Professional Documents

Culture Documents

Study Note 3, Page 148-196

Uploaded by

samstarmoonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Study Note 3, Page 148-196

Uploaded by

samstarmoonCopyright:

Available Formats

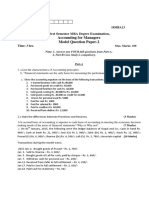

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

STUDY NOTE 3

RECEIPTS & PAYMENTS AND

INCOME & EXPENDITURE ACCOUNTS

This study note includes -

Final Accounts and Balance Sheet of Non-Profit Seeking Concerns

3.1. FINAL ACCOUNTS AND BALANCE SHEET OF NON-PROFIT

SEEKING CONCERNS

Certain concerns like Clubs, Charitable Institutions, Medical Association, Societies, etc. do not

intend to earn profit. They render service to the society or to their members. Their members do

not get any share of profit or dividend. They get medical, educational, cultural or sports facili-

ties. These concerns arc known as non-profit concerns as their transactions arc service-based

but not profit-based.

Their annual accounts are regularly prepared to convey their financial affairs to their members

or others like (govt. etc.) for seeking financial grants. If the size of the concern is small, the

accounting records are usually kept tinder single entry system. Complete double entry system

is followed only in big concerns. In any case they all prepare (A) A Receipts & Payments

Account for a financial period; (B) An Income & Expenditure Account for a financial period

and (C) A Balance Sheet at the end of the financial period.

A. Receipts & Payments Account

1. It is an Account which contains all Cash and Bank transactions made by a non-

profit organization during a particular financial period.

2. It starts with the opening balances of Cash and Bank. All Cash Receipts during the

period are debited to it.

3. All Cash Payments during the period are credited to this Account. It ends with the

closing Cash and Bank Balances.

4. While recording the Cash and Bank transactions all entries are made on Cash Basis.

No distinction is made between capital and revenue items. No adjustment is made

for outstanding or prepaid amounts.

5. It is simply a summary of Cash Book.

148 FINANCIAL ACCOUNTING

B. Income & Expenditure Account

1. Its form is similar to that of a Profit & Loss Account.

2. All expenses of revenue nature for the particular period are debited to this Account o n

accrual basis.

3. Similarly all revenue incomes related to the particular period are credited to this account

on accrual basis.

4. All Capital incomes and Expenditures are excluded.

5. Only current years incomes and expenses are recorded. Amounts related to other p e -

riods are deducted. Amounts outstanding for the current year are added.

6. Profit on Sale of Asset is credited. Loss on Sale of Asset is debited. Annual Depre ciation

on Assets is also debited.

7. The final balance of this account is a credit balance. it is called a Surplus of incomes over

Expenditure and added with Capital or General Fund etc. in the Balance Sheet.

8. If the final balance is a debit balance it shows a deficit or Shortage and is deducted from

Capital or General Fund etc. in the Balance Sheet.

C. Balance Sheet

The Balance Sheet is prepared in the similar way as followed in a Trading concern. The mar-

shalling of the assets and liabilities may be made in order of liquidity or in order of perma-

nence.

Nots For solving problems a student may have to prepare an opening Balance Sheet also, to

fing out opening Capital Fund of a period

FINANCIAL ACCOUNTING 149

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Distinction between Receipts & Payment Account and income & Expenditure Account

Receipts & Payments Account Income & Expenditure Account

1 It closely resembles the Cash Book of a 1 It closely resembles the Profit & Loss

Trading concern is simply a summarised Account of a Trading concern.

Cash Book.

2. Incomes are debited and Expenditures 2 Incomes are credited and Expenditures

are credited. are debited.

Transactions are recorded on Cash basis.

3. Amounts related to previous period or 3 Transactions are recorded on accrual

future period may remain basis. All amounts not related to the

included. Outstanding amount for current period are excluded.

current year is excluded. Outstanding amounts of current period

are added.

4. It records both Capital and Revenue 4 It records only items of Revenue.

items.

5. It serves the purpose of a Real Account. 5 It serves the purpose of a Nominal

Account.

6. It starts with opening Cash and Bank 6 It does not record such balances.

Balances and ends with dosing Cash and Rather its final balance shows a surplus

Bank Balances. or a deficit for the period.

7. It does not record notional loss or non- 7 It considers all such expenses for

cash expenses like bad debts, matching against revenues

depreciations etc.

8. Its dosing balance is carried forward to 8 Its closing balance is transferred to

the same account of the next accounting Capital Fund or General Fund or

period. Accumulated Fund in the same

periods Balance Sheet.

9. It helps to prepare an Income & 9 It helps to prepare a Balance Sheet.

Expenditure A/c.

Some Important Considerations

1 Capital Fund : it is also called General Fund or Accumulated Fund. it is actually the

Capital of a non-profit concern. It may be found out as the excess of assets over

liabilities. Usually Surplus or Deficit during a period is added with or deducted from

it. A portion of Capitalised incomes like donations may be added with it.

2. Special Fund It may be created out of special donation or subscription or out of a por-

tion of the Surplus For example a club may have a Building Fund. It may be s e d

for meeting some specific expenses or for acquiring an asset. If any income is derived out

of investments made against this fund or if any profit or loss occurs due to sale of such

investments, such income or profit or loss is transferred to this fund.

150 FINANCIAL ACCOUNTING

Other Treatments

(a) If the Special Fund is used to meet an expense

Special Fund A/c Dr.

To Bank A/c (amt. of expense)

The balance of the Fund is shown as a liability. If the balance is transferred to Capital

Fund, the entry will be

Special Fund A/c Dr.

To Capital Fund A/c (Balance of Special Fund )

(b) If the Special Fund is used to purchase an asset

Asset A/c Dr.

To Bank A/c (Cost of the asset I

Special Fund A/c Dr.

To Capital Fund A/c (Special Fund closed)

3. Donations

(a) Donation received for a particular purpose should be credited to Special Fund. For ex-

ample, Donation received for Building should be credited to Building Fund A/c.

(b) For other donations received the by-laws or rules of the concern should be followed.

(c) If there is no such rule, donations received of non-recurring nature should be credited to

Capital Fund. Recurring donations received should be credited to Income & Expenditure

Account.

(d) Donation paid by the concern should be debited to Income & Expenditure Account.

4. Legacy received It is to he directly added with Capital Fund alter deduction of tax, if any).

It is a kind of donation received according to the will made by a deceased person.

5. Entrance Fees or Admission Fees

(a) The rules or by-laws of the concern should be followed.

(b) If there is no such rule, Admission or Entrance Fees paid once by members for acquiring

membership should be added with Capital Fund.

(c) If such fees are of small amounts covering the expenses of admission only, the fees may be

credited to Income & Expenditure Account.

6. Subscriptions

(a) Annual subscriptions are credited to Income & Expenditure Account on accrual basis.

FINANCIAL ACCOUNTING 151

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

(b) Life membership subscription is usually credited to a separate account shown as a liabil-

ity. Annual Subscription apportioned out of that is credited to Income & Expenditure

Account and deducted from the liability. Thus the balance is carried forward till the

contribution by a member is fully exhausted. If any mem ber dies before hand, the balance

of his life Membership contribution is trans ferred to Capital Fund or General Fund.

A. Income & Expenditure Account

1. Ignore opening and closing Cash and Bank Balances.

2. Ignore Capital Receipts and Capital Payments.

3. Debit Revenue payments (from the credit side of the R & P A/c). Add outstand ing ex-

penses of current year. Deduct expenses related to last year or next year.

4. Credit Revenue receipts (from the debit side of the R & P A/c). Add outstand ing incomes

of current year. Deduct incomes related to next year or last year.

5. Debit Depreciation for current year. Also debit loss on sale of any fixed asset. Credit profit

on sale of any fixed asset.

6. Remember that the debit side of this Account stands for Expenditure and its credit side

represents Incomes. If the final balance is a credit balance, it is SurpIus~ [because In-

comes are morel. If the final balance is a debit balance, it is Deficit [because expenses

are morel.

B. Balance Sheet

1. First check up whether the opening Capital Fund is given. If not, prepare an open i n g

Balance Sheet. Record opening Cash and Bank Balances (as given in the R & P A/c). Also

record other opening assets and liabilities (as given in the information). The excess of

assets over liabilities is Capital or General or Accumulated Fund.

2. Prepare the Closing Balance Sheet at the end of the year with

(i) Closing Cash and Bank Balances (as given in the R & P A/c)

(ii) Other Closing assets and liabilities (ascertained from information).

(iii) Capital Payments and Receipts not shown in Income. & Expenditure Account.

(iv) Add purchase of asset, deduct sale of asset during the year. Deduct deprecia-

tion.

(v) Add surplus with and deduct deficit from opening Capital Fund. You get Clos-

ing Capital Fund.

(vi) Make other adjustments as asked for.

llustration .

Special Points : (a) Preparation of Income & Expenditure Account and calculation of Closing

Capital Fund; (b) Loss on Sale of Asset; (c) Donation to a Specific Fund.

152 FINANCIAL ACCOUNTING

The following is the Receipts and Payments Account of a Club for the year ended 31st Decem-

ber. 1995 Receipts Cash in hand (1.1.95) Rs. 1,000; Cash at Bank (1.1.95) Rs. 4.000; Donation for

Building

Rs. 10.000; Sate of Furniture (Balance on 1.1.95 Rs. 100) Rs. 80; Sale of Newspapers Rs. 200;

Subscriptions Rs. 20,000.

Payments : Sports Materials Rs. 2.500; Salaries Rs. 3,250; Furniture Rs. 1.600: Newspapers Rs.

500:

Building Fund Investment Rs. 10.000; Tournament Expenses Rs. 11.000; Postage Rs. 200; Cash

in hand (closing balance) Rs. 1.030: Cash at Bank (Closing Balance) Rs. 5.200.

The following adjustments are to be made

6) Of the Subscriptions collected Rs. 2,000 was outstanding for 1994; (ii) on 1.1.95 Stock of

Raw Materials was Rs. 500 and 1.1.96 it. was Rs. 700.

Prepare the Income and Expenditure Account for the year ended 31st December. 1995 and

show the Capital Fund of the Club as on that date.

Solution:

Dr . Income & Expenditure Account for the year ended 31.12.1995 Cr.

Expenditure Amount Amount Income Amount Amount

Rs. Rs. Rs. Rs.

To Salaries 3,250 By Subscription 20,000

,, Purchase of Newspapers 500 Less :Received

for last year 2,000 18,000

,, Tournament Expenses 11,000 By Safe of old

Newspapers 200

,, Postage 200

,, Use of Sports Materials

Opening Stock 500

Add: Purchase 2500

3,000

Less : Closing Stock 700 2,300

,,Loss on Sale of Furniture

[100 80] 20

,,Surplus (Excess of Income

over Expenditure) 930

18200 18,200

FINANCIAL ACCOUNTING 153

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Statement Showing Capital Fund as on 31.12.95

Amount Amount

Rs. Rs.

Assets as on 1.1.95

Cash in hand 1,000

Cash at Bank 4,000

Furniture 100

Sports Materials Subscriptions 500

Outstanding for 1994 2000 7,600

Less : Liabilities on 1.1.95 Nil

Capital Fund on 1.1.95 7600

Add : Surplus for the year

ended on 31.12.95 930

Capital Fund on 31.12.95 8,530

Notes

Donation Received for Building should be credited to Building Fund Account

(b) Both opening and dosing stocks of Sports Materials as given. So the use or consumption of

sports materials during the year has been debited to I & E Ac.

(c) Preparation of Income & Expenditure Account from Relevant Information

Illustration. The Comrades Club makes up its accounts to 31st December in each year. On 31st

December. 1995 the cashier of the club absconded leaving behind no information or cash. An

examination of the records showed that the books had not been written up for a considerable

time and it was decided to reconstruct the figures from 1.1.1995.

A summary of the Bank Account for the year showed that

Amt. Rs. Amt. Rs.

Balance on 1.1.1995 420 Rent & Rates 460

Bank Deposits 42,610 Insurance 40

Light & Heat 156

Bar Purchases 35,067

Telephone 59

Cash Withdrawn 5,848

Balance as on31.12.95 1,400

43,030 43,030

154 FINANCIAL ACCOUNTING

The following information is also obtained

I. The barman places takings in the bank night safe on his way home for crediting to the club

account. The duplicate paying-in-slips totaled Rs. 40,610 for the year. The treasurer had

no access to bar takings.

2. The receipt counterfoils for members subscriptions totaled Rs. 3,050 for the year.

3. A summary of expenditure for petty cash and wages revealed Glasses, crockery main

tenance Rs. 1,310; WagesRs. 2,650; Sundry ExpensesRs. 475

4. Outstanding or Prepaid Amounts were

31.12.94 31.12.95

Prepaid Rates Rs. 26 Rs. 28

Outstanding Expenses Rs. 64 Rs. 100

The Bar Stock on 1.1.1995 was Rs. 3,607 and 31.12.95 Rs. 2,916. Opening Cash with the Cashier

at the beginning of the year 1995 was Rs. 35 only.

Prepare an Income & Expenditure Account of the club for the year ended 31.12.1995.

Working Notes:

1. Cash Defalcation by Cashier

Dr. Cash Account Cr.

Particulars Amount Particulars Amount

Rs. Rs.

To Balance b/f 35 By Bank [Difference in 2,000

Subscriptions 3,050 deposited amount 42,610

Bank (Withdrawals from Bank) 5,848 40,610)

Glasses, Crockery etc. 1,310

Wages 2,650

SundryExpenses 475

Defalcation of 2,498

Cash (Balance Figure)

8,933 8,933

FINANCIAL ACCOUNTING 155

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Rent & Rates

Rs.

Paid from Bank 460

+ Prepaid of last year 26

486

Prepaid Rates of current year 28

458

Profit from Bar Rs.

Bar Sales (Deposited by Barman] 40,610

+ Closing Bar Stock 2,916

43,526

Opening Stock 3,607

39,919

Purchases 35,067

4,852

Solution

Comrades Club

Dr. Income and Expenditure Account for the year ended 31.12.1995 Cr.

Particulars Amount Amount Particulars Amount Amount

Rs. Rs. Rs. Rs..

To Rent & Rates [Note 2] 458 By Subscriptions 3,050

Insurance 40 Profit from Bar 4,852

Light & Heat 156

Telephone Charges 59

Glass and Crockery 1,310

Maintenance

Wages 2,650

Sundry Expenses 475

Add Outstanding for 95 100

575

Less : Outstanding for 94 64 511

Defalcation of Cash 2,498

Surplus (Excess of Income 220

over expenditure)

7,902 7,902

156 FINANCIAL ACCOUNTING

Illustration

(a) Preparation of Receipts & Payments Account and Balance Sheet from Income &

Expenditure Account and other information; (b) Opening Cash balance not given

The Income & Expenditure Account of Delight Club for the year 1995 was as follows

Particulars Amt. Rs. Particulars Amt. Rs.

To Salaries 47,500 By Subscriptions 75,000

General Expenses 5,000 Entrance Fees 2,500

Audit Fees 2,500 Contribution for

Annual Dinner 10,000

Secretarys Honorarium 10,000 Profit on Annual Sports 7,500

Printing & Stationery. 4,500

Annual Dinner Expenses 15000

Interest and Bank Charges 1,500

Depreciation on Sports

Equipments 3,000

Surplus 6,000

95,000 95,000

The account had been prepared after the following adjustments : Subscriptions outstanding at

the end of 1994Rs. 6,000; Subscriptions received in advance on 31.12.1994Rs. 4.500; Sub-

scriptions received in advance on 31.12.1995Rs. 2,700; Subscriptions outstanding on

31.12.1995Rs. 7.500

Salaries outstanding at the beginning of 95 and at the end of 95 were respectively Rs. 4,000

and Rs. 4,500. General expenses include insurance prepaid to the tune of Rs. 600. Audit Fee for

1995 is as yet unpaid. During 1995 Audit Fees for 1994 amounting to Rs. 2,000 was paid.

The club owned a football ground valued at Rs. 1,00,000. It had Sports Equipments of Rs.

26,000 on 1.1.1995. On 31.12.1995 such Sports Equipments after depreciation amounted to Rs.

27,000. In 1994 the club raised a bank loan of Rs. 20,000 which remained outstanding through-

out 1995. On 31st December, 1995 Cash in hand amounted to Rs. 16,000.

Prepare the Receipts & Payments Account for 1995 and a Balance Sheet as on 31.12.1995.

Working Notes : [Unlike the previous illustrations, here accounts are being shown to find out

missing figures]

FINANCIAL ACCOUNTING 157

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Subscription Received in Cash In 1995

Dr. Subscription Account Cr

Particulars Amount Particulars Amount

Rs Rs.

To Balance b/f (0/S on 1.1.95) 6,000 Balance c/f (OIS on 31.12.95) 4,500

Subscription Recd. in Advance 2,700 Cash (Balance Figure) 71,700

Income & Expenditure A/c (given) 75,000 Balance c/f (OIS on 31.12.95 7,500

83,700 83,700

Purchase of Sports Equipment

Dr. Sports Equipments Account Cr.

Particulars Amount Particulars Amount

Rs. Rs

To Balance b/f 26,000 By Depreciation 3,000

Cash (Purchases Balance Figure) 4000 Balance c/f 27,000

30,000 30,000

Salaries Paid by Cash

Dr. Salary Account Cr.

Particulars Amount Particulars Amount

Rs. Rs.

To Cash (Paid = Balance Figure) 47,000 By Balance b/f

(0/S on 1.1.95) 4,000

Balance c/f (0/S on 31.12.95) 4,500 Income & Expenditure

A/c (given) 47,500

51,500 51,500

158 FINANCIAL ACCOUNTING

Capital Fund on 1.1.1995

Balance Sheet as on 1.1.1995

Liabilities Amount Assets Amount

Rs. Rs.

Outstanding Audit Fees 2,000 Cash in hand 13,900

Outstanding Salaries 4,000 (Balance Figure of R & P A/c]

Subscription Received in Adv. 4,500 Outstanding Subscription 6,000

Bank Loan 20,000 Sports Equipments 26,000

Capital Fund (Excess of Football Ground 1,00,000

Assets over Liabilities) 1,15,400

1,45,900 1,45,900

Solution

Delight Club

Dr. Receipts & Payments Account for the year ended 31.12.1995 Cr.

Receipts Amount Payments Amount

Rs. Rs.

To Balance b/f (Bal. figure) 13,900 By Salaries [Note 3] 47,000

Subscription (Note 1] 71,700 General Expenses (5,000 + 600) 5,600

Entrance Fees 2,500 Audit Fees (1994) 2,000

Contribution to Annual 10,000 Sports Equipments 4,000

Dinner Secretarys Honorarium 10,000

Profit on Annual Sports 7,500 Printing & Stationery 4,500

Annual Dinner Expenses 15,000

Interest and Bank Charges 1,500

Balance c/f 16,000

1,05,600 1,05,600

FINANCIAL ACCOUNTING 159

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Balance Sheet as on 31.12.1995

Liabilities Amount Amount Assets Amount Amount

Rs. Rs. Rs. Rs.

Outstanding Salaries 4,500 Cash in hand 16,000

Outstanding Audit Fees 2,500 Insurance Paid in Adv. 600

Prereceived Subscription 2,700 Accrued Subscription 7500

Bank Loan 20,000 Sports Equipment 26000

Accumulated Fund : Add : Purchase 4000

Opening Balance 1,15,400 30,000

Add: Surplus 6,000 121400 Less : Depreciation 3000 27000

Football Ground 100000

151100 151100

Ilustration

Preparation of Receipts & Payments Accounts and Preparation of Income & Expenditure Ac-

count.

The accountant of City Club gave the following information about the receipts and payments

of the club for the year ended 31st March, 1994.

Receipts Rs. Payments Rs.

Subscriptions 62,130 Premises 30,000

Fair Receipts 7,200 Rent 2,400

Variety show Receipts (net) 12,810 Rates and Stationery 3,780

Interest 690 Printing & Stationery 1,410

Bar Collections 22,350 Sundry Expenses 5,350

Wages 2,520

Fair Expenses 7,170

Honorarium to Secretary 11,000

Bar Purchases (Payment) 17,310

Repairs 960

New Car (less proceeds of old car) 37,800

160 FINANCIAL ACCOUNTING

The following additional information could be obtained :

1.4.93 (Rs.) 31.3.94 (Rs.)

Cash in hand 450 nil

Bank Balance as per Cash Book 24,420 10,350

Cheque issued for Sundry Expenses not presented 270 90

to the bank (entry has been duly made in the Cash

book)

Subscriptions Due 3,600 2,940

Premises at cost 87,000 117,000

Provision for Depreciation on Premises 56,400

Car at cost 36,570 46,800

Accumulated Depreciation on Car 30,870

Bar Stock 2,130 2,610

Creditors for Bar Purchases 1,770 1,290

Annual Honorarium to Secretary is Rs. 12,000 Depreciation on Premises is to be provided at

5% on written down value. Depreciation on new car is to be provided at 20%.

You are required to prepare Receipts and Payments Account and Income and Expenditure

Account for the year ended 31.3.94.

Working Notes :

1.Particulars of Car :

Rs.

New Car

Net Amount 37,800

Add : Sale proceeds of Old Car 9,000

Actual Cost 46,800

Less : Depreciation @ 20% 9,360

37,440

Old Car

Sale proceeds 9000

Less: Written Down Value : Cost -

Provision for Depreciation or,

[36,570 30,870] 5700

Profit on Sale 3300

FINANCIAL ACCOUNTING 161

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Cheques issued for Sundry Expenses not presented to the Bank need not be considered as

Bank Balance as per Cash Book is given and the entry for the expenses have been duly made in

the Cash Book.

Solution :

City Club

Receipts and Payments Account for the year ended 31 March, 1994

Dr. Cr.

Receipts Amount Payments Amount

Rs. Rs.

ToBalance b/f : By Premises 30000

Cash on hand 450 Rent 2400

Cash at Bank 24420 Rates & Taxes 3780

Subscriptions 62130 Printing & Stationery 1410

Sundry Expenses 5350

Fair Receipts 7200 Wages 2520

Variety Show Receipts (Net) 12810 Fair Expenses 7170

Interest 690 Honorarium to Secretary 11000

Bar Collections 22350 Payments for Bar Purchases 17310

Sale Proceeds of Old Car 9000 Repairs 960

Cost of New Car 46800

Balance c/f : Cash at Bank 10350

139050 139050

162 FINANCIAL ACCOUNTING

City Club

Income and Expenditure Account for the year ended 31 March, 1994

Dr. Cr

Expenditure Amount Amount Income Amount Amount

Rs. Rs. Rs. Rs.

To Rent 2400 By Subscription 62130

Rates & Taxes 3780 Add: Amount Due

On 31.3.94. 2940

Printing & Stationery 1410 65070

Wages 2520 Less: Amount Due

Honorarium to Secy. 11000 On 31.3.93 3600 61470

Add: O/S on 31.3.94 1000 12000 Profit on Sale of

Sundry Expenses 5350 Old Car [Note 1] 3300

Repairs 960 Profit from Bar

Depreciation : [Note 2] 6000

On Car [Note 1] 9360 Variety Show

On Premises

[5% of 60600] 3030 12390 Receipts (net) 12810

Income from Fair :

Surplus (Excess of Receipts 7200

Incomes over Less : Expenses 7170 30

Expenditure, transfer 43490 Interest 690

to Capital Fund)

84300 84300

Ilustration

Chanditala Audit Education Society submits to you the following Receipts & Payments Ac-

count and Income & Expenditure Account for the year ended 31st March, 1996.

FINANCIAL ACCOUNTING 163

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Receipts and Payments Account (1995-96)

Dr. Cr.

Receipts Amt. Rs Payments Amt. Rs.

To Balance b/d 450 By Printing Charges 75

Interest : 1994-95 100 Advertisement 141

1995-96 150 250 Salary to staff 1300

Tuition Fees : (including payment

1995-96 1000 for 1994 -95)

1996-97 100 1100 Rent 520

Entrance Fees : Miscellaneous Expenses 110

1995-96 420 Furniture Purchased 670

Membership Fees : Balance c/d 1374

1994-95 300

1995-96 1150

1996-97 390 1840

Miscellaneous

Income 130

4190 4190

Income and Expenditure Account (1995-96)

Expenditure Rs. Income Rs.

To Printing Charges 80 By Tuition Fees 1100

Advertisement 150 Membership Fees 1150

Rent 600 Miscellaneous Income 130

Salary to Staff 1200 Interest 160

Miscellaneous Expenses 110

Excess of Income over

Expenditure 400

2540 2540

164 FINANCIAL ACCOUNTING

You are asked to prepare the Balance Sheet of the Society as on 31st March , 1995 and 31st

March , 1996 :

Additional information :

The Society has the following assets on 31st March , 1995 :

Investment Rs. 4000; Furniture Rs. 2000; Liability Rs. 1500.

Working Note :

A. For the Balance Sheet as on 31.3.1995

i) Salary to staff

Rs.

Payment as per R & P A/c (including payment for 1995-96) 1300

Less: Payment for 1995-96 as per Income & Expenditure A/c 1200

Outstanding on 31.3.1995 100

ii) Membership Fees of 1994-95 received in 1995-96 Rs. 300

Membership Fees Receivable (or due to be received) on 31.3.1995 = Rs. 300

iii) Interest Rs. 100 for 1994-95 received in 1995-96

Outstanding interest Receivable Rs. 100

B. For the Balance Sheet as on 31.3.1996

i) Outstanding/prepaid Expenses

Amount payable Amount paid Prepaid Outstanding to

as Per I & E A/c as Per R & P A/c be paid

Rs. Rs. Rs. Rs.

Printing Charges 80 75 5

Advertisement 150 141 9

Rent 600 520 80

FINANCIAL ACCOUNTING 165

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

ii) Outstanding/prepaid income

Amount payable Amount paid Prepaid Outstanding to

as Per I & E A/c as Per R & P A/c be paid

Rs. Rs. Rs. Rs.

Tuition Fees 1100 1000 100

100 (96-97) 100

Membership Fees 1150 1150

390 (96-97) 390

Interest 160 150 10

iii) Entrance Fees Rs. 420 recorded in R & P A/c but not in I & E A/c Entrance Fees

Capitalised Rs. 420

Solution :

Chanditala Audit Education Society

Balance Sheet as on 31.3.1995

Liabilities Amount Assets Amount

Rs. Rs.

Capital Fund 8250 Furniture 2000

(Excess of Assets over Liabi.) Investments 4000

Outstanding Salary 100 Library Books 1500

Interest Receivable 100

Membership Fees Receivable 300

Cash 450

8350 8350

166 FINANCIAL ACCOUNTING

Balance Sheet as on 31.3.1995

Liabilities Amount Amount Assets Amount Amount

Rs. Rs. Rs. Rs.

Capital Fund 8250 Furniture 2000

Add : Surplus 400 Add : Purchase 670 2670

Entrance Fees

Capitalised 420 9070 Investments 4000

Incomes Received in Library Books 1500

Advance :

Tuition 100 Interest Receivable 10

Membership Fees 390 490 Tuition Fees

Receivable 100

Outstanding

Liabilities for Cash 1374

Printing Charges 5

Advertisement 9

Rent 80 94

9654 9654

Ilustration

Preparation of R & P A/c, I & E A/c and Balance Sheet for the initial/starting year of a club

from information given.

The following information were obtained from the books of Delhi Club as on 31.3.1998 at the

end of the first year of the club. You are required to prepare Receipts and Payments Account,

Income and Expenditure Account for the year ended 31.3.1998 and a Balance Sheet as at31.3.1998

on mercantile basis :

i) Donations received for Building and Library Room Rs. 200000.

ii) Other revenue income and actual receipts :

FINANCIAL ACCOUNTING 167

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Revenue Income Actual Receipts

Rs. Rs.

Entrance Fees 17000 17000

Subscription 20000 19000

Locker Rents 600 600

Sundry Income 1600 16000

Refreshment Account 16000

iii) Other revenue expenditure and actual payments :

Revenue Expenditure Actual Payments

Rs. Rs.

Land (Cost Rs. 10000) 10000

Furniture (Cost Rs. 146000) 130000

Salaries 5000 4800

Maintenance of Playgrounds 2000 1000

Rent 8000 8000

Refreshment Account 8000

Donation to the extent of Rs. 25000 were utilised for the purchase of Liabrary Books, balance

was still utilised. In order to keep it safe, 9% Govt. Bonds of Rs. 160000 were purchased on

31.3.1998. Remaining amount was put in the Bank on 31.3.1998 under the term deposit. Depre-

ciation at 10% p.a. was to be provided for the whole year on Furniture and Library Books.

Please Note That

1. This is the first year. The Club has no Capital Fund at the beginning.

2. Donation must be capitalized as it has been made towards Building and Library

Room.

3. The Investments in 9% Govt. Bonds have been made on the closing day of the year.

So no interest has accrued.

4. The cost of Furniture purchased is 146000 whereas payments made are Rs. 13000. It

means Credit Purchase is Rs. 16000.

168 FINANCIAL ACCOUNTING

Solution :

Delhi Club

Receipts and Payments Account for the year ended 31 March, 1998

Dr. Cr.

Receipts Amount Payments Amount

Rs. Rs.

To Donations for Building By Land 10000

and Library Room 200000 Furniture 130000

Entrance Fees 17000 Salaries 4800

Subscription 19000 Maintenance of

Playgrounds 1000

Locker Rents 600 Rent 8000

Sundry Incomes 1060 Payments for Refreshments 8000

Receipts from

Refreshment Library Books 25000

Account 16000 9% Govt. Bonds 160000

Balance c/f :

Overdraft 108140 Term Deposit with Bank 15000

361800 361800

FINANCIAL ACCOUNTING 169

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Income and Expenditure Account for the year ended 31 March, 1998

Dr. Cr

Expenditure Amount Amount Income Amount Amount

Rs. Rs. Rs. Rs.

To Salaries 4800 By Entrance Fees 17000

Add:- Outstanding 200 5000 Less:- Capitalised 17000

Maintenance of

Playground 1000 Locker Rent 600

Add:- Outstanding 1000 2000

Rent 8000 Sundry Incomes 1060

Add: Outstanding 540 1600

Depreciation on:- Income from

Refreshment:

Furniture @ 10%p.a. 14600 Receits 16000

Library Books@10%p.a 2500 17100 Less:- Payment 8000 8000

Surplus (Excess of Subcriptions 19000

Income over Add: Outstanding

Expenditure) 15100 On 31.3.94. 1000 20000

47200 47200

170 FINANCIAL ACCOUNTING

Balance Sheet as on 31.3.1998

Liabilities Amount Amount Assets Amount Amount

Rs. Rs. Rs. Rs.

Capital Fund Land 10000

Opening Balance Nil Furniture 146000

Add : Surplus 15100 15100 Less:Depreciation 14600 131400

Building &

Library Fund 200000 Library Books 25000

Creditors for Furniture 16000 Less:- Depreciation 2500 22500

Creditors for Term Deposit

Liabilities for: with Bank 15000

Salaries 200 9% Govt. Bonds

(Investment) 160000

Maintenance of Outstanding

Playground 1000 Income for :

Bank Overdraft 108140 Subscription 1000

Sundry Income 540 1540

340440 340440

EXERCISE

Problem I.

Preparation of only Income and Expenditure Account

A summary of receipts and payments of Agragami Club for one year is given below (year

ended 31st March, 1991)

FINANCIAL ACCOUNTING 171

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Receipts Rs. Payments Rs.

To Opening Balance 3,000 By Salaries & Rent 1,500

Subscription 20,000 Electric Charges 300

Donations 5,000 Sports Expenses 1,000

Entrance Fees 1,000 Sports goods purchase 9,000

Interest 100 Books purchase 5,000

Charity show Receipts 2,400 Miscellaneous Expenses 700

Charity show Expenses 2,000

Investment 8,000

Closing balance 4,000

31,500 31 500

Following information are available at the end of the year :

(i) Of the total subscriptions received Rs. 500 for 198990 and Rs. 600 for 1991-92 but

Rs. 100 is due for 1990-91.

(ii) The total sum received on Entrance fees is to be transferred to Capital Fund.

(iii) Salary is remaining due to be paid Rs. 300.

(iv) Interest is receivable Rs. 500.

The club had the following assets on the opening day of the year Sports goods Rs. 3,000; Books

Rs. 2,000; Investment Rs. 6,000.

From the above information prepare an Income and Expenditure Account for the year

(1990-91)

(Ans & Hints : Surplus Rs. 21,200

(a) Donations have been treated as revenue receipts as these have not been made to

any special fund,

(b) Sports goods Purchases, Investment and Books Purchases are to be treated as

Capital Expenditure]

172 FINANCIAL ACCOUNTING

Problem 2.

Preparation of income & Expenditure Account and Balance Sheet

Following is the Receipts and Payments Account of a club for the year ended 31st March, 1996

Receipts Rs. Payments Rs.

Cash in hand 50 Salaries 2,400

Cash at Bank 565 Rent 720

Subscription Postage 30

(including Rs. 100 for 94-95 Printing & Stationery 255

and Rs. 150 for 96-97) 4,550 Electricity charges 300

Interest on Investments 2,000 Meeting Expenses 150

Bank Interest 25 Purchase of library books 1,000

Sale of Furniture 300 Investment in bonds 1,000

Cash in hand 155

Cash at Bank 1,480

7,490 7,490

The following additional information is supplied to you

1. On 1st April. 1995 the club had the following assets and liabilities : (a) Invest

ments costing Rs. 40,000; (b) Furniture Rs. 3,000; (C) Library Books Rs. 5,000;

(d) Liability for rent Rs. 60 and Salary Rs. 200.

2. On 31st March, 1996 rent Rs. 60 and Salary Rs. 200 were in arrear.

3. The book value of furniture sold was Rs. 250.

Prepare the Income & Expenditure Account of the Club for the year ended 31st March, 1996

and the Balance Sheet as at that date.

(Ans: SurplusRs.2,520; Total of Balance Sheet on 31.3.96. Rs. 51,385]

Problem 3.

The following particulars relate to International Club for the year ended 31.12.95. You are

required to prepare therefrom an Income and Expenditure Account for the year and a Balance

Sheet as on 31.12.95.

FINANCIAL ACCOUNTING 173

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Summary of Cash Book

Rs.. Rs.

Balance from last year 2,350 Salaries 1200

Entrance Fees 300 Electricity 120

Subscription Newspapers and Journals 525

1994 50 Fixed deposits 2,500

1995 3,500 Utensils 200

1996 75 3,625 Payment to creditors 1,000

Profit from Refreshment 100 Balance carried forward 1,150

to next year

Locker Rents 200

Sundry Income 120

6,695 6,695

The assets and liabilities on 1st January 1995 were Utensils. Rs. 800 Furniture Rs~ 2.500:Con-

sumable stores Rs, 350 and Creditors Rs. 1,200.

On 31 .12.95 value of consumable stores was Rs. 700; creditors amounted to Rs. 550: the

subscriptions outstanding were Rs. 75 and the interest accrued on fixed deposit was Rs, 25.

(Ans: Surplus 2,475 (after crediting entrance fees); Capital Fund on 1.1.95 Rs. 4,850; Total of

Balance Sheet on 31.12.95 As. 7,950)

Problem 4.

Calculation of Medicine purchase and calculation of depreciation from balances of asset ac-

counts.

From the following particulars related to Vcnkataswamy Charitable Hospital, prepare an

Income and Expenditure Account for the year ended 31st December, 1995 and a Balance

Sheet on that date.

174 FINANCIAL ACCOUNTING

Receipts Rs. Payments Rs.

Balance in hand on 1.1.95 7,130 Payments for Medicines 30,590

Subscriptions 48,000 Honorarium to Medical staff 9,000

Donations 14,500 Salaries to House Staff 27,500

Interest on Investment @ 7% 7,000 Petty Expenses 460

Proceeds from Annual Day 10,450 Equipment Purchase 15,000

Expenses for Annual Day 751

Closing Balance 3,779

87,080 87,080

Additional information :

On 31.12.94 (Rs.) On 3L12.95 (Rs.)

Subscription Due 240 280

Subscription Received in Advance 64 100

Stock of Medicines 8,810 9,740

Value of equipment 21,200 31,600

Buildings 40,000 38,000

Outstanding liability to Medicine suppliers 10,000 8,000

(Ans: Surplus Rs. 7,983; Capital Fund on 1.1.95 Rs. 1,67,316; Total o( Balance Sheet on 31.12.95

Rs, 1,83,399)

(Hints : This problem has a close similarity with Illustration No. 4.)

(a) Calculate medicine purchased. Then calculate medicine used. It is Rs. 27,660.

(b) Calculate depreciation on Equipment and Buildings :

Depreciation Op. Balance + Purchase - Closing Balance

Depreciation on Equipment Rs. 4,600 and on Buildings Rs. 2.000

(C) Calculate Capital Fund on 1.1.95)

FINANCIAL ACCOUNTING 175

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Problem 5.

D Literary Society showed the following position on 31st December. 1995 Balance Sheet as at

31st December, 1994

Liabilities Rs. Assets Rs.

Capital Fund 79,300 Electrical Fittings 15,000

Outstanding Expenses 700 Furniture 5,000

Books 40,000

Investment in

Securities 15,000

Cash at Bank 2,500

Cash in hand 2, 500

80,000 80,000

Receipts and Payments Account for the year ending on 31st December, 1995

Receipts Rs. Payments Rs.

To Balance b/d By Electric Charges 720

Cash at Bank 2,500 Postage & Stationery 500

Cash in hand 2,500 Telephone charges 500

Entrance Fees 3,000 Books Purchased (1.1.95) 6,000

Membership Subscriptions 20,000 Outstanding Expenses 700

Sale proceeds of Old Rent Account 8,800

Newspapers 150 Investment in Securities

Hire of lecture Hall 2,000 (1.7.95) 4,000

Interest on Securities 800 Salaries A/c 6,600

Balance c/d : Cash at Bank 2,000

Cash in hand 1,130

30,950 30,950

You are required to prepare an Income & Expenditure Account for the year ending on

31.12.1995 and a Balance Sheet on that date after incorporating the following adjustments

176 FINANCIAL ACCOUNTING

(i) Membership subscriptions included Rs. 1.000 received in advance.

(ii) Provide for outstanding Rent Rs. 400 and Salaries Rs. 300.

(iii) Books to be depreciated @ 10% including additions. Electrical Fittings and

Furniture are also to be depreciated at the same rate.

(iv) 75% of the Entrance Fees are to be capitalised.

(v) Interest on Securities to be calculated at 5% p.a.

[Ans: Deficit Rs. 1670; Total ol Balance Sheet an 31.12.95 As. 81,580]

Hints (I) Outstanding Expenses paid for last year wit not appear In I & E A/cJ

Problem 6.

Partly Trading and Partly Non-Trading Concern

On 1.4.95 the financial position of Babu Sangshad. a cultural club was as follows

Liabilities Rs. Assets Rs.

Capital Fund 4.200 Equipments 1,640

Creditor for expenses 160 Furniture 1,160

Bar Stock 880

Outstanding Subscription

for 94.95 240

Cash. 440

4,360 4,360

Its Receipts and Payments for the year ended 31st March, 1996 were

Receipts Rs. Payment Rs.

Opening Balance 440 Creditors for expenses for 94-95 160

Subscriptions : General Expenses 9,240

1994-95 . 160 Printing & Postage 600

1995-96 8,160 Equipments Purchases (31.3.96) 640

1996-97 120 Lighting & Rent 1,080

Bar Sales 10,240 Purchase of Bar goods 5,840

Receipts from Annual Day 800 Annual Day Expenses 1,280

Closing Balance (31.3.96) 1,080

19,920 19,920

FINANCIAL ACCOUNTING 177

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Addilional Information : (a) Rs. 264 is yet to be received as subsription for 1995-96; (b) Bar

Stock on 3 1.3.96 Rs. 840; Furniture to be written down by Rs. 100; (c) Depreciation on Equip-

ments to be provided at 25% pa.

Prepare the Bar Trading Account and Income and Expenditure Account for the year ended

31.3.1996 and a Balance Sheet on that date.

[Ans: Surplus Rs. 874; Total Balance Sheet As. 5,194]

[Hints:(a)Subscription for 94-9 5 still outstanding on 31.3.96 Rs.240 - RS.16O=RS.80]

Problem 7.

From the following particulars relating to S. M. Charitable Hospital. prepare Income & Expen-

diture

Account for the year ended 31st December, 1995 and a Balance Sheet on that date.

Dr. Receips & Payments Account for the year endEd 31st December, 1995 Cr.

Receipts Rs. Payments Rs.

To Balance b/d 7,130 By Medicines 30,590

Subscriptions 47,996 Doctors Honorarium 9,000

Donations 14,500 Salaries 27,500

Interest on Investments 7,000 Petty Expenses 461

(@ 7% for full year) Equipment 15,000

Proceeds from Charity Show 10,450 Expenses on Charity Show 750

Balance c/d 3,775

87,076 87,076

Additional Information

1.1.95 (Rs.) 31.12.95 (Rs.)

(i) Subscriptions due 240 280

(ii) Subscriptions received in advance 64100

(iii) Stock of Medicines 8,810 9.740

(iv) Estimated Value of Equipments 2 1.200 31,600

(v) Buildings (cost less depreciation) 40,000 38,000

(Ans : N Donation sc fully Capitalized, Deficit Ra 8,521; Depreciation on Equipment 4,600)

178 FINANCIAL ACCOUNTING

Problem. 8.

Correction of Receipts & Payments Account before preparation of Income & Expenditure Ac-

count etc.

The Receipts & Payments Account of your local club could not be correctly drawn because of

the following additional information :

The Club had on 1.1.1995 : Furniture Rs. 200; 6% Investments Rs. 3.000; Sports Materials Rs.

740.

On 3 1.12.95 the club had Outstanding Subscription Rs. 30. Subscription paid in advance Rs.

10.

Stock of Sports materials Rs. 200. The Interest on Investment for the year remained due.

Rectify the following Receipts & Payments Account for the year ended 31.12.95. Draw the

Income & Expenditure Account for the year ended 31.12.95 and a Balance Sheet as on that date.

Dr. Receipts & Payments Account for the year ended 31st December, 1995 Cr.

Receipts Rs. Payments Rs.

To Balance b/d 50 By Expenses [including payment 700

Subscriptions 510 for sports materials Rs. 300]

Add: Outstanding 20 Loss on Sale of Furniture 20

530 (Cost Price Rs. 50)

Less: Pre-Received 10

last year 520 Balance c/d 10,050

Other Fees 200

Donations for Building 10,000

10,770 10,770

Assume that there is no error in cash balances and that no depreciation is to be charged on

fixed assets.

(Ans: Total of Redrafted Receipts & Payrnents Account Ra 10,750; Surplus Rs 370 Balance

Sheet Total Rs. 13,640; Opening Capital Fund Rs. 4,000]

Problem 9.

The following is the Receipts & Payments Account for Tamil Mandalam for the year ended

31st March 1996 :

FINANCIAL ACCOUNTING 179

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Receipts Rs. Payments Rs.

To Cash at Bank 12,500 By Salaries 2,500

Subscriptions 52,500 Printing & Stationery 1,250

To Annual Day Receipts 26,800 By Annual Day Expenses 1,500

Symposium Receipts 22,500 Symposium Expenses 10,000

Dividends on Shares 2,500 Telephone Charge 2,500

Sundry Expenses 2,000

Shares Purchased 75,000

Postage & Telegrams 2.200

Building Maintenance 6,340

Cash at Bank 13,510

1,16,800 1,16,800

Following further information isfurnished :

1. The value of Building owned bythe society stood at Rs. 50.000 on 1st April. 1995.Depre-

ciation @ 5% p.a. is to be provided.

2. There were 200 members paying subscription @ Rs. 250 per annum each.

3. As on 1st April, 1995 no subscription had been received in advance but sub scriptions

were outstanding to the extent of Rs. 1000. As at 31st March, 1996 Subscriptions outstand-

ing were Rs. 1,500.

4. Postage stamps worth Rs. 250 were with the secretary at the beginning of the year and the

stamps at the end of the year were of the value of Rs. 150.

5. The Investment in shares at the beginning of the year were to the extent of Rs. 5.000.

6. An amount of Rs. 250 in respect of the Annual Day Receipts was yet to be received.

7. Hire of telephone paid in advance Rs. 300.

8. Outstanding amount of symposium receipts on 31.3.1996 Rs. 2,500. Prepare the Income &

Expenditure Account for the year ended 31st March, 1996 and the Balance Sheet as on

that date.

[Ans: Excess of Income Over Expenditure Rs, 68.960)

180 FINANCIAL ACCOUNTING

(Hints : Total of Balance Sheet on 31.3.96 As. 1,43210; Opening Capital/Accumulated Fund

As. ~8,750; Subscriptions Recd in Advance = 53,000 200 x 250 = As. 3.000.; Profit on

Symposium 22,500 10,000 2.500 (o/s rent) As. 10,000)

Problem 10.

Dr. Following Receips & Payments Account of Calcutta Club for the year ended 31st March

1996 Cr.

Receipts Rs. Payments Rs.

To Balance b/f By Secretarys Remuneration 6,000

Cash 2,000 Salary to Staff 5,000

Bank 10,000 Canteen Expenses 12,000

Subscriptions : Construction of Buildings 15,000

For 1994-95 200 Balance c/f:

For 1995-96 5,000 Cash 800

For 1996-97 100 5,300 Bank 2,000

Interest @ 5% on Govt.

Securities 2,000

(Bought in the past at

1% discount)

Sale of Old Furniture 1,000

Sale of New papers 500

Canteen Receipts 10,000

Donation to Building Fund 10,000

40,800 40,800

From the additional information given below, prepare the Income & Expenditure Account

for the year ended 31st March, 1996 and a Balance Sheet on that date

FINANCIAL ACCOUNTING 181

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Balance on 313.95 Balance on 31.3.96

Rs. Rs

(a) Subscriptions Receivable 1,000 ?

(b) Subscriptions Received in Advance 200 100

(c) Outstanding Staff Salary 2,000 1,000

(d) Canteen Expenses Paid in

Advance (Subsidy to canteen) 1,000 500

(e) Furniture 10,000 ?

(f) Construction Expenses

Outstanding - 2,000

(g) Subscription receivable for

95-96 was Rs. 5,500

(h) The book value of furniture sold

was R.s. 3.000

(i) Depreciation to be charged on

furniture @ 10%.

[Ans: Deficit Rs. 7,200, Total of Balance of Balance Sheet on 31.3.96 Rs. 67,300]

(Hints : (I) Value of Govt Securities(ii) Subscnption receivable on 31 .3.96 Rs. Rs.

Total Amount Receivable 5,500

Received for 95-96 5,000

Nominal Value = 2000/0.05

= Rs. 40000 Received for 94-95 200 5,200

Less :1% Discount = 400 Due for 95-96 300

+Due for 94-95 [Rs.1,000 -

Received Rs. 200) 800

At Cost Rs. 39600 Total Due 1,100

Problem 11. The Receipts & Payments Account of Vinod Nursing Society for the year

ended 31st December, 1995 was as follows :

182 FINANCIAL ACCOUNTING

Receipts Rs. Payments Rs.

To Balance at Bank on 1.1.95 : By Salaries 7,150

(a) Deposit on Building Fund 19,000 Medicines 2,100

(b) Current Account 1,260 Rent, Rates & Taxes 900

Members Subscriptions : Electricity 600

Annual 12,900 Telephone, postage etc. 400

Life 5,000 General Expenses 1,700

Fees from Non-Members 1,200 Car Expenses 350

Grants from local Authority 2,500 Cost of Second-hand car 8.860

Donations for Building Fund 5,000 Balance at Bank on 31.12.95

Interest on Deposit on

Building Fund 1,140 (a) Deposit on Building Fund 25,140

(b) Current Account 800

48,000 48,000

Additional Information available

(a) In 1995 the society purchased a plot of Freehold Land costing Rs. 8.000.

(b) Fees from non-members include Rs. 50 as fees received in advance for 1995.

(c) Rent of Rs. 50 for January, 1996 was paid on 15th December. 1995.

(d) Salaries of Rs. 650 for December. 1995 remained due to be paid on 31.12.95.

(e) Members annual subscriptions include Rs: 200 due for 1994.

(f) It is decided to allocate life members subscriptions, arising for the first time in

1995. to revenue over a ten year peiod.

Prepare the Income & Expenditure Account for the year ended December 31, 1995 and a Bal-

ance Sheet as on that date.

[Ans: Suplus Rs. 3050; Total of Balance Sheet Rs. 42,850)

Preparation of Income & Expenditure Account etc. from Trial Balance/Other Information

Problem 12.

From Bank and Cash Summary

The Bank and Cash Summary of Evergreen Club for the year ended 31.12.1995 was as fol-

lows :

FINANCIAL ACCOUNTING 183

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Rs Rs

Balance at Bank on 1.1.95 9,970 Bar Purchases 41,290

Cash in hand on 1.1.95 210 Wages 7,410

Joining Fees 560 Electricity 1,100

Subscriptions 4,120 Rent 2,300

Bar Sales 52,000 Postage & Stationery 750

Receipts from Cricket Festivals 3,100 Ground Expenses 560

Interest on W. B. Govt. Loan 350

Expenses of Cricket

Tournament 1,140

New Mowing Machine 760

General Expenses 1,020

Purchase of Rs.10,000

7% W. B. Govt. Loan 10,000

Cash in hand on 31.12.95 360

Balance at Bank on 31.12.95 3,620

70,310 70,310

Additional Information Provided :

1. Bar Stock valued at cost Rs. 4.260 on 31.12.95 was Rs. 290 higher than the value of stock on

1.1.95.

2. On 31.12.95 outstanding rent was Rs. 350, outstanding electricity Rs. 120 and rates paid in

advance was 210.

On 31.12.94 outstanding rent was Rs. 200, outstanding electricity Rs. 140 and rates paid in

advance Rs. 190.

3. Fixtures & Fittings on 31st December, 1994 amounted to Rs. 5,040. Depreication is to be

provided @ 121/2% p.a.

4. The new Mowing machine purchased on 1st may. 1995 represented the net payment after

taking ml consideration a trade-in-allowance of Rs. 140 on the old machine included Rs.

200 for the old machine. Depreciation on machines and equipments is

to be provided @ 20% p.a.

Prepare an Income & Expenditure Account for the year ended 31st December, 1995 a n d

a Balance Sheet as on that date.

184 FINANCIAL ACCOUNTING

[Ans : Surplus Rs. 3,010; Total of Balance Sheet on 31.12.95 25,080)

[Hints (i) Opening Capital Fund = Rs. 21,040

(ii) Trade-in-allowance denotes the Selling Price of old asset exchanged with the

net asset. So Cost of New Machine = 760 + 140 = Rs. 900, And Selling Price of

old machine = Ra. 140.

The old machine was used for 4 months (1.1.95 to 30.4.95). Its Depreciation

=200 x20/100 x 4/12. =13.

its W.D.Valueon 1.5.95=20013= Rs.187... Loss on sale was Rs.187-Rs.140 = Rs.47.

(iii) DepreciatIon on Machines and Equipments

On sold asset = Rs. 13

On rest of Old assets (2,000 200) x 20/100 = Rs. 360

On new Machine (1.5 to 31.12) 900 x20/100 x 8/12 = Rs. 120

Rs. 493

Problem 13.

Defalcation of Cash

The Managing Committee of Social Club is concerned about the clubs financial position

following It sudden disappearnce of the treasurer on 31st December, 1995, the annual ac-

counting date.

On 31.12.1994 the clubs Balance Sheet had shown the following position

Liabilites Rs. Assets Rs.

Capital Fund 1,20,490 Furniture and Equipment

at cost 60,000

Creditors for Provisions 20,600

Subscription in Advance 1,000 Less : Depreciation 30,000

30,000

Stock of Provisions 25,000

Subscriptions Due 2,000

Balance with Bank 83,000

Cash in hand 2,090

1,42,090 1,42,090

FINANCIAL ACCOUNTING 185

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

You also obtained the following information :

1. Members pay an annual subscription of Rs. 100. An examination of duplicate receipt book

showed that during the year ended 31st December, 1995. 480 members had paid the cur-

rent years subscription; five members had paid off arrears of previous year and ten mem-

bers had paid in advance for 1996. Five members had resigned without pay ing the previ-

ous years subscription and at the end of the year there were 500 members on the register.

2. The Cash Book has not been written up but an analysis of petty cash vouchers for the Year

showed the following expenditure : Purchase of ProvisionsRs. 59.400: SalariesRs.

36.000; Stationery and PostageRs. 2,000; RepairsRs. 3,600; Miscella

neous ExpensesRs. 3.400

3. The Refreshment Room-in-charge had handed over the takings daily to the treasurer with

till rolls which cannot be found. However he states that average gross profit on Sales

would be 40%. The stock of provisions on 31st December, 1995 was Rs. 28,400 and Cash in

hand Rs. 4,360.

4. A summary of Bank Statement for the year showed the following :

Rs. Rs.

Opening Balance 83,000 Payments for Provisions 2,60,000

Deposits 4,15,780 Salary 1,06,500

Rent and Rates 60,000

Light & Power 20,000

Telephone 2,900

Repairs 18,600

Balance on 31.12.95 30,780

4,98,780 4,98,780

5. A bundle of unpaid bills has been found in the treasurers desk, which has been

summarised as follows : Purchase of ProvisionRs. 64.600; Electric BillsRs. 1,600;

Printing & Stationery Rs. 2,100; TelephoneRs. 600

6. Depreciation is to be provided on Furniture and Equipment @ 20% on original cost.

You are required to prepare : (I) Cash Account for the year ended 31st December,

1995; (2) An Income & Expenditure Account for the year ended 31st December, 1995

and (3) A Balance Sheet on that date.

(Ans: (a) Profit front Provisions Sale As. 2,4O.OO (b) Defalcation of Cash As. 1,27,050

(C) Deficit (Excess Expenditure) Rs 1,O685O debiting defalcation of cash as a loss; (d)

Balance Sheet Total Rs 83,540)

186 FINANCIAL ACCOUNTING

Problem 14.

A comprehensive problem

Punnya Trust runs a charitable hospital and a dispensary and for the year ended 31st March.

1996, the following balances were extracted from its books

Dr. (Rs.) Cr. (Rs)

Capital Fund 18,00,000

Donations Received in the yearl 2,00,000

Fees received from patients 6,00,000

Recovery for amenitiesrent etc. 5,50,000

Recovery for food supplies 2,80,000

Surgical Equipments 9,10,000

Buildings, Theatres etc 6,40,000

Consumption of:

Medicines 2,40,000

Food scuffs 1,80,000

Chemicals etc. 60,000

Closing Stock of:

Medicines etc. 40,000

Food Stuffs. 8,000

Chemicals etc. 2,000

Sale of medicines (dispensary) 6,20,000

Opening Stock of medicines (dispensary) 1,10,000

Purchases of medicines (dispensary) 6,00,000

Salaries

Administration Staff 60,000

Doctors, Nurses, Orderlies etc. 3,00,000

Assistants at Dispensary 30,000

Electricity & Power Charges

Hospital 2,10,000

FINANCIAL ACCOUNTING 187

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Dr. (Rs.) Cr. (Rs)

Dispensary 4,000

Furniture, Fittings and Equipments 1,60,000

Ambulance 60,000

Postage, telephone charges etc.

less recovery 52,000

Subscription to Medical Journals 42,000

Ambulance Maintenance Charges

less recoveries 1,600

Consumption of linen, bed sheets etc. 1,80,000

Fixed Deposits (made on 10.8.94) for

3 years at interest of 11% p.a.) 10,00,000

Cash in hand 12,100

Cash at Bank 70,500

Sundry Debtors (Dispensary) 1,21,000

Sundry Creditors (Dispensary) 82,000

Remuneration to trustees and trust

office expenses etc. 42,000

Additional Information

(i) The dispensary supplies medicines to hospitals on requisition and delivery notes for which

no adjustment has been made in the books. Cost of supplies in the year was Rs. 1,20.000.

(ii) Stock of medicines at close at dispensary was Rs. 80,000.

(iii) Stock of medicines on 31st March, 1996 at the hospital included Rs. 8,000 worth of medi-

cines belonging to the patients; this has not been considered in arriving at the figure of

consumption of medicines.

(iv) Donations were received towards the corpus of the trust.

(v) One of the wel-wishers donated Surgery equipment, whose market value was Rs. 80,000

on 15th August, 1995.

(vi) The hospital is to receive a grant of 25% of the amount spent on treatment of poorpatients,

from the local Branch of the Red Cross Society, Such expenditure for the year was

Rs. 1,00,000.

188 FINANCIAL ACCOUNTING

VII) Out of the fees recovered from the patients, 10% is to be given to specialists retained; (viii)

Depreciation on closing balances of assets to be provided as Sur gical Equipments20%;

Buildings 5%; Furniture and Fittings10%; Ambulance30%

Prepare the Income & Expenditure Statement of the dispensary, trust and the hospital for

the year end March, 1996 and statement of affairs of the trust as at that date.

(Ans: Profit from Dispensary As. 76,000; Excess of Expenditure over Income (Deficit) of Hospital

As. 2,67,400; Net Deficit of I? Trust Rs. 175,400; Total of Statement of Affairs Rs. 30.46,600]

[Hints : (a) Net Purchase of Medicines at Dispensary As. 6,00,000 As. 1,20,000 (being

cost of medicines supplied to hospital, = Rs. 4,80,000

(b) Debit Op. Stock As, 1,10,000, Net Purchase As. 480,000, Salaries 10 Assistants As. 30,000,

Electric Charges As. 4,000 And Credit Sales As. 6,20,000 and Closing Stock As. 80,000 to

Dispensary Trading /Pl. Ac. You get Profit As. 76,000.

(C) For Hospital I & E A/c debit Items are consurnption of Medicines (2,40,000 + 8,000 +

1.20,000) As. 3,68,000, Foodstuff Rs. 1,80,000, Chemicals 60.00Cr, Salaries to Doctors etc. &

Administration Staff As. 3,60,000; Fees to specialists Rs. 60,000; Electricity etc. 2,10,000;

Subs. to Medical Journals As. 42,000; Consumption of linen, bedsheets etc. 1,80,000; De-

preciation on Surgical Equipments Rs.1,98,000, on Building As. 32,000, Furniture etc. 16,000,

Ambulance Rs. 18,000.

Credit Items are : Fees from Patients; Recovery of Rent; Recovery for foods, Ambulance

Receipts, grant from Red Cross (25% of 1,00.000).

(d) For Trust I & E Nc debit Deficit From Hospital, Trustees Remuneration etc. and Postage,

Telephone Charges etc. Credit Profit from Dispensary Interest on FixedDeposit. (11% of

10,00,000).

(e) Surgical Equipment 9,10,000 + 80,000 = 9,90,000

Depreciation 20% = 1,98,000

7,92,000

Problem I5.

Preparation of Receipts and Payments

Prepare Receipts & Payments Account for the year ended 31st December, 1996 from the

following

The Income & Expenditure Account for the year ending 31st December, 1996

FINANCIAL ACCOUNTING 189

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Rs. Rs.

Salaries 12,000 By Subscription 20,000

Printing & Stationery 3,000 Donation 10.000

Deprciation on Fixed Assets 5,000 Sundry Income 1,000

Surplus 11,000

31,000 31,000

Other information : Cash in hand on 1.1.1996 Rs. 6,000; Donation Capitalised @ 50%; Subcription

due 15 Rs. 2,000; Sundry Incomes Accrued Rs. 200; Subscription due for 1996 Rs. 1,000; Salaries

due for s. 1,000; Subscription received in advance in 1996 Rs. 500; Salaries due for 1996 Rs.

1,200; Printing stationery prepaid Rs. 200.

[Closing Balance of R & P A/c.Rs. 33.300]

Preperation of Receipts and payment Account

Problem 16.

Preperation of Receipts and Payments Account -

Rock City Sports Club gives you the following informations

Income and Expenditure Account for the year ended~ 31st march, 1996

Expenditure Rs. Income Rs.

Coach Remuneration 9,000 By Subscription 50.000

Stuff Salaries 12,000 Bar Receipts 12,000

Rent for ground 6,000 Less:Expenses 10,000 2,000

Repairs 6,500 Sale of used kits 2,000

Sundry Expenses 3,500 ~ Rent of Hall 6,000

Guround Maintenance 9,000

Depreciation on Furniture 1,500

Excess opf Income

over Expenditure 12,500

60,000 60,000

190 FINANCIAL ACCOUNTING

Balance Sheets as at 31.3.95 and 31.3.96

31.3.95 Liabilities 31.3.96 31.3.95 Assets 31.3.96

44,000 Capital Fund 62,500 21,000 Furniture 19500

4,000 Subscription

Received

in Advance 3,000 6,000 Outstanding

Subscription 8,000

1,500 Sundry Expenses 1,000 5,000 Cash in hand 4,000

2,000 Staff Salaries 3,000 22,500 Fixed Deposit 30,000

3,000 Rent of ground 2,000 Cash at Bank 10,000

54,500 71,500 54,500 71,500

Stall Salaries, Sundry Expenses and Ground Rent due in March, 1995 had been paid during the

year ended 313.96. Subscription received in advance is in respect of subsequent year. Subscrip-

tion due in March 1995 was received in full before March. 1996.

The increase in Capital Fund was due to receipt of entrance for of Rs. 6,000 during the year

ended 1.3.96 in addition to the surplus earned.

Prepare the Receipts and Payments Account of Rock City Club for the year ended 31st March,

1996.

[Ans : Cash in hand and Cash at Bank as also Fixed Deposits on 31.3.95 (opening) and on

31.3.96 (Closing) are given, so the totals of the debit side and Credit side of the Receipts and

Payments Account should be the same.]

(Hints : Subscriptions received: For 1994-95 = As. 6,000; For 1995-96 = As. 38,000; For 1996-97 =

Rs. 3,000]

Problem 17.

The Income & Expenditure Account of Bharat Bhermi Club for the year ended 31st March,

1996 is given below:

FINANCIAL ACCOUNTING 191

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Rs. Rs.

To Salaries 24,000 By Subscription 72,000

Rent 10.800 Entrance Fees 8,000

Rates & Taxes 600 Surplus on Publications

of Souvenirs 4,500

Postage & Telephones 720 Profit on Sale of Sports

Materials 1200

Affiliation Fees to All India Interest on Investments 600

Hanball Association 1,200 Miscellaneous Income 225

Sports Materials 15,750

Electric Charges 1,200

Repairs & Maintenance of

Handball Court 9,600

Depreciation on Assets

@ 10% 4,800

Surplus 17,855

86,525 86,525

The following further information is made available

Balance on 31.3.95 Rs. Balance on 31.3.96 Rs.

Sundry Assets 44,000 ?

Bank Balance 4,800 ?

Subscription in Arrear 4.750 3,500

Subscription Received in

Advance1 400 2,600

5% Investments 12,00 12,000

Outstanding Expenses :

Salaries 600 1,200

Rent900 1,800

Rates & Taxes Nil 600

Court Maintenance 780 320

Outstanding Amounts for

Purchase of Sports Materials 1,400 2,950

Prize Fund 4,600 3,250

192 FINANCIAL ACCOUNTING

Problem 19.

From the following, prepare the Receipts & Payments Account of Padatik Club for the year

ended 31st December, 1995.

Income and Expenditure Account For the year ended 31.12.1995

Expenditure Rs. Incomes Rs.

To Maintenance 682 By Subscription 4,000

Match Expenses 1,325 Less : For last year 600

Salaries 1,100 3,400

Add: Outstanding 100 1,200 Add: Outstanding at end 800 4,200

Conveyance 80 Donation 500

Upkeep of Lawn 425 Interest on Deposits 90

Postage Purchases 105 Add: Accrual 90 180

Add : Opening Stock 75 Profit on Sale of Crockery 80

(Selling Price Rs. 180)

Less : Closing Stock 90 90 Excess Expenditure over Income 55

Cricket Expenditure 972

Add:Stock at begining 321

1293

Less : Stock at end 280 1,013

Sundries 200

5,015 5,015

FINANCIAL ACCOUNTING 193

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Balance Sheet as on 31.12.1995

Liabilities Rs. Assets Rs.

Entrance Fees 275 Cash in hand 220

Outstanding Salary 100 Cash at Bank 2,331

Tournament Fund 2000 Investments 3,000

Less : Expenses 1,880 120 Crockery in deposits 265

Capital Fund 7,266 Investment in Shares 570

Less: Excess of Expendi. 55 Postage (Stock) 90

Over Income 7,211 Stock of Cricket Good 280

Subscription outstanding

1994 60

1995 800 860

Accrual Interest 90

7,706 7,706

Miscellaneous

Problem 20.

Preparation of Balance Sheets

The Receipts and Payments Account and the Income and Expenditure Account of Sabbath

Recreation Club for the year ended 31st December, 1995 were as follows :

Receipts Rs. Payments Rs.

To Balance b/f 1,500 By Books Purchased 1,000

Subscription : 1994 600 Printing and stationery 200

1995 4,300 4,900

Salary 1,500

Interest 500 Advertisement 200

Donation for special Fund 300 Electric charges 400

Rent : 1994 150 Balance c/f 4,350

1995 300 450

7,650 7,650

194 FINANCIAL ACCOUNTING

Dr. Income And Expenditure Account Cr.

Expenditure Rs. Income Rs.

To Salary 1,800 By Interest 400

Tent Hire 200 Subscriptions 4,800

Electric charges 400 Rent 300

Depreciation on Buildings 750

Printing and stationary 200

Advertisement 150

Surplus 2,000

5,500 5,500

The clubs assets on 1st January, 1995 were :

Buildings Rs. 15,000; Books Rs. 10,000; Furniture Rs. 1,000 and Investments Rs. 10,000

Liabilities as on that date were Rs. 50 for advertisement and Rs. 100 for salary.

You are required to prepare the Balance Sheets of the club on 31. 12. 1994 and 31. 12. 1995.

[Ans : Opening Capital Fund Rs. 38,100; Balance Sheet Totals on 31. 12. 1994 Rs. 38,250 on 31.

12. 1995 Rs. 41,100]

Problem 21.

Preparation of Receipts & Payments Account, Income & Expenditure Account and Balance

Sheet.

The following balance have been entracted from the books of xyz club for the year ended 31st

march, 1996.

Rs.

Restaurant Stock on 31st March, 1995 3,900

Furniture as at 31st March, 1995 8,400

Additions to furniture during the year 5,400

Billiards Table and other accessories on 31st March, 1995 8,900

China Glass, Cutlery and linen as on 31st March, 1995 2,500

FINANCIAL ACCOUNTING 195

RECEIPTS & PAYMENTS AND INCOME & EXPENDITURE ACCOUNTS

Restaurant Receipts during the year 3,61,600

Receipts from Billiards Room during the year 25,600

Subscriptions Received during the year 31,500

Interest on Deposit received during the year 1,500

Secretarys honorarium 30,000

Purchases for Restaurant 2,07,800

Rent & Rates 34,900

Wages (restaurant Rs. 50,000) 92,300

Repairs & Renewals 17,900

Fuel . 17,700

Lighting 2,200

Sundry Expenses 13,400

Cash in hand as on 31st March, 1995 1,350

Bank Balance as on 31st March, 1995 9,150

Bank Deposit @ 10% as on 31st March, 1995 30,000

Capital Fund as on 31st March, 1995 66,000

The payment for purchases includes Rs. 3,000 for the year ended 31st March, 1995. Restaurant

stocks on 31st March, 1996 were Rs. 4,500. Included in the subscriptions received were Rs.

4,800 for previous year and Rs. 1,200 for the year ended 31st March, 1997. Subscriptions out-

standing on 31st March, 1996 were Rs 5.000.

Depreciation should be provided as follows

China glass, cuttery and linen @ 20%, furniture @ 10% and Billiards Table & Accessories @

15%. The cost of the boarding expenses of the staff amounted to Rs. 27,500 of which Rs. 20,000

is to be charged to restaurant.

Prepare the Receipts & Payments Account, Income & Expenditure Account and Balance Sheet

showing the working of the restaurant separately. Cash in hand on 31st March, 1996 amounted

to Rs. 2,600.

(Ans: Restaurant Profit As. 96,700; Excess of Income Over Expenditure Rs., 4,885; Balance

Sheet Total on 31. 3. 1996 As. 72,085)

196 FINANCIAL ACCOUNTING

You might also like

- Solved Problems: OlutionDocument5 pagesSolved Problems: OlutionSavoir PenNo ratings yet

- As-11 The Effects of Changes in Foreign Exchange RatesDocument21 pagesAs-11 The Effects of Changes in Foreign Exchange RatesDipen AdhikariNo ratings yet

- Accounting Round 1 Ans KeyDocument21 pagesAccounting Round 1 Ans KeyMalhar ShahNo ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Sectional and Self Balancing SystemDocument7 pagesSectional and Self Balancing SystemBhupender Singh Kaushal78% (9)

- Ca Ipcc Costing and Financial Management Suggested Answers May 2015Document20 pagesCa Ipcc Costing and Financial Management Suggested Answers May 2015Prasanna KumarNo ratings yet

- Fa IiiDocument76 pagesFa Iiirishav agarwalNo ratings yet

- Amalgamation & Sale of Partnership Firm AccountingDocument24 pagesAmalgamation & Sale of Partnership Firm AccountingJoshua johnNo ratings yet

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- Corporate Accounting ProblemDocument6 pagesCorporate Accounting ProblemparameshwaraNo ratings yet

- Dissolutioni of Partnership FirmDocument69 pagesDissolutioni of Partnership FirmbinuNo ratings yet

- Unit 5: Death of A PartnerDocument23 pagesUnit 5: Death of A PartnerKARTIK CHADHANo ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaVarun reddyNo ratings yet

- 7948final Adv Acc Nov05Document16 pages7948final Adv Acc Nov05Kushan MistryNo ratings yet

- Reliance Industries - Wikipedia, The Free EncyclopediaDocument9 pagesReliance Industries - Wikipedia, The Free Encyclopediapaulrulez31570% (2)

- Unit 3: Trial Balance: Learning OutcomesDocument13 pagesUnit 3: Trial Balance: Learning Outcomesviveo23No ratings yet

- CA Final Costing Guideline Answers May 2015Document12 pagesCA Final Costing Guideline Answers May 2015jonnajon92-1No ratings yet

- 12 Accountancy sp04Document45 pages12 Accountancy sp04Priyansh AryaNo ratings yet

- 37 19 Branch Accounts Theory ProblemsDocument19 pages37 19 Branch Accounts Theory Problemsemmanuel Johny100% (2)

- Accounting For Specialized Institution Set 2 Scheme of ValuationDocument19 pagesAccounting For Specialized Institution Set 2 Scheme of ValuationTitus Clement100% (1)

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- Final Accounts of Banking Company (Lecture 01Document8 pagesFinal Accounts of Banking Company (Lecture 01akash gautamNo ratings yet

- Exempt IncomeDocument18 pagesExempt IncomeSarvar PathanNo ratings yet

- Unit 6: Average Due Date: Learning OutcomesDocument21 pagesUnit 6: Average Due Date: Learning OutcomesAshish SultaniaNo ratings yet

- CA IPCC Branch AccountsDocument19 pagesCA IPCC Branch AccountsAkash Gupta75% (4)

- Dimensions of Working Capital ManagementDocument22 pagesDimensions of Working Capital ManagementRamana Rao V GuthikondaNo ratings yet

- Costing AssignmentDocument15 pagesCosting AssignmentSumit SumanNo ratings yet

- Leverage Unit-4 Part - IIDocument34 pagesLeverage Unit-4 Part - IIAstha ParmanandkaNo ratings yet

- SM-2 - Lesson - 1 To 7 in EnglishDocument128 pagesSM-2 - Lesson - 1 To 7 in EnglishMayank RajputNo ratings yet

- 1164914469ls 1Document112 pages1164914469ls 1krishnan bhuvaneswariNo ratings yet

- 16 - IND AS 108 - Operating Segment Final (R)Document18 pages16 - IND AS 108 - Operating Segment Final (R)S Bharhath kumarNo ratings yet

- FM Kaplan Study Text 2023-06Document810 pagesFM Kaplan Study Text 2023-06Akash AjayNo ratings yet

- Chapter 11 Hire Purchase and Instalment Sale Transactions PDFDocument52 pagesChapter 11 Hire Purchase and Instalment Sale Transactions PDFEswari GkNo ratings yet

- Corporate Accounting - IiDocument26 pagesCorporate Accounting - Iishankar1287No ratings yet

- Financial Services Numerical ExamplesDocument21 pagesFinancial Services Numerical ExamplesgauravNo ratings yet

- Management Accounting Chapter 4: Fund Flow Statement (FFS) : o o o o oDocument21 pagesManagement Accounting Chapter 4: Fund Flow Statement (FFS) : o o o o oHemantha RajNo ratings yet

- Banking Company Final Accounts: Profit, Loss, Assets, LiabilitiesDocument20 pagesBanking Company Final Accounts: Profit, Loss, Assets, LiabilitiesPaulomi LahaNo ratings yet

- As 16Document11 pagesAs 16Harsh PatelNo ratings yet

- CA Notes Sale of Goods On Approval or Return Basis PDFDocument14 pagesCA Notes Sale of Goods On Approval or Return Basis PDFBijay Aryan Dhakal100% (1)

- Receivables ManagementDocument4 pagesReceivables ManagementVaibhav MoondraNo ratings yet

- Insurance Annual ReportsDocument5 pagesInsurance Annual ReportsPraveen JoeNo ratings yet

- 02 Per. Invest 26-30Document5 pages02 Per. Invest 26-30Ritu SahaniNo ratings yet

- Computer in AccountingDocument13 pagesComputer in AccountingViransh Coaching ClassesNo ratings yet

- Reconstruction InternalDocument12 pagesReconstruction InternalsviimaNo ratings yet

- Cash Flow For Study29072021Document60 pagesCash Flow For Study29072021URANo ratings yet

- 18415compsuggans PCC FM Chapter7Document13 pages18415compsuggans PCC FM Chapter7Mukunthan RBNo ratings yet

- Suggested Answer Paper CAP III Dec 2019Document142 pagesSuggested Answer Paper CAP III Dec 2019Roshan PanditNo ratings yet

- Balance Sheet of Tata MotorsDocument10 pagesBalance Sheet of Tata Motorssarvesh.bhartiNo ratings yet

- Budget Imp Qs PDFDocument13 pagesBudget Imp Qs PDFkritikaNo ratings yet

- TVM Sums & SolutionsDocument7 pagesTVM Sums & SolutionsRupasree DeyNo ratings yet

- FR ConsolidationDocument31 pagesFR Consolidationvignesh_vikiNo ratings yet

- Working Capital ManagementDocument32 pagesWorking Capital ManagementrutikaNo ratings yet

- Working Capital MGTDocument14 pagesWorking Capital MGTrupaliNo ratings yet

- Clubs and SocietyDocument7 pagesClubs and SocietyJAPHET NKUNIKANo ratings yet

- Study Note 3, Page 114-142Document29 pagesStudy Note 3, Page 114-142s4sahithNo ratings yet

- TOPIC ONE, NON FOR PROFIT copyDocument10 pagesTOPIC ONE, NON FOR PROFIT copymichaelkanje28No ratings yet

- 12TH CH-7 Not For Profit Organisation - 123Document55 pages12TH CH-7 Not For Profit Organisation - 123LalitKukrejaNo ratings yet

- NCERT Solutions For Class 12 Accountancy Chapter 1 - Accounting For Not For Profit Organisation - 67pDocument67 pagesNCERT Solutions For Class 12 Accountancy Chapter 1 - Accounting For Not For Profit Organisation - 67pshanmugam PalaniappanNo ratings yet

- Non-Profit Organization Financial StatementsDocument21 pagesNon-Profit Organization Financial StatementsJayakrishnan Er E RNo ratings yet

- Accounting for Not-for-Profit OrganisationsDocument4 pagesAccounting for Not-for-Profit OrganisationsChandreshNo ratings yet

- Offer Letter - Ganesh RDocument7 pagesOffer Letter - Ganesh RsamstarmoonNo ratings yet

- RealisticMeshFill PDFDocument24 pagesRealisticMeshFill PDFjorgequiatNo ratings yet

- Antifungal PropertieS of Neem PDFDocument9 pagesAntifungal PropertieS of Neem PDFDeepak KocherNo ratings yet

- SHOP & SMILE: REWARD PROGRAMDocument20 pagesSHOP & SMILE: REWARD PROGRAMsamstarmoonNo ratings yet

- SHOP & SMILE: REWARD PROGRAMDocument20 pagesSHOP & SMILE: REWARD PROGRAMsamstarmoonNo ratings yet

- Wealth Tax InterDocument66 pagesWealth Tax IntersamstarmoonNo ratings yet

- Std12 Phy Vol 1Document237 pagesStd12 Phy Vol 1Aaron Merrill50% (2)