Professional Documents

Culture Documents

Chapter 4 Solutions

Uploaded by

Thevan Aruljothi0 ratings0% found this document useful (0 votes)

14 views7 pagesOriginal Title

Chapter 4 Solutions.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views7 pagesChapter 4 Solutions

Uploaded by

Thevan AruljothiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

Problem 4-13 (45 minutes)

Weighted-Average Method

1. Equivalent Units of Production

Materials Conversion

Transferred to next department* ..................... 380,000 380,000

Ending work in process:

Materials: 40,000 units x 75% complete ......... 30,000

Conversion: 40,000 units x 25% complete...... 10,000

Equivalent units of production.......................... 410,000 390,000

*Units transferred to the next department = Units in beginning work in

process + Units started into production Units in ending work in

process = 70,000 + 350,000 40,000 = 380,000

2. Cost per Equivalent Unit

Materials Conversion

Cost of beginning work in process ................. $ 86,000 $ 36,000

Cost added during the period ....................... 447,000 198,000

Total cost (a) ............................................... $533,000 $234,000

Equivalent units of production (b) ................. 410,000 390,000

Cost per equivalent unit, (a) (b) ................ $1.30 $0.60

3. Cost of Ending Work in Process Inventory and Units Transferred Out

Materials Conversion Total

Ending work in process inventory:

Equivalent units of production

(materials: 40,000 units x 75%

complete; conversion: 40,000

units x 25% complete) ....... 30,000 10,000

Cost per equivalent unit ....... $1.30 $0.60

Cost of ending work in process

inventory........................... $39,000 $6,000 $45,000

Units completed and transferred out:

Units transferred to the next

department ....................... 380,000 380,000

Cost per equivalent unit ....... $1.30 $0.60

Cost of units completed and

transferred out .................. $494,000 $228,000 $722,000

Problem 4-13 (continued)

4. Cost Reconciliation

Costs to be accounted for:

Cost of beginning work in process inventory

($86,000 + $36,000) ................................. $122,000

Costs added to production during the period

($447,000 + $198,000) .............................. 645,000

Total cost to be accounted for ...................... $767,000

Costs accounted for as follows:

Cost of ending work in process inventory ...... $ 45,000

Cost of units completed and transferred out .. 722,000

Total cost accounted for ............................... $767,000

Problem 4-15 (45 minutes)

Weighted-Average Method

1. Equivalent units of production

Materials Conversion

Transferred to next department* ..................... 270,000 270,000

Ending work in process:

Materials: 45,000 units x 100% complete ....... 45,000

Conversion: 45,000 units x 60% complete ...... 27,000

Equivalent units of production.......................... 315,000 297,000

*Units transferred to the next department = Units in beginning work in

process + Units started into production Units in ending work in

process = 35,000 + 280,000 45,000 = 270,000

2. Cost per equivalent unit

Materials Conversion

Cost of beginning work in process ................. $ 43,400 $ 20,300

Cost added during the period ....................... 397,600 187,600

Total cost (a) ............................................... $441,000 $207,900

Equivalent units of production (b) ................. 315,000 297,000

Cost per equivalent unit, (a) (b) ................ $1.40 $0.70

3. Cost of ending work in process inventory and units transferred out

Materials Conversion Total

Ending work in process inventory:

Equivalent units of production .. 45,000 27,000

Cost per equivalent unit ........... $1.40 $0.70

Cost of ending work in process

inventory............................... $63,000 $18,900 $81,900

Units completed and transferred out:

Units transferred to the next

department ........................... 270,000 270,000

Cost per equivalent unit ........... $1.40 $0.70

Cost of units completed and

transferred out ...................... $378,000 $189,000 $567,000

Problem 4-16 (45 minutes)

Weighted-Average Method

1. a. Work in ProcessBlending ................ 147,600

Work in ProcessBottling .................. 45,000

Raw Materials .............................. 192,600

b. Work in ProcessBlending ................ 73,200

Work in ProcessBottling .................. 17,000

Salaries and Wages Payable ......... 90,200

c. Manufacturing Overhead ................... 596,000

Accounts Payable ......................... 596,000

d. Work in ProcessBlending ................ 481,000

Manufacturing Overhead .............. 481,000

Work in ProcessBottling .................. 108,000

Manufacturing Overhead .............. 108,000

e. Work in ProcessBottling .................. 722,000

Work in ProcessBlending ........... 722,000

f. Finished Goods ................................. 920,000

Work in ProcessBottling............. 920,000

g. Accounts Receivable.......................... 1,400,000

Sales ........................................... 1,400,000

Cost of Goods Sold ............................ 890,000

Finished Goods ............................ 890,000

Problem 4-16 (continued)

2.

Accounts Receivable Raw Materials

(g) 1,400,000 Bal. 198,600 (a) 192,600

Bal. 6,000

Work in Process Work in Process

Blending Department Bottling Department

Bal. 32,800 (e) 722,000 Bal. 49,000 (f) 920,000

(a) 147,600 (a) 45,000

(b) 73,200 (b) 17,000

(d) 481,000 (d) 108,000

Bal. 12,600 (e) 722,000

Bal. 21,000

Finished Goods Manufacturing Overhead

Bal. 20,000 (g) 890,000 (c) 596,000 (d) 589,000

(f) 920,000 Bal. 7,000

Bal. 50,000

Accounts Payable Salaries and Wages Payable

(c) 596,000 (b) 90,200

Sales Cost of Goods Sold

(g) 1,400,000 (g) 890,000

Problem 4-17 (60 minutes)

Weighted-Average Method

1. Computation of equivalent units in ending inventory:

Mixing Materials Conversion

Units transferred to the next department ........ 60.0 60.0 60.0

Ending work in process:

Mixing: 1 unit 100% complete................ 1.0

Materials: 1 unit 20% complete.............. 0.2

Conversion: 1 unit 10% complete........... 0.1

Equivalent units of production ........................ 61.0 60.2 60.1

2. Costs per equivalent unit:

Mixing Materials Conversion

Cost of beginning work in process inventory.... $ 1,640 $ 26 $ 105

Cost added during the period ......................... 94,740 8,402 61,197

Total cost...................................................... $96,380 $8,428 $61,302

Equivalent units of production ........................ 61.0 60.2 60.1

Cost per equivalent unit ................................. $1,580 $140 $1,020

Problem 4-17 (continued)

3. Costs of ending work in process inventory and units transferred out:

Mixing Materials Conversio

Ending work in process inventory:

Equivalent units of production ................... 1.0 0.2 0.

Cost per equivalent unit ............................ $1,580 $140 $1,02

Cost of ending work in process inventory ... $1,580 $28 $10

Units completed and transferred out:

Units transferred to the next department ... 60.0 60.0 60.

Cost per equivalent unit ............................ $1,580 $140 $1,02

Cost of units transferred out ...................... $94,800 $8,400 $61,20

4. Cost reconciliation:

Cost to be accounted for:

Cost of beginning work in process inventory

($1,640 + $26 + $105) ............................. $ 1,771

Cost added to production during the period

($94,740 + $8,402 + $61,197) .................. 164,339

Total cost to be accounted for ...................... $166,110

Costs accounted for as follows:

Cost of ending work in process inventory ...... $ 1,710

Cost of units transferred out ........................ 164,400

Total cost accounted for............................... $166,110

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TW BT 01 - Barstock Threaded Type Thermowell (Straight) : TWBT - 01Document3 pagesTW BT 01 - Barstock Threaded Type Thermowell (Straight) : TWBT - 01Anonymous edvYngNo ratings yet

- Buildingawinningsalesforce WP DdiDocument14 pagesBuildingawinningsalesforce WP DdiMawaheb ContractingNo ratings yet

- MCQs - Chapters 31 - 32Document9 pagesMCQs - Chapters 31 - 32Lâm Tú HânNo ratings yet

- DIFFERENTIATING PERFORMANCE TASK FOR DIVERSE LEARNERS (Script)Document2 pagesDIFFERENTIATING PERFORMANCE TASK FOR DIVERSE LEARNERS (Script)Laurice Carmel AgsoyNo ratings yet

- Minuets of The Second SCTVE MeetingDocument11 pagesMinuets of The Second SCTVE MeetingLokuliyanaNNo ratings yet

- Morse Potential CurveDocument9 pagesMorse Potential Curvejagabandhu_patraNo ratings yet

- 21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREDocument170 pages21st CENTURY TECHNOLOGIES - PROMISES AND PERILS OF A DYNAMIC FUTUREpragya89No ratings yet

- Ds-Module 5 Lecture NotesDocument12 pagesDs-Module 5 Lecture NotesLeela Krishna MNo ratings yet

- TrellisDocument1 pageTrellisCayenne LightenNo ratings yet

- Zahid Imran CVDocument4 pagesZahid Imran CVDhia Hadj SassiNo ratings yet

- Code ExplanantionDocument4 pagesCode ExplanantionVivek JadiyaNo ratings yet

- Vedic Maths Edited 2Document9 pagesVedic Maths Edited 2sriram ANo ratings yet

- NGCP EstimatesDocument19 pagesNGCP EstimatesAggasid ArnelNo ratings yet

- 1996 OKI LCD Driver Controller DatabookDocument232 pages1996 OKI LCD Driver Controller Databookpiptendo100% (1)

- Freshers Jobs 26 Aug 2022Document15 pagesFreshers Jobs 26 Aug 2022Manoj DhageNo ratings yet

- JP Selecta IncubatorDocument5 pagesJP Selecta IncubatorAhmed AlkabodyNo ratings yet

- Principles of Business Grade 10 June 2021 Time: 1 1/2 Hrs. Paper 2 Answer ONLY 1 Question in Section I. Section IDocument3 pagesPrinciples of Business Grade 10 June 2021 Time: 1 1/2 Hrs. Paper 2 Answer ONLY 1 Question in Section I. Section Iapi-556426590No ratings yet

- Presentation Municipal Appraisal CommitteeDocument3 pagesPresentation Municipal Appraisal CommitteeEdwin JavateNo ratings yet

- Lab 2 - Using Wireshark To Examine A UDP DNS Capture Nikola JagustinDocument6 pagesLab 2 - Using Wireshark To Examine A UDP DNS Capture Nikola Jagustinpoiuytrewq lkjhgfdsaNo ratings yet

- Properties of LiquidsDocument26 pagesProperties of LiquidsRhodora Carias LabaneroNo ratings yet

- ArcGIS Shapefile Files Types & ExtensionsDocument4 pagesArcGIS Shapefile Files Types & ExtensionsdanangNo ratings yet

- 100 20210811 ICOPH 2021 Abstract BookDocument186 pages100 20210811 ICOPH 2021 Abstract Bookwafiq alibabaNo ratings yet

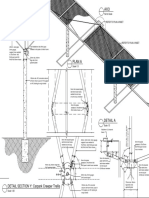

- ARC-232, Material Construction 2Document4 pagesARC-232, Material Construction 2danishali1090No ratings yet

- OVDT Vs CRT - GeneralDocument24 pagesOVDT Vs CRT - Generaljaiqc100% (1)

- Chapter Three: Tools For Exploring The World: Physical, Perceptual, and Motor DevelopmentDocument43 pagesChapter Three: Tools For Exploring The World: Physical, Perceptual, and Motor DevelopmentHsieh Yun JuNo ratings yet

- Answer Key To World English 3 Workbook Reading and Crossword Puzzle ExercisesDocument3 pagesAnswer Key To World English 3 Workbook Reading and Crossword Puzzle Exercisesjuanma2014375% (12)

- Rubric For Aet570 BenchmarkDocument4 pagesRubric For Aet570 Benchmarkapi-255765082No ratings yet

- Settlement Report - 14feb17Document10 pagesSettlement Report - 14feb17Abdul SalamNo ratings yet

- Research Paper On Air QualityDocument4 pagesResearch Paper On Air Qualityluwahudujos3100% (1)