Professional Documents

Culture Documents

Cap 1 Tablas

Uploaded by

ar_alcari0 ratings0% found this document useful (0 votes)

30 views20 pagesTabla Cap. 1 Finanza para directivos

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTabla Cap. 1 Finanza para directivos

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views20 pagesCap 1 Tablas

Uploaded by

ar_alcariTabla Cap. 1 Finanza para directivos

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 20

A B C D E F G

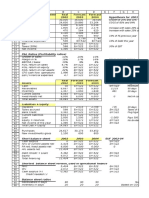

1 Profit and Loss Statement

2 (thousand of euros) 2000 2001 2002 2000 2001

3 Sales 10,000 20,000 30,000 100% 100%

4 COGS 8,000 16,200 24,600 80% 81%

5 Gross Margin 2,000 3,800 5,400 20% 19%

6 Salaries 200 1,000 1,800 2% 5%

7 Overhead 100 385 470 1% 2%

8 EBITDA 1,700 2,415 3,130 17% 12%

9 Depreciation 500 550 600 5% 3%

10 EBIT 1,200 1,865 2,530 12% 9%

11 Financial expenses Err:522 Err:522 Err:522 Err:522 Err:522

12 EBT Err:522 Err:522 Err:522 Err:522 Err:522

13 Taxes (30%) Err:522 Err:522 Err:522 Err:522 Err:522

14 Net Income Err:522 Err:522 Err:522 Err:522 Err:522

15

16 P&L Ratios (Profitability ratios)

17 Growth of sales 150% 100% 50%

18 Margin in % 20% 19% 18% Gross margin / Sales

19 EBITDA / Sales 17% 12% 10%

20 ROS, return on sales Err:522 Err:522 Err:522 Net income / Sales

21 ROE, return on equity Err:522 Err:522 Err:522 Net income / Equity

22 ROA, return on net assets Err:522 Err:522 Err:522 EBIT / Net assets

23 CFO cash flow from operati Err:522 Err:522 Err:522 Net income + depreciation

24 EBIT/ Financial expenses Err:522 Err:522 Err:522

25

26

27 Assets 2000 2001 2002 SUF 2000-02

28 Cash Err:522 Err:522 Err:522 Err:522

29 Receivables 1,667 3,333 6,667 5,000

30 Inventory 667 1,350 1,367 700

31 Current assets, CA Err:522 Err:522 Err:522

32 Fixed Assets net, FA 5,000 5,500 6,000 1,000

33 Total assets Err:522 Err:522 Err:522

34

35 Liabilities + Equity

36 Payables 720 1,407 2,051 1,332

37 Taxes accrued Err:522 Err:522 Err:522 Err:522

38 Bank Credit Err:522 Err:522 Err:522 Err:522

39 Current liabilities Err:522 Err:522 Err:522

40 Loan 3,000 2,500 2,000 -1,000

41 Equity + reserves 3,000 Err:522 Err:522 Err:522

42 Net income of the year Err:522 Err:522 Err:522 Err:522

43 Total Liab.+ Equity Err:522 Err:522 Err:522

44

45 Purchases 8,637 16,883 24,617

46 New investments gross 1,050 1,100 Variation net assets + depreciation

47

48 Short balance sheet 2000 2001 2002 SUF 2000-02

49 Cash surplus Err:522 Err:522 Err:522 Err:522

50 NFO or current assets net Err:522 Err:522 Err:522 Err:522

51 FA or fixed assets net 5,000 5,500 6,000 1,000

52 NA, net assets Err:522 Err:522 Err:522

53

54 D, Debt Err:522 Err:522 Err:522 Err:522

55 E, Equity Err:522 Err:522 Err:522 Err:522

56 Total financing Err:522 Err:522 Err:522

57

58 Shortest balance sheet version, used in operational finance

59 NFO Err:522 Err:522 Err:522 Err:522

60 WC Err:522 Err:522 Err:522 Err:522

61 Cash surplus (+) Err:522 Err:522 Err:522 Err:522

62 Credit needed (-)

63

64 Balance sheet ratios

65 Receivables in days 60 60 80 Using 360 days

66 Inventory in days 30 30 20 Based on COGS of this year

67 Payables in days 30 30 30

68 NFO / Sales in % Err:522 Err:522 Err:522

A B C D E F G

69 Leverage = Liab. / Equity Err:522 Err:522 Err:522

70 Debt / Ebitda Err:522 Err:522 Err:522

H

1

2 2002

3 100%

4 82%

5 18%

6 6%

7 2%

8 10%

9 2%

10 8%

11 Err:522

12 Err:522

13 Err:522

14 Err:522

15

16

17

Gross margin /18 Sales

19

Net income / Sales20

Net income / Equity

21

22

Net income + 23 depreciation

24

25

26

SUF 2000-02

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

Variation net assets

46+ depreciation

47

SUF 2000-02

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

Using

65 360 days

Based on COGS 66 of this year

67

68

H

69

70

A B C D E F G H

1 Profit and Loss Statement

2 (millio of euros) 2000 2001 2002 2000 2001 2002

3 Sales 87,000 84,016 74,233 100% 100% 100%

4 COGS 63,895 60,810 53,350

5 Gross Margin 23,105 23,206 20,883

6 Marketing, selling and administra 10,376 11,329 10,200

7 Other operating expenses 6,782 5,819 5,067

8 EBITDA 5,947 6,058 5,616

9 Depreciation 6,264 4,126 3,334

10 EBIT -317 1,932 2,282

11 Financial income 2,995 1,543 1,090

12 EBT 2,678 3,475 3,372

13 Taxes 781 849 867

14 Minorities 191 -29 -60

15 Net Income 2,088 2,597 2,445

16

17 P&L Ratios (Profitability ratios)

18 Growth of sales

19 Margin in % Gross margin / sales

20 EBITDA / Sales

21 ROS, return on sales Net income / sales

22 ROE, return on equity Net income / equity

23 ROA, return on net assets EBIT / Net assets

24 CFO cash flow from operations Net income + depreciation

25 EBIT/ Financial expenses na na na

26

27

28 Assets 2000 2001 2002 SUF 2003-01

29 Cash 8,593 11,595 12,799

30 Receivables 29,014 21,795 20,324

31 Inventory 13,406 10,672 10,366

32 Current assets 51,013 44,062 43,489

33 Fixed Assets net 39,105 33,877 34,116

34 Total assets 90,118 77,939 77,605

35

36 Liabilities + Equity

37 Payables 10,798 8,649 8,404

38 Taxes accrued 754 661 870

39 Bank Credit 32,972 25,402 22,754

40 Current liabilities 44,524 34,712 32,028

41 Loan 17,762 19,165 21,228

42 Equity + reserves 25,744 21,465 21,904

43 Net income of the year 2,088 2,597 2,445

44 Total Liab.+ Equity 90,118 77,939 77,605

45

46 Purchases

47 New investments gross Variation assets net + depreciation

48

49 Short balance sheet 2001 2002 2003 SUF 2003-01

50 Cash surplus

51 NFO or current assets net

52 FA or fixed assets net

53 NA, net assets

54

55 Debt

56 Equity

57 Total financing

58

59 Shortest balance sheet version, used in operational finance

60 NFO

61 WC

62 Cash surplus (+)

63 Credit needed (-)

64 Verify: Credit - Cash = It must be same result as in line 62.

65

66 Balance sheet ratios

67 Receivables in days

68 Inventory in days

69 Payables in days

70 NFO / Sales in %

71 Leverage = Liab. / Equity

72 Debt / Ebitda

73

A B C D E F G H

74

75

76

77

78 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

79

80

81 1. Big numbers

82 Margin and operating expenses. Big depreciation but decreasing. Big finamncial income, but decreasing

83 The financial income is not coherent with the cash in the BS and with debt. We should ask the co.

84

85 2. Sales and growth

86 Big decline in sales. Negative sign. The company must be abandon some products or markets.

87

88 3. Margin and evolution

89 Stable margin at 28%. Good sign.

90

91 4. Ebitda / Sales

92 Big operating and selling expenses, decreasing in $, but not in % over sales. Negative

93 Ebitda / Sales increasin slightly

94

95 5. ROS

96 ROS increasing, thanks to big decrease in depreciation and big financial income.

97 It seems that the company makes money with the financing side rather than the productioon side

98

99 6. ROE

100 Increasing ROE, due to slight increase in net income and big decrease in equity

101

102 7. Financial expenses

103 None. Financial income is much bigger than financial expenses.

104

105 8. Net income and CFO

106 CFO decreasing. It is about one fifth of the debt

107 9. Risks

108

109 10. ROA

110 The ROA is rather small, compared with other alternative investments (like the stock market)

111 Again, the profit comes from financial business rather than production business

112

113 Summary

114 The company seems to be under restructuring, with decreasin sales and expenses.

115 Now, it is out of the red figures. Reasonable ROE. Most of the profit comes from financial operations.

116

117

118 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

119

120 1. Big numbers

121 In the short balance sheet we see the main investment, NFO 34 billion and FA 34 billion

A B C D E F G H

1 Profit and Loss Statement

2 (million of euros) 2000 2001 2002 2000 2001 2002

3 Sales 87,000 84,016 74,233 100% 100% 100%

4 COGS 63,895 60,810 53,350 73% 72% 72%

5 Gross Margin 23,105 23,206 20,883 27% 28% 28%

6 Marketing, selling and administra 10,376 11,329 10,200 12% 13% 14%

7 Other operating expenses 6,782 5,819 5,067 8% 7% 7%

8 EBITDA 5,947 6,058 5,616 7% 7% 8%

9 Depreciation 6,264 4,126 3,334 7% 5% 4%

10 EBIT -317 1,932 2,282 0% 2% 3%

11 Financial income 2,995 1,543 1,090 3% 2% 1%

12 EBT 2,678 3,475 3,372 3% 4% 5%

13 Taxes 781 849 867 1% 1% 1%

14 Minorities 191 -29 -60 0% 0% 0%

15 Net Income 2,088 2,597 2,445 2% 3% 3%

16

17 P&L Ratios (Profitability ratios)

18 Growth of sales -3% -12%

19 Margin in % 27% 28% 28% Gross margin / sales

20 EBITDA / Sales 7% 7% 8%

21 ROS, return on sales 2.4% 3.1% 3.3% Net income / sales

22 ROE, return on equity 8% 12% 11% Net income / equity

23 ROA, return on net assets 0% 3% 3% EBIT / Net assets

24 CFO cash flow from operations 8,352 6,723 5,779 Net income + depreciation

25 EBIT/ Financial expenses na na na

26

27

28 Assets 2000 2001 2002 SUF 2003-01

29 Cash 8,593 11,595 12,799 4,206

30 Receivables 29,014 21,795 20,324 -8,690

31 Inventory 13,406 10,672 10,366 -3,040

32 Current assets 51,013 44,062 43,489

33 Fixed Assets net 39,105 33,877 34,116 -4,989

34 Total assets 90,118 77,939 77,605

35

36 Liabilities + Equity

37 Payables 10,798 8,649 8,404 -2,394

38 Taxes accrued 754 661 870 116

39 Bank Credit 32,972 25,402 22,754 -10,218

40 Current liabilities 44,524 34,712 32,028

41 Loan 17,762 19,165 21,228 3,466

42 Equity + reserves 25,744 21,465 21,904 -3,840

43 Net income of the year 2,088 2,597 2,445 357

44 Total Liab.+ Equity 90,118 77,939 77,605

45

46 Purchases 63,895 58,076 53,044

47 New investments gross -1,102 3,573 Variation assets net + depreciation

48

49 Short balance sheet 2001 2002 2003 SUF 2003-01

50 Cash surplus 8,593 11,595 12,799 4,206

51 NFO or current assets net 30,868 23,157 21,416 -9,452

52 FA or fixed assets net 39,105 33,877 34,116 -4,989

53 NA, net assets 78,566 68,629 68,331

54

55 Debt 50,734 44,567 43,982 -6,752

56 Equity 27,832 24,062 24,349 -3,483

57 Total financing 78,566 68,629 68,331

58

59 Shortest balance sheet version, used in operational finance

60 NFO 30,868 23,157 21,416 -9,452

61 WC 6,489 9,350 11,461 4,972

62 Cash surplus (+) -24,379 -13,807 -9,955 14,424

63 Credit needed (-)

64 Verify: Credit - Cash = 24,379 13,807 9,955 It must be same result as in line 62.

65

66 Balance sheet ratios

67 Receivables in days 120 93 99

68 Inventory in days 76 63 70

69 Payables in days 61 51 57

70 NFO / Sales in % 35% 28% 29%

71 Leverage = Liab. / Equity 2.2 2.2 2.2

72 Debt / Ebitda 8.5 7.4 7.8

73

A B C D E F G H

74

75

76

77

78 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

79

80

81 1. Big numbers

82 Margin and operating expenses. Big depreciation but decreasing. Big finamncial income, but decreasing

83 The financial income is not coherent with the cash in the BS and with debt. We should ask the co.

84

85 2. Sales and growth

86 Big decline in sales. Negative sign. The company must be abandon some products or markets.

87

88 3. Margin and evolution

89 Stable margin at 28%. Good sign.

90

91 4. Ebitda / Sales

92 Big operating and selling expenses, decreasing in $, but not in % over sales. Negative

93 Ebitda / Sales increasin slightly

94

95 5. ROS

96 ROS increasing, thanks to big decrease in depreciation and big financial income.

97 It seems that the company makes money with the financing side rather than the productioon side

98

99 6. ROE

100 Increasing ROE, due to slight increase in net income and big decrease in equity

101

102 7. Financial expenses

103 None. Financial income is much bigger than financial expenses.

104

105 8. Net income and CFO

106 CFO decreasing. It is about one fifth of the debt

107 9. Risks

108

109 10. ROA

110 The ROA is rather small, compared with other alternative investments (like the stock market)

111 Again, the profit comes from financial business rather than production business

112

113 Summary

114 The company seems to be under restructuring, with decreasin sales and expenses.

115 Now, it is out of the red figures. Reasonable ROE. Most of the profit comes from financial operations.

116

117

118 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

119

120 1. Big numbers

121 In the short balance sheet we see the main investment, NFO 34 billion and FA 34 billion

A B C D E F G H

1 Cuenta de Resultados

2 (miles de euros) 2000 2001 2002 2000 2001 2002

3 Ventas 10,000 20,000 30,000 100% 100% 100%

4 CMV 8,000 16,200 24,600 80% 81% 82%

5 Margen bruto 2,000 3,800 5,400 20% 19% 18%

6 Salarios 200 1,000 1,800 2% 5% 6%

7 Gastos generales 100 385 470 1% 2% 2%

8 EBITDA 1,700 2,415 3,130 17% 12% 10%

9 Amortizacin 500 550 600 5% 3% 2%

10 EBIT o BAIT 1,200 1,865 2,530 12% 9% 8%

11 Gastos financieros Err:522 Err:522 Err:522 Err:522 Err:522 Err:522

12 EBT o BAT Err:522 Err:522 Err:522 Err:522 Err:522 Err:522

13 Impuestos (30%) Err:522 Err:522 Err:522 Err:522 Err:522 Err:522

14 BN Beneficio neto Err:522 Err:522 Err:522 Err:522 Err:522 Err:522

15

16 Ratios de cuenta de resultados

17 Crecimiento de ventas 150% 100% 50%

18 Margen in % 20% 19% 18% Margen bruto / ventas

19 EBITDA / ventas 17% 12% 10%

20 ROS, rentabilidad s/ ventas Err:522 Err:522 Err:522 Beneficio neto / ventas

21 ROE, rentab. recursos propi Err:522 Err:522 Err:522 Beneficio neto / recursos propios

22 ROA, rentabilidad activo Err:522 Err:522 Err:522 EBIT / activo neto

23 CFO cash flow operaciones Err:522 Err:522 Err:522 Beneficio neto + amortizacin

24 EBIT/ intereses Err:522 Err:522 Err:522

25

26

27 Activo 2000 2001 2002 COAF 2000-02

28 Caja Err:522 Err:522 Err:522 Err:522

29 Clientes 1,667 3,333 6,667 5,000

30 Existencias 667 1,350 1,367 700

31 Activo circulante, AC Err:522 Err:522 Err:522

32 Activo fijo neto, AF 5,000 5,500 6,000 1,000

33 Activo total Err:522 Err:522 Err:522

34

35 Pasivo

36 Proveedores 720 1,407 2,051 1,332

37 Impuestos a pagar Err:522 Err:522 Err:522 Err:522

38 Crdito bancario Err:522 Err:522 Err:522 Err:522

39 Pasivo circulantes Err:522 Err:522 Err:522

40 Prstamo bancario 3,000 2,500 2,000 -1,000

41 Recursos propios 3,000 Err:522 Err:522 Err:522

42 Beneficio del ao Err:522 Err:522 Err:522 Err:522

43 Total pasivo Err:522 Err:522 Err:522

44

45 Compras 8,637 16,883 24,617

46 Nueva inversin bruta 1,050 1,100 Variacin de activo + amortizacin

47

48 Balance resumido 2000 2001 2002 COAF 2000-02

49 Caja excedente Err:522 Err:522 Err:522 Err:522

50 NOF o circulante neto Err:522 Err:522 Err:522 Err:522

51 AF o activo fijo neto 5,000 5,500 6,000 1,000

52 AN o activos netos Err:522 Err:522 Err:522

53

54 Deuda (a largo y corto) Err:522 Err:522 Err:522 Err:522

55 Recursos propios + Benefic Err:522 Err:522 Err:522 Err:522

56 Total financiacin Err:522 Err:522 Err:522

57

58 Extracto del balance usado en finanzas operativas

59 NOF Err:522 Err:522 Err:522 Err:522

60 FM Err:522 Err:522 Err:522 Err:522

61 Caja excedente (+) Err:522 Err:522 Err:522 Err:522

62 o crdito necesario (-)

63

64 Ratios de balance

65 Das de cobro 60 60 80 Con ao de 360 das

66 Das de existencias 30 30 20 Basado en CMV de este ao

67 Das de pago 30 30 30

68 NOF / Ventas en % Err:522 Err:522 Err:522

69 Apalancamiento Err:522 Err:522 Err:522

A B C D E F G H

70 Deuda / Ebitda Err:522 Err:522 Err:522

A B C D E F G H

1 Cuenta de Resultados

2 (millones de euros) 2000 2001 2002 2000 2001 2002

3 Ventas 87,000 84,016 74,233 100% 100% 100%

4 CMV 63,895 60,810 53,350

5 Margen bruto 23,105 23,206 20,883

6 Gastos de ventas y advos. 10,376 11,329 10,200

7 Otros gastos operativos 6,782 5,819 5,067

8 EBITDA 5,947 6,058 5,616

9 Amortizacin 6,264 4,126 3,334

10 EBIT -317 1,932 2,282

11 Ingresos financieros 2,995 1,543 1,090

12 EBT 2,678 3,475 3,372

13 Impuestos 781 849 867

14 Minoritarios 191 -29 -60

15 Beneficio neto 2,088 2,597 2,445

16

17 Ratios de cuenta de resultados

18 Crecimiento de ventas

19 Margen in % Margen bruto / ventas

20 EBITDA / ventas

21 ROS, rentabilidad s/ ventas Beneficio neto / ventas

22 ROE, rentab. recursos propios Beneficio neto / recursos propios

23 ROA, rentabilidad activo EBIT / activo neto

24 CFO cash flow operaciones Beneficio neto + amortizacin

25 EBIT/ intereses na na na

26

27

28 Activo 2000 2001 2002 COAF 2003-01

29 Caja 8,593 11,595 12,799

30 Clientes 29,014 21,795 20,324

31 Existencias 13,406 10,672 10,366

32 Activo circulante, AC 51,013 44,062 43,489

33 Activo fijo neto, AF 39,105 33,877 34,116

34 Activo total 90,118 77,939 77,605

35

36 Pasivo

37 Proveedores 10,798 8,649 8,404

38 Impuestos a pagar 754 661 870

39 Crdito bancario 32,972 25,402 22,754

40 Pasivo circulantes 44,524 34,712 32,028

41 Prstamo bancario 17,762 19,165 21,228

42 Recursos propios 25,744 21,465 21,904

43 Beneficio del ao 2,088 2,597 2,445

44 Total pasivo 90,118 77,939 77,605

45

46 Compras

47 Nueva inversin bruta Variacin de activo + amortizacin

48

49 Balance resumido 2001 2002 2003 COAF 2003-01

50 Caja excedente

51 NOF o circulante neto

52 AF o activo fijo neto

53 AN o activos netos

54

55 Deuda (a largo y corto)

56 Recursos propios + Beneficio

57 Total financiacin

58

59 Extracto del balance usado en finanzas operativas

60 NOF

61 FM

62 Caja excedente (+)

63 o crdito necesario (-)

64 Comprobacin: Crdito - Caja = Debe dar lo mismo que lnea 62.

65

66 Ratios de balance

67 Das de cobro

68 Das de existencias

69 Das de pago

70 NOF / Ventas en %

71 Apalancamiento

72 Deuda / Ebitda

73

A B C D E F G H

74

75 NO INCLUIR A PARTIR DE AQU

76

77

78 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

79

80

81 1. Big numbers

82 Margin and operating expenses. Big depreciation but decreasing. Big finamncial income, but decreasing

83 The financial income is not coherent with the cash in the BS and with debt. We should ask the co.

84

85 2. Sales and growth

86 Big decline in sales. Negative sign. The company must be abandon some products or markets.

87

88 3. Margin and evolution

89 Stable margin at 28%. Good sign.

90

91 4. Ebitda / Sales

92 Big operating and selling expenses, decreasing in $, but not in % over sales. Negative

93 Ebitda / Sales increasin slightly

94

95 5. ROS

96 ROS increasing, thanks to big decrease in depreciation and big financial income.

97 It seems that the company makes money with the financing side rather than the productioon side

98

99 6. ROE

100 Increasing ROE, due to slight increase in net income and big decrease in equity

101

102 7. Financial expenses

103 None. Financial income is much bigger than financial expenses.

104

105 8. Net income and CFO

106 CFO decreasing. It is about one fifth of the debt

107 9. Risks

108

109 10. ROA

110 The ROA is rather small, compared with other alternative investments (like the stock market)

111 Again, the profit comes from financial business rather than production business

112

113 Summary

114 The company seems to be under restructuring, with decreasin sales and expenses.

115 Now, it is out of the red figures. Reasonable ROE. Most of the profit comes from financial operations.

116

117

118 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

119

120 1. Big numbers

121 In the short balance sheet we see the main investment, NFO 34 billion and FA 34 billion

A B C D E F G H

1 Cuenta de Resultados

2 (millones de euros) 2000 2001 2002 2000 2001 2002

3 Ventas 87,000 84,016 74,233 100% 100% 100%

4 CMV 63,895 60,810 53,350 73% 72% 72%

5 Margen bruto 23,105 23,206 20,883 27% 28% 28%

6 Gastos de ventas y advos. 10,376 11,329 10,200 12% 13% 14%

7 Otros gastos operativos 6,782 5,819 5,067 8% 7% 7%

8 EBITDA 5,947 6,058 5,616 7% 7% 8%

9 Amortizacin 6,264 4,126 3,334 7% 5% 4%

10 EBIT -317 1,932 2,282 0% 2% 3%

11 Ingresos financieros 2,995 1,543 1,090 3% 2% 1%

12 EBT 2,678 3,475 3,372 3% 4% 5%

13 Impuestos 781 849 867 1% 1% 1%

14 Minoritarios 191 -29 -60 0% 0% 0%

15 Beneficio neto 2,088 2,597 2,445 2% 3% 3%

16

17 Ratios de cuenta de resultados

18 Crecimiento de ventas -3% -12%

19 Margen in % 27% 28% 28% Margen bruto / ventas

20 EBITDA / ventas 7% 7% 8%

21 ROS, rentabilidad s/ ventas 2.4% 3.1% 3.3% Beneficio neto / ventas

22 ROE, rentab. recursos propios 8% 12% 11% Beneficio neto / recursos propios

23 ROA, rentabilidad activo 0% 3% 3% EBIT / activo neto

24 CFO cash flow operaciones 8,352 6,723 5,779 Beneficio neto + amortizacin

25 EBIT/ intereses na na na

26

27

28 Activo 2000 2001 2002 COAF 2003-01

29 Caja 8,593 11,595 12,799 4,206

30 Clientes 29,014 21,795 20,324 -8,690

31 Existencias 13,406 10,672 10,366 -3,040

32 Activo circulante, AC 51,013 44,062 43,489

33 Activo fijo neto, AF 39,105 33,877 34,116 -4,989

34 Activo total 90,118 77,939 77,605

35

36 Pasivo

37 Proveedores 10,798 8,649 8,404 -2,394

38 Impuestos a pagar 754 661 870 116

39 Crdito bancario 32,972 25,402 22,754 -10,218

40 Pasivo circulantes 44,524 34,712 32,028

41 Prstamo bancario 17,762 19,165 21,228 3,466

42 Recursos propios 25,744 21,465 21,904 -3,840

43 Beneficio del ao 2,088 2,597 2,445 357

44 Total pasivo 90,118 77,939 77,605

45

46 Compras 63,895 58,076 53,044

47 Nueva inversin bruta -1,102 3,573 Variacin de activo + amortizacin

48

49 Balance resumido 2001 2002 2003 COAF 2003-01

50 Caja excedente 8,593 11,595 12,799 4,206

51 NOF o circulante neto 30,868 23,157 21,416 -9,452

52 AF o activo fijo neto 39,105 33,877 34,116 -4,989

53 AN o activos netos 78,566 68,629 68,331

54

55 Deuda (a largo y corto) 50,734 44,567 43,982 -6,752

56 Recursos propios + Beneficio 27,832 24,062 24,349 -3,483

57 Total financiacin 78,566 68,629 68,331

58

59 Extracto del balance usado en finanzas operativas

60 NOF 30,868 23,157 21,416 -9,452

61 FM 6,489 9,350 11,461 4,972

62 Caja excedente (+) -24,379 -13,807 -9,955 14,424

63 o crdito necesario (-)

64 Comprobacin: Crdito - Caja = 24,379 13,807 9,955 Debe dar lo mismo que lnea 62.

65

66 Ratios de balance

67 Das de cobro 120 93 99

68 Das de existencias 76 63 70

69 Das de pago 61 51 57

70 NOF / Ventas en % 35% 28% 29%

71 Apalancamiento 2.2 2.2 2.2

72 Deuda / Ebitda 8.5 7.4 7.8

73

A B C D E F G H

74

75

76

77 NO INCLUIR A PARTIR DE AQU

78 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

79

80

81 1. Big numbers

82 Margin and operating expenses. Big depreciation but decreasing. Big finamncial income, but decreasing

83 The financial income is not coherent with the cash in the BS and with debt. We should ask the co.

84

85 2. Sales and growth

86 Big decline in sales. Negative sign. The company must be abandon some products or markets.

87

88 3. Margin and evolution

89 Stable margin at 28%. Good sign.

90

91 4. Ebitda / Sales

92 Big operating and selling expenses, decreasing in $, but not in % over sales. Negative

93 Ebitda / Sales increasin slightly

94

95 5. ROS

96 ROS increasing, thanks to big decrease in depreciation and big financial income.

97 It seems that the company makes money with the financing side rather than the productioon side

98

99 6. ROE

100 Increasing ROE, due to slight increase in net income and big decrease in equity

101

102 7. Financial expenses

103 None. Financial income is much bigger than financial expenses.

104

105 8. Net income and CFO

106 CFO decreasing. It is about one fifth of the debt

107 9. Risks

108

109 10. ROA

110 The ROA is rather small, compared with other alternative investments (like the stock market)

111 Again, the profit comes from financial business rather than production business

112

113 Summary

114 The company seems to be under restructuring, with decreasin sales and expenses.

115 Now, it is out of the red figures. Reasonable ROE. Most of the profit comes from financial operations.

116

117

118 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

119

120 1. Big numbers

121 In the short balance sheet we see the main investment, NFO 34 billion and FA 34 billion

A B C D E F G H

1 Demonstrativo de Resultados

2 (milhares de euros) 2000 2001 2002 2000 2001 2002

3 Vendas 10,000 20,000 30,000 100% 100% 100%

4 CMV 8,000 16,200 24,600 80% 81% 82%

5 Margem bruta 2,000 3,800 5,400 20% 19% 18%

6 Salrios 200 1,000 1,800 2% 5% 6%

7 Despesas gerais 100 385 470 1% 2% 2%

8 EBITDA 1,700 2,415 3,130 17% 12% 10%

9 Amortizao 500 550 600 5% 3% 2%

10 EBIT ou BAIT 1,200 1,865 2,530 12% 9% 8%

11 Despesas financeiras Err:522 Err:522 Err:522 Err:522 Err:522 Err:522

12 EBT ou BAT Err:522 Err:522 Err:522 Err:522 Err:522 Err:522

13 Impostos (30%) Err:522 Err:522 Err:522 Err:522 Err:522 Err:522

14 LL Lucro lquido Err:522 Err:522 Err:522 Err:522 Err:522 Err:522

15

16 ndices do demonstrativo de resultados

17 Crescimento das vendas 150% 100% 50%

18 Margem em % 20% 19% 18% Margem bruta / vendas

19 EBITDA / vendas 17% 12% 10%

20 ROS, rentabilidade s/ venda Err:522 Err:522 Err:522 Lucro lquido / vendas

21 ROE, rentab. recursos prpr Err:522 Err:522 Err:522 Lucro lquido / recursos prprios

22 ROA, rentabilidade ativo Err:522 Err:522 Err:522 EBIT / ativo lquido

23 CFO cash flow operaes Err:522 Err:522 Err:522 Lucro lquido + amortizao

24 EBIT/ juros Err:522 Err:522 Err:522

25

26

27 Ativo 2000 2001 2002 COAF 2000-02

28 Caixa Err:522 Err:522 Err:522 Err:522

29 Clientes 1,667 3,333 6,667 5,000

30 Estoques 667 1,350 1,367 700

31 Ativo circulante, AC Err:522 Err:522 Err:522

32 Ativo fixo lquido, AF 5,000 5,500 6,000 1,000

33 Ativo total Err:522 Err:522 Err:522

34

35 Passivo

36 Fornecedores 720 1,407 2,051 1,332

37 Impostos a pagar Err:522 Err:522 Err:522 Err:522

38 Crdito bancrio Err:522 Err:522 Err:522 Err:522

39 Passivo circulante Err:522 Err:522 Err:522

40 Emprstimo bancrio 3,000 2,500 2,000 -1,000

41 Recursos prprios 3,000 Err:522 Err:522 Err:522

42 Lucro do ano Err:522 Err:522 Err:522 Err:522

43 Total passivo Err:522 Err:522 Err:522

44

45 Compras 8,637 16,883 24,617

46 Novo investimento bruto 1,050 1,100 Variao do ativo + amortizao

47

48 Balano resumido 2000 2001 2002 COAF 2000-02

49 Caixa excedente Err:522 Err:522 Err:522 Err:522

50 NOF ou circulante lquido Err:522 Err:522 Err:522 Err:522

51 AF ou ativo fixo lquido 5,000 5,500 6,000 1,000

52 AN ou ativo lquido Err:522 Err:522 Err:522

53

54 Dvida (a longo e a curto) Err:522 Err:522 Err:522 Err:522

55 Recursos prprios + Lucro Err:522 Err:522 Err:522 Err:522

56 Total financiamento Err:522 Err:522 Err:522

57

58 Extrato do balano utilizado em finanas operacionais

59 NOF Err:522 Err:522 Err:522 Err:522

60 CG Err:522 Err:522 Err:522 Err:522

61 Caixa excedente (+) Err:522 Err:522 Err:522 Err:522

62 ou crdito necessrio (-)

63

64 ndices do balano

65 Dias de cobrana 60 60 80 Anno de 360 das

66 Dias de estoques 30 30 20 Basado en CMV de iste anno

67 Dias de pagamento 30 30 30

68 NOF / Vendas em % Err:522 Err:522 Err:522

69 Alavancamento Err:522 Err:522 Err:522

A B C D E F G H

70 Dvida / Ebitda Err:522 Err:522 Err:522

A B C D E F G H

1 Demonstrativo de Resultados

2 (milhes de euros) 2000 2001 2002 2000 2001 2002

3 Vendas 87,000 84,016 74,233 100% 100% 100%

4 CMV 63,895 60,810 53,350

5 Margem bruta 23,105 23,206 20,883

6 Despesas de vendas e advos. 10,376 11,329 10,200

7 Outras despesas operacionais 6,782 5,819 5,067

8 EBITDA 5,947 6,058 5,616

9 Amortizao 6,264 4,126 3,334

10 EBIT -317 1,932 2,282

11 Receitas financeiras 2,995 1,543 1,090

12 EBT 2,678 3,475 3,372

13 Impostos 781 849 867

14 Minoritrios 191 -29 -60

15 Lucro lquido 2,088 2,597 2,445

16

17 ndices do demonstrativo de resultados

18 Crescimento das vendas

19 Margem em % Margem bruta / vendas

20 EBITDA / vendas

21 ROS, rentabilidade s/ vendas Lucro lquido / vendas

22 ROE, rentab. recursos prprios Lucro lquido / recursos prprios

23 ROA, rentabilidade ativo EBIT / ativo lquido

24 CFO cash flow operaes Lucro lquido + amortizao

25 EBIT/ juros na na na

26

27

28 Ativo 2000 2001 2002 COAF 2003-01

29 Caixa 8,593 11,595 12,799

30 Clientes 29,014 21,795 20,324

31 Estoques 13,406 10,672 10,366

32 Ativo circulante, AC 51,013 44,062 43,489

33 Ativo fixo lquido, AF 39,105 33,877 34,116

34 Ativo total 90,118 77,939 77,605

35

36 Passivo

37 Fornecedores 10,798 8,649 8,404

38 Impostos a pagar 754 661 870

39 Crdito bancrio 32,972 25,402 22,754

40 Passivo circulante 44,524 34,712 32,028

41 Emprstimo bancrio 17,762 19,165 21,228

42 Recursos prprios 25,744 21,465 21,904

43 Lucro do ano 2,088 2,597 2,445

44 Total passivo 90,118 77,939 77,605

45

46 Compras

47 Novo investimento bruto Variao do ativo + amortizao

48

49 Balano resumido 2001 2002 2003 COAF 2003-01

50 Caixa excedente

51 NOF ou circulante lquido

52 AF ou ativo fixo lquido

53 AN ou ativo lquido

54

55 Dvida (a longo e a curto)

56 Recursos prprios + Lucro

57 Total financiamento

58

59 Extrato do balano utilizado em finanas operacionais

60 NOF

61 CG

62 Caixa excedente (+)

63 ou crdito necessrio (-)

64 Comprovao: Crdito - Caixa = Tem de ser o mesmo nmero da linha 62.

65

66 ndices do balano

67 Dias de cobrana

68 Dias de estoques

69 Dias de pagamento

70 NOF / Vendas em %

71 Alavancamento

72 Dvida / Ebitda

73

A B C D E F G H

74

75 NO INCLUIR A PARTIR DE AQU

76

77

78 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

79

80

81 1. Big numbers

82 Margin and operating expenses. Big depreciation but decreasing. Big finamncial income, but decreasing

83 The financial income is not coherent with the cash in the BS and with debt. We should ask the co.

84

85 2. Sales and growth

86 Big decline in sales. Negative sign. The company must be abandon some products or markets.

87

88 3. Margin and evolution

89 Stable margin at 28%. Good sign.

90

91 4. Ebitda / Sales

92 Big operating and selling expenses, decreasing in $, but not in % over sales. Negative

93 Ebitda / Sales increasin slightly

94

95 5. ROS

96 ROS increasing, thanks to big decrease in depreciation and big financial income.

97 It seems that the company makes money with the financing side rather than the productioon side

98

99 6. ROE

100 Increasing ROE, due to slight increase in net income and big decrease in equity

101

102 7. Financial expenses

103 None. Financial income is much bigger than financial expenses.

104

105 8. Net income and CFO

106 CFO decreasing. It is about one fifth of the debt

107 9. Risks

108

109 10. ROA

110 The ROA is rather small, compared with other alternative investments (like the stock market)

111 Again, the profit comes from financial business rather than production business

112

113 Summary

114 The company seems to be under restructuring, with decreasin sales and expenses.

115 Now, it is out of the red figures. Reasonable ROE. Most of the profit comes from financial operations.

116

117

118 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

119

120 1. Big numbers

121 In the short balance sheet we see the main investment, NFO 34 billion and FA 34 billion

A B C D E F G H

1 Demonstrativo de Resultados

2 (milhes de euros) 2000 2001 2002 2000 2001 2002

3 Vendas 87,000 84,016 74,233 100% 100% 100%

4 CMV 63,895 60,810 53,350 73% 72% 72%

5 Margem bruta 23,105 23,206 20,883 27% 28% 28%

6 Despesas de vendas e advos. 10,376 11,329 10,200 12% 13% 14%

7 Outras despesas operacionais 6,782 5,819 5,067 8% 7% 7%

8 EBITDA 5,947 6,058 5,616 7% 7% 8%

9 Amortizao 6,264 4,126 3,334 7% 5% 4%

10 EBIT -317 1,932 2,282 0% 2% 3%

11 Receitas financeiras 2,995 1,543 1,090 3% 2% 1%

12 EBT 2,678 3,475 3,372 3% 4% 5%

13 Impostos 781 849 867 1% 1% 1%

14 Minoritrios 191 -29 -60 0% 0% 0%

15 Lucro lquido 2,088 2,597 2,445 2% 3% 3%

16

17 ndices do demonstrativo de resultados

18 Crescimento das vendas -3% -12%

19 Margem em % 27% 28% 28% Margem bruta / vendas

20 EBITDA / vendas 7% 7% 8%

21 ROS, rentabilidade s/ venda 2.4% 3.1% 3.3% Lucro lquido / vendas

22 ROE, rentab. recursos prpr 8% 12% 11% Lucro lquido / recursos prprios

23 ROA, rentabilidade ativo 0% 3% 3% EBIT / ativo lquido

24 CFO cash flow operaes 8,352 6,723 5,779 Lucro lquido + amortizao

25 EBIT/ juros na na na

26

27

28 Ativo 2000 2001 2002 COAF 2003-01

29 Caixa 8,593 11,595 12,799 4,206

30 Clientes 29,014 21,795 20,324 -8,690

31 Estoques 13,406 10,672 10,366 -3,040

32 Ativo circulante, AC 51,013 44,062 43,489

33 Ativo fixo lquido, AF 39,105 33,877 34,116 -4,989

34 Ativo total 90,118 77,939 77,605

35

36 Passivo

37 Fornecedores 10,798 8,649 8,404 -2,394

38 Impostos a pagar 754 661 870 116

39 Crdito bancrio 32,972 25,402 22,754 -10,218

40 Passivo circulante 44,524 34,712 32,028

41 Emprstimo bancrio 17,762 19,165 21,228 3,466

42 Recursos prprios 25,744 21,465 21,904 -3,840

43 Lucro do ano 2,088 2,597 2,445 357

44 Total passivo 90,118 77,939 77,605

45

46 Compras 63,895 58,076 53,044

47 Novo investimento bruto -1,102 3,573 Variao do ativo + amortizao

48

49 Balano resumido 2001 2002 2003 COAF 2003-01

50 Caixa excedente 8,593 11,595 12,799 4,206

51 NOF ou circulante lquido 30,868 23,157 21,416 -9,452

52 AF ou ativo fixo lquido 39,105 33,877 34,116 -4,989

53 AN ou ativo lquido 78,566 68,629 68,331

54

55 Dvida (a longo e a curto) 50,734 44,567 43,982 -6,752

56 Recursos prprios + Lucro 27,832 24,062 24,349 -3,483

57 Total financiamento 78,566 68,629 68,331

58

59 Extrato do balano utilizado em finanas operacionais

60 NOF 30,868 23,157 21,416 -9,452

61 CG 6,489 9,350 11,461 4,972

62 Caixa excedente (+) -24,379 -13,807 -9,955 14,424

63 ou crdito necessrio (-)

64 Comprovao: Crdito - Caixa = 24,379 13,807 9,955 Tem de ser o mesmo nmero da linha 62.

65

66 ndices do balano

67 Dias de cobrana 120 93 99

68 Dias de estoques 76 63 70

69 Dias de pagamento 61 51 57

70 NOF / Vendas em % 35% 28% 29%

71 Alavancamento 2.2 2.2 2.2

72 Dvida / Ebitda 8.5 7.4 7.8

73

A B C D E F G H

74

75

76

77 NO INCLUIR A PARTIR DE AQU

78 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

79

80

81 1. Big numbers

82 Margin and operating expenses. Big depreciation but decreasing. Big finamncial income, but decreasing

83 The financial income is not coherent with the cash in the BS and with debt. We should ask the co.

84

85 2. Sales and growth

86 Big decline in sales. Negative sign. The company must be abandon some products or markets.

87

88 3. Margin and evolution

89 Stable margin at 28%. Good sign.

90

91 4. Ebitda / Sales

92 Big operating and selling expenses, decreasing in $, but not in % over sales. Negative

93 Ebitda / Sales increasin slightly

94

95 5. ROS

96 ROS increasing, thanks to big decrease in depreciation and big financial income.

97 It seems that the company makes money with the financing side rather than the productioon side

98

99 6. ROE

100 Increasing ROE, due to slight increase in net income and big decrease in equity

101

102 7. Financial expenses

103 None. Financial income is much bigger than financial expenses.

104

105 8. Net income and CFO

106 CFO decreasing. It is about one fifth of the debt

107 9. Risks

108

109 10. ROA

110 The ROA is rather small, compared with other alternative investments (like the stock market)

111 Again, the profit comes from financial business rather than production business

112

113 Summary

114 The company seems to be under restructuring, with decreasin sales and expenses.

115 Now, it is out of the red figures. Reasonable ROE. Most of the profit comes from financial operations.

116

117

118 QUESTIONS. Analysis of the P&L (for 2003 and recent evolution)

119

120 1. Big numbers

121 In the short balance sheet we see the main investment, NFO 34 billion and FA 34 billion

You might also like

- Análisis financiero Leche Gloria 2021Document69 pagesAnálisis financiero Leche Gloria 2021Mariely Echeverría Bazan100% (1)

- Contestacion-de-Aumento-de-Pension-de-Alimentos - RoneyDocument5 pagesContestacion-de-Aumento-de-Pension-de-Alimentos - RoneyAldo Sosa Ojeda100% (2)

- Plan de Clase Filosofía Unidad IDocument5 pagesPlan de Clase Filosofía Unidad ILuis Adan Garnica Rodriguez88% (8)

- Fabulas Budistas PDFDocument14 pagesFabulas Budistas PDFEdgar ArrudaNo ratings yet

- Johnson, Samuel - Prefacio A ShakespeareDocument73 pagesJohnson, Samuel - Prefacio A ShakespeareFernando Marcelo100% (1)

- Excel Del Trabajo de Finanzas 3Document7 pagesExcel Del Trabajo de Finanzas 3Alex BustosNo ratings yet

- Exel Ejerccicio 6Document10 pagesExel Ejerccicio 6andresNo ratings yet

- Viva AirlinesDocument21 pagesViva Airlinesnatalia salcedoNo ratings yet

- Gerencia FinancieraDocument8 pagesGerencia FinancieraValen LopezNo ratings yet

- Ejem 3) - 01Document13 pagesEjem 3) - 01Juan Carlos Otrillas MendozaNo ratings yet

- Análisis Razonado76129263 202203Document13 pagesAnálisis Razonado76129263 202203Susana Alejandra Riquelme CartesNo ratings yet

- CASO M&MDocument7 pagesCASO M&MSoledad MamaniNo ratings yet

- Recuperatorio 2022 AnalisisDocument3 pagesRecuperatorio 2022 AnalisisAlejandroNo ratings yet

- Informacion Financiera Dic-2022Document17 pagesInformacion Financiera Dic-2022Yesika GalindresNo ratings yet

- Gerencia Financiera 2Document21 pagesGerencia Financiera 2Diana paola Bosa BustosNo ratings yet

- CASO 3.caso Práctico - White Owl - Envío2Document1 pageCASO 3.caso Práctico - White Owl - Envío2Yesseña MuñozNo ratings yet

- Herr y Técnicas - Por ResolverDocument3 pagesHerr y Técnicas - Por ResolverJoel ChapaNo ratings yet

- Taller Valoracion 2Document20 pagesTaller Valoracion 2Yennifer PaolaNo ratings yet

- Estados Financieros Práctica AlumnosDocument50 pagesEstados Financieros Práctica AlumnosjhosnarvzNo ratings yet

- Estados Financieros 2021Document84 pagesEstados Financieros 2021salazarromero2013No ratings yet

- Propuesta Valoración FRINOXDocument9 pagesPropuesta Valoración FRINOXJorge ArangoNo ratings yet

- Puntos 3,4, 5Document7 pagesPuntos 3,4, 5Oscar Daniel Otavo BenavidesNo ratings yet

- Caso Del Examen ParcialDocument11 pagesCaso Del Examen ParcialMIGUEL ANGEL SILVESTRE VARGASNo ratings yet

- Prueba Solemne Introduccià N A Las Finanzas Segundo Semestre 2022Document5 pagesPrueba Solemne Introduccià N A Las Finanzas Segundo Semestre 2022nicolasbarraza7No ratings yet

- Análisis Razonado90690000 202212Document20 pagesAnálisis Razonado90690000 202212Victoria CaneloNo ratings yet

- Ejercicio Práctico 4Document3 pagesEjercicio Práctico 4GreciaEcheZapataNo ratings yet

- Anexos - Estados FinancierosDocument10 pagesAnexos - Estados FinancierosJULIAN LOPEZ RODRIGUEZNo ratings yet

- Anexos - Estados FinancierosDocument27 pagesAnexos - Estados FinancierosJULIAN LOPEZ RODRIGUEZNo ratings yet

- Parcial 2 Estructura ContableDocument19 pagesParcial 2 Estructura ContableWENDY PAOLA HERRERA VALDÉSNo ratings yet

- Hoja de Trabajo. EVADocument2 pagesHoja de Trabajo. EVAKatherine Alejandra Duarte BezaNo ratings yet

- Puntaje Obtenido:: DNI Apellido Nombre PuntajeDocument19 pagesPuntaje Obtenido:: DNI Apellido Nombre PuntajeLuisikuuNo ratings yet

- Evidencia 3 SaDocument12 pagesEvidencia 3 Salupita andradeNo ratings yet

- YAR - Taller de Ratios Financieros S-4 2022-I-1Document17 pagesYAR - Taller de Ratios Financieros S-4 2022-I-1Edison Pareja EscalanteNo ratings yet

- Taller de Presupuesto Corte IIDocument29 pagesTaller de Presupuesto Corte IInaydu cardenasNo ratings yet

- Parcial FinanzasDocument16 pagesParcial FinanzasNatalia PajaNo ratings yet

- Examen Parcial Management AccountingDocument11 pagesExamen Parcial Management AccountingKETTY MARLENI TELLO PASHANASINo ratings yet

- Análisis financiero empresa 2021Document31 pagesAnálisis financiero empresa 2021batman goticaNo ratings yet

- Ejemplo - 01 - 2021 2Document38 pagesEjemplo - 01 - 2021 2ariel genaroNo ratings yet

- Admin KyeDocument7 pagesAdmin KyeKelly QuevedoNo ratings yet

- Cálculos Ebitda Éxito 2022Document6 pagesCálculos Ebitda Éxito 2022Stephany Viviana Mantilla MantillaNo ratings yet

- Análisis de estados financieros de Importadora San Ignacio 2021Document14 pagesAnálisis de estados financieros de Importadora San Ignacio 2021AlejandraNo ratings yet

- Alfa SRL 2Document96 pagesAlfa SRL 2SilfredoNo ratings yet

- Administracion Financiera I - CopecDocument12 pagesAdministracion Financiera I - CopecPAULINA TOBAR VALVERDENo ratings yet

- Taller de Ensayo - EVADocument5 pagesTaller de Ensayo - EVAFrancisco JavierNo ratings yet

- Taller de Ensayo - EVADocument5 pagesTaller de Ensayo - EVAFrancisco JavierNo ratings yet

- Taller de Ensayo - MEVADocument5 pagesTaller de Ensayo - MEVAFrancisco JavierNo ratings yet

- Taller de Ensayo - MElVADocument5 pagesTaller de Ensayo - MElVAFrancisco JavierNo ratings yet

- Actividad 3Document10 pagesActividad 3zuleima guarin salazarNo ratings yet

- Actividad 6 Analisis FinancieroDocument9 pagesActividad 6 Analisis FinancieroMary Gonzalez OspinaNo ratings yet

- Av - Ah Leche Gloria SaDocument46 pagesAv - Ah Leche Gloria SaMariely Echeverría BazanNo ratings yet

- Iberdrola Fact SheetDocument1 pageIberdrola Fact SheetBetsy CarmonaNo ratings yet

- Agro SuperDocument11 pagesAgro Superjo.raipanNo ratings yet

- Análisis Razonado76129263 202206Document13 pagesAnálisis Razonado76129263 202206Diego Valenzuela GonzálezNo ratings yet

- Pacific Grove Spice CompanyDocument3 pagesPacific Grove Spice CompanyLaura JavelaNo ratings yet

- Ceres Jardinería Empresa Presentación PDFDocument4 pagesCeres Jardinería Empresa Presentación PDFScribdTranslationsNo ratings yet

- S2 - Taller Evaluado 2308Document3 pagesS2 - Taller Evaluado 2308Luis AscencioNo ratings yet

- Ejercicios PortafolioDocument81 pagesEjercicios PortafolioVaale Isidro67% (3)

- Trabajo Grupal Finanzas IIIDocument10 pagesTrabajo Grupal Finanzas IIIAlex BustosNo ratings yet

- Análisis Razonado76306696 202203Document5 pagesAnálisis Razonado76306696 202203KIKE PLAZANo ratings yet

- Plantilla Saga FalabellaDocument3 pagesPlantilla Saga FalabellaElsa Nogueras LatorreNo ratings yet

- Práctica 3Document4 pagesPráctica 3jo enciNo ratings yet

- Formulacion de ProyectosDocument17 pagesFormulacion de ProyectosIGNACIO ENRIQUE LAGOS CAAMAÃ'ONo ratings yet

- INFORME DE LOS ESTADOS FINANCIEROS DE BOSQUES AMAZONICOZ S.A.Document46 pagesINFORME DE LOS ESTADOS FINANCIEROS DE BOSQUES AMAZONICOZ S.A.Valeria siomeNo ratings yet

- FT - Cobertor Filtro Serie 2000Document1 pageFT - Cobertor Filtro Serie 2000ar_alcariNo ratings yet

- 3M X5p3eDocument2 pages3M X5p3ear_alcariNo ratings yet

- Ficha Proveedor Peltor Fono Auditivo Adosado A Casco SNR 32 DB 96975Document2 pagesFicha Proveedor Peltor Fono Auditivo Adosado A Casco SNR 32 DB 96975fiorella gutierrezNo ratings yet

- Respiradores Serie 7500 de Media CaraDocument1 pageRespiradores Serie 7500 de Media Caraar_alcariNo ratings yet

- Ficha-Tecnica-Protecta-Varios 1342275 PDFDocument4 pagesFicha-Tecnica-Protecta-Varios 1342275 PDFar_alcariNo ratings yet

- Arnes Dielectrico 4 ArgollasDocument4 pagesArnes Dielectrico 4 Argollasar_alcariNo ratings yet

- Ficha TécnicaDocument1 pageFicha Técnicaar_alcariNo ratings yet

- Gafas de seguridad VIRTUA 3M AO SafetyDocument3 pagesGafas de seguridad VIRTUA 3M AO Safetyar_alcariNo ratings yet

- DS0062012TR Reglamento de La Ley #29741, Ley Que Crea El Fondo Complementario de Jubilación Minera, Metalúrgica y SiderúrgicaDocument8 pagesDS0062012TR Reglamento de La Ley #29741, Ley Que Crea El Fondo Complementario de Jubilación Minera, Metalúrgica y SiderúrgicaSiul PepeNo ratings yet

- 3M Prot Ocular - Antiparra GG 500Document1 page3M Prot Ocular - Antiparra GG 500ar_alcariNo ratings yet

- FT Cartucho Multigas Abek1 6059Document2 pagesFT Cartucho Multigas Abek1 6059Julio HerediaNo ratings yet

- Touchntuff 92-600Document2 pagesTouchntuff 92-600ar_alcariNo ratings yet

- DS 016-2016-TRDocument2 pagesDS 016-2016-TRyesenia cruz calizaya100% (1)

- 3M Prot Resp Libre Mant 1870Document1 page3M Prot Resp Libre Mant 1870ar_alcariNo ratings yet

- Ficha Astro Lite PDFDocument1 pageFicha Astro Lite PDFLuis MartínezNo ratings yet

- Receta para Elaborar ToffeeDocument2 pagesReceta para Elaborar Toffeear_alcariNo ratings yet

- FCC Contabilidad 2da ParteDocument60 pagesFCC Contabilidad 2da Partear_alcariNo ratings yet

- Cap 2 TablasDocument12 pagesCap 2 Tablasar_alcariNo ratings yet

- Consumidor CononorteDocument8 pagesConsumidor CononorteWalter AldereteNo ratings yet

- Trabajo Intervencion en Recursos Humanos FINALDocument7 pagesTrabajo Intervencion en Recursos Humanos FINALRaquel CabreraNo ratings yet

- Teorías de la Demanda de Dinero: Cuantitativas, Cartera y Neo-CuantitativaDocument5 pagesTeorías de la Demanda de Dinero: Cuantitativas, Cartera y Neo-CuantitativaSheylla Lali Villavicencio TiconaNo ratings yet

- Diagnóstico Educación Media Colegio Santísima TrinidadDocument17 pagesDiagnóstico Educación Media Colegio Santísima TrinidadWilliam MoralesNo ratings yet

- Deber Ensayo Los ValoresDocument3 pagesDeber Ensayo Los ValoresJefferson D. Valenzuela CoralNo ratings yet

- Recibo de Pago de 10053720Document1 pageRecibo de Pago de 10053720JuanNo ratings yet

- ItgsDocument2 pagesItgsMaria Jose Morales Galvis - EstudianteNo ratings yet

- Cro No GramaDocument1 pageCro No GramaEber Espinoza ChipanaNo ratings yet

- TESISDocument230 pagesTESISEmelda LuzNo ratings yet

- Organismos internacionales DDHHDocument17 pagesOrganismos internacionales DDHHanubidNo ratings yet

- Autonomo TodossssssssssDocument102 pagesAutonomo Todossssssssssnaomigalvez30No ratings yet

- DX Org Vol - Formulario de RegistroDocument10 pagesDX Org Vol - Formulario de RegistroASOCIACIÓN CULTURAL VOCES ENTRE TABLASNo ratings yet

- 16 Dir - 2008-Cumplimiento Mandatos JudicialesDocument19 pages16 Dir - 2008-Cumplimiento Mandatos JudicialesAlc Zam CusNo ratings yet

- Evaluacion Cargos TransitoriosDocument1 pageEvaluacion Cargos TransitoriosViviNo ratings yet

- Repaso ProbatorioDocument2 pagesRepaso ProbatorioYalder Duarte GalvisNo ratings yet

- CLAMIDIADocument11 pagesCLAMIDIAJordy IsraelNo ratings yet

- Caso 2Document2 pagesCaso 2Jose0% (1)

- Instituto Tecnologico de Los MochisDocument3 pagesInstituto Tecnologico de Los MochisNieblas MicheelNo ratings yet

- Historia Cultural de La Papa y FrutillaDocument8 pagesHistoria Cultural de La Papa y Frutillaisaacgabriel123No ratings yet

- Misa Julio 2023Document12 pagesMisa Julio 2023Antonio FloresNo ratings yet

- Intruccion Al MarketingDocument4 pagesIntruccion Al MarketingArnold GarciaNo ratings yet

- La Elusión Tributaria: A. Cómo Sortear Las Consecuencias TributariasDocument6 pagesLa Elusión Tributaria: A. Cómo Sortear Las Consecuencias Tributarias스체No ratings yet

- Garabandal PeritoDocument122 pagesGarabandal PeritoMartín ProzapasNo ratings yet

- Diseño Marca Zarcero PDFDocument161 pagesDiseño Marca Zarcero PDFDagne PovedaNo ratings yet

- Orientaciones NEEP-SAE PDFDocument9 pagesOrientaciones NEEP-SAE PDFManzanita ConfitadaNo ratings yet

- 8 SAP Central Finance Eliminación Del Sistema de Carga Inicial y Restablecimiento - LimpiezaDocument3 pages8 SAP Central Finance Eliminación Del Sistema de Carga Inicial y Restablecimiento - LimpiezaJuan100% (1)

- M.C. 1.4 Bill George El LiderazgoDocument7 pagesM.C. 1.4 Bill George El LiderazgoGuillermo HernandezNo ratings yet