Professional Documents

Culture Documents

Comprehensive Tax Reform Program

Uploaded by

Angeli Lou Joven VillanuevaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comprehensive Tax Reform Program

Uploaded by

Angeli Lou Joven VillanuevaCopyright:

Available Formats

Tax Reform for Acceleration and Inclusion (TRAIN): An Instrument for National Survival and Growth

I. Introduction

Real positive change or Tunay na pagbabago has always been the mantra of the Duterte

Administration since he took his oath of office. This change include comprehensive and

inclusive growth manifested by a comfortable life for all, improved public services, more and

better jobs and more money put in the peoples pockets.

Thus, the President, during his first State of the Nation Address urged both houses of the

Congress to pass in haste the Tax Reform for Acceleration and Inclusion Bill.

The aforementioned tax policy reform is seen as a measure to raise additional investments,

along with sustainable borrowings, budget reform, and tax and customs administration

reform. These measures are anchored in the vision of reducing poverty rate from 21.6% in

2016 to 14% in 2022, equating to 6 million Filipinos uplifted, and further eradicating it by

2040; increase gross national income from USD 3,500 to USD 4,100 in 2022, and to 12,000

USD in 2022 to achieve high income status where Malaysia and South Korea are today.

II. What is TRAIN?

In essence, the Tax Reform for Acceleration and Inclusion (TRAIN) is the re-modelling of the

Philippines antiquated tax system to be simpler, fairer and more efficient for all, while also

raising the resources needed to invest in infrastructure and people and to lessen the overall

tax burden of the poor and the middle class.

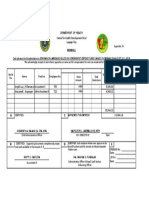

It could be noted that among the neighboring Southeast Asian countries, Philippines has the

highest rate of income tax, thus tantamount to lesser money taken home by the working class.

Comparison of the tax rate imposed in the Philippines vs other neighboring countries.

III. Scope of TRAIN

Tax Reform proposal will be able to fund investments in

Education- Achieve 100% enrollment and completion rates, build 13,553 classrooms, hire

181,980 more teachers between 2017 and 2020

Infrastructure- fund infra programs of dpwh consists of major highways, expressways and

flood control projects

Investment needs-

Health- Upgrade 704 local hospitals, 100% coverage of philhealth, build 15,988 new barangay

health stations, hire additional doctors, nurses, dentists, pharmacists, med tech, public health

associates and UHC implementers.

IV.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- 2022 COMMERCIAL LAW - PREWEEKxLMT PDFDocument82 pages2022 COMMERCIAL LAW - PREWEEKxLMT PDFAngeli Lou Joven VillanuevaNo ratings yet

- 1 2022 POLITICAL LAW - PREWEEKxLMTDocument89 pages1 2022 POLITICAL LAW - PREWEEKxLMTImee Callao67% (3)

- Ponencias of J. Caguioa in CIVIL LAW (2022) PDFDocument76 pagesPonencias of J. Caguioa in CIVIL LAW (2022) PDFAngeli Lou Joven VillanuevaNo ratings yet

- 2 2022 LABOR LAW - PREWEEKxLMTDocument90 pages2 2022 LABOR LAW - PREWEEKxLMTImee CallaoNo ratings yet

- Comprehensive Tax Reform ProgramDocument6 pagesComprehensive Tax Reform ProgramAngeli Lou Joven VillanuevaNo ratings yet

- The Fundamental Powers of The State PDFDocument15 pagesThe Fundamental Powers of The State PDFAngeli Lou Joven VillanuevaNo ratings yet

- Comprehensive Tax Reform ProgramDocument6 pagesComprehensive Tax Reform ProgramAngeli Lou Joven VillanuevaNo ratings yet

- Pelayo vs. Lauron 12 Phil 453Document3 pagesPelayo vs. Lauron 12 Phil 453Dahlia B. SalamatNo ratings yet

- Test QuestionsDocument25 pagesTest QuestionsAngeli Lou Joven VillanuevaNo ratings yet

- Legal TechniquesDocument1 pageLegal TechniquesAngeli Lou Joven VillanuevaNo ratings yet

- Pelayo Vs LauronDocument19 pagesPelayo Vs LauronAngeli Lou Joven VillanuevaNo ratings yet

- Tips For Digesting Cases PDFDocument3 pagesTips For Digesting Cases PDFManolo L LandigNo ratings yet

- Rules of Procedure Governing Inquiries in Aid of LegislationDocument7 pagesRules of Procedure Governing Inquiries in Aid of LegislationAngeli Lou Joven VillanuevaNo ratings yet

- Comprehensive Tax Reform ProgramDocument6 pagesComprehensive Tax Reform ProgramAngeli Lou Joven VillanuevaNo ratings yet

- Philippine Independence ActDocument12 pagesPhilippine Independence ActAndrew ZhangNo ratings yet

- Tips For Digesting Cases PDFDocument3 pagesTips For Digesting Cases PDFManolo L LandigNo ratings yet

- Position PaperDocument3 pagesPosition PaperAngeli Lou Joven VillanuevaNo ratings yet

- Pilapil Vs SomeraDocument2 pagesPilapil Vs SomeraAngeli Lou Joven VillanuevaNo ratings yet

- PP Vs JuguetaDocument3 pagesPP Vs JuguetaAngeli Lou Joven VillanuevaNo ratings yet

- PP Vs JuguetaDocument3 pagesPP Vs JuguetaAngeli Lou Joven VillanuevaNo ratings yet

- Pilapil Vs SomeraDocument2 pagesPilapil Vs SomeraAngeli Lou Joven VillanuevaNo ratings yet

- Extrajudicial Killings and Enforced Disappearances in The PhilippinesDocument2 pagesExtrajudicial Killings and Enforced Disappearances in The PhilippinesAngeli Lou Joven VillanuevaNo ratings yet

- Test QuestionsDocument1 pageTest QuestionsAngeli Lou Joven VillanuevaNo ratings yet

- Appendix 33 - PayrollDocument1 pageAppendix 33 - PayrollAngeli Lou Joven Villanueva100% (1)

- Sagrada Orden v. NACOCODocument11 pagesSagrada Orden v. NACOCOsigfridmonteNo ratings yet

- Cy 2019 NepDocument8 pagesCy 2019 NepAngeli Lou Joven VillanuevaNo ratings yet

- PPMPDocument1 pagePPMPAngeli Lou Joven VillanuevaNo ratings yet

- Supreme Court: Custom SearchDocument7 pagesSupreme Court: Custom SearchAngeli Lou Joven VillanuevaNo ratings yet

- Appendix 45 - Itinerary of TravelDocument4 pagesAppendix 45 - Itinerary of TravelAngeli Lou Joven Villanueva100% (2)

- Ang Yu Asuncion v. Court of Appeals, 238 SCRA 602, December 2, 1994Document8 pagesAng Yu Asuncion v. Court of Appeals, 238 SCRA 602, December 2, 1994denver41No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Impact of The Tomato Agroindustry On The RuralDocument9 pagesThe Impact of The Tomato Agroindustry On The RuralBrian CastilloNo ratings yet

- Healthy Spaces and Places.Document11 pagesHealthy Spaces and Places.Marvin CJNo ratings yet

- Edu Prob PPT SamiDocument15 pagesEdu Prob PPT SamiYe Geter Lig NegnNo ratings yet

- Lao NSEDP VI Draft FinalDocument194 pagesLao NSEDP VI Draft FinalRajesh KumarNo ratings yet

- Acknowledgement: KIRAN NARANG The Guide of TheDocument25 pagesAcknowledgement: KIRAN NARANG The Guide of Theollieace100% (1)

- FINANCING IN EDUCATION As An ADMINISTRATIVE FUNCTIONDocument14 pagesFINANCING IN EDUCATION As An ADMINISTRATIVE FUNCTIONjames paulo abando100% (6)

- (Project Feasibility Report) : THE Lutheran University of PNGDocument63 pages(Project Feasibility Report) : THE Lutheran University of PNGromeorabNo ratings yet

- Case Study (Bangladesh and Pakistan)Document2 pagesCase Study (Bangladesh and Pakistan)maresNo ratings yet

- Myers - 1986 - The Environmental Dimension To Security IssuesDocument7 pagesMyers - 1986 - The Environmental Dimension To Security IssuesDimitris KantemnidisNo ratings yet

- 75 Ways Socialism Has Improved America - Daily Kos ClassicsDocument8 pages75 Ways Socialism Has Improved America - Daily Kos Classicsdisaacson1No ratings yet

- Cambridge O Level: Economics 2281/21 May/June 2020Document15 pagesCambridge O Level: Economics 2281/21 May/June 2020Jack KowmanNo ratings yet

- Role of Regional Rural Banks in Poverty Alleviation Through MicroDocument1 pageRole of Regional Rural Banks in Poverty Alleviation Through MicroHitesh ShahNo ratings yet

- Rajasthani Folklore and WomenDocument31 pagesRajasthani Folklore and WomenBasudhara Roy ChatterjeeNo ratings yet

- Developing Cultural Competence in Multicultural WorldDocument22 pagesDeveloping Cultural Competence in Multicultural Worldapi-659623153No ratings yet

- Labor ProblemsDocument9 pagesLabor ProblemsJohn Michael ToleteNo ratings yet

- Essay Complete DraftDocument4 pagesEssay Complete Draftapi-438381739No ratings yet

- 59 CBCF 4 C 5412 e 789826279Document189 pages59 CBCF 4 C 5412 e 789826279FRANSISCO SANGANo ratings yet

- A Research On Affordable HousingDocument3 pagesA Research On Affordable HousingEditor IJTSRDNo ratings yet

- Chapter OneDocument36 pagesChapter Onebwire stephenNo ratings yet

- Harvard Case Study-YashaswiniDocument5 pagesHarvard Case Study-Yashaswiniankit__bansal100% (1)

- Poverty As A ChallengeDocument23 pagesPoverty As A ChallengePreetha Balaji100% (1)

- Charcoal Production in San Narciso, Quezon, Philippines And: An Ethical ConsiderationDocument14 pagesCharcoal Production in San Narciso, Quezon, Philippines And: An Ethical ConsiderationDave Ralph Portugal MagsinoNo ratings yet

- Gender and Climate Change:: Mozambique Case StudyDocument47 pagesGender and Climate Change:: Mozambique Case StudyGerevoNo ratings yet

- WIOA Eligibility Desk Aid: Financial Aid Income GuidelinesDocument2 pagesWIOA Eligibility Desk Aid: Financial Aid Income GuidelinesSampath NellutlaNo ratings yet

- An Operational Planning Is A Subset of Strategic Work PlanDocument7 pagesAn Operational Planning Is A Subset of Strategic Work PlansumathiklNo ratings yet

- Healthcare in India:: Current State and Key ImperativesDocument60 pagesHealthcare in India:: Current State and Key ImperativessonamNo ratings yet

- Gandhian ThoughtDocument8 pagesGandhian Thoughtraghvendra shrivastavaNo ratings yet

- Discuss The Limitations and Improvements of The National Rural Development Policy-2001 PDFDocument10 pagesDiscuss The Limitations and Improvements of The National Rural Development Policy-2001 PDFBushra Khatun Jannat100% (1)

- SELCO Foundation - SELCAP ReportDocument126 pagesSELCO Foundation - SELCAP ReportOutreach Selco FoundationNo ratings yet

- Features of Indian Economy Since IndependenceDocument12 pagesFeatures of Indian Economy Since IndependenceAman KapoorNo ratings yet