Professional Documents

Culture Documents

2017 05 13 11 25 52 683 - 1494654952683 - XXXPK8680X - Otd

Uploaded by

kshitijOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2017 05 13 11 25 52 683 - 1494654952683 - XXXPK8680X - Otd

Uploaded by

kshitijCopyright:

Available Formats

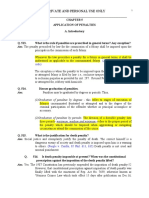

INCOME TAX DEPARTMENT

TAX AND COMPUTATION SHEET

Name & Address

RAMESH CHANDRA KATIYAR

CENTRE VIGYAN VIHAR, DELHI, DELHI, 110092

I.

ASSESSEE

AND

PAN Status Gender

RETURN

DETAILS APAPK8680H INDIVIDUAL Male

Due Date Filing Date Assessment year Acknowledgement No.

04-08-2010 28-07-2010 2010-11 5763

DIN Section AO Description

2011201010069486992T 1431a WARD 2, PATHANKOT

1 Returned Income/Loss 4,23,360

2 Assessed Income/Loss 4,23,360

II.

INCOME 3 Net Agricultural Income 0

4 Special Rate Income 0

5 TDS and TCS 5,000

6 Total Advance Tax 0

III.

PREPAID 7 Self Assessment Tax 0

TAXES

8 Other Payments (Less previously issued refunds) 0

9 Total Prepaid Tax 5,000

10 Special Rate Tax 0

11 Tax 38,672

12 Rebate 0

13 Surcharge 0

14 Education Cess and Higher Education Cess 1,160

15 Relief 0

16 u/s 234A 0

17 u/s 234B 7,656

IV. 18 u/s 234C 1,290

DEMAND/

19 Total Interest Due 8,946

REFUND

20 Total Tax & Interest Due 48,778

21 Less Prepaid Tax 5,000

22 Amount Payable/Refundable 43,778

23 Manual Refund 0

24 Interest chargeable/charged from Assessee u/s 234D 0

25 Addl. Tax on Distributed Profits 0

26 Interest Payable /Paid to Assessee 0

27 Interest chargeable/charged from Assessee u/s 220(2) 0

28 Net Amount Payable/Refundable 43,780

Please note that this is NOT an intimation/order. This information sheet shows the computation of tax and interest for the assessment

year mentioned. This is a taxpayer friendly measure to provide information to taxpayers for previous assessment years where return

was not processed at the Centralized Processing Center, Income Tax Department, Bangalore and where taxpayer may not readily

possess the intimation sheet/order issued by the Department.

While the demand (Net Amount Payable) shown at SI 28 above should normally be the same as shown on the e-Filing Portal, any

difference may be due to adjustment of refund and/or tax-paid, if any

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 3 Year Ll.b-Lecturenotes - First YearDocument1,385 pages3 Year Ll.b-Lecturenotes - First YearGAVASKAR S0% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Pavan Settlement AgreementDocument9 pagesPavan Settlement AgreementSurbhi GuptaNo ratings yet

- Digest CasesDocument194 pagesDigest Casesbingadanza90% (21)

- Torts and Damages Green NotesDocument34 pagesTorts and Damages Green NotesNewCovenantChurchNo ratings yet

- Republic v. Gimenez, G.R. No. 174673 (2016)Document4 pagesRepublic v. Gimenez, G.R. No. 174673 (2016)Gio FadrigalanNo ratings yet

- Digest - Pretty Vs UKDocument1 pageDigest - Pretty Vs UKabbydoodlelismsNo ratings yet

- In The Matter of The Estate of Emil H. Johnson, 39 Phil 156, G.R. No. 12767, November 16, 1918Document1 pageIn The Matter of The Estate of Emil H. Johnson, 39 Phil 156, G.R. No. 12767, November 16, 1918Gi NoNo ratings yet

- PADCOM Vs Ortigas CenterDocument2 pagesPADCOM Vs Ortigas CenterRaymondNo ratings yet

- Downloaded From WWW - ETTV.tvDocument1 pageDownloaded From WWW - ETTV.tvkshitijNo ratings yet

- Engineering Chemistry by Sunita RattanDocument12 pagesEngineering Chemistry by Sunita Rattankshitij0% (1)

- CDS-1 February 2015 English Answer KeyDocument1 pageCDS-1 February 2015 English Answer KeykshitijNo ratings yet

- Engineering Chemistry by Sunita Rattan PDFDocument2 pagesEngineering Chemistry by Sunita Rattan PDFkshitijNo ratings yet

- 2013 Paper PDFDocument14 pages2013 Paper PDFkshitijNo ratings yet

- Chapter 3 Motion in A Straight Line PDFDocument35 pagesChapter 3 Motion in A Straight Line PDFGeeteshGuptaNo ratings yet

- 2017 05 13 11 25 14 517 - 1494654914517 - XXXPK8680X - OtdDocument1 page2017 05 13 11 25 14 517 - 1494654914517 - XXXPK8680X - OtdkshitijNo ratings yet

- Main PDFDocument23 pagesMain PDFkshitijNo ratings yet

- WAP To Input Radius of The Circle According To The Choice of UserDocument2 pagesWAP To Input Radius of The Circle According To The Choice of UserkshitijNo ratings yet

- 11 Chemistry Notes Chapter 7Document8 pages11 Chemistry Notes Chapter 7kshitijNo ratings yet

- Aieee 2012 SolutionsDocument27 pagesAieee 2012 SolutionsAryyama JanaNo ratings yet

- WAP To Input A No From User From 1 To 12 Show The Corresponding Month and Days of The MonthDocument2 pagesWAP To Input A No From User From 1 To 12 Show The Corresponding Month and Days of The MonthkshitijNo ratings yet

- WAP To Accept A Number and If It Is Even Print Its Square Otherwise CubeDocument1 pageWAP To Accept A Number and If It Is Even Print Its Square Otherwise CubekshitijNo ratings yet

- Solutions To Concepts: Chapter - 1Document4 pagesSolutions To Concepts: Chapter - 1Jayanth VgNo ratings yet

- C++ programs on circle, triangle, number operations, conditional statements (40Document18 pagesC++ programs on circle, triangle, number operations, conditional statements (40kshitijNo ratings yet

- Mathspoint - Co.in Straight Lines-I IIT-JEE (XI)Document8 pagesMathspoint - Co.in Straight Lines-I IIT-JEE (XI)kshitijNo ratings yet

- Integration Formulas: 1. Common IntegralsDocument5 pagesIntegration Formulas: 1. Common IntegralssiegherrNo ratings yet

- PrnitDocument1 pagePrnitkshitijNo ratings yet

- Offer Letter: July 01, 2021 Norma Delgado 760-807-7021Document2 pagesOffer Letter: July 01, 2021 Norma Delgado 760-807-7021Norma DuenasNo ratings yet

- Control of Padi and Rice Act 1994 - Act 522Document26 pagesControl of Padi and Rice Act 1994 - Act 522peterparkerNo ratings yet

- A Famous Contemporary LeaderDocument10 pagesA Famous Contemporary LeaderelissaysmnNo ratings yet

- People vs. GungonDocument26 pagesPeople vs. GungonDenNo ratings yet

- Valenzuela Theft Conviction UpheldDocument2 pagesValenzuela Theft Conviction UpheldDanielleNo ratings yet

- Voluntary LiquidationDocument15 pagesVoluntary LiquidationSonu KumarNo ratings yet

- Torts-Midterms PDFDocument89 pagesTorts-Midterms PDFLeo GarciaNo ratings yet

- CBSE Class 9 Social Science Important Questions on Working of InstitutionsDocument4 pagesCBSE Class 9 Social Science Important Questions on Working of InstitutionsIX-I 35 Yash KanodiaNo ratings yet

- RPA1951Document118 pagesRPA1951Rubal Tajender MalikNo ratings yet

- University of The East - Caloocan College of Arts and Sciences Department of Social Sciences School Year 2011-2012Document10 pagesUniversity of The East - Caloocan College of Arts and Sciences Department of Social Sciences School Year 2011-2012Dan GregoriousNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Citadines T's & C's 6.08.18Document5 pagesCitadines T's & C's 6.08.18NeenNo ratings yet

- 2017 Exam Scope With Answers CompletedDocument34 pages2017 Exam Scope With Answers CompletedMpend Sbl CkkNo ratings yet

- BA 7107 Legal Aspects of BusinessDocument53 pagesBA 7107 Legal Aspects of BusinessRajesh Kumar100% (1)

- CIVIL PROCEDURE LAND ORDER SALEDocument4 pagesCIVIL PROCEDURE LAND ORDER SALEVieanne ChristensenNo ratings yet

- For Private and Personal Use OnlyDocument31 pagesFor Private and Personal Use OnlyShazna SendicoNo ratings yet

- NLRB: IATSE Hiring Hall Rules UnlawfulDocument8 pagesNLRB: IATSE Hiring Hall Rules UnlawfulLaborUnionNews.comNo ratings yet

- Company Secretarial PracticeDocument76 pagesCompany Secretarial PracticemanishnainaniNo ratings yet

- Umedsinh Chavda Vs UOIDocument3 pagesUmedsinh Chavda Vs UOIPramodKumarNo ratings yet

- Goa Buildings Lease, Rent and Eviction Control Act SummaryDocument40 pagesGoa Buildings Lease, Rent and Eviction Control Act SummaryJay KothariNo ratings yet

- People Vs Santayana: Plaintiff: People of The Philippines Defendant: Jesus SantayanaDocument6 pagesPeople Vs Santayana: Plaintiff: People of The Philippines Defendant: Jesus SantayanaGil Ray Vergara OntalNo ratings yet

- Order Ganting FurloughDocument1 pageOrder Ganting FurloughKathrina Jane PalacpacNo ratings yet