Professional Documents

Culture Documents

DRE

Uploaded by

BVMF_RICopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DRE

Uploaded by

BVMF_RICopyright:

Available Formats

B3 - Brasil, Bolsa, Balco

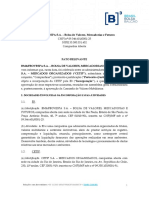

Demonstrao do resultado (consolidado) / Income statement (consolidated)

Variao Variao

(Em milhares de Reais, exceto quando indicado) (In thousand of Brazilian Reals, unless otherwise indicated) 1T17 1T16 4T16

1T17/1T16 1T17/4T16

Receita total Total revenues 1,043,494 977,841 6.7% 1,060,374 -1.6%

Neg. e/ou Liq - BM&F Trading/settlement - BM&F 250,551 277,736 -9.8% 259,853 -3.6%

Derivativos Derivatives 245,522 272,308 -9.8% 254,984 -3.7%

Cmbio Foreign exchange 5,029 5,428 -7.4% 4,869 3.3%

Ativos Securities - - - - -

Neg. e/ou Liq. - Bovespa Trading/Settlement - Bovespa 272,393 224,132 21.5% 272,923 -0.2%

Negociao - emolumentos de prego Trading fees 44,066 36,019 22.3% 43,537 1.2%

Transaes - compensao e liquidao Clearing fees 222,310 183,704 21.0% 224,209 -0.8%

Outras Others 6,017 4,409 36.5% 5,177 16.2%

Segmento de ttulos e valores mobilirios (UTVM) - Cetip - Securities segment (UTVM) 274,949 262,947 4.6% 270,960 1.5%

Registro Registration fees 25,164 27,193 -7.5% 28,323 -11.2%

Custdia Asset under permanency 124,734 120,401 3.6% 122,531 1.8%

Utilizao mensal Monthly utilization 60,551 57,207 5.8% 56,253 7.6%

Transaes Transaction fees 38,352 34,254 12.0% 39,988 -4.1%

Outras receitas de servios Other revenue from services 26,148 23,892 9.4% 23,865 9.6%

Segmento de financiamentos (UFIN) - Cetip Cetip - Financing segment (UFIN) 103,658 89,505 15.8% 97,372 6.5%

SNG SNG 38,420 35,054 9.6% 36,129 6.3%

Sistema de contratos Contracts systems (Sircof) 48,118 40,501 18.8% 45,829 5.0%

Market data e desenvolvimento de solues Market data and development of solutions 16,712 13,164 27.0% 14,965 11.7%

Outras receitas de servios financiamentos Other revenues 408 786 -48.1% 449 -9.1%

Outras receitas Other revenues 141,943 123,521 14.9% 159,266 -10.9%

Emprstimos de valores mobilirios Securities lending 26,991 23,156 16.6% 26,311 2.6%

Listagem de valores mobilirios Listing 14,478 13,555 6.8% 13,336 8.6%

Depositria, custdia e back-office Depository, custody and back-office 50,855 36,465 39.5% 51,240 -0.8%

Acesso dos participantes de negociao Trading access (Brokers) 8,330 9,779 -14.8% 8,415 -1.0%

Vendors - cotaes e info. de mercado Vendors 25,918 27,298 -5.1% 25,444 1.9%

Banco BM&FBOVESPA BM&FBOVESPA bank 10,254 9,338 9.8% 11,041 -7.1%

Outras Others 5,117 3,930 30.2% 23,479 -78.2%

Dedues da receita Revenue deductions (102,587) (103,392) -0.8% (102,094) 0.5%

PIS e Cofins PIS and Cofins (85,907) (80,498) 6.7% (85,537) 0.4%

Impostos sobre servios Service tax (16,680) (22,894) -27.1% (16,557) 0.7%

Receita lquida Net revenues 940,907 874,449 7.6% 958,280 -1.8%

Despesas Expenses (754,518) (320,649) 135.3% (438,856) 71.9%

Pessoal e encargos Personnel (171,966) (160,935) 6.9% (229,680) -25.1%

Processamento de dados Data processing (58,038) (54,926) 5.7% (56,623) 2.5%

Depreciao e amortizao Deprec. and amortization (52,976) (49,911) 6.1% (52,546) 0.8%

Servios de terceiros Third-party services (11,967) (11,461) 4.4% (22,096) -45.8%

Manuteno em geral Maintenance (5,053) (4,898) 3.2% (5,739) -11.9%

Comunicaes Communication (2,538) (2,828) -10.3% (2,545) -0.3%

Promoo e divulgao Marketing (5,155) (3,606) 43.0% (9,379) -45.0%

Impostos e taxas Taxes (2,769) (1,979) 39.9% (2,673) 3.6%

Honorrios do conselho/comits Board/comittees compensation (4,248) (3,021) 40.6% (4,448) -4.5%

Relacionada combinao com a Cetip Related to the combination with Cetip (275,700) (4,565) 5,939.4% (9,674) 2,749.9%

Diversas Others (164,107) (22,519) 628.7% (43,453) 277.7%

Resultado operacional Operating income 186,389 553,800 -66.3% 519,424 -64.1%

Margem operacional Operating margin 19.8% 63.3% -4,352 bps 54.2% -3,439 bps

Reduo ao valor recupervel de ativos Impairment (65,508) - - - -

Resultado de equivalncia patrimonial Equity in income of investees 176 289 -39.1% 355 -50.4%

Resultado financeiro Financial result 198,826 198,750 0.0% 196,551 1.2%

Receitas financeiras Financial income 476,564 263,900 80.6% 386,451 23.3%

Despesas financeiras Financial expenses (277,738) (65,150) 326.3% (189,900) 46.3%

Resultado antes da tributao sobre o lucro Income before taxes 319,883 752,839 -57.5% 716,330 -55.3%

Imposto de renda e contribuio social Income tax and social contribution (110,738) (278,120) -60.2% 362,267 -130.6%

Corrente Current (87,051) (80,021) 8.8% 725,743 -112.0%

Diferido Deferred (23,687) (198,099) -88.0% (363,476) -93.5%

Lucro lquido do perodo Net income 209,145 474,719 -55.9% 1,078,597 -80.6%

Margem lquida Net margin 22.2% 54.3% -3,206 bps 112.6% -9,033 bps

Atribudos aos: Attributable to:

Acionistas da BM&FBOVESPA BM&FBOVESPAs shareholders 209,026 474,566 -56.0% 1,078,399 -80.6%

Margem lquida Net margin 22.2% 54.3% -3,205 bps 112.5% -9,032 bps

Participao dos no controladores Minority interest 119 153 -22.2% 198 -39.9%

EBITDA ajustado Adjusted EBITDA 649,318 608,276 6.7% 615,520 5.5%

Margem EBITDA ajustada Adjusted EBITDA margin 69.0% 69.6% -55 bps 64.2% 478 bps

Despesas ajustadas Adjusted expenses (252,175) (232,403) 8.5% (304,996) -17.3%

Lucro lquido ajustado Adjusted net income 523,604 477,579 9.6% 675,441 -22.5%

Ajustes no resultado operacional Adjustments to operating income 1T17 1T16 Var. 4T16 Var.

Resultado operacional Operating income 186,389 553,800 -66.3% 519,424 -64.1%

(+) Despesas relacionadas combinao com a Cetip (+) Expenses related to the combination with Cetip 275,700 4,565 5,939.4% 9,674 2,749.9%

(+) Despesas extraordinria com concesso de aes (+) Non-recurring expenses with stock grant - - - 33,876 -

(+) Provises extraordinrias (+) Provises extraordinrias 134,253 - - - -

Resultado operacional ex- itens no recorrentes Operating income ex- non-recurring items 596,342 558,365 6.8% 562,974 5.9%

Ajustes nas despesas Adjustments to expenses 1T17 1T16 Var. 4T16 Var.

Despesas Expenses (754,518) (320,649) 135.3% (438,856) 71.9%

(+) Depreciao e amortizao (+) Deprec. and amortization 52,976 49,911 6.1% 52,546 0.8%

(+) Concesso/opo de aes (+) Stock grant/option 25,330 29,671 -14.6% 64,503 -60.7%

(+) Despesas relacionadas combinao com a Cetip (+) Expenses related to the combination with Cetip 275,700 4,565 5,939.4% 9,674 2,749.9%

(+) Provises (recorrentes e no recorrentes) (+) Provisions (recurring and non-recurring) 148,336 4,099 3,518.9% 7,136 1,978.6%

Despesas ajustadas Adjusted expenses (252,175) (232,403) 8.5% (304,996) -17.3%

Ajustes nas despesas com pessoal Adjustments to personnel expenses 1T17 1T16 Var. 4T16 Var.

Pessoal Personnel (171,966) (160,935) 6.9% (229,680) -25.1%

(+) Concesso/opo de aes (+) Stock grant/option 25,330 29,671 -14.6% 64,503 -60.7%

Despesas de pessoal ajustadas Adjusted personel expenses (146,637) (131,264) 11.7% (165,177) -11.2%

Ajustes no lucro lquido (impactos extraordinrios) Adjustments to net income (extraordinary impacts) 1T17 1T16 Var. 4T16 Var.

Lucro lquido (atribudos aos acionistas) Net income (attributable to shareholders) 209,026 474,566 -56.0% 1,078,399 -80.6%

(+) Despesas relacionadas combinao com a Cetip (lquid (+) Expenses related to the combination with Cetip (net of t 182,736 3,013 5,965.1% 6,385 2,762.0%

(+) Provises extraordinrias (lquido de imposto) (+) Extraordinary provisions (net of taxes) 88,607 - - - -

(+) Reduo ao valor recupervel de ativos (lquido de impos (+) Impairment (net of taxes) 43,235 - - - -

(+) Desp. extraordinria com concesso de aes (lq. de im (+) Non-recurring expenses with stock grant (net of tax) - - - 22,358 -

(+) Ajuste ganho de capital na alienao das aes do CME (+) CME Group shares sale capital gain adjustment - - - (431,701) -

Lucro Lquido ex- itens no recorrentes Net income ex- non-recurring items 523,604 477,579 9.6% 675,441 -22.5%

You might also like

- AGE Incorporacao - Boletim de VotoDocument5 pagesAGE Incorporacao - Boletim de VotoBVMF_RINo ratings yet

- PROPOSTA CONSOLIDADA ReduzidaDocument359 pagesPROPOSTA CONSOLIDADA ReduzidaBVMF_RINo ratings yet

- Julgamento CARF 2010-2011 Sem Julgamento PTDocument1 pageJulgamento CARF 2010-2011 Sem Julgamento PTBVMF_RINo ratings yet

- B3 - Edital de Convocacao (AGE de Incorporacao CETIP)Document2 pagesB3 - Edital de Convocacao (AGE de Incorporacao CETIP)BVMF_RINo ratings yet

- B3 AGE Incorporacao Proposta Da AdministracaoDocument15 pagesB3 AGE Incorporacao Proposta Da AdministracaoBVMF_RINo ratings yet

- PROPOSTA CONSOLIDADA ReduzidaDocument359 pagesPROPOSTA CONSOLIDADA ReduzidaBVMF_RINo ratings yet

- AGE Incorporacao - Boletim de VotoDocument5 pagesAGE Incorporacao - Boletim de VotoBVMF_RINo ratings yet

- Apresenta??o MensalDocument48 pagesApresenta??o MensalBVMF_RINo ratings yet

- Fato RelevanteDocument2 pagesFato RelevanteBVMF_RINo ratings yet

- 1T17 - Apresentao de ResultadosDocument23 pages1T17 - Apresentao de ResultadosBVMF_RINo ratings yet

- Apresenta??o MensalDocument48 pagesApresenta??o MensalBVMF_RINo ratings yet

- B3 - Brasil, Bolsa, Balcão: Demonstração Do Resultado (Consolidado) / Income Statement (Consolidated)Document1 pageB3 - Brasil, Bolsa, Balcão: Demonstração Do Resultado (Consolidado) / Income Statement (Consolidated)BVMF_RINo ratings yet

- 1T17 - Apresentacao de ResultadosDocument23 pages1T17 - Apresentacao de ResultadosBVMF_RINo ratings yet

- BVMF 1T17 Earnings Release PORT 2017 05 12Document13 pagesBVMF 1T17 Earnings Release PORT 2017 05 12BVMF_RINo ratings yet

- 1T17 - Apresentacao de ResultadosDocument23 pages1T17 - Apresentacao de ResultadosBVMF_RINo ratings yet

- Ata Da RCA de 12/05/2017 13:00Document3 pagesAta Da RCA de 12/05/2017 13:00BVMF_RINo ratings yet

- Fato RelevanteDocument4 pagesFato RelevanteBVMF_RINo ratings yet

- BVMF 1T17 Earnings Release PORT 2017 05 12Document13 pagesBVMF 1T17 Earnings Release PORT 2017 05 12BVMF_RINo ratings yet

- CVM 358 Individual (Companhia) - 04 2017Document3 pagesCVM 358 Individual (Companhia) - 04 2017BVMF_RINo ratings yet

- BVMF 1T17Document79 pagesBVMF 1T17BVMF_RINo ratings yet

- BVMF 1T17 Earnings Release PORT 2017 05 12Document13 pagesBVMF 1T17 Earnings Release PORT 2017 05 12BVMF_RINo ratings yet

- BMFBOVESPA - Calendrio Anual 2017 v3Document2 pagesBMFBOVESPA - Calendrio Anual 2017 v3BVMF_RINo ratings yet

- AG Mapa Final de Votacao 2017 05 10 ANEXODocument3 pagesAG Mapa Final de Votacao 2017 05 10 ANEXOBVMF_RINo ratings yet

- BVMF 1T17Document79 pagesBVMF 1T17BVMF_RINo ratings yet

- DFPDocument79 pagesDFPBVMF_RINo ratings yet

- UntitledDocument174 pagesUntitledBVMF_RINo ratings yet

- CVM 358 Companhia - Abril 2017Document3 pagesCVM 358 Companhia - Abril 2017BVMF_RINo ratings yet

- 2017 05 04 Comunicado Ao Mercado - Balanco Operacional - Abr2017Document4 pages2017 05 04 Comunicado Ao Mercado - Balanco Operacional - Abr2017BVMF_RINo ratings yet

- CVM 358 ConsolidadaDocument2 pagesCVM 358 ConsolidadaBVMF_RINo ratings yet