Professional Documents

Culture Documents

CREBA Case Tax Digest in Bullet Points

Uploaded by

Erika Bianca Paras0 ratings0% found this document useful (0 votes)

18 views1 pagecreba case tax digest in bullet points (MCIT)

Original Title

CREBA Case tax digest in bullet points

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcreba case tax digest in bullet points (MCIT)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views1 pageCREBA Case Tax Digest in Bullet Points

Uploaded by

Erika Bianca Parascreba case tax digest in bullet points (MCIT)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

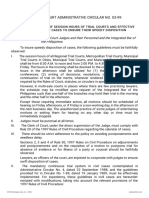

Special Rules!

expenditures such as administrative and interest expenses

1. Chamber of Real Estate Builders Association v. Executive were not taken into account. Thus pegging the tax base of

Secretary! MCIT on gross income is tantamount to confiscation of capital

Chamber of REB is an association of real estate developers and because gross income unlike net income is not realized gain.!

builders in the Philippines! Court disagrees.!

Taxes are the lifeblood of the government.!

It assails the validity of the imposition of minimum corporate

income tax (MCIT) on corporations.! Power to tax is plenary and unlimited in its range.!

Tax statutes will not be shot down as unconstitutional on the

Section 27(E) provides for MCIT on domestic corporations,

implemented by RR 9-98.! mere allegation of arbitrariness by the taxpayer.!

Certainly an income tax is arbitrary and confiscatory if it taxes

Chamber argues that the MCIT violates the due process clause

because it levies income tax even if there is no realized gain.! capital because capital is not income.!

But MCIT is not a tax on capital!!

ISSUE: WHETHER OR NOT THE IMPOSITION OF THE MCIT

ON DOMESTIC CORPORATIONS IS UNCONSTITUTIONAL! MCIT is imposed on gross income arrived at by deducting the

capital spent by a corporation in the sale of its goods (cost of

HELD!

goods) and other direct expenses from gross sales.!

Under the MCIT scheme, a corporation, beginning on its 4th

year of operation, is assessed an MCIT of 2% of its gross MCIT is not an additional imposition because it is imposed in

lieu of normal net income tax if the latter is lower than MCIT.!

income when such MCIT is greater than the normal corporate

income tax imposed under 27(A).! !

2. CIR v. PAL!

If regular income tax is higher than MCIT, the corp does not

pay MCIT.! 3. Manila Wine Merchants v. CIR!

4. CIR v. Tuason!

Any excess of MCIT over normal tax shall be carried forward

and credited against normal income tax for 3 immediately 5. Cyanamid v. CA!

succeeding taxable years.! 6. BIR Ruling 25-02

The MCIT is a result of the perceived inadequacy of the self-

assessment system in capturing the true income of

corporations.!

It is a means to make sure that everyone will make some

minimum contribution to support the public sector.!

Domestic corps owe their corporate existence and their

privilege to do business to the government. They benefit from

government efforts to improve financial market and to ensure

a favorable business climate.!

It is to go around schemes of under-declaration of income or

over-deduction of expenses otherwise called tax shelters!

MCIT not violative of due process!!

Chamber claims that gross income only considers the cost of

goods sold and other direct expenses; other major

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Last Will and TestamentDocument3 pagesLast Will and TestamentAtty. Emmanuel Sandicho100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Sample Trust Notes PDFDocument18 pagesSample Trust Notes PDFJay Crae100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Succession QuestionsDocument2 pagesSuccession QuestionsErika Bianca ParasNo ratings yet

- Rule of EquityDocument11 pagesRule of EquityNeha MakeoversNo ratings yet

- La Tondena Distillers Vs CADocument2 pagesLa Tondena Distillers Vs CAJL A H-Dimaculangan100% (1)

- Ateneo Law Conflict of Laws SyllabusDocument8 pagesAteneo Law Conflict of Laws SyllabusErika Bianca ParasNo ratings yet

- California Non-Party DiscoveryDocument74 pagesCalifornia Non-Party Discoverymonicagraham100% (4)

- UN Human RightsDocument33 pagesUN Human RightsNeelesh Bhandari100% (2)

- Administrative Law: Commissions of Inquiry Act, 1952Document18 pagesAdministrative Law: Commissions of Inquiry Act, 1952Varun Yadav100% (3)

- Revised Code of ConductDocument58 pagesRevised Code of ConductMar DevelosNo ratings yet

- Case Study of A BarangayDocument5 pagesCase Study of A BarangayKourej Neyam Cordero100% (2)

- People V LalliDocument6 pagesPeople V LalliErika Bianca ParasNo ratings yet

- ROBERN DEVELOPMENT CORPORATION Vs PELADocument14 pagesROBERN DEVELOPMENT CORPORATION Vs PELAGenevieve BermudoNo ratings yet

- British American Tobacco DigestsDocument3 pagesBritish American Tobacco DigestsErika Bianca ParasNo ratings yet

- 53454-1999-Strict Observance of Session Hours of TrialDocument5 pages53454-1999-Strict Observance of Session Hours of TrialErika Bianca ParasNo ratings yet

- Metrobank CaseDocument9 pagesMetrobank CaseErika Bianca ParasNo ratings yet

- Paris Principles National Human RightsDocument3 pagesParis Principles National Human RightsErika Bianca ParasNo ratings yet

- Comparing Regional Human Rights SystemsDocument10 pagesComparing Regional Human Rights SystemsNatalia Torres ZunigaNo ratings yet

- PurominesDocument6 pagesPurominesErika Bianca ParasNo ratings yet

- Final Report On The Impact of International Human Rights Law On General International LawDocument12 pagesFinal Report On The Impact of International Human Rights Law On General International LawErika Bianca ParasNo ratings yet

- Udhr PDFDocument39 pagesUdhr PDFNatsu DragneelNo ratings yet

- Insurance Case OriginalDocument2 pagesInsurance Case OriginalErika Bianca ParasNo ratings yet

- PracwritDocument20 pagesPracwritErika Bianca ParasNo ratings yet

- Philippine Constitution PDFDocument53 pagesPhilippine Constitution PDFErika Bianca ParasNo ratings yet

- Insurance CaseDocument2 pagesInsurance CaseErika Bianca ParasNo ratings yet

- Republic of The Philippines: Supreme CourtDocument12 pagesRepublic of The Philippines: Supreme CourtErika Bianca ParasNo ratings yet

- Third Division: Syllabus SyllabusDocument4 pagesThird Division: Syllabus SyllabusErika Bianca ParasNo ratings yet

- Supreme Court: Today Is Friday, May 11, 2018Document4 pagesSupreme Court: Today Is Friday, May 11, 2018Erika Bianca ParasNo ratings yet

- Spouses Chuy TanDocument9 pagesSpouses Chuy TanErika Bianca ParasNo ratings yet

- Supreme Court: Today Is Friday, May 11, 2018Document4 pagesSupreme Court: Today Is Friday, May 11, 2018Erika Bianca ParasNo ratings yet

- CA upholds registered owner's right to possession in unlawful detainer caseDocument4 pagesCA upholds registered owner's right to possession in unlawful detainer caseErika Bianca ParasNo ratings yet

- AFP V SanvictoresDocument10 pagesAFP V SanvictoresErika Bianca ParasNo ratings yet

- Supreme Court Provides Guidance on Transfer Pricing AnalysisDocument4 pagesSupreme Court Provides Guidance on Transfer Pricing AnalysisJm CruzNo ratings yet

- Ramos V Potenciano DigestDocument1 pageRamos V Potenciano DigestErika Bianca ParasNo ratings yet

- DBP V ClargesDocument15 pagesDBP V ClargesErika Bianca ParasNo ratings yet

- SC upholds reconveyance of disputed propertyDocument12 pagesSC upholds reconveyance of disputed propertyErika Bianca ParasNo ratings yet

- Nego Finals ReviewerDocument4 pagesNego Finals ReviewerErika Bianca ParasNo ratings yet

- Republic Vs Tampus GR 214243Document2 pagesRepublic Vs Tampus GR 214243RR F100% (1)

- STEP Implementing GuidelinesDocument6 pagesSTEP Implementing GuidelinesRico TedlosNo ratings yet

- People v. VeraDocument63 pagesPeople v. VeraJeremy MercaderNo ratings yet

- Gajendra Singh Yadav Vs Union of IndiaDocument3 pagesGajendra Singh Yadav Vs Union of IndiaShreya SinhaNo ratings yet

- Condillac, Essay On The Origin of Human KnowledgeDocument409 pagesCondillac, Essay On The Origin of Human Knowledgedartgunn3445No ratings yet

- UBC Vs Agaba KamukamaDocument6 pagesUBC Vs Agaba KamukamaKellyNo ratings yet

- Kanun - WikiDocument6 pagesKanun - WikiPhilip SuitorNo ratings yet

- Federal Register Limits PW4000 Engine Surges on TakeoffDocument6 pagesFederal Register Limits PW4000 Engine Surges on TakeoffRitesh SaxenaNo ratings yet

- Final Project of CompanyDocument30 pagesFinal Project of CompanySanni KumarNo ratings yet

- Moot 1 PDFDocument15 pagesMoot 1 PDFVivek SinghNo ratings yet

- 1 Santos V SantosDocument12 pages1 Santos V SantosMarioneMaeThiamNo ratings yet

- Contributor Agreement Form - AMPSDocument10 pagesContributor Agreement Form - AMPSEntorque RegNo ratings yet

- Bophal Gas TrasgedyDocument8 pagesBophal Gas TrasgedyMayank ShakyaNo ratings yet

- Heirs of Demetria Lacsa vs Court of AppealsDocument2 pagesHeirs of Demetria Lacsa vs Court of AppealsJennilyn TugelidaNo ratings yet

- Spring Air ModelDocument22 pagesSpring Air Modelwa190100% (1)

- Soliman V FernandezDocument5 pagesSoliman V FernandezarnyjulesmichNo ratings yet

- Professional Misconduct of Lawyers in IndiaDocument9 pagesProfessional Misconduct of Lawyers in IndiaAshu 76No ratings yet

- Trust Test Answer ShenaDocument7 pagesTrust Test Answer ShenaShena JaiNo ratings yet

- Terry Simonton, Jr. v. Franklin Tennis, 3rd Cir. (2011)Document11 pagesTerry Simonton, Jr. v. Franklin Tennis, 3rd Cir. (2011)Scribd Government DocsNo ratings yet

- Grievance ManagementDocument11 pagesGrievance ManagementAtulith KumarNo ratings yet

- (CLJ) Court TestimonyDocument51 pages(CLJ) Court TestimonyEino DuldulaoNo ratings yet