Professional Documents

Culture Documents

ACC-ACF2100 Topic 7 Presentation Question Solution

Uploaded by

DanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC-ACF2100 Topic 7 Presentation Question Solution

Uploaded by

DanCopyright:

Available Formats

ACC/ACF2100 Financial Accounting

Topic 7 Consolidation: Wholly Owned Subsidiaries Presentation Question

On 1 July 2017, Hawk Ltd acquired all the issued shares (cum div.) of Magpie Ltd for

$1,200,000. At this date the equity of Magpie Ltd consisted of:

Share capital $850 000

General reserve $55 000

Retained earnings $245 000

At acquisition date, Magpie Ltd reported a dividend payable of $2 000. All the identifiable

assets and liabilities of Magpie Ltd were recorded at amounts equal to their fair values

except for:

Carrying amount Fair value

Plant (cost $250 000) $200 000 $220 000

Land 320 000 350 000

Inventory 58 000 64 000

The plant was considered to have a further five year life. All inventory was sold by 30 June

2018. The dividend payable recorded at acquisition date was paid in July 2017.

Required

Prepare the acquisition analysis and consolidation worksheet entries for the preparation by

Hawk Ltd of its consolidated financial statements at 30 June 2018. Explain why each entry is

required.

Prepared by Dr Lisa Powell

ACC/ACF2100 Financial Accounting

Topic 7 Consolidation: Wholly Owned Subsidiaries Presentation Question

Solution

STEP 1: Acquisition analysis at 1 July 2017:

FVINA of Magpie Ltd = ($850 000 + $55 000 + $245 000) (equity)

+ $20 000 (1 30%) (plant BCVR)

+ $30 000 (1 30%) (land BCVR)

+ $6 000 (1 30%) (inventory BCVR)

= $1 189 200

Consideration transferred = $1 200 000 2 000 dividend receivable

= $1 198 000

Goodwill = $8 800

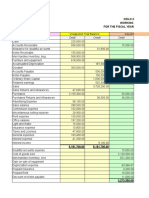

Worksheet entries at 30 June 2018 (1 year since acquisition)

STEP 2: BCVR entries (plant and land on hand, inventory sold in current year)

Accumulated depreciation plant Dr 50 000

Plant Cr 30 000

DTL (30%) Cr 6 000

BCVR Cr 14 000

CA of plant increased by $20 000 (TTD), so depn increases (20 000/5) $4 000 p.a.

Depreciation expense Dr 4 000

Accumulated depreciation Cr 4 000

CA of plant (TTD) reduced by $4 000, so reverse (4 000 x 30%) $1 200 from DTL

DTL Dr 1 200

Income tax expense Cr 1 200

Land Dr 30 000

DTL (30%) Cr 9 000

BCVR Cr 21 000

Cost of sales Dr 6 000

Income tax expense (30%) Cr 1 800

Transfer from BCVR (RE) Cr 4 200

Prepared by Dr Lisa Powell

STEP 3: Pre-acquisition entries

At 30 June 2018 (1 year since acquisition), the pre-acquisition entries would be

Need to consider

- inventory sold in current year

- dividend payable at acquisition has been paid dividend payable and receivable

accounts closed off hence no entry required

Retained earnings (1/7/16) Dr 245 000

Share capital Dr 850 000

General reserve Dr 55 000

BCVR Dr 39 200

Goodwill Dr 8 800

Shares in Magpie Ltd Cr 1 198 000

Transfer from BCVR (RE) Dr 4 200

BCVR Cr 4 200

(Sale of inventory)

Prepared by Dr Lisa Powell

You might also like

- Sol. Man. Chapter 4 Consol. Fs Part 1Document37 pagesSol. Man. Chapter 4 Consol. Fs Part 1itsmenatoy43% (7)

- 2023_TaxReturnDocument27 pages2023_TaxReturnLuiNo ratings yet

- Use The Following Information For The Next Three Questions:: Rainy SunnyDocument14 pagesUse The Following Information For The Next Three Questions:: Rainy SunnyAndy Lalu100% (3)

- Analogue Electronics Complete Course Summary Notes With Examples HDDocument121 pagesAnalogue Electronics Complete Course Summary Notes With Examples HDDanNo ratings yet

- Tax Law Review Course OverviewDocument14 pagesTax Law Review Course OverviewEduard Riparip100% (2)

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- Chapter 4 - Consolidated Financial Statements (Part 1)Document32 pagesChapter 4 - Consolidated Financial Statements (Part 1)Philip RososNo ratings yet

- CORPORATE INCOME TAX (Answer Key)Document5 pagesCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNo ratings yet

- Statement of Comprehensive IncomeDocument23 pagesStatement of Comprehensive IncomeAbdulmajed Unda MimbantasNo ratings yet

- AC3102 SemGrp 2 Presentation 3Document24 pagesAC3102 SemGrp 2 Presentation 3Melati SepsaNo ratings yet

- Final Payment Certificate DomesticDocument1 pageFinal Payment Certificate DomesticDen OghangsombanNo ratings yet

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Document6 pagesDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooNo ratings yet

- IT - Ch7 Theory Quiz On Introduction To Regular Income Tax (AE 201 - Income Taxation)Document6 pagesIT - Ch7 Theory Quiz On Introduction To Regular Income Tax (AE 201 - Income Taxation)Mary Jescho Vidal Ampil100% (1)

- CONSOLIDATED FINANCIAL STATEMENTSDocument7 pagesCONSOLIDATED FINANCIAL STATEMENTSMya Hmuu KhinNo ratings yet

- CONSOLIDATED STATEMENTSDocument8 pagesCONSOLIDATED STATEMENTSJingwen YangNo ratings yet

- Tutorial_11_Interco_transactions.docxDocument15 pagesTutorial_11_Interco_transactions.docxBình QuốcNo ratings yet

- Week 8 Tutorial SolutionsDocument21 pagesWeek 8 Tutorial SolutionsKashif Munir IdreesiNo ratings yet

- Balance Sheet IAS 1Document3 pagesBalance Sheet IAS 1briankuria21No ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Zoom SlidesDocument10 pagesZoom SlidesTuấn Kiệt NguyễnNo ratings yet

- 7.8 BCHNDocument7 pages7.8 BCHNChiêu HạNo ratings yet

- Question 75: Basic Consolidation: Profit For The Year 9,000 3,000Document5 pagesQuestion 75: Basic Consolidation: Profit For The Year 9,000 3,000Lidya Abera100% (1)

- Full goodwill method consolidated financial statementsDocument29 pagesFull goodwill method consolidated financial statementsWang ChoiNo ratings yet

- XnomnDocument9 pagesXnomnJingwen YangNo ratings yet

- Chapter 4Document36 pagesChapter 4MARRIETTE JOY ABADNo ratings yet

- Module 3Document17 pagesModule 3Alpha RamoranNo ratings yet

- Assignment IV Advanced Financial Accounting Chapter 4&5Document6 pagesAssignment IV Advanced Financial Accounting Chapter 4&5Lidya AberaNo ratings yet

- Intermediate Accounting 3 Activity 2 ProblemsDocument4 pagesIntermediate Accounting 3 Activity 2 ProblemsLars FriasNo ratings yet

- Account For Home Office and Branch Transactions. ProblemDocument2 pagesAccount For Home Office and Branch Transactions. ProblemDevine Grace A. MaghinayNo ratings yet

- Akl P4.3 & P4.4Document18 pagesAkl P4.3 & P4.4Dhivena JeonNo ratings yet

- AC3202 WK2 Exercises SolutionsDocument11 pagesAC3202 WK2 Exercises SolutionsLong LongNo ratings yet

- Chapter 5 Solutions To PostDocument43 pagesChapter 5 Solutions To PostJax TellerNo ratings yet

- ACCT 410 Candel Financial StatementDocument14 pagesACCT 410 Candel Financial StatementAthia Adams-KerrNo ratings yet

- Steps to consolidate financial statementsDocument5 pagesSteps to consolidate financial statementsIlham FaridNo ratings yet

- Prepare Financial StatementsDocument16 pagesPrepare Financial StatementsDayaan ANo ratings yet

- Solution Practice 6 Consolidations 3Document8 pagesSolution Practice 6 Consolidations 3Mya Hmuu KhinNo ratings yet

- ACC723 TUTORIAL 5 SOLUTIONSDocument3 pagesACC723 TUTORIAL 5 SOLUTIONSJohn TomNo ratings yet

- Seminar 2 FeedbackDocument5 pagesSeminar 2 FeedbackjekaterinaNo ratings yet

- AKL Kelompok 2Document11 pagesAKL Kelompok 2Wbok ZapztwvNo ratings yet

- Application and Analysis Exercises 28.1 and 28.2Document8 pagesApplication and Analysis Exercises 28.1 and 28.2Peper12345No ratings yet

- ACT 310part B PDFDocument5 pagesACT 310part B PDFNiloy NeogiNo ratings yet

- Balance Sheet and Cash Flow Statement AnalysisDocument3 pagesBalance Sheet and Cash Flow Statement AnalysisAmit GodaraNo ratings yet

- ConsolidationsDocument6 pagesConsolidationsPRANJLINo ratings yet

- Practice Prepare FSDocument8 pagesPractice Prepare FSĐạt LêNo ratings yet

- Intragroup transactions consolidationDocument20 pagesIntragroup transactions consolidationmmNo ratings yet

- past examDocument9 pagespast examHaziNo ratings yet

- Final ExamDocument5 pagesFinal ExamSultan LimitNo ratings yet

- Adv Acc 2 Module 1 Topic1.2Document5 pagesAdv Acc 2 Module 1 Topic1.2James CantorneNo ratings yet

- Steps to consolidate financial statements for PT A and PT BDocument5 pagesSteps to consolidate financial statements for PT A and PT BMega RefiyaniNo ratings yet

- AF210 Unit 4 Tutorial SolutionsDocument5 pagesAF210 Unit 4 Tutorial SolutionsChand DivneshNo ratings yet

- Assignment 3Document14 pagesAssignment 3Jiaxi WNo ratings yet

- Calculating Impairment Loss and Depreciation ExpenseDocument5 pagesCalculating Impairment Loss and Depreciation Expenselimon islamNo ratings yet

- Tham KhaoDocument17 pagesTham KhaoTram NguyenNo ratings yet

- ACCT3004Document8 pagesACCT3004algiak94No ratings yet

- Mid-year acquisition consolidated statementDocument4 pagesMid-year acquisition consolidated statementOmolaja IbukunNo ratings yet

- Assignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliDocument5 pagesAssignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliReema SajuNo ratings yet

- Sem_7.xlsxDocument84 pagesSem_7.xlsxBình QuốcNo ratings yet

- Financial Position Summary of AC GroupDocument11 pagesFinancial Position Summary of AC GroupKhandarmaa LkhagvaNo ratings yet

- Week 2: Accounting for fair value adjustmentsDocument58 pagesWeek 2: Accounting for fair value adjustmentsMichael Al100% (1)

- Chapter 25Document19 pagesChapter 25shivanthi nisansalaNo ratings yet

- Tutorial 10 Consolidation: Intragroup Transactions (Chapter 28)Document4 pagesTutorial 10 Consolidation: Intragroup Transactions (Chapter 28)DGNo ratings yet

- Final Accounts 1. As Per Schedule III of Companies Act 2013, Prepare Financial Statement For Gillette India PVT LTDDocument3 pagesFinal Accounts 1. As Per Schedule III of Companies Act 2013, Prepare Financial Statement For Gillette India PVT LTDermiasNo ratings yet

- Memorandum Question 10 Jeff Limited 2021Document2 pagesMemorandum Question 10 Jeff Limited 2021NOKUHLE ARTHELNo ratings yet

- Tutorial 4 SolutionsDocument5 pagesTutorial 4 SolutionsnaboumilikaNo ratings yet

- Sankofa Group Consolidated Financial PositionDocument5 pagesSankofa Group Consolidated Financial PositionLaud ListowellNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Acquisition Journal EntriesDocument13 pagesAcquisition Journal EntriesVishal PatelNo ratings yet

- Sonometer Report ReflectionDocument3 pagesSonometer Report ReflectionDanNo ratings yet

- Sonometer ReportDocument2 pagesSonometer ReportDanNo ratings yet

- Transport Concession Form PDFDocument2 pagesTransport Concession Form PDFDanNo ratings yet

- C program to read input port and toggle LEDsDocument1 pageC program to read input port and toggle LEDsDanNo ratings yet

- Momentum and Impulse ReportDocument2 pagesMomentum and Impulse ReportDanNo ratings yet

- ACC-ACF2100 Lecture 2 HandoutDocument9 pagesACC-ACF2100 Lecture 2 HandoutDanNo ratings yet

- Kerbal ReportDocument3 pagesKerbal ReportDanNo ratings yet

- Host - Scheme - 2018 - Calendar - and - Information - Pack - PDF Filename UTF-8''Host Scheme 2018 Calendar and Information PackDocument9 pagesHost - Scheme - 2018 - Calendar - and - Information - Pack - PDF Filename UTF-8''Host Scheme 2018 Calendar and Information PackDanNo ratings yet

- TRC3801 Exam 2016 (13 Sept)Document19 pagesTRC3801 Exam 2016 (13 Sept)DanNo ratings yet

- ACC2100 Financial Accounting Impairment and Business CombinationsDocument7 pagesACC2100 Financial Accounting Impairment and Business CombinationsDanNo ratings yet

- ACC-ACF2100 Topic 4 Presentation QuestionDocument1 pageACC-ACF2100 Topic 4 Presentation QuestionDanNo ratings yet

- Acc - Acf2100 Lecture 4Document19 pagesAcc - Acf2100 Lecture 4DanNo ratings yet

- Native LogDocument1 pageNative LogDanNo ratings yet

- Tute 6Document2 pagesTute 6DanNo ratings yet

- Assignment 1 V 2Document3 pagesAssignment 1 V 2DanNo ratings yet

- Programmable Calculator UIDocument9 pagesProgrammable Calculator UIDanNo ratings yet

- Mean Median Mode Range Hard WorksheetDocument2 pagesMean Median Mode Range Hard WorksheetDanNo ratings yet

- Tax Payment ReceiptDocument2 pagesTax Payment ReceiptMian EnterprisesNo ratings yet

- Train Law Ra 10953Document32 pagesTrain Law Ra 10953IanaNo ratings yet

- Required Estate Docs ExplainedDocument3 pagesRequired Estate Docs ExplainedgregNo ratings yet

- Tutorial Test 2: Nicole ConsultingDocument2 pagesTutorial Test 2: Nicole ConsultingTrinh Nguyen Linh ChiNo ratings yet

- 1 AssignmentDocument4 pages1 AssignmentHammad Hassan AsnariNo ratings yet

- Distribute A231 - BKAT3033 - Tutorial 123 - QDocument7 pagesDistribute A231 - BKAT3033 - Tutorial 123 - QallyaNo ratings yet

- Profits and Gains of Business or ProfessionDocument17 pagesProfits and Gains of Business or Professionapi-3832224No ratings yet

- Self Declaration Form - Sec-80DDocument1 pageSelf Declaration Form - Sec-80DDrVarsha Priya SinghNo ratings yet

- SSVF Financial Assessment FormDocument4 pagesSSVF Financial Assessment Formthe tigerNo ratings yet

- Donor's Tax Exam AnswersDocument6 pagesDonor's Tax Exam AnswersKyla BarbosaNo ratings yet

- 21 - MCQ Set Off and Carry ForwardDocument9 pages21 - MCQ Set Off and Carry ForwardSajid YaqoobNo ratings yet

- Factor Company Is Planning To Add A New Product ToDocument1 pageFactor Company Is Planning To Add A New Product ToAmit PandeyNo ratings yet

- Financial Accounting 1: Chapter 4 Special Journal EntriesDocument24 pagesFinancial Accounting 1: Chapter 4 Special Journal EntriesCabdiraxmaan GeeldoonNo ratings yet

- 1 Use Worksheet 11 1 To Determine Whether The Woodsons HaveDocument2 pages1 Use Worksheet 11 1 To Determine Whether The Woodsons Havetrilocksp SinghNo ratings yet

- PubCorp PFDA Vs Central Board of AssementDocument1 pagePubCorp PFDA Vs Central Board of AssementCristine Joy KwongNo ratings yet

- Filling Up BIR Form 1700Document1 pageFilling Up BIR Form 1700Renalyn ParasNo ratings yet

- Polar Sports: Where Does Polar Sports Fit in The Course?Document21 pagesPolar Sports: Where Does Polar Sports Fit in The Course?SmartunblurrNo ratings yet

- Ind As 105 105: Non-Current Asset Classified As Held For Sale & Discontinued Business / OperationDocument6 pagesInd As 105 105: Non-Current Asset Classified As Held For Sale & Discontinued Business / OperationAayush MayankNo ratings yet

- Descriptive Guidelines On Flexi Pay ComponentsDocument5 pagesDescriptive Guidelines On Flexi Pay Componentsshannbaby22No ratings yet

- Accounting cycle for Zebenai LaundryDocument2 pagesAccounting cycle for Zebenai Laundrypoli nik100% (3)

- Income Tax Statement PDFDocument4 pagesIncome Tax Statement PDFSuyash SirNo ratings yet

- GST Past Exam AnalysisDocument17 pagesGST Past Exam AnalysisSuraj PawarNo ratings yet

- Exercises/Assignments Answer The Following ProblemsDocument22 pagesExercises/Assignments Answer The Following ProblemsLuigi Enderez BalucanNo ratings yet