Professional Documents

Culture Documents

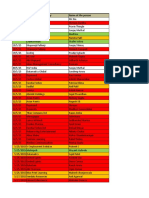

Profit and Loss Projection

Uploaded by

Ryuki BelamiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profit and Loss Projection

Uploaded by

Ryuki BelamiCopyright:

Available Formats

Notes on Preparation

You may want to print this information to use as reference later. To delete these instruct

box and then press the DELETE key.

You should change "category 1, category 2", etc. labels to the actual names of your sales cate

for each month. The spreadsheet will add up total annual sales. In the "%" columns, the spread

Profit and Loss Projection (12 Months) contributed by each category.

Enter your Company Name here

COST OF GOODS SOLD (also called Cost of Sales or COGS): COGS are those expenses dir

your products or services. For example, purchases of inventory or raw materials, as well as the

Fiscal Year Begins employees directly involved in producing your products/services, are included in COGS. These

Jan-08 along with the volume of production or sales. Study your records to determine COGS for each

the key to profitability for most businesses, so approach this part of your forecast with great ca

product/service, analyze the elements of COGS: how much for labor, for materials, for packing

LY

etc.? Compare the Cost of Goods Sold and Gross Profit of your various sales categories. Whic

.%

8

8

8

8

8

8

8

B/A

y-0

g-0

v-0

AR

p-0

c-0

r-0

b-0

n-0

n-0

r- 0

t-0

least - and why? Underestimating COGS can lead to under pricing, which can destroy your abi

l-0

IND

%

%

%

Ma

Ma

Oc

No

Ap

Au

YE

De

Se

Fe

Ju

Ju

Ja

and be realistic. Enter the COGS for each category of sales for each month. In the "%" column

%

Revenue (Sales) COGS as a % of sales dollars for that category.

Category 1 - - - - - - - - - - - - 0 -

Category 2 - - - - - - - - - GROSS- PROFIT: Gross

- - Total0Sales

Profit is - minus Total COGS. In the "%" columns, the sprea

Category 3 - - - - - - - - - of Total-Sales. - - 0 -

Category 4 - - - - - - - - - - - - 0 -

Category 5 - - - - - - - - - OPERATING - EXPENSES

- (also- called0 Overhead):

- These are necessary expenses which, howe

Category 6 - - - - - - - - - or buying - your products/services.

- - Rent, 0 utilities,

- telephone, interest, and the salaries (and payr

Category 7 - - - - - - - - - employees - are examples.

- Change- the0 names

- of the Expense categories to suit your type of bu

Total Revenue (Sales) 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 0 0.0 You0 may

0.0 need0to0.0combine0some 0.0 categories,

0 0.0 however, to stay within the 20 line limit of the spre

remain reasonably fixed regardless of changes in sales volume. Some, like sales commissions

Cost of Sales utilities, may vary with the time of year. Your projections should reflect these fluctuations. The o

Category 1 - - - - - - - - - simulate - your financial

- - nearly

reality as 0 as -possible. In the "%" columns, the spreadsheet will s

Category 2 - - - - - - - - - -

Total Sales. - - 0 -

Category 3 - - - - - - - - - - - - 0 -

Category 4 - - - - - - - - - NET PROFIT:

- The spreadsheet

- - will subtract

0 - Total Operating Expenses from Gross Profit to cal

Category 5 - - - - - - - - - it will show

- Net Profit

- as a % of- Total Sales.

0 -

Category 6 - - - - - - - - - - - - 0 -

Category 7 - - - - - - - - - INDUSTRY

- AVERAGES:

- The first

- column,

0 -labeled "IND. %" is for posting average cost factors

Total Cost of Sales 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - Industry

0 - average

0 data

- is commonly

0 - available

0 - from industry associations, major manufacturers

and local colleges, Chambers of Commerce, and public libraries. One common source is the b

Gross Profit 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - by Robert

annually 0 -Morris0Associates.

- 0It can

- be found in major libraries, and your banker almos

your expenses will be exactly in line with industry averages, but they can be helpful in areas in

Expenses

Salary expenses - - - - - - - - - - - - 0 -

Payroll expenses - - - - - - - - - - - - 0 -

Outside services - - - - - - - - - - - - 0 -

Supplies (office and

operating) - - - - - - - - - - - - 0 -

Repairs and

maintenance - - - - - - - - - - - - 0 -

Advertising - - - - - - - - - - - - 0 -

Car, delivery and travel - - - - - - - - - - - - 0 -

Accounting and legal - - - - - - - - - - - - 0 -

Rent & Related Costs - - - - - - - - - - - - 0 -

Telephone - - - - - - - - - - - - 0 -

Utilities - - - - - - - - - - - - 0 -

Insurance - - - - - - - - - - - - 0 -

Taxes (real estate, etc.) - - - - - - - - - - - - 0 -

Interest - - - - - - - - - - - - 0 -

Depreciation - - - - - - - - - - - - 0 -

Other expenses (specify) - - - - - - - - - - - - 0 -

Other expenses (specify) - - - - - - - - - - - - 0 -

Other expenses (specify) - - - - - - - - - - - - 0 -

Misc. (unspecified) - - - - - - - - - - - - 0 -

Total Expenses 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 -

Net Profit Before Taxes

Income Taxes - - - - - - - - - - - - -

Net Operating Income 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 - 0 -

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PepsiCo India Fact Sheet: Key Details on Lay's Brand History and Market LeadershipDocument5 pagesPepsiCo India Fact Sheet: Key Details on Lay's Brand History and Market LeadershiprummanakhanNo ratings yet

- Recommendations to Revive StarbucksDocument4 pagesRecommendations to Revive StarbucksVic RabayaNo ratings yet

- Fernandez vs. Dela RosaDocument2 pagesFernandez vs. Dela RosaCeCe Em50% (4)

- Tax SyllabusDocument7 pagesTax Syllabuscrizzia fanugaNo ratings yet

- SEC Opinion Romulo MabantaDocument7 pagesSEC Opinion Romulo MabantaMRose SerranoNo ratings yet

- Complete Fico ManualDocument374 pagesComplete Fico ManualJigar Shah96% (23)

- 2019 - ACA Exam Dates and Deadlines - WebDocument2 pages2019 - ACA Exam Dates and Deadlines - WebSree Mathi SuntheriNo ratings yet

- Test Bank, Solutions Manual, Ebooks - List 5Document4 pagesTest Bank, Solutions Manual, Ebooks - List 5smtbportal0% (1)

- Data Base ListDocument33 pagesData Base ListKrishna Chaitanya V S100% (1)

- Industrial Organization: Contemporary Theory and Practice (3 Edition)Document11 pagesIndustrial Organization: Contemporary Theory and Practice (3 Edition)kcp123No ratings yet

- Air BlueDocument10 pagesAir BlueAli SaimaNo ratings yet

- October 2014 Line Blind ReportDocument70 pagesOctober 2014 Line Blind Reportr_chulinNo ratings yet

- Lenovo IBDocument11 pagesLenovo IBsatyakidutta007100% (1)

- Brantford 2011 Financial ReportsDocument168 pagesBrantford 2011 Financial ReportsHugo RodriguesNo ratings yet

- Register with AMFIDocument3 pagesRegister with AMFIDeepak Iyer Deepu0% (1)

- Case StudyDocument2 pagesCase StudyNatalie ChehraziNo ratings yet

- Company Representative Meeting RecordsDocument24 pagesCompany Representative Meeting RecordsJagadamba RealtorNo ratings yet

- IMFAHE Quarter Course 2 - Innovation Entrepreneurship LeadershipDocument4 pagesIMFAHE Quarter Course 2 - Innovation Entrepreneurship LeadershipDaniel NeryNo ratings yet

- WileyCIA P1 All Q ADocument333 pagesWileyCIA P1 All Q APaul Arjay Tatad100% (1)

- Boi Questionairre For Loans Above N 10 MillionDocument21 pagesBoi Questionairre For Loans Above N 10 MillionAdegboyega AdeyemiNo ratings yet

- Takeover of Raasi Cements by India CementsDocument7 pagesTakeover of Raasi Cements by India CementsankitNo ratings yet

- Combining Home Office and Branch Financial StatementsDocument34 pagesCombining Home Office and Branch Financial Statementskiki dwiNo ratings yet

- Entrepreneurship Starting and Managing Your Own BusinessDocument14 pagesEntrepreneurship Starting and Managing Your Own BusinessAbdul Halil AbdullahNo ratings yet

- Principles of ManagementDocument29 pagesPrinciples of ManagementBon Carlo Medina MelocotonNo ratings yet

- PAC DocumentDocument554 pagesPAC DocumentOlakachuna AdonijaNo ratings yet

- PDocument14 pagesPnanusanaiNo ratings yet

- Relation of Partners in A PartnershipDocument17 pagesRelation of Partners in A PartnershipImran Rashid DarNo ratings yet

- Setlawke International TaxationDocument37 pagesSetlawke International TaxationAhmad ObaidatNo ratings yet

- Mergers and AcquisitionDocument17 pagesMergers and AcquisitionRaghu NarayanNo ratings yet

- Benchmarking PDFDocument138 pagesBenchmarking PDFCrystal KlineNo ratings yet