Professional Documents

Culture Documents

Sage Nominal Codes

Uploaded by

malinkalon120 ratings0% found this document useful (0 votes)

1K views2 pagesCodes for Assest, Liabilities and Equity

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCodes for Assest, Liabilities and Equity

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1K views2 pagesSage Nominal Codes

Uploaded by

malinkalon12Codes for Assest, Liabilities and Equity

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 2

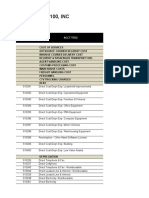

Sage Default Nominal Codes 1.

0010 Freehold property 5201 Closing stock

0011 Leasehold property 6000 Productive Labour

0020 Plant & Machinery 6001 Cost of sales labour

0021 Plant & m/cy depreciation 6002 Sub-contractors

0030 Office equipment 6100 Sales commissions

0031 Office equipt depreciation 6200 Sales promotion

0040 Furniture & fixtures 6201 Advertising

0041 Furniture & fxts depreciation 6202 Gifts & samples

0050 Motor Vehicles 6203 PR (literature 7 brochures)

0051 Motor vehicles depreciation 6900 Miscellaneous expenses

1001 Stock 7000 Gross wages

1002 Work in progress 7001 Directors salaries

1003 Finished goods 7002 Directors remuneration

1100 Debtors Control account 7003 Staff salaries

1101 Sundry debtors 7004 Wages regular

1102 Other debtors 7005 Wages casual

1103 Prepayments 7006 Employers NI

1200 Bank current account 7007 Employers pensions

1210 Bank deposit account 7008 Recruitment expenses

1220 Building society account 7009 Adjustments

1230 Petty cash 7010 SSP reclaimed

1235 Cash receipts 7011 SMP reclaimed

1240 Company credit card 7100 Rent

1250 Credit card receipts 7102 Water rates

2100 Creditors control account 7103 General rates

2101 Sundry creditors 7104 Premises insurance

2102 Other creditors 7200 Electricity

2109 Accruals 7201 Gas

2200 Sales Tax control account (VAT) 7202 Oil

2201 Purchase Tax control account (VAT) 7203 Other heating costs

2202 VAT liability 7300 Fuel & oil (MOTOR)

2210 PAYE 7301 Repairs & servicing (MOTOR)

2211 National Insurance 7302 Licenses

2220 Net wages 7303 Vehicle insurance

2230 Pension fund 7304 Miscellaneous motor

2300 Loans 7350 Scale charges

2310 Hire purchase 7400 Travelling

2320 Corporation tax 7401 Car hire

2330 Mortgages 7402 Hotels

3010 Preference shares 7403 UK Entertainment

3100 Reserves 7404 Overseas Entertainment

3101 Undistributed reserves 7405 Overseas travelling

3200 Profit & Loss Account 7406 Subsistence

4000 Sales type A 7500 Printing

4001 Sales type B 7501 Postage & carriage

4002 Sales type C 7502 Telephone

4009 Discounts allowed 7503 Telex/telegram/fax

4100 Sales type D 7504 Office stationery

4101 Sales type E 7505 Books etc

4200 Sale of Assets 7600 Legal fees

4400 Credit charges (late payments) 7601 Audit & accountancy fees

4900 Miscellaneous income 7602 Consultancy fees

4901 Royalties received 7603 Professional fees

4902 Commissions received 7700 Equipment hire

4903 Insurance claims 7701 Office m/c maintenance

4904 Rent income 7800 Repairs & renewals

4905 Distribution & carriage 7801 Cleaning

5000 Materials purchased 7802 Laundry

5001 Materials imported 7803 Premises expenses

5002 Miscellaneous purchases 7900 Bank interest paid

5003 Packaging 7901 Bank charges

5009 Discounts taken 7902 Currency charges

5100 Carriage 7903 Loan interest paid

5101 Import duty 7904 HP interest

5102 Transport insurance 7905 Credit charges

5200 Opening stock 7906 Exchange rate variance

Sage Default Nominal Codes 2.

8000 Depreciation

8001 Plant & m/cy depreciation

8002 Furniture/fittings depreciation

8003 Vehicle depreciation

8004 Office equipment depreciation

8100 Bad debt write off

8102 Bad debt provision

8200 Donations

8201 Subscriptions

8202 Clothing costs

8203 Training costs

8204 Insurance

8205 Refreshments

9998 Suspense account

9999 Mispostings account

You might also like

- Everything Positive About Negative Working Capital: A Conceptual Analysis of Indian FMCG SectorDocument36 pagesEverything Positive About Negative Working Capital: A Conceptual Analysis of Indian FMCG SectorAritrika PaulNo ratings yet

- Warren BuffettDocument4 pagesWarren BuffettJawahirul MahbubiNo ratings yet

- MNL Want To Lose Weight Eat Off A Crinkly Plate AdvDocument5 pagesMNL Want To Lose Weight Eat Off A Crinkly Plate AdvMarek Kleniec0% (1)

- Double Entry BookkeepingDocument23 pagesDouble Entry BookkeepingAhrian BenaNo ratings yet

- Oxford Handbook of Commercial Correspondence (New Edition) : December 2005 Volume 9, Number 3Document3 pagesOxford Handbook of Commercial Correspondence (New Edition) : December 2005 Volume 9, Number 3Huỳnh Hồng HiềnNo ratings yet

- Meetings in English - Unit 3 PDFDocument4 pagesMeetings in English - Unit 3 PDFAswathy CjNo ratings yet

- Lesson PlanDocument4 pagesLesson Planapi-294829353No ratings yet

- IELTS Reading Classification QuestionDocument6 pagesIELTS Reading Classification Questionedscott66No ratings yet

- CH 1 Introduction To AccountingDocument53 pagesCH 1 Introduction To AccountingUmmu ZubairNo ratings yet

- Accounting JournalDocument6 pagesAccounting JournaledwinjethromoliverosNo ratings yet

- IC Accounting Journal Template Updated 8552Document6 pagesIC Accounting Journal Template Updated 8552MochdeedatShonhajiNo ratings yet

- Chart of AccountDocument4 pagesChart of AccountShang BugayongNo ratings yet

- Chart of AccountsDocument4 pagesChart of Accountsjyllstuart100% (3)

- Shareholders' Funds Reserves and SurplusDocument3 pagesShareholders' Funds Reserves and SurplusBalaji GaneshNo ratings yet

- Charts of Accounts of Eagle Wheels Auto Solutions For QBDocument16 pagesCharts of Accounts of Eagle Wheels Auto Solutions For QBMuhammad UsmanNo ratings yet

- DAFTAR AKUN PT SEJAHTERA - ExcelDocument9 pagesDAFTAR AKUN PT SEJAHTERA - ExcelDesi ErmitaNo ratings yet

- Chart of AccountsDocument1 pageChart of Accountsaugusto silvaNo ratings yet

- Chart of Accounts: (Categories of Income and Expenses) Income (Revenues)Document1 pageChart of Accounts: (Categories of Income and Expenses) Income (Revenues)augusto silvaNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word DocumentDipok DasNo ratings yet

- Opening Assets Liab + Eq: Octane B. S & I.SDocument7 pagesOpening Assets Liab + Eq: Octane B. S & I.SRashmi KumariNo ratings yet

- Partnership Final Account and Balance SheetDocument42 pagesPartnership Final Account and Balance SheetAnandkumar Gupta0% (1)

- Shareholders' Funds Reserves and SurplusDocument10 pagesShareholders' Funds Reserves and SurplusBalaji GaneshNo ratings yet

- Sample chart accountsDocument3 pagesSample chart accountsJulie R. UgsodNo ratings yet

- Chart of Accounts: Account NumberingDocument15 pagesChart of Accounts: Account NumberingrjrjrjNo ratings yet

- Fam - Session ViiDocument8 pagesFam - Session ViiMukund kelaNo ratings yet

- Tall 9.0 Practical QuestionsDocument14 pagesTall 9.0 Practical QuestionsBarani Dharan100% (3)

- Practice QuestionDocument2 pagesPractice QuestionFadzai MutangaNo ratings yet

- Balance sheet and income statement analysisDocument8 pagesBalance sheet and income statement analysisAnindya BasuNo ratings yet

- Answers - Adjusting Entries AssignmentDocument5 pagesAnswers - Adjusting Entries AssignmentJames Matthew LomongoNo ratings yet

- O Level Accounts Important QuestionsDocument55 pagesO Level Accounts Important QuestionsibrahoNo ratings yet

- Dirt Bikes motorcycle sales and financial statements 2010-2014Document7 pagesDirt Bikes motorcycle sales and financial statements 2010-2014khang nguyenNo ratings yet

- Default Chart of AccountsDocument4 pagesDefault Chart of Accountsjmanzungu2820No ratings yet

- Mid Sem Paper SolutionDocument2 pagesMid Sem Paper Solutionwww.tejashrai1072000No ratings yet

- Incomplete Records MTQDocument5 pagesIncomplete Records MTQqas4476pubNo ratings yet

- Final Accounts QuestionsDocument6 pagesFinal Accounts QuestionsGandharva Shankara Murthy100% (1)

- Past PaperDocument6 pagesPast PaperNadineNo ratings yet

- Final Account Numerical ProblemDocument56 pagesFinal Account Numerical ProblemPrasad BhanageNo ratings yet

- Budget Template - Class Sheet (19th Batch)Document22 pagesBudget Template - Class Sheet (19th Batch)Shahanara AkterNo ratings yet

- Problem 1Document3 pagesProblem 1karthikeyan01No ratings yet

- Laporan KeuanganDocument18 pagesLaporan KeuanganJirjiz RasheedNo ratings yet

- ACCT 126 Fundamentals of Accounting Adjusting Entries PracticeDocument4 pagesACCT 126 Fundamentals of Accounting Adjusting Entries PracticeAliyah AliNo ratings yet

- Accounting for Dickinson CompanyDocument38 pagesAccounting for Dickinson CompanyPhương NguyễnNo ratings yet

- Particulars Amt: Trading, Profit and Loss A/CDocument5 pagesParticulars Amt: Trading, Profit and Loss A/CKave MathiNo ratings yet

- Modern Languages University Course DetailsDocument3 pagesModern Languages University Course DetailsJawad AzizNo ratings yet

- Journal 3.8Document12 pagesJournal 3.8nahar570No ratings yet

- Solution Past Year Exam Financial Statements GCDocument12 pagesSolution Past Year Exam Financial Statements GCFara husnaNo ratings yet

- Sample Chart of AccountsDocument5 pagesSample Chart of AccountssnsdyurijjangNo ratings yet

- Construction Chart of Accounts: Account Type Account No. Account Name Current AssetsDocument10 pagesConstruction Chart of Accounts: Account Type Account No. Account Name Current AssetsTy ChanreaksmeyNo ratings yet

- Airfreight 2100 Cost CodesDocument12 pagesAirfreight 2100 Cost Codes175pauNo ratings yet

- Trial BalanceDocument5 pagesTrial BalanceHanna Ysabelle AldeaNo ratings yet

- Nur Qaseh SDN BHD Soci CorrectedDocument5 pagesNur Qaseh SDN BHD Soci CorrectedSyza LinaNo ratings yet

- Accounting Problem B Abeleda (AutoRecovered)Document14 pagesAccounting Problem B Abeleda (AutoRecovered)xjammer100% (2)

- Mock Solutions - MMDocument24 pagesMock Solutions - MMNitish YadavNo ratings yet

- GL Code GLDocument6 pagesGL Code GLFranckNo ratings yet

- Cash Flow Statement - Amith PanickerDocument5 pagesCash Flow Statement - Amith PanickerAmith PanickerNo ratings yet

- UntitledDocument8 pagesUntitledMingxNo ratings yet

- Tally Practice BookDocument20 pagesTally Practice BookJancy SunishNo ratings yet

- Cochin MarineDocument4 pagesCochin MarineSivasaravanan A TNo ratings yet

- Tally Practice PaperDocument20 pagesTally Practice PaperAjitesh anand100% (2)

- USAR Chart of Accounts ReviewDocument8 pagesUSAR Chart of Accounts ReviewManel AmaratungaNo ratings yet

- Enhanced Consol LoanDocument8 pagesEnhanced Consol LoanjoancuteverNo ratings yet

- Personal Notes in Insurance LawDocument10 pagesPersonal Notes in Insurance LawRusty Nomad100% (1)

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDocument3 pagesEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of Registrationrebs9No ratings yet

- Your Future in Forex! The SECRET Is Yours 1453750681forexDocument214 pagesYour Future in Forex! The SECRET Is Yours 1453750681forexdanadamsfxNo ratings yet

- Bank Gaurantee - Legal PerspectiveDocument16 pagesBank Gaurantee - Legal PerspectiveAbhijithsr TvpmNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha Supreme (UIN 110N160V03) TandCDocument32 pagesTata AIA Life Insurance Sampoorna Raksha Supreme (UIN 110N160V03) TandCPradeep KshatriyaNo ratings yet

- Operational Risk Compliance Manager in Washington DC Resume Karen McKoyDocument2 pagesOperational Risk Compliance Manager in Washington DC Resume Karen McKoyKarenMcKoyNo ratings yet

- Scenario Analysis of The COVID-19 Pandemic-Final PDFDocument126 pagesScenario Analysis of The COVID-19 Pandemic-Final PDFSourav KumarNo ratings yet

- HEC Rules for Employee Appointment, Promotion & TransferDocument63 pagesHEC Rules for Employee Appointment, Promotion & TransferidreesnazimNo ratings yet

- Role of BrokerDocument16 pagesRole of BrokerajmeranamitNo ratings yet

- Construction Claims DelaysDocument23 pagesConstruction Claims Delaysgerx11xregNo ratings yet

- Insurance InsightsDocument20 pagesInsurance InsightsRaju JainNo ratings yet

- Lic Agent SatisfactionDocument32 pagesLic Agent SatisfactionAmit Pasi100% (1)

- Federal Income Tax CourseDocument1,001 pagesFederal Income Tax CourseDeroy GarryNo ratings yet

- UnitedHealth Group, Inc. Initiating Coverage ReportDocument10 pagesUnitedHealth Group, Inc. Initiating Coverage Reportmikielam23No ratings yet

- HDFC Life Click 2 Invest - Ulip - GJ - IllustrationDocument3 pagesHDFC Life Click 2 Invest - Ulip - GJ - IllustrationYashpal SinghNo ratings yet

- Emirates Pilot Pay & Benefits GuideDocument1 pageEmirates Pilot Pay & Benefits Guideibraim864227No ratings yet

- Certificate of Marine Cargo Insurance: OriginalDocument3 pagesCertificate of Marine Cargo Insurance: OriginalMauricio Montaño MelgarNo ratings yet

- Insurance Act 1938 IIBSDocument23 pagesInsurance Act 1938 IIBSbapparoyNo ratings yet

- QS - Indian Bank - Initiating CoverageDocument11 pagesQS - Indian Bank - Initiating CoverageratithaneNo ratings yet

- LUX CorporateDocument49 pagesLUX Corporatepwrsys18No ratings yet

- Application For VAT Registration UKDocument4 pagesApplication For VAT Registration UKKeyconsulting UKNo ratings yet

- Selling Skills WorkbookDocument25 pagesSelling Skills WorkbookalokmenoninNo ratings yet

- Swasthya SathiDocument68 pagesSwasthya Sathiniliw44578No ratings yet

- Certificate of Property Insurance: Tommy RayDocument1 pageCertificate of Property Insurance: Tommy RayZafarNo ratings yet

- Portfolio Management Banking SectorDocument133 pagesPortfolio Management Banking SectorNitinAgnihotri100% (1)

- IC - 67 Marine InsuranceDocument23 pagesIC - 67 Marine InsuranceMahendra Kumar YogiNo ratings yet

- ERM in Pharmaceutical Industry - Case Study of Johnson & JohnsonDocument12 pagesERM in Pharmaceutical Industry - Case Study of Johnson & JohnsonSamhitha KandlakuntaNo ratings yet

- List of Consumer Reporting CompaniesDocument37 pagesList of Consumer Reporting CompaniesCoral LionNo ratings yet