Professional Documents

Culture Documents

Preliminaries - Introduction

Uploaded by

Wan HaziqCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preliminaries - Introduction

Uploaded by

Wan HaziqCopyright:

Available Formats

PRELIMINARIES

COST COMPONENT

Built up rate for Preliminaries divided into three categories:

1) INITIAL COST : associated with the expense to provide the items

that should be provided at the beginning of the contract period.

2) PROGRESSIVE COST : which are costs that occur continuously

or at certain times during the term of the contract.

3) FINAL COST : the cost to perform a task that occurs at the end of

the contract period.

There are various factors which affected the calculation of price for

Preliminaries items such as :

1) Contract Sum.

2) Size of project.

3) Complexity of project.

4) Location.

5) Site condition.

6) Construction period.

7) Etc

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

1

PRELIMINARIES

CONDITIONS OF CONTRACT

A. Document Contract

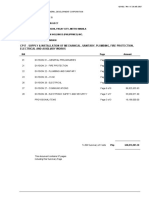

BIL ITEMS RM

1 Assumptions:

1 set of architects drawing = 20 sheets

1 set of engineers drawing = 70 sheets

Drawing price = RM6.50 / sheet

2 Document Contract (including binding) 1,500.00

3 Drawings

Architects drawing

= 20 sheets @ RM6.50 / sheet @ 2 sets 260.00

Engineers drawing

= 70 sheets @ RM6.50 / sheet @ 2 sets 910.00

4 Add 10% Overhead

Add 5% Profit

TOTAL COST

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

2

PRELIMINARIES

B. Statutory Obligations

Connection to main for services such as water reticulation,

sewerage system and etc, the fees stated in provisional sum.

Contract which exceed RM500,000.00, the contractor have to pay

0.125% levy to CIDB. If not, the penalty will apply not more than

RM50, 000.00.

http://cidbportal.aist.com.my/?q=ms/content/services-levy-payment

http://www.cidb.gov.my/v6/?q=en/faq/10

CIDB Levy

BIL ITEMS RM

1 Assumptions:

Contract Sum = RM100,000,000.00

2 Levy

= RM100,000,000.00 @ 0.125% 125,000.00

3 Add 10% Overhead

Add 5% Profit

TOTAL COST

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

3

PRELIMINARIES

C. Survey and setting out

BIL ITEMS RM

1 Professional fees for land surveyor

Initial loats the boundary 5,000.00

Gridline survey 15,000.00

2 Survey equipment

Theodolite 10,000.00

Dumpy level 3,000.00

LESS 40% credit value 5,200.00

3 Building in progress (professional fees) 15,000.00

4 Completion of project (professional fees) 5,000.00

5 Add 10% Overhead

Add 5% Profit

TOTAL COST

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

4

PRELIMINARIES

D. Insurance of Public Liability

Contractor is liable towards accident and death of public and any

damages of work while doing construction on site because the

negligence from contractor or sub-contractor.

Coverage for insurance of public liability based on risk factors such

as the causes of risk, safety on site, public access, site condition,

type of works and plant used.

BIL ITEMS RM

1 Assumption:

Rate = RM2,000.00/year for each RM100,000.00

limitation of liability (including 25% of insurance

agents' commissions)

Limitation of liability = RM500,000.00

Construction Period = 2 years

2 Premium

RM10,000.00 @ 2 years 20,000.00

6% goods and service tax 600.00

Duty stamp 10.00

20,610.00

3 Add 10% Overhead

Add 5% Profit

TOTAL COST

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

5

PRELIMINARIES

E. Workmen Compensation

Cover compensation for the workers which salary exceeds

RM2000.00/month.

However, this item not inserted in the Preliminaries because the

change of standard form of contract PWD 203A.

Contractors can price this item under Overhead.

BIL ITEMS RM

1 Assumption:

Rate = 2% (1-3% depends on type of work)

Estimate total workers salary (exceed

RM2,000.00/month) = 10-25% of contract sum.

2 Premium

3% (RM10,000,000.00 x 10%) 30,000.00

6% goods and service tax 600.00

Duty stamp 10.00

30,610.00

3 Add 10% Overhead

Add 5% Profit

TOTAL COST

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

6

PRELIMINARIES

F. Employees Social Security Act 1969

Cover compensation for the workers which salary NOT exceeds

RM2000.00/month.

The contractors need to be registered under PERKESO

(Pertubuhan Keselamatan Sosial) and paid the monthly

contributions.

There are two (2) types of Social Security Protection Scheme

which are :

o Employment Injury Scheme & Invalidity Scheme

Contribution = Workers (0.50%) and Employer (1.75%)

o Employment Injury Scheme ONLY (for the worker which

exceed 55 years old and workers which not contribute to

both scheme before 50 years old).

Contribution = Employer (1.75%)

BIL ITEMS RM

1 Assumption:

Numbers of skilled workers = 30 people

Numbers of unskilled workers = 45 people

Average salary of skilled workers = RM80.00/day

Average salary of unskilled workers = RM45.00/day

Working days = 26 days/month

Employers contribution = 1.75%

2 Estimated monthly income

Skilled workers

= 30 people @ RM80.00/day @ 26 days/month 62,400.00

Unskilled workers

= 45 people @ RM45.00/day @ 26 days/month 52,650.00

115,050.00

3 Estimated income per 1 year

RM115,050.00 @ 24 months 2,761,200.00

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

7

PRELIMINARIES

4 Contribution of contractor per 1 year

= 1.75% @ 2,761,200.00 48,321.00

5 Add 10% Overhead

Add 5% Profit

TOTAL COST

Rate of contributions available at

http://www.perkeso.gov.my/en/social-security-protection/employer-employee-eligibilty/rate-

of-contributions.html

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

8

PRELIMINARIES

G. Foreign Workers Insurance

Foreign Worker Insurance Guarantee is a guarantee required by

Immigration Department under Regulation 21 of the Immigration

Regulations from Employers as a security deposit for the

employment of foreign workmen in various sectors.

In the event that any of the foreign workman (men) is/are to be

repatriated to their home country, this insurance serves as a

guarantee to the Director General of Immigration Department up to

the maximum aggregate sum of the guarantee value.

Sources : https://www.msig.com.my/business-insurance/products/foreign-worker-insurance-scheme/

BIL ITEMS RM

1 Assumption:

Number of foreign workers = 20 people

Construction period = 2 years

2 Premium (depends on the insurance institution)

RM72.00 @ 20 people @ 2 years 2,880.00

6% goods and service tax 172.80

Duty stamp 10.00

3,062.80

3 Add 10% Overhead

Add 5% Profit

TOTAL COST

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

9

PRELIMINARIES

H. Insurance of Works

Contractors have to insured the loss and damage on works

because of fir, lightning, explosion, etc. before start the works.

Premium will be calculated as per :

o Rate @ Amount Insured.

The rate will depends on :

o Type the use of the building

o Type of construction

o Class of city

BIL ITEMS RM

1 Assumption:

Rate = 0.25% (0.10-0.50% depends on 3 criteria

above)

2 Premium

0.25% @ RM10,000,000.00 25,000.00

6% goods and service tax 600.00

Duty stamp 10.00

25,610.00

3 Add 10% Overhead

Add 5% Profit

TOTAL COST

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

10

PRELIMINARIES

J. Contractors All Risks (CAR)

Contractors are permitted to take CAR in order to cover the

insurance for Public Liability and Works.

Premium will be calculated as per :

o Rate @ Amount Insured.

The rate will depends on the type of construction example :

o Residential = 0.20%

o Road = 0.30%

*depends on the insurance institution

BIL ITEMS RM

1 Assumption:

Professional fees = 10% of the contract sum

Rate = 0.20%

2 Amount Insured

Contract Sum 10,000,000.00

Cleaning debris 50,000.00

Professional fees 1,000,000.00

11,050,000.00

3 Premium

0.20% @ RM11,050,000.00 22,100.00

6% goods and service tax 1,326.00

Duty stamp 10.00

23,436.00

4 Add 10% Overhead

Add 5% Profit

TOTAL COST

DQS281 MEASUREMENT OF CONSTRUCTION WORKS IV

COST ANALYSIS

11

You might also like

- Section 1 - PreliminariesDocument284 pagesSection 1 - PreliminariesNor Nadhirah NadzreyNo ratings yet

- Approximate QuantitiesDocument5 pagesApproximate QuantitiesRanjith Ekanayake50% (2)

- Dqs389-Interim PaymentDocument31 pagesDqs389-Interim Paymentillya amyraNo ratings yet

- Cost Analysis and Benchmarking 1st Edition RicsDocument45 pagesCost Analysis and Benchmarking 1st Edition RicsZzzdddNo ratings yet

- Take Off List Framed Structure. WestgatecghhhiDocument11 pagesTake Off List Framed Structure. WestgatecghhhiTashamiswa MajachaniNo ratings yet

- Schedule of RatesDocument42 pagesSchedule of RatesShaukat Ali KhanNo ratings yet

- Calculating Labour and Material Cost FluctuationsDocument10 pagesCalculating Labour and Material Cost FluctuationsChinthaka AbeygunawardanaNo ratings yet

- BILLS OF QUANTITIES – PRICING PREAMBLESDocument21 pagesBILLS OF QUANTITIES – PRICING PREAMBLESYash SharmaNo ratings yet

- Dayang Sabriah Safri MFKA2009Document114 pagesDayang Sabriah Safri MFKA2009Muhammad AmirNo ratings yet

- To Give A Reasonably Accurate Idea of The CostDocument6 pagesTo Give A Reasonably Accurate Idea of The Costmichael_angelo_pangilinan9286No ratings yet

- Contract Payment Questions AnsweredDocument8 pagesContract Payment Questions Answeredaniza zazaNo ratings yet

- 16a Bill 1 PreliminariesDocument41 pages16a Bill 1 PreliminariesdophongxdNo ratings yet

- 03 - Condition of Tendering - 593.plumbing & SanitaryDocument5 pages03 - Condition of Tendering - 593.plumbing & SanitaryMohd AlfitriNo ratings yet

- 03 Interim ValuationsDocument26 pages03 Interim ValuationsAkeel AyashNo ratings yet

- Letter of InvitationDocument6 pagesLetter of InvitationfgfNo ratings yet

- Modern Agro Project ReportDocument47 pagesModern Agro Project ReportCik Sri Syarifah100% (1)

- Practice Notes FOR Quantity Surveyors: Cost Control and Financial StatementsDocument7 pagesPractice Notes FOR Quantity Surveyors: Cost Control and Financial StatementsAliNo ratings yet

- Contract. EthicsDocument27 pagesContract. EthicsNeib Kriszah AlbisNo ratings yet

- PQQ Evaluation Matrix and GuidelinesDocument25 pagesPQQ Evaluation Matrix and GuidelinesKaranjit SigotNo ratings yet

- Construction Management Assignment GuideDocument8 pagesConstruction Management Assignment GuideArslan TahirNo ratings yet

- Tendering Estimating Assignment 01Document10 pagesTendering Estimating Assignment 01LokuliyanaN100% (1)

- Questionnaire For Quantity SurveyorDocument6 pagesQuestionnaire For Quantity SurveyorhismaNo ratings yet

- Tutorial 5 AnswerDocument3 pagesTutorial 5 AnswerYougoige LowNo ratings yet

- Report on Quantity Surveying Project Highlighting Constraints and Skills AcquiredDocument21 pagesReport on Quantity Surveying Project Highlighting Constraints and Skills Acquiredyouth initiatives mhondoro100% (1)

- Proposed Pavilion at Cooray Play Ground Final BillDocument44 pagesProposed Pavilion at Cooray Play Ground Final BillSanjeewa Kulasooriya0% (1)

- Interim Valuation Format - Lump Sum ContractDocument394 pagesInterim Valuation Format - Lump Sum ContractKumuduhasa Pathirana50% (2)

- Final AccountsDocument2 pagesFinal AccountsrachuNo ratings yet

- BESMM4 1-41 Sections PricedDocument132 pagesBESMM4 1-41 Sections PricedJimoh SodiqNo ratings yet

- What Is The Meaning of Variation OrderDocument2 pagesWhat Is The Meaning of Variation OrderFaty BercasioNo ratings yet

- Topic 2 - Cost IndexDocument26 pagesTopic 2 - Cost IndexAlwin ChgNo ratings yet

- 001 - Flow Chart Under Fidic 1987Document16 pages001 - Flow Chart Under Fidic 1987JobJobNo ratings yet

- Quantity Surveyor Practice AssignmentDocument16 pagesQuantity Surveyor Practice AssignmentThilina Fernando100% (1)

- DQS360 Tutorial 5 Constraints & Basic Features of Project SoftwareDocument3 pagesDQS360 Tutorial 5 Constraints & Basic Features of Project Softwarelily0% (1)

- Listing Roof Trusses JKRDocument12 pagesListing Roof Trusses JKRSyamil DzulfidaNo ratings yet

- SR (1) .Quantity SurveyorDocument4 pagesSR (1) .Quantity SurveyorpoplinuiytNo ratings yet

- De Assignment (FINAL)Document21 pagesDe Assignment (FINAL)ChungHuiPing100% (1)

- Ashgal Document PDFDocument182 pagesAshgal Document PDFmamman64No ratings yet

- Quantity Surveying GUDocument24 pagesQuantity Surveying GUTigst Tigst YzachewNo ratings yet

- Firm's References for Pier Construction Supervision ProjectDocument18 pagesFirm's References for Pier Construction Supervision ProjectMwesigwa DaniNo ratings yet

- Wages Report 2011Document321 pagesWages Report 2011Clemence TanNo ratings yet

- Preliminary Cost Estimate for Proposed BuildingDocument3 pagesPreliminary Cost Estimate for Proposed BuildingAdib HilmanNo ratings yet

- Quantity Surveying PracticesDocument4 pagesQuantity Surveying PracticesHimal Nilanka Rathnayaka0% (1)

- SBEC 2312 Lecture 2 PDFDocument25 pagesSBEC 2312 Lecture 2 PDFnzy06No ratings yet

- KLCC & KLCC Convention Centre Fire Safety TourDocument13 pagesKLCC & KLCC Convention Centre Fire Safety TourXin Min ChongNo ratings yet

- @qlassicDocument3 pages@qlassicNorizam AyobNo ratings yet

- Variations OrdersDocument11 pagesVariations OrdersGiora RozmarinNo ratings yet

- Botswana - Guideline 5 - Planning and Environmental Impact (2001)Document108 pagesBotswana - Guideline 5 - Planning and Environmental Impact (2001)وردة حزيرانNo ratings yet

- Measure and Pay Contracts ExplainedDocument3 pagesMeasure and Pay Contracts ExplainedRanjith Ekanayake100% (2)

- Preamble Civil 2008Document4 pagesPreamble Civil 2008erickyfmNo ratings yet

- Effects of Variation OrdersDocument3 pagesEffects of Variation OrdersNicoletaLiviaNo ratings yet

- Measuring Building Perimeters and Centrelines - Worked Examples PDFDocument22 pagesMeasuring Building Perimeters and Centrelines - Worked Examples PDFEzra MeshackNo ratings yet

- Bill of QuantitiesDocument9 pagesBill of QuantitiesEnaleen TuplanoNo ratings yet

- 0.quantification and Costing - Slides - Lvl3Document19 pages0.quantification and Costing - Slides - Lvl3xyzhyn100% (1)

- Quantity Measurement (Substructure)Document3 pagesQuantity Measurement (Substructure)muhdakmaladnanNo ratings yet

- Microsoft Powerpoint - Chapter 6 - Tender Documentation.Document53 pagesMicrosoft Powerpoint - Chapter 6 - Tender Documentation.Azzri FazrilNo ratings yet

- Comparison Standard Form Nazib FaizalDocument9 pagesComparison Standard Form Nazib FaizalJames YapNo ratings yet

- New Guidelines Streamline Landed Home ExtensionsDocument24 pagesNew Guidelines Streamline Landed Home ExtensionsH C YeoNo ratings yet

- Apsr Sor2010Document118 pagesApsr Sor2010Hemant Sharma100% (1)

- La Vida Project - RevisionDocument109 pagesLa Vida Project - RevisionBernard PanchoNo ratings yet

- One Short Engineering: Daily Site Diary 3/9/2021Document1 pageOne Short Engineering: Daily Site Diary 3/9/2021Wan HaziqNo ratings yet

- PROTELLUS-Variation Order No.1Document7 pagesPROTELLUS-Variation Order No.1Wan HaziqNo ratings yet

- Coastal Protection Structures GuideDocument7 pagesCoastal Protection Structures GuideWan HaziqNo ratings yet

- How To Have An Effective RehearselDocument10 pagesHow To Have An Effective RehearselWan HaziqNo ratings yet

- Applying Method Related Charges in Civil EngineeringDocument15 pagesApplying Method Related Charges in Civil EngineeringWan Haziq100% (1)

- Harbours, Ports and Jetties: A GuideDocument4 pagesHarbours, Ports and Jetties: A GuideWan HaziqNo ratings yet

- Case Study of Tiana, Elmina Garden As BTS DevelopmentDocument18 pagesCase Study of Tiana, Elmina Garden As BTS DevelopmentWan HaziqNo ratings yet

- iWash Auto Care Company AnalysisDocument19 pagesiWash Auto Care Company AnalysisWan Haziq100% (3)

- ECA Template FormDocument4 pagesECA Template FormLi Ping100% (2)

- Telecommunication PosterDocument3 pagesTelecommunication PosterWan HaziqNo ratings yet

- About Energy DrinksDocument10 pagesAbout Energy DrinksWan HaziqNo ratings yet

- IoT Facilitates Construction Teams in Delivering Projects on TimeDocument17 pagesIoT Facilitates Construction Teams in Delivering Projects on TimeWan HaziqNo ratings yet

- Owners Not Liable for Contractor's NegligenceDocument7 pagesOwners Not Liable for Contractor's NegligenceWan Haziq100% (1)

- Factors Affecting Safety and Health Amongst Workers in Construction SiteDocument13 pagesFactors Affecting Safety and Health Amongst Workers in Construction SiteWan HaziqNo ratings yet

- Costing - Road & HarstandingDocument7 pagesCosting - Road & HarstandingWan HaziqNo ratings yet

- Example of Foreign WorkersDocument24 pagesExample of Foreign WorkersWan HaziqNo ratings yet

- Pam 98 Form of ContractDocument40 pagesPam 98 Form of ContractWan Haziq0% (1)

- The Surveyor (2008)Document216 pagesThe Surveyor (2008)Wan HaziqNo ratings yet

- Project Management - ControllingDocument16 pagesProject Management - ControllingWan HaziqNo ratings yet

- CERC Order on Adani Power Petition for Tariff RevisionDocument94 pagesCERC Order on Adani Power Petition for Tariff RevisionPranay GovilNo ratings yet

- MBA Financial Management Chapter 1 OverviewDocument80 pagesMBA Financial Management Chapter 1 Overviewadiba10mkt67% (3)

- Exposing the Financial Core of the Transnational Capitalist ClassDocument26 pagesExposing the Financial Core of the Transnational Capitalist ClassMichinito05No ratings yet

- Lady M Confections case discussion questions and valuation analysisDocument11 pagesLady M Confections case discussion questions and valuation analysisRahul Sinha40% (10)

- Organization & EthicsDocument11 pagesOrganization & EthicsAvijeet ChowdhuryNo ratings yet

- Reaction PaperDocument2 pagesReaction PaperPark Be HarvNo ratings yet

- IOE425 Syllabus Winter 2017 002 v1.1Document7 pagesIOE425 Syllabus Winter 2017 002 v1.1jstnjoseNo ratings yet

- Financial Ratio Analysis of Dabur India LimitedDocument44 pagesFinancial Ratio Analysis of Dabur India LimitedRajesh Kumar roulNo ratings yet

- Franchising in PhilippinesDocument17 pagesFranchising in PhilippinesJohn PublicoNo ratings yet

- Project Synopses:: School ERP SystemDocument4 pagesProject Synopses:: School ERP SystemHarish KatheNo ratings yet

- Form 6 (Declaration of Compliance)Document1 pageForm 6 (Declaration of Compliance)Zaim AdliNo ratings yet

- Application Form Application Form: Bologna Bologna November NovemberDocument4 pagesApplication Form Application Form: Bologna Bologna November NovemberKiran MalviyaNo ratings yet

- Bicolandia Drug Vs CirDocument6 pagesBicolandia Drug Vs CiritatchiNo ratings yet

- Auditing Theory Cabrera ReviewerDocument49 pagesAuditing Theory Cabrera ReviewerCazia Mei Jover81% (16)

- Pt. Shantui Indonesia: InvoiceDocument5 pagesPt. Shantui Indonesia: InvoiceTOBI RIANTONo ratings yet

- Abbott Vascular Coronary Catheter FSN 3-16-17Document7 pagesAbbott Vascular Coronary Catheter FSN 3-16-17medtechyNo ratings yet

- Tally 7.2Document38 pagesTally 7.2sarthakmohanty697395No ratings yet

- Group8 StayZIllaDocument8 pagesGroup8 StayZIllaRibhav KhattarNo ratings yet

- Farrukh Mushtaq ResumeDocument2 pagesFarrukh Mushtaq ResumeFarrukh M. MirzaNo ratings yet

- Lecture 12 Structural Identification and EstimationDocument211 pagesLecture 12 Structural Identification and Estimationfarhad shahryarpoorNo ratings yet

- GR 177592 Alilin v. Petron, 2014Document2 pagesGR 177592 Alilin v. Petron, 2014Ellis LagascaNo ratings yet

- Boots Case StudyDocument4 pagesBoots Case StudyGeorge Lugembe MalyetaNo ratings yet

- SMART DISHA ACADEMY CAPITAL MARKET AND DERIVATIVE MARKET MODULE TESTDocument7 pagesSMART DISHA ACADEMY CAPITAL MARKET AND DERIVATIVE MARKET MODULE TESTVaghela RavisinhNo ratings yet

- Answers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. ADocument13 pagesAnswers To Multiple Choice - Theoretical: 1. A 6. B 2. D 7. C 3. A 8. C 4. C 9. A 5. A 10. AMaica GarciaNo ratings yet

- Auditor-General's ReportDocument91 pagesAuditor-General's ReportAnthony PindaNo ratings yet

- Transaction Banking Trends in Transaction Banking Report Survey Report v21Document16 pagesTransaction Banking Trends in Transaction Banking Report Survey Report v21Shifat HasanNo ratings yet

- Ias8 PDFDocument3 pagesIas8 PDFNozipho MpofuNo ratings yet

- Group Directory: Commercial BankingDocument2 pagesGroup Directory: Commercial BankingMou WanNo ratings yet

- Garment On Hanger SystemsDocument8 pagesGarment On Hanger SystemspithalokaNo ratings yet

- Information Governance Analysis and StrategyDocument44 pagesInformation Governance Analysis and StrategyJem MadriagaNo ratings yet