Professional Documents

Culture Documents

2016 California Resident Income Tax Return Form 540 2ez

Uploaded by

api-351598796Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2016 California Resident Income Tax Return Form 540 2ez

Uploaded by

api-351598796Copyright:

Available Formats

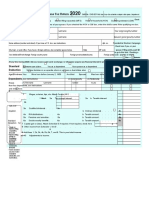

TAXABLE YEAR FORM

2016 California Resident Income Tax Return 540 2EZ

Your first name Initial Last name Suffix Your SSN or ITIN

Bob Wang 666 - 66 - 6666 A

If joint tax return, spouse's/RDP's first name Initial Last name Suffix Spouse's/RDP's SSN or ITIN

R

Additional information (see instructions)

Street address (number and street) or PO box Apt. no/ste. no. PMB/private mailbox RP

213131 dsadasd ave,

City (If you have a foreign address, see instructions.) State ZIP code

rjsakj sajdk CA 4 5 4 5 7

Foreign country name Foreign province/state/county Foreign postal code

Date Your DOB (mm/dd/yyyy) Spouse's/RDP's DOB (mm/dd/yyyy)

of

Birth 06/16/1974

Prior If you filed your 2015 tax return under a different last name, write the last name only from the 2015 tax return.

Name Taxpayer Spouse/RDP

, .

Filing Status Filing Status. Check the box for your filing status. See instructions. , .

Check only one.

1

Single

, .

2 Married/RDP filing jointly (even if only one spouse/RDP had income) , .

4 Head of household. STOP! See instructions.

, .

5 Qualifying widow(er) with dependent child. Enter year spouse/RDP died.

, .

If your California filing status is different from your federal filing status, check the box here. . . . . . . . . . . . . . . . .

, .

Exemptions 6 If another person can claim you (or your spouse/RDP) as a dependent on his or her tax return,

even if he or she chooses not to, you must see the instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

, .

7 Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 . . . . . . . 7

, .

8 Dependents: (Do not include yourself or your spouse/RDP) Enter number of dependents here . . . . 8

Dependent 1 Dependent 2 Dependent 3

First Name

.

Last Name

.

SSN

.

Dependent's

relationship , .

to you

3111163 Form 540 2EZ C1 2016 Side 1

Your name: Wang Your SSN or ITIN: 666 - 66 - 6666 , .

. only

,Whole dollars

Taxable

Income and

Credits 9 Total wages (federal Form W-2, box 16). See instructions. . . . . . . . . . . . . . . . . . 9 , 3 2 . 00

, .

10 Total interest income (Form 1099-INT, box 1). See instructions. . . . . . . . . . . . . . 10 , . 00

11 Total dividend income (Form 1099-DIV, box 1a). See instructions. . . . . . . . . . . . 11 , , 3 . 30. 000

12 Total pension income. See instructions. Taxable amount. . . . . . . . . 12 , 3 . 00

13 Total capital gains distributions from mutual funds (Form 1099-DIV, box 2a).

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 , 3 3 . 00

16 Add line 9, line 10, line 11, line 12, and line 13.. . . . . . . . . . . . . . . . . . . . . . . . . . 16

Enclose, but do

not staple, any , 1 0 1 . 00

payment.

17 Using the 2EZ Table for your filing status, enter the tax for the amount on line 16.

Caution: If you checked the box on line 6, STOP. See instructions for

completing the Dependent Tax Worksheet. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 , 0 . 00

18 Senior exemption: See instructions. If you are 65 or older and entered 1 in the

box on line 7, enter $111. If you entered 2 in the box on line 7, enter $222 . . . . . 18 0 . 00

19 Nonrefundable renters credit. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . 19 6 0 . 00

20 Credits. Add line 18 and line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 6 0 . 00

21 Tax. Subtract line 20 from line 17. If zero or less, enter -0- . . . . . . . . . . . . . . . . 21 , 0 . 00

22 Total tax withheld (federal Form W-2, box 17 or Form 1099-R, box 12) . . . . . . . 22 , 1 3 3 . 00

, .

23 Earned Income Tax Credit (EITC). See instructions for FTB 3514 . . . . . . . . . . . . 23 , . 00

24 Total payments. Add line 22 and line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24 ,1 3 3 . 00

Use Tax

25 Use tax. See instructions . . . . . . . . . . . . . . . . . . . . . . 25 , . 00 , .

26 Payments balance. If line 24 is more than line 25, subtract line 25 from line 24 . 26 ,1 3 3 . 00

, .

27 Use Tax balance. If line 25 is more than line 24, subtract line 24 from line 25 . . 27 , 0 . 00

Overpaid 28 Overpaid tax. If line 26 is more than line 21, subtract line 21 from line 26 . . . . . 28 ,1 3 3 . 00

Tax/

Tax Due. 29 Tax due. If line 26 is less than line 21, subtract line 26 from line 21.

See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29 , 0 . 00

This space reserved for 2D barcode

Side 2 Form 540 2EZ C1 2016 3112163

Your name: Wang Your SSN or ITIN: 666 - 66 - 6666

Voluntary Contributions

Code Amount

California Seniors Special Fund. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

Alzheimers Disease/Related Disorders Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

Rare and Endangered Species Preservation Program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

California Breast Cancer Research Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

California Firefighters Memorial Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

Emergency Food for Families Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

California Peace Officer Memorial Foundation Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

California Sea Otter Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

California Cancer Research Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

NO LONGER AVAILABLE 0 . 00

Child Victims of Human Trafficking Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

School Supplies for Homeless Children Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

State Parks Protection Fund/Parks Pass Purchase . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

Protect Our Coast and Oceans Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

Keep Arts in Schools Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

State Childrens Trust Fund for the Prevention of Child Abuse . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

Prevention of Animal Homelessness and Cruelty Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

Revive the Salton Sea Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

California Domestic Violence Victims Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

Special Olympics Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

Type 1 Diabetes Research Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 00

30 Add amounts in code 400 through code 435. These are your total contributions . . . . . . . . . . . . .

0 . 00

3113163 Form 540 2EZ C1 2016 Side 3

Your name: Wang Your SSN or ITIN: 666 - 66 - 6666

Amount 31 AMOUNT YOU OWE. Add line 27, line 29, and line 30. See instructions. Do not send cash.

You Owe Mail to: FRANCHISE TAX BOARD

PO BOX 942867

SACRAMENTO CA 94267-0001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , 0 . 00

Pay online Go to ftb.ca.gov for more information.

Direct 32 REFUND OR NO AMOUNT DUE. Subtract line 30 from line 28. See instructions.

Deposit

(Refund Mail to: FRANCHISE TAX BOARD

Only) PO BOX 942840

SACRAMENTO CA 94240-0001 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32 ,1 3 3 . 00

Fill in the information to authorize direct deposit of your refund into one or two accounts.

Do not attach a voided check or a deposit slip. Have you verified the routing and

account numbers? Use whole dollars only.

All or the following amount of my refund (line 32) is authorized for direct deposit into the

account shown below:

Type

Routing number Checking Account number 33 Direct deposit amount

0 2 1 3 2 1 2 3 1 Savings , . 00

The remaining amount of my refund (line 32) is authorized for direct deposit into the account shown below:

Type

Routing number Checking Account number 34 Direct deposit amount

Savings , . 00

To learn about your privacy rights, how we may use your information, and the consequences for not providing the requested information, go to

ftb.ca.gov and search for privacy notice. To request this notice by mail, call 800.852.5711.

Under penalties of perjury, I declare that, to the best of my knowledge and belief, the information on this tax return is true, correct, and complete.

Your signature Date Spouses/RDPs signature (if a joint tax return, both must sign)

X X

Your email address. Enter only one email address.

Preferred phone number

Sign ADSAD@QEA.COM (545) 454-8789

()

Here Paid preparers signature (declaration of preparer is based on all information of which preparer has any knowledge)

It is unlawful

to forge a

spouses/RDPs Firms name (or yours, if self-employed) PTIN

signature.

Joint tax return?

See instructions. Firms address FEIN

Do you want to allow another person to discuss this tax return with us? See instructions. . . . Yes No

Print Third Party Designees Name Telephone Number

()

Side 4 Form 540 2EZ C12016 3114163

You might also like

- U.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010Document6 pagesU.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010victor liuNo ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- HRBlockDocument7 pagesHRBlocksusu ultra menNo ratings yet

- Brooklyn Museum 2019 IRS Form 990Document64 pagesBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNo ratings yet

- Request For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429Document2 pagesRequest For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429DrmookieNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetDavid FreiheitNo ratings yet

- Think Computer Foundation 2009 Tax ReturnDocument10 pagesThink Computer Foundation 2009 Tax ReturnTaxManNo ratings yet

- 2009 Income Tax ReturnDocument5 pages2009 Income Tax Returngrantj820No ratings yet

- Eric Lesser & Alison Silber - 2013 Joint Tax ReturnDocument2 pagesEric Lesser & Alison Silber - 2013 Joint Tax ReturnSteeleMassLiveNo ratings yet

- 2021 - TaxReturn 2pagessignedDocument3 pages2021 - TaxReturn 2pagessignedDedrick RiversNo ratings yet

- Rs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Document17 pagesRs Accounting and Tax Services Inc 10 Fairway Drive Suite 201A Deerfield Beach, FL 33441 (888) 341-2429Moysés Isper NetoNo ratings yet

- 2010 Income Tax ReturnDocument2 pages2010 Income Tax ReturnCkey ArNo ratings yet

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDocument3 pages2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedNo ratings yet

- 2021-2022 Tax ReturnDocument3 pages2021-2022 Tax ReturnMmmmmmmNo ratings yet

- U.S. Departing Alien Income Tax Return: Print or TypeDocument4 pagesU.S. Departing Alien Income Tax Return: Print or TypeDavid WebbNo ratings yet

- U.S. Individual Income Tax Return: See Separate InstructionsDocument4 pagesU.S. Individual Income Tax Return: See Separate InstructionsNewsTeam20100% (1)

- Estimated Tax for IndividualsDocument12 pagesEstimated Tax for IndividualsJob SchwartzNo ratings yet

- Hall Tax Services Hall Tax Professionals Chicago Heights Il 60411Document34 pagesHall Tax Services Hall Tax Professionals Chicago Heights Il 60411Rendy MomoNo ratings yet

- 2021TaxReturnPDF 221003 100736Document18 pages2021TaxReturnPDF 221003 100736Tracy SmithNo ratings yet

- Hillside Children's Center, New York 2014 IRS ReportDocument76 pagesHillside Children's Center, New York 2014 IRS ReportBeverly TranNo ratings yet

- File your 1040 tax return onlineDocument2 pagesFile your 1040 tax return onlineSammi Bowe100% (1)

- Income Tax Return 2019Document6 pagesIncome Tax Return 2019Cindy WheelerNo ratings yet

- Amara Enyia's 2017 Tax ReturnDocument4 pagesAmara Enyia's 2017 Tax ReturnMark Konkol100% (1)

- Young Acc 137 Kongai, Tsate 1040Document26 pagesYoung Acc 137 Kongai, Tsate 1040Kathy YoungNo ratings yet

- 2007 Federal ReturnDocument2 pages2007 Federal ReturnbradybunnellNo ratings yet

- Tax ReturnDocument4 pagesTax ReturncykablyatNo ratings yet

- Gov. Walz 2019 Federal Tax Return - RedactedDocument11 pagesGov. Walz 2019 Federal Tax Return - RedactedTim Walz for GovernorNo ratings yet

- Planilla Federal Keyla 2021Document2 pagesPlanilla Federal Keyla 2021Keyla VelezNo ratings yet

- Individual Tax ReturnDocument6 pagesIndividual Tax Returnaklank_218105No ratings yet

- LIBRO 9 Derecho RomanoDocument30 pagesLIBRO 9 Derecho RomanoDomingo VasquezNo ratings yet

- 2011 Income Tax ReturnDocument4 pages2011 Income Tax Returnsalazar17No ratings yet

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- US Tax ReturnDocument13 pagesUS Tax Returnjamo christineNo ratings yet

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- Bruce Byrd 2013 Tax Return - T13 - For - Records PDFDocument69 pagesBruce Byrd 2013 Tax Return - T13 - For - Records PDFjessica50% (2)

- Ezra Daniels TaxDocument11 pagesEzra Daniels TaxJulio Romero100% (1)

- Certain Government Payments: Copy B For RecipientDocument2 pagesCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationMarlena Anne GusmanoNo ratings yet

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNo ratings yet

- 2013 Tax Return (Shep-Ty DBA Embrace)Document24 pages2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNo ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- 2020 Partnership Tax ReturnDocument18 pages2020 Partnership Tax ReturnEdwin Altamiranda100% (2)

- Tax - 2020-2021 PDFDocument2 pagesTax - 2020-2021 PDFShanto ChowdhuryNo ratings yet

- Electronic Filing Instructions For Your 2008 Federal Tax ReturnDocument14 pagesElectronic Filing Instructions For Your 2008 Federal Tax ReturnjakeNo ratings yet

- Windward Fund's 2018 Tax FormsDocument49 pagesWindward Fund's 2018 Tax FormsJoe SchoffstallNo ratings yet

- Zambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Document15 pagesZambrano Tax-Pro & Services 2752 Eagle Canyon DR S Kissimmee, FL 34746 407-334-2907Yaidhyt PradoNo ratings yet

- Tax FormsDocument2 pagesTax FormsBridget May Cruz100% (1)

- 2020 0605 Return MspaduaDocument1 page2020 0605 Return MspaduaEljoe VinluanNo ratings yet

- 2022 Individual Tax Organizer FillableDocument6 pages2022 Individual Tax Organizer FillableTham DangNo ratings yet

- Semir Demiri 50 14Th ST North Edgartown Ma 02539Document2 pagesSemir Demiri 50 14Th ST North Edgartown Ma 02539SemirNo ratings yet

- Square 2022 W-2Document2 pagesSquare 2022 W-2Zane CardinalNo ratings yet

- Gene Locke Tax Return, 2006Document25 pagesGene Locke Tax Return, 2006Lee Ann O'NealNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Andres AlcantarNo ratings yet

- 2016 California Resident Income Tax Return Form 540 2ezDocument4 pages2016 California Resident Income Tax Return Form 540 2ezapi-354477702No ratings yet

- 16 540-SignedDocument5 pages16 540-Signedapi-352277890No ratings yet

- 2016 540 California Resident Income Tax ReturnDocument34 pages2016 540 California Resident Income Tax Returnapi-3512139760% (1)

- 2016 540 California Resident Income Tax ReturnDocument5 pages2016 540 California Resident Income Tax Returnapi-351213976No ratings yet

- 540 FinalDocument5 pages540 Finalapi-350796322No ratings yet

- Case 2 (1-4)Document6 pagesCase 2 (1-4)zikril94No ratings yet

- General journal entries for consulting businessDocument22 pagesGeneral journal entries for consulting businessPauline Bianca70% (10)

- All Template Chapter 6 As of September 10 2019Document32 pagesAll Template Chapter 6 As of September 10 2019Aira Dizon50% (2)

- How Much Is The Distributable Income of The GPP?Document2 pagesHow Much Is The Distributable Income of The GPP?Katrina Dela CruzNo ratings yet

- Financial Frictions and Fluctuations in VolatilityDocument55 pagesFinancial Frictions and Fluctuations in VolatilityHHHNo ratings yet

- 04 Victorias Milling Co. Inc. vs. Municipality of VictoriasDocument2 pages04 Victorias Milling Co. Inc. vs. Municipality of VictoriasJamaica Cabildo ManaligodNo ratings yet

- Fabozzi Fofmi4 Ch28 ImDocument15 pagesFabozzi Fofmi4 Ch28 ImAndreea ConoroNo ratings yet

- Acer, Inc: Taiwan's Rampaging DragonDocument20 pagesAcer, Inc: Taiwan's Rampaging DragonPravin Dhas100% (5)

- Microeconomics U5Document59 pagesMicroeconomics U5LilyNo ratings yet

- OnlinePayslip Pages NewPayslipModuleDocument1 pageOnlinePayslip Pages NewPayslipModulerujean romy p guisando57% (7)

- Comparative Study of Airline Merger PerformanceDocument14 pagesComparative Study of Airline Merger Performancefemi1989100% (1)

- Jenga Inc Solution Year 1 Year 2: © Corporate Finance InstituteDocument2 pagesJenga Inc Solution Year 1 Year 2: © Corporate Finance InstitutePirvuNo ratings yet

- Cash Flow Statement GuideDocument37 pagesCash Flow Statement GuideAshekin MahadiNo ratings yet

- Tutorial Services Business PlanDocument43 pagesTutorial Services Business PlanSandeep Kodan100% (5)

- Municipal Finance and Service Delivery in GujaratDocument30 pagesMunicipal Finance and Service Delivery in GujaratKrunal BhanderiNo ratings yet

- Corporate Finance: Topic: Company Analysis "Infosys"Document6 pagesCorporate Finance: Topic: Company Analysis "Infosys"Anuradha SinghNo ratings yet

- VAT Refund for Export CorporationDocument5 pagesVAT Refund for Export CorporationAustin Viel Lagman MedinaNo ratings yet

- TDS CertificateDocument2 pagesTDS Certificatetauqeer25No ratings yet

- Covivio Hotels Bond Investor PresentationDocument57 pagesCovivio Hotels Bond Investor PresentationTung NgoNo ratings yet

- Analisis Pengukuran Tingkat Kesehatan Perbankan Syariah Dengan Menggunakan Metode Camel Pada Pt. Bank Mandiri Syariah TBKDocument21 pagesAnalisis Pengukuran Tingkat Kesehatan Perbankan Syariah Dengan Menggunakan Metode Camel Pada Pt. Bank Mandiri Syariah TBKKey JannahNo ratings yet

- FRX2Any v.12.14.01 DEMO MANAGEMENT REPORTDocument3 pagesFRX2Any v.12.14.01 DEMO MANAGEMENT REPORTkrisNo ratings yet

- Asset AccountingDocument19 pagesAsset AccountingAniruddha SonpatkiNo ratings yet

- Ebs-Strategy-R12.2 Roadmap PDFDocument156 pagesEbs-Strategy-R12.2 Roadmap PDFSrinivasa Rao AsuruNo ratings yet

- Bethlehem Steel Case StudyDocument24 pagesBethlehem Steel Case StudyS. Michael Ratteree100% (1)

- Guzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodDocument2 pagesGuzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodGerald SantosNo ratings yet

- 9781337913201.112 Warren Acct28e ch11Document81 pages9781337913201.112 Warren Acct28e ch11cielocastanedaNo ratings yet

- Basics of Demand and SupplyDocument29 pagesBasics of Demand and SupplyNuahs Magahat100% (2)

- Calpine Corp. The Evolution From Project To Corporate FinanceDocument4 pagesCalpine Corp. The Evolution From Project To Corporate FinanceDarshan Gosalia100% (1)

- Government Accounting: (Unified Account Code Structure)Document13 pagesGovernment Accounting: (Unified Account Code Structure)Mariella AngobNo ratings yet

- 2014 15 Tax Planning Guide - 29 01 15Document252 pages2014 15 Tax Planning Guide - 29 01 15DaneGilbertNo ratings yet