Professional Documents

Culture Documents

Rural Rental Housing Loans (Section 515) : Program Basics

Uploaded by

SUPER INDUSTRIAL ONLINE0 ratings0% found this document useful (0 votes)

28 views2 pagesOriginal Title

19565_515_ruralrental.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views2 pagesRural Rental Housing Loans (Section 515) : Program Basics

Uploaded by

SUPER INDUSTRIAL ONLINECopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Rural Rental Housing Loans

(Section 515)

September 2002

The Rural Housing Service (RHS) is a part of PROGRAM BASICS

Rural Development (RD) in the U.S. Department

of Agriculture (USDA). It operates a broad range Rural Rental Housing Loans are direct, competitive

mortg age loans m ade to provide afforda ble multifamily

of programs that were formerly administered by

rental housing for very low-, low-, and moderate-income

the Farmers Home Administration to support fam ilies, e lderly persons, an d persons with disab ilities. This

affordable housing and community development is primarily a direct housing mortgage program; its funds

in rural areas. RHS both provides direct loans may also be used to buy and improve land and to provide

(made and serviced by USDA staff) and also necessary facilities such as water and waste disposal

systems.

guarantees loans for mortgages extended and

serviced by others.

ELIGIBLE ACTIVITIES

The RHS National Office is located in

Washington, D.C., and is responsible for setting Ownership: Individuals, partnerships, limited

partne rships, for-p rofit corp ora tions, no nprofit

policy, developing regulations, and performing

organizations, limited equity cooperatives, Native American

oversight. RHS employs a central collection and tribes, and public ag encies are eligible to apply. For-profit

servicing center in St. Louis, Mo. and a borrowers must agree to operate on a limited -profit basis

computerized system called DLOS for Section (currently 8 percent on initial investment). Borrowers must

502 direct and Section 504 loans. In the field, be unable to obtain credit elsewhere that will enable them

to charge rents affordable to low- and moderate-income

RHS operations are carried out through the

tenants.

USDAs RD offices. Each RD State Office

administers programs in a state or multistate Tenancy: Very low-, low-, and mode rate-income fam ilies;

area. The organization of Rural Development elderly persons; and persons with handicaps and disabilities

offices within a state varies, but typically Area or are eligible to live in Section 51 5-finance d hou sing. Very

District Offices supervise Local Offices (also low income is defined as below 50 percent of the area

median income (AMI); low income is between 50 and 80

termed county or community development percent of AMI; moderate income is capped at $5,500

offices) and do the processing and servicing of above the low-income limit. Those living in sub stand ard

organizational loans and grants. Local Offices housing are given first priority for tenancy. When rental

process single family housing applications, assist assistance is used, top priority is given to very low-income

households. As of January 1, 2002, the average income of

District Offices with organizational applications

tenants was $8,028, or 25.9 percent of AMI. Incomes of

and servicing, and provide counseling to tenants receiving rental assistance averaged $6,458, or

applicant families and backup servicing as 20.8 percent o f AM I.

needed.

Competitive Applications: Rural Developm ent Sta te

Directors use needs criteria to establish a list of targeted

Rural Housing and com munities for w hich a pplica nts m ay re que st loan fund s.

Economic Development Gateway A list of these comm unities is published in a Notice of

1-877-RURAL-26 (1-877-787-2526) Funding Availability (NOFA). The applications are then

www .hud.gov/ruralgateway/ rated competitively in order to select recipients. In fiscal

U.S. Dept of Housing & Urban Development yea r 2002 only $49 million wa s ava ilable for new loans.

451 7th Street, S.W., Room 7137

Washington, DC 20410

PROJECT REQUIREMENTS B a s i c I n s t ru c t io n

Instructions 1944-E and 1930-C. RHS is developing a

Loans are for up to 30 years at an effective 1 percent

proposed rule that will reinvent these instructions.

interest rate and are amortized over 50 years. A current

rate is used for the promissory note but thereafter is used

only to determine maximum rent payments. Tenants pay FOR MORE INFORMATION

basic re nt or 30 percent of adjusted income, w hichever is

grea ter. RH S renta l assistance subsidy can be used to For additional information on Section 502 self-help and

limit tenant payments to 30 percent of their income.1 RHS , contact the RHS N ational Office, 1400 Independ ence

Loans made through contracts entered into on or after Avenue, S.W., Room 5037S, Washington, D.C. 20250; 202-

December 15, 1989 cannot be prepaid. Owners may 720-43 23. Con tact your Rura l Developm ent Sta te Office to

obtain guaranteed equity loans after 20 years as an find out the location of the Local Office closest to you, or

incentive for participation. visit www.rurdev.usda.gov/recd_map.html. Copies of RHS

regulations are available online at

S t a n d a rd s http://rdinit.usd a.go v/regs.

RHS site standards, CABO Model Energy Code, and

voluntary national model building codes apply. When

moderate rehabilitation is involved, a separate RHS

standard is used. RHS maintains square foot ranges by

number of bedrooms to limit unit size. Projects must be

designed to have two or more units per building.

V a r ia t io n s

The re are fou r varia tions of the Section 51 5 loan pro gram.

They are Cooperative Housing,2 Downtow n Renew al Areas,

Congreg ate H ousing or Grou p Ho me s for Perso ns w ith

Disabilities, and the Rural Housing Demonstration

Program.

Approval

RD State Directors use needs criteria to establish a list of

targeted comm unities for which applicants may request

loan fund s. The ap plications are then rated in ord er to

select recipients. District Directors have the authority to

app rove loa ns of up to $500,00 0. Loans of up to

$1,500 ,000 m ust be appro ved by State Dire ctors. All

requests for loans above $1,500,000 must be reviewed by

the RHS National Office.

1 For more information, see the HAC Information

Sheet on the Rural Rental Assistance Program.

2 For more information, see the HAC Information

Sheet on the Rural Cooperative Housing Loan Program.

You might also like

- USDA Guaranteed Rural Housing Loans (Section 502) : PurposeDocument2 pagesUSDA Guaranteed Rural Housing Loans (Section 502) : PurposeSUPER INDUSTRIAL ONLINENo ratings yet

- USDA Rural Development programs help rural homeowners and buyersDocument6 pagesUSDA Rural Development programs help rural homeowners and buyersSarah CornNo ratings yet

- HOU Development Updates 12082023 Friday Memo MADocument3 pagesHOU Development Updates 12082023 Friday Memo MAApril ToweryNo ratings yet

- Responses To Council Questions On Homelessness InvestmentDocument26 pagesResponses To Council Questions On Homelessness InvestmentUSA TODAY NetworkNo ratings yet

- New Orleans Soft Second Mortgage FundingDocument23 pagesNew Orleans Soft Second Mortgage FundingPropertywizzNo ratings yet

- USDA B&I Loans Help Rural Businesses & LendersDocument2 pagesUSDA B&I Loans Help Rural Businesses & Lenderststacct543No ratings yet

- Mshda MSHDA RD Development Meeting 317223 7Document35 pagesMshda MSHDA RD Development Meeting 317223 7kannansharkboyNo ratings yet

- Affordable Housing Strategies for Northwest MichiganDocument2 pagesAffordable Housing Strategies for Northwest MichiganJillian SeitzNo ratings yet

- Rental Housing Options in Washington CountyDocument24 pagesRental Housing Options in Washington CountyfoxqqqNo ratings yet

- 2024.04.02 MRC Millennia Sale Ltr to HUD_FINALDocument4 pages2024.04.02 MRC Millennia Sale Ltr to HUD_FINALSean KeenanNo ratings yet

- Opportunities For Promoting Credit For Affordable Housing in Rural AmericaDocument16 pagesOpportunities For Promoting Credit For Affordable Housing in Rural AmericaCenter for American ProgressNo ratings yet

- US RCAC Fact SheetDocument2 pagesUS RCAC Fact SheetMHDCHubNo ratings yet

- Oregon Department of Human Services Addictions and Mental Health DivisionDocument13 pagesOregon Department of Human Services Addictions and Mental Health DivisionbrainysmurphNo ratings yet

- HOAP GuidelinesDocument6 pagesHOAP GuidelineshometownhousingNo ratings yet

- Sources of CreditDocument12 pagesSources of CreditMasud HassanNo ratings yet

- Guidelines For Interest Subsidy Scheme For Housing The Urban Poor (Ishup)Document10 pagesGuidelines For Interest Subsidy Scheme For Housing The Urban Poor (Ishup)kayalonthewebNo ratings yet

- Housing Provisions in Emergency COVID 19 Relief PackageDocument3 pagesHousing Provisions in Emergency COVID 19 Relief PackageTeresa LowNo ratings yet

- The Reader: Hundreds Rally For Affordable HousingDocument12 pagesThe Reader: Hundreds Rally For Affordable HousinganhdincNo ratings yet

- The Reader: New York State and City Develop Plans To Spend Federal Neighborhood Stabilization FundsDocument8 pagesThe Reader: New York State and City Develop Plans To Spend Federal Neighborhood Stabilization FundsanhdincNo ratings yet

- Mortgage BasicsDocument37 pagesMortgage BasicsAnkita DasNo ratings yet

- CHAP Information Flyer 1Document1 pageCHAP Information Flyer 1Carlos ValentineNo ratings yet

- RCED Housing Packet 2019Document9 pagesRCED Housing Packet 2019Luke MahinNo ratings yet

- Guide To Basic Bookkeeping For NonprofitsDocument66 pagesGuide To Basic Bookkeeping For NonprofitsmahamayaviNo ratings yet

- Rural Debt Trap: Findings of The AIDIS ReportDocument3 pagesRural Debt Trap: Findings of The AIDIS ReportShraddha SharmaNo ratings yet

- BF Financing StrategiesDocument3 pagesBF Financing Strategiesgilli_99No ratings yet

- Organizations Call On FHFA To Address DisplacementDocument8 pagesOrganizations Call On FHFA To Address DisplacementPete MaddenNo ratings yet

- MethodologyDocument9 pagesMethodologyPavan Kumar SuralaNo ratings yet

- Massachusetts Rental Voucher Program MRVP InfographicDocument1 pageMassachusetts Rental Voucher Program MRVP Infographicapi-533362315No ratings yet

- Hud Dasp RTC v15Document11 pagesHud Dasp RTC v15Foreclosure FraudNo ratings yet

- Affordable Housing in Florida Book WEBDocument32 pagesAffordable Housing in Florida Book WEBJsparkleNo ratings yet

- (Done) Rural Financial Markets in Low-Income CountriesDocument11 pages(Done) Rural Financial Markets in Low-Income CountriesVadimNo ratings yet

- Rural Finance Report Examines Poverty AlleviationDocument2 pagesRural Finance Report Examines Poverty AlleviationLilian Figueroa LabrañaNo ratings yet

- A Study On Role of Financial Institutions in Providing Housing Loans To Middle Income Group in Bangalore City.Document72 pagesA Study On Role of Financial Institutions in Providing Housing Loans To Middle Income Group in Bangalore City.Nadeem Naddu100% (1)

- Microfinance For HousingDocument14 pagesMicrofinance For HousingChristopher BennettNo ratings yet

- McKee ARPA Down PaymentDocument12 pagesMcKee ARPA Down PaymentNBC 10 WJARNo ratings yet

- City of East Lansing Avondale Square Down Payment Assistance Procedural GuideDocument13 pagesCity of East Lansing Avondale Square Down Payment Assistance Procedural GuidehometownhousingNo ratings yet

- Banking Risk DistributionDocument5 pagesBanking Risk DistributionPrashant RatnpandeyNo ratings yet

- Grant Report6 2011Document90 pagesGrant Report6 2011SkyValley92241No ratings yet

- India:: Housing Finance System Expansion ProjectDocument67 pagesIndia:: Housing Finance System Expansion ProjectAnand PeriasamyNo ratings yet

- "Your Way Home Arizona": Pima County Program DescriptionDocument3 pages"Your Way Home Arizona": Pima County Program Descriptionmarkkerrward5No ratings yet

- NHB Vishal GoyalDocument24 pagesNHB Vishal GoyalSky walkingNo ratings yet

- Navigating The World of Housing FinanceDocument9 pagesNavigating The World of Housing FinanceTanu RathiNo ratings yet

- Reverse Mortgage Primer - BOFA 2006Document24 pagesReverse Mortgage Primer - BOFA 2006ab3rdNo ratings yet

- Eco 2Document10 pagesEco 2priyaNo ratings yet

- Highlights: What We Audited and WhyDocument59 pagesHighlights: What We Audited and WhyTexas WatchdogNo ratings yet

- Rural DevelopmentDocument27 pagesRural Developmentakp200522No ratings yet

- Credit Score EssayDocument24 pagesCredit Score EssaypavistatsNo ratings yet

- Broadview Homes For A Changing Region Action PlanDocument12 pagesBroadview Homes For A Changing Region Action PlanMichaelRomainNo ratings yet

- Reverse Mortgage BasicsDocument11 pagesReverse Mortgage BasicsSidharth A.murabatteNo ratings yet

- Mortgagee Letter (ML) Implementation Process OverviewDocument2 pagesMortgagee Letter (ML) Implementation Process OverviewRafael SabinoNo ratings yet

- PA Human Service Block GrantDocument2 pagesPA Human Service Block GrantChris JandoliNo ratings yet

- Americas Rental HousingDocument36 pagesAmericas Rental HousingMariaNugrahiniNo ratings yet

- Demand Letter To HUDDocument3 pagesDemand Letter To HUDSean KeenanNo ratings yet

- Opening The Door To Homeownership: Homebuyer Loan ProgramsDocument10 pagesOpening The Door To Homeownership: Homebuyer Loan ProgramsAnwar BrooksNo ratings yet

- Self-Employment and Entrepreneurship Development Programmes: Integrated Rural Development ProgrammeDocument7 pagesSelf-Employment and Entrepreneurship Development Programmes: Integrated Rural Development ProgrammeVirender KulhariaNo ratings yet

- Land to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesFrom EverandLand to Lots: How to Borrow Money You Don't Have to Pay Back and LAUNCH Master Planned CommunitiesNo ratings yet

- Will Reverse Mortgages be the Salvation of Baby Boomer Retirees?From EverandWill Reverse Mortgages be the Salvation of Baby Boomer Retirees?No ratings yet

- The Top Vendors of Food Service Equipment Supplies On The WebDocument17 pagesThe Top Vendors of Food Service Equipment Supplies On The WebSUPER INDUSTRIAL ONLINENo ratings yet

- PicnicTablesandBenches PDFDocument1 pagePicnicTablesandBenches PDFSUPER INDUSTRIAL ONLINENo ratings yet

- FDA GUIDE For Food Safety BilingualDocument547 pagesFDA GUIDE For Food Safety BilingualSUPER INDUSTRIAL ONLINE100% (1)

- Super Industrial Online New Products CatalogDocument26 pagesSuper Industrial Online New Products CatalogSUPER INDUSTRIAL ONLINENo ratings yet

- Hardworkers Newtork SAFETY CATALOG PDFDocument15 pagesHardworkers Newtork SAFETY CATALOG PDFSUPER INDUSTRIAL ONLINENo ratings yet

- SIO March 2018 PARK CATALOG PDFDocument18 pagesSIO March 2018 PARK CATALOG PDFSUPER INDUSTRIAL ONLINENo ratings yet

- Sio Green Products PDFDocument22 pagesSio Green Products PDFSUPER INDUSTRIAL ONLINENo ratings yet

- Find The Top Vendors in CabinetsDocument1 pageFind The Top Vendors in CabinetsSUPER INDUSTRIAL ONLINENo ratings yet

- The Best Industrial Products of 2018Document1 pageThe Best Industrial Products of 2018SUPER INDUSTRIAL ONLINENo ratings yet

- Directorio GeneralDocument136 pagesDirectorio GeneralBLANCA100% (2)

- 2018 Sio Green and Residential Products PDFDocument15 pages2018 Sio Green and Residential Products PDFSUPER INDUSTRIAL ONLINENo ratings yet

- Hardworker Catalog Safety PDFDocument3 pagesHardworker Catalog Safety PDFSUPER INDUSTRIAL ONLINENo ratings yet

- Directorio GeneralDocument136 pagesDirectorio GeneralBLANCA100% (2)

- Sio Green Products PDFDocument22 pagesSio Green Products PDFSUPER INDUSTRIAL ONLINENo ratings yet

- SIO March 2018 Cataklog PDFDocument23 pagesSIO March 2018 Cataklog PDFSUPER INDUSTRIAL ONLINENo ratings yet

- Guia Comercial de La Industria de Empaques, Envases y Embalajes en Norte AmericaDocument737 pagesGuia Comercial de La Industria de Empaques, Envases y Embalajes en Norte AmericaSUPER INDUSTRIAL ONLINENo ratings yet

- Consejos para Prevencion de AccidentesDocument265 pagesConsejos para Prevencion de AccidentesSUPER INDUSTRIAL ONLINENo ratings yet

- Bilingual Packaging GuideDocument2,103 pagesBilingual Packaging GuideSUPER INDUSTRIAL ONLINENo ratings yet

- Osha 3165Document1 pageOsha 3165Jair Alejandro CANo ratings yet

- Osha 3151Document48 pagesOsha 3151Andronicus KarisaNo ratings yet

- Osha 2254Document270 pagesOsha 2254Allen Savage100% (4)

- Consejos para Prevencion de AccidentesDocument40 pagesConsejos para Prevencion de AccidentesSUPER INDUSTRIAL ONLINENo ratings yet

- Consejos para Prevencion de AccidentesDocument40 pagesConsejos para Prevencion de AccidentesSUPER INDUSTRIAL ONLINENo ratings yet

- Consejos para Prevencion de Accidentes en El TrabajoDocument3 pagesConsejos para Prevencion de Accidentes en El TrabajoSUPER INDUSTRIAL ONLINENo ratings yet

- Consejos para Prevencion de AccidentesDocument22 pagesConsejos para Prevencion de AccidentesSUPER INDUSTRIAL ONLINENo ratings yet

- Consejos para Prevencion de AccidentesDocument2 pagesConsejos para Prevencion de AccidentesSUPER INDUSTRIAL ONLINENo ratings yet

- OSHA Small Business HandbookDocument56 pagesOSHA Small Business HandbookkoshijosephNo ratings yet

- p1 PDFDocument2 pagesp1 PDFSUPER INDUSTRIAL ONLINENo ratings yet

- US Internal Revenue Service: p5Document2 pagesUS Internal Revenue Service: p5IRSNo ratings yet

- Daya CMT SDN BHD V Yuk Tung Construction SDN BHDDocument97 pagesDaya CMT SDN BHD V Yuk Tung Construction SDN BHDLinda AQNo ratings yet

- Mi Chagrita CaprichosaDocument1 pageMi Chagrita CaprichosaByePawellNo ratings yet

- Pretrial Brief (Final Draft Version)Document7 pagesPretrial Brief (Final Draft Version)Carla VirtucioNo ratings yet

- Special Proceedings 16Document72 pagesSpecial Proceedings 16Irish Dale Louise M. DimitimanNo ratings yet

- Case 3Document35 pagesCase 3Μιχαήλ εραστής του ροσαριούNo ratings yet

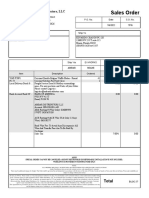

- Sales Order: Ambar Distributors, LLCDocument1 pageSales Order: Ambar Distributors, LLCEduardo ChaconNo ratings yet

- Institute of Law Nirma University: Contract Law Ii Research Paper ON Shareholders AgreementDocument20 pagesInstitute of Law Nirma University: Contract Law Ii Research Paper ON Shareholders AgreementShane Sharma JohnNo ratings yet

- January Current AffairsDocument40 pagesJanuary Current AffairsmsaibalajiNo ratings yet

- Research On Reasonable Accommodation ADA CaseDocument4 pagesResearch On Reasonable Accommodation ADA Caseapi-403032371No ratings yet

- VidAngel MotionDocument15 pagesVidAngel MotionTHROnlineNo ratings yet

- Basics of Iprs: Dr. D.P.Verma Asstt - Professor Law H.P.University Regional CentreDocument23 pagesBasics of Iprs: Dr. D.P.Verma Asstt - Professor Law H.P.University Regional CentreNeetek SahayNo ratings yet

- Criminal Law 1 - Student'sDocument809 pagesCriminal Law 1 - Student'sApol GimenezNo ratings yet

- Limkaichong V COMELEC - Section 1Document2 pagesLimkaichong V COMELEC - Section 1Kiana Abella100% (1)

- Mock Bar QuestionnaireDocument2 pagesMock Bar Questionnairekrypna100% (1)

- The Effects of Arbitration On The Building IndustryDocument83 pagesThe Effects of Arbitration On The Building IndustryChristopher Amasor AdokuruNo ratings yet

- Bio W. Todd HarveyDocument1 pageBio W. Todd HarveyburkeharveyNo ratings yet

- Philippine Supreme Court Decisions on Constitutionality of LawsDocument64 pagesPhilippine Supreme Court Decisions on Constitutionality of Lawswesternwound82No ratings yet

- Iloilo City Regulation Ordinance 2011-307Document8 pagesIloilo City Regulation Ordinance 2011-307Iloilo City Council100% (2)

- Pari Passu Principle CaseDocument26 pagesPari Passu Principle CasefridzNo ratings yet

- Belum Aktivasi PDM Kota LhokseumaweDocument10 pagesBelum Aktivasi PDM Kota LhokseumaweSyaiful AnwarNo ratings yet

- United Pepsi-Cola Union V LaguesmaDocument4 pagesUnited Pepsi-Cola Union V LaguesmaCZARINA ANN CASTRONo ratings yet

- U. P. State Medical Faculty: Application Form For Paramedical Diploma RegistrationDocument2 pagesU. P. State Medical Faculty: Application Form For Paramedical Diploma Registrationdr. rajendra kumarNo ratings yet

- Aws WHB2 CH18 PDFDocument29 pagesAws WHB2 CH18 PDFAlex SalasNo ratings yet

- Images Antiscalants MSDS English Rpi-3000a enDocument9 pagesImages Antiscalants MSDS English Rpi-3000a enBilgi KurumsalNo ratings yet

- Law On Legal Process PDFDocument23 pagesLaw On Legal Process PDFSandra SantosNo ratings yet

- Legal Theory 2ND PROJECT PDF - 4 4Document1 pageLegal Theory 2ND PROJECT PDF - 4 4SabaNo ratings yet

- Khan Case Appeal Final Ruling OpinionDocument13 pagesKhan Case Appeal Final Ruling OpinionLB68No ratings yet

- Crim Law Rev 1 - Faqs - Revised V 3Document496 pagesCrim Law Rev 1 - Faqs - Revised V 3ED RCNo ratings yet

- Travel Itinerary: V1C1NRDocument6 pagesTravel Itinerary: V1C1NRVida Da Guía DiplNo ratings yet

- Special Law For RegistrationDocument122 pagesSpecial Law For RegistrationRamesh BharadwajNo ratings yet