Professional Documents

Culture Documents

Emerald SDN BHD

Uploaded by

Brenda Tan0 ratings0% found this document useful (0 votes)

16 views3 pagesAT T11 Q1

Original Title

AT T11 Q1

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAT T11 Q1

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views3 pagesEmerald SDN BHD

Uploaded by

Brenda TanAT T11 Q1

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

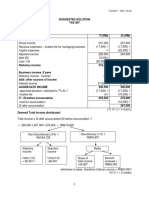

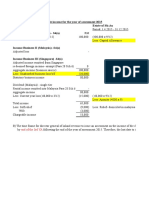

Emerald Sdn Bhd

Section 4 (C) Dividend income - RM RM RM Permitted expenses:

- isb Exempted -

- Foreign Exempted -

-

Section 4 (C) Interest income - 30,000.00 -

-

Less: Expenses -

- Interest incurred (35,000.00) -

Adjusted income - -

-

Section 4 (D) - Royalty income 50,000.00 -

-

Section 4 (D) - Rental income 250,000.00 -

-

Less: Expenses

Interest incurred 24,000.00

- Assessment 20,000.00

- Repair and maintenance 33,000.00 (77,000.00) -

173,000.00 -

223,000.00 -

Less : Function of permitted expenses

AX(B/4C) = 108,500X330,000(4x621,000) -

= 14,414 -

-

OR

5% of B = 0.05 of 330,000

=16500

Whichever is the LOWER (14,414.00)

Approved donation (10,000.00)

10% of AI (223,000)

198,586.00

Tax payable @ 24% 49646.44

Permitted expenses: RM

Director remuneration 30,000.00

Employee salary 20,000.00

Accoutning fee and secretarialo fee 10,000.00

Audit fee 5,000.00

Printing and stationeray 2,500.00

Food -

Management fee 1,000.00

Rental and maintenance fee ( for office 40,000.00

Entertainment -

Interest incurred on share acquired -

Interest incurred on deposit placed -

Find management expenses ( on Share -

Depreciation -

108,500.00 A

Royalty 50,000.00

Interest 30,000.00

Rent 250,000.00

330,000.00 B

Dividend (Malaysia ) 80000

Dividend ( Foreign ) 125000

Gain from realisation of investment 86000

621,000.00 C

You might also like

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- CMA Bangladesh Advanced Financial Accounting ExamDocument4 pagesCMA Bangladesh Advanced Financial Accounting ExamHossainNo ratings yet

- Paramita SDN BHD - Tax Computation For YA 2016 RM Permitted ExpensesDocument2 pagesParamita SDN BHD - Tax Computation For YA 2016 RM Permitted ExpensesBrenda TanNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Solution Tax667 - Jun 2018Document9 pagesSolution Tax667 - Jun 2018Aiyani NabihahNo ratings yet

- Income Taxation 2019 Chapter 13A 13C 14 BanggawanDocument8 pagesIncome Taxation 2019 Chapter 13A 13C 14 BanggawanEricka Einjhel Lachama100% (8)

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDocument16 pagesProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseChrismae Monteverde SantosNo ratings yet

- FPQ1 - Answer KeyDocument6 pagesFPQ1 - Answer KeyJi YuNo ratings yet

- Reviewer TAX - Google DocsDocument3 pagesReviewer TAX - Google DocsAnnabel MendozaNo ratings yet

- Solution Manual Chapter 13 B MC Problems 1Document3 pagesSolution Manual Chapter 13 B MC Problems 1Mallet S. GacadNo ratings yet

- TAX Final Preboard Examination - Solutions PDFDocument15 pagesTAX Final Preboard Examination - Solutions PDF813 cafeNo ratings yet

- Tax 667 SolutionsDocument7 pagesTax 667 SolutionsAiyani NabihahNo ratings yet

- Batch 93 FAR First Preboard February 2023 - SolutionDocument5 pagesBatch 93 FAR First Preboard February 2023 - SolutionlorenzNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- Suggested Answers TAX667 - DEC 2016Document7 pagesSuggested Answers TAX667 - DEC 2016diysNo ratings yet

- T11 Ans. 1Document1 pageT11 Ans. 1PUI TUNG CHONGNo ratings yet

- Sol. Man. - Chapter 7 - Notes (Part 1)Document13 pagesSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNo ratings yet

- Solution Tax667 - Dec 2016Document7 pagesSolution Tax667 - Dec 2016Zahiratul QamarinaNo ratings yet

- F7 - Mock A - AnswersDocument6 pagesF7 - Mock A - AnswerspavishneNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- ACCT6005 COMPANY ACCOUNTING ASSESSMENT 2 CASE STUDYDocument8 pagesACCT6005 COMPANY ACCOUNTING ASSESSMENT 2 CASE STUDYRuhan SinghNo ratings yet

- F6mys 2016 Jun A Hybrid PDFDocument9 pagesF6mys 2016 Jun A Hybrid PDFsahrasaqsdNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Multiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)Document4 pagesMultiple Choice-Problem 1: September 15 - Chapter 7-Introduction To Regular Income Taxation (Assignment)anitaNo ratings yet

- Tla-7 1Document17 pagesTla-7 1Trisha Monique VillaNo ratings yet

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeDocument15 pagesSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument9 pagesInterim Financial Reporting: Problem 45-1: True or FalseAudrey AganNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument9 pagesInterim Financial Reporting: Problem 45-1: True or FalseAudrey AganNo ratings yet

- Assignment1 BonutanHMDocument4 pagesAssignment1 BonutanHMmaegantrish543No ratings yet

- Sol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1B 1Document15 pagesSol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1B 1Rezzan Joy Camara MejiaNo ratings yet

- Sol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1BDocument10 pagesSol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1BMahasia MANDIGAN100% (1)

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Non-Profit Organizations: Problem 16-1: Multiple ChoiceDocument7 pagesNon-Profit Organizations: Problem 16-1: Multiple ChoiceKyla Ramos Diamsay100% (1)

- Share Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessDocument17 pagesShare Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessBabu babuNo ratings yet

- CPAR B94 TAX Final PB Exam - Answers - SolutionsDocument12 pagesCPAR B94 TAX Final PB Exam - Answers - SolutionsSilver LilyNo ratings yet

- Cañezal Assignment 2 CHECKEDDocument6 pagesCañezal Assignment 2 CHECKEDFeliz Victoria CañezalNo ratings yet

- Abc1 - FinalDocument7 pagesAbc1 - FinalSakshi ShardaNo ratings yet

- Term Test-1 SolutionDocument6 pagesTerm Test-1 Solutionlalshahbaz57No ratings yet

- Chapter 13 A-C PDFDocument13 pagesChapter 13 A-C PDFKim Arvin DalisayNo ratings yet

- R2 TAX ML Solution CMA June 2020 Exam.Document6 pagesR2 TAX ML Solution CMA June 2020 Exam.Pavel DhakaNo ratings yet

- Statement of Comprehensive Income: Problem 1: True or FalseDocument17 pagesStatement of Comprehensive Income: Problem 1: True or FalsePaula Bautista100% (3)

- Interim Financial Reporting Chapter 45 ProblemsDocument7 pagesInterim Financial Reporting Chapter 45 ProblemsRey Joyce AbuelNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseXyverbel Ocampo RegNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDocument13 pagesNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- 10 Task PerformanceDocument5 pages10 Task Performancejeffersam31No ratings yet

- Class Discussion BLEMBA 31A Day2Document27 pagesClass Discussion BLEMBA 31A Day2Bayu Aji PrasetyoNo ratings yet

- Computational multiple choice partnership liquidation problemsDocument4 pagesComputational multiple choice partnership liquidation problemsmhikeedelantarNo ratings yet

- Par CorDocument11 pagesPar CorIts meh Sushi100% (1)

- ACCT223 AY 21 22 Mid-Term AnswersDocument5 pagesACCT223 AY 21 22 Mid-Term AnswersLIAW ANN YINo ratings yet

- Inventory, Purchases, Sales and Expenses ReportDocument10 pagesInventory, Purchases, Sales and Expenses ReportnovyNo ratings yet

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Critical Success FactorsDocument4 pagesCritical Success FactorsBrenda TanNo ratings yet

- Critical Success FactorsDocument15 pagesCritical Success FactorsjsdhilipNo ratings yet

- ConvertibleDocument2 pagesConvertibleBrenda TanNo ratings yet

- At T11 Q4Document4 pagesAt T11 Q4Brenda TanNo ratings yet

- Science Form 2 Notes Chapter 1 Chapter 4Document19 pagesScience Form 2 Notes Chapter 1 Chapter 4Brenda TanNo ratings yet

- Tutorial 12 Chargeable Income Calculation 2015Document2 pagesTutorial 12 Chargeable Income Calculation 2015Brenda TanNo ratings yet

- (A) (I) & (Ii) PA Trust RM Distributable IncomeDocument3 pages(A) (I) & (Ii) PA Trust RM Distributable IncomeBrenda TanNo ratings yet

- Strength: SWOT of Proton Holdings BerhadDocument3 pagesStrength: SWOT of Proton Holdings BerhadBrenda TanNo ratings yet

- ConvertibleDocument2 pagesConvertibleBrenda TanNo ratings yet

- Nil Nil NilDocument3 pagesNil Nil NilBrenda TanNo ratings yet

- Tutorial 11 Question 3 Paramita Sdn. BHDDocument2 pagesTutorial 11 Question 3 Paramita Sdn. BHDBrenda TanNo ratings yet

- Tut 14 Revision AnswerDocument21 pagesTut 14 Revision AnswerBrenda TanNo ratings yet

- At T13 Q3Document5 pagesAt T13 Q3Brenda TanNo ratings yet

- Modul 2 PDFDocument11 pagesModul 2 PDFKhairul HaqeemNo ratings yet

- New Microsoft PowerPoint DocumentDocument105 pagesNew Microsoft PowerPoint DocumentBrenda TanNo ratings yet

- Document 8Document2 pagesDocument 8Brenda TanNo ratings yet

- TAX T5 Question 1Document2 pagesTAX T5 Question 1Brenda TanNo ratings yet

- Document 1Document1 pageDocument 1Brenda TanNo ratings yet

- Document 5Document2 pagesDocument 5Brenda TanNo ratings yet

- Document 2Document1 pageDocument 2Brenda TanNo ratings yet

- AP Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionDocument1 pageAP Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionBrenda TanNo ratings yet

- Introduction To Accounting and BusinessDocument49 pagesIntroduction To Accounting and BusinessMatthew AlexanderNo ratings yet

- AR Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionDocument1 pageAR Invoice Audit Trail Listing: Debit Credit Date Doc No Due Date Terms Acc. No. Acc. Description Trans. DescriptionBrenda TanNo ratings yet

- Document 1Document1 pageDocument 1Brenda TanNo ratings yet

- Hardner Sci Am FinalDocument4 pagesHardner Sci Am FinalBrenda TanNo ratings yet

- Document 1Document1 pageDocument 1Brenda TanNo ratings yet

- TejbirDocument1 pageTejbirTejbir SinghNo ratings yet

- Avenue E-Commerce Limited: 00009595951004031712 Crate IdDocument2 pagesAvenue E-Commerce Limited: 00009595951004031712 Crate IdAbhishek LodhaNo ratings yet

- Aug 10 PayslipDocument1 pageAug 10 PayslipBry GutierrezNo ratings yet

- IRS Publication Form 8283Document2 pagesIRS Publication Form 8283Francis Wolfgang UrbanNo ratings yet

- Tax1 SummaryDocument8 pagesTax1 SummarychimchimcoliNo ratings yet

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of IndiaRavi AroraNo ratings yet

- Statement of Assests 2012Document3 pagesStatement of Assests 2012Mark Anthony S. MoralesNo ratings yet

- Module 3 - Sources of IncomeDocument3 pagesModule 3 - Sources of IncomeMaryrose SumulongNo ratings yet

- Introduction Taxation PowersDocument15 pagesIntroduction Taxation PowersRena Rose MalunesNo ratings yet

- Target recovery arrears CGST Central Excise Division JabalpurDocument3 pagesTarget recovery arrears CGST Central Excise Division JabalpurAshish KhandelwalNo ratings yet

- The Dynamics of Windfall Taxation System20092Document9 pagesThe Dynamics of Windfall Taxation System20092Mouni SheoranNo ratings yet

- Encouraging Women EntrepreneurshipDocument3 pagesEncouraging Women Entrepreneurshipjasson babaNo ratings yet

- Solved Englesbe Company S Futa Tax Liability Was 289 50 Futa Tax ForDocument1 pageSolved Englesbe Company S Futa Tax Liability Was 289 50 Futa Tax ForAnbu jaromiaNo ratings yet

- Property Twins Cashflow Spreadsheet - v0.5Document7 pagesProperty Twins Cashflow Spreadsheet - v0.5Vivek HandaNo ratings yet

- Q Test FAR570 Jan 2022Document6 pagesQ Test FAR570 Jan 2022fareen faridNo ratings yet

- Silkair vs. CirDocument2 pagesSilkair vs. CirKath Leen100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Akshat JainNo ratings yet

- Kalyani Technoforge LTD - 301 - 18-10-2021Document1 pageKalyani Technoforge LTD - 301 - 18-10-2021Pragnesh PrajapatiNo ratings yet

- FAR.2639 - Accounting Changes and ErrorsDocument24 pagesFAR.2639 - Accounting Changes and Errorslijeh312No ratings yet

- 8107 1 Introduction+to+Taxation 1Document36 pages8107 1 Introduction+to+Taxation 1Isabel ArcangelNo ratings yet

- Hdfcbank Credit CtalogueDocument1 pageHdfcbank Credit CtalogueDrSudhanshu MishraNo ratings yet

- 5.1.0 Tax Capital AllowanceDocument8 pages5.1.0 Tax Capital AllowanceshaunNo ratings yet

- CIR vs. BurmeisterDocument13 pagesCIR vs. BurmeisterMaan MabbunNo ratings yet

- Delivery Challan: N/A N/A N/A N/A N/A N/A 0% - 1Document1 pageDelivery Challan: N/A N/A N/A N/A N/A N/A 0% - 1Laxminarayan KarNo ratings yet

- Notice Concerning Fiduciary Relationship: IdentificationDocument2 pagesNotice Concerning Fiduciary Relationship: IdentificationMaryUmbrello-DresslerNo ratings yet

- Notification No. 16/2021 - Central Tax (Rate)Document2 pagesNotification No. 16/2021 - Central Tax (Rate)santanu sanyalNo ratings yet

- Composition Invoice FormatDocument1 pageComposition Invoice FormatArpitNo ratings yet

- Tax Invoice DetailsDocument1 pageTax Invoice DetailsDipin JainNo ratings yet

- CIR Vs CA GR 125355Document6 pagesCIR Vs CA GR 125355Melo Ponce de LeonNo ratings yet

- Direct Tax Notes SummaryDocument224 pagesDirect Tax Notes SummaryPreeti Ray100% (1)