Professional Documents

Culture Documents

Chapter 8

Uploaded by

WaleedKhalid0 ratings0% found this document useful (0 votes)

12 views2 pagesChapter 8 Contents

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentChapter 8 Contents

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesChapter 8

Uploaded by

WaleedKhalidChapter 8 Contents

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Shahid Nawaz

Entrepreneurship

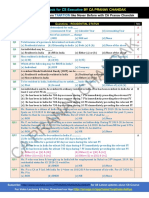

Chapter 8: Assessing a New Venture

Financial Strengths and Viability

Financial Management deals with two ii. Whether it is financially sound

activities: raising money and managing overall?

The answer to the 1st Q. is provided by these

companys finances in a way that achieves

2 ratios: Working Capital & Current

the highest rate of return. Ratio.

iii. Statement of Cash Flows (summarizes

The FM of a firm deals with following

the changes in a firms cash position for

questions on an ongoing basis: a specified period of time and details

How are we doing? Are we making or losing why the change occurred)

money? Operating activities (include net

How much cash do we have on hand? income (or loss), depreciation,

How efficiently are we utilizing our assets? changes in current assets and current

Overall, are we in good shape financially? liabilities other than cash and short-

term debt)

Financial Objectives of a Firm:

Profitability Investing activities (include the

purchase, sale, or investment in fixed

Liquidity

assets, such as real estate, equipment,

A/R & Inventory

and buildings)

Efficiency

Financing activities (include cash

Stability raised during the period by

The Process of Financial Management: borrowing money or selling stock

Financial statement (historical financial and/ or cash used during the period

statements, pro forma financial statements), by paying dividends, buying back

Forecasts, Budgets, Financial Ratios outstanding stock, or buying back

outstanding bonds)

1. Preparation of Historic Financial Ratio Analysis

Statements Comparing a Firms Results versus Plans

2. Preparation of Forecasts Comparing a Firms Financial Results to

3. Preparation of Pro Forma Financial Industry Norms

Statements Step 2: Preparation of Forecasts:

4. Ongoing Analysis of Financial Forecasts are predictions of a firms future

Results sales, expenses, income, and capital

Step 1: Historical Financial Statements: expenditures.

i. Income Statement (reflects the Completely new firms typically base their

results of the operations of a firm forecasts on:

over a specified period of time) A good-faith estimate of sales, and

Net sales On industry averages,

Cost of sales (or CGS) Or the experiences of similar start-

Operating expenses ups for cost of goods sold and other

In evaluating a firms income statements, 2 expenses.

ratios are most important: Assumption Sheet

Profit margin Types of Forecasts:

i. Sales Forecast:

Price-to-earnings ratio (or P/E Ratio)

Regression analysis

ii. Balance Sheet (is a snapshot of a ii. Forecast of CGS and Other items:

companys assets, liabilities, and OE Percent-of-sales method

at a specific point in time) Constant ratio method of

Major categories of Assets: forecasting

Current, Fixed, Other Assets In addition to computing sales forecasts, a

Major categories of Liabilities: new venture should calculate break-even

Current, Long-term liabilities point to determine if the proposed venture is

When evaluating a Balance Sheet, The 2 feasible?

primary Qs. are: BEP = TFC/ (P-AVC)

i. Whether a firm has sufficient Step 3: Preparation of Pro Forma

short-term assets to cover its Financial Statements

short-term debts? Step 4: Ongoing Analysis of Financial

Results

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Shahid Nawaz EntrepreneurshipDocument2 pagesShahid Nawaz EntrepreneurshipWaleedKhalidNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Contents of Business PlanDocument1 pageContents of Business PlanWaleedKhalidNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Contents of Business PlanDocument1 pageContents of Business PlanWaleedKhalidNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- IB Final Project ReportDocument46 pagesIB Final Project ReportWaleedKhalidNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- IB Final Project ReportDocument46 pagesIB Final Project ReportWaleedKhalidNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Introduction To Professional Salesmanship: Learning CompetenciesDocument12 pagesIntroduction To Professional Salesmanship: Learning CompetenciesHannah Sophia Morales0% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- B71fedca 95fa 4b5b B32e A2fa493fbdeaDocument22 pagesB71fedca 95fa 4b5b B32e A2fa493fbdeaRaj DasNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Chapter 3 - Page 7 ROE and EVA Answer: D Diff: MDocument2 pagesChapter 3 - Page 7 ROE and EVA Answer: D Diff: MpompomNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- McDonald's Financial Analysis and Corporate ValuationDocument23 pagesMcDonald's Financial Analysis and Corporate ValuationRahil VermaNo ratings yet

- Debt Rest. & Ret. Ben. - QuizDocument4 pagesDebt Rest. & Ret. Ben. - QuizMike Oliver NualNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Corporate Income TaxDocument24 pagesCorporate Income TaxRIRI RUMAIZHANo ratings yet

- Managing Productivity and MarketingDocument19 pagesManaging Productivity and MarketingBianca LizardoNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Feasibility Study On A Street Food SellerDocument24 pagesFeasibility Study On A Street Food SellerMarie WrightNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Accounting FormulaDocument4 pagesAccounting FormulaAndrea AbayaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Business Administration Paper 2000 SEC-optimized titleDocument37 pagesBusiness Administration Paper 2000 SEC-optimized titleKeera KilerNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Laporan Keuangan PT BFI Finance IndonesiaDocument103 pagesLaporan Keuangan PT BFI Finance IndonesiaAdi HamdaniNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Residential Status MCQs - Part 1Document5 pagesResidential Status MCQs - Part 1Manikandan ManoharNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Chapter 2 Payroll NotesDocument7 pagesChapter 2 Payroll NotesHarithaNo ratings yet

- Multiple Choice Questions 1 Eddie A Single Taxpayer Has W 2 IncomeDocument1 pageMultiple Choice Questions 1 Eddie A Single Taxpayer Has W 2 IncomeTaimour HassanNo ratings yet

- PI-Management Preparation Kit 2023Document61 pagesPI-Management Preparation Kit 2023Vineet UttamNo ratings yet

- (Handbook of Macroeconomics 1, Part C) John B. Taylor and Michael Woodford (Eds.) - North Holland (1999)Document566 pages(Handbook of Macroeconomics 1, Part C) John B. Taylor and Michael Woodford (Eds.) - North Holland (1999)Raphael BacchiNo ratings yet

- Previous Years' Examination Questions on Ratio AnalysisDocument25 pagesPrevious Years' Examination Questions on Ratio AnalysisHarsahib SinghNo ratings yet

- 17,605.40 Tumbled The: Hapter QueryDocument10 pages17,605.40 Tumbled The: Hapter QueryAashish mishraNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NeracaDocument3 pagesNeracaanasatriNo ratings yet

- ABC Costing PDFDocument33 pagesABC Costing PDFDrpranav SaraswatNo ratings yet

- Adjustments Quiz 1Document6 pagesAdjustments Quiz 1Christine Mae BurgosNo ratings yet

- Gaston v. Republic Bank G.R No. L 77194Document5 pagesGaston v. Republic Bank G.R No. L 77194Rachel CayangaoNo ratings yet

- Financial Results For June 30, 2015 (Standalone) (Result)Document1 pageFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Valuation: Packet 2 Relative Valuation, Asset-Based Valuation and Private Company ValuationDocument170 pagesValuation: Packet 2 Relative Valuation, Asset-Based Valuation and Private Company Valuationluvie melatiNo ratings yet

- Statement For Aug 18, 2023Document1 pageStatement For Aug 18, 2023Hawa KabiaNo ratings yet

- Cazeñas-Debit Credit MemoDocument35 pagesCazeñas-Debit Credit MemoMicah Hanna Mae CazenasNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Adoption of IFRSDocument13 pagesAdoption of IFRSsuryamlacwNo ratings yet

- Ac FY Bcom (Raj) 8Document97 pagesAc FY Bcom (Raj) 8arg16No ratings yet

- Knoll Furniture CaseDocument5 pagesKnoll Furniture CaseIni EjideleNo ratings yet

- Fsa 3,4,5Document17 pagesFsa 3,4,5wambualucas74No ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)