Professional Documents

Culture Documents

Income Tax Declaration-1

Uploaded by

Kumaravel0 ratings0% found this document useful (0 votes)

9 views1 pageincome tax declaration format,useful to declare tax

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentincome tax declaration format,useful to declare tax

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageIncome Tax Declaration-1

Uploaded by

Kumaravelincome tax declaration format,useful to declare tax

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

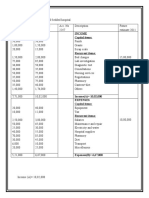

KOYAMA Precision Works INDIA Pvt Ltd

Employee's Income Tax Declaration Form for the Financial Year 2016-17

Name : C.Kumaravel PAN No : ATVPK8664L

Designation : Deputy Manager - Quality DOB : 18.07.1977

Department : Quality Assurance

S. No. DESCRIPTION Proposed Investment

A Particulars of Income other than salary from Koyama (optional)

1 Other Incomes (specify)

DETAIL OF HOUSE PROPERTY FOR CLAIMING REBATE UNDER SECTION

B

24 OF THE I.T ACT :

Address of house property :

Whether self occupied : (Yes /No)

If no , Net annual income of house property

Amount of housing loan Interest for the F.Y. 2016-17 148,642.00

Amount of Interest for Pre-Contruction Period (as per Income Tax Rule)

C HRA: RENT PAID PER MONTH 180,000.00

D INVESTMENTS U/S 80C, 80CCC, 80CCD

1 Public Provident Fund

2 Contribution to Certain Pension Funds

3 Housing Loan Principal Repayment 84302

4 Insurance Premium 25230

109,532.00

5 Term Deposit with Schedule Bank

6 National Saving Scheme / Certificate

7 Mutual Fund

8 Children Tuition Fees

9 Others, (Please specify if any)

Total Investments U/S 80C - limited to Rs 1,50,000/-

only

ADDITIONAL BENEFIT -Section 80CCD - National Pension Scheme (NPS)

Rs 50000

E OTHER PERMITTED DEDUCTIONS

80D - Medical Insurance Premium (Maximum Rs. 25,000

1

(Rs. 30,000 for senior citizens)

2 80G - Donations

4 Others - (Please specify if any) Medical 15000 15000

Kindly Submit this form before 24 Feb 2017

I, do hereby declare that the proof of investments will be submitted by 24th February , 2017. Further, in case of any change in

above declaration, I would inform the company . I shall indemnify Koyama for all cost and consequences if any information is

found to be incorrect.

I further declare that company can deduct Rs. ---------- P.M as TDS from my salary w.e.f 24-02-2017

Signature with date

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- 4M Change Management Rule RevisedDocument2 pages4M Change Management Rule RevisedKumaravelNo ratings yet

- 4M Changing Point ManagementDocument7 pages4M Changing Point ManagementKumaravelNo ratings yet

- 2044IATF BDocument3 pages2044IATF BKumaravelNo ratings yet

- Chemical & Mechanical Properties Comparison at External LabDocument4 pagesChemical & Mechanical Properties Comparison at External LabKumaravelNo ratings yet

- Koya India Quality ReportDocument1 pageKoya India Quality ReportKumaravelNo ratings yet

- Attribute Measurement System Analysis Timesheet Processing Cost Data Integrity Project PurposeDocument10 pagesAttribute Measurement System Analysis Timesheet Processing Cost Data Integrity Project PurposensadnanNo ratings yet

- CMR For 2gs Am CrackDocument7 pagesCMR For 2gs Am CrackKumaravelNo ratings yet

- Total Quality Management: Total-Made Up of Whole Quality-Degree of Excellence A Product orDocument6 pagesTotal Quality Management: Total-Made Up of Whole Quality-Degree of Excellence A Product orKumaravelNo ratings yet

- Iatf Gap Analysis ToolDocument100 pagesIatf Gap Analysis ToolKumaravel100% (3)

- Nabl Scope 1Document1 pageNabl Scope 1KumaravelNo ratings yet

- List of Special CharacteristicsDocument2 pagesList of Special CharacteristicsKumaravelNo ratings yet

- Internal / External Communication PlanDocument3 pagesInternal / External Communication PlanKumaravelNo ratings yet

- QA Lot Management Sheet Quantity CheckDocument4 pagesQA Lot Management Sheet Quantity CheckKumaravelNo ratings yet

- Attribute Measurement System Analysis Timesheet Processing Cost Data Integrity Project PurposeDocument10 pagesAttribute Measurement System Analysis Timesheet Processing Cost Data Integrity Project PurposensadnanNo ratings yet

- APQP & PPAP Training Evaluation QuestionnaireDocument2 pagesAPQP & PPAP Training Evaluation QuestionnaireKumaravel81% (16)

- Weighing Machine Maintenance Check SheetDocument1 pageWeighing Machine Maintenance Check SheetKumaravel100% (2)

- ISO 9001 2015 and IATF 16949 Vs ISO TS 16949 2009 Comparison Matrix by American Systems Registrar PDFDocument116 pagesISO 9001 2015 and IATF 16949 Vs ISO TS 16949 2009 Comparison Matrix by American Systems Registrar PDFDL50% (2)

- 2GS AM Spline Thickness Seggregation DataDocument1 page2GS AM Spline Thickness Seggregation DataKumaravelNo ratings yet

- IATF Implementation Plan and Co-Ordinator RolesDocument3 pagesIATF Implementation Plan and Co-Ordinator RolesKumaravel50% (2)

- IATF 16949 ClientsDocument126 pagesIATF 16949 ClientsKumaravel100% (1)

- (2-22) Process ChangeDocument6 pages(2-22) Process ChangeKumaravelNo ratings yet

- 3h56 KoyamaDocument2 pages3h56 KoyamaKumaravelNo ratings yet

- (2-01) QAM Registration SheetDocument1 page(2-01) QAM Registration SheetKumaravelNo ratings yet

- Quality Biweekly Report Mar 2018Document3 pagesQuality Biweekly Report Mar 2018KumaravelNo ratings yet

- Lot analysis report for special characteristicsDocument1 pageLot analysis report for special characteristicsKumaravelNo ratings yet

- Traceability Check Sheet - Koyama IndiaDocument12 pagesTraceability Check Sheet - Koyama IndiaKumaravelNo ratings yet

- India Yamaha Motor Pvt Ltd safety audit checklist for supplier partsDocument1 pageIndia Yamaha Motor Pvt Ltd safety audit checklist for supplier partsKumaravelNo ratings yet

- Packing standards for parts deliveryDocument4 pagesPacking standards for parts deliveryKumaravelNo ratings yet

- ISO 9001-2015 Vs ISO 9001-2008 Matrix ENDocument11 pagesISO 9001-2015 Vs ISO 9001-2008 Matrix ENTomas Morales100% (1)

- Process Check Sheet - Koyama IndiaDocument8 pagesProcess Check Sheet - Koyama IndiaKumaravelNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Springtek Mattress InvoiceDocument1 pageSpringtek Mattress InvoiceRavi kumar BhukyaNo ratings yet

- HR Case StudiedDocument2 pagesHR Case StudiedSafuan Saad100% (2)

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- Processing Classes (SAP HCM)Document5 pagesProcessing Classes (SAP HCM)chinnipappu1No ratings yet

- Progress Report Charging Proposal2Document2 pagesProgress Report Charging Proposal2jonathan a. magdosaNo ratings yet

- Audit & Taxation Course at Dow University Covers Key PrinciplesDocument5 pagesAudit & Taxation Course at Dow University Covers Key PrinciplesMuhammad RizwanNo ratings yet

- Import and Export Under GSTDocument50 pagesImport and Export Under GSTSONICK THUKKANINo ratings yet

- Partnership vs Corporation Law QuestionsDocument2 pagesPartnership vs Corporation Law Questionserica insiongNo ratings yet

- Taxation Sia/Tabag TAX.2903-Donor's Tax OCTOBER 2020Document8 pagesTaxation Sia/Tabag TAX.2903-Donor's Tax OCTOBER 2020Bryan Christian MaragragNo ratings yet

- 1 Principles of TaxationDocument11 pages1 Principles of TaxationDiana SheineNo ratings yet

- Income Capital ItemsDocument2 pagesIncome Capital ItemsDeepti KukretiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Padmanabhan RNo ratings yet

- Nepalese Tax BibliographyDocument3 pagesNepalese Tax BibliographyromanNo ratings yet

- Samuel Project2Document69 pagesSamuel Project2John EzewuzieNo ratings yet

- Intraperiod Tax AllocationDocument2 pagesIntraperiod Tax AllocationAllen KateNo ratings yet

- NullDocument4 pagesNullapi-25425285No ratings yet

- Bill FaisalabadDocument2 pagesBill FaisalabadTech With UsNo ratings yet

- 2019 1099-Consol Morgan Stanley 5948 KentDocument10 pages2019 1099-Consol Morgan Stanley 5948 Kentesteysi775No ratings yet

- Richard Pieris Exports PLCDocument9 pagesRichard Pieris Exports PLCDPH ResearchNo ratings yet

- Super Top-Up Medicare Policy Premium Chart - Including GSTDocument6 pagesSuper Top-Up Medicare Policy Premium Chart - Including GSTvinay_814585077No ratings yet

- RCO Commentary Finance Bill 2023-24Document26 pagesRCO Commentary Finance Bill 2023-24drtunioNo ratings yet

- Amazon V IRS - IRS Opening BriefDocument143 pagesAmazon V IRS - IRS Opening BriefDaniel BallardNo ratings yet

- LSPU Provides Quality Education Through Responsive InstructionDocument4 pagesLSPU Provides Quality Education Through Responsive InstructionJhervhee A. ArapanNo ratings yet

- Computation of Total Income (As Per Normal Provisions) Income From Salary (Chapter IV A) 4746736Document10 pagesComputation of Total Income (As Per Normal Provisions) Income From Salary (Chapter IV A) 4746736nABSAMNNo ratings yet

- uFELEKU AYENACHEWDocument50 pagesuFELEKU AYENACHEWamanualNo ratings yet

- Settlement Commissionb Tax FDDocument15 pagesSettlement Commissionb Tax FDhani diptiNo ratings yet

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDocument1 pageThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byVidhyarthi PhotocopyNo ratings yet

- Question Tax Project Jan 2022 - 18012022Document7 pagesQuestion Tax Project Jan 2022 - 18012022MOHAMAD FARHAN AQMAL MOHD HERMIENo ratings yet

- CIR Vs BOAC Case DigestDocument1 pageCIR Vs BOAC Case DigestJamie BerryNo ratings yet

- Norwegian Tax Administration Service Centre GuideDocument17 pagesNorwegian Tax Administration Service Centre GuideFahadNo ratings yet