Professional Documents

Culture Documents

Meaning of Cost Reconciliation Statement

Uploaded by

mahendrabpatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Meaning of Cost Reconciliation Statement

Uploaded by

mahendrabpatelCopyright:

Available Formats

Introduction

A manufacturing concern may adopt either inter graded accounting system or non-

integral accounting system. Under integrated account ting system, only one set of books

is maintained to record both costing and financial transaction, therefore, under this

system, both financial accounts

and cost accounts give similar results. But in non-integral accounting system, separate

books are maintained for costing and financial transactions, which may exhibit different

result i.e. profit or loses. In other words, when cost accounts and financial accounts are

maintained independently by a concern, the profit or loss shown by the cost accounts

may not reconcile the profit or losses shown different by cost account and financial

accounts by preparing a statement called 'cost reconciliation statement'.

Meaning of cost reconciliation

statement

A statement which is prepared for reconciling the profit between financial and cost

account is known's as cost reconciliation statement statement. A cost reconciliation

statement is a statement recording the profit or losses shown by the cost accounts and

financial account. It is a statement where the causes for the difference in net profit or

net loss between cost and financial accounts are established and suitable adjustments

are made to remove them. In other words, cost reconciliation statement is a statement

prepared for the purpose of reconciling or agreeing the result (i.e. Net profit or net loss)

of financial accounts with the results of cost accounts by making suitable adjustment for

the items responsible for the disagreement. In short, it is the statement through which

reconciliation or agreement between the results (profit or losses) of cost account and

financial account is affected.

Need for reconciliation

Reconciliation between the result of the two sets of accounts in necessary due

to the following reasons:

a. It helps to check the arithmetical accuracy of both the sets of accounts.

b. Management is enabling to know the reasons for the difference in results of both cost

and financial account.

c. It explains reasons for different which facilitate internal control

d. It ensures the reliability of cost data.

e. It promotes co-ordination between cost and financial department.

f. It helps in formulation of policies regarding absorption of overheads and depreciation

and stock valuation methods

g. It ensures managerial decision-making

Causes or reason for difference in profits or

losses

The disagreement between cost and financial results arise due to the following

reasons:

a. Items shown only in financial account

b. Items shown only in cost account

c. Over or under absorption of overhead

d. Different in valuation of stock.

e. Difference method of charging depreciation.

f. Abnormal gain or losses.

Items shown only in financial

account

There are certain items of income and expenditures which are shown only in financial

accounts not in cost accounts. As a result, the profit or loss as per cost accounts would

be quite different from the profit or loss as per the financial accounts these items of

financial nature can be divided in three groups:

Items shown only in cost

account

There are very few items, which are shown only in cost accounts but not in the financial

accounts as they do not represent any transaction with outsides. These items are also

responsible for the disagreement of the result shown by the two sets of accounts. These

items are:

Over or under absorption of

overhead

In cost accounts, overhead are charges on the basis of pre-determined percentage. But,

in financial account they are charged with the actual amount. This results over or under

absorption of overheads in cost accounts and may be the main reason for different in

profits disclosed by cost accounts and financial accounts.

Difference in valuation of stocks

In financial accounts, stocks are valued at cost or market price, whichever is lower, but

in cost accounts, stocks are valued only at its cost price. This result in some different in

result i.e. profit or loss. The effect of stock valuation on profit is shown on the following

table:

Difference methods of charging

depreciation

There are different methods of charging depreciation. In financial account, depreciation

may be calculated on straight line or diminishing balance method as per income tax act.

But in cost accounts, depreciation is calculated on the basis of used of the assets

(generally machine hours).

Abnormal gains and losses

Abnormal gains and losses are shown in financial accounts while they are completely

excluded from cost accounts. Goods lost but fire, theft, accident or cost of abnormal idle

time are example of abnormal losses which are shown in financial accounts but not in

cost accounts. Such abnormal gains and losses also lead to disagreement of cost and

financial accounts results.

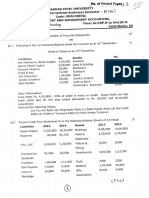

Preparation of cost reconciliation

statement

If there is a difference in the results shown by the cost accounts and financial accounts,

then only a cost reconciliation statement is prepared to reconcile their results by

removing their differences.

A cost reconciliation statement is prepared on the same footing on which a bank

reconciliation statement is prepared. The preparation of cost reconciliation statement

involves the following steps:

Step 1: start with profit or loss shown by any one set of accounts such as:

Net profit as per cost account

Net profit as per financial account

Net loss as per cost account

Net loss as per financial account

Step 2: find out the cause of difference that result the disagreement between

the profit shown by cost account and financial account. The causes of difference

and their effect on privet are as follows:

Concept And Meaning Of Cost Reconciliation Statement And Need

For Reconciliation

Cost Reconciliation Statement

A manufacturing concern may adopt either Integrated Accounting System or Non-

Integral Accounting System. Under Integrated Accounting System, only one set of books is

maintained to record both costing and financial transaction, therefore, under this system, both

financial accounts and cost accounts give similar results. But in Non-

Integral Accounting System, separate books are maintained for costing and financial

transactions, which may exhibit different results i.e. profits or losses. In other words, when cost

accounts and financial accounts are maintained independently by a concern, the profit or loss

shown by the cost accounts may not agree with the profit or loss shown by the financial

accounts. In this situation, it is needed to reconcile the profits or losses shown differently by cost

accounts and financial account by preparing a statement called ' Cost Reconciliation Statement'

A statement which is prepared for reconciling the profit between financial account and cost

accountis known as cost reconciliation statement. A cost reconciliation statement is a statement

reconciling the profits or losses shown by cost accounts and financial accounts. It is a statement

wherein the causes responsible for the difference in net profit or loss between cost and financial

accounts are established and suitable adjustments are made to remove them. In other words,

cost reconciliation statement is prepared for the purpose of reconciling or agreeing the results of

financial accounts with the results of cost accounts by making suitable adjustments for the items

responsible for the disagreement. In short, it is the statement through which reconciliation or

agreement between the results (profits or losses) of cost accounts and financial accounts is

effected.

Need For Reconciliation

Reconciliation between the results of two sets of accounts is necessary due to the following

reasons:

1. Reconciliation helps to check the arithmetical accuracy of both sets of accounts.

2. Management is enable to know the reasons for the difference in results of both cost and

financial accounts.

3. Reconciliation explains reasons for difference which facilitate internal control.

4. Reconciliation ensures the reliability of cost data.

5. Reconciliation promotes co-ordination between cost and financial departments.

6. Reconciliation helps in formulation of policies regarding absorption of overheads and

depreciation and stock valuation method.

7. Reconciliation ensures managerial decision-making.

Causes Or Reasons For Difference In Profits Or Losses Between Cost

Account And Financial Account

You might also like

- What Is Cost Reconciliation Statement?Document2 pagesWhat Is Cost Reconciliation Statement?mahendrabpatelNo ratings yet

- Applied Cost AccountingDocument6 pagesApplied Cost AccountingNandhini MNo ratings yet

- ReconciliationDocument15 pagesReconciliationManisha AmudaNo ratings yet

- 1587226653unit 4, Cost Accounting, Sem4Document5 pages1587226653unit 4, Cost Accounting, Sem4Sanjukta Das100% (1)

- Reconciliation - PPTDocument7 pagesReconciliation - PPTHemant bhanawatNo ratings yet

- Reconciliation of Cost and Financial Accounts PDFDocument14 pagesReconciliation of Cost and Financial Accounts PDFvihangimadu100% (2)

- Accounting Cycle: BusinessDocument6 pagesAccounting Cycle: BusinessRenu KulkarniNo ratings yet

- Accounting Worksheet and Financial StatementsDocument12 pagesAccounting Worksheet and Financial StatementsChona MarcosNo ratings yet

- Activity 1 Chapter 8 Olbpac AnsDocument2 pagesActivity 1 Chapter 8 Olbpac AnsCherry Ann OlasimanNo ratings yet

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsFrom EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNo ratings yet

- Proforma of A Reconciliation StatementDocument5 pagesProforma of A Reconciliation StatementAtul Mumbarkar50% (2)

- Module 6 - Worksheet and Financial Statements Part IDocument12 pagesModule 6 - Worksheet and Financial Statements Part IMJ San Pedro100% (1)

- Acc. 101-True or False and IdentificationDocument9 pagesAcc. 101-True or False and IdentificationAuroraNo ratings yet

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Libby 4ce Solutions Manual - Ch04Document92 pagesLibby 4ce Solutions Manual - Ch047595522No ratings yet

- Accrual Accounting and Financial Reporting ConceptsDocument4 pagesAccrual Accounting and Financial Reporting ConceptsGesa StephenNo ratings yet

- 5.3.1the Worksheet DoneprintDocument12 pages5.3.1the Worksheet DoneprintPgumballNo ratings yet

- Akm 1Document7 pagesAkm 1Mohammad Alfiyan SyahrilNo ratings yet

- CHAPTER 5 Adjusting The Accounts (Module)Document19 pagesCHAPTER 5 Adjusting The Accounts (Module)Chona MarcosNo ratings yet

- Chapter-2 Intainship ProjectDocument8 pagesChapter-2 Intainship ProjectAP GREEN ENERGY CORPORATION LIMITEDNo ratings yet

- Unit 11 Reconciliation of Cost Financial: AccountsDocument18 pagesUnit 11 Reconciliation of Cost Financial: AccountsDrJay DaveNo ratings yet

- Accounting Worksheet GuideDocument3 pagesAccounting Worksheet GuideShenina ManaloNo ratings yet

- COSTING Chapter 2Document14 pagesCOSTING Chapter 2Raksha ShettyNo ratings yet

- Audit of Income and Expenditure Account 1.1Document27 pagesAudit of Income and Expenditure Account 1.1Akshata Masurkar100% (1)

- Chapter-3 FINANCIAL STATEMENT PREPARATIONDocument21 pagesChapter-3 FINANCIAL STATEMENT PREPARATIONWoldeNo ratings yet

- BBA-4 Cost Acc.Unit 1Document5 pagesBBA-4 Cost Acc.Unit 1TilluNo ratings yet

- Audit of Financial StatementDocument23 pagesAudit of Financial StatementGurpreet KaurNo ratings yet

- Midterm Assignment No.2 - Worksheet and Financial StatementDocument2 pagesMidterm Assignment No.2 - Worksheet and Financial StatementAbbyNo ratings yet

- Prepare Basic Financial StatementsDocument6 pagesPrepare Basic Financial StatementsMujieh NkengNo ratings yet

- Tax Accounting vs GAAP ForumDocument4 pagesTax Accounting vs GAAP Forumadhi anoragaNo ratings yet

- IE132 Financial AccountingDocument8 pagesIE132 Financial AccountingAndrea Padilla MoralesNo ratings yet

- Analyzing Trial Balances and Preparing Financial StatementsDocument3 pagesAnalyzing Trial Balances and Preparing Financial StatementsBUNTY GUPTANo ratings yet

- 3 Difference Between FA, CA & MADocument9 pages3 Difference Between FA, CA & MAamits3989No ratings yet

- Lesson 3: Basic Accounting: Completing The Accounting Cycle Adjusting The AccountsDocument18 pagesLesson 3: Basic Accounting: Completing The Accounting Cycle Adjusting The AccountsAra ArinqueNo ratings yet

- Reporting Comprehensive Income, Equity Changes, and Key Financial StatementsDocument9 pagesReporting Comprehensive Income, Equity Changes, and Key Financial StatementsAbigail Elsa Samita Sitakar 1902113687No ratings yet

- Amodia (Accounting Notes - Worksheet)Document3 pagesAmodia (Accounting Notes - Worksheet)CLUVER AEDRIAN AMODIANo ratings yet

- Accounting Basics 1Document3 pagesAccounting Basics 1Irene the Fire CatNo ratings yet

- Reconciliation of Cost and Financial AccountsDocument18 pagesReconciliation of Cost and Financial AccountsHari RamNo ratings yet

- Financial Accounting Canadian 6th Edition Libby Solutions Manual 1Document107 pagesFinancial Accounting Canadian 6th Edition Libby Solutions Manual 1sharon100% (43)

- Financial Accounting Canadian 6th Edition Libby Solutions Manual 1Document36 pagesFinancial Accounting Canadian 6th Edition Libby Solutions Manual 1richardacostaqibnfpmwxd100% (22)

- Reconciliation of Cost and Financial AccountsDocument18 pagesReconciliation of Cost and Financial Accountsdoselo7432No ratings yet

- Analyzing Financial Statements and Potentially Misreported COGSDocument10 pagesAnalyzing Financial Statements and Potentially Misreported COGSBastianFeryNo ratings yet

- Mba NotesDocument264 pagesMba NotesVartika NagarNo ratings yet

- Chan-A Comparison of Government Accounting and Business AccountingDocument13 pagesChan-A Comparison of Government Accounting and Business AccountingAndy LincolnNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Acc Assign1Document24 pagesAcc Assign1chandresh_johnsonNo ratings yet

- Aik CH 6Document15 pagesAik CH 6rizky unsNo ratings yet

- Topic 3 4 5 6 7 Cash Flow Analysis CFO CFI CFFDocument22 pagesTopic 3 4 5 6 7 Cash Flow Analysis CFO CFI CFFYadu Priya DeviNo ratings yet

- Financial statements components and relationshipsDocument2 pagesFinancial statements components and relationshipsAlexsiah De VeraNo ratings yet

- ON Ntegrated Ccounts: Basic Concepts and FormulaeDocument0 pagesON Ntegrated Ccounts: Basic Concepts and FormulaeRajan PvNo ratings yet

- Cost AccountinDocument144 pagesCost AccountinbrianNo ratings yet

- Unit - 4 Final AccountDocument39 pagesUnit - 4 Final AccountHusain BohraNo ratings yet

- What Is An Extended TrialDocument19 pagesWhat Is An Extended TrialocalmaviliNo ratings yet

- Ska 78910.Document81 pagesSka 78910.Dyah Putu PuspandariNo ratings yet

- Reconciliation of Cost and Financial AccountsDocument18 pagesReconciliation of Cost and Financial AccountsHari RamNo ratings yet

- SM-2 - Lesson - 1 To 7 in EnglishDocument128 pagesSM-2 - Lesson - 1 To 7 in EnglishMayank RajputNo ratings yet

- StarFarm Finance OfficerDocument7 pagesStarFarm Finance OfficerZany KhanNo ratings yet

- Unit V Cost of CapitalDocument24 pagesUnit V Cost of CapitalmahendrabpatelNo ratings yet

- Assignenment 1 DT Unit 1Document9 pagesAssignenment 1 DT Unit 1mahendrabpatelNo ratings yet

- Material Variance: Unit 2 Standard Costing (MA-06101355)Document12 pagesMaterial Variance: Unit 2 Standard Costing (MA-06101355)mahendrabpatelNo ratings yet

- BASIC FEATURE OF Financial StatementDocument6 pagesBASIC FEATURE OF Financial StatementmahendrabpatelNo ratings yet

- Get Started Right AwayDocument2 pagesGet Started Right AwaymahendrabpatelNo ratings yet

- Financial Accounting IntroductionDocument15 pagesFinancial Accounting IntroductionmahendrabpatelNo ratings yet

- Historia Del Mondonguito A La ItalianaDocument7 pagesHistoria Del Mondonguito A La ItalianaJuan OrocoNo ratings yet

- Advance Financial Management-IDocument5 pagesAdvance Financial Management-ImahendrabpatelNo ratings yet

- 1 CostsheetDocument8 pages1 CostsheetNash ShahNo ratings yet

- SP Uni CA 2015Document3 pagesSP Uni CA 2015mahendrabpatelNo ratings yet

- MotivationDocument6 pagesMotivationmahendrabpatelNo ratings yet

- Meaning of Cost Reconciliation StatementDocument5 pagesMeaning of Cost Reconciliation StatementmahendrabpatelNo ratings yet

- Ch1 6Document109 pagesCh1 6Tia MejiaNo ratings yet

- Question BankDocument31 pagesQuestion BankmahendrabpatelNo ratings yet

- SP Uni CA 2016 MayDocument4 pagesSP Uni CA 2016 MaymahendrabpatelNo ratings yet

- Amit ResumeDocument3 pagesAmit ResumemahendrabpatelNo ratings yet

- SP Uni CA 2016Document2 pagesSP Uni CA 2016mahendrabpatelNo ratings yet

- SP Uni CA 2013Document3 pagesSP Uni CA 2013mahendrabpatelNo ratings yet

- API Format 2017Document4 pagesAPI Format 2017mahendrabpatelNo ratings yet

- SP Uni CA 1Document4 pagesSP Uni CA 1mahendrabpatelNo ratings yet

- Cost and Management Accounting exam questions and ratiosDocument3 pagesCost and Management Accounting exam questions and ratiosmahendrabpatelNo ratings yet

- TestDocument2 pagesTestmahendrabpatelNo ratings yet

- Capital BudgetingDocument24 pagesCapital BudgetingmahendrabpatelNo ratings yet

- Capital StructureDocument37 pagesCapital StructuremahendrabpatelNo ratings yet

- TestDocument2 pagesTestmahendrabpatelNo ratings yet

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelNo ratings yet

- A2Z FincialDocument3 pagesA2Z FincialmahendrabpatelNo ratings yet

- Instructor Effectiveness Form (IEF) Cronbach ReliabilitiesDocument3 pagesInstructor Effectiveness Form (IEF) Cronbach ReliabilitiesmahendrabpatelNo ratings yet

- Wu Tang Financial Excel SpreadsheetDocument16 pagesWu Tang Financial Excel SpreadsheetJason BurgoyneNo ratings yet

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikNo ratings yet

- Struktur Modal Optimal Dan Kecepatan Penyesuaian Studi Empiris Di Bursa Efek IndonesiaDocument20 pagesStruktur Modal Optimal Dan Kecepatan Penyesuaian Studi Empiris Di Bursa Efek IndonesiaChandra Bagas AlfianNo ratings yet

- Valuing Rent-Controlled Residential PropertiesDocument14 pagesValuing Rent-Controlled Residential PropertiesiugjkacNo ratings yet

- US Internal Revenue Service: f6198 - 1999Document1 pageUS Internal Revenue Service: f6198 - 1999IRSNo ratings yet

- M.Nor Abdul Razak - EditDocument8 pagesM.Nor Abdul Razak - EditWredha KusumaNo ratings yet

- Credit Transactions Case DigestDocument6 pagesCredit Transactions Case DigestMousy GamalloNo ratings yet

- Current Liabilities, Contingencies, and Time Value of Money Chapter ExercisesDocument44 pagesCurrent Liabilities, Contingencies, and Time Value of Money Chapter ExercisesAarti J0% (2)

- Practie-Test-For-Econ-121-Final-Exam 1Document1 pagePractie-Test-For-Econ-121-Final-Exam 1mehdi karamiNo ratings yet

- Islamic Economics PDFDocument214 pagesIslamic Economics PDFDzaky Ahmad NaufalNo ratings yet

- PF Transfer From Satyam / Mahindra Satyam To New Employer - FAQ'sDocument3 pagesPF Transfer From Satyam / Mahindra Satyam To New Employer - FAQ'sbhavNo ratings yet

- HUDEX Power Monthly Report January 2020Document6 pagesHUDEX Power Monthly Report January 2020Kovács IstvánNo ratings yet

- BANKING AWARENESS WITH MULTIPLE CHOICE QUESTIONSDocument458 pagesBANKING AWARENESS WITH MULTIPLE CHOICE QUESTIONSAbhi Saha100% (2)

- Sample Paper 1 MCQ AccDocument2 pagesSample Paper 1 MCQ AccDRNo ratings yet

- PM Sect B Test 5Document3 pagesPM Sect B Test 5FarahAin FainNo ratings yet

- XXXXXXXXXX1191 20230728113715988340..Document6 pagesXXXXXXXXXX1191 20230728113715988340..MOHAMMAD IQLASHNo ratings yet

- NTS - Candidate (Portal)Document3 pagesNTS - Candidate (Portal)MUHAMMAD FAIZAANNo ratings yet

- 57 Marketing Tips For Financial Advisors by James Pollard - The Advisor Coach LLCDocument85 pages57 Marketing Tips For Financial Advisors by James Pollard - The Advisor Coach LLCAravamudhan Srinivasan100% (4)

- HEC Financial Rules - 2009Document23 pagesHEC Financial Rules - 2009Shahid Malik0% (1)

- 4 Chapter 1 - Executive SummaryDocument5 pages4 Chapter 1 - Executive Summaryleejay029No ratings yet

- Valuation 1Document22 pagesValuation 1Nisa AnnNo ratings yet

- Greenpanel Annual Report Highlights Broad-basing StrategyDocument134 pagesGreenpanel Annual Report Highlights Broad-basing Strategykdinesh05No ratings yet

- Managerial Accounting II Case Study Analysis Harsh ElectricalsDocument7 pagesManagerial Accounting II Case Study Analysis Harsh ElectricalsSiddharth GargNo ratings yet

- Sbi Service Rules 2015Document25 pagesSbi Service Rules 2015Jeeban MishraNo ratings yet

- ActivityDocument3 pagesActivityPoy TañedoNo ratings yet

- Final Accounts PPT APTDocument36 pagesFinal Accounts PPT APTGaurav gusai100% (1)

- Annual Report KIJA 2015 56 - 63Document210 pagesAnnual Report KIJA 2015 56 - 63David Susilo NugrohoNo ratings yet

- Unit 3-Time Value of MoneyDocument12 pagesUnit 3-Time Value of MoneyGizaw BelayNo ratings yet

- Hewlett PackardDocument31 pagesHewlett PackardAamir Awan0% (2)

- Preqin Quarterly Private Debt Update Q2 2015Document8 pagesPreqin Quarterly Private Debt Update Q2 2015ed_nycNo ratings yet