Professional Documents

Culture Documents

Bawag Company Profile

Uploaded by

Adam KecskemétiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bawag Company Profile

Uploaded by

Adam KecskemétiCopyright:

Available Formats

BANKING

SEPTEMBER 8, 2016

COMPANY PROFILE BAWAG P.S.K.

Vienna, Austria

Table of Contents: Company Overview

COMPANY OVERVIEW 1

FINANCIAL HIGHLIGHTS Bank fr Arbeit und Wirtschaft und Oesterreichische Postsparkasse AG (BAWAG P.S.K.) operates

(AS REPORTED) 2

as a universal bank in Austria. As of 31 December 2015, it held a 4.2% share among Austrian

BUSINESS ACTIVITIES 3

DISTRIBUTION CAPACITY AND MARKET

banking institutions, based on its total consolidated assets of 35.7 billion (30 June 2016: 34.7

SHARE 4 billion).

OWNERSHIP AND STRUCTURE 5

Ownership Structure 6 BAWAG P.S.K. offers a range of retail and corporate banking products, including deposit-taking

Subsidiaries and Associates 7

facilities, loans and investment services. Moreover, it provides international business products,

COMPANY MANAGEMENT 8

COMPANY HISTORY 10

such as commercial real-estate financing, capital market solutions, and securities and asset

PEER GROUP 11 management services. While the bank operates primarily in Austria, it also has a presence in core

RELATED WEBSITES AND INFORMATION Western European markets.

SOURCES 11

MOODYS RELATED RESEARCH 12

The bank was established in 2005 as a result of the merger of two Austrian banks, the trade union

Bank fr Arbeit und Wirtschaft (BAWAG) and the postal savings bank Oesterreichische

Postsparkasse AG (P.S.K.). As of 31 December 2015, the banks largest shareholders were Cerberus

Analyst Contacts: Capital Management L.P. (Cerberus, 52.14% stake) and GoldenTree Asset Management L.P.

(GoldenTree, 39.77%).

FRANKFURT +49.69.70730.700

Source: Company Reports, Moodys Research, sterreichische Nationalbank (OeNB)

Torsten-Alexander +49.69.70730.796

Thebes

Associate Analyst

torsten.thebes@moodys.com

Bernhard Held, CFA +49.69.70730.973

Vice President - Senior Analyst

bernhard.held@moodys.com

Carola Schuler +49.69.70730.766

Managing Director - Banking

carola.schuler@moodys.com

This report, exclusively provided to you by

Moodys, presents a convenient summary of

as reported, publicly available information.

The information is not adjusted for Moodys

analytic purposes. For Moodys Ratings,

Opinion and Analytics on this company,

please [Click here]. To access the latest

Moodys Credit Opinion on this company,

please [Click here].

BANKING

Financial Highlights (as Reported)

Note: The financials presented below are those reported by the entity and are not adjusted for Moodys analytic

purposes. For Moodys generated ratios on BAWAG P.S.K., please see the <issuer page on moodys.com.>

EXHIBIT 1

Latest Full-Year Results

% Change % Change

(in Million) 31-Dec-15 31-Dec-14 31-Dec-13 15/14 14/13

Total Assets 35,708 34,651 36,402 3.0 (4.8)

Total Shareholders Equity 2,957 2,405 2,798 22.9 (14.0)

Shareholders Equity excluding Minority Interest 2,956 2,405 2,403 22.9 0.1

Own Funds N/A 2,672 2,991 N/A (10.7)

Common Equity Tier 1 Ratio (%) 12.9 12.1 9.4 80 bps 270 bps

Net Income 418 334 231 25.2 44.8

Net Income Attributable to Equity Holders 418 333 229 25.5 45.4

Note: The financials for 2015, except for net income, reflect the consolidated results of BAWAG Holding GmbH, while those for 2014 and 2013 reflect

the consolidated results of BAWAG P.S.K. group (see also Exhibit 7). Net income in 2015 was reported at the level of BAWAG P.S.K. group.

Source: Company Reports

EXHIBIT 2

Latest First-Half Results

% Change

(in Million) 30-June-16 30-June-15 16/15

Total Assets 34,729 34,005 2.1

Total Shareholders Equity 3,226 2,791 15.6

Shareholders Equity excluding Minority Interest 3,224 2,791 15.5

Own Funds N/A N/A N/A

Common Equity Tier 1 Ratio (%) 15.1 14.3 80 bps

Net Income 284 209 36.0

Net Income Attributable to Equity Holders 284 209 35.9

Note: The financials reflect the consolidated results of BAWAG Holding GmbH, except for Net Income, which reflects the consolidated results of

BAWAG P.S.K. group.

Source: Company Report

This publication does not announce

a credit rating action. For any

credit ratings referenced in this

publication, please see the ratings

tab on the issuer/entity page on

www.moodys.com for the most

updated credit rating action

information and rating history.

2 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

Business Activities

BAWAG P.S.K. offers a range of retail and corporate banking products and services.

It operates through the following six key segments: BAWAG P.S.K. Retail; easygroup; DACH 1 Corporates and

Public Sector; International Business; Treasury Services and Markets; and the Corporate Center. During the

first half-year ended 30 June 2016 (H1 2016), the largest contributor to the banks net interest income was

the BAWAG P.S.K. Retail segment.

BAWAG P.S.K. Retail: This segment, which in H1 2016 accounted for 45.7% of the banks net interest

income, provides private customers and small businesses with lending, investment, insurance, real estate

leasing and social housing-related services. As of 30 June 2016, it reported total business volume of 9.3

billion.

easygroup: This segment, which in H1 2016 accounted for 14.7% of the banks net interest income,

provides private and small business customers, both domestically and internationally, with savings accounts,

loans, bank and credit cards, payment processing, and automobile and mobile leasing services. As of 30 June

2016, this segment reported total consolidated assets of 3.2 billion.

DACH Corporates and Public Sector: This segment, which in H1 2016 accounted for 10.9% of the banks

net interest income, includes the banks corporate and public lending business, as well as other fee-driven

financial services for domestic customers (i.e. including, but not limited to, cross-border activities). As of 30

June 2016, it reported total consolidated assets of 7.4 billion.

International Business: This segment, which in H1 2016 accounted for 18.3% of the banks net interest

income, offers lending activities to international corporates as well as international real estate financing

activities outside the DACH region through transactions originated by the banks London office. As of 30

June 2016, this segment reported total consolidated assets of 5.0 billion.

Treasury Services and Markets: This segment, which in H1 2016 accounted for 7.6% of the banks net

interest income, conducts trading and investment activities for the banks customers, including asset-

liability management services. It also manages the banks liquidity, and the investment results of its

portfolio of financial securities. As of 30 June 2016, this segment reported total consolidated assets of 6.3

billion.

Corporate Center: This segment, which accounted for 2.8% of the banks net interest income in H1 2016,

performs central administrative functions, including providing legal services, and managing risks and group

asset-liabilities. It also comprises unallocated expenses related to group-wide support functions, such as risk

management, regulatory reporting and hedging activities. It includes results from the banks subsidiaries and

participatory holdings. As of 30 June 2016, this segment reported total consolidated assets of 3.4 billion.

Source: Company Report

1

The DACH region comprises Germany, Austria and Switzerland

3 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

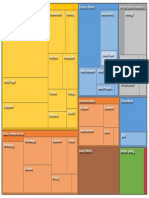

EXHIBIT 3

Business Segment

(% of Net Interest Income, consolidated, for H1 2016)

Corporate Center

Treasury Services and 2.8%

Markets

7.6%

DACH Corporates and

Public Sector

10.9%

BAWAG P.S.K. Retail

45.7%

easygroup

14.7%

International Business

18.3%

Source: Company Report (interim report June 2016, Pg: 45)

EXHIBIT 4

Profit/Loss Before Tax by Business Segment

(consolidated, in Million)

H1 June 2015 H1 June 2016

100

82.9

80.1

80

54.9 55.8

60

44.6 44.6

40 36.0

16.8 21.2 20.9

20

6.8 7.0

0

BAWAG P.S.K. Retail easygroup DACH Corporates and International Business Treasury Services and Corporate Center

Public Sector Markets

Source: Company Report (interim report June 2016, Pg: 45 and 46)

Distribution Capacity and Market Share

As of 31 December 2015, BAWAG P.S.K. operated through a centrally managed distribution network in

Austria, comprising approximately 480 branches, which are operated in cooperation with sterreichische

Post AG (Austrian Post). In October 2014, it opened a branch office in London.

BAWAG P.S.K. also provides e-banking services and an online customer platform, as well as direct banking

operations carried out through its wholly owned subsidiary easybank AG, in addition to its nationwide self-

service terminal network.

4 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

Geographically, the banks loan portfolio was distributed as follows:

EXHIBIT 5

BAWAG P.S.K.

Loans (%)

Geographical Segment 31-Dec-15 31-Dec-14

Western Europe 89 89

North America 8 6

Southern Europe 1 3

Central and Eastern Europe (CEE) 1 1

Others 1 1

Total 100 100

Source: Company Report

BAWAG P.S.K. operates a comprehensive retail banking franchise, with a market share of over 5.6% in terms

of key deposit products in Austria, as of 31 December 2015.

The banks market shares among Austrian banking institutions were as follows:

EXHIBIT 6

Market Shares of BAWAG P.S.K.

(% Share) 31-Mar-16 31-Dec-15 31-Dec-14

Total Loans 6.2 6.4 6.0

Total Assets 4.1 4.2 3.9

Note: Total Loans for the Austrian banking sector is calculated by adding Loans to domestic non-banks and Loans to foreign non-banks

Source: Company Reports, Moodys Research, OeNB

Ownership and Structure

As of 31 December 2015, BAWAG P.S.K. had 250 million shares outstanding.

The share capital of BAWAG P.S.K. was primarily owned by Cerberus (52.14% stake) and GoldenTree

(39.77%) through BAWAG Holding Gmbh, which is wholly owned by the Dutch financial holding company

Promontoria Sacher Holding NV. The remaining shares were held by a variety of Austrian and non-Austrian

minorities.

Source: Company Report

5 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

Ownership Structure

EXHIBIT 7

Ownership Structure as of 31 December 2015

Source: Company Reports

6 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

Subsidiaries and Associates

As of 31 December 2015, the banks consolidated subsidiaries were as follows:

EXHIBIT 8

BAWAG P.S.K.

Subsidiary Location % Held

Banks

BAWAG Malta Bank Limited 2 Sliema 100.00

BAWAG P.S.K. Wohnbaubank Aktiengesellschaft Vienna 100.00

easybank AG Vienna 100.00

Real Estate

BAWAG P.S.K. IMMOBILIEN GmbH Vienna 100.00

BPI Holding GmbH & Co KG. Vienna 100.00

R & B Leasinggesellschaft m.b.H. Vienna 100.00

RVG Realittenverwertungsgesellschaft m.b.H. Vienna 100.00

Leasing

ACP IT-Finanzierungs GmbH Vienna 75.00

BAWAG P.S.K. IMMOBILIENLEASING GmbH Vienna 100.00

BAWAG P.S.K. Kommerzleasing GmbH Vienna 100.00

BAWAG P.S.K. LEASING GmbH & Co. MOBILIENLEASING KG. Vienna 100.00

BAWAG P.S.K. LEASING GmbH Vienna 100.00

BAWAG P.S.K. LEASING Holding GmbH Vienna 100.00

BAWAG P.S.K. MOBILIENLEASING GmbH Vienna 100.00

CVG Immobilien GmbH Vienna 100.00

HBV Holding und Beteiligungsverwaltung GmbH Vienna 100.00

KLB Baulandentwicklung GmbH Vienna 100.00

Leasing-west GmbH Kiefersfelden 100.00

M. Sittikus Str. 10 Errichtungs GmbH Vienna 100.00

P.S.K. IMMOBILIENLEASING GmbH Vienna 100.00

RF 17 BAWAG Immobilienleasing GmbH Vienna 100.00

RF fnfzehn BAWAG Mobilien-Leasing Gesellschaft m.b.H. Vienna 100.00

RF zwlf BAWAG Leasing Gesellschaft m.b.H. Vienna 100.00

START Immobilienleasing GmbH Vienna 100.00

VB Leasing Finanzierungsgesellschaft m.b.H. Vienna 100.00

VB Technologie Finanzierungs GmbH Vienna 100.00

2

Entity was sold and deconsolidated in January 2016.

7 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

EXHIBIT 8

BAWAG P.S.K.

Subsidiary Location % Held

Other Non-Credit Institutions

BAWAG P.S.K. Versicherung Aktiengesellschaft Vienna 25.00

E2E Kreditmanagement GmbH Vienna 100.00

E2E Service Center Holding GmbH Vienna 100.00

E2E Transaktionsmanagement GmbH Vienna 100.00

PSA Payment Services Austria GmbH Vienna 20.82

P.S.K. Beteiligungsverwaltung GmbH Vienna 100.00

Source: Company Report

Company Management

Managing Board Current Title Responsibilities

Byron Haynes Chairman of the Managing Board and Chief Executive Corporate Office, Human Resources, Legal,

Officer, Retail Banking and Small Business; Retail Sales, Marketing and Products, Digital

Wiener Brse AG, Bausparkasse Wstenrot AG, BAWAG Banking

P.S.K. Versicherung AG and CEESEG Aktiengesellschaft:

Member of the Supervisory Board

Corey Pinkston Member of the Managing Board and Head of Corporate Austrian Corporate Business, International

Lending and Investments, and Treasury Services and Business, Treasury Services and Markets,

Markets Operations Capital Markets

Anas Abuzaakouk Member of the Managing Board and Chief Financial Integration Management, Controlling and

Officer ALM, Accounting and Participations,

Procurement, Real Estate and Facility

Management

Stefan Barth Member of the Managing Board and Chief Risk Officer Strategic Risk, Corporate and Institutional

Risk, Retail Risk and Administration

Sat Shah Member of the Managing Board and Chief Operating Strategy and Communications, Operations,

Officer Quality Management, Information

Technology

Supervisory Board Affiliation Committees

Franklin W. Hobbs Chairman of the Supervisory Board; Nomination Committee (C), Remuneration

Ally Financial, Inc.: Chairperson and Member of the Committee (C), Committee for Management

Supervisory Board; Board Matters (C), Related Parties Special Audit

Committee (C)

Molson Coors Brewing Company: Member of the

Supervisory Board

Keith Tietjen Deputy Chairman of the Supervisory Board Audit and Compliance Committee (C),

Remuneration Committee, Committee for

Management Board Matters, Related Parties

Special Audit Committee

Cees Maas Deputy Chairman of the Supervisory Board Audit and Compliance Committee, Risk and

Credit Committee, Nomination Committee,

Remuneration Committee, Committee for

Management Board Matters, Related Parties

Special Audit Committee

Pieter Korteweg Deputy Chairman of the Supervisory Board; Nomination Committee, Committee for

AirCap Holdings NV: Non-Executive Director and Management Board Matters

Chairperson

8 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

Supervisory Board Affiliation Committees

Frederick S. Haddad Member of the Supervisory Board Audit and Compliance Committee, Risk and

Credit Committee, Nomination Committee,

Remuneration Committee, Committee for

Management Board Matters, Related Parties

Special Audit Committee

Chad A. Leat Member of the Supervisory Board; Risk and Credit Committee (C)

Paceline Holdings and Norwegian Cruise Line

Holdings Ltd.: Member of the Supervisory Board

Walter Oblin Member of the Supervisory Board Audit and Compliance Committee, Risk and

Credit Committee

Andr Weiss Member of the Supervisory Board N/A

Ingrid Streibel-Zarfl Member of the Supervisory Board, Works Council Audit and Compliance Committee, Risk and

delegate Credit Committee, Nomination Committee,

Remuneration Committee, Related Parties

Special Audit Committee

Beatrix Prll Member of the Supervisory Board, Works Council Risk and Credit Committee, Nomination

delegate Committee, Remuneration Committee, Related

Parties Special Audit Committee

Konstantin Latsunas Member of the Supervisory Board, Works Council Audit and Compliance Committee

delegate

Verena Spitz Member of the Supervisory Board, Works Council N/A

delegate

Beate Schaffer State Commissioner N/A

Markus Chmelik Deputy State Commissioner N/A

Note: As of March 2016; (C) = Committee Chairman

Source: Company Reports

EXHIBIT 9

Corporate Governance Structure as of March 2016

Source: Company Report

9 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

Company History

BAWAG P.S.K. originated as BAWAG, which had been established in 1922 as a trade union bank, and P.S.K.,

which had been founded in 1883 as a government-owned postal savings bank.

In 1995, Bayerische Landesbank acquired a 46.43% stake in BAWAG, which was sold in 2004 to the

Association of Austrian Trade Unions (OeGB). In 2000, BAWAG (along with an investor consortium)

acquired full ownership of P.S.K., which it merged and fully integrated into the new BAWAG P.S.K. in 2005.

In 2006, the Republic of Austria granted a guarantee to restabilise the bank following a class action suit

against it in the US. Later that year, the OeGB decided to sell its shares in BAWAG P.S.K. to a consortium

managed by Cerberus, comprising Austrian Post, Generali Holding AG and Wuestenrot Verwaltungs- und

Dienstleistungen GmbH, as well as a sub-consortium of several Austrian industrialists. In May 2007, the

consortium completed its acquisition of BAWAG P.S.K. The injection of capital by the new owner replaced

the guarantee granted in favour of the bank by the Republic of Austria.

Over 200708, as part of a new strategy to streamline its operations, the bank sold some of its noncore

businesses, including its subsidiaries in Slovakia and the Czech Republic, and several real estate assets.

Furthermore, Sparda Bank AG was merged into the bank.

In 2010, BAWAG P.S.K. started to put its subsidiaries in Ireland into liquidation. Consequently, it liquidated

BAWAG International Finance Ltd. (Ireland) in 2010, Datchet Limited in April 2011, and Polestar Limited and

Shrivenham Limited in 2012. Moreover, the bank has reduced the number of companies active in

Liechtenstein (through mergers) and Jersey (through closings), and has terminated its operations in the UK.

In 2010, it liquidated BAWAG P.S.K. Jersey Auto Finance Ltd., Auto Finance Jersey I Ltd. and Auto Finance

Jersey II Ltd.

During the fourth quarter of 2013, BAWAG P.S.K. merged with sterreichische Verkehrskreditbank AG

(VKB). Consequently, BAWAG P.S.K. took over the rail cargo operations and payment services of Austrian

Railways, which had previously been handled by VKB.

In October 2014, BAWAG P.S.K. signed a definitive agreement to sell its asset management subsidiary,

BAWAG P.S.K. INVEST, to the asset management company Amundi. As part of the agreement, the bank will

continue to distribute its former subsidiarys products. As of February 2015, BAWAG P.S.K. INVEST was a

wholly owned subsidiary of Amundi. Since November 2014, BAWAG P.S.K., through its ultimate parent

entity Promontoria Sacher Holding N.V., is listed as a significant supervised entity in the newly established

single supervisory mechanism and is therefore primarily supervised by the European Central Bank (ECB).

In August 2015, the bank signed the purchase for the domestic leasing operations of the Austrian co-

operative Volksbanken sector (VB-Leasing), thereby turning BAWAG P.S.K. into the third-largest automotive

lessor in Austria. In December 2015, BAWAG P.S.K. purchased a UK retail mortgage portfolio in the amount

of GBP 1.8 billion.

In January 2016, BAWAG P.S.K. sold its operations in Malta and in June 2016, the bank announced the

acquisition of start:bausparkasse, an Austrian savings and loan association, as well as IMMO-Bank, an

Austrian financing provider for real estate companies and social housing associations, both formerly

institutions of the Austrian Volksbanken sector.

Source: Company Reports, Moodys Research

10 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

Peer Group

Erste Bank

Raiffeisen Bank International

UniCredit Bank Austria

DNB Bank ASA

Danske Bank A/S

Swedbank AB

Commerzbank AG

Norddeutsche Landesbank GZ

Landesbank Hessen-Thringen GZ

Related Websites and Information Sources

For additional information, please see:

the companys website: www.bawagpsk.com

the central banks website: www.oenb.at

the national regulators website: www.fma.gv.at

the ECBs regulatory website: www.bankingsupervision.europa.eu

MOODYS has provided links or references to third party World Wide Websites or URLs ("Links or References") solely for your

convenience in locating related information and services. The websites reached through these Links or References have not

necessarily been reviewed by MOODYS, and are maintained by a third party over which MOODYS exercises no control.

Accordingly, MOODYS expressly disclaims any responsibility or liability for the content, the accuracy of the information, and/or

quality of products or services provided by or advertised on any third party web site accessed via a Link or Reference. Moreover,

a Link or Reference does not imply an endorsement of any third party, any website, or the products or services provided by any

third party.

11 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

Moodys Related Research

Credit Opinion:

BAWAG P.S.K: Update Following Lowering of Macro Profile

Issuer-specific Research:

BAWAG P.S.K.: Strong, Sustainable Profits Buck Trends in the Austrian Banking Sector, June 2016

(1028610)

BAWAG P.S.K.s Improving Profitability and Capital Ratios Are Credit Positive, August 2015 (183600)

Banking System Research:

Banking System Outlook: Austria, August 2016 (1035959)

Banking System Profile: Austria, August 2016 (191493)

Austrian banks will benefit from government plan to reduce bank levy, July 2016 (191008)

Austrian application of BRRD to wind down entity Heta sets precedent, March 2015 (1003540)

To access any of these reports, click on the entry above. Note that these references are current as of the date of publication of

this report and that more recent reports may be available. All research may not be available to all clients.

12 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

BANKING

Report Number: 191971

Author Editor

Torsten-Alexander Thebes Kamin Au

Production Associate

Prabhakaran Ganesan

2016 Moodys Corporation, Moodys Investors Service, Inc., Moodys Analytics, Inc. and/or their licensors and affiliates (collectively, MOODYS). All rights reserved.

CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. AND ITS RATINGS AFFILIATES (MIS) ARE MOODYS CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT

RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCH PUBLICATIONS PUBLISHED BY MOODYS (MOODYS

PUBLICATIONS) MAY INCLUDE MOODYS CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS, OR DEBT OR DEBT-LIKE

SECURITIES. MOODYS DEFINES CREDIT RISK AS THE RISK THAT AN ENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS AS THEY COME DUE AND ANY

ESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANY OTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET

VALUE RISK, OR PRICE VOLATILITY. CREDIT RATINGS AND MOODYS OPINIONS INCLUDED IN MOODYS PUBLICATIONS ARE NOT STATEMENTS OF CURRENT OR HISTORICAL

FACT. MOODYS PUBLICATIONS MAY ALSO INCLUDE QUANTITATIVE MODEL-BASED ESTIMATES OF CREDIT RISK AND RELATED OPINIONS OR COMMENTARY PUBLISHED BY

MOODYS ANALYTICS, INC. CREDIT RATINGS AND MOODYS PUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, AND CREDIT RATINGS

AND MOODYS PUBLICATIONS ARE NOT AND DO NOT PROVIDE RECOMMENDATIONS TO PURCHASE, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDIT RATINGS

NOR MOODYS PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FOR ANY PARTICULAR INVESTOR. MOODYS ISSUES ITS CREDIT RATINGS AND

PUBLISHES MOODYS PUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL, WITH DUE CARE, MAKE ITS OWN STUDY AND

EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FOR PURCHASE, HOLDING, OR SALE.

MOODYS CREDIT RATINGS AND MOODYS PUBLICATIONS ARE NOT INTENDED FOR USE BY RETAIL INVESTORS AND IT WOULD BE RECKLESS AND INAPPROPRIATE FOR RETAIL

INVESTORS TO USE MOODYS CREDIT RATINGS OR MOODYS PUBLICATIONS WHEN MAKING AN INVESTMENT DECISION. IF IN DOUBT YOU SHOULD CONTACT YOUR FINANCIAL OR

OTHER PROFESSIONAL ADVISER.

ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO, COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR

OTHERWISE REPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED, REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH

PURPOSE, IN WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSON WITHOUT MOODYS PRIOR WRITTEN CONSENT.

All information contained herein is obtained by MOODYS from sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error as well as other

factors, however, all information contained herein is provided AS IS without warranty of any kind. MOODY'S adopts all necessary measures so that the information it uses in assigning a

credit rating is of sufficient quality and from sources MOODY'S considers to be reliable including, when appropriate, independent third-party sources. However, MOODYS is not an auditor and

cannot in every instance independently verify or validate information received in the rating process or in preparing the Moodys Publications.

To the extent permitted by law, MOODYS and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability to any person or entity for any indirect,

special, consequential, or incidental losses or damages whatsoever arising from or in connection with the information contained herein or the use of or inability to use any such information,

even if MOODYS or any of its directors, officers, employees, agents, representatives, licensors or suppliers is advised in advance of the possibility of such losses or damages, including but not

limited to: (a) any loss of present or prospective profits or (b) any loss or damage arising where the relevant financial instrument is not the subject of a particular credit rating assigned by

MOODYS.

To the extent permitted by law, MOODYS and its directors, officers, employees, agents, representatives, licensors and suppliers disclaim liability for any direct or compensatory losses or

damages caused to any person or entity, including but not limited to by any negligence (but excluding fraud, willful misconduct or any other type of liability that, for the avoidance of doubt, by

law cannot be excluded) on the part of, or any contingency within or beyond the control of, MOODYS or any of its directors, officers, employees, agents, representatives, licensors or suppliers,

arising from or in connection with the information contained herein or the use of or inability to use any such information.

NO WARRANTY, EXPRESS OR IMPLIED, AS TO THE ACCURACY, TIMELINESS, COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCH RATING OR

OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODYS IN ANY FORM OR MANNER WHATSOEVER.

Moodys Investors Service, Inc., a wholly-owned credit rating agency subsidiary of Moodys Corporation (MCO), hereby discloses that most issuers of debt securities (including corporate and

municipal bonds, debentures, notes and commercial paper) and preferred stock rated by Moodys Investors Service, Inc. have, prior to assignment of any rating, agreed to pay to Moodys

Investors Service, Inc. for appraisal and rating services rendered by it fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policies and procedures to address

the independence of MISs ratings and rating processes. Information regarding certain affiliations that may exist between directors of MCO and rated entities, and between entities who hold

ratings from MIS and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annually at www.moodys.com under the heading Investor Relations

Corporate Governance Director and Shareholder Affiliation Policy.

Additional terms for Australia only: Any publication into Australia of this document is pursuant to the Australian Financial Services License of MOODYS affiliate, Moodys Investors Service Pty

Limited ABN 61 003 399 657AFSL 336969 and/or Moodys Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intended to be provided only to

wholesale clients within the meaning of section 761G of the Corporations Act 2001. By continuing to access this document from within Australia, you represent to MOODYS that you are, or

are accessing the document as a representative of, a wholesale client and that neither you nor the entity you represent will directly or indirectly disseminate this document or its contents to

retail clients within the meaning of section 761G of the Corporations Act 2001. MOODYS credit rating is an opinion as to the creditworthiness of a debt obligation of the issuer, not on the

equity securities of the issuer or any form of security that is available to retail investors. It would be reckless and inappropriate for retail investors to use MOODYS credit ratings or publications

when making an investment decision. If in doubt you should contact your financial or other professional adviser.

Additional terms for Japan only: Moody's Japan K.K. (MJKK) is a wholly-owned credit rating agency subsidiary of Moody's Group Japan G.K., which is wholly-owned by Moodys Overseas

Holdings Inc., a wholly-owned subsidiary of MCO. Moodys SF Japan K.K. (MSFJ) is a wholly-owned credit rating agency subsidiary of MJKK. MSFJ is not a Nationally Recognized Statistical

Rating Organization (NRSRO). Therefore, credit ratings assigned by MSFJ are Non-NRSRO Credit Ratings. Non-NRSRO Credit Ratings are assigned by an entity that is not a NRSRO and,

consequently, the rated obligation will not qualify for certain types of treatment under U.S. laws. MJKK and MSFJ are credit rating agencies registered with the Japan Financial Services Agency

and their registration numbers are FSA Commissioner (Ratings) No. 2 and 3 respectively.

MJKK or MSFJ (as applicable) hereby disclose that most issuers of debt securities (including corporate and municipal bonds, debentures, notes and commercial paper) and preferred stock rated

by MJKK or MSFJ (as applicable) have, prior to assignment of any rating, agreed to pay to MJKK or MSFJ (as applicable) for appraisal and rating services rendered by it fees ranging from

JPY200,000 to approximately JPY350,000,000.

13 SEPTEMBER 8, 2016 COMPANY PROFILE: BAWAG P.S.K.

You might also like

- Bank Management and Control: Strategy, Pricing, Capital and Risk ManagementFrom EverandBank Management and Control: Strategy, Pricing, Capital and Risk ManagementNo ratings yet

- Rothschild Annual Report 2007 - 08 - FinalDocument61 pagesRothschild Annual Report 2007 - 08 - FinalellokosNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Annual Report 2022: Credit Suisse Group AGDocument452 pagesAnnual Report 2022: Credit Suisse Group AGSubash NehruNo ratings yet

- Csgag Csag Ar 2019 enDocument588 pagesCsgag Csag Ar 2019 enThaís Ribeira de PaulaNo ratings yet

- CSG Ar 2019 en PDFDocument442 pagesCSG Ar 2019 en PDFBelalHossainNo ratings yet

- B2Holding ReportDocument155 pagesB2Holding ReportRoshan RahejaNo ratings yet

- Nyse Ubs 2006Document256 pagesNyse Ubs 2006rgq4fsm7hcNo ratings yet

- Interim Report Highlights Strong Growth and ProfitabilityDocument50 pagesInterim Report Highlights Strong Growth and ProfitabilityLegonNo ratings yet

- Transition To IFRS by Deutsche BankDocument45 pagesTransition To IFRS by Deutsche BankShaurya FatesariaNo ratings yet

- UBS HandbookDocument152 pagesUBS HandbookcarecaNo ratings yet

- Media Release 2/09 Swisslog With Stable Operating Profit EBITADocument8 pagesMedia Release 2/09 Swisslog With Stable Operating Profit EBITArupmhatreNo ratings yet

- Axpo Solutions Annual Report 2021 2022Document132 pagesAxpo Solutions Annual Report 2021 2022VioletaNo ratings yet

- Annual Report Shows £10.6B Loss Due to Market TurmoilDocument114 pagesAnnual Report Shows £10.6B Loss Due to Market TurmoilsaxobobNo ratings yet

- ING Group 2009AnnualReport-SecDocument312 pagesING Group 2009AnnualReport-Secadarshhoizal21No ratings yet

- Novobanco - Supplement To Prospectus - December 2022Document4 pagesNovobanco - Supplement To Prospectus - December 2022thamsanqamanciNo ratings yet

- CSG Ar 2018 enDocument452 pagesCSG Ar 2018 enHaitham FathiNo ratings yet

- Deutsche Bank Ag - 2023 02 21Document6 pagesDeutsche Bank Ag - 2023 02 21Nuria PuenteNo ratings yet

- 1h2016 Presentation Results FinaDocument27 pages1h2016 Presentation Results FinaRobert SullivanNo ratings yet

- BFM ASSIGNMENT 2 ANALYSISDocument14 pagesBFM ASSIGNMENT 2 ANALYSISTabrej AlamNo ratings yet

- Exam 8nov21 - With Solution Topics-1Document15 pagesExam 8nov21 - With Solution Topics-1surfistasafonsoeliseuNo ratings yet

- Voting RightsDocument146 pagesVoting RightsNagasa Fufa (Sihran)No ratings yet

- Ar VW FS Ag 2017Document150 pagesAr VW FS Ag 2017Tangirala AshwiniNo ratings yet

- Hlag H1 2022 EngDocument54 pagesHlag H1 2022 EngEric LopesNo ratings yet

- May 2006 Examinations: Strategy LevelDocument32 pagesMay 2006 Examinations: Strategy Levelmagnetbox8No ratings yet

- 2020 07 Irish Funds Austria Distribution Guide FinalDocument8 pages2020 07 Irish Funds Austria Distribution Guide FinalFitriaty FaridaNo ratings yet

- IR Presentation: Mitsubishi UFJ Financial Group, IncDocument90 pagesIR Presentation: Mitsubishi UFJ Financial Group, IncyolandaNo ratings yet

- Deutsche Post AG DHL Group Financial AnalysisDocument16 pagesDeutsche Post AG DHL Group Financial AnalysisvarunabyNo ratings yet

- Investment Report: Whitbread PLCDocument18 pagesInvestment Report: Whitbread PLCThanh VânNo ratings yet

- Financial Statement of Analysis Horizontal and VerticalDocument7 pagesFinancial Statement of Analysis Horizontal and VerticalALYSSA MARIE NAVARRANo ratings yet

- Ar2015e 0Document276 pagesAr2015e 0ed bookerNo ratings yet

- HSBC STG IB League 2021 Case StudyDocument12 pagesHSBC STG IB League 2021 Case StudyvaibhavNo ratings yet

- UBS Debt Investr PresentationDocument36 pagesUBS Debt Investr PresentationNacho DalmauNo ratings yet

- P Smallcap Ar EngDocument27 pagesP Smallcap Ar EngxiaokiaNo ratings yet

- Covestro Overview Key DataDocument9 pagesCovestro Overview Key DataTobias JankeNo ratings yet

- Annual Report 2016Document40 pagesAnnual Report 2016Muhammad NoumanNo ratings yet

- ING Press Release 1Q2020Document27 pagesING Press Release 1Q2020Pau LaguertaNo ratings yet

- Hiap Teck Venture Berhad :2QFY07/10 Net Profit Dips QoQ - 31/03/2010Document3 pagesHiap Teck Venture Berhad :2QFY07/10 Net Profit Dips QoQ - 31/03/2010Rhb InvestNo ratings yet

- Bond Buyback at Deutsche Bank: Running Head: 1Document10 pagesBond Buyback at Deutsche Bank: Running Head: 1NarinderNo ratings yet

- Swedbank Annual Report 2010Document184 pagesSwedbank Annual Report 2010Swedbank AB (publ)No ratings yet

- 2019 20 Business Model and Facts Voestalpine GroupDocument101 pages2019 20 Business Model and Facts Voestalpine GroupReinaldo CarrilloNo ratings yet

- Hang Seng Bank 2020 Annual Report SummaryDocument257 pagesHang Seng Bank 2020 Annual Report SummarySaxon ChanNo ratings yet

- Pictet-Human-R EUR - FACTSHEET - LU2247920262 - EN - DEFAULT - 31jan2022Document4 pagesPictet-Human-R EUR - FACTSHEET - LU2247920262 - EN - DEFAULT - 31jan2022ATNo ratings yet

- Half-Yearly Report: Financial Year 2021Document16 pagesHalf-Yearly Report: Financial Year 2021Trina NaskarNo ratings yet

- 8273 WrightDocument11 pages8273 WrightFauzi Al nassarNo ratings yet

- BANK Quarterly Jun 10Document27 pagesBANK Quarterly Jun 10alihennawiNo ratings yet

- 2016 Roadshow PresentationDocument41 pages2016 Roadshow PresentationAli Gokhan KocanNo ratings yet

- MLC CaseDocument8 pagesMLC CaseDoddy RachmatNo ratings yet

- Initiating Coverage - Unichem LabsDocument12 pagesInitiating Coverage - Unichem LabsshahavNo ratings yet

- Half-Year Report 2010: Swatch Group - Record Half-Year Results in Terms of Both Sales and ProfitDocument15 pagesHalf-Year Report 2010: Swatch Group - Record Half-Year Results in Terms of Both Sales and ProfitMan Tan CheongNo ratings yet

- 0427-Canon Schweiz AG-Fairness Opinion E-20090831-DeDocument22 pages0427-Canon Schweiz AG-Fairness Opinion E-20090831-DeVictor Huaranga CoronadoNo ratings yet

- Hong Leong Bank Berhad: Stronger Net Profit, But Mainly Due To Low Tax Rate - 25/05/2010Document5 pagesHong Leong Bank Berhad: Stronger Net Profit, But Mainly Due To Low Tax Rate - 25/05/2010Rhb InvestNo ratings yet

- PSE2022 Annual Report enDocument276 pagesPSE2022 Annual Report enRICARDO LEONEL SALAS VARGASNo ratings yet

- ING Posts 3Q17 Net Result of EUR 1,376 MillionDocument30 pagesING Posts 3Q17 Net Result of EUR 1,376 MillionmattierzaNo ratings yet

- Hock Seng Lee Berhad: 1HFY12/10 Net Profit Grows by A Whopping 36% YoY - 26/08/2010Document3 pagesHock Seng Lee Berhad: 1HFY12/10 Net Profit Grows by A Whopping 36% YoY - 26/08/2010Rhb InvestNo ratings yet

- Hai-O Enterprise Berhad: FY04/11 Membership To Contract - 29/07/2010Document5 pagesHai-O Enterprise Berhad: FY04/11 Membership To Contract - 29/07/2010Rhb InvestNo ratings yet

- Cong Thuc Chuong Financial AnlysisDocument17 pagesCong Thuc Chuong Financial Anlysis720i0180No ratings yet

- Gulshan Polyols Limited: Stock Performance Details Shareholding Details - September 2015Document6 pagesGulshan Polyols Limited: Stock Performance Details Shareholding Details - September 2015Dharmendra B MistryNo ratings yet

- Allianz Malaysia Berhad: Net Profit Grew 48.5% YoY - 26/08/2010Document3 pagesAllianz Malaysia Berhad: Net Profit Grew 48.5% YoY - 26/08/2010Rhb InvestNo ratings yet

- Deutsche Bank Dr. Josef AckermannDocument32 pagesDeutsche Bank Dr. Josef AckermannLuis Rguez. Del BarrioNo ratings yet

- International Sales Commission Agreement TemplateDocument6 pagesInternational Sales Commission Agreement TemplateJames MurrayNo ratings yet

- Adam Kecskemeti SCA Assignment PDFDocument25 pagesAdam Kecskemeti SCA Assignment PDFAdam KecskemétiNo ratings yet

- Nodes Compared by Number of Coding References PDFDocument1 pageNodes Compared by Number of Coding References PDFAdam KecskemétiNo ratings yet

- Nodes Compared by Number of Coding References PDFDocument1 pageNodes Compared by Number of Coding References PDFAdam KecskemétiNo ratings yet

- Market Research 2 - S - AmericaDocument2 pagesMarket Research 2 - S - AmericaAdam KecskemétiNo ratings yet

- Business Leadership Roles and SkillsDocument5 pagesBusiness Leadership Roles and SkillsAdam KecskemétiNo ratings yet

- Construction and Projects Saudi Arabia OverviewDocument11 pagesConstruction and Projects Saudi Arabia OverviewSen HuNo ratings yet

- Knowledge ManagementDocument10 pagesKnowledge ManagementAdam KecskemétiNo ratings yet

- IKEA and HofstedeDocument34 pagesIKEA and HofstedeAdam Kecskeméti0% (2)

- Currentaccountstatement 18102023-S33iujDocument4 pagesCurrentaccountstatement 18102023-S33iujjuliaechardhqa85No ratings yet

- eStmt_2024-01-31Document4 pageseStmt_2024-01-31ellamaekitchensNo ratings yet

- Invoice 54480Document1 pageInvoice 54480combatgoaNo ratings yet

- SB - Kishore and Tarun PDFDocument1 pageSB - Kishore and Tarun PDFsheetalNo ratings yet

- Dishonoured ChequeDocument13 pagesDishonoured ChequeZonal AccountantNo ratings yet

- Revision of Service Charges - DepositDocument10 pagesRevision of Service Charges - DepositThe QuintNo ratings yet

- INSPECTIONDocument43 pagesINSPECTIONdharampurhaNo ratings yet

- John Linus D. Junio Q2 G-11 Piaget Gen Math Mod 3 AnnuityDocument3 pagesJohn Linus D. Junio Q2 G-11 Piaget Gen Math Mod 3 AnnuityJohnLi JunioNo ratings yet

- Виписка з банкуDocument1 pageВиписка з банкуЛаріна ТетянаNo ratings yet

- DBG Y9 WT4 GHW4 G LHiDocument5 pagesDBG Y9 WT4 GHW4 G LHiamit06sarkarNo ratings yet

- Lecture 6 Cash BookDocument9 pagesLecture 6 Cash BookChaudhry F MasoodNo ratings yet

- Management of Non Performing Assets Public Sector BankDocument76 pagesManagement of Non Performing Assets Public Sector BankShubham MuktiNo ratings yet

- Going To The BankDocument6 pagesGoing To The BankFigen ErgürbüzNo ratings yet

- Everyday English 3: Direct Speech / Reported Speech, Reporting VerbsDocument5 pagesEveryday English 3: Direct Speech / Reported Speech, Reporting Verbsadriana884No ratings yet

- Jharkhand University of Technology Fee ChallanDocument1 pageJharkhand University of Technology Fee ChallanAbhishek 18CED31No ratings yet

- The Supplemental Prospectus of An Actual Offering by Royal BankDocument2 pagesThe Supplemental Prospectus of An Actual Offering by Royal BankAmit PandeyNo ratings yet

- Engineering Economy (Board Exam Problems) : University of Science and Technology of Southern PhilippinesDocument5 pagesEngineering Economy (Board Exam Problems) : University of Science and Technology of Southern PhilippinesVea ValcorzaNo ratings yet

- Simple Interest & Simple DiscountDocument32 pagesSimple Interest & Simple DiscountHarold Kian50% (2)

- Chapter 12 (Saunders)Document13 pagesChapter 12 (Saunders)sdgdfs sdfsfNo ratings yet

- 03 Interchange Pricing Grids Presentation Feb 2012Document99 pages03 Interchange Pricing Grids Presentation Feb 201288quiznos88100% (1)

- Letters of Credit and RMG ExportDocument2 pagesLetters of Credit and RMG ExportMohammad Shahjahan SiddiquiNo ratings yet

- Comparative Study Between Public and Private BankDocument40 pagesComparative Study Between Public and Private BankRashmi ShuklaNo ratings yet

- What Are The Different Types of Interest and Why Do They MatterDocument6 pagesWhat Are The Different Types of Interest and Why Do They MatterRochelle Anne OpinaldoNo ratings yet

- General Terms & Conditions For LoansDocument14 pagesGeneral Terms & Conditions For Loansvignesh sNo ratings yet

- SRS Document - Project ArrowDocument4 pagesSRS Document - Project ArrowRanier RanierNo ratings yet

- Movie Review Inside JobDocument7 pagesMovie Review Inside JobVikram Singh MeenaNo ratings yet

- MBL Internship ReportDocument34 pagesMBL Internship ReportAyman Ahmed Cheema0% (1)

- Export FinanceDocument56 pagesExport Financesahil8844100% (1)

- Compound InterestDocument25 pagesCompound InterestGemma Canong Magdato50% (2)

- LCR and NSFR ARUSHADocument23 pagesLCR and NSFR ARUSHAgeminiNo ratings yet