Professional Documents

Culture Documents

Exercise 14

Uploaded by

dwitaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 14

Uploaded by

dwitaCopyright:

Available Formats

EXERCISE 14-9

(a) January 1, 2010

Cash 860.651.79

Bonds Payable 860,651.79

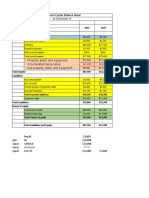

(b) Schedule of Interest Expense and Bond Premium Amortization

Effective-Interest Method

12% Bonds Sold to Yield 10%

Date Cash Interest Premium Jumlah

Paid Expense Amortized tercatat

obligasi

1/1/15 860,651.79

12/31/15 96,000.00* 86,065.18 9,934.82 850,716.97

12/31/16 96,000.00 85,071.70 10,928.30 839,788.67

12/31/17 96,000.00 83,978.87 12,021.13 827,767.54

* 96.000 = $800.000 x 0,12

** 86.065,18 = $86.065,18 x 0,10

(c) December 31, 2015

Interest Expense 86,065.18

Bonds Payable (premium) 9,934.82

Cash 96,000.00

(d) December 31, 2016

Interest Expense 83,978.87

Bonds Payable premium) 12,021.13

Cash 96,000.00

EXERCISE 14-11

(a) 1. January 1, 2015

1.

Land 300,000

Notes Payable 300,000

(The $300,000 capitalized land cost

represents the present value of the note

discounted

for five years at 11%.)

2.

Equipment $297,079

Notes Payable $297,079

Computation of the present value of the

note

Present value of $400,00 due in 8 years at $173,572

11%

$400,000 X 0.43393 *

Present value of $24,000 payable annually 123,507

for

8 years at 11% annually $24,000 X

5.14612

Present value of the note $297,079

*4043393 ( 1/(1,11^8))

**5,14612= 1- (1/(1,11^8))/ 0,11

(b)

31 des 2015

1. Interest Expense 33,000

Notes Payable($300,000 X 0.11) . 33,000

2. Interest Expense ($297,079 X 0.11 ) 32,679

Notes Payable 8,679

Cash ($400,000 X 0.06) 24,000

EXERCISE 14-12

(a)

Nilai nominal of the zero-interest-bearing note $600,00

Discounting factor (12% for 3 periods) = 1/(1,12^3) X 0.71178

Jumalh yang idcatat for the land at January 1, 2015 $427,068

Nilai tercatat of the note at January 1, 2015 $427,068

Applicable interest rate (12%) X 0 .12

Interest expense to be reported in 2015 $ 51,248

(b) January 1, 2015

Cash 4,000,000

Notes Payable ($4,000,000 X 0.68301) 2,732,040

Unearned Revenue 1,267,960*

*$4,000,000 ($4,000,000 X 0.68301) = $1,267,960

Nilai tercatat of the note at January 1, 2011 $2,732,040

Applicable interest rate (10%) X 0.10

Interest expense to be reported for 2015 $ 273,204

EXERCISE 14-20

(a) Gottlieb Co.s entry:

Note Payable 199,800

Property 90,000

Gain on Disposition of Property

(140,000 90,000 50,000

Gain on Extinguishment of Debt 59,800*

*199,800 140,000

(b) Present value of restructured cash flows:

Present value of $220,000 due in 2 years

at 8%, interest payable annually

($220,000 X 0.85734 *(1/1.18^2) $188,615

Present value of $11,000 interest payable

annually for 2 years at 8% (Table 6-4

($11,000 X 1.78326* (1-(1,08^2))/0,08)) 19,616

Fair value of note $208,231

Vargo Corp.s entries

2015 Note Payable (Old) 270,000

Gain on Extinguishment of Debt 61,769

Note Payable (New) 208,231

2016 Interest Expense ($208,231 X 8%). 16,658

Note Payable 5,658

Cash (5% X $220,000) 11,000

2017 Interest Expense [($208,231 + $5,658) X .08] 17,111

Note Payable 213,889

Cash [$220,000 + (5% X $220,000)] 231,000

PROBLEM 14-2

(a) Present value of the principal

$2,000,000 X 0.38554 (PV10, 10%) $ 771,080

Present value of the interest payments

$210,000* X 6.14457 (PVOA10, 10%) 1,290,360

Present value (selling price of the bonds) $2,061,440

*$2,000,000 X 10.5% = $210,000

Cash $2,061,440

Bonds Payable $2,061,440

(b)

Date Cash Interest Premium Jumlah

Paid Expense Amortized tercatat of

Bonds

1/1/04 $2,061,440

1/1/15 $210,000 $206,144 $3,856 2,057,584

1/1/16 210,000 205,758 4,242 2,053,342

1/1/17 210,000 205,334 4,666 2,048,676

1/1/18 210,000 204,868 5,132 2,043,544

(c) jumlah tercatat of 1/1/17 $2,048,676

Less: Amortization of bond premium (5,132 2) 2,566

Carrying amount as of 7/1/17 $2,046,110

Reacquisition price $1,065,000

Carrying amount as of 7/1/17 ($2,046,110 2) (1,023,055)

Loss $ 41,945

Entry for accrued interest

Interest Expense ($204,868 X 1/2 X 1/2) 51,217

Bonds Payable 1,283

Cash ($210,000 X 1/2 X 1/2 52,500

Entry for reacquisition

Bonds Payable 1,023,055

Loss on Extinguishment of Bonds 41,945

Cash 1,065,000

*Premium as of 7/1/17 to be written off ($2,046,110 $2,000,000) X 1/2 =

$23,055

The loss is reported as other income and expense

PROBLEM 14-5

(a) December 31, 2015

Computer 409,806.00

Notes Payable 409,806.00

(Computer capitalized at the present

value of the note$600,000 X 0.68301)

(b) December 31, 2016

Depreciation Expense 67,961.20

Accumulated DepreciationComputer 67,961.20

[($409,806 $70,000) 5]

Interest Expense 40,980.60

Notes Payable 40,980.60

Schedule of Note Discount Amortization

Date Debit, Interest Expense Carrying Amount

Credit, Notes Payable of Note

12/31/15 $409,806.00

12/31/16 $40,980.60 450,786.60

12/31/17 45,078.66 495,865.26

12/31/18 49,586.53 545,451.79

12/31/19 54,548.21* 600,000.00

*3.03 adjustment due to rounding.

(c) December 31, 2017

Depreciation Expense 67,961.20

Accumulated DepreciationComputer 67,961.20

Interest Expense 45,078.66

Notes Payable 45,078.66

PROBLEM 14-8

1. Sanford Co

1/3/15 Cash 472,090*

Bonds Payable 472,090

*Present value of $500,000 due in 7 periods at 6%

($500,000 X .66506) $332,530

Present value of interest payable semiannually

($25,000 X 5.58238 139,560

Proceeds from sale of bonds $472,090

1/9/15 Interest Expense 28,325*

Bonds Payable 3,325

Cash 25,000

31/12/15 Interest Expense 19,017

Bonds Payable ($3,525 X 4/6) 2,350

Interest Payable ($25,000 X 4/6) 16,667

1/3/16 Interest Expense 9,508

Interest Payable 16,667

Bonds Payable ($3,525 X 2/6 1,175

Cash 25,000

1/9/16 Interest Expense 28,736

Bonds Payable 3,736

Cash 25,000

31/12/16 Interest Expense 19,308

Bonds Payable ($3,961 X 4/6) 2,641

Interest Payable 16,667

Schedule of Bond Discount Amortization

Effective-Interest Method

10% Bonds Sold to Yield 12%

Date Cash Interest Discount Carrying

Paid Expense Amortized Amount of

Bonds

3/1/10 $472,090

9/1/10 $25,000 $28,325 $3,325 475,415

3/1/11 25,000 28,525 3,525 478,940

9/1/11 25,000 28,736 3,736 482,676

3/1/12 25,000 28,961 3,961 486,637

9/1/12 25,000 29,198 4,198 490,835

3/1/13 25,000 29,450 4,450 495,285

9/1/13 25,000 29,715* 4,715 500,000

*Rounded $2.

2. Titania Co.

1/6/15 Cash 425,853

Bonds Payable 425,853

Present value of $400,000 due in 8 periods at 5%

($400,000 X0 .67684) $270,736

Present value of interest payable semiannually

($24,000 X 6.46321) 155,117

Proceeds from sale of bonds $425,853

1/12/15 Interest Expense 21,293*

Bonds Payable 2,707

Cash ($400,000 X 0.12 X 6/12 24,000

31/12/15 Interest Expense ($21,157 X 1/6) 3,526

Bonds Payable ($2,843 X 1/6) 474

Interest Payable ($24,000 X 1/6) 4,000

1/16/15 Interest Expense ($21,157 X 5/6) 17,631

Interest Payable 4,000

Bonds Payable ($2,843 X 5/6) 2,369

Cash 24,000

1/10/15 Interest Expense ($21,015 X .3* X 4/6) 4,203

Bonds Payable ($2,985 X .3 X 4/6) 597

Cash 4,800

*$120,000 $400,000 = .3

*Reacquisition price

$126,000 ($120,000 X 12% X 4/12) $121,200

Net carrying amount of bonds redeemed:

($420,303* X .30) $597 (125,494)

Gain on extinguishment $ (4,294)

11/12/15 Interest Expense ($21,015 X .7*) 14,711

Bonds Payable ($2,985 X .7) 2,089

Cash ($24,000 X .7) 16,800

*($400,000 $120,000) $400,000 = .7

31/12/15 Interest Expense ($20,866 X .7 X 1/6) 2,434

Bonds Payable ($3,134 X .7 X 1/6) 366

Interest Payable ($24,000 X .7 X 1/6) 2,800

1/6/15 Interest Expense ($20,866 X .7 X 5/6) 12,172

Interest Payable 2,800

Bonds Payable ($3,134 X .7 X 5/6) 1,828

Cash ($24,000 X .7) 16,800

1/12/15 Interest Expense ($20,709 X .7) 14,496

Bonds Payable ($3,291 X .7 2,304

Cash ($24,000 X .7) 16,800

Date Cash Interest Premium Carrying

Paid Expense Amortized Amount of

Bonds

6/1/10 $425,853

12/1/10 $24,000 $21,293 $2,707 423,146

6/1/11 24,000 21,157 2,843 420,303

12/1/11 24,000 21,015 2,985 417,318

6/1/12 24,000 20,866 3,134 414,184

12/1/12 24,000 20,709 3,291 410,893

6/1/13 24,000 20,545 3,455 407,438

12/1/13 24,000 20,372 3,628 403,810

6/1/14 24,000 20,190* 3,810 400,000

*$.50 disesuaikan.

You might also like

- Ds Iron Condor StrategiaDocument43 pagesDs Iron Condor StrategiaFernando ColomerNo ratings yet

- Apple Inc. - Dupont Analysis For Class-1 - Group - 11Document24 pagesApple Inc. - Dupont Analysis For Class-1 - Group - 11Anurag SharmaNo ratings yet

- TE040 Test Script APDocument28 pagesTE040 Test Script APphoganNo ratings yet

- E-14 AfrDocument5 pagesE-14 AfrInternational Iqbal ForumNo ratings yet

- Real Estate Investing Resources at Mesa LibraryDocument4 pagesReal Estate Investing Resources at Mesa LibraryNgo Van Hieu0% (4)

- Annual ReportDocument193 pagesAnnual ReportShafali R ChandranNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Chapter 14 AKM Kieso - Jawab SoalDocument6 pagesChapter 14 AKM Kieso - Jawab SoalNABILAH KHANSA 1911000089No ratings yet

- New Model of NetflixDocument17 pagesNew Model of NetflixPencil ArtistNo ratings yet

- 16Document23 pages16Alex liao0% (1)

- Day-6 Cash FlowsDocument47 pagesDay-6 Cash FlowsRajsri RaajarrathinamNo ratings yet

- Financial Analysis: Horizontal Analysis: (As Per Excel)Document7 pagesFinancial Analysis: Horizontal Analysis: (As Per Excel)mehar noorNo ratings yet

- ACCT503 W4 Case Study V2Document18 pagesACCT503 W4 Case Study V2AriunaaBoldNo ratings yet

- Apple Blossom Cologne Company Common Size Financial Statement Desember 31, 2003Document1 pageApple Blossom Cologne Company Common Size Financial Statement Desember 31, 2003Lintang UtomoNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Accounting-2009 Resit ExamDocument18 pagesAccounting-2009 Resit ExammasterURNo ratings yet

- Equity ResearchDocument24 pagesEquity ResearchMaxime BayenNo ratings yet

- Money Demand and SupplyDocument22 pagesMoney Demand and SupplyHarsh Shah100% (1)

- Additional Deferred Tax Examples.2Document3 pagesAdditional Deferred Tax Examples.2milton1986100% (1)

- Week 2 Tutorial Questions and SolutionsDocument3 pagesWeek 2 Tutorial Questions and Solutionsmuller1234No ratings yet

- Mobile Money Account Guide 1Document84 pagesMobile Money Account Guide 1Martins Othniel100% (1)

- t10 2010 Jun QDocument10 pagest10 2010 Jun QAjay TakiarNo ratings yet

- Canara Bank OfficersDocument2,524 pagesCanara Bank Officerssaurs283% (6)

- Group valuation modelDocument3 pagesGroup valuation modelSoufiane EddianiNo ratings yet

- Acquisition of Bonds Using Effective InterestDocument2 pagesAcquisition of Bonds Using Effective InterestTin BatacNo ratings yet

- Dipifr Int 2010 Dec A PDFDocument11 pagesDipifr Int 2010 Dec A PDFPiyal HossainNo ratings yet

- 2014 CommentaryDocument46 pages2014 Commentaryduong duongNo ratings yet

- NATIONAL OPEN UNIVERSITY OF NIGERIA FINANCIAL ACCOUNTING EXAMDocument6 pagesNATIONAL OPEN UNIVERSITY OF NIGERIA FINANCIAL ACCOUNTING EXAMjoshua yakubuNo ratings yet

- Earn Hart Corporation Has Outstanding 3 000 000 Shares of Common PDFDocument1 pageEarn Hart Corporation Has Outstanding 3 000 000 Shares of Common PDFAnbu jaromiaNo ratings yet

- AFM Notes by - Taha Popatia - Volume 1Document68 pagesAFM Notes by - Taha Popatia - Volume 1Ashfaq Ul Haq OniNo ratings yet

- ACCA F7 December 2013 Q1 Workings Consolidated Financial StatementsDocument3 pagesACCA F7 December 2013 Q1 Workings Consolidated Financial StatementsKian TuckNo ratings yet

- 2 PDocument238 pages2 Pbillyryan1100% (3)

- 20 Additional Practice IAS 7Document20 pages20 Additional Practice IAS 7Nur FazlinNo ratings yet

- BFC5935 - Tutorial 9 SolutionsDocument6 pagesBFC5935 - Tutorial 9 SolutionsXue XuNo ratings yet

- Day 1Document11 pagesDay 1Abdullah EjazNo ratings yet

- Assignment ..Document5 pagesAssignment ..Mohd Saddam Saqlaini100% (1)

- Adjusted Present Value Method of Project AppraisalDocument7 pagesAdjusted Present Value Method of Project AppraisalAhmed RazaNo ratings yet

- Sol 3 CH 6Document46 pagesSol 3 CH 6Aditya KrishnaNo ratings yet

- IfDocument14 pagesIfĐặng Thuỳ HươngNo ratings yet

- Consolidated Income StatementsDocument34 pagesConsolidated Income StatementsJuBin DeliwalaNo ratings yet

- Financial Forecasting: Pro Forma Statements Using Percent-of-SalesDocument3 pagesFinancial Forecasting: Pro Forma Statements Using Percent-of-SalesMikie AbrigoNo ratings yet

- 2016 CommentaryDocument41 pages2016 Commentaryduong duongNo ratings yet

- Case 20: The Walt Disney Company: Strategic ManagementDocument31 pagesCase 20: The Walt Disney Company: Strategic ManagementAYU SINAGANo ratings yet

- Advanced Taxation Exam Nov 2010Document10 pagesAdvanced Taxation Exam Nov 2010Kelvin KeNo ratings yet

- CH 03Document4 pagesCH 03flrnciairnNo ratings yet

- Assignment SalmanDocument9 pagesAssignment SalmanSalman AtherNo ratings yet

- 1655965117leases - IFRS 16Document9 pages1655965117leases - IFRS 16Akash BenedictNo ratings yet

- Real Options and Capital Budgeting (I Wish I Had A Crystal Ball)Document4 pagesReal Options and Capital Budgeting (I Wish I Had A Crystal Ball)Ian S. DaosNo ratings yet

- DCF 2 CompletedDocument4 pagesDCF 2 CompletedPragathi T NNo ratings yet

- Financial Management 2 - BirminghamDocument21 pagesFinancial Management 2 - BirminghamsimuragejayanNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- Financial Instrument - Kam (Part1)Document70 pagesFinancial Instrument - Kam (Part1)Kamaruzzaman Mohd100% (1)

- Monthly Info 2023.08Document10 pagesMonthly Info 2023.08onlychess96No ratings yet

- MS Brothers Super Rice MillDocument9 pagesMS Brothers Super Rice MillMasud Ahmed khan100% (1)

- F7 - Mock A - AnswersDocument6 pagesF7 - Mock A - AnswerspavishneNo ratings yet

- 8 (C) of 97th AIBB COMDocument1 page8 (C) of 97th AIBB COMShamima AkterNo ratings yet

- Loan Amortization Schedule - LDocument8 pagesLoan Amortization Schedule - Lrizwan6261No ratings yet

- Week 3 Tutorial Solutions (S1)Document14 pagesWeek 3 Tutorial Solutions (S1)Silo KetenilagiNo ratings yet

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- Ratio Analysis Using The DuPont ModelDocument10 pagesRatio Analysis Using The DuPont ModelDharini Raje SisodiaNo ratings yet

- Ch08 Harrison 8e GE SM (Revised)Document102 pagesCh08 Harrison 8e GE SM (Revised)Muh BilalNo ratings yet

- Unit 2: Accounting Concepts and Trial BalanceDocument12 pagesUnit 2: Accounting Concepts and Trial Balanceyaivna gopeeNo ratings yet

- Ratio Analysis of Eastern Bank LtdDocument19 pagesRatio Analysis of Eastern Bank LtdshadmanNo ratings yet

- Tutorial 8Document3 pagesTutorial 8Aaron Tan Wayne JieNo ratings yet

- AC2101 SemGrp4 Team6Document34 pagesAC2101 SemGrp4 Team6Kwang Yi JuinNo ratings yet

- UntitledDocument21 pagesUntitleddhirajpironNo ratings yet

- Final F09 SolutionDocument5 pagesFinal F09 SolutionWyatt Niblett-wilsonNo ratings yet

- Capital GainDocument1 pageCapital GaindwitaNo ratings yet

- Accounting for Pensions and Postretirement Benefits ExpenseDocument3 pagesAccounting for Pensions and Postretirement Benefits ExpensedwitaNo ratings yet

- International Standards Accounting and Reporting: QuestionsDocument1 pageInternational Standards Accounting and Reporting: QuestionsdwitaNo ratings yet

- International Standards Accounting and Reporting: QuestionsDocument1 pageInternational Standards Accounting and Reporting: QuestionsdwitaNo ratings yet

- 13Document2 pages13dwitaNo ratings yet

- CH 15Document79 pagesCH 15zetNo ratings yet

- CH 23Document90 pagesCH 23Grace Dana100% (1)

- P&S Bylaw 2072 II Amendment in NepaliDocument27 pagesP&S Bylaw 2072 II Amendment in NepaliNarayanPrajapatiNo ratings yet

- Statement of Account Summary and Transaction DetailsDocument3 pagesStatement of Account Summary and Transaction Detailsfahad chaudhryNo ratings yet

- Medfield Pharmaceuticals' Valuation and Strategic OptionsDocument9 pagesMedfield Pharmaceuticals' Valuation and Strategic OptionsvATSALANo ratings yet

- Mohammad Renaldy - CVDocument10 pagesMohammad Renaldy - CVSales ExecutiveNo ratings yet

- Module 2 Math of InvestmentDocument17 pagesModule 2 Math of InvestmentvlythevergreenNo ratings yet

- (No Subject) - Inbox - Yahoo! MailDocument2 pages(No Subject) - Inbox - Yahoo! Mailpradhap87No ratings yet

- Interest Rates and Bond Valuation Chapter 6Document29 pagesInterest Rates and Bond Valuation Chapter 6Mariana MuñozNo ratings yet

- Annual Report 2011Document56 pagesAnnual Report 2011Mark EpersonNo ratings yet

- Report On Trend Analysis - SCBNLDocument23 pagesReport On Trend Analysis - SCBNLAsad KamranNo ratings yet

- Cebu International Finance Corporation V CA AlegreDocument4 pagesCebu International Finance Corporation V CA AlegreJANE MARIE DOROMALNo ratings yet

- Indian Overseas Bank PO 2009 Solved Question PaperDocument8 pagesIndian Overseas Bank PO 2009 Solved Question Paperkapeed_supNo ratings yet

- Social ResponsibilityDocument10 pagesSocial ResponsibilityMark Ed MontoyaNo ratings yet

- Financing Your: Massachusetts Institute of TechnologyDocument12 pagesFinancing Your: Massachusetts Institute of TechnologyTruong CaiNo ratings yet

- Banking Sector Overview: Definitions, Regulation, FunctionsDocument39 pagesBanking Sector Overview: Definitions, Regulation, FunctionsDieu NguyenNo ratings yet

- Akhuwat Foundation Services BreakdownDocument30 pagesAkhuwat Foundation Services BreakdownAdeel KhanNo ratings yet

- Dubai Islamic Bank (E-Com)Document23 pagesDubai Islamic Bank (E-Com)Zain Ul Abideen100% (1)

- PDF - 2669819112.schedule of Service Charges FinacleDocument15 pagesPDF - 2669819112.schedule of Service Charges FinacleNirmal singhNo ratings yet

- Gitex - Shopper - 2019 - 1 of 1 PDFDocument1 pageGitex - Shopper - 2019 - 1 of 1 PDFJishnu CheemenNo ratings yet

- Foreign Exchange Rate and PoliciesDocument24 pagesForeign Exchange Rate and PoliciesbharatNo ratings yet

- Business Communication Project-NBP Gomal University Branch DiKhanDocument10 pagesBusiness Communication Project-NBP Gomal University Branch DiKhan✬ SHANZA MALIK ✬No ratings yet

- Karnataka Bank AR 2020-21 10.08.2021Document255 pagesKarnataka Bank AR 2020-21 10.08.2021Karthik KarthikNo ratings yet

- MR - Manoj B Wilson: Page 1 of 3 M-87654321-1Document3 pagesMR - Manoj B Wilson: Page 1 of 3 M-87654321-1Manoj WilsonNo ratings yet

- FITJEE 10th Class Quiz 24-10-2021 Q.PDocument8 pagesFITJEE 10th Class Quiz 24-10-2021 Q.PSurya RaoNo ratings yet