Professional Documents

Culture Documents

Bizmates Trainers' Briefing On BIR Compliance

Uploaded by

joahnabulanadiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bizmates Trainers' Briefing On BIR Compliance

Uploaded by

joahnabulanadiCopyright:

Available Formats

INTRODUCTORY QUESTIONS AND ANSWERS

Q1: Who are professionals?

A: Professionals are those who practice their profession or calling, with or without license under

a regulatory board or body.

Professionals with license under a regulatory board include Certified Public Accountants (CPAs),

practicing lawyers, doctors of medicines, dentists, architects, engineers and teachers. Bloggers,

internet marketers, web designers, writers and other persons who provide specialized services

can also be considered professionals, though they may not have professional licenses under a

regulatory body. 1 Online Business English Trainers are classified under professionals who

provide specialized service.

Q2: What is the nature of the 10% withholding tax? What is the purpose of BIR Form 2307

attached to our email on payroll computation at the end of each month?

A: The 10% withholding tax is not the tax itself. It is the government's (BIR) method of collecting

income tax in advance from the income of the taxpayers (trainers) through their withholding

agent (Bizmates).2

The document, BIR Form 2307 (Certificate of Creditable Tax Withheld) serves as proof that the

company remits 10% of your gross income to the government. The amount of withholding tax on

compensation as shown in BIR Form 2307 shall be claimed by the taxpayer (trainer) as tax credit

against his income tax liability for the quarter (BIR Form 1701Q) or year (BIR 1701). 3 Hence, as

a result of computing for the ITR, the trainer doesn't have to pay for anything because of the

allowable deductions and claiming the 10% withholding tax (as per BIR 2307) as his tax credit.

Q3: Now that I have a BIR TIN and BIR 2307s issued by the company, can I automatically

file my Annual ITR for the year 2015 before April 15, 2016?

A: No. If you inquire at BIR on how to file Annual ITR, they would tell you the same thing that

you cannot file your ITR unless you are registered as self-employed professional. Some of

you might think that you are already registered because you already obtained your BIR TIN. Of

course, you do not stop there. For clarification, application for BIR TIN should not be confused

with registration as taxpayer.

Q4: What are the benefits and advantages of professionals who register with the BIR?

If you are a professional, whos required to register as a self-employed individual, but still not

registered with the BIR and not filing income tax returns, the following are the things you must

consider.

1. Your annual income tax return (BIR form 1701) will serve as your proof of earnings,

which you can use for obtaining loans with different institutions, such as banks, credit

cooperatives, lending companies, SSS and PAG-IBIG. You can also use it to apply for

credit cards.

2. Filing your Income Tax Return and paying the right tax are contributing to the progress

of the country. As a citizen you should be helping in the development and progress of

your nation. Your tax money helps build roads and bridges, provide basic medical care

to, compensates our police and armed forces to protect and defend our country, and so

much more.

3. Moreover, youll be able to claim your tax credit, if overpaid.

4. By being registered with the BIR and having official receipts (OR) under your name, your

clients will have more confidence of getting your services.

Trainers Hang-out and Discussions on BIR Compliance 12.14. 2015

Page 1 of 8

5. You can save money in the future by paying your taxes on time and avoiding penalties,

such as interests, surcharges and compromise.

6. You will not be charged with tax evasion, which is punishable by the law.

7. and other ethical and moral benefits, such as having a clear conscience and having

good night sleeps. 4

Note: Our FAQs Q8-6 provided a link where the BIR provides stiff penalties for tax evasion:

http://www.gov.ph/2014/04/01/who-are-required-to-file-income-tax-returns/

According to the site from the Official Gazette:

When you dont pay your taxes or when you dont file an income tax return (or do it the wrong way, or whatever),

you are charged with:

Tax evasion When an individual or a corporation willfully uses illegal means to avoid paying taxes or the right amount

of taxes. Tax evaders will be fined no less than P30,000 pesos but no more than P100,000, and suffer imprisonment of no

less than two years but no more than four years.5

Q5: What is an income tax return?

A: An income tax return is a document in which the taxpayer formally makes a report on his

gross income and deductions to the Bureau of Internal Revenue (BIR). 6

If you are employed with only one employer with a certain number of employees, your employer

files your ITR in your behalf which is called Substituted Filing (BIR 2316 Certificate of

Compensation Payment or Income Tax Withheld). Being self-employed professionals, we file our

own income tax return.

Q6: When should the income tax return be filed?

A: In the case of an individual with income from business or practice of profession, quarterly and

annual income tax returns should be filed as follows:

First Quarter (January to March) On or before April 15

Second Quarter (April to June) On or before August 15

Third Quarter (July to September) On or before November 15

Annual (January to December) On or before April 15 of the succeeding year7

Q7: Considering that my job is not visible because I work at home, am I safe by getting

away with paying my taxes?

A: No. The BIR would still find out. Bizmates is require to submit an alphabetical list of employees

and list of payees (Alphalist) on income payments subject to creditable and final withholding

taxes which are required to be attached as integral part of their Annual Information Returns and

Monthly Remittance Returns.8 Our names are included in their Alphalist. The BIRs Integrated

Tax System (ITS) detects non-filing or non-payment of tax returns by a taxpayer.

BIR REGISTRATION

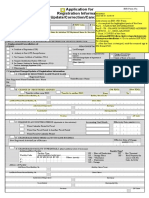

Q8: As an Online Business English Trainer, what requirements do I need to comply to

register with the BIR?

A: Your Revenue District Office (RDO) may require you to secure the following:

1. Annual Registration Fee of P500 (to be paid at Authorized Agent Banks)

2. Completely filled BIR 0605 (Payment Form) please see Annex A

3. Completely filled BIR 1901 (Application for Registration) please see Annex B

Trainers Hang-out and Discussions on BIR Compliance 12.14. 2015

Page 2 of 8

4. Photocopy of occupational permit please see Annex C

Note: For steps in acquiring Occupational Permit, kindly refer to page 6 of this hand-out

5. Photocopy of NSO certified birth certificate of taxpayer and dependent

6. Php15 for the documentary stamp tax (DST) to be attached to your Certificate of

Registration (COR) or BIR 2303 please see Annex D

7. Attend the required taxpayers briefing at the RDO before the release of your COR.

After securing these documents, your RDO will issue you the following:

1. Certificate of Registration (BIR 2303) Annex D

2. Ask for Receipt Poster

Note: The following requirements are listed in Tax Guide for Professionals

1. Birth Certificate or any documents showing name, address, and birth date;

2. Mayors Permit, if applicable;

3. DTI Certificate of Business Name to be submitted prior to issuance of the Certificate of Registration or BIR

Form No. 2303, if applicable;

4. Professional Regulation Commission ID, if applicable; and

5. Payment of Professional Tax Receipt (PTR) from the local government, if applicable.

COMMON PROBLEM with BIR REGISTRATION

Q9: When I visited my RDO to register as self-employed professional, BIR asked me to

secure DTI Permit and Mayor's Business Permit. Do I really need to secure these

documents?

A: No. Please let them understand that you are doing business in the exercise of

profession and what you need is Occupational Permit hence, the Mayor's Business Permit and

DTI Permit can be dispensed with.

Q10: After obtaining my COR, what else do I need to comply?

A: After getting your Certificate of Registration, your RDO will also require you to comply the

following:

1. Register your book of accounts using BIR 1905 please see Annex E, and have them

stamped at your RDO.

a. Journal

b. Ledger

2. Apply for Receipts using BIR Form No. 1906 (Authority to Print) 9 please see Annex F

Usually, the BIR accredited printing press who will print your receipts can assist you on the

registration of your official receipts. Your receipts should be serially numbered. It also indicates your name,

business style (profession), TIN and your registered business /office address (residence where you teach).

Note: Some RDOs may be bent with this rule on requiring freelance professionals to issue receipts. If your RDO

would not require you to issue receipts, you are lucky. For clarification, kindly visit your respective RDO.

Q11: Are we really required to issue receipts?

A: Yes, we are. You may wonder how come we are required to issue receipts and to whom do we

issue receipts. It could be confusing, considering that we teach Japanese students who pay to

Bizmates, hence, we presume that Bizmates would already issue them receipts.

Under the Tax Code, all persons subject to internal revenue tax are required to issue an invoice

for each sale of goods and an official receipt (OR) for services rendered valued at Php 25.00 or

more.10 Even though we earn peanuts, we are required to issue receipts to Bizmates for

professional services rendered. Given that we earn more than Php 25.00 for teaching, we are

required to issue the company receipts for our professional fees, not to our students.

Trainers Hang-out and Discussions on BIR Compliance 12.14. 2015

Page 3 of 8

Q12: What are the taxes I need to pay?

A: Being self-employed NON-VAT taxpayers, we are subject to the following:

1. 3% monthly percentage tax (BIR Form 2551M)11 please see Annex G

2. quarterly income tax (1701Q) please see Annex H

3. annual income tax (1701)

In our case, the only burden we trainers have to pay is the percentage tax.* Being exempted from

VAT, As discussed earlier in Q2, we dont have to pay anything for filing our income tax returns (BIR

1701Q and BIR 1701) because of claiming the 10% withholding tax as our tax credit.

How to Compute the Percentage Tax? Sample Computation October 2015 Compensation

Gross Pay: Php 13,750

Net amount received Php XXX Net amount received Php 12,375

Add: 10% Add: +

Expanded Withholding Tax Php XXX 10% Expanded Withholding Tax 1,375

________ ________

Total Professional Fee Php XXX Total Professional Fee Php 13,750

Multiply by Multiply by x

3% percentage tax Php XXX 3% percentage tax .03

________ ________

Percentage Tax Due Php XXX12 Percentage Tax Due Php 412.50

*Business tax rates may either be:

1. Value Added Tax (VAT)- 12% if gross professional fees exceed Php 1,919,500 for a 12- month period; or

2. Percentage Tax (PT) or NON-VAT-3% if gross professional fees total Php 1,919,500 and below for a 12-month period.13

ELECTRONIC FILING AND PAYMENT SYSTEM

Q13: Im a very busy person. Is there a convenient way for me to file and pay my taxes without hiring

a bookkeeper?

A: Yes, there is. You can conveniently file and pay your taxes through eFPS which stands for Electronic

Filing and Payment System. It refers to the system developed and maintained by the Bureau of Internal

Revenue (BIR) for electronically filing tax returns, including attachments, if any, and paying taxes due

thereon, specifically through the internet.

Q14: Why do we need to use eFPS? What are its objectives?

A: With eFPS, taxpayers can avail of a paperless tax filing experience and can also pay their taxes online

through the convenience of an internet-banking service via debit from their enrolled bank account. In

addition, since eFPS is available on the Internet, taxpayers can file and pay for their taxes anytime,

anywhere as long as he or she is using a computer with an internet connection.

Q15: What are the expected benefits of the system?

A: The eFPS is:

1. Convenient to use - it is quick and simple to use, as well as secure.

2. Interactive - information exchange is immediate and online, users get immediate feedback from the

system when enrolling, e-filing or performing e-payments.

3. Self-validating - errors are minimized because all of the information supplied by the taxpayer is

validated before final submission.

Trainers Hang-out and Discussions on BIR Compliance 12.14. 2015

Page 4 of 8

4. Fast - response or acknowledgment time is quicker than manual filing.

5. Readily available - eFPS is available 24 hours a day, 7 days a week including holidays.

6. Secure - return and payment transactions are more secure, as all data transmission is encrypted.

7. Cost effective - processing cost of returns and payments is minimized (e.g. receiving, pre-processing,

encoding, error-handling and storage).

Q16: Who is eligible to use the system?

A: Qualified taxpayers who need to file and pay their taxes to the Philippine government are encouraged to

use the system.

Q17: Is there any additional cost that the taxpayer will incur upon availment of this system?

A: None whatsoever, enrollment and usage of eFPS is FREE of charge. However, check with your bank

(where you have enrolled for e-payment) if they charge fees and/or if your need to maintain a minimum

ADB (Average Daily Balance). 14

Q18: Who are those mandated to use eFPS?

A: Those mandated are the following:

Taxpayer Account Management Program (TAMP) Taxpayers (RR No. 10-2014)

Accredited Importer and Prospective Importer required to secure the BIR-ICC & BIR-BCC (RR No. 10-2014)

National Government Agencies (NGAs) (RR No. 1-2013)

All Licensed Local Contractors (RR No. 10-2012)

Enterprises Enjoying Fiscal Incentives (PEZA, BOI, Various Zone Authorities, Etc.) (RR No. 1-2010)

Top 5,000 Individual Taxpayers (RR No. 6-2009)

Corporations with Paid-Up Capital Stock of P10 Million and above (RR No. 10-2007)

Corporations with Complete Computerized Accounting System (CAS) (RR No. 10-2007)

Procuring Government Agencies with respect to Withholding of VAT and Percentage Taxes (RR No. 3-2005)

Government Bidders (RR No. 3-2005)

Insurance companies and Stock brokers (RMC No. 71-2004)

Large Taxpayers (RR No. 2-2002, as amended)

Top 20,000 Private Corporation (RR No. 2-98, as amended) 15

Q20: What are the steps in enrolling?

A: They are the following:

Step 1: Access BIR website at www.bir.gov.ph using your internet browser.

Step 2: Click eServices.

Step 3: Click either eFPS or eBIRForms

Step 4: From the Login page, click on 'Enroll to eFPS or eBIRForms

Step 5: The eFPS or eBIRForms online enrollment form appears. Complete the required fields on the

Enrollment Form page. Then, click on the "Submit" button.

Step 6: Submit to BIR a certificate authorizing any three (3) officers designated to file the return. (Under

Section 52 (A) of the Tax Code (President or representative and Treasurer or Asst. Treasurer of the

Corporation). Individuals enrolling online for themselves shall be automatically activated without

submitting any documents to BIR.16

Note: Detailed process is enumerated in RMO 24-2013.

Q19: Are all taxpayers required to electronically file returns?

A: NO, NOT ALL TAXPAYERS ARE REQUIRED TO FILE ELECTRONICALLY. Only taxpayers enumerated in

items no. 5 and 6 of REVENUE MEMORANDUM CIRCULAR NO. 19-2015 are required/mandated to file

electronically. However, nothing prevents those who are not enumerated in this RMC to voluntarily enroll

and file using either the eFPS/eBIRForms electronic platform of the BIR. 17

Trainers Hang-out and Discussions on BIR Compliance 12.14. 2015

Page 5 of 8

HOW I ACQUIRED MY OCCUPATIONAL PERMIT AT QUEZON CITY HALL

Most companies would require their employees to secure occupational permit as requirement to practice their

occupation. As a freelance professional, I secured an occupational permit not only to practice my profession but

also to secure a new Certificate of Registration at Bureau of Internal Revenue RDO 40 Cubao.

Getting an occupational permit at Quezon City Hall is not easy, compared to Tacloban City Hall, Makati City Hall

and other jurisdiction. The queue and red tape may be discouraging. Waiting in line may be laborious but your

efforts will pay off once you get your occupational permit. Now, I am writing this blog entry to help the prospect

applicants secure the documents that they need and save time from asking people from the City Hall who do not

even give clear directions (some are friendly actually).

STEP 1: SECURE CEDULA, POLICE CLEARANCE or NBI CLEARANCE, and LABORATORY TEST RESULT

AT CITY HEALTH or OTHER ACCREDITED LABORATORIES

These are the following documents I obtained. I included the fees and waiting time, for your guidance.

DOCUMENT FEE WAITING TIME

Free of Charge

Barangay Clearance Note: Some barangays charge Php30.00 for seconds

issuance and Php15.00 for the documentary stamp.

Php 55

Cedula Note: I acquired my cedula at our Barangay Hall. seconds

The fee will vary depending on the amount of income

you declared for the preceding year.

Php 250

Police Clearance Breakdown: I paid Php 150 for the issuance of police 1 to 2 hours

(or NBI Clearance) clearance and P100 for the ID, which is valid for one

year. You may actually opt for NBI Clearance which

cost P115.

In order to secure NBI clearance, you will need at least 2 valid IDs with address in Quezon City. On the other

hand, getting a police clearance only requires 1 valid ID with address in Quezon City. If you don't have one, a

barangay clearance will do. My driver's license is still addressed in Tacloban City, so I had to secure a barangay

clearance from the barangay hall. They asked me for proof of billing with my name on it. I presented original

copies of my bank statement and internet bill that is why they issued me the document. I acquired cedula at the

barangay hall, too so there's no need to acquire cedula at the city hall anymore.

While waiting for your police clearance you may go to any nearby accredited laboratory to have your stool and

sputum examined. I chose Gilcare Diagnostics because of its short waiting time. I did not choose City Health

because I've read in some blogs that getting the applicants' specimens examined and waiting for the result there

takes forever.

STEP 2: SECURE ORDER OF PAYMENT FOR MAYOR'S PERMIT and HEALTH CERTIFICATE

After obtaining the documents, you are ready to get your order of payment at the tent in front of Land Bank. There

are separate lines for getting order of payments for Mayor's Permit and Health Certificate, respectively. It took me

almost an hour to wait in each line.

STEP 3: PAY AT THE CITY TREASURER'S CASHIER

The City Treasurer's cashier is located near Landbank. It took me more than an hour to wait in line just to pay. I

paid Php170 for Mayor's Permit and Php94 for the Health Certificate.

STEP 4: SECURE APPLICATION FORM FOR OCCUPATIONAL PERMIT

Oh, yes. After paying at the City Treasurer's Cashier, I had to go back to the same tent in front of Landbank just

to fall in line for the application form. I waited for less than an hour to fall in line for a piece of paper. It would be

too late to complain because I am a step away to get my occupational permit.

Trainers Hang-out and Discussions on BIR Compliance 12.14. 2015

Page 6 of 8

Oh, and by the way, the Quezon City Hall website says you can actually download the form to avoid the long

queue. I did not notice any applicants filling up a downloaded form so I just followed what they did by falling in

line.

STEP 5: HAVE YOUR PICTURE TAKEN AT THE BUSINESS PERMIT LICENSING OFFICE

I actually fell in line for less than 30 minutes, so it was okay. I met a beauty consultant from Revlon who happened

to be processing her occupational permit, too. Her name is Adele and she works in Ortigas. Having our picture

taken was quick.

STEP 6: WAIT FOR THE RELEASE OF YOUR OCCUPATIONAL PERMIT AT THE BASEMENT

Well, we waited for more than 2 hours for the release of our occupational permit which I did not mind at all

because we were given the chance to sit down. So, while waiting for the document, Adele and I had a long

conversation. The security guard in charge of the release was actually very nice.

Notice the discrepancies with the amount I paid at the City Treasurer's cashier and the amount indicated in my

occupational permit.

ACTUAL AMOUNT PAID AT AMOUNT INDICATED IN THE

DOCUMENT THE CITY TREASURERS OCCUPATIONAL PERMIT

CASHIER

Mayors Permit Php 170 Php 150

Health Certificate Php 94 Php 50

A total discrepancy of Php 64.00! Actually, the small amount is no big deal to me that is why I did not contest

that small discrepancy. However, it crossed my mind that if we would consider the number of taxpayers getting

an occupational permit every year, then Quezon City would raise a lot of revenue.

Anyway, to those who came across my blog entry, please do not be discouraged with the process I went through

because by the time you apply for occupational permit, you might not experience the hours of waiting I went

through. One reason why it took two days to process my occupational permit is because I applied on January

2015. January is the month when employees would also renew their permits and they are required to renew before

January 31. Meaning to say, there was plenty of people. The process would also depend on your City Hall. I've

heard that the processes in Makati and Bulacan are faster, compared to Quezon City.

To our Business Processing and Licensing Division, I have suggestions which I highly recommend as a taxpayer

of Quezon City. If you come across my blog, I hope you consider my constructive criticism. The problem is the

difficulty in processing our occupational permit. I see the root cause in the unnecessary queues. The taxpayers

need to fall in line five times, to wit:

1) Get order of payment for mayor's permit.

2) Get order of payment for health certificate.

3) Pay at the City Treasurer's cashier.

4) Get application form for occupational permit.

5) Have our picture taken at BPLO building and wait for the release of the occupational permit.

So, here are my suggestions: The queues in numbers 1 and 2 can be consolidated in one queue and there's no

need for a queue in number 4 anymore. I suggest that application forms should be readily available with the

security guard just like SSS, BIR and other government agencies. Your website provided a link to download the

application form for printing and that's good. In cases of long queues, a personnel should check the requirements

of applicants waiting in line to see whether they are complete or not. I noticed some applicants who fell in line for

nothing because they lack requirements. Remember, these people are taxpayers too. We contribute a lot in raising

revenue for Quezon City. So, I suggest for your division to assist us by restructuring the process in getting permits

especially during peak times. If Quezon City is promoting Anti-Red Tape, you can start by eliminating the

unnecessary queues. 18

Trainers Hang-out and Discussions on BIR Compliance 12.14. 2015

Page 7 of 8

_________________

References

1 Blog by Victorino Abrugar, CPA - http://businesstips.ph/how-to-register-with-the-bir-for-professionals/

2 Reviewer on Taxation by Atty. Victorino C. Mamalateo 2014 Edition pg. 337

3 Ibid pg. 344

4 Blog by Louis Delos Angeles, CPA - http://investinginphilippines.com/benefits-of-filing-your-income-tax-return/

5 Sec. 254 National Internal Revenue Code

6 Income Tax Law and Accounting by Virgilio T. Reyes 2012 Edition

7 Tax Guide for Professionals pg. 8 - ftp://ftp.bir.gov.ph/webadmin1/pdf/taxguide.pdf

8 Revenue Regulations No. 10-2008 Section 2.83.3, as amended

9 National Internal Revenue Code (NIRC) Sec. 238

10 NIRC Sec. 237

11 NIRC Sec. 116

12 Tax Guide for Professionals pg. 6

13 NIRC Sec. 109 (v), as amended

14 https://efps.bir.gov.ph/eFPSFAQ.html

15 Revenue Memorandum Circular (RMC) 19-2015 No. 5

16 RMC 19-2015 No. 8

17 RMC 19-2015 No. 9

18 http://joahnacheska.blogspot.com/2015/02/how-i-acquired-my-occupational-permit.html

Trainers Hang-out and Discussions on BIR Compliance 12.14. 2015

Page 8 of 8

You might also like

- Last Pay CertificateDocument2 pagesLast Pay Certificatekingfairgod100% (1)

- Internship ContractDocument8 pagesInternship ContractAbelardo DaculongNo ratings yet

- Non-Disclosure Agreement For Deped Email AccountDocument1 pageNon-Disclosure Agreement For Deped Email AccountJay Ralph DizonNo ratings yet

- Application For Increase On FeesDocument14 pagesApplication For Increase On FeesJomar Gadong100% (1)

- Republic of The Philippines Position Description Form DBM-CSC Form No. 1Document2 pagesRepublic of The Philippines Position Description Form DBM-CSC Form No. 1Allan AñonuevoNo ratings yet

- Far Assignments Chapter 1Document16 pagesFar Assignments Chapter 1Vesenth May Magaro RubinosNo ratings yet

- Annex 1 JDVP-TVL Application Form - (Edited)Document1 pageAnnex 1 JDVP-TVL Application Form - (Edited)Pauljam Onamor89% (9)

- Bir Form 1902Document2 pagesBir Form 1902Jayson Garcia100% (1)

- NC3 Bookeeping Practice Set Answer (Blank Form)Document29 pagesNC3 Bookeeping Practice Set Answer (Blank Form)AcissejNo ratings yet

- Lecture 11 - Termination of EmploymentDocument105 pagesLecture 11 - Termination of EmploymentSteps Rols100% (1)

- CS Prof. and Subprof. ExamDocument6 pagesCS Prof. and Subprof. ExamKristeine Lim100% (2)

- Republic Act 7610 or Also Known As Special Protection of Children Against Child AbuseDocument5 pagesRepublic Act 7610 or Also Known As Special Protection of Children Against Child AbuseClyde Angelo Amihan MonevaNo ratings yet

- Interview Questions For Bir: AnswerDocument3 pagesInterview Questions For Bir: AnswerTiffNo ratings yet

- The Resignation LetterDocument1 pageThe Resignation LetterEllang OrtigozaNo ratings yet

- Request Letter For ReimbursementDocument1 pageRequest Letter For ReimbursementKrisha Joy MorilloNo ratings yet

- Hiring IT TechnicianDocument4 pagesHiring IT TechnicianDaryl Macario100% (1)

- Strategic Planning-Business Enterprise SimulationDocument17 pagesStrategic Planning-Business Enterprise SimulationLeo SuingNo ratings yet

- BIR 1905 Form (Update or Transfer of RDO)Document4 pagesBIR 1905 Form (Update or Transfer of RDO)lily mayersNo ratings yet

- PhilHealth Er2 Form PDFDocument2 pagesPhilHealth Er2 Form PDFJOHN SPARKS100% (1)

- BIR Form 2305 ExcelDocument1 pageBIR Form 2305 ExcelFrancisco Galvez33% (3)

- Service Incentive Leave & Maternity LeaveDocument9 pagesService Incentive Leave & Maternity LeaveJujitsu AmaterasuNo ratings yet

- Coa 2012-001Document51 pagesCoa 2012-001Earl Clarence InesNo ratings yet

- 51talk Main Characters PDFDocument13 pages51talk Main Characters PDFGraceCorditaNo ratings yet

- 51talk NTT RemindersDocument5 pages51talk NTT RemindersKhaira Racel Jay PucotNo ratings yet

- Asian Learning Center Senior High School: Work Immersion Performance AppraisalDocument4 pagesAsian Learning Center Senior High School: Work Immersion Performance AppraisalBrylle Mac Angela100% (1)

- Rarejob Interview Questions 29 Questions and Answers by Ryan BrownDocument2 pagesRarejob Interview Questions 29 Questions and Answers by Ryan BrownChim Sholaine Arellano100% (1)

- Philippines, Inc. Trainer Portal ManualDocument18 pagesPhilippines, Inc. Trainer Portal ManualKw1kS0T1k100% (1)

- BusinessMath Module5 13-16Document64 pagesBusinessMath Module5 13-16Precious SarcillaNo ratings yet

- Travel Authority For Official Travel NEW TEMPLATE 2022Document4 pagesTravel Authority For Official Travel NEW TEMPLATE 2022Tonet Salago CantereNo ratings yet

- Nosi & NosaDocument58 pagesNosi & NosaAl SimbajonNo ratings yet

- Tally Sheet (Check Sheet) : TemplateDocument7 pagesTally Sheet (Check Sheet) : TemplateHomero NavarroNo ratings yet

- Philippine Health Insurance Corporation: Republic of The PhilippinesDocument1 pagePhilippine Health Insurance Corporation: Republic of The PhilippinesRonald LeabresNo ratings yet

- Tips and Answer Key For Civil Service ReDocument122 pagesTips and Answer Key For Civil Service Rekleint berdosNo ratings yet

- Ladderized Mostly Asked QuestionsDocument7 pagesLadderized Mostly Asked QuestionsLovella PaladoNo ratings yet

- Lesson 3-Workers Rights and ResponsibilitiesDocument17 pagesLesson 3-Workers Rights and ResponsibilitiesCrisa Marie Sta. Teresa100% (1)

- Pds Form TemplateDocument4 pagesPds Form TemplateJM FormalesNo ratings yet

- Legal Basis For Implementing Grievance Proceedings at Deped: Legal Unit Atty. Ariz Delson CawilanDocument44 pagesLegal Basis For Implementing Grievance Proceedings at Deped: Legal Unit Atty. Ariz Delson CawilanEnric DescalsotaNo ratings yet

- Compliance Audit Action CatalogueDocument3 pagesCompliance Audit Action CatalogueLucille AramburoNo ratings yet

- Dedication and Acknowledgement AllDocument15 pagesDedication and Acknowledgement AllMylen CastilloNo ratings yet

- BIR FORM NO 1902 Application For RegistrationDocument2 pagesBIR FORM NO 1902 Application For RegistrationJeffrey TrazoNo ratings yet

- Travel Authority For Personal TravelDocument1 pageTravel Authority For Personal TravelDarlene100% (1)

- What Are Phrasal VerbsDocument19 pagesWhat Are Phrasal VerbsGina Hong HongNo ratings yet

- Red Ribbon RequirementsDocument3 pagesRed Ribbon RequirementsMichael Gerard100% (1)

- Civil Service Daily Time Record FormDocument1 pageCivil Service Daily Time Record FormpanonsNo ratings yet

- Work Experience Sheet: Instructions: 1. Include Only The Work Experiences Relevant To The Position Being Applied ToDocument3 pagesWork Experience Sheet: Instructions: 1. Include Only The Work Experiences Relevant To The Position Being Applied Tokresta padillaNo ratings yet

- TESDA ESL Program Registration Requirements ChecklistDocument2 pagesTESDA ESL Program Registration Requirements ChecklistWalter Evans Lasula100% (2)

- Sample Leave FormDocument3 pagesSample Leave FormwillmacayNo ratings yet

- Complete Income Generating Project in SchoolDocument78 pagesComplete Income Generating Project in SchoolEcila DigoNo ratings yet

- Expanded Syllabus Criminal Law 1: Under Law of Home State of VesselDocument6 pagesExpanded Syllabus Criminal Law 1: Under Law of Home State of VesselNarisa JaymeNo ratings yet

- Activity Design ExamplesDocument29 pagesActivity Design Examplesapi-352971355No ratings yet

- Providing Relevant Education for YouthDocument79 pagesProviding Relevant Education for YouthMitch HayagNo ratings yet

- RareJob Tutor Website - Demo - Lesson Application 2Document2 pagesRareJob Tutor Website - Demo - Lesson Application 2Donna Jane SimeonNo ratings yet

- Post TransactionDocument69 pagesPost TransactionRonyla EnriquezNo ratings yet

- Building Permits ResearchesDocument3 pagesBuilding Permits ResearchesAnonymous SvycgnNo ratings yet

- Introduction To Career Guidance and DevelopmentDocument13 pagesIntroduction To Career Guidance and Developmentirish xNo ratings yet

- Safeguarding standards for online school activitiesDocument24 pagesSafeguarding standards for online school activitiesMA Vic100% (2)

- Transfer Pension DocumentsDocument8 pagesTransfer Pension DocumentsJose Ramon Dalo BautistaNo ratings yet

- Academic FreedomDocument13 pagesAcademic Freedomdaniel besina jrNo ratings yet

- How To Register A Sole Proprietor Business in The Philippines?Document23 pagesHow To Register A Sole Proprietor Business in The Philippines?Lei Anne MirandaNo ratings yet

- From An Employee To A SelfDocument3 pagesFrom An Employee To A SelfChristine BobisNo ratings yet

- Affidavit Income DeclarationDocument1 pageAffidavit Income Declarationjoahnabulanadi0% (1)

- Percentage Tax and BIR 2307 QueryDocument1 pagePercentage Tax and BIR 2307 QueryjoahnabulanadiNo ratings yet

- Miravite Table of ContentsDocument5 pagesMiravite Table of ContentsjoahnabulanadiNo ratings yet

- Central Phone Number Direct LiineDocument1 pageCentral Phone Number Direct LiinejoahnabulanadiNo ratings yet

- Trainer - S Briefing On BIR ComplianceDocument8 pagesTrainer - S Briefing On BIR ComplianceGui PeNo ratings yet

- CA IPCC Inter Income Tax Revision - Kalpesh Classes PDFDocument61 pagesCA IPCC Inter Income Tax Revision - Kalpesh Classes PDFSandra MaloosNo ratings yet

- Tax - Planning - and - Managerial - Decisions 4th ChapterDocument16 pagesTax - Planning - and - Managerial - Decisions 4th ChapterVidya VidyaNo ratings yet

- Income Tax of Individuals: Income Taxation 5Th Edition (By: Valencia & Roxas)Document19 pagesIncome Tax of Individuals: Income Taxation 5Th Edition (By: Valencia & Roxas)Love FreddyNo ratings yet

- Poor People! Stop Paying Tax!Document49 pagesPoor People! Stop Paying Tax!LewisJamesBrownNo ratings yet

- Philippine Income Taxation For Basic KnowledgeDocument8 pagesPhilippine Income Taxation For Basic KnowledgeAnonymous BvmMuBSwNo ratings yet

- TaxesDocument30 pagesTaxesapi-3256211040% (1)

- Accounting For Government Grants and Disclosure of Government AssistanceDocument18 pagesAccounting For Government Grants and Disclosure of Government AssistanceMaria DevinaNo ratings yet

- Annual Income Tax Return: II014 Income From Profession-Graduated IT Rates II013 Mixed Income-Graduated IT RatesDocument1 pageAnnual Income Tax Return: II014 Income From Profession-Graduated IT Rates II013 Mixed Income-Graduated IT Ratesmary grace villasenorNo ratings yet

- Supreme Court Decision on Tax Credits for Senior Citizen DiscountsDocument16 pagesSupreme Court Decision on Tax Credits for Senior Citizen DiscountsCharmaine Valientes CayabanNo ratings yet

- Agriculturl Income: Section Section 2 (1A)Document95 pagesAgriculturl Income: Section Section 2 (1A)leela naga janaki rajitha attiliNo ratings yet

- CIR vs. PNB 736 SCRA 609 2014 VELOSODocument2 pagesCIR vs. PNB 736 SCRA 609 2014 VELOSOAnonymous MikI28PkJc100% (2)

- Taxation of Conjugal IncomeDocument1 pageTaxation of Conjugal Incomek santosNo ratings yet

- Principles of Taxation: Certificate in Accounting and Finance Stage ExaminationDocument5 pagesPrinciples of Taxation: Certificate in Accounting and Finance Stage ExaminationMobeen SheikhNo ratings yet

- River Estates SDN BHD V Director General of 1981 MLJ 99Document11 pagesRiver Estates SDN BHD V Director General of 1981 MLJ 99Kacang Keedut100% (1)

- WWF Taxation Order FOrmatDocument6 pagesWWF Taxation Order FOrmatSohaib ZafarNo ratings yet

- The Taxation of Employee Fringe BenefitsDocument28 pagesThe Taxation of Employee Fringe Benefitswakemeup143No ratings yet

- BIR - Remittance of CWT (Form 1606) Discussion 1Document92 pagesBIR - Remittance of CWT (Form 1606) Discussion 1Roy RitagaNo ratings yet

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument3 pages1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsLLYOD FRANCIS LAYLAYNo ratings yet

- Philippine Mining Act of 1995 (Ra 7942 PDFDocument32 pagesPhilippine Mining Act of 1995 (Ra 7942 PDFEdnalynTrixiaNo ratings yet

- TaxDocument4 pagesTaxCielito AlvarezNo ratings yet

- Allowable Deductions from Gross Income (34 charactersDocument17 pagesAllowable Deductions from Gross Income (34 charactersCharlotte GallegoNo ratings yet

- Income Tax All Chapter CA Inter V05 PDFDocument203 pagesIncome Tax All Chapter CA Inter V05 PDFSubhamNo ratings yet

- Quarterly Corporate Income Tax Annual Declaration and Quarterly Payments of Income TaxesDocument2 pagesQuarterly Corporate Income Tax Annual Declaration and Quarterly Payments of Income TaxesshakiraNo ratings yet

- Philippine Refining Company (Now Known As "Unilever Philippines (PRC), Inc."), Petitioner, vs. Court of Appeals, Court of Tax Appeals, and The Commissioner of Internal Revenue, G.R. No. 118794Document5 pagesPhilippine Refining Company (Now Known As "Unilever Philippines (PRC), Inc."), Petitioner, vs. Court of Appeals, Court of Tax Appeals, and The Commissioner of Internal Revenue, G.R. No. 118794Mae TrabajoNo ratings yet

- Income Tax On CorporationDocument54 pagesIncome Tax On CorporationJamielene Tan100% (1)

- Circular-No-10-2022 Income Tax ActDocument4 pagesCircular-No-10-2022 Income Tax Actsaurabh14014No ratings yet

- SRRVDocument25 pagesSRRVMhatet Malanum Tagulinao-TongcoNo ratings yet

- Income Taxation - Tabag 2018Document33 pagesIncome Taxation - Tabag 2018Patrice De CastroNo ratings yet

- Mercury Drug v. Cir G.R. 164050Document16 pagesMercury Drug v. Cir G.R. 164050ATTYSMDGNo ratings yet

- DTB Orientation (PIT & CIT) FINALDocument37 pagesDTB Orientation (PIT & CIT) FINALCourt NanquilNo ratings yet