Professional Documents

Culture Documents

GS Select Information

Uploaded by

CrowdfundInsiderCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GS Select Information

Uploaded by

CrowdfundInsiderCopyright:

Available Formats

GOLDMAN SACHS PRIVATE BANK SELECT

A digital lending solution for Financial

Advisors and their clients

INTRODUCING

GOLDMAN SACHS PRIVATE BANK SELECT

Goldman Sachs Private Bank Select (GS Select)

is a securities-based lending solution that uses POTENTIAL USES OF

diversified, non-retirement investment assets in a GS SELECT

clients pledged account as collateral. Our digital

platform allows you to quickly and seamlessly PERSONAL BUSINESS

establish a revolving line of credit for your clients,

providing easy access to liquidity. And our high- Real estate Liquidity

touch servicing ensures easy management of your

Tax Acquisitions

clients loans.

obligations

Startup/seed

Tuition funding

LOAN FEATURES

SIZE: From $75,000 to $25 million, with initial minimum

draw requirements of $75,000 and subsequent draws

starting at $2,500 WHY GS SELECT?

USE: Any purpose other than purchasing or carrying margin BENEFITS OF PROGRAM

stock

Retain assets under

FACILITY TYPE: Revolving line of credit; clients can borrow,

management

repay, and re-borrow multiple times

Attract new business

COLLATERAL: Non-retirement investment assets, including Provide comprehensive

stocks, bonds, mutual funds, and exchange-traded funds wealth management

INTEREST RATE: 1-month LIBOR plus a spread determined

by loan amount, reset monthly BENEFITS OF PLATFORM

REPAYMENT: Interest only, payable monthly; principal can State-of-the-art technology

be repaid at any time without penalty provides quick loan processing

Intuitive desktop interface

TERM: There is no maturity date; repayment can be

provides full transparency into

demanded at any time

application and loan status

FEES: No application, origination, or annual fees Loan origination and servicing

support provided by phone and

DOCUMENTS: No personal financial statements, tax returns, in person

or paper applications

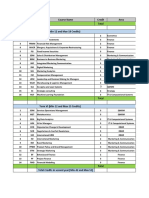

HOW IT WORKS

GS Selects digital platform allows you to seamlessly establish a revolving line of credit for

your clients, providing easy access to liquidity, often within 24 hours.

STEP ESTIMATED TIME TO COMPLETE STAKEHOLDER

1 Term sheet Under

created 10 min

Financial Lender

(optional) Advisor

2 Application Under

CLIENT initiated 5 min

PROFILE Financial

Advisor

Lender

3 Application Under

AT LEAST completed 15 min

Client

$150,000 OF NON-

RETIREMENT

ASSETS UNDER 4 Underwriting Under

5 min

MANAGEMENT Automated GS

Select System

5 Collateral Under

accounts 5 min

SUFFICIENT Financial

pledged Advisor

COLLATERAL TO

FULLY SUPPORT

6 Loan Under

LOAN, PLUS reviewed 5 min

Financial Advisor

INCREMENTAL Supervisor

OUTSIDE LIQUIDITY

7 Loan agreement Under

reviewed 30 min

Client

and signed

GOOD CREDIT

Loan booked* Start to finish:

Under

24 hrs Automated GS

Select System

U.S. RESIDENCY

*Client draw next day once collateral is confirmed.

Credit qualification and collateral are subject to approval. Additional terms and conditions would apply. Loans are offered by the Salt Lake City branch of Goldman Sachs Bank USA

(GS Bank), a New York statechartered bank and a wholly owned subsidiary of The Goldman Sachs Group, Inc. GS Bank is a member of the Federal Reserve System and Member

FDIC. Equal Housing Lender. Goldman Sachs Private Bank Select is a business of GS Bank. Copyright 2017 Goldman Sachs, All Rights Reserved.

You might also like

- 2020 Queens Awards Enterprise Press BookDocument126 pages2020 Queens Awards Enterprise Press BookCrowdfundInsiderNo ratings yet

- 2020 Queens Awards Enterprise Press BookDocument126 pages2020 Queens Awards Enterprise Press BookCrowdfundInsiderNo ratings yet

- Monzo Annual Report 2019Document92 pagesMonzo Annual Report 2019CrowdfundInsider100% (2)

- A Financial System That Creates Economic Opportunities Nonbank Financi...Document222 pagesA Financial System That Creates Economic Opportunities Nonbank Financi...CrowdfundInsiderNo ratings yet

- Bank of Canada Staff Working Paper :document de Travail Du Personnel 2018 - 34 Incentive Compatibility On The Blockchainswp2018-34Document19 pagesBank of Canada Staff Working Paper :document de Travail Du Personnel 2018 - 34 Incentive Compatibility On The Blockchainswp2018-34CrowdfundInsiderNo ratings yet

- UK Cryptoassets Taskforce Final Report Final WebDocument58 pagesUK Cryptoassets Taskforce Final Report Final WebCrowdfundInsiderNo ratings yet

- House of Commons Treasury Committee Crypto AssetsDocument53 pagesHouse of Commons Treasury Committee Crypto AssetsCrowdfundInsider100% (1)

- OCC Fintech Charter Manual: Considering-charter-Applications-fintechDocument20 pagesOCC Fintech Charter Manual: Considering-charter-Applications-fintechCrowdfundInsiderNo ratings yet

- Cooperation Agreement Asic CSSF 4 OctoberDocument6 pagesCooperation Agreement Asic CSSF 4 OctoberCrowdfundInsiderNo ratings yet

- Annual Report and Consolidated Financial Statements For The Year Ended 31 March 2018Document47 pagesAnnual Report and Consolidated Financial Statements For The Year Ended 31 March 2018CrowdfundInsiderNo ratings yet

- Annual Report and Consolidated Financial Statements For The Year Ended 31 March 2018Document47 pagesAnnual Report and Consolidated Financial Statements For The Year Ended 31 March 2018CrowdfundInsiderNo ratings yet

- Token Alliance Whitepaper WEB FINALDocument108 pagesToken Alliance Whitepaper WEB FINALCrowdfundInsiderNo ratings yet

- AlliedCrowds Cryptocurrency in Emerging Markets DirectoryDocument20 pagesAlliedCrowds Cryptocurrency in Emerging Markets DirectoryCrowdfundInsiderNo ratings yet

- Bitcoin Foundation Letter To Congressman Cleaver 5.1.18Document7 pagesBitcoin Foundation Letter To Congressman Cleaver 5.1.18CrowdfundInsiderNo ratings yet

- Crowdcube 2018 Q2 Shareholder Update 2Document11 pagesCrowdcube 2018 Q2 Shareholder Update 2CrowdfundInsiderNo ratings yet

- Robert Novy Deputy Assistant Director Office of Investigations United States Secret Service Prepared Testimony Before the United States House of Representatives Committee on Financial Services Subcommittee on Terrorism and Illicit FinanceDocument7 pagesRobert Novy Deputy Assistant Director Office of Investigations United States Secret Service Prepared Testimony Before the United States House of Representatives Committee on Financial Services Subcommittee on Terrorism and Illicit FinanceCrowdfundInsiderNo ratings yet

- Speech by Dr. Veerathai Santiprabhob Governor of The Bank of Thailand July 2018Document6 pagesSpeech by Dr. Veerathai Santiprabhob Governor of The Bank of Thailand July 2018CrowdfundInsiderNo ratings yet

- Let Entrepreneurs Raise Capital Using Finders and Private Placement Brokers by David R. BurtonDocument6 pagesLet Entrepreneurs Raise Capital Using Finders and Private Placement Brokers by David R. BurtonCrowdfundInsiderNo ratings yet

- Initial Coin Offerings Report PWC Crypto Valley June 2018Document11 pagesInitial Coin Offerings Report PWC Crypto Valley June 2018CrowdfundInsiderNo ratings yet

- HR 5877 The Main Street Growth ActDocument10 pagesHR 5877 The Main Street Growth ActCrowdfundInsiderNo ratings yet

- FINRA Regulatory-Notice-18-20 Regarding Digital AssetsDocument4 pagesFINRA Regulatory-Notice-18-20 Regarding Digital AssetsCrowdfundInsiderNo ratings yet

- Mueller Indictment of 12 Russian HackersDocument29 pagesMueller Indictment of 12 Russian HackersShane Vander HartNo ratings yet

- EBA Report On Prudential Risks and Opportunities Arising For Institutions From FintechDocument56 pagesEBA Report On Prudential Risks and Opportunities Arising For Institutions From FintechCrowdfundInsiderNo ratings yet

- Cryptocurrencies and The Economics of Money - Speech by Hyun Song Shin Economic Adviser and Head of Research BISDocument5 pagesCryptocurrencies and The Economics of Money - Speech by Hyun Song Shin Economic Adviser and Head of Research BISCrowdfundInsiderNo ratings yet

- Virtual Currencies and Central Bans Monetary Policy - Challenges Ahead - European Parliament July 2018Document33 pagesVirtual Currencies and Central Bans Monetary Policy - Challenges Ahead - European Parliament July 2018CrowdfundInsiderNo ratings yet

- Testimony On "Oversight of The U.S. Securities and Exchange Commission" by Jay Clayton Chairman, U.S. Securities and Exchange Commission Before The Committee On Financial Services June 21 2018Document25 pagesTestimony On "Oversight of The U.S. Securities and Exchange Commission" by Jay Clayton Chairman, U.S. Securities and Exchange Commission Before The Committee On Financial Services June 21 2018CrowdfundInsiderNo ratings yet

- Ontario Securities Commissionn Inv Research 20180628 Taking-Caution-ReportDocument28 pagesOntario Securities Commissionn Inv Research 20180628 Taking-Caution-ReportCrowdfundInsiderNo ratings yet

- The OTCQX Advantage - Benefits For International CompaniesDocument20 pagesThe OTCQX Advantage - Benefits For International CompaniesCrowdfundInsiderNo ratings yet

- Funding Circle Oxford Economics Jobs Impact Report 2018Document68 pagesFunding Circle Oxford Economics Jobs Impact Report 2018CrowdfundInsiderNo ratings yet

- Bill - 115 S 2756Document7 pagesBill - 115 S 2756CrowdfundInsiderNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- StatementDocument10 pagesStatementdoninsgusts016No ratings yet

- Financial Accounting Report (Partnership - Group 2)Document20 pagesFinancial Accounting Report (Partnership - Group 2)syednaim0300No ratings yet

- Retail Management: A Strategic Approach: 11th EditionDocument9 pagesRetail Management: A Strategic Approach: 11th EditionMohamed El KadyNo ratings yet

- HBR White Paper - Future-Proofing B2B SalesDocument11 pagesHBR White Paper - Future-Proofing B2B SalesMahesh PatilNo ratings yet

- A Study of Artificial Intelligence and Its Role in Human Resource ManagementDocument6 pagesA Study of Artificial Intelligence and Its Role in Human Resource Management19266439No ratings yet

- T7 TCS 【愛知】Bilingual Design Engineer PDFDocument3 pagesT7 TCS 【愛知】Bilingual Design Engineer PDFchutiyaNo ratings yet

- Module 8-MRP and ErpDocument25 pagesModule 8-MRP and ErpDeryl GalveNo ratings yet

- UCSP EssayDocument1 pageUCSP EssayLovely SalvatierraNo ratings yet

- Technical Delivery Manager IT EDM 040813Document2 pagesTechnical Delivery Manager IT EDM 040813Jagadish GaglaniNo ratings yet

- Timex - Marketing MixDocument11 pagesTimex - Marketing MixHimanMohapatra100% (1)

- Hippo Case StudyDocument3 pagesHippo Case StudyAditya Pawar 100100% (1)

- Business DiversificationDocument20 pagesBusiness DiversificationRajat MishraNo ratings yet

- Bank Panin Dubai Syariah GCG Report 2018Document117 pagesBank Panin Dubai Syariah GCG Report 2018kwon jielNo ratings yet

- MB4 - Compliance Requirements 010615Document12 pagesMB4 - Compliance Requirements 010615ninja980117No ratings yet

- 2023.02.09 CirclesX PetitionDocument161 pages2023.02.09 CirclesX Petitionjamesosborne77-1100% (2)

- Binod RajwarDocument3 pagesBinod RajwarSHYAMA AUTOMOBILESNo ratings yet

- Business Data Modelling - Why and HowDocument18 pagesBusiness Data Modelling - Why and HowYoussef El MeknessiNo ratings yet

- Finance, Marketing & HR courses in MBA 2nd yearDocument28 pagesFinance, Marketing & HR courses in MBA 2nd yearGaneshRathodNo ratings yet

- Nbaa BylawsDocument49 pagesNbaa BylawsAmaniNo ratings yet

- Introduction To Fintech: Igor PesinDocument56 pagesIntroduction To Fintech: Igor PesinLittle NerdNo ratings yet

- Ford Case StudyDocument2 pagesFord Case StudyasrikalyanNo ratings yet

- SAP Agricultural Contract ManagementDocument14 pagesSAP Agricultural Contract ManagementPaulo FranciscoNo ratings yet

- Inventory Valuation: First in First Out (FIFO) Last in First Out (LIFO) Average Cost Method (AVCO)Document9 pagesInventory Valuation: First in First Out (FIFO) Last in First Out (LIFO) Average Cost Method (AVCO)Abhilash JhaNo ratings yet

- Rain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Document7 pagesRain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Alejandra JamboNo ratings yet

- Problem Solving: A: What Is The Capital Balance of Bea On December 31, 2022?Document6 pagesProblem Solving: A: What Is The Capital Balance of Bea On December 31, 2022?Actg SolmanNo ratings yet

- Contract LetterDocument5 pagesContract LetterprashantNo ratings yet

- IPCC SM Notes by CA Swapnil Patni Sir May 2019 PDFDocument77 pagesIPCC SM Notes by CA Swapnil Patni Sir May 2019 PDFBlSt SamarNo ratings yet

- LeanIX WhitePaper Integrate ITFM and EA With LeanIX and Apptio ENDocument13 pagesLeanIX WhitePaper Integrate ITFM and EA With LeanIX and Apptio ENSocialMedia NewLifeNo ratings yet

- Sample Questions For 2019-2020 Following Sample Questions Are Provided For The Benefits of Students. They Are Indicative OnlyDocument33 pagesSample Questions For 2019-2020 Following Sample Questions Are Provided For The Benefits of Students. They Are Indicative OnlyPrathamesh ChawanNo ratings yet

- Account Analysis Statement GuideDocument6 pagesAccount Analysis Statement GuideCr CryptoNo ratings yet