Professional Documents

Culture Documents

Accounting Heads of Incomes

Uploaded by

kpsrikanthvOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Heads of Incomes

Uploaded by

kpsrikanthvCopyright:

Available Formats

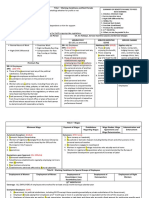

ACCOUNTING HEADS OF INCOMES / EXPENSES

ACCOUNTING HEADS OF

S. NO. I T E M S C O V E R E D

INCOMES / EXPENSES

1 Basic salary 1 Basic portion of total salary payable to em

2 Bonus 1 Bonus expense for the year as per provisio

Incentive paid to staff over and above the

3 Incentive to Staff 1 (MUST BE APPROVED BY BRANCH A

VOUCHER)

4 House Rent Allowance 1 House rent allowance portion of total sala

5 Transport Allowance 1 Transport allowance portion of total salar

Stipend/apprenticeship charges paid to tra

6A. Stipend Account 1

conveyance expenses account)

6B. Stipend payable 1 Stipend amount payable to trainees etc. as

Charges paid to consultant or for advertis

7 Recruitment Expenses 1

staff or and their interview, screening, ind

8 Telephone expenses reimbursement 1 Telephone expenses reimbursed to office

Petty telephone expenses incurred by field

2

NOT be reimbursed under this head and

9 Medical Expenses reimbursement 1 Medical expenses reimbursed to office sta

10A. Employer's contribution to ESI 1 Will be debited at the time of monthly clo

10B. Employees' contribution to ESI payable 1 Will be credited at the time of making pro

2 Will be debited at the time of making pay

10C. ESI payable 1 Will be credited at the time of monthly cl

2 Will be debited at the time of making pay

Will be debited at the time of monthly clo

11A. Employer's contribution to provident fund 1

fund excluding PF admin charges and ED

Employees' contribution to provident fund

11B. 1 Will be credited at the time of making pro

payable

2 Will be debited at the time of making pay

11C. PF payable 1 Will be credited at the time of monthly cl

2 Will be debited at the time of making pay

12 Provident fund admin charges 1 Total admin charges on provident fund

13 EDLI Charges (PF) 1 A/c No. 21 payment as per PF challan

14A. Staff Welfare (In office) 1 Lunch/dinner expenses for staff IN THE

2 General pantry consumable items (tea-cof

3 Medicines etc.for maintaining First aid fa

Expenses incurred for any lunch/dinner w

4

expenses account).

14 B. Staff Welfare (Out of office) 1 Lunch/dinner expenses of staff OUTSIDE

Expenses incurred for any lunch/dinner ou

2

Travelling expenses account).

Staff insurance premium paid to Vipul M

settlement entries a new a/c has to be ope

15 Staff Insurance 1

credited and on its payment to concerned

imprest a/c.

16 Festival Expenses 1 Diwali expenses & other expenses on fest

17 Rates & Taxes 1 Stamp paper charges.

EXCLUDE Filing fees of Company's Ann

2

Fees and subscription account)

18A. Conveyance Expenses (Others) 1 Conveyance expenses other than from off

Monthly/daily/periodical/actual charges p

2

for actual conveyance expenses incurred)

Late night charges for duty (as overtime)

3

this account only ,

4 Stipend paid to trainees in operation depa

18B. Conveyance Expenses (To and fro residence) 1 Conveyance charges paid to staff for goin

Expenses of travelling within India for of

19 Travelling Expenses -Domestic 1 lunch/dinner ,IF PAID by person travellin

expenses will be booked by that branch on

Expenses incurred on stay/accommodatio

2 agreement (such as hotel/lodge etc.) WIL

BUSINESS PROMOTION / SALES PRO

EXCLUDE any expenses of lunch/dinner

3

expenses account ).

20 Travelling Expenses -Foreign 1 Expenses related to travel outside India ,in

2 Without BILLS and AUTHORISATION

20A. Free/Concessional tkts to staff 1 Any amount of concession or free tkts giv

21 Cellular Phone Expenses 1 Expenses of mobile phones owned by the

2 EXCLUDE any reimbursed to satff for m

22 Telephone Expenses 1 Telephone expenses of landline phones in

2 EXCLUDE all cellular phone expenses.

3 EXCLUDE all petty telephone expenses (

EXLUDE all purchase or repair of telepho

4 telephones/mobile phones will be capital

maintenance-Plant and machinery accoun

Telephone expenses incurred by despatch

23 Telephone Expenses (Petty) 1

booths etc.(Other than telephone calls cha

No entry will be passed in this account an

24 Courier Expenses 1

Telegram expenses account (as below).

25 Postage, Courier & Telegram Expenses 1 Expenses related to postage stamps purch

Courier charges paid billwise/monthly to

2

clients and other offices/places for officia

26 Communication Charges 1 Internet subscription fee/charges paid to I

2 Internet CD ROMs (Excluding Blank CD

3 GPRS charges (Excluding cost of new GP

27 Printing & Stationery 1 Forms of all types including passport form

2 BLANK CDs (excluding internet CD RO

3 All stationery items e.g. pens, folders, yel

Printing of ticket jackets, booking-docket

4 and brown envelops, corporate files, invit

brochure files and other items of stationer

Cartridges and ribbons for computer print

5

MAINTENANCE ACCOUNT.

6 EXLUDE stamp papers purchase (It will

Insurance charges paid for cars, scooters,

28A. Vehicle insurance (Non commercial) 1

held for other than commercial purpose)

28B. Vehicle insurance (Commercial) Insurance charges paid for vehicles held f

Only one account named RENT will be m

29 Lease Rent 1

entry of rent or any other expense will be

30 A. Rent 1 Rent of office premises.

2 Rent of room taken at airport for facilitati

3 EXCLUDE guest house rent (It will go to

30 B. Guest House Rent 1 Rent of flats, guest houses and other acco

30 C. Parking Rent 1 Rent of parking space if taken on rent.

30 D. Rent payable 1 Rent payable referred in 30A above will c

Guest house rent payable referred in 30B

30 E. Guest House Rent payable

in this account

31 Legal & Professional Charges 1 Fee paid to Internal auditors for audit wor

2 Retainership fees (e.g. for Airlines reco /T

3 Fee paid to any Lawyer etc. for defending

4 Fee paid for Assets valuation charges to V

5 Fee for Drafting any legal or other docum

6 EXCLUDE--

(a) Any Advisory service/consultancy charge

(b) Statutory auditor's fee for conducting Stat

(c) Snacks/Lunch/Dinner expenses incurred f

(d) Any other expenses (such as provision for

(e) Stamp paper purchase.

(f) Documents attestation charges paid to not

Consultancy charges paid to any consulta

32 Consultancy Charges 1 Management consultancy,Advisory servic

and no fees for defending any suit/case or

33A. Professional Tax (Employer's share) 1 Will be debited by professional tax of em

33B. Professional Tax (Employees' share) payable 1 Will be credited by employees' share of p

2 Will be debited on payment of employees

34 Software Expenses 1 All expenses related to maintenance and u

2 EXCLUDE Internet charges and Internet

35 Fees & Subscription 1 Membership fee paid to IATA

2 Amedeus subscription fee.

3 Charges paid to Notary public for attestat

4 Any other fee of related nature.

36 Security Expenses 1 Charges paid for Security services at offic

37 Newpapers, Books & Periodicals Expenses 1 Any books purchased by or any other dep

2 Monthly charges of Newspapers/Magazin

3 Excel books of Flights' schedule informat

38 Meeting & Conference Expenses 1 Expenses incurred for holding any meetin

2 Lunch/dinner/snacks expenses incurred at

3 Charges related to lunch/dinner/snacks an

Expenses incurred for giving any advertis

39 Advertisement Expenses 1

channel/Newsletter/periodical etc.for the

EXCLUDE charges paid for advertisemen

2

new staff at office (It will go to Recruitme

40 Vehicle Parking Expenses 1 Charges related to parking of vehicles out

41A. Vehicle Petrol Expenses- Non commercial 1 Petrol and Diesel for Non commercial veh

2 Monthly charges for petrol/diesel for vehi

3 Exclude engine oil (It will go to vehicle m

41B. Vehicle Petrol Expenses- Commercial 1 Petrol and Diesel for commercial vehicles

2 Monthly charges for petrol/diesel for vehi

3 Exclude engine oil (It will go to vehicle m

42 Car Expenses 1 Payment of hire charges of cars taken on

43 Business Promotion Expenses 1 Expenses of snacks, lunch, dinner with cl

2 Any gift, bouquet etc. presented to client/

3 EXCLUDE expenses incurred for any lun

NO ENTRY WILL BE PASSED IN THIS

44 Sales Promotion Expenses 1

Business promotion a/c).

45 Office Expenses 1 General charges of maintenance of office

EXCLUDE House keeping charges (e.g. P

2

maintenance-Building account)

EXCLUDE pest control charges (e.g. Pay

3

maintenance-Building account)

46 A. Electricity & Generator Expenses 1 Monthly or Bi-monthly power/electricity

2 Generator Diesel expenses.

3 EXCLUDE any repair/Maintenance of ge

46 B. Guest House Charges 1 Electricity Charges and other maintenanc

47 Repair & Maintenance- Plant & Machinery Maintenance/AMC and repair charges rel

(a) Air conditioners (Centralised/Split/Windo

(b) Xerox/photostat machines, Ticket validati

(c) Faxes, Telephones instruments, Cellular/m

(d) LCD projectors,Stabilizers, Fire extinguis

(e) Vacuum cleaners, microwave ovens, lami

(f) Water purifiers, Tea/coffee machines, wa

Repair and maintenance charges of vehicl

48 A. Vehicle Maintenance (Non commercial) 1

motor bikes etc.)

2 EXCLUDE vehicle petrol and parking ch

3 EXCLUDE vehicle insurance charges.

48 B. Vehicle Maintenance (Commerical) 1 Repair and maintenance charges of comm

2 EXCLUDE vehicle petrol and parking ch

3 EXCLUDE vehicle insurance charges.

49 Repair & Maintenance- Building 1 House keeping charges such office cleani

2 Expenses for repair of building in case of

3 Will NOT include guest house building m

50 Repair & Maintenance 1 NO ENTRIES TO BE MADE IN THIS A

51 Repair & Maintenance - Others 1 Repair expenses other than of vehicles, co

Computer maintenance / Computer expenses /

52 1 Maintenance/AMC and repair charges rel

Repair and maint- Computers

(a) Computers (i.e. including its peripheral ite

(b) Printers (Laser, Dot-matrix, Deskjet)

(c) Scanners

(d) UPS system.

Purchase of connectors, cords, cables, oth

2 external and internal modems, RAMs, CD

switches, adapter etc.EXCLUDING BAL

3 Printers' Cartridges (Including refilling) a

Exclude Internet subscription (ISP) charg

4

fee, and all Other charges related to electr

5 Exclude purchase of External CD writer (

Amount charged by bank for services ren

53 Bank Charges 1

on dishonour of cheque etc.)

EXCLUDE any charges/commission paid

2

fees, Guarantee charges (These will go to

Loss incurred on sale of fixed assets after

54 Loss on Sale of Fixed Assets 1

sale of asset.

55 Short & Excess expenses 1 Very small expenses or adjustments not c

56 Donation 1 Donation made to nay charitable associati

57 Difference in Foreign Exchange 1 Difference between billing amount and am

58 Interest on bank loan 1 Interest paid on Bank Cash credit / Overd

59 Interest on Vehicle Loans (Non commercial) 1 Interest portion of secured Non commerci

59A. Interest on Vehicle Loans (Commercial) 1 Interest portion of secured Commercial ve

60 Interest on Other Loan 1 Interest portion of secured/unsecured loan

61 Prior period expenses 1 Expenses related to prior period (i.e. prev

62 Prior period income 1 Income related to prior period (i.e. previo

63 Audit expenses 1 Expenses for Lunch/dinner/snacks with au

2 Internal auditors lunch/dinner charges wil

64 Finance charges 1 Any charges/commission paid for sanctio

2 Loan processing fees.

3 Guarantee charges.

You might also like

- Tally Tips - Accounting Heads of Incomes - ExpensesDocument16 pagesTally Tips - Accounting Heads of Incomes - Expensesakhil kotiyalNo ratings yet

- Tally Tips - Accounting Heads of Incomes - ExpensesDocument12 pagesTally Tips - Accounting Heads of Incomes - ExpensescooNo ratings yet

- As 15Document12 pagesAs 15abhishekkapse654No ratings yet

- Tally Tips - Accounting Heads of Incomes - ExpensesDocument7 pagesTally Tips - Accounting Heads of Incomes - ExpensesSayed Muntazir Hussain100% (3)

- FAR SU11 Core Concepts PDFDocument3 pagesFAR SU11 Core Concepts PDFkoti kebeleNo ratings yet

- Pas 19 Employee BenefitsDocument14 pagesPas 19 Employee BenefitsKelzarineah FludgeNo ratings yet

- Chapter - 1: Quick Revision Notes Accounting For Not-For-Profit Organisation General FormatsDocument3 pagesChapter - 1: Quick Revision Notes Accounting For Not-For-Profit Organisation General FormatsSadik ShaikhNo ratings yet

- Governmental and Nonprofit Accounting 10th Edition Smith Test BankDocument12 pagesGovernmental and Nonprofit Accounting 10th Edition Smith Test Bankadelarichard7bai100% (31)

- Governmental and Nonprofit Accounting 10Th Edition Smith Test Bank Full Chapter PDFDocument33 pagesGovernmental and Nonprofit Accounting 10Th Edition Smith Test Bank Full Chapter PDFJoanSmithrgqb100% (11)

- Service Charges: Sno HeadDocument57 pagesService Charges: Sno HeadRakshit Ranjan SinghNo ratings yet

- Pre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsDocument11 pagesPre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsKristine JarinaNo ratings yet

- Chapter 4: Adjustments, Financial Statements, and Financial ResultsDocument36 pagesChapter 4: Adjustments, Financial Statements, and Financial ResultsBarry PatnettNo ratings yet

- Chart Showing Computation of 'Salary' IncomeDocument3 pagesChart Showing Computation of 'Salary' IncomeRocky RkNo ratings yet

- Income Under Head SalariesDocument8 pagesIncome Under Head Salaries887 shivam guptaNo ratings yet

- Salary Part 1Document4 pagesSalary Part 1887 shivam guptaNo ratings yet

- IA2 10 01 Employee Benefits PDFDocument17 pagesIA2 10 01 Employee Benefits PDFAzaria MatiasNo ratings yet

- ACCT 301B - Exam 1 ReviewDocument9 pagesACCT 301B - Exam 1 ReviewJudith GarciaNo ratings yet

- Accounting Manual Employee Benefits Accounting Manual-Employee BenefitsDocument29 pagesAccounting Manual Employee Benefits Accounting Manual-Employee BenefitsRamkrishnarao BVNo ratings yet

- Governmental and Nonprofit Accounting 10th Edition Smith Test Bank DownloadDocument12 pagesGovernmental and Nonprofit Accounting 10th Edition Smith Test Bank DownloadBeverly Dow100% (24)

- Domestic Credit Related Service Charges: Head Office, BangaloreDocument27 pagesDomestic Credit Related Service Charges: Head Office, BangaloreAnwesha SinghNo ratings yet

- PKFS Advance Salary PDFDocument3 pagesPKFS Advance Salary PDFMuhammad Tauseef100% (1)

- National Bank of Pakistan Product Key Fact Statement: 2% of Adjustment Amount + FEDDocument3 pagesNational Bank of Pakistan Product Key Fact Statement: 2% of Adjustment Amount + FEDMuhammad TauseefNo ratings yet

- Test Bank For Governmental and Nonprofit Accounting 10th Edition by FreemanDocument13 pagesTest Bank For Governmental and Nonprofit Accounting 10th Edition by FreemanDavidRobinsonfikq100% (39)

- Lesson 2Document12 pagesLesson 2devravidhan382No ratings yet

- C18 - Defined Benefit Plan PDFDocument23 pagesC18 - Defined Benefit Plan PDFKristine Diane CABAnASNo ratings yet

- Basic Annual Financial Report Example 2Document7 pagesBasic Annual Financial Report Example 2Bé TiếnNo ratings yet

- Salary Structure and Benefits - EClerxDocument5 pagesSalary Structure and Benefits - EClerxBhanuNo ratings yet

- AllowncesDocument4 pagesAllowncesAman GuptaNo ratings yet

- Income Under The Head SalaryDocument14 pagesIncome Under The Head SalaryTarun SinghalNo ratings yet

- Service Charges W.E.F 18.11.2022Document58 pagesService Charges W.E.F 18.11.2022anandNo ratings yet

- (GM FM DPW) : Summary of Benefits Payable To Piece-Rate WorkersDocument3 pages(GM FM DPW) : Summary of Benefits Payable To Piece-Rate WorkersWorstWitch TalaNo ratings yet

- Compensation IncomeDocument5 pagesCompensation IncomegelinepardilloNo ratings yet

- MAT Minimum Alternate Tax - 8 Marks (A) (I) Basic: Simple Hai !Document3 pagesMAT Minimum Alternate Tax - 8 Marks (A) (I) Basic: Simple Hai !srushti thoratNo ratings yet

- Tax Reviewer (Mfp-2)Document13 pagesTax Reviewer (Mfp-2)Mikaela Pamatmat100% (1)

- Service-Charges 01.01.2022 WEBDocument58 pagesService-Charges 01.01.2022 WEBRenesh RNo ratings yet

- Elements: Capital Adequecy Operating Performance Ratio (OPR)Document3 pagesElements: Capital Adequecy Operating Performance Ratio (OPR)HMS DeedNo ratings yet

- Employee Benefits Part 1.1Document5 pagesEmployee Benefits Part 1.1Shanelle SilmaroNo ratings yet

- Topic 4 - Completing The Accounting CycleDocument52 pagesTopic 4 - Completing The Accounting CycleLA Syamsul100% (1)

- Gross Income: Income Earned Through The Actual, Direct, Personal Effort of The TaxpayerDocument9 pagesGross Income: Income Earned Through The Actual, Direct, Personal Effort of The TaxpayerKen RaquinioNo ratings yet

- Employee BenefitsDocument3 pagesEmployee BenefitsJAY AUBREY PINEDANo ratings yet

- TDS Rate DetailsDocument10 pagesTDS Rate DetailsAsif Assistant ManagerNo ratings yet

- BCAH Accounts - August 2023 5Document15 pagesBCAH Accounts - August 2023 5Rm ShobuzNo ratings yet

- Income Tax (B.com Ii)Document9 pagesIncome Tax (B.com Ii)iramanwarNo ratings yet

- TAX 06.2 - Fringe Benefit TaxDocument2 pagesTAX 06.2 - Fringe Benefit TaxMary Louise CamposanoNo ratings yet

- Computation of Income Class 3Document22 pagesComputation of Income Class 3Abubakkar SiddiqueNo ratings yet

- 4.03 Key Terms For Preparing PayrollDocument21 pages4.03 Key Terms For Preparing Payrollapi-262218593No ratings yet

- Policy No Policy OnDocument8 pagesPolicy No Policy OnSudhakar RNo ratings yet

- Chap 9 Lecture Notes 2022 - Student VerDocument30 pagesChap 9 Lecture Notes 2022 - Student VerThương ĐỗNo ratings yet

- Chapter 4 Accounting For Disbursement and Related TransactionsDocument3 pagesChapter 4 Accounting For Disbursement and Related TransactionsShaira BugayongNo ratings yet

- Queries - Project Logistic Tarahan - MY - GENDocument3 pagesQueries - Project Logistic Tarahan - MY - GENAnonymous DQ4wYUmNo ratings yet

- Commercial Proposal - RHR 14.02.2023Document3 pagesCommercial Proposal - RHR 14.02.2023JOhnNo ratings yet

- QQ Employees Benefit 4Document2 pagesQQ Employees Benefit 4Norlailah AmanollahNo ratings yet

- Adjusting Up To Preparation of FS Readings - 156627851Document19 pagesAdjusting Up To Preparation of FS Readings - 156627851GwenNo ratings yet

- Insurance Accounting TerminologiesDocument16 pagesInsurance Accounting Terminologieskumaryashwant1984No ratings yet

- Chapter-07: Monthly Remuneration of Each of The Officers and Employees. Piece Work System & Overtime Working EtcDocument8 pagesChapter-07: Monthly Remuneration of Each of The Officers and Employees. Piece Work System & Overtime Working Etcmaheshkumar744No ratings yet

- Full Course Wrap Up - Student VerDocument33 pagesFull Course Wrap Up - Student VerThương ĐỗNo ratings yet

- Poa FormatDocument4 pagesPoa FormatSumithaNo ratings yet

- Intermediate Accounting 3Document10 pagesIntermediate Accounting 3AngelaMariePeñarandaNo ratings yet

- Sample Balance Sheet Concierge Service IndustryDocument12 pagesSample Balance Sheet Concierge Service IndustrykpsrikanthvNo ratings yet

- Which of The Following Accounts Is Debited If Depreciation Is A Production Cost?Document3 pagesWhich of The Following Accounts Is Debited If Depreciation Is A Production Cost?kpsrikanthvNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Kanakadhara With MeaningDocument8 pagesKanakadhara With MeaningkpsrikanthvNo ratings yet

- Bank Asia LTD CRMDocument12 pagesBank Asia LTD CRMIslam MuhammadNo ratings yet

- A Comparative Study of Loans and Advances of Federal BankDocument95 pagesA Comparative Study of Loans and Advances of Federal Bankpranoy100% (2)

- I: Multiple Choice (30 Points) : These Statements Are True or False? (25 Points/correct Answer)Document4 pagesI: Multiple Choice (30 Points) : These Statements Are True or False? (25 Points/correct Answer)Mỹ Dung PhạmNo ratings yet

- Articles Banking Terms Glossary of BankinDocument27 pagesArticles Banking Terms Glossary of Bankincoolguy.sudheer604762No ratings yet

- Group5 - ICLA - VISHAL GARGDocument14 pagesGroup5 - ICLA - VISHAL GARGharshkarNo ratings yet

- Pra Perjanjian KSODocument9 pagesPra Perjanjian KSORiska Ilmii ImranNo ratings yet

- General Terms and Conditions of South Indian Bank For Credit Facilities PDFDocument29 pagesGeneral Terms and Conditions of South Indian Bank For Credit Facilities PDFbaba ramdevNo ratings yet

- Chapter 14Document4 pagesChapter 14ks1043210No ratings yet

- New Board Induction: Prepared and Facilitated by Sirengo Maurice For KUSCCODocument56 pagesNew Board Induction: Prepared and Facilitated by Sirengo Maurice For KUSCCOSirengo Maurice0% (1)

- Conceptual Frameworks and Accounting Standards PDFDocument58 pagesConceptual Frameworks and Accounting Standards PDFJieyan Oliveros0% (1)

- Rohan CTCDocument1 pageRohan CTCRohanNo ratings yet

- Application Form For Housing Loan - PNBDocument10 pagesApplication Form For Housing Loan - PNBIndrajit ShorcarNo ratings yet

- l5 - Credit and Debt 4Document14 pagesl5 - Credit and Debt 4api-290878974No ratings yet

- What Is The Issue That Is Being Addressed?Document4 pagesWhat Is The Issue That Is Being Addressed?Diela KasimNo ratings yet

- Thesis Report of 5 BankDocument180 pagesThesis Report of 5 BankMd KamruzzamanNo ratings yet

- Contracts ReviewerDocument6 pagesContracts ReviewerMark Noel SanteNo ratings yet

- Mathematics Mock TestDocument8 pagesMathematics Mock TestDaisy Jane PimentelNo ratings yet

- Bank Course OutlineDocument17 pagesBank Course Outlinemarivic hammidanyNo ratings yet

- How To Start A Micro Lending Business PDFDocument2 pagesHow To Start A Micro Lending Business PDFJamesObstaculoNo ratings yet

- Determinants of Financial Performance of Commercial Banks in Nepal - MBS ThesisDocument73 pagesDeterminants of Financial Performance of Commercial Banks in Nepal - MBS ThesisIshworNinabung83% (6)

- Decoding Reliance Ind's 3% Effective Tax Rate: M.P. Drags Vaccination Numbers To 52.83 Lakh On TuesdayDocument12 pagesDecoding Reliance Ind's 3% Effective Tax Rate: M.P. Drags Vaccination Numbers To 52.83 Lakh On TuesdayHimanshu ShirshNo ratings yet

- Private Placement MemorandumDocument40 pagesPrivate Placement MemorandumtomerNo ratings yet

- Forex Gains and Losses Notes 2020Document46 pagesForex Gains and Losses Notes 2020chelasimunyolaNo ratings yet

- Project Analysis For Potential InvestorsDocument4 pagesProject Analysis For Potential Investorsjackson priorNo ratings yet

- Yuliongsiu v. PNB G.R. No. L 19227Document3 pagesYuliongsiu v. PNB G.R. No. L 19227Lexa L. DotyalNo ratings yet

- Lydia Trottier Has Prepared Baked Goods For Sale Since 1998 PDFDocument3 pagesLydia Trottier Has Prepared Baked Goods For Sale Since 1998 PDFLet's Talk With HassanNo ratings yet

- Working Capital Management of Durgapur Steel PlantDocument67 pagesWorking Capital Management of Durgapur Steel Plantrutvik080808No ratings yet

- Bangladesh Bank: Financial Stability DepartmentDocument165 pagesBangladesh Bank: Financial Stability DepartmentAsif NawazNo ratings yet

- HERO One PagerDocument1 pageHERO One PagerSenator Mike LeeNo ratings yet

- Cwes Loan Application Form - Revised April 2018-2Document4 pagesCwes Loan Application Form - Revised April 2018-2Cyber Ishiara83% (6)