Professional Documents

Culture Documents

Income Tax Problems

Uploaded by

Pam Otic-ReyesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Problems

Uploaded by

Pam Otic-ReyesCopyright:

Available Formats

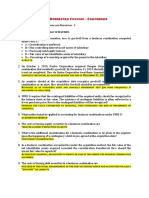

Income Tax problems Midterms VI-9.

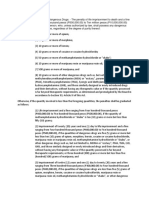

In 2015, ABC Corporation gave the following fringe

benefits to its employees:

I. In 2015,Pnoy, single and a native of Maguindanao, To managerial employees P1,360,000

received during the year the following: To rank and file employees 5,000,000

Proceeds from copyright royalty, net of tax P11,250

Proceeds from mineral claim royalty, net of tax 12,000 The allowable deduction from the gross income of the

Share from trading partnership, net of Corporation for the fringe benefits given to employees is?

withholding tax 270,000

VII. In 2015, ABC Corporation provided a 3-day vacation in

1. How much is the total final tax on Pnoys income? Tagaytay to all of its employees of which 80% are rank and

2. How much is the income tax due and payable of Pnoy in file. Total expenses incurred by the company for the said

2015? vacation amounted to P1M.

10. The total fringe benefit tax expense is?

II-3. An alien individual asked you to assist him in the 11. The total deductible expense is?

preparation of his tax return for his income in 2014. He

provided you the following information: VIII. Pedro, single is a minimum wage earner of EDT

Gross business income, Philippines P1,000,000 Manufacturing Corporation. In addition to his basic

Gross business income, Canada 5,000,000 minimum wage of P144,000 for the year, he also received

Business expenses, Philippines 300,000 the following benefits:

Business expenses, Canada 800,000 De minimis, P60,000 (P20,000 over the ceiling)

Philippine charity sweepstakes winnings 500,000 13th month pay and other benefits, P122,000

Singapore sweepstakes winnings 400,000 12. Pedros taxable income should be?

Interest income-BDO in Canada 100,000

Interest income received from a depository IX. Hananiah Corporation, a corporation engaged in business

bank under FCDS, Philippines 300,000 in the Philippines and abroad has the following data for the

current year:

The taxpayer is single, resident of Manila and had three Gross Income, Philippines P975,000

qualified dependent brothers. What amount should be Expenses, Philippines 750,000

reported by him as his taxable income for 2014? Gross Income, Malaysia 770,000

Expenses, Malaysia 630,000

III-4. Juan is a resident of QC. He sold his family home for Interest on bank deposit 25,000

P4,000,000 which was previously acquired for P2,000,000. Determine the income tax due if the corporation is

Juan compiled all BIR requirements to avail of tax 13. Domestic Corporation?

exemption and spent P2,500,000 in acquiring new family 14. Resident Foreign Corporation?

home. How much is the capital gains tax to be paid by Juan? 15. Non-resident Foreign Corporation?

IV. A resident citizen, married, with a 2 qualified dependent X. A domestic corporation provided the following data:

children has the following data for the year 2015: Gross profit from sales P3,000,000

Gross sales, Philippines P5,000,000 Business expenses 1,800,000

Sales returns and allowances, Philippines 500,000 Dividend from domestic corporation 100,000

Cost of sales, Philippines 1,500,000 Dividend income from resident corporation 50,000

Gross sales, Ukraine 3,000,000 Dividend income from nonresident

Sales return and allowances, Ukraine 200,000 corporation 40,000

Cost of sales, Ukraine 800,000 Capital gain on sale of land in the

Business expenses, Philippines 500,000 Philippines (SP-P1.5M; FMV-P1.8M; Cost-

Business expenses, Ukraine 300,000 P1.5M) 500,000

Interest income, peso bank deposit BDO- Capital gain on sale of land in China (SP-

Marikina 20,000 1.5M; FMV-P1.8M; Cost-P1.3M) 200,000

Interest income, US Dollar deposit BDO- Capital gain on shares of domestic

Mandaluyong 50,000 corporation (direct sale to buyer) 120,000

Gain from sale of residential house and lot Gain on sale of shares of a domestic

(Selling price P3,000,000; FMV, time of corporation thru local stock exchange (SP-

sale, P5,000,000) 500,000 P200,000; Cost-P150,000) 50,000

Gain from sale of shares of stock listed and

traded in the local stock exchange (selling Interest income from:

price, P100,000) 30,000 Notes receivable P20,000

Gain from sale of shares of stock not traded Bank deposits (peso accounts) 30,000

in the local stock exchange 150,000 Bank deposits (foreign currencies) 25,000

Treasury bills 10,000

5. How much is the total final tax on passive income?

6. How much is the capital gains tax due? 16. The income tax due for the year is?

7. How much is the taxable net income? 17. The total capital gains tax for the year is?

18. The total final taxes on passive income for the year is?

V-8. How much is the allowable deduction from business

income of a domestic corporation which granted and paid

P102,000 fringe benefits to its key officers in 2012?

You might also like

- Notes in CostDocument2 pagesNotes in CostKristine PerezNo ratings yet

- Traditional vs ABC costing comparisonDocument2 pagesTraditional vs ABC costing comparisonMitzi EstelleroNo ratings yet

- 1Document19 pages1Angelica Castillo0% (1)

- Chapter 20 (5) : Variable Costing For Management AnalysisDocument39 pagesChapter 20 (5) : Variable Costing For Management AnalysisJames BarzoNo ratings yet

- Acc213 Reviewer Final QuizDocument9 pagesAcc213 Reviewer Final QuizNelson BernoloNo ratings yet

- Voyager IncDocument1 pageVoyager IncLian GarlNo ratings yet

- Practical Accounting 1 ReviewerDocument13 pagesPractical Accounting 1 ReviewerKimberly RamosNo ratings yet

- Chapter 7 - Conversion Cycle P4Document26 pagesChapter 7 - Conversion Cycle P4Joana TrinidadNo ratings yet

- Module 1.a The Accountancy ProfessionDocument6 pagesModule 1.a The Accountancy ProfessionJonathanTipay0% (1)

- Costacc Final ExamDocument20 pagesCostacc Final ExamGemNo ratings yet

- Gross Profit MethodDocument15 pagesGross Profit MethodJeffrel Mae Montaño BrilloNo ratings yet

- Q - Add or Drop A SegmentDocument1 pageQ - Add or Drop A SegmentIrahq Yarte TorrejosNo ratings yet

- Job Costing Finished Goods InventoryDocument46 pagesJob Costing Finished Goods InventoryNavindra JaggernauthNo ratings yet

- Case 7-20 Contact Global Our Analysis-FinalsDocument11 pagesCase 7-20 Contact Global Our Analysis-FinalsJenny Malabrigo, MBANo ratings yet

- Understanding Zero-Rated VAT TransactionsDocument36 pagesUnderstanding Zero-Rated VAT TransactionsCoreen Samaniego0% (2)

- 105 PrelimDocument10 pages105 PrelimEly DoNo ratings yet

- Kid - Questions and AnswerDocument4 pagesKid - Questions and AnswersurvivalofthepolyNo ratings yet

- Philippine Taxation Questions GuideDocument36 pagesPhilippine Taxation Questions GuideShaira BugayongNo ratings yet

- Luigi Balucan Inacc3 Week 2Document12 pagesLuigi Balucan Inacc3 Week 2Luigi Enderez BalucanNo ratings yet

- 05 - CAPITAL STRUCTURE AND LEVERAGE - PROBLEMS With AnswersDocument6 pages05 - CAPITAL STRUCTURE AND LEVERAGE - PROBLEMS With AnswersMerr Fe PainaganNo ratings yet

- Chapter 6 - Fundamentals of Product and Service CostingDocument26 pagesChapter 6 - Fundamentals of Product and Service Costingalleyezonmii100% (1)

- Central Plain University income tax calculationDocument3 pagesCentral Plain University income tax calculationLFGS Finals0% (1)

- Direct Costing and CVP AnalysisDocument25 pagesDirect Costing and CVP AnalysisQueeny Mae Cantre ReutaNo ratings yet

- BLT Quizzer Unknown Donors TaxDocument6 pagesBLT Quizzer Unknown Donors TaxtrishaNo ratings yet

- 1st Midterm Deptal QuizDocument2 pages1st Midterm Deptal QuizJason C0% (2)

- Ac2102 TPDocument6 pagesAc2102 TPNors PataytayNo ratings yet

- Operating Segment StudentsDocument4 pagesOperating Segment StudentsAG VenturesNo ratings yet

- Departmentalization QuizDocument1 pageDepartmentalization QuizPamela GalangNo ratings yet

- Calculating variable and fixed costs for units producedDocument12 pagesCalculating variable and fixed costs for units producedashibhallau100% (1)

- Business and Transfer TaxesDocument4 pagesBusiness and Transfer TaxesClariceIra GarciaNo ratings yet

- Seatwork # 1Document2 pagesSeatwork # 1Joyce Anne GarduqueNo ratings yet

- Cost Accounting Cycle (Multiple Choice)Document3 pagesCost Accounting Cycle (Multiple Choice)Rosselle Manoriña100% (1)

- Chapter 4 Answer Cost AccountingDocument19 pagesChapter 4 Answer Cost AccountingJuline Ashley A CarballoNo ratings yet

- Expenses Contribution MarginratioDocument3 pagesExpenses Contribution MarginratioMike Oshaunessy BaconNo ratings yet

- 4a Standard Costs and Analysis of VariancesDocument3 pages4a Standard Costs and Analysis of VariancesGina TingdayNo ratings yet

- Session # 3 - Accounting CaseletsDocument2 pagesSession # 3 - Accounting CaseletsMandapalli SatishNo ratings yet

- MASDocument46 pagesMASKyll Marcos0% (1)

- ECO 444 Investments Test Bank-No AnswersDocument17 pagesECO 444 Investments Test Bank-No AnswersAllan Genesis Romblon100% (1)

- CTDI Tax Formatting QuestionsDocument13 pagesCTDI Tax Formatting QuestionsMaryane AngelaNo ratings yet

- BALIMBIN TBLTpg83-94Document14 pagesBALIMBIN TBLTpg83-94mariyha Palanggana0% (1)

- Introduction To Business TaxationDocument12 pagesIntroduction To Business TaxationMariel CadayonaNo ratings yet

- Quiz 12 Budgeting and Profit Planning SolutionsDocument6 pagesQuiz 12 Budgeting and Profit Planning Solutionsralphalonzo100% (1)

- Chapter 12 - Dealings in Properties - AnswerDocument7 pagesChapter 12 - Dealings in Properties - AnswerAnonymous eyw8h69EZuNo ratings yet

- 3RD Accrued Liabilities and Deferred RevenueDocument5 pages3RD Accrued Liabilities and Deferred RevenueAnthony DyNo ratings yet

- Lecture 3 Quiz - SchoologyDocument4 pagesLecture 3 Quiz - Schoologylinkin soy0% (1)

- MT Quiz 1 MasterDocument2 pagesMT Quiz 1 MasterChristine Dela Rosa CarolinoNo ratings yet

- SpoilageDocument17 pagesSpoilageBhawin DondaNo ratings yet

- Name: Date: SectionDocument3 pagesName: Date: SectionPrincess Frean VillegasNo ratings yet

- Process Costing SWDocument2 pagesProcess Costing SWChristine AltamarinoNo ratings yet

- 7.3.1 Topic Test Questions AnswersDocument34 pages7.3.1 Topic Test Questions AnswersliamdrlnNo ratings yet

- Essay on Activity-Based Costing for Ingersol DraperiesDocument13 pagesEssay on Activity-Based Costing for Ingersol DraperiesLhorene Hope DueñasNo ratings yet

- Chapter 12-14Document18 pagesChapter 12-14Serena Van Der WoodsenNo ratings yet

- Results For Item 2Document26 pagesResults For Item 2Kath LeynesNo ratings yet

- TAX Tabag First Preboard Set A October 2019: Page 1 of 4Document4 pagesTAX Tabag First Preboard Set A October 2019: Page 1 of 4Paula VillarubiaNo ratings yet

- 84881793Document6 pages84881793Joel Christian MascariñaNo ratings yet

- Taaaaax PDFDocument40 pagesTaaaaax PDFAnne Marieline BuenaventuraNo ratings yet

- Domestic Corporation Dividend Withholding TaxDocument4 pagesDomestic Corporation Dividend Withholding TaxLFGS FinalsNo ratings yet

- MASTERY TAXATION October-2019 PDFDocument12 pagesMASTERY TAXATION October-2019 PDFJuvelyn Gregorio100% (1)

- Tax Pre TestDocument40 pagesTax Pre TestjohnlerrysilvaNo ratings yet

- Tax Calculation for CJR's 2018 IncomeDocument1 pageTax Calculation for CJR's 2018 IncomeEdnel LoterteNo ratings yet

- Section Five Republict Act Nine One Six FiveDocument1 pageSection Five Republict Act Nine One Six FivePam Otic-ReyesNo ratings yet

- Section Eleven Republic Act Nine One Six FiveDocument2 pagesSection Eleven Republic Act Nine One Six FivePam Otic-ReyesNo ratings yet

- PNB vs. Viuda JoseDocument3 pagesPNB vs. Viuda JosePam Otic-ReyesNo ratings yet

- What Is An Evidence - Sec 1 PDFDocument1 pageWhat Is An Evidence - Sec 1 PDFPam Otic-ReyesNo ratings yet

- Vintola Vs VintolaDocument1 pageVintola Vs VintolaPam Otic-ReyesNo ratings yet

- Unciano Paramedical CollegeDocument3 pagesUnciano Paramedical CollegePam Otic-ReyesNo ratings yet

- Vintola Vs VintolaDocument1 pageVintola Vs VintolaPam Otic-ReyesNo ratings yet

- Section Twenty One RA 9165Document1 pageSection Twenty One RA 9165Pam Otic-ReyesNo ratings yet

- Section Twenty One RA 9165Document1 pageSection Twenty One RA 9165Pam Otic-ReyesNo ratings yet

- Prudential Bank's Trust Receipts Give It Priority Over Labor ClaimsDocument2 pagesPrudential Bank's Trust Receipts Give It Priority Over Labor ClaimsPam Otic-ReyesNo ratings yet

- Rosemarie M. Lee vs. Hon. RodilDocument2 pagesRosemarie M. Lee vs. Hon. RodilPam Otic-ReyesNo ratings yet

- Colinares vs. VelosoDocument1 pageColinares vs. VelosoPam Otic-ReyesNo ratings yet

- FUJIKI Vs MARINAY - RussDocument3 pagesFUJIKI Vs MARINAY - RussPam Otic-ReyesNo ratings yet

- Ramirez VS CaDocument1 pageRamirez VS CaPam Otic-ReyesNo ratings yet

- Frenzel Vs Catito GR143958Document2 pagesFrenzel Vs Catito GR143958Pam Otic-Reyes100% (2)

- Audi AG Vs Mejia - RemRev Case DigestDocument2 pagesAudi AG Vs Mejia - RemRev Case DigestPam Otic-ReyesNo ratings yet

- Barons MKTG VS Ca - Human Relations Case # 3Document2 pagesBarons MKTG VS Ca - Human Relations Case # 3Pam Otic-ReyesNo ratings yet

- People vs. PosadaDocument7 pagesPeople vs. PosadaPam Otic-ReyesNo ratings yet

- Cadalin Vs POEADocument3 pagesCadalin Vs POEAPam Otic-ReyesNo ratings yet

- UST Vs Board of Tax AppealsDocument2 pagesUST Vs Board of Tax AppealsPam Otic-Reyes100% (1)

- UST Vs Board of Tax AppealsDocument2 pagesUST Vs Board of Tax AppealsPam Otic-Reyes100% (1)

- De Roy Vs CaDocument1 pageDe Roy Vs CaPam Otic-ReyesNo ratings yet

- Llorente Vs CA GR124371Document1 pageLlorente Vs CA GR124371Pam Otic-ReyesNo ratings yet

- Supreme Court Reverses Illegal Possession ConvictionDocument2 pagesSupreme Court Reverses Illegal Possession ConvictionPam Otic-ReyesNo ratings yet

- Borja Vs Vda DeborjaDocument3 pagesBorja Vs Vda DeborjaPam Otic-ReyesNo ratings yet

- Juan de Dios CarlosDocument4 pagesJuan de Dios CarlosPam Otic-ReyesNo ratings yet

- Dacasin Vs DacasinDocument2 pagesDacasin Vs DacasinPam Otic-ReyesNo ratings yet

- Borja Vs Vda DeborjaDocument3 pagesBorja Vs Vda DeborjaPam Otic-ReyesNo ratings yet

- Globemackay Vs TobiasDocument3 pagesGlobemackay Vs TobiasPam Otic-ReyesNo ratings yet

- Gashem Shookat Baksh VS Ca (Human Relations)Document2 pagesGashem Shookat Baksh VS Ca (Human Relations)Pam Otic-ReyesNo ratings yet

- CH 8 Abs-Var Costing & Inv MNGTDocument21 pagesCH 8 Abs-Var Costing & Inv MNGTArnalistan EkaNo ratings yet

- Chapter - IV Chit Funds - The Evolution, Operational Scenario, Role and Regulatory FrameworkDocument79 pagesChapter - IV Chit Funds - The Evolution, Operational Scenario, Role and Regulatory FrameworkkanikabholaNo ratings yet

- Test Bank For Financial Management 13thDocument28 pagesTest Bank For Financial Management 13thisrael_zamora6389100% (1)

- Triveni TurbineDocument14 pagesTriveni Turbinecanaryhill100% (1)

- Ultratech Acquisition of Jaypee CementDocument9 pagesUltratech Acquisition of Jaypee CementAakashNo ratings yet

- Coca-Cola analysis focuses on long-term track recordDocument11 pagesCoca-Cola analysis focuses on long-term track recorddarwin12100% (1)

- Spatial Tech IPO ValuationDocument6 pagesSpatial Tech IPO ValuationHananie NanieNo ratings yet

- Hotel Audit PolicyDocument6 pagesHotel Audit PolicyZiaul Huq50% (2)

- IAS 41 Accounting for Agricultural ActivityDocument5 pagesIAS 41 Accounting for Agricultural ActivityArney GumbleNo ratings yet

- Audit of Receivables at Far Eastern UniversityDocument6 pagesAudit of Receivables at Far Eastern UniversityKenneth A. S. AlabadoNo ratings yet

- Essential Characteristics of TaxDocument1 pageEssential Characteristics of TaxMarinelle MejiaNo ratings yet

- Demand, Supply, and The Market Process: Full Length Text - Micro Only Text - Macro Only TextDocument66 pagesDemand, Supply, and The Market Process: Full Length Text - Micro Only Text - Macro Only TextCeline YoonNo ratings yet

- Master Budget Example MC Watters AIP8-13Document2 pagesMaster Budget Example MC Watters AIP8-13Muhammed muhabaNo ratings yet

- PWC Illustrative Ifrs Consolidated Financial Statements For 2019 Year EndsDocument223 pagesPWC Illustrative Ifrs Consolidated Financial Statements For 2019 Year EndsAngu SelvanNo ratings yet

- Shinepukur Ceramics Limited: Balance Sheet StatementDocument9 pagesShinepukur Ceramics Limited: Balance Sheet StatementTahmid Shovon100% (1)

- Chapter 22 Fiscal Policy and Monetary PolicyDocument68 pagesChapter 22 Fiscal Policy and Monetary PolicyJason ChungNo ratings yet

- Exhibit(s) 1 (Asset Purchase Agreement)Document57 pagesExhibit(s) 1 (Asset Purchase Agreement)LegalEagleNo ratings yet

- Municipal Finance and Service Delivery in GujaratDocument30 pagesMunicipal Finance and Service Delivery in GujaratKrunal BhanderiNo ratings yet

- A-4 Purple Form Farewell Grant ApplicationDocument2 pagesA-4 Purple Form Farewell Grant Applicationabubakar younasNo ratings yet

- Restaurant Cum Fast FoodDocument23 pagesRestaurant Cum Fast FoodAbdul Saboor AbbasiNo ratings yet

- Taxation I-P1 - (NOV-08), ICABDocument2 pagesTaxation I-P1 - (NOV-08), ICABgundapolaNo ratings yet

- (B) Superannuation Standard Choice Form - ShortDocument2 pages(B) Superannuation Standard Choice Form - ShortAnonymous FsIAZZ9llxNo ratings yet

- Chapter 15 Measurement of Economic Performance (I)Document61 pagesChapter 15 Measurement of Economic Performance (I)Jason Chung100% (1)

- Circular Flow of EconomyDocument19 pagesCircular Flow of EconomyAbhijeet GuptaNo ratings yet

- Airbnb CaseDocument2 pagesAirbnb CaseVân Anh Phan0% (1)

- Adw e 14Document4 pagesAdw e 14Paapu ChellamNo ratings yet

- Palepu 3e ch4Document21 pagesPalepu 3e ch4Nadine SantosNo ratings yet

- File: Chapter 03 - Consolidations - Subsequent To The Date of Acquisition Multiple ChoiceDocument58 pagesFile: Chapter 03 - Consolidations - Subsequent To The Date of Acquisition Multiple Choicejana ayoubNo ratings yet

- CH 07Document99 pagesCH 07homeboimartinNo ratings yet

- 47 RP V Soriano PDFDocument12 pages47 RP V Soriano PDFBrenda de la GenteNo ratings yet