Professional Documents

Culture Documents

Format No. BCCM163458/PS-2 Schedule of Prices Withholding Tax For Non-Resident Bidders or Its Permanent Establishment (Pe) in India

Uploaded by

Bathina Srinivasa RaoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Format No. BCCM163458/PS-2 Schedule of Prices Withholding Tax For Non-Resident Bidders or Its Permanent Establishment (Pe) in India

Uploaded by

Bathina Srinivasa RaoCopyright:

Available Formats

Name of work: Design, Engineering, Supply, Installation, Testing &

Commissioning and Comprehensive Post Warranty Annual Maintenance

Contract for 3 years of Automatic Rim Seal Fire Protection System for

External Floating Roof type Crude Oil Storage Tank (Tank No. 502) at

BARAUNI REFINERY

[ISO 9001-2000, 14001 & Barauni Refinery.

OHSAS-18001 certified]

Tender No.: BCCM163458

Format No. BCCM163458/PS-2

SCHEDULE OF PRICES

WITHHOLDING TAX FOR NON-RESIDENT BIDDERS OR ITS PERMANENT

ESTABLISHMENT (PE) IN INDIA

(Bidders who do not fall in this category shall put "Not Applicable" in this format.)

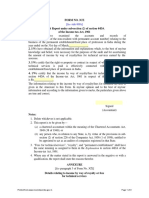

SL. DUTY/TAX Amount on Currency Rate WITHHOLDING TAX

NO which the of the of Tax (C=A*B)

Duty/ Tax mentioned (%)

is amount at IN FIGS. IN WORDS

applicable (A) (B)

(A)

1 WITHHOLDING

TAX

Notes:-

1. Notwithstanding anything mentioned in the contract, Letter of Acceptance, BID Documents or any

correspondences, following clauses shall be applicable with respect to Indian Income Tax including

withholding tax.

2. The CONTRACTOR shall be exclusively responsible and liable to pay all income taxes on any

payments arising out of the Contract, whether payable in India or in any other jurisdiction.

3. Any payment to non-resident or its permanent establishment (PE) in India which is chargeable to

tax in India attracts withholding tax in India under Income Tax Act, 1961 shall be subject to provisions

of Double Taxation Avoidance Agreement (DTAA), wherever applicable, for withholding tax purposes

only.

4. Contractor shall not include Withholding tax/Tax deductible at source in its quoted price.

Withholding Tax as applicable as per Indian Income Tax Act read with respective Double Taxation

Avoidance Agreement (hereinafter referred as "DTAA") will be borne by IOCL.

5. Notwithstanding Clause "3" above, where Contractor intends to obtain a Certificate of lower or Nil

Withholding Tax/Tax deductible at source in terms of provisions of Indian Income Tax Act, 1961 and

rules made thereunder, Withholding tax/Tax deductible at source will be deducted from amount

BARAUNI REFINERY In harmony with nature

Name of work: Design, Engineering, Supply, Installation, Testing &

Commissioning and Comprehensive Post Warranty Annual Maintenance

Contract for 3 years of Automatic Rim Seal Fire Protection System for

External Floating Roof type Crude Oil Storage Tank (Tank No. 502) at

BARAUNI REFINERY

[ISO 9001-2000, 14001 & Barauni Refinery.

OHSAS-18001 certified]

Tender No.: BCCM163458

payable under the contract as per Certificate issued by tax authorities under Income Tax Act, 1961

and rules made thereunder and same shall not be borne by IOCL.

6. In all cases whether Withholding tax/Tax deductible at source is borne by IOCl as described in

Clause 114" above or deducted from amount payable as per contract as described in Clause 115"

above, Certificate of Withholding tax/Tax deducted at source will be provided by IOCl enabling

contractor to claim credit of the same in their country of residence.

7. To facilitate benefits of DTAA, Contractor shall provide copy of (i) Tax Residence Certificate (TRC),

(ii) Form 10F as described in Rule 21AB of Income Tax Rules, 1962, (iii), NO PERMANENT

ESTABLISHMENT CERTIFICATE (NO PEl as may be required, (iv) Permanent Account Number

(PAN), if available. (v) any other document(S) which might be required to enable IOCl to apply Lower

OR NIL rate of withholding tax.

Stamp & Signature of the bidder

BARAUNI REFINERY In harmony with nature

You might also like

- CipconstructionclaimrevenueDocument5 pagesCipconstructionclaimrevenueIRSNo ratings yet

- Tender Doc Part 1Document97 pagesTender Doc Part 1vandana sahdevNo ratings yet

- FinaltenderDocument85 pagesFinaltenderRiyaz ShaikhNo ratings yet

- Section L of Tender DocumentDocument32 pagesSection L of Tender DocumentMark KNo ratings yet

- Bid Evaluation Criteria & Evaluation MethodologyDocument5 pagesBid Evaluation Criteria & Evaluation MethodologyVipul MishraNo ratings yet

- Parking Shelters at Bareilly Air Force StationDocument120 pagesParking Shelters at Bareilly Air Force StationSandeep Saini100% (1)

- 2.0 Annexure A, I, II and V Has Been Amended As Under Instead of ExistingDocument42 pages2.0 Annexure A, I, II and V Has Been Amended As Under Instead of Existingsri_lntNo ratings yet

- 03 (Three) Months: 7,900.00 (Rupees Seven Thousand and Nine Hundred Only)Document2 pages03 (Three) Months: 7,900.00 (Rupees Seven Thousand and Nine Hundred Only)anshul jainNo ratings yet

- Sandwish PanelDocument47 pagesSandwish PanelMohammad AnwarNo ratings yet

- CORRIGENDUM2Document4 pagesCORRIGENDUM2Shalini BorkerNo ratings yet

- Qualification Requirement: Tender Spec. No. - 11/SE/EDCH/2020-21Document2 pagesQualification Requirement: Tender Spec. No. - 11/SE/EDCH/2020-21anant_sahu_1No ratings yet

- Specification No.:SR-I/C&M/I-1101/2008 Proposal Page 1 of 6Document6 pagesSpecification No.:SR-I/C&M/I-1101/2008 Proposal Page 1 of 6Saptarshi ChatterjeeNo ratings yet

- Indian Oil Corporation Limited Western Region Pipelines, Chaksu Technical Services DepartmentDocument2 pagesIndian Oil Corporation Limited Western Region Pipelines, Chaksu Technical Services Departmentpmcmbharat264No ratings yet

- Mumbai TendernoticeDocument6 pagesMumbai TendernoticeRahul HanumanteNo ratings yet

- Name of Work: SPL Repair To Certain Billets (P-66) Under Ge Af Adm Area at Af Station AgraDocument61 pagesName of Work: SPL Repair To Certain Billets (P-66) Under Ge Af Adm Area at Af Station AgraFakeNo ratings yet

- Section LL of Tender DocumentDocument10 pagesSection LL of Tender DocumentMark KNo ratings yet

- Form No 3CEDocument3 pagesForm No 3CE123vidyaNo ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- Tendernotice 1Document9 pagesTendernotice 1infoNo ratings yet

- Tendernotice 1Document7 pagesTendernotice 1Monish MNo ratings yet

- T 96875 QTNDocument12 pagesT 96875 QTNsrijan018No ratings yet

- Income Tax Proof Documents Submission Guidelines (2019-2020)Document13 pagesIncome Tax Proof Documents Submission Guidelines (2019-2020)Jigar PatelNo ratings yet

- Garden Reach Shipbuilders Notice Inviting TenderDocument22 pagesGarden Reach Shipbuilders Notice Inviting TenderAmiya Kumar DasNo ratings yet

- Burn Standard Company Limited: Burnstandard@yahoo - Co.inDocument10 pagesBurn Standard Company Limited: Burnstandard@yahoo - Co.inArjun PalNo ratings yet

- Indian Oil Corporation Limited Bongaigaon Refinery Tender No - NITDocument2 pagesIndian Oil Corporation Limited Bongaigaon Refinery Tender No - NITgurpreets_807665No ratings yet

- BHEL SC Test Tender - DocumentDocument16 pagesBHEL SC Test Tender - DocumentYagnikNo ratings yet

- General Instructions & Terms & Conditions For Services Against Request For Proposal 1 General InstructionsDocument6 pagesGeneral Instructions & Terms & Conditions For Services Against Request For Proposal 1 General InstructionsSas CentreNo ratings yet

- Add/Alt Married Accn South Zone & MES Area BinnaguriDocument11 pagesAdd/Alt Married Accn South Zone & MES Area Binnaguritally3tallyNo ratings yet

- Nit 944Document68 pagesNit 944parthasarathipalNo ratings yet

- Border Roads Organisation Ministry of Defence Chief Engineer Project DantakDocument73 pagesBorder Roads Organisation Ministry of Defence Chief Engineer Project DantakParmeshwar PrasadNo ratings yet

- Indian Oil Corporation invites bids for Natural Gas Conditioning Skid EPC jobDocument5 pagesIndian Oil Corporation invites bids for Natural Gas Conditioning Skid EPC jobMehtab Alam ShaikhNo ratings yet

- Providing Manpower Assistance for Instrumentation DepartmentDocument5 pagesProviding Manpower Assistance for Instrumentation DepartmentDharmenderSinghChoudharyNo ratings yet

- Fighting Equipment/System Repair/servicing/maintenance/installation WorksDocument3 pagesFighting Equipment/System Repair/servicing/maintenance/installation Workspmcmbharat264No ratings yet

- ATC 7 Buyerhydrabad6Document20 pagesATC 7 Buyerhydrabad6TENDER AWADH GROUPNo ratings yet

- I-REC - Standard Terms and Conditions - UAE-dubaiDocument12 pagesI-REC - Standard Terms and Conditions - UAE-dubailuxusNo ratings yet

- TenderDocument55 pagesTenderGokulnath KumarNo ratings yet

- Term Contract for Hose Management ServicesDocument25 pagesTerm Contract for Hose Management ServicesTechnical A-Star Testing & Inspection Malaysia100% (1)

- Military Engineer ServicesDocument35 pagesMilitary Engineer Servicesbharath gowdaNo ratings yet

- Military Engineer Services Notice of Tender (Nit)Document6 pagesMilitary Engineer Services Notice of Tender (Nit)STEP ELEVATORSNo ratings yet

- Tendernotice 1Document5 pagesTendernotice 1Shafaq SulmazNo ratings yet

- Check List For Commercial Terms: CL-E-R02-07-08-2020Document3 pagesCheck List For Commercial Terms: CL-E-R02-07-08-2020rafikul123No ratings yet

- Name of Work: Term Contract For Artificer Work For Area Under Age B/R-I of Ge (Af) Adm Area at Af Station AgraDocument62 pagesName of Work: Term Contract For Artificer Work For Area Under Age B/R-I of Ge (Af) Adm Area at Af Station AgraFakeNo ratings yet

- AtcDocument21 pagesAtcgoyalcommercialcoNo ratings yet

- 21c835 5Document3 pages21c835 5shubhamkumar.arch12No ratings yet

- Military Engineer Services: P&G ContdDocument44 pagesMilitary Engineer Services: P&G Contdmvs srikarNo ratings yet

- Tender Document Section LLDocument10 pagesTender Document Section LLMark KNo ratings yet

- Tendernotice_1 - 2024-04-14T172235.064Document5 pagesTendernotice_1 - 2024-04-14T172235.064mmesvikaspuri6No ratings yet

- Latest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Document0 pagesLatest Circulars, Notifications and Press Releases: 2. This Notification Shall Come Into Force From The 1Ketan ThakkarNo ratings yet

- Special Conditions of Contract for Overhauling of Boiler Pressure PartsDocument18 pagesSpecial Conditions of Contract for Overhauling of Boiler Pressure PartsRAMAN SHARMANo ratings yet

- Tender Document PDFDocument204 pagesTender Document PDFSuraj SNo ratings yet

- Mes Tendernotice 1Document7 pagesMes Tendernotice 1VIVEK SAININo ratings yet

- Part I: Statutory Update: © The Institute of Chartered Accountants of IndiaDocument41 pagesPart I: Statutory Update: © The Institute of Chartered Accountants of IndiaApeksha ChilwalNo ratings yet

- ATC 6 Buyerkurukshetra1Document48 pagesATC 6 Buyerkurukshetra1TENDER AWADH GROUPNo ratings yet

- Tendernotice 1Document7 pagesTendernotice 1Ravi kumarNo ratings yet

- ATC 6 Buyerkurukshetra1Document47 pagesATC 6 Buyerkurukshetra1TENDER AWADH GROUPNo ratings yet

- Tender CAMC of Voltas AC 21 22Document11 pagesTender CAMC of Voltas AC 21 22Ayush GuptaNo ratings yet

- The Following Bid Specific Data Shall Amend And/or Supplement The Provisions in The GTC/SLADocument38 pagesThe Following Bid Specific Data Shall Amend And/or Supplement The Provisions in The GTC/SLATENDER AWADH GROUPNo ratings yet

- Corporate Head Quarters,: Support-Eproc@nic - inDocument14 pagesCorporate Head Quarters,: Support-Eproc@nic - inJohn Son GNo ratings yet

- LOBPENGGPT01201112 File3of3Document461 pagesLOBPENGGPT01201112 File3of3Vikas TanejaNo ratings yet

- Royale Aspira New PDFDocument2 pagesRoyale Aspira New PDFVikas SinghNo ratings yet

- Ind-As 115 Education MaterialDocument146 pagesInd-As 115 Education MaterialRanjan Rajourya100% (1)

- Legal GuideDocument82 pagesLegal GuideralgrigNo ratings yet

- Filing Procedure PDFDocument1 pageFiling Procedure PDFBathina Srinivasa RaoNo ratings yet

- Building A Better Partnership Between Finance and StrategyDocument4 pagesBuilding A Better Partnership Between Finance and StrategyRaghvendra ToliaNo ratings yet

- Building A Better Partnership Between Finance and StrategyDocument4 pagesBuilding A Better Partnership Between Finance and StrategyRaghvendra ToliaNo ratings yet

- Asian Paints Book of Colours 2016 Guide to Home Decor TrendsDocument148 pagesAsian Paints Book of Colours 2016 Guide to Home Decor TrendssandeepNo ratings yet

- Colour Sheet HouseDocument5 pagesColour Sheet HouseBathina Srinivasa RaoNo ratings yet

- Colour Sheet HouseDocument5 pagesColour Sheet HouseBathina Srinivasa RaoNo ratings yet

- Zero-Based Budgeting Gets A Second LookDocument5 pagesZero-Based Budgeting Gets A Second LookBathina Srinivasa RaoNo ratings yet

- Indirect TaxesDocument15 pagesIndirect TaxesBathina Srinivasa RaoNo ratings yet

- The CFOs Role in Helping Companies Navigate The Coronavirus CrisisDocument6 pagesThe CFOs Role in Helping Companies Navigate The Coronavirus CrisisBathina Srinivasa RaoNo ratings yet

- Questions in GST - AKDocument2 pagesQuestions in GST - AKBathina Srinivasa RaoNo ratings yet

- 12 Physics Notes ch04 Moving Charges and Magnetism PDFDocument3 pages12 Physics Notes ch04 Moving Charges and Magnetism PDFBathina Srinivasa RaoNo ratings yet

- Venkatramani Case Study On Input Tax Credit PDFDocument15 pagesVenkatramani Case Study On Input Tax Credit PDFBathina Srinivasa RaoNo ratings yet

- Contentious Issues in GST 11.10.2018Document24 pagesContentious Issues in GST 11.10.2018Bathina Srinivasa RaoNo ratings yet

- CPE Training Accountants Report by R Vikram PDFDocument45 pagesCPE Training Accountants Report by R Vikram PDFBathina Srinivasa RaoNo ratings yet

- Bhupendra ICAI Bglore GST - 12 Oct 2018 - FinalDocument10 pagesBhupendra ICAI Bglore GST - 12 Oct 2018 - FinalBathina Srinivasa RaoNo ratings yet

- Access VBA TrainerDocument61 pagesAccess VBA TraineriwankurniaNo ratings yet

- Mergers Workbook II-Electronic WorksheetsDocument11 pagesMergers Workbook II-Electronic WorksheetsBathina Srinivasa RaoNo ratings yet

- FEMA - NIRC ICSI - 07 Nov 2015 - Vijay Gupta - VKGN - FinalDocument88 pagesFEMA - NIRC ICSI - 07 Nov 2015 - Vijay Gupta - VKGN - FinalBathina Srinivasa RaoNo ratings yet

- T Shape SkillsDocument3 pagesT Shape SkillsBathina Srinivasa RaoNo ratings yet

- Roth Fee052912Document1 pageRoth Fee052912Bayu kristiantoNo ratings yet

- Important Treatments and Diclosures in IND As Collected From Different Balance Sheet of CompaniesDocument22 pagesImportant Treatments and Diclosures in IND As Collected From Different Balance Sheet of CompaniesBathina Srinivasa RaoNo ratings yet

- Ebiz Steps PDFDocument59 pagesEbiz Steps PDFBathina Srinivasa RaoNo ratings yet

- Retail Sector - GST GUIDEDocument13 pagesRetail Sector - GST GUIDEBathina Srinivasa RaoNo ratings yet

- Reclassification of Oci To P&L Example With EntriesDocument4 pagesReclassification of Oci To P&L Example With EntriesBathina Srinivasa RaoNo ratings yet

- Full Book PP Sacm&Dd-2016Document377 pagesFull Book PP Sacm&Dd-2016Bathina Srinivasa RaoNo ratings yet

- Shipping For Duty DrawbackDocument12 pagesShipping For Duty DrawbackshasvinaNo ratings yet

- Taxguru - In-Step Up To Ind As 101 First Time Adoption of Indian Accounting Standards IND-AsDocument6 pagesTaxguru - In-Step Up To Ind As 101 First Time Adoption of Indian Accounting Standards IND-AsBathina Srinivasa RaoNo ratings yet

- Complaint Trial Tech For SubmissionDocument15 pagesComplaint Trial Tech For SubmissionRichard Laggui SuyuNo ratings yet

- TENANCY AGREEMENT (S)Document6 pagesTENANCY AGREEMENT (S)Shavneil ChandNo ratings yet

- People V QuashaDocument1 pagePeople V Quashaerikha_aranetaNo ratings yet

- Rizona Ourt of PpealsDocument8 pagesRizona Ourt of PpealsScribd Government DocsNo ratings yet

- DNB NOR ASA BankindustrisammenrøreDocument2 pagesDNB NOR ASA Bankindustrisammenrøreindigo1967No ratings yet

- Francisco vs. NLRCDocument2 pagesFrancisco vs. NLRCLorelie Dema-alaNo ratings yet

- Transcription of Videotaped Deposition of Ryan Anderson BellDocument99 pagesTranscription of Videotaped Deposition of Ryan Anderson BellMike LinNo ratings yet

- Almario vs. Alba 127 SCRA 69 G.R. No. L-66088 January 25, 1984Document14 pagesAlmario vs. Alba 127 SCRA 69 G.R. No. L-66088 January 25, 1984Eriyuna100% (1)

- 12 - Claverias Vs QuingcoDocument10 pages12 - Claverias Vs QuingcoDazzle DuterteNo ratings yet

- UP JPIA Constitution GuideDocument13 pagesUP JPIA Constitution GuideMoninaRoseTeNo ratings yet

- Jurisprudence Sem 5Document16 pagesJurisprudence Sem 5Apoorva Chandra0% (1)

- Consumer Dispute ResolutionDocument23 pagesConsumer Dispute ResolutionEric PottsNo ratings yet

- US vs Mexico, General Claims Commission (Chattin Case 1927): Mexican Authorities Violated International Standards in American's Arrest & ImprisonmentDocument1 pageUS vs Mexico, General Claims Commission (Chattin Case 1927): Mexican Authorities Violated International Standards in American's Arrest & ImprisonmentInna Marie Caylao75% (4)

- Maternal Deprivation: Effects and PreventionDocument24 pagesMaternal Deprivation: Effects and PreventionRashmi Negi50% (2)

- Syquia vs. Court of Appeals, 217 SCRA 624 (1993)Document10 pagesSyquia vs. Court of Appeals, 217 SCRA 624 (1993)Katch RoraldoNo ratings yet

- Elder-Abuse-policy-brief 101Document5 pagesElder-Abuse-policy-brief 101Grape JuiceNo ratings yet

- Phil. Employ Services and Resources, Inc. vs. Joseph ParamioDocument5 pagesPhil. Employ Services and Resources, Inc. vs. Joseph ParamioDanny FentomNo ratings yet

- CGCAnnual Report 2009Document8 pagesCGCAnnual Report 2009Suzette ArmijoNo ratings yet

- Ib3 Mirasol V DPWHDocument4 pagesIb3 Mirasol V DPWHJarvin David ResusNo ratings yet

- Philippines, Romulo Padlan and Arturo Siapno,: Delia D. Romero, vs. People of TheDocument72 pagesPhilippines, Romulo Padlan and Arturo Siapno,: Delia D. Romero, vs. People of TheJoyce Ann CaigasNo ratings yet

- Metropolitan Bank & Trust Company Vs Asb Holdings, Inc. Case DigestDocument3 pagesMetropolitan Bank & Trust Company Vs Asb Holdings, Inc. Case DigestNullus cumunisNo ratings yet

- FEDERICO vs. COMELECDocument2 pagesFEDERICO vs. COMELECKeilah Arguelles100% (1)

- United States Court of Appeals, Second Circuit.: No. 1793, Docket 81-7456Document3 pagesUnited States Court of Appeals, Second Circuit.: No. 1793, Docket 81-7456Scribd Government DocsNo ratings yet

- Police Corruption: A Widespread ProblemDocument1 pagePolice Corruption: A Widespread ProblemAries BordonadaNo ratings yet

- Think & Learn Leave Policy SummaryDocument10 pagesThink & Learn Leave Policy SummaryRakshitAnandNo ratings yet

- EVIDENCE RULESDocument10 pagesEVIDENCE RULESAna FosterNo ratings yet

- Highbrow ComplaintDocument13 pagesHighbrow ComplaintKenan FarrellNo ratings yet

- Activity #1: Introduction To Philosophy of The Human Person Instructor: Kenneth L. CrisostomoDocument5 pagesActivity #1: Introduction To Philosophy of The Human Person Instructor: Kenneth L. CrisostomoFritzey Faye RomeronaNo ratings yet

- 59 Dulay V DulayDocument2 pages59 Dulay V Dulaycris100% (3)

- How To Save Income Tax Through Planning - RediffDocument3 pagesHow To Save Income Tax Through Planning - Rediffsirsa11No ratings yet