Professional Documents

Culture Documents

2017AACCT101

Uploaded by

Ryan De Vera PagalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2017AACCT101

Uploaded by

Ryan De Vera PagalCopyright:

Available Formats

ACCT 101

Introduction to Financial Accounting

The Wharton School

Spring, 2017

Professors:

Victor J. Defeo

1311 Steinberg Hall Dietrich Hall

Email: defeo@wharton.upenn.edu

Frank Zhou

1310 Steinberg Hall Dietrich Hall

Email: szho@wharton.upenn.edu

Teaching Assistants:

Frantz Famie dfrantz@wharton.upenn.edu

Nichel Gaba nichel@wharton.upenn.edu

Julie Ming juming@wharton.upenn.edu

Rupsa Mukherjee rupsa@wharton.upenn.edu

Please contact the teaching assistants for course content related questions only. Any questions

regarding course registration, exam scheduling, or course withdrawals should be emailed to the

instructors.

Teaching Assistant Office Hours/Location: SHDH 420, hours to be posted on Canvas

Professor Office Hours/Location: Defeo: Tuesday, 1-3 pm, SHDH 1311

Zhou: Tuesday, 3-5 pm, SHDH 1310

Course objectives: The objective of the course is to learn to read, understand, and analyze

financial statements. The course is intended for students with no previous exposure to financial

accounting. The course adopts a decision-maker perspective of accounting by emphasizing the

relation between accounting data and the underlying economic events that generated them. The

course focuses initially on how to record economic events in the accounting records (i.e.,

bookkeeping and accrual accounting) and how to prepare and interpret the primary financial

statements that summarize a firm's economic transactions (i.e., the balance sheet, the income

statement, and the statement of cash flows).

Course handouts: Class notes, cases, homework assignments, and solutions to the cases and

problems will be available on Canvas.

Textbook: Pearson publishing has put together a custom package for this course. The custom

package consists of(1) Introduction to Financial Accounting by Horngren, Sundem, Elliott and

Philbrick (2nd custom edition) and (2) Wharton Accounting 101 Supplemental and Solutions

Manual. These two books are sold in a bundle by the bookstore. Alternatively, (1) is a standalone

textbook and can be purchased from external vendors. Several copies of the custom package are

on reserve at Lippincott Library.

Accounting 101, Syllabus -- Spring 2017 Page 1

Role of Textbook and Class Notes: The textbook covers the basic material in the course. The

lectures will cover the more important and difficult material as well as some additional material

not covered in the textbook. The class schedule at the end of the syllabus provides the page

numbers that correspond to the material we will cover in class. Suggested problems from the

textbook will be posted on Canvas and covered in recitation. The suggested readings and

problems are for those who want additional clarification or practice. The textbook is used as a

supplement for lecture notes, not as a substitute. Class notes will be posted to Canvas. Be aware

that the lectures often contain problems which summarize the material in a way different from

the textbook. Homework and exams will be based exclusively on material covered in the

class notes.

Course Website: To access the course website, go to https://canvas.upenn.edu and choose ACCT

101 Spring 2017. Various course materials, including class notes and exam and homework

solutions, will be distributed exclusively through Canvas. Make sure you have access to this

website. Each enrolled Penn student can use their PennKey username and password for access.

Classroom Environment: I expect that students will be prepared for class. I suggest the

following routine:

Before class, read the class notes posted on Canvas.

Take notes in class.

If you are having difficulty, read the specified pages of the textbook and work through

the end of chapter problems and solutions to supplement your understanding of the

material.

If you are still having difficulty, attend the Friday recitation sessions led by the teaching

assistants. During these sessions, the TAs will review suggested problems from the

textbook.

I also expect that you will treat this course as a professional engagement.

Please be on time and remain throughout the class meeting.

Cell phones off during class time AND during office hour visits.

Display courteous behavior to your classmates. Please do not ask your professor to make

exceptions to course policies that would be unfair to other students in the course.

Follow the Code of Academic Integrity. On behalf of the majority of the students who

make an honest effort in this class, I will take action against anyone suspected of

breaching this Code.

Accounting 101, Syllabus -- Spring 2017 Page 2

Exams: There will be two midterm exams and a final exam:

Midterm 1 Monday, February 20 6:00 7:20 pm

Midterm 2 Wednesday, March 29 6:00 7:20 pm

Final (Tentative) Thursday May 4 6:00 7:20 pm

Exams are administered in the evening and are not cumulative.

Practice exam questions and their solutions will be posted on Canvas for your reference. The

practice questions may differ from the questions for the actual exam.

The graded exam will be distributed by your TA in recitation. The final exam will be available

from the Accounting Department at the beginning of the next semester.

If you need additional time on an exam because of a university-recognized disability, I must be

informed directly by the Office of Student Disability Services. I will make whatever

accommodations are recommended by them.

Exam Regrades: If you believe your exam is incorrectly graded, submit the entire original,

unmarked copy of the complete exam to your professor (not your TA) within ten days from the

day when the graded exam first was made available. With the exam, you should include a brief

explanation of your request.

Absences on Exam Days: Only your professor can grant permission to be excused from a

scheduled exam because of a scheduling conflict or illness. Teaching assistants cannot grant such

permission.

To be excused from a scheduled exam because of a scheduling conflict, students must provide

documented evidence of the conflict. Only scheduling conflicts related to academic activities or

university representation will be considered---internships, interviews, family vacations, or other

travel plans are not acceptable scheduling conflicts. Notify your professor of any conflict via

email within two weeks of the start of classes.

To be excused from a scheduled exam because of illness, students must consult with their

professor and provide documented evidence of the illness. A course absence report in and of

itself, does not excuse you from an exam. Minor illnesses, including upper respiratory infections

(i.e., colds), or fatigue, are examples of unacceptable reasons for missing an exam. Illness

during the time that a student had intended to study for an exam is not an acceptable reasons for

missing an exam.

A student who has permission to miss an exam due to a scheduling conflict or illness will

receive a grade of incomplete for the semester and will be required to take a make-up

exam on the Universitys officially scheduled make-up exam date during the following

semester. After the student takes the make-up, the incomplete will be changed to the

earned course grade. If a student fails to show up for the make-up, he/she will receive a

grade of zero for the exam.

Accounting 101, Syllabus -- Spring 2017 Page 3

STUDENTS WHO MISS AN EXAM WITHOUT MAKING ARRANGEMENTS IN ACCORDANCE

WITH THE ABOVE GUIDELINES WILL RECEIVE A GRADE OF ZERO FOR THE RELEVANT

EXAM.

Homework: There will be three homework assignments to be completed during the semester.

The homework assignments will be posted on Canvas and announced in class. Homework

assignments can be completed as part of a group but all homework must be submitted

individually.

Homework assignments must be submitted electronically through Canvas by 9 a.m. on the

due date. Directions for submitting homework will be distributed via Canvas, and I

strongly encourage you to submit your homework answers well in advance of the 9 a.m.

deadline. Late submissions, multiple submissions, and hard-copies are not accepted.

Because these homework assignments will be graded electronically, it is important that you

submit the answers in the form indicated by the question. In particular, make sure that you

submit the answers in the denomination requested (e.g., thousands of dollars or millions of

dollars, etc.) and in the precision requested (e.g., rounded to the nearest third decimal, etc.).

Homework Due Dates: Refer to Class Schedule.

Grading: The course grades will be assigned using the following weights:

Homework 10%

First exam 25%

Second exam 30%

Final exam 35%

Each homework assignment will be assigned the same weight for grading purposes. Students

taking the class pass/fail must achieve a grade of "D" or higher to get a "Pass". There is no

possibility of earning extra credit or of changing the above weights. Any questions about grades,

grading curves, etc. should be addressed to your professor via the course e-mail.

Accounting 101, Syllabus -- Spring 2017 Page 4

Accounting 101

Class Schedule

Spring, 2017

"S-" refers to material in the "Wharton Accounting 101 Supplement"

"Case" refers to additional material available online through Canvas

DATE TOPICS TEXTBOOK READINGS

Session 1 Wed 1/11 Introduction Chapter 1

Mon 1/16 Martin Luther King Day No Class

Overview of Financial Statements

Session 2 Wed 1/18 Chapter 2

Balance Sheet Concepts

Balance Sheet Concepts Accounting

Session 3 Mon 1/23 Chapter 3

Process

Session 4 Wed 1/25 Income Statement Concepts Chapter 2

Income Statement Concepts Chapter 2

Session 5 Mon 1/30

Accounting Process Chapter 4

Session 6 Wed 2/1 The Accounting Cycle Chapter 3

Session 7 Mon 2/6 Statement of Cash Flows Chapter 5

Session 8 Wed 2/8 Statement of Cash Flows Chapter 5

Timing of Revenue Recognition Chapter 2: p. 47, 52

Session 9 Mon 2/13 Chapter 4: p. 140-146

Homework #1 due (by 9am) Chapter 6: p. 232, 233

Session 10 Wed 2/15 Catch up and Review

Exam 1 (6:00 7:20 pm)

Mon 2/20

(Session 1 10, inclusive)

Chapter 12: p 520-536

Session 11 Wed 2/22 Financial Statement Analysis

Case: Who Am I?

Accounting for Sales and

Session 12 Mon 2/27 Chapter 6

Receivables

Accounting for Sales and Chapter 6

Session 13 Wed 3/1

Receivables Case: Timberland

Accounting 101, Spring 2017

SPRING BREAK

Monday, March 6 to Sunday, March 12

Session 14 Mon 3/13 Inventories Cost Methods Chapter 7

Chapter 7

Session 15 Wed 3/15 Inventories Cost Methods

Case: Snap-On Tools

Session 16 Mon 3/20 Long-Lived Assets Chapter 8

Chapter 8

Session 17 Wed 3/22 Long-Lived Assets

Case: Snap-On Tools

Catch up and Review

Session 18 Mon 3/27

Homework #2 Due (by 9am)

Exam 2 (6:00 7:20 pm)

Wed 3/29

(Sessions 11 18, inclusive)

Liabilities Present Value

Session 19 Mon 4/3 Chapter 9

Notes and Mortgages

Session 20 Wed 4/5 Liabilities Bonds Chapter 9

Chapter 9, S-1

Session 21 Mon 4/10 Liabilities - Leases

Case: Safeway

Session 22 Wed 4/12 Shareholders Equity Chapter 10

Deferred Taxes Chapter 9: p. 403-406,

Session 23 Mon 4/17

Homework #3 Due (by 9am) S-1

Session 24 Wed 4/19 Intercorporate Investments Chapter 11

Chapter 11

Session 25 Mon 4/24 Intercorporate Investments

Case: Deere

Session 26 Wed 4/26 Catch-up and Review

Exam 3 (6:00 7:20)

Thurs 5/4

(Sessions 19 26, inclusive)

Accounting 101, Spring 2017

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Hotel Design Planning and DevelopmentDocument30 pagesHotel Design Planning and DevelopmentTio Yogatma Yudha14% (7)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sample Report Standard Quality On Crawlspace EplansDocument1 pageSample Report Standard Quality On Crawlspace EplansRyan De Vera PagalNo ratings yet

- Reaction rate determination and simulation of hydrogenation processDocument3 pagesReaction rate determination and simulation of hydrogenation processToMemNo ratings yet

- Fy16 Aec Test Drive Bim Deployment Workbook enDocument40 pagesFy16 Aec Test Drive Bim Deployment Workbook enRicardo FigueiraNo ratings yet

- FIDE Foundation Trainer Guide - BookDocument96 pagesFIDE Foundation Trainer Guide - BookKaos Aquarius100% (3)

- Grivas, Efstratios - Fide Trainers' Commission Vol. 6 The Art of Exchanges 2015Document82 pagesGrivas, Efstratios - Fide Trainers' Commission Vol. 6 The Art of Exchanges 2015Ryan De Vera PagalNo ratings yet

- Opening White English Opening Black Defence Against d4 and E4Document3 pagesOpening White English Opening Black Defence Against d4 and E4Ryan De Vera PagalNo ratings yet

- Trivial Endings - Revealing The Secrets - BookDocument128 pagesTrivial Endings - Revealing The Secrets - Bookkkk kkkkNo ratings yet

- Flowchart - For - Eit - Waiver (Not Applicable in My Case) PDFDocument1 pageFlowchart - For - Eit - Waiver (Not Applicable in My Case) PDFRyan De Vera PagalNo ratings yet

- Grivas, Efstratios - FIDE Grand-Prix Sharjah 2017Document62 pagesGrivas, Efstratios - FIDE Grand-Prix Sharjah 2017Ryan De Vera PagalNo ratings yet

- Advanced Chess School - Volume 4 - Imbalances of Bishops & Knights - Efstratios Grivas - 2014Document82 pagesAdvanced Chess School - Volume 4 - Imbalances of Bishops & Knights - Efstratios Grivas - 2014Tux Ino100% (1)

- Fide Trainers Commission Advanced Chess School Vol 7 The Passed PawnDocument82 pagesFide Trainers Commission Advanced Chess School Vol 7 The Passed PawnMarciusBrandão100% (3)

- Allow. Soil Bearing Pressure Kpa Higher Load KN Lower Required Footing Area M2 Square Dimension MDocument3 pagesAllow. Soil Bearing Pressure Kpa Higher Load KN Lower Required Footing Area M2 Square Dimension MRyan De Vera PagalNo ratings yet

- EIT/LSIT Certification: Information and Application (Engineer-in-Training/Land Surveyor-in-Training)Document3 pagesEIT/LSIT Certification: Information and Application (Engineer-in-Training/Land Surveyor-in-Training)Ryan De Vera PagalNo ratings yet

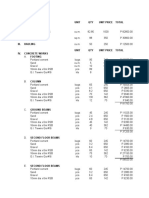

- Sta. Rosa Detailed BOQDocument5 pagesSta. Rosa Detailed BOQRyan De Vera PagalNo ratings yet

- Edu July 2008Document16 pagesEdu July 2008Ryan De Vera PagalNo ratings yet

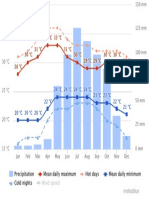

- Cabanatuan Temperature (Meteoblue)Document1 pageCabanatuan Temperature (Meteoblue)Ryan De Vera PagalNo ratings yet

- Allow. Soil Bearing Pressure Kpa Higher Load KN Lower Required Footing Area M2 Square Dimension MDocument3 pagesAllow. Soil Bearing Pressure Kpa Higher Load KN Lower Required Footing Area M2 Square Dimension MRyan De Vera PagalNo ratings yet

- Computer & Study TablesDocument12 pagesComputer & Study TablesRyan De Vera PagalNo ratings yet

- UHP-SCT-C00-UYX-F-3001 - Design Criteria For Civil Structural Works - Rev.2Document46 pagesUHP-SCT-C00-UYX-F-3001 - Design Criteria For Civil Structural Works - Rev.2Ryan De Vera PagalNo ratings yet

- Development Development: Pays BackDocument7 pagesDevelopment Development: Pays BackRyan De Vera PagalNo ratings yet

- UHP-SCT-C00-UYX-F-3001 - Design Criteria For Civil Structural Works - Rev.2 PDFDocument46 pagesUHP-SCT-C00-UYX-F-3001 - Design Criteria For Civil Structural Works - Rev.2 PDFRyan De Vera PagalNo ratings yet

- 1253926997-BS Architecture CurriculumDocument41 pages1253926997-BS Architecture CurriculumRyan De Vera PagalNo ratings yet

- 1261091909-Prboa On Pice PostDocument56 pages1261091909-Prboa On Pice PostRyan De Vera PagalNo ratings yet

- UHP-SCT-C00-UYX-F-3001 - Design Criteria For Civil Structural Works - Rev.2Document46 pagesUHP-SCT-C00-UYX-F-3001 - Design Criteria For Civil Structural Works - Rev.2Ryan De Vera PagalNo ratings yet

- Basics of Polynomials: Coefficients, Degree, and Leading TermsDocument6 pagesBasics of Polynomials: Coefficients, Degree, and Leading TermsRyan De Vera PagalNo ratings yet

- 12su High Tech High Chula Vista CADocument12 pages12su High Tech High Chula Vista CARyan De Vera PagalNo ratings yet

- 13F Malaysia Energy Commission Headquarters Putrajaya Malaysia PDFDocument7 pages13F Malaysia Energy Commission Headquarters Putrajaya Malaysia PDFRyan De Vera PagalNo ratings yet

- Functions and Graphs GuideDocument77 pagesFunctions and Graphs GuideIrfan ŠarićNo ratings yet

- Tropical: Net ZeroDocument11 pagesTropical: Net ZeroRyan De Vera PagalNo ratings yet

- 13F Malaysia Energy Commission Headquarters Putrajaya MalaysiaDocument7 pages13F Malaysia Energy Commission Headquarters Putrajaya MalaysiaRyan De Vera PagalNo ratings yet

- WebsiteDocument1 pageWebsiteRyan De Vera PagalNo ratings yet

- ASD Manual and AISC LRFD Manual For Bolt Diameters Up To 6 Inches (150Document1 pageASD Manual and AISC LRFD Manual For Bolt Diameters Up To 6 Inches (150rabzihNo ratings yet

- K Series Parts List - 091228Document25 pagesK Series Parts List - 091228AstraluxNo ratings yet

- Choose the Best WordDocument7 pagesChoose the Best WordJohnny JohnnieeNo ratings yet

- A Woman's Talent Is To Listen, Says The Vatican - Advanced PDFDocument6 pagesA Woman's Talent Is To Listen, Says The Vatican - Advanced PDFhahahapsuNo ratings yet

- Ogl422 Milestone Three Team 11 Intro Training Session For Evergreen MGT Audion Recording Due 2022apr18 8 30 PM PST 11 30pm EstDocument14 pagesOgl422 Milestone Three Team 11 Intro Training Session For Evergreen MGT Audion Recording Due 2022apr18 8 30 PM PST 11 30pm Estapi-624721629No ratings yet

- The Graduation Commencement Speech You Will Never HearDocument4 pagesThe Graduation Commencement Speech You Will Never HearBernie Lutchman Jr.No ratings yet

- (App Note) How To Design A Programmable Gain Instrumentation AmplifierDocument7 pages(App Note) How To Design A Programmable Gain Instrumentation AmplifierIoan TudosaNo ratings yet

- Classification of Textile Testing - OrDNURDocument6 pagesClassification of Textile Testing - OrDNURKazi ShorifNo ratings yet

- Intec Waste PresiDocument8 pagesIntec Waste Presiapi-369931794No ratings yet

- COT EnglishDocument4 pagesCOT EnglishTypie ZapNo ratings yet

- Center of Gravity and Shear Center of Thin-Walled Open-Section Composite BeamsDocument6 pagesCenter of Gravity and Shear Center of Thin-Walled Open-Section Composite Beamsredz00100% (1)

- Febrile SeizureDocument3 pagesFebrile SeizureClyxille GiradoNo ratings yet

- Published Filer List 06072019 Sorted by CodeDocument198 pagesPublished Filer List 06072019 Sorted by Codeherveduprince1No ratings yet

- Obat LasaDocument3 pagesObat Lasaibnunanda29No ratings yet

- Wika Type 111.11Document2 pagesWika Type 111.11warehouse cikalongNo ratings yet

- Design and Analysis of Algorithms Prof. Madhavan Mukund Chennai Mathematical Institute Week - 01 Module - 01 Lecture - 01Document8 pagesDesign and Analysis of Algorithms Prof. Madhavan Mukund Chennai Mathematical Institute Week - 01 Module - 01 Lecture - 01SwatiNo ratings yet

- Chapter 08Document18 pagesChapter 08soobraNo ratings yet

- Linguistics: Chapter 1 - 10Document41 pagesLinguistics: Chapter 1 - 10Ahmad A. JawadNo ratings yet

- EMMS SpecificationsDocument18 pagesEMMS SpecificationsAnonymous dJtVwACc100% (2)

- A.2.3. Passive Transport Systems MCQsDocument3 pagesA.2.3. Passive Transport Systems MCQsPalanisamy SelvamaniNo ratings yet

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument35 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDrMichelleHutchinsonegniq100% (15)

- Legal Principles and The Limits of The Law Raz PDFDocument33 pagesLegal Principles and The Limits of The Law Raz PDFlpakgpwj100% (2)

- Strain Gauge Sensor PDFDocument12 pagesStrain Gauge Sensor PDFMario Eduardo Santos MartinsNo ratings yet

- IEC-60721-3-3-2019 (Enviromental Conditions)Document12 pagesIEC-60721-3-3-2019 (Enviromental Conditions)Electrical DistributionNo ratings yet

- AIATS 2021 (OYMCF) Test 01 Offline - Code A - SolutionsDocument34 pagesAIATS 2021 (OYMCF) Test 01 Offline - Code A - Solutionsbhavyakavya mehta100% (1)

- Genre Worksheet 03 PDFDocument2 pagesGenre Worksheet 03 PDFmelissaNo ratings yet

- Hardware Purchase and Sales System Project ProfileDocument43 pagesHardware Purchase and Sales System Project Profilesanjaykumarguptaa100% (2)