Professional Documents

Culture Documents

Workplace Pensions 2017

Uploaded by

Jeremy KurnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Workplace Pensions 2017

Uploaded by

Jeremy KurnCopyright:

Available Formats

AGEING BRITAIN

People are living longer than ever before, and yet the state suggested developed countries should raise their retirement

pension age has remained stagnant at 65 for men (and age to at least 70 by 2050 as the number of people over 65

lower for women) for years. However, the cost of retirement more than triples to 2.1 billion.

has surged as pension costs for the Treasury followed the

same trajectory as life expectancy, which has increased by And yet, an increasing amount of employees wish to

more than a decade over the past 50 years. continue employment past the state pension age, with

seven out of ten citing income and savings-related

The state pension age for both men and women is set concerns. And while data shows that workers want

to reach 66 by 2020, rising further to 67 and 68 over the the option of flexible retirement, not all businesses are

coming decades. The World Economic Forum has even prepared to offer it.

PATH TO STATE PENSION AGE AND RETIREMENT TIME FLEXIBLE RETIREMENT OPTIONS

Projected state pension age under current legislation and proportion of adult life in retirement Data shows a gap between what employees want

and what is offered by employers

Proportion of adult Female life expectancy State pension age under Offered benefit by employer

life in retirement current legislation

Male life expectancy Very or extremely important to employees

90

85

58%

80 52%

RETIREMENT

75

70

45%

34%

65

60

32%

55

28%

50

AGE

45

WORKING LIFE

40

35

30

25

20

15

10

CHILDHOOD

5

0

2020 2030 2040 2050 2060 Phased Ability to work past

retirement retirement age

Government Actuarys Department/Office

for National Statistics 2016

HOW UK WORKERS SEE

THEIR RETIREMENT 36%

I will change the way I

work (working part time or

14% temporary contracts), but

only for a while before I

I will change the way I eventually give up paid work

work (working part time or altogether

temporary contracts) and

will continue paid work

throughout retirement in

some capacity

10% 28%

I will keep working as I I will immediately stop

currently do; retirement age working altogether and

wont make a difference to the enter full retirement

way I work

12%

Other/dont know

REASONS PEOPLE WILL CONTINUE WORK AT RETIREMENT AGE

7/10

workers expect to continue

57%

Want to keep active/

brain alert

37%

Enjoy my work/career

32%

General anxieties

about retirement income

and savings

working at retirement age

because of income and

savings-related concerns

MEAN AGE AT WHICH PEOPLE EXPECT TO RETIRE 32% 24% 23%

65 Concerned social Concerned that my Not saved enough on

security benefits are less retirement plan benefits a consistent basis

64 than expected are less than expected

Age expected to retire

63

62

21% 20% 6%

61

60

Expect employment to be Retirement income Planning a career

18-24 25-34 35-44 45-54 55-64 my primary income while less than expected due break/time out

Current age transitioning to retirement to recession

Aegon 2016

You might also like

- Voya Cares Employment Extenders - Voz MediaDocument18 pagesVoya Cares Employment Extenders - Voz MediaVozMediaNo ratings yet

- 2023 On Q Job Satisfaction Report - Salary DataDocument38 pages2023 On Q Job Satisfaction Report - Salary DataBenjamim MonfrediniNo ratings yet

- Arc 2021 Session 5 Paper 1 CarcilloDocument13 pagesArc 2021 Session 5 Paper 1 CarcillogiaNo ratings yet

- g20 Women@Work Ilo OecdDocument11 pagesg20 Women@Work Ilo Oecdkunal sengarNo ratings yet

- Robotics Technology and Firm-Level Employment Adjustment in JapanDocument33 pagesRobotics Technology and Firm-Level Employment Adjustment in JapanShivaranjini RamendranNo ratings yet

- 68 32 Presentasi Perusahaan Fy 2020 Indicative ResultsDocument47 pages68 32 Presentasi Perusahaan Fy 2020 Indicative ResultsIvanNo ratings yet

- The Future of Work Could Bring More Inequality, Social Tensions - BloombergDocument3 pagesThe Future of Work Could Bring More Inequality, Social Tensions - BloombergYC TeoNo ratings yet

- Report 2021 Mba Employment ReportDocument19 pagesReport 2021 Mba Employment Reportsayan halderNo ratings yet

- How Does Japan Compare?: Key FindingsDocument2 pagesHow Does Japan Compare?: Key Findingssuraj_12No ratings yet

- Slid CH04Document48 pagesSlid CH04muneera aljaberiNo ratings yet

- Credited Into Employee Age (Years) Contribution Rate (For Monthly Wages $1,500)Document2 pagesCredited Into Employee Age (Years) Contribution Rate (For Monthly Wages $1,500)Kshitij VijayvergiaNo ratings yet

- Credited Into Employee Age (Years) Contribution Rate (For Monthly Wages $1,500)Document2 pagesCredited Into Employee Age (Years) Contribution Rate (For Monthly Wages $1,500)Shaan RoyNo ratings yet

- Coe SsaDocument5 pagesCoe SsaKasia GodlewskaNo ratings yet

- India's Best Workplaces in BFSI 2021Document20 pagesIndia's Best Workplaces in BFSI 2021Amisha LalNo ratings yet

- FMCG Sector Employee Benefits Liability and Funding Study 2021Document12 pagesFMCG Sector Employee Benefits Liability and Funding Study 2021Aashna JainNo ratings yet

- FiguresDocument3 pagesFigureskzNo ratings yet

- Arcelik Beko LLC 20120314 PDFDocument100 pagesArcelik Beko LLC 20120314 PDFJane SavinaNo ratings yet

- Working After 65Document12 pagesWorking After 65cipcivilNo ratings yet

- Reforms Corresponding To The Population Ageing: The Case of JapanDocument22 pagesReforms Corresponding To The Population Ageing: The Case of JapanADBI EventsNo ratings yet

- 2022 OOS Short Information English v2Document2 pages2022 OOS Short Information English v2Constantin NedelcuNo ratings yet

- Executive Summary ITDocument1 pageExecutive Summary ITNephtys ChanceNo ratings yet

- Spiva Us Mid Year 2021Document36 pagesSpiva Us Mid Year 2021Gábor ZsédelyNo ratings yet

- Accounts Payable v0.2 p1Document10 pagesAccounts Payable v0.2 p1rahul100000No ratings yet

- Chapter 6: Data Analysis and Interpretation.: 6.2 Biographical InformationDocument24 pagesChapter 6: Data Analysis and Interpretation.: 6.2 Biographical InformationKavisha singhNo ratings yet

- Retirement Age Trends and The Shift in Workplace Pensions: Gary BurtlessDocument22 pagesRetirement Age Trends and The Shift in Workplace Pensions: Gary BurtlessNational Press FoundationNo ratings yet

- 2020 Chief Procurement Officer Flash SurveyDocument11 pages2020 Chief Procurement Officer Flash SurveyHanumat Sastry V MalladiNo ratings yet

- Pp2023e PressReleaseDocument4 pagesPp2023e PressReleaseCerio DuroNo ratings yet

- Evy Haryadi - IICCS ForumDocument12 pagesEvy Haryadi - IICCS ForumbudisulaksonoNo ratings yet

- U.S. Economic Outlook: January 2023: EconomicsDocument15 pagesU.S. Economic Outlook: January 2023: EconomicsRuiNo ratings yet

- India - Media Landscape (2022)Document68 pagesIndia - Media Landscape (2022)emba22006No ratings yet

- ZomatoDocument6 pagesZomatoChandra Sekhar GudaNo ratings yet

- Supplement: 7-8 Years 12%Document3 pagesSupplement: 7-8 Years 12%kzNo ratings yet

- ILO, 2019 The Global Labour Income Share and DistributionDocument7 pagesILO, 2019 The Global Labour Income Share and DistributionBarbara PintoNo ratings yet

- 6.future PotentialsDocument5 pages6.future PotentialscesarNo ratings yet

- SLRP Pillar 3 T5 T6Document4 pagesSLRP Pillar 3 T5 T6Rachelle RicioNo ratings yet

- Citn Presentation DR Olusegun Omisakin 2021Document12 pagesCitn Presentation DR Olusegun Omisakin 2021Rasheed LawalNo ratings yet

- Project On Employee RetentionDocument57 pagesProject On Employee RetentionRoyal ProjectsNo ratings yet

- Dse Placement ReportDocument89 pagesDse Placement ReportVeera RaghavanNo ratings yet

- PhillyforeDocument16 pagesPhillyforeapi-25887578No ratings yet

- Skin Care in Singapore DatagraphicsDocument4 pagesSkin Care in Singapore DatagraphicsLong Trần HoàngNo ratings yet

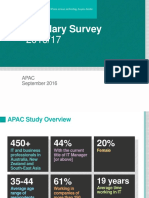

- 2016 Salary Survey Apac FinalDocument29 pages2016 Salary Survey Apac Finald0wnl02dNo ratings yet

- Pareto Charts Explained for Identifying Main Causes of ProblemsDocument5 pagesPareto Charts Explained for Identifying Main Causes of ProblemsTrexie PalenciaNo ratings yet

- Gender Ratio in Tobacco Industry of BangladeshDocument10 pagesGender Ratio in Tobacco Industry of BangladeshDiganta DebnathNo ratings yet

- MCG 2022 MCU Summary ReviewDocument11 pagesMCG 2022 MCU Summary ReviewMedical Service MPINo ratings yet

- Earnings Differences Between Men and Women: Full Length Text - Micro Only TextDocument12 pagesEarnings Differences Between Men and Women: Full Length Text - Micro Only TextGvantsa MorchadzeNo ratings yet

- Tesla OverviewDocument1 pageTesla OverviewMayank MahajanNo ratings yet

- An Overview of The Total Advertising IndustryDocument1 pageAn Overview of The Total Advertising Industrypeninah annNo ratings yet

- Transformation of The Automobile IndustryDocument33 pagesTransformation of The Automobile IndustryAmitNo ratings yet

- Dse Placement Report PDFDocument78 pagesDse Placement Report PDFAbhijithKríshñàNo ratings yet

- School Form 6 (SF6) Summarized Report On Promotion and Learning Progress & AchievementDocument1 pageSchool Form 6 (SF6) Summarized Report On Promotion and Learning Progress & AchievementMagno PakingganNo ratings yet

- Acr 2019Document66 pagesAcr 2019Awab SibtainNo ratings yet

- VivaDocument47 pagesVivaPradipta KafleNo ratings yet

- KPI S Planta IH SULLANA 2020Document7 pagesKPI S Planta IH SULLANA 2020Emilio GarciaNo ratings yet

- RKL Investor Presentation Jan 2020Document44 pagesRKL Investor Presentation Jan 2020Jammigumpula PriyankaNo ratings yet

- Gender Males Females Others 17 13 0 56.7% 43.3% 0Document1 pageGender Males Females Others 17 13 0 56.7% 43.3% 0Phúc Diễm NguyễnNo ratings yet

- How Do ESOPs WorkDocument1 pageHow Do ESOPs WorkSatheesh KannanNo ratings yet

- Summer Placement 2019 21mbaDocument11 pagesSummer Placement 2019 21mbaSaarthak BadaniNo ratings yet

- The Future of PensionsDocument24 pagesThe Future of PensionspsacafpcNo ratings yet

- OUTPUTYUKDEVITADocument2 pagesOUTPUTYUKDEVITADesi HjsNo ratings yet

- Creating a Sticky Workplace People Love:: By Focusing On Those That StayFrom EverandCreating a Sticky Workplace People Love:: By Focusing On Those That StayNo ratings yet

- Party in The USA - Miley CyrusDocument2 pagesParty in The USA - Miley CyrusJeremy Kurn100% (1)

- River - Leon BridgesDocument2 pagesRiver - Leon BridgesJeremy KurnNo ratings yet

- Crazy Love - Van MorrisonDocument1 pageCrazy Love - Van MorrisonJeremy KurnNo ratings yet

- Modern office trends that didn't lastDocument1 pageModern office trends that didn't lastJeremy KurnNo ratings yet

- Respect - Aretha FranklinDocument2 pagesRespect - Aretha FranklinJeremy Kurn100% (1)

- Don T Stop Til You Get Enough Michael JacksonDocument8 pagesDon T Stop Til You Get Enough Michael JacksonJose San MartinNo ratings yet

- Angel From Montgomery - Bonnie RaittDocument1 pageAngel From Montgomery - Bonnie RaittJeremy KurnNo ratings yet

- Taxing Times: Marginal Corporate Income Tax Rates by Region/GroupDocument1 pageTaxing Times: Marginal Corporate Income Tax Rates by Region/GroupJeremy KurnNo ratings yet

- Mobile Moments That Changed The WorldDocument1 pageMobile Moments That Changed The WorldJeremy KurnNo ratings yet

- Airbnb'S Impact On Hotels: Cheaper PriceDocument1 pageAirbnb'S Impact On Hotels: Cheaper PriceJeremy KurnNo ratings yet

- Water Pressure: Joint FirstDocument1 pageWater Pressure: Joint FirstJeremy KurnNo ratings yet

- UK manufacturing productivity levels by industryDocument1 pageUK manufacturing productivity levels by industryJeremy KurnNo ratings yet

- Cardiovascular Health 2016Document1 pageCardiovascular Health 2016Jeremy KurnNo ratings yet

- Cfo Outlook: Source: IBM 2016 Source: IBM 2016Document1 pageCfo Outlook: Source: IBM 2016 Source: IBM 2016Jeremy KurnNo ratings yet

- Future of Work 2016Document1 pageFuture of Work 2016Jeremy KurnNo ratings yet

- Mobile Business 2017Document1 pageMobile Business 2017Jeremy KurnNo ratings yet

- Future of Packaging 2016Document1 pageFuture of Packaging 2016Jeremy KurnNo ratings yet

- The Rising Cost of University: 1,728 904 926k 966k 971k 1.01m 7,450Document1 pageThe Rising Cost of University: 1,728 904 926k 966k 971k 1.01m 7,450Jeremy KurnNo ratings yet

- Data Economy 2016Document1 pageData Economy 2016Jeremy KurnNo ratings yet

- Top Strategic Priorities and Challenges for CEOsDocument1 pageTop Strategic Priorities and Challenges for CEOsJeremy KurnNo ratings yet

- The Beauty Economy 2016 PDFDocument1 pageThe Beauty Economy 2016 PDFJeremy KurnNo ratings yet

- Modern office trends that didn't lastDocument1 pageModern office trends that didn't lastJeremy KurnNo ratings yet

- The Consequences of Rising Carbon EmissionsDocument1 pageThe Consequences of Rising Carbon EmissionsJeremy KurnNo ratings yet

- Diversity and Inclusion 2016Document1 pageDiversity and Inclusion 2016Jeremy KurnNo ratings yet

- What customers want most from insurers: Value, trust and serviceDocument1 pageWhat customers want most from insurers: Value, trust and serviceJeremy KurnNo ratings yet

- Global Wearable Shipments & Market Share ForecastDocument1 pageGlobal Wearable Shipments & Market Share ForecastJeremy KurnNo ratings yet

- Corporate Treasury 2016Document1 pageCorporate Treasury 2016Jeremy KurnNo ratings yet

- Supply Chain 2017 PDFDocument1 pageSupply Chain 2017 PDFJeremy KurnNo ratings yet

- Virtual Augmented Reality 2016Document1 pageVirtual Augmented Reality 2016Jeremy KurnNo ratings yet

- Favourite Fictional Characters TimeDocument1 pageFavourite Fictional Characters TimeJeremy KurnNo ratings yet

- Trade UnionDocument22 pagesTrade UnionEmilia Nkem Ohaegbuchi-Opara100% (1)

- G.R. No. 114337 September 29, 1995 NITTO ENTERPRISES, Petitioner, National Labor Relations Commission and Roberto Capili, RespondentsDocument24 pagesG.R. No. 114337 September 29, 1995 NITTO ENTERPRISES, Petitioner, National Labor Relations Commission and Roberto Capili, RespondentsLuis de leonNo ratings yet

- Sample Employmentcontract HeadcookDocument2 pagesSample Employmentcontract HeadcookNikka VerdeNo ratings yet

- Machinary For Prevention & Settlement of Industrial DisputeDocument8 pagesMachinary For Prevention & Settlement of Industrial DisputenibinbalNo ratings yet

- Assignment Flow Chart March 27, 2023Document2 pagesAssignment Flow Chart March 27, 2023Enrique BentoyNo ratings yet

- The Historical Evolution of HRMDocument6 pagesThe Historical Evolution of HRMMukesh DroliaNo ratings yet

- G4 Labour Act 2048Document59 pagesG4 Labour Act 2048Purna GhaleNo ratings yet

- Construction Personnel Request FormDocument1 pageConstruction Personnel Request FormAl-kenzar TahirNo ratings yet

- 21 Biggs Vs BoncacasDocument2 pages21 Biggs Vs BoncacasCAMANo ratings yet

- Introduction to Child Labour in India and Measures to Combat ItDocument2 pagesIntroduction to Child Labour in India and Measures to Combat ItPrachi DesaiNo ratings yet

- HR Gd-Pi Guide: Compiled by HR DirectionDocument12 pagesHR Gd-Pi Guide: Compiled by HR DirectionPratik BafnaNo ratings yet

- Personal Sample of Legal OpinionDocument2 pagesPersonal Sample of Legal Opinionbloome9ceeNo ratings yet

- Employee RetentionDocument13 pagesEmployee RetentionZsazsaNo ratings yet

- Acknowledgement: Overview of Recruitment and Selection 1Document81 pagesAcknowledgement: Overview of Recruitment and Selection 1Roushan AraNo ratings yet

- Avari Hotel HRM Project02Document47 pagesAvari Hotel HRM Project02Aroosh Adnan100% (1)

- Career Guidance Program: Quarter 3 - Module 3Document10 pagesCareer Guidance Program: Quarter 3 - Module 3jessica laranNo ratings yet

- Payslip - 2019 08 31 - ID 40025704Document1 pagePayslip - 2019 08 31 - ID 40025704R KNo ratings yet

- Conbook Below55 Jan2016 PDFDocument20 pagesConbook Below55 Jan2016 PDFConstantino L. Ramirez III100% (1)

- Work Life in JapanDocument8 pagesWork Life in Japanbstar1No ratings yet

- Exercitii HellaDocument1 pageExercitii HellaOana M. MitriaNo ratings yet

- Leave Policy For Different Sectors in IndiaDocument8 pagesLeave Policy For Different Sectors in IndiaRaja SekharNo ratings yet

- Managing Human Resources 17Th Edition PDF Full ChapterDocument41 pagesManaging Human Resources 17Th Edition PDF Full Chapterhelen.bolden534100% (25)

- Worker's Rights and The History of Labor UnionsDocument2 pagesWorker's Rights and The History of Labor UnionsTreyLukeNo ratings yet

- Department of Labor: Wh1385stateDocument1 pageDepartment of Labor: Wh1385stateUSA_DepartmentOfLaborNo ratings yet

- List of Labor CasesDocument2 pagesList of Labor CasesNar D DoNo ratings yet

- Voters List Individual Members of HRD NetworkDocument52 pagesVoters List Individual Members of HRD NetworkhafizsulemanNo ratings yet

- Cases. 3. Regular To Seasonal EmployeeDocument29 pagesCases. 3. Regular To Seasonal EmployeeLecdiee Nhojiezz Tacissea SalnackyiNo ratings yet

- Vitality Health Enterprises IncDocument10 pagesVitality Health Enterprises IncNadya SafarinaNo ratings yet

- Checked by Taj HRM 380 2 Quiz 2 Basic Compensation Group D Name MD Imrul Murshed AlifDocument2 pagesChecked by Taj HRM 380 2 Quiz 2 Basic Compensation Group D Name MD Imrul Murshed AlifSaifur Rahman 1621171030No ratings yet

- 207.1 SyllabusDocument8 pages207.1 SyllabusCecilia PasanaNo ratings yet