Professional Documents

Culture Documents

10 Park ISM ch10 PDF

Uploaded by

Benn DoucetOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 Park ISM ch10 PDF

Uploaded by

Benn DoucetCopyright:

Available Formats

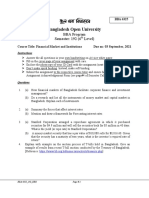

10-1

Chapter 10 Developing Project Cash Flows

Generating Net Cash Flows

10.1

dB= 4% t= 35%

dE= id=

dO= MARR= 15%

tCG= 17.5% N= 5

Year 0 1 2 3 4 5

Income Statement

Revenues 2,965,524 2,965,524 2,965,524 2,965,524 2,965,524

Expenses

Materials

Labour

Overhead

O&M 330,000 380,000 430,000 480,000 530,000

Debt interest - - - - -

CCA

Building @dB 250,000 490,000 470,400 451,584 433,521

Machines @dE - - - - -

Others @dO - - - - -

Taxable income 2,385,524 2,095,524 2,065,124 2,033,940 2,002,003

Income taxes @t 834,933 733,433 722,793 711,879 700,701

Net income 1,550,590 1,362,090 1,342,330 1,322,061 1,301,302

Cash Flow Statement

Operating activities

Net income 1,550,590 1,362,090 1,342,330 1,322,061 1,301,302

CCA 250,000 490,000 470,400 451,584 433,521

Investment activities

Land

Building (12,500,000) 14,000,000

Machines

Others

Disposal tax effect

Land -

Building (995,927)

Machines -

Others -

Financing activities

Principal portion - - - - -

Net cash flow (12,500,000) 1,800,590 1,852,090 1,812,730 1,773,645 14,738,896

PE(MARR) = -

AE(MARR) = -

IRR= 15.00%

The rent per apartment is $2,965,524/50 = $59,310.48/year.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-2

*

10.2

dB= t= 35%

dE= 30% id=

dO= MARR=

tCG= N= 7

Year 0 1 2 3 4 5 6 7

Income Statement

Revenues 120,000 120,000 120,000 120,000 120,000 120,000 120,000

Expenses

Materials

Labour

Overhead

O&M

Debt interest - - - - - - -

CCA

Building @dB - - - - - - -

Machines @dE 27,750 47,175 33,023 23,116 16,181 11,327 7,929

Others @dO - - - - - - -

Taxable income 92,250 72,825 86,978 96,884 103,819 108,673 112,071

Income taxes @t 32,288 25,489 30,442 33,909 36,337 38,036 39,225

Net income 59,963 47,336 56,535 62,975 67,482 70,638 72,846

Cash Flow Statement

Operating activities

Net income 59,963 47,336 56,535 62,975 67,482 70,638 72,846

CCA 27,750 47,175 33,023 23,116 16,181 11,327 7,929

Investment activities

Land

Building

Machines (185,000) 40,000

Others

Disposal tax effect

Land -

Building -

Machines (7,525)

Others -

Financing activities

Principal portion - - - - - - -

Net cash flow (185,000) 87,713 94,511 89,558 86,091 83,663 81,964 113,250

PE(MARR) = $ 451,750

AE(MARR) = $ 64,536

IRR= 44.87%

*

An asterisk next to a problem number indicates that the solution is available to students

on the Companion Website.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-3

10.3

dB= t= 40%

dE= 30% id=

dO= MARR= 15%

tCG= N= 6

Year 0 1 2 3 4 5 6

Income Statement

Revenues 25,000 25,000 25,000 25,000 25,000 25,000

Expenses

Materials

Labour

Overhead

O&M 7,000 7,000 7,000 7,000 7,000 7,000

Debt interest - - - - - -

CCA

Building @dB - - - - - -

Machines @dE 8,250 14,025 9,818 6,872 4,811 3,367

Others @dO - - - - - -

Taxable income 9,750 3,975 8,183 11,128 13,189 14,633

Income taxes @t 3,900 1,590 3,273 4,451 5,276 5,853

Net income 5,850 2,385 4,910 6,677 7,914 8,780

Cash Flow Statement

Operating activities

Net income 5,850 2,385 4,910 6,677 7,914 8,780

CCA 8,250 14,025 9,818 6,872 4,811 3,367

Investment activities

Land

Building

Machines (55,000) -

Others

Disposal tax effect

Land -

Building -

Machines 3,143

Others -

Financing activities

Principal portion - - - - - -

Net cash flow (55,000) 14,100 16,410 14,727 13,549 12,724 15,290

PE(MARR) = $ 35 Yes, buy the machine.

AE(MARR) = $ 9

IRR= 15.02%

The machine should be bought because its PE(MARR) is greater than 0.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-4

*

10.4

dB= 4% t= 40%

dE= 30% id=

dO= MARR=

tCG= 20% N= 5

Year 0 1 2 3 4 5

Income Statement

Revenues 2,200,000 2,200,000 2,200,000 2,200,000 2,200,000

Expenses

Materials

Labour

Overhead

O&M 1,280,000 1,280,000 1,280,000 1,280,000 1,280,000

Debt interest - - - - -

CCA

Building @dB 10,000 19,600 18,816 18,063 17,341

Machines @dE 75,000 127,500 89,250 62,475 43,733

Others @dO - - - - -

Taxable income 835,000 772,900 811,934 839,462 858,927

Income taxes @t 334,000 309,160 324,774 335,785 343,571

Net income 501,000 463,740 487,160 503,677 515,356

Cash Flow Statement

Operating activities

Net income 501,000 463,740 487,160 503,677 515,356

CCA 85,000 147,100 108,066 80,538 61,073

Investment activities

Land (100,000) 115,000

Building (500,000) 575,000

Machines (500,000) 50,000

Others

Disposal tax effect

Land (3,000)

Building (48,528)

Machines 20,817

Others -

Financing activities

Principal portion - - - - -

Net cash flow (1,100,000) 586,000 610,840 595,226 584,215 1,285,718

PE(MARR) = $2,562,000

AE(MARR) = $ 512,400

IRR= 51.28%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-5

10.5

Year: 1 2 3 4 5

Total distance/year (m): 2000 2000 2000 2000 2000

Production rate (m/hr) 5 5 5 4.5 4

Required hours/year: 400 400 400 444 500

Operating cost/year: 6000 6000 6000 6667 7500

dB= t= 34%

dE= 30% id=

dO= MARR=

tCG= N= 5

Year 0 1 2 3 4 5

Income Statement

Revenues - - - -

Expenses

Materials/Labour

Overhead

O&M 6,000 6,000 6,000 6,667 7500

Debt interest - - - - -

CCA

Building @dB - - - - -

Machines @dE 27,000 45900 32,130 22,491 55,744

Others @dO - - - - -

Taxable income (33,000) (51,900) (38,130) (29,158) (23,244)

Income taxes @t (11,220) (17,646) (12,964) (9,914) (7,903)

Net income (21,780) (34,254) (25,166) (19,244) (15,341)

Cash Flow Statement

Operating activities

Net income (21,780) (34,254) (25,166) (19,244) (15,341)

CCA 27,000 45,900 32,130 22,491 15,744

Investment activities

Land

Building

Machines (180,000) 40,000

Others

Disposal tax effect

Land -

Building -

Machines (1,110)

Others -

Financing activities

Principal portion - - - - -

Net cash flow (180,000) 5,220 11,646 6,964 3,247 39,293

PE(MARR) = $ (113,630)

AE(MARR) = $ (22,726)

IRR= -21.47%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-6

*

10.6

dB= t= 35%

dE= 45% id=

dO= MARR= 13%

tCG= N= 5

Year 0 1 2 3 4 5

Income Statement

Revenues 52,000 52,000 52,000 52,000 52,000

Expenses

Materials

Labour

Overhead

O&M 32,000 12,000 12,000 12,000 12,000

Debt interest - - - - -

CCA

Building @dB - - - - -

Machines @dE 23,400 36,270 19,949 10,972 6,034

Others @dO - - - - -

Taxable income (3,400) 3,730 20,052 29,028 33,966

Income taxes @t (1,190) 1,306 7,018 10,160 11,888

Net income (2,210) 2,425 13,033 18,868 22,078

Cash Flow Statement

Operating activities

Net income (2,210) 2,425 13,033 18,868 22,078

CCA 23,400 36,270 19,949 10,972 6,034

Investment activities

Land

Building

Machines (104,000) -

Others

Disposal tax effect

Land -

Building -

Machines 2,581

Others -

Financing activities

Principal portion - - - - -

Net cash flow (104,000) 21,190 38,695 32,982 29,840 30,693

PE(MARR) = $ 2,874

AE(MARR) = $ 817

IRR= 14.09%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-7

10.7

dB= t= 40%

dE= 45% id=

dO= MARR= 12%

tCG= N= 5

Year 0 1 2 3 4 5

Income Statement

Revenues 20,160 20,160 20,160 20,160 20,160

Expenses

Materials

Labour

Overhead

O&M 10,000 10,000 10,000 10,000 10,000

Debt interest - - - - -

CCA

Building @dB - - - - -

Machines @dE 4,163 6,452 3,549 1,952 1,073

Others @dO - - - - -

Taxable income 5,998 3,708 6,611 8,208 9,087

Income taxes @t 2,399 1,483 2,645 3,283 3,635

Net income 3,599 2,225 3,967 4,925 5,452

Cash Flow Statement

Operating activities

Net income 3,599 2,225 3,967 4,925 5,452

CCA 4,163 6,452 3,549 1,952 1,073

Investment activities

Land

Building

Machines (18,500) 1,850

Others

Disposal tax effect

Land -

Building -

Machines (215)

Others -

Financing activities

Principal portion - - - - -

Net cash flow (18,500) 7,761 8,677 7,515 6,877 8,160

PE(MARR) = $ 9,696

AE(MARR) = $ 2,690

IRR= 31.79%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-8

10.8

dB= t= 40%

dE= 20% id=

dO= MARR= 12%

tCG= N= 6

Year 0 1 2 3 4 5 6

Income Statement

Revenues 300,000 300,000 300,000 300,000 300,000 300,000

Expenses

Materials 50,000 50,000 50,000 50,000 50,000 50,000

Labour 80,000 80,000 80,000 80,000 80,000 80,000

Overhead

O&M - - - - -

Debt interest - - - - - -

CCA

Building @dB - - - - - -

Machines @dE 12,000 21,600 17,280 13,824 11,059 8,847

Others @dO - - - - - -

Taxable income 158,000 148,400 152,720 156,176 158,941 161,153

Income taxes @t 63,200 59,360 61,088 62,470 63,576 64,461

Net income 94,800 89,040 91,632 93,706 95,364 96,692

Cash Flow Statement

Operating activities

Net income 94,800 89,040 91,632 93,706 95,364 96,692

CCA 12,000 21,600 17,280 13,824 11,059 8,847

Investment activities

Land

Building

Machines (120,000) -

Others

Disposal tax effect

Land -

Building -

Machines 14,156

Others -

Financing activities

Principal portion - - - - - -

Net cash flow (120,000) 106,800 110,640 108,912 107,530 106,424 119,695

PE(MARR) = $ 330,446

AE(MARR) = $ 80,373

IRR= 88.28%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-9

10.9

dB= t= 40%

dE= 30% id=

dO= MARR=

tCG= N= 5

Year 0 1 2 3 4 5

Income Statement

Revenues 250,000 250,000 250,000 250,000 250,000

Expenses

Materials - - - -

Labour - - - -

Overhead

O&M 50,000 50,000 50,000 50,000 50,000

Debt interest - - - - -

CCA

Building @dB - - - - -

Machines @dE 45,000 76,500 53,550 37,485 26,240

Others @dO - - - - -

Taxable income 155,000 123,500 146,450 162,515 173,761

Income taxes @t 62,000 49,400 58,580 65,006 69,504

Net income 93,000 74,100 87,870 97,509 104,256

Cash Flow Statement

Operating activities

Net income 93,000 74,100 87,870 97,509 104,256

CCA 45,000 76,500 53,550 37,485 26,240

Investment activities

Land

Building

Machines (300,000) 5,000

Others

Disposal tax effect

Land -

Building -

Machines 22,490

Others -

Financing activities

Principal portion - - - - -

Net cash flow (300,000) 138,000 150,600 141,420 134,994 157,986

PE(MARR) = $ 423,000

AE(MARR) = $ 84,600

IRR= 38.32%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-10

10.10

dB= t= 35%

dE= 35% id=

dO= MARR= 10%

tCG= N= 9

Year 0 1 2 3 4 5 6 7 8 9

Income Statement

Revenues 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000 10,000

Expenses

Materials - - - - - - - -

Labour - - - - - - - -

Overhead

O&M - - - - - - - -

Debt interest - - - - - - - - -

CCA

Building @dB - - - - - - - - -

Machines @dE 8,750 14,438 9,384 6,100 3,965 2,577 1,675 1,089 708

Others @dO - - - - - - - - -

Taxable income 1,250 (4,438) 616 3,900 6,035 7,423 8,325 8,911 9,292

Income taxes @t 438 (1,553) 215 1,365 2,112 2,598 2,914 3,119 3,252

Net income 813 (2,884) 400 2,535 3,923 4,825 5,411 5,792 6,040

Cash Flow Statement

Operating activities

Net income 813 (2,884) 400 2,535 3,923 4,825 5,411 5,792 6,040

CCA 8,750 14,438 9,384 6,100 3,965 2,577 1,675 1,089 708

Investment

activities

Land

Building

Machines (50,000) -

Others

Disposal tax effect

Land -

Building -

Machines 460

Others -

Financing activities

Principal portion - - - - - - - - -

Net cash flow (50,000) 9,563 11,553 9,785 8,635 7,888 7,402 7,086 6,881 7,208

PE(MARR) = $ 469

AE(MARR) = $ 82

IRR= 10.26%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-11

*

10.11

dB= t= 40%

dE= 30% id=

dO= MARR= 15%

tCG= N= 5

Year 0 1 32 4 5

Income Statement

Revenues 130,000 130,000 130,000 130,000 130,000

Expenses

Materials - - - -

Labour - - - -

Overhead

O&M 20,000 20,000 20,000 20,000 20,000

Debt interest - - - - -

CCA

Building @dB - - - - -

Machines @dE 45,017 76,529 53,570 37,499 26,249

Others @dO - - - - -

Taxable income 64,983 33,471 56,430 72,501 83,751

Income taxes @t 25,993 13,388 22,572 29,000 33,500

Net income 38,990 20,083 33,858 43,501 50,250

Cash Flow Statement

Operating activities

Net income 38,990 20,083 33,858 43,501 50,250

CCA 45,017 76,529 53,570 37,499 26,249

Investment activities

Land

Building

Machines (300,113) -

Others

Disposal tax effect

Land -

Building -

Machines 24,499

Others -

Financing activities

Principal portion - - - - -

Net cash flow (300,113) 84,007 96,612 87,428 81,000 100,999

PE(MARR) = $ -

AE(MARR) = $ -

IRR= 15.00%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-12

Investment in Working Capital

*

10.12

dB= 4% t= 40%

dE= 30% id=

dO= 0% MARR= 15%

tCG= 20% N= 10

Year 0 1 2 3 4 5 6 7 8 9 10

Income Statement

Revenues 875,000 875,000 875,000 875,000 875,000 875,000 875,000 875,000 875,000 875,000

Expenses

Materials - - - - - - - - -

Labour - - - - - - - - -

Overhead

O&M 425,000 425,000 425,000 425,000 425,000 425,000 425,000 425,000 425,000 425,000

Debt interest - - - - - - - - - -

CCA

Building @dB 30,000 58,800 56,448 54,190 52,022 49,942 47,944 46,026 44,185 42,418

Machines @dE 75,000 127,500 89,250 62,475 43,733 30,613 21,429 15,000 10,500 7,350

Others @dO - - - - - - - - - -

Taxable income 345,000 263,700 304,302 333,335 354,245 369,446 380,627 388,974 395,315 400,232

Income taxes @t 138,000 105,480 121,721 133,334 141,698 147,778 152,251 155,589 158,126 160,093

Net income 207,000 158,220 182,581 200,001 212,547 221,667 228,376 233,384 237,189 240,139

Cash Flow Statement

Operating activities

Net income 207,000 158,220 182,581 200,001 212,547 221,667 228,376 233,384 237,189 240,139

CCA 105,000 186,300 145,698 116,665 95,755 80,554 69,373 61,026 54,685 49,768

Investment activities

Land (250,000) 500,000

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-13

Building (1,500,000) 700,000

Machines (500,000) 50,000

Others (150,000) 150,000

Disposal tax effect

Land (50,000)

Building 127,210

Machines (13,140)

Others -

Financing activities

Principal portion - - - - - - - - - -

Net cash flow (2,400,000) 312,000 344,520 328,279 316,666 308,302 302,222 297,749 294,411 291,874 1,753,977

PE(MARR) = $ (462,642)

AE(MARR) = $ (92,182)

IRR= 10.65%

With working capital: PE(15%) = - $462,642, Not justified

Without working capital: PE(15%) = - $349,720, Still not justified

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-14

10.13

dB= t= 35%

dE= 30% id=

dO= 0% MARR= 18%

tCG= N= 6

Year 0 1 2 3 4 5 6

Income Statement

Revenues 55,800 55,800 55,800 55,800 55,800 55,800

Expenses

Materials - - - - -

Labour - - - - -

Overhead

O&M 8,120 8,120 8,120 8,120 8,120 8,120

Debt interest - - - - - -

CCA

Building @dB - - - - - -

Machines @dE 9,825 16,703 11,692 8,184 5,729 4,010

Others @dO - - - - - -

Taxable income 37,855 30,978 35,988 39,496 41,951 43,670

Income taxes @t 13,249 10,842 12,596 13,824 14,683 15,284

Net income 24,606 20,135 23,392 25,672 27,268 28,385

Cash Flow Statement

Operating activities

Net income 24,606 20,135 23,392 25,672 27,268 28,385

CCA 9,825 16,703 11,692 8,184 5,729 4,010

Investment activities

Land

Building

Machines (65,500) 3,000

Others (10,000) 10,000

Disposal tax effect

Land -

Building -

Machines 2,225

Others -

Financing activities

Principal portion - - - - - -

Net cash flow (75,500) 34,431 36,838 35,084 33,856 32,997 47,621

PE(MARR) = $ 51,015

AE(MARR) = $ 14,586

IRR= 41.36%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-15

10.14 All in '000 dollars

dB= 4% t= 40%

dE= 30% id=

dO= 0% MARR= 20%

tCG= N= 10

1 2 3

Year -2 -1 0 1 2 3 4 5 6 7 8 9 10

Income Statement

Revenues 45,000 49,500 54,450 59,895 65,885 72,473 65,226 58,703 52,833 47,550

Expenses

Materials - - - - - - - - -

Labour - - - - - - - - -

Overhead

O&M 500 2,500 2,000 36,000 39,600 43,560 47,916 52,708 57,978 52,181 46,962 42,266 38,040

Debt interest - - - - - - - - - -

CCA

Building @dB 40 78 75 72 69 67 64 61 59 57

Machines @dE 450 765 536 375 262 184 129 90 63 44

Others @dO - - - - - - - - - -

Taxable income (500) (2,500) (2,000) 8,510 9,057 10,279 11,532 12,845 14,244 12,853 11,589 10,445 9,409

Income taxes @t (200) (1,000) (800) 3,404 3,623 4,112 4,613 5,138 5,698 5,141 4,636 4,178 3,764

Net income (300) (1,500) (1,200) 5,106 5,434 6,168 6,919 7,707 8,547 7,712 6,954 6,267 5,646

Cash Flow Statement

Operating activities

Net income (300) (1,500) (1,200) 5,106 5,434 6,168 6,919 7,707 8,547 7,712 6,954 6,267 5,646

CCA - - - 490 843 611 447 332 250 192 151 122 101

Investment activities

Land

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-16

Building (2,000) 1,000

Machines (3,000) 300

Others (4,500) (450) (495) (545) (599) (659) 725 652 587 528 4,755

Disposal tax effect

Land -

Building 143

Machines (79)

Others

Financing activities

Principal portion - - - - - - - - - -

Net cash flow (300) (1,500) (10,700) 5,146 5,782 6,234 6,767 7,380 9,522 8,556 7,692 6,917 11,865

PE(MARR) = $ 9,162 at the beginning of the first R&D year

AE(MARR) = $ 2,021 each year over 13 years

IRR= 45.31% considering all net cash flows during the 13 years

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-17

Effects of Borrowing

10.15

dB= 4% t= 35%

dE= id= 10%

dO= MARR= 15%

tCG= 17.5% N= 5

Year 0 1 2 3 4 5

Income Statement

Revenues 1,896,945 1,896,945 1,896,945 1,896,945 1,896,945

Expenses

Materials

Labour

Overhead

O&M 330,000 380,000 430,000 480,000 530,000

Debt interest 1,250,000 1,045,253 820,032 572,288 299,770

CCA

Building @dB 250,000 490,000 470,400 451,584 433,521

Machines @dE - - - - -

Others @dO - - - - -

Taxable income 66,945 (18,308) 176,513 393,073 633,654

Income taxes @t 23,431 (6,408) 61,780 137,576 221,779

Net income 43,514 (11,900) 114,734 255,497 411,875

Cash Flow Statement

Operating activities

Net income 43,514 (11,900) 114,734 255,497 411,875

CCA 250,000 490,000 470,400 451,584 433,521

Investment activities

Land

Building (12,500,00) 14,000,000

Machines

Others

Disposal tax effect

Land -

Building (995,927)

Machines -

Others -

Financing activities

Principal portion 12,500,000 (2,047,469) (2,252,215) (2,477,437) (2,725,181) (2,997,699)

Net cash flow - (1,753,954) (1,774,116) (1,892,303) (2,018,099) 10,851,771

PE(MARR) = $130,509

AE(MARR) = $38,933

IRR= 16.08%

Annual rent per apartment needed = $ 37,939

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-18

*

10.16

dB= t= 35%

dE= 30% id= 10%

dO= MARR=

tCG= N= 7

Year 0 1 2 3 4 5 6 7

Income Statement

Revenues 120,000 120,000 120,000 120,000 120,000 120,000 120,000

Expenses

Materials

Labour

Overhead

O&M

Debt interest 18,500 14,800 11,100 7,400 3,700

CCA

Building @dB - - - - - - -

Machines @dE 27,750 47,175 33,023 23,116 16,181 11,327 7,929

Others @dO - - - - - - -

Taxable income 73,750 58,025 75,878 89,484 100,119 108,673 112,071

Income taxes @t 25,813 20,309 26,557 31,319 35,042 38,036 39,225

Net income 47,938 37,716 49,320 58,165 65,077 70,638 72,846

Cash Flow Statement

Operating activities

Net income 47,938 37,716 49,320 58,165 65,077 70,638 72,846

CCA 27,750 47,175 33,023 23,116 16,181 11,327 7,929

Investment activities

Land

Building

Machines (185,000) 40,000

Others

Disposal tax effect

Land -

Building -

Machines (7,525)

Others -

Financing activities

Principal portion 185,000 (37,000) (37,000) (37,000) (37,000) (37,000)

Net cash flow - 38,688 47,891 45,343 44,281 44,258 81,964 113,250

PE(MARR) = $ 415,675

AE(MARR) = $ 59,382

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-19

10.17

dB= t= 40%

dE= 30% id= 11%

dO= MARR=

tCG= N= 5

Year 0 1 2 3 4 5

Income Statement

Revenues 250,000 250,000 250,000 250,000 250,000

Expenses

Materials - - - -

Labour - - - -

Overhead

O&M 50,000 50,000 50,000 50,000 50,000

Debt interest 16,500 13,851 10,910 7,645 4,022

CCA

Building @dB - - - - -

Machines @dE 45,000 76,500 53,550 37,485 26,240

Others @dO - - - - -

Taxable income 138,500 109,649 135,540 154,870 169,739

Income taxes @t 55,400 43,860 54,216 61,948 67,895

Net income 83,100 65,790 81,324 92,922 101,843

Cash Flow Statement

Operating activities

Net income 83,100 65,790 81,324 92,922 101,843

CCA 45,000 76,500 53,550 37,485 26,240

Investment activities

Land

Building

Machines (300,000) 5,000

Others

Disposal tax effect

Land -

Building -

Machines 22,490

Others -

Financing activities

Principal portion 150,000 (24,086) (26,735) (29,676) (32,940) (36,564)

Net cash flow (150,000) 104,014 115,555 105,198 97,467 119,009

PE(MARR) = $ 391,243 Annual Loan Payment = $ 40,586

AE(MARR) = $ 78,249

IRR= 65.93%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-20

10.18

dB= t= 40%

dE= 100% id= 10%

dO= MARR= 15%

tCG= N= 2

Year 0 1 2

Income Statement

Revenues 30,000 30,000

Expenses

Materials

Labour

Overhead

O&M 5,000 5,000

Debt interest 1,000 524

CCA

Building @dB - -

Machines @dE 10,000 10,000

Others @dO - -

Taxable income 14,000 14,476

Income taxes @t 5,600 5,790

Net income 8,400 8,686

Cash Flow Statement

Operating activities

Net income 8,400 8,686

CCA 10,000 10,000

Investment activities

Land

Building

Machines (20,000) 8,000

Others

Disposal tax effect

Land -

Building -

Machines (3,200)

Others -

Financing activities

Principal portion 10,000 (4,762) (5,238)

Net cash flow (10,000) 13,638 18,248

PE(MARR) = $15,657 Annual loan payment = $5,762

AE(MARR) = $9,631

IRR= 119.51%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-21

10.19

dB= t= 40%

dE= 30% id= 9%

dO= MARR= 18%

tCG= N= 10

Year 0 1 2 3 4 5 6 7 8 9 10

Income Statement

Revenues 135,000 135,000 135,000 135,000 135,000 135,000 135,000 135,000 135,000 135,000

Expenses

Materials

Labour

Overhead

O&M

Debt interest 13,500 9,000 4,500

CCA

Building @dB - - - - - - - - - -

Machines @dE 30,000 51,000 35,700 24,990 17,493 12,245 8,572 6,000 4,200 2,940

Others @dO - - - - - - - - - -

Taxable income 91,500 75,000 94,800 110,010 117,507 122,755 126,428 129,000 130,800 132,060

Income taxes @t 36,600 30,000 37,920 44,004 47,003 49,102 50,571 51,600 52,320 52,824

Net income 54,900 45,000 56,880 66,006 70,504 73,653 75,857 77,400 78,480 79,236

Cash Flow Statement

Operating activities

Net income 54,900 45,000 56,880 66,006 70,504 73,653 75,857 77,400 78,480 79,236

CCA 30,000 51,000 35,700 24,990 17,493 12,245 8,572 6,000 4,200 2,940

Investment activities

Land

Building

Machines (200,000) 20,000

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-22

Others

Disposal tax effect

Land -

Building -

Machines (5,256)

Others -

Financing activities

Principal portion 150,000 (50,000) (50,000) (50,000)

Net cash flow (50,000) 34,900 46,000 42,580 90,996 87,997 85,898 84,429 83,400 82,680 96,920

PE(MARR) = $241,597

AE(MARR) = $53,759

IRR= 92.24% Yes, justified

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-23

10.20

dB= t= 35%

dE= 30% id= 10%

dO= MARR= 18%

tCG= N= 5

Year 0 1 2 3 4 5

Income Statement

Revenues - - - -

Expenses

Materials

Labour

Overhead

O&M

Debt interest 84,000 70,241 55,106 38,458 20,145

CCA

Building @dB - - - - -

Machines @dE 315,000 535,500 374,850 262,395 183,677

Others @dO - - - - -

Taxable income (399,000) (605,741) (429,956) (300,853) (203,821)

Income taxes @t (139,650) (212,009) (150,485) (105,298) (71,337)

Net income (259,350) (393,732) (279,471) (195,554) (132,484)

Cash Flow Statement

Operating activities

Net income (259,350) (393,732) (279,471) (195,554) (132,484)

CCA 315,000 535,500 374,850 262,395 183,677

Investment activities

Land

Building

Machines (2,100,000) 210,000

Others

Disposal tax effect

Land -

Building -

Machines 76,502

Others -

Financing activities

Principal portion 840,000 (137,590) (151,349) (166,484) (183,132) (201,445)

Net cash flow (1,260,000) (81,940) (9,581) (71,105) (116,291) 136,250

PE(MARR) = $(1,380,024) Annual loan payment = $ 221,590

AE(MARR) = $(441,301)

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-24

10.21

dB= t= 36%

dE= 30% id= 12%

dO= MARR= 15%

tCG= N= 6

Year 0 1 2 3 4 5 6

Income Statement

Revenues 10,000 10,000 10,000 10,000 10,000 10,000

Expenses

Materials

Labour

Overhead

O&M

Debt interest 4,800 4,209 3,546 2,804 1,973 1,042

CCA

Building @dB - - - - - -

Machines @dE 6,000 10,200 7,140 4,998 3,499 2,449

Others @dO - - - - - -

Taxable income (800) (4,409) (686) 2,198 4,528 6,509

Income taxes @t (288) (1,587) (247) 791 1,630 2,343

Net income (512) (2,821) (439) 1,407 2,898 4,165

Cash Flow Statement

Operating activities

Net income (512) (2,821) (439) 1,407 2,898 4,165

CCA 6,000 10,200 7,140 4,998 3,499 2,449

Investment activities

Land

Building

Machines (40,000) 3,000

Others

Disposal tax effect

Land -

Building -

Machines 977

Others -

Financing activities

Principal portion 40,000 (4,929) (5,521) (6,183) (6,925) (7,756) (8,687)

Net cash flow - 559 1,858 518 (520) (1,359) 1,905

PE(MARR) = $2,082 Annual loan payment = $ 9,729

AE(MARR) = $550

IRR= Undefined IRR does not exist. Cannot use the IRR method.

Acceptable based on the PE criterion.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-25

Generalized Cash Flow Method

*

10.22

dB= t= 40%

dE= 30% id= 10%

dO= MARR= 14%

tCG= N= 8

Year 0 1 2 3 4 5 6 7 8

Income Statement

Revenues 40,000 40,000 40,000 40,000 40,000 40,000 40,000 40,000

Expenses

Materials

Labour

Overhead

O&M 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000

Debt interest 4,000 3,650 3,265 2,842 2,377 1,865 1,301 682

CCA

Building @dB - - - - - - - -

Machines @dE 16,500 28,050 19,635 13,745 9,621 6,735 4,714 3,300

Others @dO - - - - - - - -

Taxable income 14,500 3,300 12,100 18,413 23,002 26,401 28,984 31,018

Income taxes @t 5,800 1,320 4,840 7,365 9,201 10,560 11,594 12,407

Net income 8,700 1,980 7,260 11,048 13,801 15,840 17,391 18,611

Cash Flow Statement

Operating activities

Net income 8,700 1,980 7,260 11,048 13,801 15,840 17,391 18,611

CCA 16,500 28,050 19,635 13,745 9,621 6,735 4,714 3,300

Investment activities

Land

Building

Machines (110,000) 10,000

Others

Disposal tax effect

Land -

Building -

Machines (920)

Others -

Financing activities

Principal portion 40,000 (3,498) (3,848) (4,232) (4,656) (5,121) (5,633) (6,196) (6,816)

Net cash flow (70,000) 21,702 26,182 22,662 20,137 18,301 16,942 15,908 24,175

PE(MARR) = $28,459 Annual loan payment = $7,498

AE(MARR) = $6,135

IRR= 26.00%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-26

10.23 (a) Without debt financing

dB= t= 35% Lease cost

dE= 15% id= Beginning?

dO= MARR= 9% 0

tCG= N= 5

Year 0 1 2 3 4 5

Input Data:

Revenues 1,500 1,500 1,500 1,500 1,500

Expenses

Materials

Labour

Overhead

O&M - - - -

Investments

Land

Building

Machines 6,000 2,000

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - - - -

Debt interest - - - - - -

CCA

Building @dB - - - - - -

Machines @dE 450 833 708 601 511

Others @dO - - - - - -

Disposal tax effect

Land -

Building -

Machines 314

Others -

Cash Flow Elements:

Revenue (1-t): 975 975 975 975 975

- Costs (1-t): - - - - -

+ Beginning adjust? - - - - - -

- Interest (1-t): - - - - -

+ t CCA: 158 291 248 211 179

Investments (6,000) 2,314

Debts: - - - - - -

Net Cash Flow: (6,000) 1,133 1,266 1,223 1,186 3,468

PE(MARR) = $143

AE(MARR) = $37

IRR= 9.77%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-27

10.23 (b) With debt financing

dB= t= 35% Lease cost

dE= 15% id= 9% Beginning?

dO= MARR= 9% 0

tCG= N= 5

Year 0 1 2 3 4 5

Input Data:

Revenues 1,500 1,500 1,500 1,500 1,500

Expenses

Materials

Labour

Overhead

O&M - - - -

Investments

Land

Building

Machines 6,000 2,000

Others

Borrowed Money: 6,000

Calculated Entries:

Debt principal: 1,003 1,093 1,191 1,298 1,415

Debt interest 540 450 351 244 127

CCA

Building @dB - - - - -

Machines @dE 450 833 708 601 511

Others @dO - - - - -

Disposal tax effect

Land -

Building -

Machines 314

Others -

Cash Flow Elements:

Revenue (1-t): 975 975 975 975 975

- Costs (1-t): - - - - -

+ Beginning adjust? - - - - - -

- Interest (1-t): (351) (292) (228) (159) (83)

+ t CCA: 158 291 248 211 179

Investments (6,000) 2,314

Debts: 6,000 (1,003) (1,093) (1,191) (1,298) (1,415)

Net Cash Flow: - (221) (119) (197) (272) 1,970

PE(MARR) = $633 Annual loan payment = $1,543

AE(MARR) = $163

IRR= 40.72%

(c) The option with debt financing is better. Its PE value is $633, larger than the one

without debt financing (PE of $143).

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-28

*

10.24

dB= t= 40% Lease cost

dE= 30% id= 10% Beginning?

dO= MARR 12% 0

tCG= = 5

N=

Year 0 1 2 3 4 5

Input Data:

Revenues 60,000 60,000 60,000 60,000 60,000

Expenses

Materials

Labour

Overhead

O&M - - - -

Investments

Land

Building

Machines 150,000 50,000

Others

Borrowed Money: 150,000

Calculated Entries:

Debt principal: 24,570 27,027 29,729 32,702 35,972

Debt interest 15,000 12,543 9,840 6,867 3,597

CCA

Building @dB - - - - -

Machines @dE 22,500 38,250 26,775 18,743 13,120

Others @dO - - - - -

Disposal tax effect

Land -

Building -

Machines (7,755)

Others -

Cash Flow Elements:

Revenue (1-t): 36,000 36,000 36,000 36,000 36,000

- Costs (1-t): - - - - -

+ Beginning adjust? - - - - - -

- Interest (1-t): (9,000) (7,526) (5,904) (4,120) (2,158)

+ t CCA: 9,000 15,300 10,710 7,497 5,248

Investments (150,000) 42,245

Debts: 150,000 (24,570) (27,027) (29,729) (32,702) (35,972)

Net Cash Flow: - 11,430 16,748 11,077 6,674 45,362

PE(MARR) = $61,422 Annual loan payment = $39,570

AE(MARR) = $17,039

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-29

10.25 All numbers in '000 dollars

dB= t= 38% Lease cost

dE= 25% id= 12% Beginning?

dO= MARR= 18% 0

tCG= N= 15

Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Input Data:

Revenues 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000

Expenses

Materials

Labour

Overhead

O&M 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000

Investments

Land

Building

Machines 62,000 9,300

Others

Borrowed Money: 55,800

Calculated Entries:

Debt principal: 55,800

Debt interest 6,696 6,696 6,696 6,696 6,696 6,696 6,696 6,696 6,696 6,696

CCA

Building @dB - - - - - - - - - - - - - - -

Machines @dE 7,750 13,563 10,172 7,629 5,722 4,291 3,218 2,414 1,810 1,358 1,018 764 573 430 322

Others @dO - - - - - - - - - - - - - - -

Disposal tax effect

Land -

Building -

Machines (3,167)

Others -

Cash Flow Elements:

Revenue (1-t): 21,700 21,700 21,700 21,700 21,700 21,700 21,700 21,700 21,700 21,700 21,700 21,700 21,700 21,700 21,700

- Costs (1-t): (12,400) (12,400) (12,400) (12,400) (12,400) (12,400) (12,400) (12,400) (12,400) (12,400) (12,400) (12,400) (12,400) (12,400) (12,400)

+ Beginning adjust? - - - - - - - - - - - - - - - -

- Interest (1-t): (4,152) (4,152) (4,152) (4,152) (4,152) (4,152) (4,152) (4,152) (4,152) (4,152) - - - - -

+ t CCA: 2,945 5,154 3,865 2,899 2,174 1,631 1,223 917 688 516 387 290 218 163 122

Investments (62,000) 6,133

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-30

Debts: 55,800 - - - - - - - - - (55,800) - - - -

Net Cash Flow: (6,200) 8,093 10,302 9,014 8,047 7,323 6,779 6,371 6,066 5,836 (50,136) 9,687 9,590 9,518 9,463 15,556

PE(MARR) = $24,980 Yes, its PE is greater than 0 at MARR = 18%.

AE(MARR) = $4,906

IRR: 139.95%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-31

Comparing Mutually Exclusive Alternatives

10.26 Option 1: Retained earnings

dB= t= 39% Lease cost

dE= 30% id= Beginning?

dO= MARR= 18% 0

tCG= N= 6

Year 0 1 2 3 4 5 6

Input Data:

Revenues 174,000 174,000 174,000 174,000 174,000 174,000

Expenses

Materials

Labour

Overhead

O&M 22,000 22,000 22,000 22,000 22,000 22,000

Investments

Land

Building

Machines 220,000 30,000

Others 25,000 25,000

Borrowed Money:

Calculated Entries:

Debt principal: - - - - - -

Debt interest - - - - - -

CCA

Building @dB - - - - - -

Machines @dE 33,000 56,100 39,270 27,489 19,242 13,470

Others @dO - - - - - -

Disposal tax effect

Land -

Building -

Machines 557

Others -

Cash Flow Elements:

Revenue (1-t): 106,140 106,140 106,140 106,140 106,140 106,140

- Costs (1-t): (13,420) (13,420) (13,420) (13,420) (13,420) (13,420)

+ Beginning adjust? - - - - - - -

- Interest (1-t): - - - - - -

+ t CCA: 12,870 21,879 15,315 10,721 7,504 5,253

Investments (245,000) 55,557

Debts: - - - - - - -

Net Cash Flow: (245,000) 105,590 114,599 108,035 103,441 100,224 153,530

PE(MARR) = $146,575

AE(MARR) = $41,907

IRR= 38.75%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-32

10.26 Option 2: Amortized loan

dB= t= 39% Lease cost

dE= 30% id= 12% Beginning?

dO= MARR= 18% 0

tCG= N= 6

Year 0 1 2 3 4 5 6

Input Data:

Revenues 174,000 174,000 174,000 174,000 174,000 174,000

Expenses

Materials

Labour

Overhead

O&M 22,000 22,000 22,000 22,000 22,000 22,000

Investments

Land

Building

Machines 220,000 30,000

Others 25,000 25,000

Borrowed Money: 220,000

Calculated Entries:

Debt principal: 27,110 30,363 34,006 38,087 42,658 47,776

Debt interest 26,400 23,147 19,503 15,423 10,852 5,733

CCA

Building @dB - - - - - -

Machines @dE 33,000 56,100 39,270 27,489 19,242 13,470

Others @dO - - - - - -

Disposal tax effect

Land -

Building -

Machines 557

Others -

Cash Flow Elements:

Revenue (1-t): 106,140 106,140 106,140 106,140 106,140 106,140

- Costs (1-t): (13,420) (13,420) (13,420) (13,420) (13,420) (13,420)

+ Beginning adjust? - - - - - - -

- Interest (1-t): (16,104) (14,120) (11,897) (9,408) (6,620) (3,497)

+ t CCA: 12,870 21,879 15,315 10,721 7,504 5,253

Investments (245,000) 55,557

Debts: 220,000 (27,110) (30,363) (34,006) (38,087) (42,658) (47,776)

Net Cash Flow: (25,000) 62,376 70,117 62,132 55,946 50,947 102,257

PE(MARR) = $205,038 Annual loan pay: $53,510

AE(MARR) = $58,623

IRR= 255.17%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-33

10.26 Option 3: Leasing

dB= t= 39% Lease cost

dE= 30% id= Beginning?

dO= MARR= 18% 1

tCG= N= 6

Year 0 1 2 3 4 5 6

Input Data:

Revenues 174,000 174,000 174,000 174,000 174,000 174,000

Expenses

Materials

Labour

Overhead 22,000 22,000 22,000 22,000 22,000 22,000

O&M 55,000 55,000 55,000 55,000 55,000 55,000

Investments

Land

Building

Machines

Others 25,000 25,000

Borrowed Money:

Calculated Entries:

Debt principal: - - - - - -

Debt interest - - - - - -

CCA

Building @dB - - - - - -

Machines @dE - - - - - -

Others @dO - - - - - -

Disposal tax effect

Land -

Building -

Machines -

Others -

Cash Flow Elements:

Revenue (1-t): 106,140 106,140 106,140 106,140 106,140 106,140

- Costs (1-t): (46,970) (46,970) (46,970) (46,970) (46,970) (13,420)

+ Beginning adjust? (55,000) 21,450

- Interest (1-t): - - - - - -

+ t CCA: - - - - - -

Investments (25,000) 25,000

Debts: - - - - - - -

Net Cash Flow: (80,000) 59,170 59,170 59,170 59,170 59,170 139,170

PE(MARR) = $156,588

AE(MARR) = $44,770

IRR= 73.96%

Conclusion: Option 2 is the best with the highest PE value. Buy the machine via borrowing.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-34

*

10.27 Option 1: Leasing

dB= t= 40% Lease

dE= id= cost

dO= MARR= 12% Beginnin

tCG= N= 30 g?

1

Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

Input Data:

Revenues - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Expenses

Materials

Labour

Overhead - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

O&M 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000 84,000

Investments

Land

Building

Machines

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Debt interest - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

CCA

Building @dB - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Machines @dE - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Others @dO - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Disposal tax effect

Land -

Building -

Machines -

Others -

Cash Flow Elements:

Revenue (1-t): - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- Costs (1-t): (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) -

+ Beginning adjust? (84,000) 33,600

- Interest (1-t): - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

+ t CCA: - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Investments - -

Debts: - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Net Cash Flow: (84,000) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) (50,400) 33,600

PE(MARR) = $(487,178)

AE(MARR) = $(60,480)

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-35

*

10.27 Option 2: Purchase

dB= 4% t= 40% Lease cost

dE= id= Beginning

dO= MARR= 12% ?

tCG= N= 30 1

Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

Input Data:

Revenues - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Expenses

Materials

Labour

Overhead 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500 42,500

O&M (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000) (60,000)

Investments

Land 150,000 150,000

Building 700,000 70,000

Machines

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Debt interest - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

CCA

Building @dB 14,000 27,440 26,342 25,289 24,277 23,306 22,374 21,479 20,620 19,795 19,003 18,243 17,513 16,813 16,140 15,495 14,875 14,280 13,709 13,160 12,634 12,129 11,643 11,178 10,731 10,301 9,889 9,494 9,114 8,749

Machines @dE - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Others @dO - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Disposal tax effect

Land -

Building 55,994

Machines -

Others -

Cash Flow Elements:

Revenue (1-t): - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- Costs (1-t): 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 10,500 (25,500)

+ Beginning adjust? 60,000 (24,000)

- Interest (1-t): - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

+ t CCA: 5,600 10,976 10,537 10,115 9,711 9,322 8,950 8,592 8,248 7,918 7,601 7,297 7,005 6,725 6,456 6,198 5,950 5,712 5,483 5,264 5,054 4,851 4,657 4,471 4,292 4,121 3,956 3,797 3,646 3,500

Investments (850,000) 275,994

Debts: - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Net Cash Flow: (790,000) 16,100 21,476 21,037 20,615 20,211 19,822 19,450 19,092 18,748 18,418 18,101 17,797 17,505 17,225 16,956 16,698 16,450 16,212 15,983 15,764 15,554 15,351 15,157 14,971 14,792 14,621 14,456 14,297 14,146 229,994

PE(MARR) = $(632,662

)

AE(MARR) = $(78,541)

IRR= -0.43%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-36

*

10.27 Option 3: Remodelling

dB= 4% t= 40% Lease cost

dE= id= Beginning?

dO= MARR= 12% 1

tCG= N= 30

Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

Input Data:

Revenues - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Expenses

Materials

Labour

Overhead 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000 33,000

O&M 9,000 9,500 10,000 10,500 11,000 11,500 12,000 12,500 13,000 13,500 14,000 14,500 15,000 15,500 16,000 16,500 17,000 17,500 18,000 18,500 19,000 19,500 20,000 20,500 21,000 21,500 22,000 22,500 23,000 23,500

Investments

Land 60,000

Building 300,000 60,000

Machines

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Debt interest - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

CCA

Building @dB 6,000 11,760 11,290 10,838 10,404 9,988 9,589 9,205 8,837 8,484 8,144 7,818 7,506 7,205 6,917 6,641 6,375 6,120 5,875 5,640 5,415 5,198 4,990 4,790 4,599 4,415 4,238 4,069 3,906 3,750

Machines @dE - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Others @dO - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Disposal tax effect

Land -

Building 11,998

Machines -

Others -

Cash Flow Elements:

Revenue (1-t): - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- Costs (1-t): (25,500) (25,800) (26,100) (26,400) (26,700) (27,000) (27,300) (27,600) (27,900) (28,200) (28,500) (28,800) (29,100) (29,400) (29,700) (30,000) (30,300) (30,600) (30,900) (31,200) (31,500) (31,800) (32,100) (32,400) (32,700) (33,000) (33,300) (33,600) (33,900) (19,800)

+ Beginning adjust? (9,000) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) (200) 9,400

- Interest (1-t): - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

+ t CCA: (300,000) 2,400 4,704 4,516 4,335 4,162 3,995 3,836 3,682 3,535 3,393 3,258 3,127 3,002 2,882 2,767 2,656 2,550 2,448 2,350 2,256 2,166 2,079 1,996 1,916 1,840 1,766 1,695 1,627 1,562 1,500

Investments 131,998

Debts: - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

Net Cash Flow: ( 309,000) (23,300) (21,296) (21,784) (22,265) (22,738) (23,205) (23,664) (24,118) (24,565) (25,007) (25,442) (25,873) (26,298) (26,718) (27,133) (27,544) (27,950) (28,352) (28,750) (29,144) (29,534) (29,921) (30,304) (30,684) (31,060) (31,434) (31,805) (32,173) (32,538) 123,097

PE(MARR) = $(500,353)

AE(MARR) = $(62,116)

IRR= Undefined

Conclusion: Option 1 (leasing) is the best as it has the least negative PE value.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-37

10.28 Option 1: Plant A All numbers in '000 dollars

dB= t= 39% Lease cost

dE= 30% id= Beginning?

dO= MARR= 12%

tCG= N= 20

0

Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Input Data:

Revenues - - - - - - - - - - - - - - - - -

Expenses

Materials

Labour

Overhead - - - - - - - - - - - - - - - - - - -

O&M 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964 1,964

Investments

Land

Building -

Machines 8,530 853

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - - - - - - - - - - - - - - - - - -

Debt interest - - - - - - - - - - - - - - - - - - - -

CCA

Building @dB - - - - - - - - - - - - - - - - - - -

Machines @dE 1,280 2,175 1,523 1,066 746 522 366 256 179 125 88 61 43 30 21 15 10 7 5 4

Others @dO - - - - - - - - - - - - - - - - - - - -

Disposal tax effect

Land -

Building -

Machines (329)

Others -

Cash Flow Elements:

Revenue (1-t): - - - - - - - - - - - - - - - - - - - -

- Costs (1-t): (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198) (1,198)

+ Beginning adjust? - - - - - - - - - - - - - - - - - - - -

- Interest (1-t): - - - - - - - - - - - - - - - - - - -

+ t x CCA: 499 848 594 416 291 204 143 100 70 49 34 24 17 12 8 6 4 3 2 1

Investments (8,530) 524

Debts: - - - - - - - - - - - - - - - - - - - - -

Net Cash Flow: (8,530) (699) (350) (604) (782) (907) (994) (1,055) (1,098) (1,128) (1,149) (1,164) (1,174) (1,181) (1,186) (1,190) (1,192) (1,194) (1,195) (1,196) (673)

PE(MARR) = $(15,176) Power needs/year = 50,000,000 kWh

AE(MARR) = $(2,032) Unit power cost = $ 0.0406 /kwh

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-38

10.28 Option 2: Plant B All numbers in '000 dollars

dB= t= 39% Lease cost

dE= 30% id= Beginning?

dO= MARR= 12%

tCG= N= 20

0

Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Input Data:

Revenues - - - - - - - - - - - - - - - - - - -

Expenses

Materials

Labour

Overhead - - - - - - - - - - - - - - - - - - -

O&M 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744 1,744

Investments

Land

Building -

Machines 9,498 950

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - - - - - - - - - - - - - - - - - -

Debt interest - - - - - - - - - - - - - - - - - - - -

CCA

Building @dB - - - - - - - - - - - - - - - - - - - -

Machines @dE 1,425 2,422 1,695 1,187 831 582 407 285 199 140 98 68 48 34 23 16 11 8 6 4

Others @dO - - - - - - - - - - - - - - - - - - - -

Disposal tax effect

Land -

Building -

Machines (367)

Others -

Cash Flow Elements:

Revenue (1-t): - - - - - - - - - - - - - - - - - - - -

- Costs (1-t): (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064) (1,064)

+ Beginning adjust? - - - - - - - - - - - - - - - - - - - - -

- Interest (1-t): - - - - - - - - - - - - - - - - - - - -

+ t CCA: 556 945 661 463 324 227 159 111 78 54 38 27 19 13 9 6 4 3 2 2

Investments (9,498) 583

Debts: - - - - - - - - - - - - - - - - - - - - -

Net Cash Flow: (9,498) (508) (119) (403) (601) (740) (837) (905) (953) (986) (1,009) (1,026) (1,037) (1,045) (1,051) (1,055) (1,057) (1,059) (1,061) (1,064) (479)

PE(MARR) = $(14,880)

AE(MARR) = $(1,992) Unit power cost = $ 0.0398 /kWh

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-39

10.28 Option 3: Plant C All numbers in '000 dollars

dB= t= 39% Lease cost

dE= 30% id= Beginning?

dO= MARR= 12% 0

tCG= N= 20

Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

Input Data:

Revenues - - - - - - - - - - - - - - - - - - -

Expenses

Materials

Labour

Overhead - - - - - - - - - - - - - - - - - - -

O&M 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632 1,632

Investments

Land

Building -

Machines 10,546 1,055

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - - - - - - - - - - - - - - - - - -

Debt interest - - - - - - - - - - - - - - - - - - - -

CCA

Building @dB - - - - - - - - - - - - - - - - - - - -

Machines @dE 1,582 2,689 1,882 1,318 922 646 452 316 221 155 109 76 53 37 26 18 13 9 6 4

Others @dO - - - - - - - - - - - - - - - - - - - -

Disposal tax effect

Land -

Building -

Machines (407)

Others -

Cash Flow Elements:

Revenue (1-t): - - - - - - - - - - - - - - - - - - - -

- Costs (1-t): (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) (996) (996)

+ Beginning adjust? - - - - - - - - - - - - - - - - - - - - -

- Interest (1-t): - - - - - - - - - - - - - - - - - - - -

+ t CCA 617 1,049 734 514 360 252 176 123 86 60 42 30 21 15 10 7 5 3 2 2

Investments (10,546) 647

Debts: - - - - - - - - - - - - - - - - - - - - -

Net Cash Flow: (10,546) (379) 53 (261) (482) (636) (744) (819) (872) (909) (935) (953) (966) (975) (981) (985) (988) (991) (992) (993) (347)

PE(MARR) = $(15,13

5)

AE(MARR) = $(2,026) Unit power cost = $0.0405 /kWh

IRR = Undefined

Conclusion: Plant B is the best as it has the lowest cost per kWh of power generated.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-40

Lease-Versus-Buy Decisions

10.29 Option 1: Leasing

dB= t= 40% Lease cost

dE= id= Beginning?

dO= MARR= 15% 1

tCG= N= 4

Year 0 1 2 3 4

Input Data:

Revenues - - -

Expenses

Materials

Labour

Overhead - - -

O&M 11,000 11,000 11,000 11,000

Investments

Land

Building -

Machines -

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - -

Debt interest - - - -

CCA

Building @dB - - - -

Machines @dE - - - -

Others @dO - - - -

Disposal tax effect

Land -

Building -

Machines -

Others -

Cash Flow Elements:

Revenue (1-t): - - - -

- Costs (1-t): (6,600) (6,600) (6,600) -

+ Beginning adjust? (11,000) - - - 4,400

- Interest (1-t): - - - -

+ t CCA: - - - -

Investments - -

Debts: - - - - -

Net Cash Flow: (11,000) (6,600) (6,600) (6,600) 4,400

PE(MARR) = $(23,554)

AE(MARR) = $(8,250)

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-41

10.29 Option 2: Buying

dB= t= 40% Lease cost

dE= 30% id= 12% Beginning?

dO= MARR= 15% 0

tCG= N= 4

Year 0 1 2 3 4

Input Data:

Revenues - - -

Expenses

Materials

Labour

Overhead - - -

O&M 1,200 1,200 1,200 1,200

Investments

Land

Building -

Machines 41,000 10,000

Others

Borrowed Money: 41,000

Calculated Entries:

Debt principal: 8,579 9,608 10,761 12,052

Debt interest 4,920 3,891 2,738 1,446

CCA

Building @dB - - - -

Machines @dE 6,150 10,455 7,319 5,123

Others @dO - - - -

Disposal tax effect

Land -

Building -

Machines 781

Others -

Cash Flow Elements:

Revenue (1-t): - - - -

- Costs (1-t): (720) (720) (720) (720)

+ Beginning adjust? - - - - -

- Interest (1-t): (2,952) (2,334) (1,643) (868)

+ t CCA: 2,460 4,182 2,927 2,049

Investments (41,000) 10,781

Debts: 41,000 (8,579) (9,608) (10,761) (12,052)

Net Cash Flow: - (9,791) (8,480) (10,196) (809)

PE(MARR) = $(22,093) Annual loan payment 13,499

AE(MARR) = $(7,738)

IRR= Undefined

Conclusion: Buying is better as it has a less negative PE value.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-42

*

10.30 The buy option

dB= t= 40% Lease cost

dE= 30% id= 10% Beginning?

dO= MARR= 15% 0

tCG= N= 4

Year 0 1 2 3 4

Input Data:

Revenues 200,000 200,000 200,000 200,000

Expenses

Materials

Labour

Overhead 10,000 10,000 10,000 10,000

O&M 40,000 40,000 40,000 40,000

Investments

Land

Building -

Machines 130,000 20,000

Others

Borrowed Money: 130,000

Calculated Entries:

Debt principal: 28,011 30,812 33,894 37,283

Debt interest 13,000 10,199 7,118 3,728

CCA

Building @dB - - - -

Machines @dE 19,500 33,150 23,205 16,244

Others @dO - - - -

Disposal tax effect

Land -

Building -

Machines 7,161

Others -

Cash Flow Elements:

Revenue (1-t): 120,000 120,000 120,000 120,000

- Costs (1-t): (30,000) (30,000)(30,000) (30,000)

+ Beginning adjust? - - - - -

- Interest (1-t): (7,800) (6,119) (4,271) (2,237)

+ t CCA: 7,800 13,260 9,282 6,497

Investments (130,000) 27,161

Debts: 130,000 (28,011) (30,812) (33,894) (37,283)

Net Cash Flow: - 61,989 66,328 61,118 84,138

PE(MARR) = $192,349 Annual loan payment: 41,011

AE(MARR) = $67,373

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-43

*

10.30 The lease option

dB= t= 40% Lease cost

dE= id= Beginning?

dO= MARR= 15% 1

tCG= N= 4

Year 0 1 2 3 4

Input Data:

Revenues 200,000 200,000 200,000 200,000

Expenses

Materials

Labour

Overhead 40,000 40,000 40,000 40,000

O&M 44,000 44,000 44,000 44,000

Investments

Land

Building -

Machines

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - -

Debt interest - - - -

CCA

Building @dB - - - -

Machines @dE - - - -

Others @dO - - - -

Disposal tax effect

Land -

Building -

Machines -

Others -

Cash Flow Elements:

Revenue (1-t): 120,000 120,000 120,000 120,000

- Costs (1-t): (50,400) (50,400) (50,400) (24,000)

+ Beginning adjust? (44,000) - - - 17,600

- Interest (1-t): - - - -

+ t CCA: - - - -

Investments - -

Debts: - - - - -

Net Cash Flow: (44,000) 69,600 69,600 69,600 113,600

PE(MARR) = $179,864 -

AE(MARR) = $63,000

IRR= 158.18%

Conclusion: The buy option is better because its PE value is larger.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-44

10.31 The borrow-and-purchase option

dB= t= 40% Lease cost

dE= 30% id= 10% Beginning?

dO= MARR= 15% 0

tCG= N= 4

Year 0 1 2 3 4

Input Data:

Revenues - - -

Expenses

Materials

Labour

Overhead - - -

O&M 12,000 12,000 12,000 12,000

Investments

Land

Building -

Machines 200,000 20,000

Others

Borrowed Money: 200,000

Calculated Entries:

Debt principal: 43,094 47,404 52,144 57,358

Debt interest 20,000 15,691 10,950 5,736

CCA

Building @dB - - - -

Machines @dE 30,000 51,000 35,700 24,990

Others @dO - - - -

Disposal tax effect

Land -

Building -

Machines 15,324

Others -

Cash Flow Elements:

Revenue (1-t): - - - -

- Costs (1-t): (7,200) (7,200) (7,200) (7,200)

+ Beginning adjust? - - - - -

- Interest (1-t): (12,000) (9,414) (6,570) (3,441)

+ t CCA: 12,000 20,400 14,280 9,996

Investments (200,000) 35,324

Debts: 200,000 (43,094) (47,404) (52,144) (57,358)

Net Cash Flow: - (50,294) (43,618) (51,634) (22,680)

PE(MARR) = $(123,633) Annual debt payment: $63,094

AE(MARR) = $(43,304)

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-45

10.31 The lease option

dB= t= 40% Lease cost

dE= id= Beginning

dO= MARR= 15% ?

tCG= N= 4 0

Year 0 1 2 3 4

Input Data:

Revenues - - -

Expenses

Materials

Labour

Overhead - - -

O&M 70,000 70,000 70,000 70,000

Investments

Land

Building -

Machines

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - -

Debt interest - - - -

CCA

Building @dB - - - -

Machines @dE - - - -

Others @dO - - - -

Disposal tax effect

Land -

Building -

Machines -

Others -

Cash Flow Elements:

Revenue (1-t): - - - -

- Costs (1-t): (42,000) (42,000) (42,000) (42,000)

+ Beginning adjust? - - - - -

- Interest (1-t): - - - -

+ t CCA: - - - -

Investments - -

Debts: - - - - -

Net Cash Flow: - (42,000) (42,000) (42,000) (42,000)

PE(MARR) = $(119,909) -

AE(MARR) = $(42,000)

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-46

10.32 The buy option

dB= t= 35% Lease cost

dE= 30% id= 12.6% Beginning?

dO= MARR= 13% 0

tCG= N= 3

Year 0 1 2 3

Input Data:

Revenues -

Expenses

Materials

Labour

Overhead -

O&M -

Investments

Land

Building -

Machines 18,000 5,800

Others

Borrowed Money: 18,000

Calculated Entries:

Debt principal: 5,304 5,972 6,724

Debt interest 2,268 1,600 847

CCA

Building @dB - - -

Machines @dE 2,700 4,590 3,213

Others @dO - - -

Disposal tax effect

Land -

Building -

Machines 594

Others -

Cash Flow Elements:

Revenue (1-t): - - -

- Costs (1-t): - - -

+ Beginning adjust? - - - -

- Interest (1-t): (1,474) (1,040) (551)

+ t CCA: 945 1,607 1,125

Investments (18,000) 6,394

Debts: 18,000 (5,304) (5,972) (6,724)

Net Cash Flow: - (5,833) (5,405) 243

PE(MARR) = $(9,226) Loan pay/yr: $7,572

AE(MARR) = $(3,908)

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-47

10.32 The lease option

dB= t= 35% Lease cost

dE= id= Beginning?

dO= MARR= 13% 1

tCG= N= 3

Year 0 1 2 3

Input Data:

Revenues -

Expenses

Materials

Labour

Overhead -

O&M 5,100 5,100 5,100

Investments

Land

Building -

Machines

Others 500 500

Borrowed Money:

Calculated Entries:

Debt principal: - - -

Debt interest - - -

CCA

Building @dB - - -

Machines @dE - - -

Others @dO - - -

Disposal tax effect

Land -

Building -

Machines -

Others -

Cash Flow Elements:

Revenue (1-t): - - -

- Costs (1-t): (3,315 (3,315) -

)

+ Beginning adjust? (5,100) - - 1,785

- Interest (1-t): - - -

+ t CCA: - - -

Investments (500) 500

Debts: - - - -

Net Cash Flow: (5,600) (3,315) (3,315) 2,285

PE(MARR) = $(9,546) -

AE(MARR) = $(4,043)

IRR= Undefined

Conclusion: The buy option is better with a higher PE value.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-48

10.33 The lease option

dB= t= 40% Lease cost

dE= id= Beginning?

dO= MARR 15% 1

tCG= = 3

N=

Year 0 1 2 3

Input Data:

Revenues -

Expenses

Materials

Labour

Overhead -

O&M 15,000 15,000 15,000

Investments

Land

Building -

Machines

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - -

Debt interest - - -

CCA

Building @dB - - -

Machines @dE - - -

Others @dO - - -

Disposal tax effect

Land -

Building -

Machines -

Others -

Cash Flow Elements:

Revenue (1-t): - - -

- Costs (1-t): (9,000) (9,000) -

+ Beginning adjust? (15,000) - - 6,000

- Interest (1-t): - - -

+ t CCA: - - -

Investments - -

Debts: - - - -

Net Cash Flow: (15,000) (9,000) (9,000) 6,000

PE(MARR) = $(25,686) -

AE(MARR) = $(11,250)

IRR= Undefined

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-49

10.33 The buy option

dB= t= 40% Lease cost

dE= 30% id= 12% Beginning?

dO= MARR= 15% 0

tCG= N= 3

Year 0 1 2 3

Input Data:

Revenues -

Expenses

Materials

Labour

Overhead -

O&M 5,000 5,000 5,000

Investments

Land

Building -

Machines 80,000 50,000

Others

Borrowed Money: 80,000

Calculated Entries:

Debt principal: 23,708 26,553 29,739

Debt interest 9,600 6,755 3,569

CCA

Building @dB - - -

Machines @dE 12,000 20,400 14,280

Others @dO - - -

Disposal tax effect

Land -

Building -

Machines (6,672)

Others -

Cash Flow Elements:

Revenue (1-t): - - -

- Costs (1-t): (3,000) (3,000) (3,000)

+ Beginning adjust? - - - -

- Interest (1-t): (5,760) (4,053) (2,141)

+ t CCA: 4,800 8,160 5,712

Investments (80,000) 43,328

Debts: 80,000 (23,708) (26,553) (29,739)

Net Cash Flow: - (27,668) (25,446) 14,160

PE(MARR) = $(33,990) Loan pay/yr: $33,308

AE(MARR) = $(14,887)

IRR= Undefined

Conclusion: The lease option is much better.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-50

*

10.34 The buy option

dB= t= 30% Lease cost

dE= 20% id= 12% Beginning?

dO= MARR= 10% 0

tCG= N= 5

Year 0 1 2 3 4 5

Input Data:

Revenues 10,000 10,000 10,000 10,000 10,000

Expenses

Materials

Labour

Overhead - - - -

O&M 2,500 2,500 2,500 2,500 2,500

Investments

Land

Building -

Machines 25,000 5,000

Others

Borrowed Money: 25,000

Calculated Entries:

Debt principal: 3,935 4,407 4,936 5,529 6,192

Debt interest 3,000 2,528 1,999 1,407 743

CCA

Building @dB - - - - -

Machines @dE 2,500 4,500 3,600 2,880 2,304

Others @dO - - - - -

Disposal tax effect

Land -

Building -

Machines 1,265

Others -

Cash Flow Elements:

Revenue (1-t): 7,000 7,000 7,000 7,000 7,000

- Costs (1-t): (1,750) (1,750) (1,750) (1,750) (1,750)

+ Beginning adjust? - - - - - -

- Interest (1-t): (2,100) (1,769) (1,399) (985) (520)

+ t CCA: 750 1,350 1,080 864 691

Investments (25,000) 6,265

Debts: 25,000 (3,935) (4,407) (4,936) (5,529) (6,192)

Net Cash Flow: - (35) 423 (6) (399) 5,494

PE(MARR) = $3,452 Annual debt payment: $6,935

AE(MARR) = $911

IRR= N/A

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-51

*

10.34 The lease option

dB= t= 30% Lease cost

dE= id= Beginning?

dO= MARR= 10% 1

tCG= N= 5

Year 0 1 2 3 4 5

Input Data:

Revenues 10,000 10,000 10,000 10,000 10,000

Expenses

Materials

Labour

Overhead 2,500 2,500 2,500 2,500 2,500

O&M 3,500 3,500 3,500 3,500 3,500

Investments

Land

Building -

Machines

Others

Borrowed Money:

Calculated Entries:

Debt principal: - - - - -

Debt interest - - - - -

CCA

Building @dB - - - - -

Machines @dE - - - - -

Others @dO - - - - -

Disposal tax effect

Land -

Building -

Machines -

Others -

Cash Flow Elements:

Revenue (1-t): 7,000 7,000 7,000 7,000 7,000

- Costs (1-t): (4,200) (4,200) (4,200) (4,200) (1,750)

+ Beginning adjust? (3,500) - - - - 1,050

- Interest (1-t): - - - - -

+ t CCA: - - - - -

Investments - -

Debts: - - - - - -

Net Cash Flow: (3,500) 2,800 2,800 2,800 2,800 6,300

PE(MARR) = $9,287 -

AE(MARR) = $2,450

IRR= 80.00%

Conclusion: The lease option is better with a higher PE value.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-52

10.35 Buy and lease out

dB= t= 35% Lease cost

dE= 40% id= Beginning?

dO= MARR= 10% 1

tCG= N= 3

Year 0 1 2 3

Input Data:

Revenues -

Expenses

Materials

Labour

Overhead -

O&M (14,431) (14,431) (14,431)

Investments

Land

Building -

Machines 53,000 22,000

Others (1,500) (1,500)

Borrowed Money:

Calculated Entries:

Debt principal: - - -

Debt interest - - -

CCA

Building @dB - - -

Machines @dE 10,600 16,960 10,176

Others @dO - - -

Disposal tax effect

Land -

Building -

Machines (2,358)

Others -

Cash Flow Elements:

Revenue (1-t): - - -

- Costs (1-t): 9,380 9,380 -

+ Beginning adjust? 14,431 - - (5,051)

- Interest (1-t): - - -

+ t CCA: 3,710 5,936 3,562

Investments (51,500) 18,142

Debts: - - - -

Net Cash Flow: (37,069) 13,090 15,316 16,653

PE(MARR) = - -

AE(MARR) = -

IRR= 10.00%

Conclusion: Charge $14,431 at the beginning of each year for three years.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-53

Short Case Studies

ST10.1 (a) and (b) All numbers in '000 dollars

dB= 4% t= 40%

dE= 30% id=

dO= MARR= 15%

tCG= 20% N= 12%

Year 0 1 2 3 4 5 6 7 8 9 10 11 12

Income Statement

Revenues 51,000 51,000 51,000 51,000 85,000 85,000 85,000 136,000 136,000 136,000 136,000 136,000

Expenses

Materials

Labour

Overhead

O&M 36,000 36,000 36,000 36,000 60,000 60,000 60,000 96,000 96,000 96,000 96,000 96,000

Debt interest - - - - - - - - - - - -

CCA

Building @dB 800 1,568 1,505 1,445 1,387 1,332 1,279 1,227 1,178 1,131 1,086 1,042

Machines @dE 14,250 24,225 16,958 11,870 8,309 5,816 4,071 2,850 1,995 1,397 978 684

Others @dO - - - - - - - - - - - -

Taxable income (50) (10,793) (3,463) 1,685 15,304 17,852 19,650 35,923 36,827 37,472 37,937 38,273

Income taxes @t (20) (4,317) (1,385) 674 6,121 7,141 7,860 14,369 14,731 14,989 15,175 15,309

Net income (30) (6,476) (2,078) 1,011 9,182 10,711 11,790 21,554 22,096 22,483 22,762 22,964

Cash Flow Statement

Operating activities

Net income (30) (6,476) (2,078) 1,011 9,182 10,711 11,790 21,554 22,096 22,483 22,762 22,964

CCA 15,050 25,793 18,463 13,315 9,696 7,148 5,350 4,077 3,173 2,528 2,063 1,727

Investment activities

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-54

Land (5,000) 8,000

Building (40,000) 30,000

Machines (95,000) 10,000

Others

Disposal tax effect

Land (600)

Building (1,992)

Machines (3,361)

Others -

Financing activities

Principal portion - - - - - - - - - - - -

Net cash flow (140,000) 15,020 19,317 16,385 14,326 18,879 17,859 17,140 25,631 25,269 25,011 24,825 66,737

PE(MARR) = $(30,264)

AE(MARR) = $(5,583)

IRR= 10.55%

(c) The project should be rejected as its IRR is lower than the MARR of 15%.

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-55

ST10.2 Morgantown Mining Company

(a) Unit-production method

(Units are thousand dollars)

0 1 2 3 4 5 6 7 8 9 10

Income Statement

Revenues (savings) $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500

Expenses:

O&M $2,400 $2,400 $2,400 $2,400 $2,400 $2,400 $2,400 $2,400 $2,400 $2,400

Depreciation $1,880 $1,880 $1,880 $1,880 $1,880 $1,880 $1,880 $1,880 $1,880 $1,880

Taxable Income $5,220 $5,220 $5,220 $5,220 $5,220 $5,220 $5,220 $5,220 $5,220 $5,220

Income Taxes (40%) $2,088 $2,088 $2,088 $2,088 $2,088 $2,088 $2,088 $2,088 $2,088 $2,088

Net Income $3,132 $3,132 $3,132 $3,132 $3,132 $3,132 $3,132 $3,132 $3,132 $3,132

Cash Flow Statement

Operating Activities:

Net Income $3,132 $3,132 $3,132 $3,132 $3,132 $3,132 $3,132 $3,132 $3,132 $3,132

Depreciation $1,880 $1,880 $1,880 $1,880 $1,880 $1,880 $1,880 $1,880 $1,880 $1,880

Investment Activities:

Investment ($19,300)

Salvage $500

Gains Tax

Working capital ($2,500) $2,500

Net Cash Flow ($21,800) $5,012 $5,012 $5,012 $5,012 $5,012 $5,012 $5,012 $5,012 $5,012 $8,012

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-56

(b) Seven-year MACRS

(Units are thousand dollars)

0 1 2 3 4 5 6 7 8 9 10

Income Statement

Revenues (savings) $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500 $9,500

Expenses:

O&M $2,400 $2,400 $2,400 $2,400 $2,400 $2,400 $2,400 $2,400 $2,400 $2,400

Depreciation $2,758 $4,727 $3,376 $2,411 $1,723 $1,722 $1,723 $861 $0 $0

Taxable Income $4,342 $2,373 $3,724 $4,689 $5,377 $5,378 $5,377 $6,239 $7,100 $7,100

Income Taxes (40%) $1,737 $949 $1,490 $1,876 $2,151 $2,151 $2,151 $2,496 $2,840 $2,840

Net Income $2,605 $1,424 $2,235 $2,814 $3,226 $3,227 $3,226 $3,744 $4,260 $4,260

Cash Flow Statement

Operating Activities:

Net Income $2,605 $1,424 $2,235 $2,814 $3,226 $3,227 $3,226 $3,744 $4,260 $4,260

Depreciation $2,758 $4,727 $3,376 $2,411 $1,723 $1,722 $1,723 $861 $0 $0

Investment Activities:

Investment ($19,300)

Salvage $500

Gains Tax ($200)

Working capital ($2,500) $2,500

Net Cash Flow ($21,800) $5,363 $6,151 $5,610 $5,224 $4,949 $4,949 $4,949 $4,604 $4,260 $7,060

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-57

ST10.3 (a) Equity financing

dB= t= 40%

dE= 30% id=

dO= MARR= 20%

tCG= N= 6

Year 0 1 2 3 4 5 6

Income Statement

Revenues 349,000 349,000 349,000 349,000 349,000 349,000

Expenses

Materials 140,000 140,000 140,000 140,000 140,000 140,000

Labour

Overhead 20,000

O&M 36,000 36,000 36,000 36,000 36,000 36,000

Debt interest - - - - - -

CCA

Building @dB - - - - - -

Machines @dE 36,000 61,200 42,840 29,988 20,992 14,694

Others @dO - - - - - -

Taxable income 117,000 111,800 130,160 143,012 152,008 158,306

Income taxes @t 46,800 44,720 52,064 57,205 60,803 63,322

Net income 70,200 67,080 78,096 85,807 91,205 94,984

Cash Flow Statement

Operating activities

Net income 70,200 67,080 78,096 85,807 91,205 94,984

CCA 36,000 61,200 42,840 29,988 20,992 14,694

Investment activities

Land

Building

Machines (240,000) 30,000

Others

Disposal tax effect

Land -

Building -

Machines 1,715

Others -

Financing activities

Principal portion - - - - - -

Net cash flow (240,000) 106,200 128,280 120,936 115,795 112,197 141,392

PE(MARR) = $155,853 -

AE(MARR) = $46,866

IRR= 43.31%

Copyright 2012 Pearson Canada Inc., Toronto, Ontario.

10-58

ST 10.3 (b) Debt financing

dB= t= 40%

dE= 30% id= 13%

dO= MARR= 20%

tCG= N= 6

Year 0 1 23 4 5 6

Income Statement

Revenues 349,000 349,000 349,000 349,000 349,000 349,000

Expenses

Materials 140,000 140,000 140,000 140,000 140,000 140,000

Labour

Overhead 20,000

O&M 36,000 36,000 36,000 36,000 36,000 36,000

Debt interest 31,200 27,451 23,215 18,428 13,019 6,907

CCA

Building @dB - - - - - -

Machines @dE 36,000 61,200 42,840 29,988 20,992 14,694

Others @dO - - - - - -

Taxable income 85,800 84,349 106,945 124,584 138,989 151,399

Income taxes @t 34,320 33,740 42,778 49,833 55,596 60,560

Net income 51,480 50,609 64,167 74,750 83,394 90,839

Cash Flow Statement

Operating activities