Guide January 2019 ENCS RevDocument1 page1601-EQ Guide January 2019 ENCS RevErika OrellanoNo ratings yet

- Percentage Tax: o o o o o oDocument11 pagesPercentage Tax: o o o o o oMark Joseph BajaNo ratings yet

- Guidelines and Instructions For BIR Form No. 2200-M Excise Tax Return For Mineral ProductsDocument1 pageGuidelines and Instructions For BIR Form No. 2200-M Excise Tax Return For Mineral ProductsCindy RioNo ratings yet

- Guidelines BIR Form No. 2000-OTDocument1 pageGuidelines BIR Form No. 2000-OTAnneNo ratings yet

- 2551 MDocument2 pages2551 MAdrian AyrosoNo ratings yet

- Guidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document1 pageGuidelines and Instructions For BIR Form No. 1601-EQ Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)Milds LadaoNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnJenel ChuNo ratings yet

- OptDocument19 pagesOptDanica SarmientoNo ratings yet

- Bir46 PDFDocument2 pagesBir46 PDFJulia SmithNo ratings yet

- Percentage Tax PDFDocument11 pagesPercentage Tax PDFRose Jean Raniel OropaNo ratings yet

- Guidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsDocument1 pageGuidelines and Instructions For BIR Form No. 1701Q Quarterly Income Tax Return For Individuals, Estates and TrustsAlyssa Hallasgo-Lopez AtabeloNo ratings yet

- Business TaxationDocument33 pagesBusiness Taxationrose querubinNo ratings yet

- Schedule 1 tax detailsDocument3 pagesSchedule 1 tax detailsAu B ReyNo ratings yet

- Taxation Report Vina MarieDocument12 pagesTaxation Report Vina MarieAnonymous gmDxRbnwONo ratings yet

- Guidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldDocument1 pageGuidelines and Instructions For BIR Form No. 0619-F (Monthly Remittance Form of Final Income Taxes WithheldMark Joseph BajaNo ratings yet

- Quarterly Percentage Tax Rates TableDocument8 pagesQuarterly Percentage Tax Rates TableAngelyn SamandeNo ratings yet

- W3 Module 3 - Tax Administration Part IIDocument14 pagesW3 Module 3 - Tax Administration Part IIElmeerajh JudavarNo ratings yet

- 0619-E Jan 2018 GuidelinesDocument1 page0619-E Jan 2018 GuidelinesFarida Wahab Mama-BasagNo ratings yet

- Percentage Tax Who Are Required To File?Document4 pagesPercentage Tax Who Are Required To File?Angelyn SamandeNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesAnonymous 1tTxK4No ratings yet

- Transfer of Shares and Real Property DST ReturnDocument1 pageTransfer of Shares and Real Property DST ReturnJeric BlasurcaNo ratings yet

- Shall File A Return Under OathDocument17 pagesShall File A Return Under OathMixx MineNo ratings yet

- Taxation 1 Lesson 1. Returns and Payment of TaxDocument42 pagesTaxation 1 Lesson 1. Returns and Payment of TaxHarui Hani-31No ratings yet

- Return of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasDocument2 pagesReturn of Percentage Tax Payable Under Special Laws: Kawanihan NG Rentas InternasAngela ArleneNo ratings yet

- Return of Percentage TaxDocument2 pagesReturn of Percentage TaxfatmaaleahNo ratings yet

- Guide to Filing BIR Form 2200-SDocument2 pagesGuide to Filing BIR Form 2200-SJoseph DoctoNo ratings yet

- Tax 1.1Document13 pagesTax 1.1Mheryza De Castro PabustanNo ratings yet

- Bir Form Percentage TaxDocument3 pagesBir Form Percentage TaxEc MendozaNo ratings yet

- Taxation Law SummerDocument6 pagesTaxation Law SummerAnita Solano BoholNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Affidavit of Income (Lubiano)Document2 pagesAffidavit of Income (Lubiano)chelissamaerojasNo ratings yet

- SPA-to-get-TOR-and-Diploma (VERONICA)Document1 pageSPA-to-get-TOR-and-Diploma (VERONICA)chelissamaerojasNo ratings yet

- Affidavit of Discrepancy (XXXXDocument1 pageAffidavit of Discrepancy (XXXXchelissamaerojasNo ratings yet

- Affidavit of IncomeDocument1 pageAffidavit of IncomechelissamaerojasNo ratings yet

- Affidavif of Change of Civil StatusDocument1 pageAffidavif of Change of Civil StatuschelissamaerojasNo ratings yet

- Motion For Postponement (Sample)Document2 pagesMotion For Postponement (Sample)chelissamaerojasNo ratings yet

- Contract of EmploymentDocument2 pagesContract of EmploymentTim SmirnoffNo ratings yet

- Affidavit of Discrepancy (XXXXDocument1 pageAffidavit of Discrepancy (XXXXchelissamaerojasNo ratings yet

- Affidavit of Declaration of Job and IncomeDocument1 pageAffidavit of Declaration of Job and IncomechelissamaerojasNo ratings yet

- 2019SECForm - 12 1 SRS For Hospitals Final 1Document38 pages2019SECForm - 12 1 SRS For Hospitals Final 1opep77No ratings yet

- Chattel MortgageDocument2 pagesChattel MortgagechelissamaerojasNo ratings yet

- Affidavit of Loss.. DiplomaDocument1 pageAffidavit of Loss.. Diplomachelissamaerojas100% (1)

- Notarial RegisterDocument4 pagesNotarial RegisterchelissamaerojasNo ratings yet

- Calbugos Iligay Farmers Association Resolution: Brgy. Calbugos, Villaba, LeyteDocument2 pagesCalbugos Iligay Farmers Association Resolution: Brgy. Calbugos, Villaba, LeytechelissamaerojasNo ratings yet

- Employment Contract (Manager)Document2 pagesEmployment Contract (Manager)chelissamaerojasNo ratings yet

- Special Power of Attorney Travel ConsentDocument2 pagesSpecial Power of Attorney Travel Consentchelissamaerojas100% (1)

- Contract of Lease Commercial BuildingDocument4 pagesContract of Lease Commercial BuildingRaffy Roncales88% (8)

- Affidavit of Cohabitation JORDADocument2 pagesAffidavit of Cohabitation JORDAchelissamaerojasNo ratings yet

- Contract of Lease Commercial BuildingDocument4 pagesContract of Lease Commercial BuildingRaffy Roncales88% (8)

- Used in Good Faith MercadoDocument1 pageUsed in Good Faith MercadochelissamaerojasNo ratings yet

- Affidavit clarifies civil statusDocument1 pageAffidavit clarifies civil statuschelissamaerojasNo ratings yet

- Affidavit correcting nameDocument2 pagesAffidavit correcting namechelissamaerojasNo ratings yet

- Verification and Cert Against Non Forum ShoppingDocument1 pageVerification and Cert Against Non Forum ShoppingchelissamaerojasNo ratings yet

- Affidavit of Loss Form 138 ShelameDocument1 pageAffidavit of Loss Form 138 ShelamechelissamaerojasNo ratings yet

- Affidavit of Undertaking Form - SOLO PARENTDocument1 pageAffidavit of Undertaking Form - SOLO PARENTJonathanNo ratings yet

- Hagad v. Gozo-DadoleDocument3 pagesHagad v. Gozo-DadolechelissamaerojasNo ratings yet

- SPA To Represent in CaseDocument2 pagesSPA To Represent in Casechelissamaerojas100% (1)

- Affidavit clarifies civil statusDocument1 pageAffidavit clarifies civil statuschelissamaerojasNo ratings yet

- Affidavit For Eligibility Under RA 7160Document1 pageAffidavit For Eligibility Under RA 7160chelissamaerojas100% (3)

- Republic of The PhilippinesDocument1 pageRepublic of The PhilippinesKezia Magsayo LumasagNo ratings yet

- Missioner of Internal Revenue vs. Kudos Metal Corporation, 620 SCRA 232, May 05, 2010Document18 pagesMissioner of Internal Revenue vs. Kudos Metal Corporation, 620 SCRA 232, May 05, 2010specialsectionNo ratings yet

- Ratio Analysis of PIADocument16 pagesRatio Analysis of PIAMalik Saad Noman100% (5)

- Problems On Cost of CapitalDocument4 pagesProblems On Cost of CapitalAshutosh Biswal100% (1)

- Axiva Sichem Pvt. LTDDocument2 pagesAxiva Sichem Pvt. LTDKishnsNo ratings yet

- Renewable Energy Act of 2008Document21 pagesRenewable Energy Act of 2008Shanielle Qim CañedaNo ratings yet

- 1099 Tax Credit For EditorsDocument1 page1099 Tax Credit For EditorsCraig Pisaris-HendersonNo ratings yet

- California LLC 1Document1 pageCalifornia LLC 1Freeman LawyerNo ratings yet

- VCE Summer Internship Program 2020: Smart Task Submission FormatDocument4 pagesVCE Summer Internship Program 2020: Smart Task Submission Formatruchit guptaNo ratings yet

- Court upholds CTA jurisdiction over estate tax dispute despite lack of refund claimDocument5 pagesCourt upholds CTA jurisdiction over estate tax dispute despite lack of refund claimYvon BaguioNo ratings yet

- Latihan 1Document25 pagesLatihan 1Sanda Patrisia KomalasariNo ratings yet

- (Revised) Post Uplb S 046 13 Nanotech RevDocument50 pages(Revised) Post Uplb S 046 13 Nanotech RevGladys Bernabe de VeraNo ratings yet

- Gains & Losses From Dealing in PropertyDocument72 pagesGains & Losses From Dealing in PropertyJoyce Nalzaro100% (2)

- Contract to Buy and Sell LandDocument4 pagesContract to Buy and Sell LandAlvin renomeron JaroNo ratings yet

- 022 Cir vs. Marubeni Corporation GR No. 137377Document1 page022 Cir vs. Marubeni Corporation GR No. 137377Anonymous MikI28PkJcNo ratings yet

- ACC 318 Advanced Taxation Course GuideDocument225 pagesACC 318 Advanced Taxation Course GuideSekar MuruganNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)AK तकNo ratings yet

- Alcantara V RepublicDocument15 pagesAlcantara V RepublicEzer SccatsNo ratings yet

- DeKalb FreePress: 10-25-19Document16 pagesDeKalb FreePress: 10-25-19Donna S. SeayNo ratings yet

- Agreement Vehicle LoanDocument22 pagesAgreement Vehicle LoanSJ Geronimo0% (1)

- New Method of National Income Accounting: Courses Offered: Rbi Grade B Sebi NabardDocument6 pagesNew Method of National Income Accounting: Courses Offered: Rbi Grade B Sebi NabardSai harshaNo ratings yet

- Pricnciple of Maximum Social AdvantageDocument8 pagesPricnciple of Maximum Social Advantagelegendishal5No ratings yet

- Gatchalian v. CollectorDocument6 pagesGatchalian v. CollectorSosthenes Arnold MierNo ratings yet

- Regulate and Tax VapingDocument6 pagesRegulate and Tax VapingSyazwan KhirudinNo ratings yet

- Invoice ExampleDocument1 pageInvoice ExamplekekerodeNo ratings yet

- The JobDocument52 pagesThe JobLerwin GaringaNo ratings yet

- Combine PDFDocument3 pagesCombine PDFKaye ApostolNo ratings yet

- Unit 18 Development Planning: Nature and Scope: 18.0 Learning OutcomeDocument16 pagesUnit 18 Development Planning: Nature and Scope: 18.0 Learning OutcomeC SathishNo ratings yet

- CMA Part 1A Macroeconomics)Document33 pagesCMA Part 1A Macroeconomics)mah800100% (3)

- BSP Personal Loan Application FormDocument2 pagesBSP Personal Loan Application FormLamson ParuaNo ratings yet

- Salary Slip OctDocument1 pageSalary Slip OctBhavesh MishraNo ratings yet