Professional Documents

Culture Documents

Worksheet Problem

Uploaded by

usernames3580 ratings0% found this document useful (0 votes)

47 views4 pagesz

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentz

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

47 views4 pagesWorksheet Problem

Uploaded by

usernames358z

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 4

Additional information:

1 Depreciation on equipment $10,000

2 Accounts receivable outstanding 40,000

Uncollectible - Estimated 5,500

3 Wages earned 12/16-12/31 1,500 Not yet paid

4 Cash borrowed 10/1 50,000

Annual interest on note 12%

Principal due in 10 years

5 Cash lent 3/1 $20,000

Interest on note 8%

6 Insurance paid (2 years) 4/1 $6,000 Initial Dr. Ins. Exp

Cr. Cash

7 Supplies remaining on hand 800

8 Customer paid 2,000 Initial Cr. Revenue

for spaghetti to make next year 1,500 pounds

9 Rent paid for December & January $2,000

Rent per month 1,000

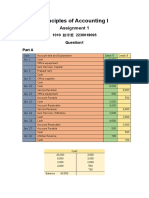

Student Name: Instructor

Class: McGraw-Hill/Irwin

Problem 02-03

PASTINA COMPANY

General Journal

Date Account Debit Credit

(1) Depreciation Expense 10,000

Accumulated Depreciation 10,000

(2) Bad debt expense 2,500

Allowance for uncollectable accts 2,500

(3) Wage expense 1,500

Wages payable 1,500

(4) Interest expense 1,500

Interest payable 1,500

(5) Interest receivable 1,333

Interest revenue 1,333

(6) Prepaid insurance 3,750

Insurance expense 3,750

(7) Supplies expense 700

Supplies 700

(8) Sales revenue 2,000

Unearned revenue 2,000

(9) Rent expense 1,000

Prepaid rent 1,000

Problem 2-3

PASTINA COMPANY

December 31, 2015

Stmt of Retained

Unadjusted Trial Balance Adjusting Entries Adjusted Trial Balance Income Stmt Earnings Balance Sheet

Account Title Debits Credits Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash 30,000

Accounts receivable 40,000

Allowance for uncollectible accounts 3,000

Supplies 1,500

Inventory 60,000

Note receivable 20,000

Interest receivable 0

Prepaid rent 2,000

Prepaid insurance 0

Equipment 80,000

Accumulated depreciation-equipment 30,000

Accounts payable 28,000

Wages payable 0

Note payable 50,000

Interest payable 0

Unearned revenue 0

Common stock 60,000

Retained earnings 24,500

Sales revenue 148,000

Interest revenue 0

Cost of goods sold 70,000

Wage expense 18,900

Rent expense 11,000

Depreciation expense 0

Interest expense 0

Supplies expense 1,100

Insurance expense 6,000

Bad debt expense 3,000

Totals 343,500 343,500

Net Income

Retained Earnings, End

Totals

Problem 2-3

PASTINA COMPANY

December 31, 2015

Unadjusted Trial Balance Adjusting Entries Adjusted Trial Balance Income Stmt Earnings Balance Sheet

Account Title Debits Credits Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash 30,000 30,000 30,000

Accounts receivable 40,000 40,000 40,000

Allowance for uncollectible accounts 3,000 2 2,500 5,500 5,500

Supplies 1,500 7 700 800 800

Inventory 60,000 60,000 60,000

Note receivable 20,000 20,000 20,000

Interest receivable 0 5 1,333 1,333 1,333

Prepaid rent 2,000 9 1,000 1,000 1,000

Prepaid insurance 0 6 3,750 3,750 3,750

Equipment 80,000 80,000 80,000

Accumulated depreciation-equipment 30,000 1 10,000 40,000 40,000

Accounts payable 28,000 28,000 28,000

Wages payable 0 3 1,500 1,500 1,500

Note payable 50,000 50,000 50,000

Interest payable 0 4 1,500 1,500 1,500

Unearned revenue 0 8 2,000 2,000 2,000

Common stock 60,000 60,000 60,000

Retained earnings 24,500 24,500 24,500

Sales revenue 148,000 8 2,000 146,000 146,000

Interest revenue 0 5 1,333 1,333 1,333

Cost of goods sold 70,000 70,000 70,000

Wage expense 18,900 3 1,500 20,400 20,400

Rent expense 11,000 9 1,000 12,000 12,000

Depreciation expense 0 1 10,000 10,000 10,000

Interest expense 0 4 1,500 1,500 1,500

Supplies expense 1,100 7 700 1,800 1,800

Insurance expense 6,000 6 3,750 2,250 2,250

Bad debt expense 3,000 2 2,500 5,500 5,500

Totals 343,500 343,500 24,283 24,283 360,333 360,333 123,450 147,333

Net Income 23,883 - - 23,883

147,333 147,333 - 48,383

Retained Earnings, End 48,383 - - 48,383

Totals 48,383 48,383 236,883 236,883

You might also like

- Abdirahman Assign 1Document8 pagesAbdirahman Assign 1Mazlax YareNo ratings yet

- Quiz Inter1 C1Document3 pagesQuiz Inter1 C1Vanessa vnssNo ratings yet

- Prepare Financial Report AssignmentDocument7 pagesPrepare Financial Report AssignmentBiruk HabtamuNo ratings yet

- Solution Aassignments CH 5Document5 pagesSolution Aassignments CH 5RuturajPatilNo ratings yet

- ch12 PDFDocument4 pagesch12 PDFCarmela Isabelle DisilioNo ratings yet

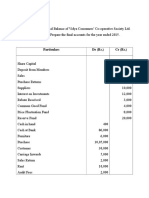

- Vidya Consumer Co-op Society AccountsDocument7 pagesVidya Consumer Co-op Society Accountsswati100% (3)

- Problem No 5.2-A Affordable Lawn Care IncDocument5 pagesProblem No 5.2-A Affordable Lawn Care IncZeeshan AjmalNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Acc Quiz1 Nguyễn Hữu Nghĩa Hs180944 Mkt1831Document4 pagesAcc Quiz1 Nguyễn Hữu Nghĩa Hs180944 Mkt1831nn27102004No ratings yet

- Discussion For Adjustment Entries - QuestionsDocument6 pagesDiscussion For Adjustment Entries - QuestionsMUHAMMAD ZAIM ILYASA KASIMNo ratings yet

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- Journal EntryDocument9 pagesJournal Entrytrisha joy de laraNo ratings yet

- QUICKDocument8 pagesQUICKnissaNo ratings yet

- 4 5Document7 pages4 5Jyan GayNo ratings yet

- PA-1 Adjusments and Worksheet (Problems)Document5 pagesPA-1 Adjusments and Worksheet (Problems)Safira ChairunnisaNo ratings yet

- Activity Review StatementDocument5 pagesActivity Review Statementangel ciiiNo ratings yet

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDocument23 pagesProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Completing The Acctg CycleDocument14 pagesCompleting The Acctg CycleHearty Hitutua100% (1)

- Last Name, Given Name, Middle NameDocument3 pagesLast Name, Given Name, Middle NameDe chavez, John carlo R.No ratings yet

- Financial Statement AdjustmentsDocument5 pagesFinancial Statement AdjustmentsHasan NajiNo ratings yet

- Toaz - Info Prelim Midterm PRDocument98 pagesToaz - Info Prelim Midterm PRClandestine SoulNo ratings yet

- Eco & Actg for Engineers Assignment SolutionsDocument6 pagesEco & Actg for Engineers Assignment SolutionsNayeem HossainNo ratings yet

- Akuntansi Chapter 4Document23 pagesAkuntansi Chapter 4Alfian Rizal MahendraNo ratings yet

- Adjusting Entries ConstantinoDocument5 pagesAdjusting Entries ConstantinoKyla Lyn OclaritNo ratings yet

- AaaaDocument5 pagesAaaaminh trungNo ratings yet

- Accounting journal entries and trial balancesDocument15 pagesAccounting journal entries and trial balancesSamuel PurbaNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- Class Exercise Sheet FourDocument9 pagesClass Exercise Sheet Fourcarol mohasebNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Poa HWDocument3 pagesPoa HW赵宇哲No ratings yet

- QUIZ 9 fINACRDocument9 pagesQUIZ 9 fINACRJen NerNo ratings yet

- Kunjaw UasDocument11 pagesKunjaw UasIvan Katibul FaiziNo ratings yet

- Quiz 9 FinacrDocument9 pagesQuiz 9 FinacrJen Ner100% (5)

- Accounting Homework AdjustmentsDocument5 pagesAccounting Homework AdjustmentsHasan NajiNo ratings yet

- 1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Document7 pages1712 Acct6174 Tmba TK4-W10-S15-R2 Team2Adzinta Syamsa100% (1)

- Adjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingDocument9 pagesAdjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingHassan AliNo ratings yet

- Fin Account-Sole Trading AnswersDocument10 pagesFin Account-Sole Trading AnswersAR Ananth Rohith BhatNo ratings yet

- Accounting Cycle SimulationDocument15 pagesAccounting Cycle SimulationMc Clent CervantesNo ratings yet

- Eg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Document15 pagesEg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Peyti PeytNo ratings yet

- Group Assignment - Questions - RevisedDocument6 pagesGroup Assignment - Questions - Revised31231023949No ratings yet

- The Hong Kong Polytechnic University Hong Kong Community CollegeDocument6 pagesThe Hong Kong Polytechnic University Hong Kong Community CollegeFung Yat Kit KeithNo ratings yet

- Real Realty financial statementsDocument4 pagesReal Realty financial statementsbadNo ratings yet

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- MD JiloDocument6 pagesMD JiloAbdi Mucee TubeNo ratings yet

- Exercises - Trial Balance and Final Accounts - PracticeDocument23 pagesExercises - Trial Balance and Final Accounts - PracticeDilfaraz Kalawat79% (38)

- Dr. Who Clinic Journal EntriesDocument18 pagesDr. Who Clinic Journal EntriesJasmine P. Manlungat - EMERALDNo ratings yet

- Module 2 Key To CorrectionsDocument5 pagesModule 2 Key To CorrectionsPlame GaseroNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Louie Anne R. Lim - 03 Activity 1Document3 pagesLouie Anne R. Lim - 03 Activity 1Louie Anne LimNo ratings yet

- SolutionsDocument10 pagesSolutionsBillah MagomaNo ratings yet

- Net Company Statement of Financial Position As of December 31, 2017 Assets Current AssetsDocument13 pagesNet Company Statement of Financial Position As of December 31, 2017 Assets Current AssetsSarah Nelle PasaoNo ratings yet

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- 4 Solution Exam Auditing 2Document5 pages4 Solution Exam Auditing 2Kristina KittyNo ratings yet

- BALI COMPANY 2020 Financial StatementsDocument4 pagesBALI COMPANY 2020 Financial Statementsshera haniNo ratings yet

- Chapter 3and 4 Assignment-QDocument2 pagesChapter 3and 4 Assignment-QBLESSEDNo ratings yet

- AC3202 WK2 Exercises SolutionsDocument11 pagesAC3202 WK2 Exercises SolutionsLong LongNo ratings yet

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Analyzing a Company's External EnvironmentDocument21 pagesAnalyzing a Company's External Environmentusernames358No ratings yet

- Midterm Exam Review Rev VersionDocument1 pageMidterm Exam Review Rev Versionusernames358No ratings yet

- Textbook Lecture Notes 2Document9 pagesTextbook Lecture Notes 2usernames358No ratings yet

- Quiz 1 Study GuideDocument7 pagesQuiz 1 Study Guideusernames358No ratings yet

- 12 13InternalControl ClassDocument53 pages12 13InternalControl Classusernames358No ratings yet

- Chapter 2 & 3 TXT ExercisesDocument6 pagesChapter 2 & 3 TXT Exercisesusernames358No ratings yet

- Chapter 1 Textbook NotesDocument3 pagesChapter 1 Textbook Notesusernames358No ratings yet

- Chapter 1 Textbook NotesDocument3 pagesChapter 1 Textbook Notesusernames358No ratings yet

- Transition WordsDocument2 pagesTransition Wordsusernames358No ratings yet

- Polar GraphsDocument1 pagePolar Graphsusernames358No ratings yet

- Chapter 4Document17 pagesChapter 4RBNo ratings yet

- Cost Volume Profit AnalysisDocument25 pagesCost Volume Profit Analysisnicole bancoro100% (1)

- Nafasi Za Kazi UdomDocument25 pagesNafasi Za Kazi UdomSwalau OmaryNo ratings yet

- ACC502Document6 pagesACC502waheedahmedarainNo ratings yet

- Processing SystemDocument2 pagesProcessing SystemInday MiraNo ratings yet

- Osama Ahmed CV 1625740321Document2 pagesOsama Ahmed CV 1625740321Ilyes BeloudaneNo ratings yet

- China Eastern Airlines Cea Corporation Limited Presents Two Sets ofDocument1 pageChina Eastern Airlines Cea Corporation Limited Presents Two Sets ofTaimour HassanNo ratings yet

- Fabm1 Lesson 2Document21 pagesFabm1 Lesson 2JoshuaNo ratings yet

- BSA and BSAIS Graduates' Readiness and Core CompetenciesDocument2 pagesBSA and BSAIS Graduates' Readiness and Core CompetenciesMark Leo Opo RetuertoNo ratings yet

- Solution Manual Advanced Accounting 11E by Beams 03 Solution Manual Advanced Accounting 11E by Beams 03Document22 pagesSolution Manual Advanced Accounting 11E by Beams 03 Solution Manual Advanced Accounting 11E by Beams 03vvNo ratings yet

- Audit of The Sales and Collection Cycle: Tests of Controls Review Questions 12-1Document22 pagesAudit of The Sales and Collection Cycle: Tests of Controls Review Questions 12-1Tilahun MikiasNo ratings yet

- ACA 212 Strategic Cost Management: Profit behavior under absorption and variable costing systemsDocument4 pagesACA 212 Strategic Cost Management: Profit behavior under absorption and variable costing systemsnot funny didn't laughNo ratings yet

- Answer For Exam Five Project One GivenDocument6 pagesAnswer For Exam Five Project One GivenGuddataa DheekkamaaNo ratings yet

- LUMS ACCT 130 Management Accounting Course OverviewDocument6 pagesLUMS ACCT 130 Management Accounting Course Overviewumar farooq malik muhammad tariqNo ratings yet

- Budgets and Managing MoneyDocument51 pagesBudgets and Managing MoneyIrtiza Shahriar ChowdhuryNo ratings yet

- Partnership Dissolution MCQ Reviewer Partnership Dissolution MCQ ReviewerDocument9 pagesPartnership Dissolution MCQ Reviewer Partnership Dissolution MCQ ReviewerKarl Wilson GonzalesNo ratings yet

- ch10 Solution Manual Managerial Accounting Tools For Business Decision Making PDFDocument62 pagesch10 Solution Manual Managerial Accounting Tools For Business Decision Making PDFMunna Bhattacharjee100% (1)

- Solution Tutorial 4 - Chapter 6 and 7Document8 pagesSolution Tutorial 4 - Chapter 6 and 7Kanda PanglimaNo ratings yet

- HINDI NATITINAG ANG PUSONG PILIPINODocument7 pagesHINDI NATITINAG ANG PUSONG PILIPINOGerwin Mangaring OrtegaNo ratings yet

- Dokumen - Tips Garrison Noreen Brewer 11th Edition Chapter 1Document34 pagesDokumen - Tips Garrison Noreen Brewer 11th Edition Chapter 1Arghya BiswasNo ratings yet

- DLL FABM Week3Document3 pagesDLL FABM Week3sweetzelNo ratings yet

- FICO Module Course ContentsDocument3 pagesFICO Module Course ContentsMohammed Nawaz Shariff100% (1)

- F7 CH 3 Tangble Non Current AssetDocument22 pagesF7 CH 3 Tangble Non Current AssetAnang WikanadiNo ratings yet

- 1356-Article Text-8875-2-10-20171105Document21 pages1356-Article Text-8875-2-10-20171105CyrelleNo ratings yet

- Accounting Equation and Basic Financial StatementsDocument47 pagesAccounting Equation and Basic Financial StatementsKei HanzuNo ratings yet

- SAP FI Dunning Procedure For Customer Outstanding InvoicesDocument11 pagesSAP FI Dunning Procedure For Customer Outstanding Invoicesficokiran88No ratings yet

- TST CSECPoag 01239020 January2022Document28 pagesTST CSECPoag 01239020 January2022Ashleigh Jarrett100% (1)

- Finance Graduate Seeks Thesis OpportunityDocument2 pagesFinance Graduate Seeks Thesis OpportunityArmiel DwarkasingNo ratings yet

- Problem Solving: Merchandising Problem (Perpetual Inventory System)Document1 pageProblem Solving: Merchandising Problem (Perpetual Inventory System)Vincent Madrid83% (6)

- Accounting Quiz Bee QuestionsDocument8 pagesAccounting Quiz Bee QuestionsJanella Patrizia67% (3)