Professional Documents

Culture Documents

Budget

Uploaded by

Norzul AfifuddinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget

Uploaded by

Norzul AfifuddinCopyright:

Available Formats

6.

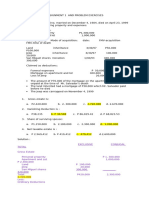

Project Budget Summary

Budget Estimation

Resource Description Year 0 Year 1 Year 2 Year 3

Software -Operating 20 000 8 000 8 000 8 000

system (OS)

that will be

added to the

table.

Hardware - Custom PCs 35 000 16 000 15 500 14 000

specialized to

add OS to the

table.

- PC for

designer

sketch and

design the

shape of table.

Labour such - Working 30 000 16 000 14 000 14 000

as hour and also

programmer, training to

marketer and master the

designer system.

Research - - Do research 24 000 4 000 3 500 3 000

Project about

Management education in

Malaysia.

- Research

about learning

environment.

- Research

about learning

patterns of

students

Manufacturing - Develop 19 000 8 000 8 000 7 500

table ready to

work unless

the OS.

Utilities - Electricity 2 000 2 000 2 000 2 000

and water bill

Total cost 130000 54 000 51 000 48 500

6.1 Analysis of Alternative

Total cost for one unit of product = RM 1000

Estimated product sale price = RM 1 800

Estimated unit sales for first year = 100 units

Estimated sales for first year = RM 180 000

6.2 Payback

Company spends RM130 000 developing and manufacturing the products then

receives a net cash return of RM180 000 a year.

Payback period = Initial Investment/Net Cash Flow

= RM130 000/RM180 000

= 0.72 years

6.3 Return on Investment (ROI)

Project alternative is expected to cost RM130 000 but provides RM160 000 in

expected benefits, therefore the project ROI would be:

Project ROI = Total Expected Benefits Total Expected Costs

Total Expected Costs

= RM160 000 RM130 000

RM130 000

= 23% per year

6.4 Net Present Value (NPV)

The expected cash flows for the next four years of the business:

Year 0 Year 1 Year 2 Year 3

Total Cash Inflows RM 0 RM180 000 RM200 000 RM220 000

Total Cash Outflows RM130 000 RM54 000 RM51 000 RM48 500

Net Cash Flow (RM130 000) RM126 000 RM149 000 RM171 500

To calculate the net present value (NPV),

Net Cash Flow

NPV= -I0 ( )

(1+r)t

Where:

I = total cost (or investment) in the project

r = discount rate

t = time period

Assuming that the management team sets the discount rate of 12 percent,

therefore we can discount the net cash flow for each period and add them up to

determine the NPV.

Time Period Calculation Discounted Cash Flow

Year 0 (RM134 000) (RM134 000)

Year 1 RM126 000 (1 + 0.12)1 RM112500

Year 2 RM149 000 (1 + 0.12)2 RM118781.89

Year 3 RM171 500 (1 + 0.12)3 RM122070.31

Net Present Value (NPV) RM219352.2

1. QUALITY ISSUES

The following is the quality issues that may occur during the development, focusing on three main

aspect:

Type Issues Description

Process Quality Standards -The quality standards set or

followed are not up to the

minimum standards

-This may affect the overall

quality of the product as well

as the project success

Product Customer Satisfaction -Product quality may does not

meet the stakeholders demand

or requirements due to issues

arise during process

-Low quality product may

ultimately decrease the

customer satisfaction and

lower the stakeholders

confidence on the success of

the product

Project Over-allocated or under- - Over-allocated may cause the

allocated resources organization to waste of

important resources such as

budget, labor that will

negatively impact the

organization

-under allocated may cause

organization to produce low

quality product due to limited

budget or timeline

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Miss Samantha D Erlston Doreen 56 B High RD Edenvale 1609: Transactions in RAND (ZAR) Accrued Bank ChargesDocument2 pagesMiss Samantha D Erlston Doreen 56 B High RD Edenvale 1609: Transactions in RAND (ZAR) Accrued Bank ChargesSamantha Erlston100% (1)

- PhilAm LIFE vs. Secretary of Finance Case DigestDocument2 pagesPhilAm LIFE vs. Secretary of Finance Case DigestDenn Reed Tuvera Jr.No ratings yet

- Information Resource ManagementDocument39 pagesInformation Resource ManagementHiko Saba100% (1)

- Famous Debit and Credit Fraud CasesDocument7 pagesFamous Debit and Credit Fraud CasesAmy Jones100% (1)

- Indian Garment IndustryDocument87 pagesIndian Garment IndustryEmmanuel Tunde Renner50% (2)

- Introduction To Business Case Study Report About SainsburysDocument13 pagesIntroduction To Business Case Study Report About Sainsburysahsan_ch786100% (1)

- FRM Part 1 Study Plan May 2017Document3 pagesFRM Part 1 Study Plan May 2017msreya100% (1)

- SAP FICO NotesDocument39 pagesSAP FICO NotesShivaniNo ratings yet

- Bank of America v. CA G.R. No. 103092Document6 pagesBank of America v. CA G.R. No. 103092Jopan SJNo ratings yet

- Porter Five Forces AnalysisDocument3 pagesPorter Five Forces Analysisazazel28No ratings yet

- CSTR SeriesDocument9 pagesCSTR SeriesNorzul AfifuddinNo ratings yet

- (Student) Cpe501 - Guideline and Format of Simulation Lab Report (Simulink) - Sept1Document1 page(Student) Cpe501 - Guideline and Format of Simulation Lab Report (Simulink) - Sept1Siti Mastura Abdul RahmanNo ratings yet

- Effect PulseDocument33 pagesEffect PulseMohd Sharu Mamat100% (1)

- EWC ReportDocument22 pagesEWC ReportNorzul AfifuddinNo ratings yet

- Reactor Selection: Cross-Sectional Diagram of Continuous Flow Stirred-Tank ReactorDocument2 pagesReactor Selection: Cross-Sectional Diagram of Continuous Flow Stirred-Tank ReactorNorzul AfifuddinNo ratings yet

- EWC ReportDocument22 pagesEWC ReportNorzul AfifuddinNo ratings yet

- Chinese Accounting VocabDocument3 pagesChinese Accounting Vocabzsuzsaprivate7365100% (1)

- Unit 07 Investigating Travel Agency OperationsDocument6 pagesUnit 07 Investigating Travel Agency OperationsVictor Oscar Nanquen OrtizNo ratings yet

- Distribution RecordsDocument10 pagesDistribution RecordsRenaldy NongbetNo ratings yet

- Quotation of Nile MiningDocument7 pagesQuotation of Nile MiningOscarNo ratings yet

- Concept Paper On GD & PIDocument9 pagesConcept Paper On GD & PIjigishhaNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- DBA Weights-PowerShares ETFsDocument7 pagesDBA Weights-PowerShares ETFsfredtag4393No ratings yet

- Ques 1Document2 pagesQues 1Renuka SharmaNo ratings yet

- Spring 2019 - MGT602 - 1Document3 pagesSpring 2019 - MGT602 - 1Bilal AhmedNo ratings yet

- Assignment 2 JRDocument5 pagesAssignment 2 JRruss jhingoorieNo ratings yet

- VKCDocument8 pagesVKCVaishnav Chandran k0% (1)

- Harbor Research - Machine To Machine (M2M) & Smart Systems Market ForecastDocument13 pagesHarbor Research - Machine To Machine (M2M) & Smart Systems Market ForecastharborresearchNo ratings yet

- Amul Taste of IndiaDocument18 pagesAmul Taste of Indiatamil maniNo ratings yet

- MI 0040 Final AssignmentDocument9 pagesMI 0040 Final Assignmentbhandari0148No ratings yet

- Matriks Keterkaitan Persyaratan Iso 9001:2015 Dengan ProsedurDocument2 pagesMatriks Keterkaitan Persyaratan Iso 9001:2015 Dengan ProsedursafwanNo ratings yet

- Rencana Bisnis Art Box Creative and Coworking SpaceDocument2 pagesRencana Bisnis Art Box Creative and Coworking SpacesupadiNo ratings yet

- A-FLY Quotation For Schindler Parts-20170815-142636703Document2 pagesA-FLY Quotation For Schindler Parts-20170815-142636703habibullaNo ratings yet

- YASHDocument15 pagesYASHyashNo ratings yet

- Portfolio October To December 2011Document89 pagesPortfolio October To December 2011rishad30No ratings yet

- Positioning and ValuesDocument215 pagesPositioning and ValuesmadihaNo ratings yet