Professional Documents

Culture Documents

The Telegraphics Terms and Conditions en PDF

Uploaded by

Anna VõOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Telegraphics Terms and Conditions en PDF

Uploaded by

Anna VõCopyright:

Available Formats

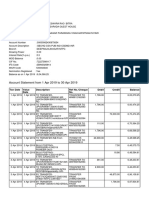

TELEGRAPHIC TRANSFER

TERMS AND CONDITIONS

1. In the absence of any specific instructions to the contrary, a Telegraphic Transfer (TT) will

be affected in the currency of the country in which payment is to be made.

2. The Bank reserves the right to draw this TT in a different place from that specified by Customer

if operational circumstances so require.

3. While the Bank will endeavour to give effect to the Customers requests regarding charges

relating to the TT, Customer understands that the Bank only has discretion regarding its own

charges. Where the Customer has requested to pay overseas charges or other banks

charges, the Bank will communicate such request but whether the beneficiary can receive the

full amount of the TT will depend on the practice adopted by the correspondent bank and/or

beneficiary bank involved, which is beyond the Banks control and the Bank cannot be held

responsible or liable for the same. The Bank is not responsible to advise Customer of any

charges which may be imposed by overseas bank or other bank and shall not be liable if such

information cannot be provided.

4. Where the Bank is unable to provide a firm exchange rate quotation, the Bank shall affect the

TT on the basis of provisional exchange rate, which shall be subject to adjustment when the

actual exchange rate is ascertained. Any difference between the provisional rate and the actual

rate shall be debited/credited (as the case may be) to the Customers account.

5. Customer hereby undertakes that all required permissions and authorizations have been

obtained and that the Bank may debit Customers account(s) with the amount of any liabilities,

cost and losses arising from any breach of this undertaking.

6. In the event that supporting documents are required for certain transactions in accordance

with the local regulations and the Banks policy, Customer undertakes that any copy of such

supporting documents certified and presented by Customer to the Bank are the true copy from

the original copy of those documents. Customer shall therefore bear full responsibility for any

information contained therein.

7. In the event that the TT is submitted to the Bank for processing but the Bank cannot process

such request because the account balance is insufficient, payment information in the TT is

deficient or unclear or the supporting documents are not in place or inadequate, the Bank shall

inform Customer of these rationales and the Bank shall be entitled to cancel the TT in

accordance with the Banks regulations if Customer does not provide further information or

submit additional supporting documents as requested by the Bank.

8. Customer agrees that the Bank, at its sole discretion and in accordance with its policy from

time to time, reserves the right to verify information on the TT by communication via telephone

with Customers authorized signatory/signatories.

9. Unless there is a specific agreement between the Bank and the Customer on the exchange

rate to be applied, the exchange rate to be applied to payment transactions that the Customer

makes involving a currency exchange is the rate announced and applied by the Bank at the

time the payment is processed. The Customer can call the Bank to find the Banks rates.

10. If the Customer makes the payment that involves an exchange into a foreign currency and that

payment is returned to the Bank, the Bank will convert at the Banks exchange rate applicable

when the Bank receives the returned payment. The Bank is not responsible for any fluctuations

in the exchange rate.

PUBLIC

Issued by HSBC Bank (Vietnam) Ltd.

11. Besides the terms and conditions provided in this document, TT and its service is also

governed by and subject to the General Terms and Conditions which is available at

www.hsbc.com.vn or at HSBCs branches or transaction offices.

12. The Bank reserves the right to amend these terms and conditions as provided in this document

from time to time as it deems appropriate and in its absolute discretion. Such amendments will

be binding upon the Customer upon the Banks giving notification to the Customer using such

means of notification as the Bank shall deem appropriate (including but not limited to display

in the premises of the Bank or any of its offices or in the Statements of Account or in the Banks

website or by such other methods as the Bank may decide). The use of service after the date

upon which any changes of these terms and conditions is to have effect (as specified in the

Banks notice) will constitute acceptance without reservation by the Customer of such

changes.

13. The Bank is at liberty to send the TT either literally or in cipher and the Bank accepts no

responsibility for any loss, delay, error, omission or mutilation which may occur in the

transmission of any message or for its misinterpretation when received.

14. Unless there is an otherwise agreement or notification, the Bank shall process a TT within the

same day if it receives such TT before cut-off time or on the next working day if it receives

such TT after cut-off time. Upon customers request and where possible, the Bank shall hold

and not process a TT until it receives a proper written instruction from customer relating to the

TT provided that such instruction must be sent to the Bank within one (01) working day from

the time the Bank receives the TT. If the Bank does not receive the said instruction, it shall

process the TT in accordance with the applicable regulations.

15. Applications for same day value are subject to cut-off times related to the geographical location

of the destination and/or the funding arrangement requirements of the settlement banks.

16. For any TT which is returned by beneficiary bank due to error made by Customer, the Bank is

entitled to automatically credit the fund back to the Customers account without informing the

Customer of such credit. It is recommended that Customer should frequently monitor its

account balance for the progress of remittance request.

PUBLIC

Issued by HSBC Bank (Vietnam) Ltd.

You might also like

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Negotiable Instruments LawDocument33 pagesNegotiable Instruments LawEj Clemena100% (1)

- Wire Transfer AgreementDocument9 pagesWire Transfer AgreementmeariclusNo ratings yet

- Digital Finance Promissory NoteDocument5 pagesDigital Finance Promissory NoteJL RangelNo ratings yet

- Section BDocument56 pagesSection BForeclosure Fraud100% (1)

- Bank Secrecy LawDocument10 pagesBank Secrecy LawJONATHAN MARIO IBENo ratings yet

- Fund TransferDocument2 pagesFund TransferQaiser KhalilNo ratings yet

- Project Preparation and Appraisal of Hotel ResortDocument81 pagesProject Preparation and Appraisal of Hotel ResortJatin RamaniNo ratings yet

- HSBC Rtgs Form - 241109Document2 pagesHSBC Rtgs Form - 241109Kevin HillNo ratings yet

- Bank Loan ContractDocument6 pagesBank Loan ContractSiddharth BaxiNo ratings yet

- Business Correspondent Agents Promote Financial Inclusion in Rural IndiaDocument7 pagesBusiness Correspondent Agents Promote Financial Inclusion in Rural IndiaRavinder Singh100% (1)

- Asset Liability ManagementDocument71 pagesAsset Liability ManagementRohit SharmaNo ratings yet

- Remittance ApplicationDocument2 pagesRemittance ApplicationChristy TiewNo ratings yet

- Letter of Explanation Template OnlineDocument1 pageLetter of Explanation Template OnlineAnna VõNo ratings yet

- Summary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeFrom EverandSummary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeNo ratings yet

- HSBC RTGS PDFDocument2 pagesHSBC RTGS PDFSamir Choudhry100% (2)

- Telegaphic Transferfom HSBCDocument2 pagesTelegaphic Transferfom HSBCTin Valdez MendozaNo ratings yet

- DCB RTGSDocument2 pagesDCB RTGSBharat VardhanNo ratings yet

- Google INSEAD PresentationDocument4 pagesGoogle INSEAD PresentationOjoOluwaseunSamsonNo ratings yet

- Conditions Precedent To DrawdownDocument10 pagesConditions Precedent To DrawdownJesseNo ratings yet

- Terms and Conditions: Mudaraba AgreementDocument10 pagesTerms and Conditions: Mudaraba AgreementchandraNo ratings yet

- Advance Tnc77Document16 pagesAdvance Tnc77Sayed MohamedNo ratings yet

- Smart Disbursement TnCsDocument4 pagesSmart Disbursement TnCsfahadnadeeem67No ratings yet

- Customer Compensation PolicyDocument15 pagesCustomer Compensation PolicyVaishnaviNo ratings yet

- Acc Opening Terms N ConditionsDocument33 pagesAcc Opening Terms N ConditionsSana mohsinNo ratings yet

- Account Closure FormDocument2 pagesAccount Closure FormchanduvermaNo ratings yet

- Acc Opening Terms N ConditionsDocument4 pagesAcc Opening Terms N ConditionsDanish NawazNo ratings yet

- Terms ConditionDocument3 pagesTerms ConditionctgmainulNo ratings yet

- Introduction of Yes BankDocument6 pagesIntroduction of Yes BankkamleshmoriNo ratings yet

- BCAFor Snapp TN CDocument26 pagesBCAFor Snapp TN Cbilal saeedNo ratings yet

- Deutsche Bank Compensation PolicyDocument7 pagesDeutsche Bank Compensation PolicySyed Ali AbbasNo ratings yet

- Deposit Account - Terms and Conditions - UpdatedDocument4 pagesDeposit Account - Terms and Conditions - UpdatedSodyJamalNo ratings yet

- Union Bank of India - Terms and ConditionsDocument5 pagesUnion Bank of India - Terms and ConditionsUmesh KaneNo ratings yet

- Most Important TNCDocument4 pagesMost Important TNCsanjana pagareNo ratings yet

- Maybank Personal Loan Terms and ConditionsDocument3 pagesMaybank Personal Loan Terms and ConditionsAisyah InsyirahNo ratings yet

- terms_and_conditionDocument1 pageterms_and_conditionmotiramdhawale2126No ratings yet

- Compensation Policy 2020 21Document14 pagesCompensation Policy 2020 21K. NikhilNo ratings yet

- Compensation Policy 28 03 2019Document10 pagesCompensation Policy 28 03 2019Arnab MitraNo ratings yet

- Remittance Service Terms ("Terms") : Page 1 of 1Document1 pageRemittance Service Terms ("Terms") : Page 1 of 1Maissa HassanNo ratings yet

- En Terms and Conditions PDFDocument7 pagesEn Terms and Conditions PDFRanjit SawantNo ratings yet

- Loan PolicyDocument5 pagesLoan PolicySoumya BanerjeeNo ratings yet

- Terms and Conditions For Notice Term DepositDocument2 pagesTerms and Conditions For Notice Term DepositdoctorirfanNo ratings yet

- Sub: Compensation Cum Customer Relation Policy 2021 - 22: Operation & Services DeptDocument20 pagesSub: Compensation Cum Customer Relation Policy 2021 - 22: Operation & Services DeptAmitKumarNo ratings yet

- BalCon TermsConditions v2Document3 pagesBalCon TermsConditions v2Monica Beluang AbellonNo ratings yet

- Sanction Letter For Overdraft Against Fixed DepositDocument4 pagesSanction Letter For Overdraft Against Fixed Depositjyotigunu817No ratings yet

- International Bank of Chicago Wire Transfer AgreementDocument5 pagesInternational Bank of Chicago Wire Transfer AgreementmeariclusNo ratings yet

- Terms and ConditionDocument1 pageTerms and ConditionkrishithamaheshNo ratings yet

- Alflah Bank SBS Step-By-Step (SBS) Monthly Installment PlanDocument3 pagesAlflah Bank SBS Step-By-Step (SBS) Monthly Installment PlanAKB 1No ratings yet

- Ott AppformDocument2 pagesOtt Appformsujay13780No ratings yet

- GENERAL TERMS & CONDITIONSDocument20 pagesGENERAL TERMS & CONDITIONSMalik RizwanNo ratings yet

- Terms and Conditions (Mobile Banking Service)Document5 pagesTerms and Conditions (Mobile Banking Service)PriyaNo ratings yet

- Loan Terms and Conditions For Overdraft Loans: Effective As of 1 January 2014Document6 pagesLoan Terms and Conditions For Overdraft Loans: Effective As of 1 January 2014Jazzd Sy GregorioNo ratings yet

- Perjanjian Kredit Tanpa Agunan - Maybank - EnglishDocument4 pagesPerjanjian Kredit Tanpa Agunan - Maybank - Englishtommy murtomoNo ratings yet

- Brac Bank Statement PolicyDocument12 pagesBrac Bank Statement Policyuriaswalliser.frnb1.04.4No ratings yet

- Terms and Condition Personal LoanDocument1 pageTerms and Condition Personal LoanSasmita PanigrahyNo ratings yet

- M Banking App PDFDocument21 pagesM Banking App PDFManmohan RathiNo ratings yet

- Lending Against Turnover Loan T C Oct 2022Document8 pagesLending Against Turnover Loan T C Oct 2022ipinloju temitopeNo ratings yet

- Standard Chartered EMI offer termsDocument2 pagesStandard Chartered EMI offer termsSanam PandeyNo ratings yet

- Compensation Policy EnglishDocument5 pagesCompensation Policy EnglishpratibhashawNo ratings yet

- CIMB Bank Philippines Terms and Conditions for REVI Credit FacilityDocument5 pagesCIMB Bank Philippines Terms and Conditions for REVI Credit FacilityRevelUp :3No ratings yet

- Annexure For AceDocument2 pagesAnnexure For AceHarinder SinghNo ratings yet

- General Terms & Conditions: Applicable To All AccountsDocument7 pagesGeneral Terms & Conditions: Applicable To All AccountsKhalid Saif JanNo ratings yet

- Konnect by HBL Saving Account Terms and ConditionsDocument4 pagesKonnect by HBL Saving Account Terms and ConditionsVc LhrNo ratings yet

- Special Pre-Approved Personal Loan TermsDocument1 pageSpecial Pre-Approved Personal Loan TermsRam Kannan PNo ratings yet

- Report On Js Bank Account OpeningDocument9 pagesReport On Js Bank Account OpeningGulraiz AhmadNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- How to Respond to Price Negotiations - Examples and TemplatesDocument3 pagesHow to Respond to Price Negotiations - Examples and TemplatesAnna VõNo ratings yet

- TRY To Do STH and TRY Doing STHDocument1 pageTRY To Do STH and TRY Doing STHAnna VõNo ratings yet

- Difference Between Evidence and ProofDocument5 pagesDifference Between Evidence and ProofAnna VõNo ratings yet

- Find YourselfDocument1 pageFind YourselfAnna VõNo ratings yet

- H Proc Notices Notices 025 K Notice Doc 24383 116103752Document5 pagesH Proc Notices Notices 025 K Notice Doc 24383 116103752Anna VõNo ratings yet

- There, There PDFDocument1 pageThere, There PDFAnna VõNo ratings yet

- Construction Permits in Cambodia - PDF SeptemberDocument3 pagesConstruction Permits in Cambodia - PDF SeptemberAnna Võ100% (1)

- Consejos para Prevencion de AccidentesDocument265 pagesConsejos para Prevencion de AccidentesSUPER INDUSTRIAL ONLINENo ratings yet

- The Design-Build-Operate Form of Contract (DBO) - 0Document4 pagesThe Design-Build-Operate Form of Contract (DBO) - 0Anna VõNo ratings yet

- Bills of Quantity AtkinsonDocument10 pagesBills of Quantity AtkinsonGalen McbrideNo ratings yet

- NFPA Journal - Hot Work Safety, May June 2017Document2 pagesNFPA Journal - Hot Work Safety, May June 2017Anna VõNo ratings yet

- Preposition: RelationDocument8 pagesPreposition: RelationAnna VõNo ratings yet

- The Telegraphics Terms and Conditions enDocument2 pagesThe Telegraphics Terms and Conditions enAnna VõNo ratings yet

- Submittal Schedule TemplateDocument2 pagesSubmittal Schedule TemplateAnna VõNo ratings yet

- Minutes KoMDocument8 pagesMinutes KoMAnna VõNo ratings yet

- DHL Express Account Open Form HK enDocument7 pagesDHL Express Account Open Form HK enAnna Võ0% (1)

- 60-HDM-7798-van Chuyen-Cty Vinalink-10.12.2015Document5 pages60-HDM-7798-van Chuyen-Cty Vinalink-10.12.2015Anna VõNo ratings yet

- 15624702052231UoGssBO9TQOUnD5 PDFDocument5 pages15624702052231UoGssBO9TQOUnD5 PDFvenkateshbitraNo ratings yet

- Bofa Approval LetterDocument3 pagesBofa Approval LetterSteve Mun GroupNo ratings yet

- Johor Corp 2008Document209 pagesJohor Corp 2008khairulkamarudinNo ratings yet

- Kalyan City - Blogspot.com 2010 09 Functions of Reserve Bank of IndiaDocument6 pagesKalyan City - Blogspot.com 2010 09 Functions of Reserve Bank of IndiaAlokdev MishraNo ratings yet

- Text BasedDocument59 pagesText Basedjack sparowNo ratings yet

- Instruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresDocument6 pagesInstruction. Encircle The Letter That Corresponds To Your Answer. Do Not Use Pencils. Avoid ErasuresstillwinmsNo ratings yet

- IBS Hyderabad Banking Management Course HandoutDocument53 pagesIBS Hyderabad Banking Management Course HandoutGowtham krishnaNo ratings yet

- Score 4.39.90Document4 pagesScore 4.39.90Aravindh MassNo ratings yet

- Journal Entry GuideDocument3 pagesJournal Entry GuideFeerose Kumar GullaNo ratings yet

- 1314-1269 Cotizacion 3 Sistemas Quoncer PDFDocument4 pages1314-1269 Cotizacion 3 Sistemas Quoncer PDFByron Xavier Lima CedilloNo ratings yet

- United Malayan Banking Corporation Berhad VDocument4 pagesUnited Malayan Banking Corporation Berhad VaishahNo ratings yet

- PMCM Company Deck June 2018Document32 pagesPMCM Company Deck June 2018Hannes Sternbeck FryxellNo ratings yet

- Shivam Thakar SIPDocument93 pagesShivam Thakar SIPabinash pasayatNo ratings yet

- Official receipt for life insurance premium paymentDocument2 pagesOfficial receipt for life insurance premium paymentLui SantosNo ratings yet

- 2005 11 03 - DR3Document1 page2005 11 03 - DR3Zach EdwardsNo ratings yet

- Journal and ledger entries for multiple accounting transactionsDocument5 pagesJournal and ledger entries for multiple accounting transactionsAdil Khan LodhiNo ratings yet

- 2.study of E-Wallet Awareness and Its Usage in MumbaiDocument14 pages2.study of E-Wallet Awareness and Its Usage in Mumbaiphamuyen11012003No ratings yet

- Charles N. Mckinney: 1960 N. Parkway, Unit #503 Memphis, TN 38112 901-570-2221Document3 pagesCharles N. Mckinney: 1960 N. Parkway, Unit #503 Memphis, TN 38112 901-570-2221api-28937734No ratings yet

- History of India's Largest Bank SBIDocument1 pageHistory of India's Largest Bank SBISNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- Understanding Customer Behavior at SCBDocument78 pagesUnderstanding Customer Behavior at SCBHimanshu Saini0% (1)

- Green HRM Practices of Foreign Banks inDocument33 pagesGreen HRM Practices of Foreign Banks inRudro Dipu50% (4)

- Money and Credit Important Questions and Answers PDFDocument12 pagesMoney and Credit Important Questions and Answers PDFAkkajNo ratings yet

- 201244WAR1Document716 pages201244WAR1Sam MaurerNo ratings yet

- Foreign Exchange Transaction Against RupiahDocument5 pagesForeign Exchange Transaction Against RupiahErick MulijadiNo ratings yet