Professional Documents

Culture Documents

1 (41) - 8

Uploaded by

Muhammad Salim Ullah KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1 (41) - 8

Uploaded by

Muhammad Salim Ullah KhanCopyright:

Available Formats

Section B ALL FOUR questions are compulsory and MUST be attempted

1 The following is a list of unit costs for a single product, incurred in a period, using either marginal costing or absorption

costing:

Marginal costing Absorption costing

$ $ $ $

Production costs:

Prime cost 420 420

Variable overhead 060 060

Fixed overhead 380

480 860

Selling & administration costs:

Variable overhead 100 100

Fixed overhead 290

100 390

Total 580 1250

The selling price of the product, throughout the period, was $1450 per unit. 11,400 units of the product were

manufactured in the period during which 11,200 units were sold. There were no finished goods at the beginning of

the period. The fixed production overhead costs per unit listed above are based on the production units for the period

and the fixed selling and administration overhead costs per unit are based on the sales units.

Required:

(a) Prepare an absorption costing profit statement for the period. The statement should include the total cost of

production, closing inventory value, total gross profit and total net profit. (8 marks)

(b) Using marginal costing, calculate for the period:

(i) total contribution; (3 marks)

(ii) total net profit; (3 marks)

(iii) break-even sales revenue. (3 marks)

(c) Explain why the net profit using absorption costing differs from that using marginal costing. (2 marks)

(19 marks)

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 9707 s15 Ms 32Document9 pages9707 s15 Ms 32Muhammad Salim Ullah KhanNo ratings yet

- SECTION 3 (80 Marks) : Page 8 of 8Document1 pageSECTION 3 (80 Marks) : Page 8 of 8Muhammad Salim Ullah KhanNo ratings yet

- Blank - 11th-2018-19Document5 pagesBlank - 11th-2018-19Muhammad Salim Ullah KhanNo ratings yet

- 9707 s04 QP 3Document4 pages9707 s04 QP 3Muhammad Salim Ullah KhanNo ratings yet

- Budgeting: Super SupremeDocument1 pageBudgeting: Super SupremeMuhammad Salim Ullah KhanNo ratings yet

- Economics: University of Cambridge International Examinations International General Certificate of Secondary EducationDocument3 pagesEconomics: University of Cambridge International Examinations International General Certificate of Secondary EducationMuhammad Salim Ullah KhanNo ratings yet

- 5 Total For This Question: 12 MarksDocument1 page5 Total For This Question: 12 MarksMuhammad Salim Ullah KhanNo ratings yet

- Isa500 Isa510 Isa520 Isa530 Isa540Document1 pageIsa500 Isa510 Isa520 Isa530 Isa540Muhammad Salim Ullah KhanNo ratings yet

- 0455 s03 Ms 1+2+3+4+6Document17 pages0455 s03 Ms 1+2+3+4+6Muhammad Salim Ullah KhanNo ratings yet

- IGCSE Business 4 AnswerDocument3 pagesIGCSE Business 4 AnswerMuhammad Salim Ullah Khan67% (3)

- IGCSE Business 5 AnswerDocument2 pagesIGCSE Business 5 AnswerMuhammad Salim Ullah Khan86% (14)

- Islamic Finance ReferencesDocument6 pagesIslamic Finance ReferencesMuhammad Salim Ullah KhanNo ratings yet

- 1429 Business Math B Com AiouDocument3 pages1429 Business Math B Com AiouMuhammad Salim Ullah Khan50% (4)

- Sample Marking GridsDocument4 pagesSample Marking GridsMuhammad Salim Ullah KhanNo ratings yet

- 6EB02 01 Que U2bDocument16 pages6EB02 01 Que U2bMuhammad Salim Ullah KhanNo ratings yet

- Netexports As % of GDPDocument2 pagesNetexports As % of GDPMuhammad Salim Ullah KhanNo ratings yet

- 9707 s12 Ms 13Document7 pages9707 s12 Ms 13Muhammad Salim Ullah KhanNo ratings yet

- ALBS Mindmap 01 PDFDocument1 pageALBS Mindmap 01 PDFMuhammad Salim Ullah KhanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ten Principles of UN Global CompactDocument2 pagesTen Principles of UN Global CompactrisefoxNo ratings yet

- Dalal Street Investment Journal PDFDocument26 pagesDalal Street Investment Journal PDFShailesh KhodkeNo ratings yet

- Attacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep DevkarDocument14 pagesAttacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep Devkarsim4misNo ratings yet

- Chapter 7 ExercisesDocument2 pagesChapter 7 ExercisesShesheng ComendadorNo ratings yet

- DPWH Natl Sewerage Septage MGMT ProgramDocument15 pagesDPWH Natl Sewerage Septage MGMT Programclint castilloNo ratings yet

- Revised Analyst's Dilemma Analysis Pallab MishraDocument2 pagesRevised Analyst's Dilemma Analysis Pallab Mishrapalros100% (1)

- Effect of Vishal Mega Mart On Traditional RetailingDocument7 pagesEffect of Vishal Mega Mart On Traditional RetailingAnuradha KathaitNo ratings yet

- GLInqueryDocument36 pagesGLInquerynada cintakuNo ratings yet

- SLC-Contract Status-20080601-20080630-ALL-REPORTWMDocument37 pagesSLC-Contract Status-20080601-20080630-ALL-REPORTWMbnp2tkidotgodotid100% (1)

- Economics Environment: National Income AccountingDocument54 pagesEconomics Environment: National Income AccountingRajeev TripathiNo ratings yet

- Credit CreationDocument17 pagesCredit Creationaman100% (1)

- Sales Quotation: Kind Attn:: TelDocument2 pagesSales Quotation: Kind Attn:: Telkiran rayan euNo ratings yet

- The Racist Roots of Welfare Reform - The New RepublicDocument6 pagesThe Racist Roots of Welfare Reform - The New Republicadr1969No ratings yet

- Peso Appreciation SeminarDocument3 pagesPeso Appreciation SeminarKayzer SabaNo ratings yet

- Tata-AIG Organisational ChartDocument4 pagesTata-AIG Organisational ChartTarun BajajNo ratings yet

- Report Sugar MillDocument51 pagesReport Sugar MillMuhammadAyyazIqbal100% (1)

- Chapter 6 - An Introduction To The Tourism Geography of EuroDocument12 pagesChapter 6 - An Introduction To The Tourism Geography of EuroAnonymous 1ClGHbiT0JNo ratings yet

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Document17 pagesGuide To Original Issue Discount (OID) Instruments: Publication 1212Theplaymaker508No ratings yet

- The Pioneer 159 EnglishDocument14 pagesThe Pioneer 159 EnglishMuhammad AfzaalNo ratings yet

- ANX6732AAQDocument1 pageANX6732AAQRathod GunvantrayNo ratings yet

- Deloitte With World Economic Forum Future of Food - Partnership-GuideDocument40 pagesDeloitte With World Economic Forum Future of Food - Partnership-GuideFred NijlandNo ratings yet

- Jose C. Guico For Petitioner. Wilfredo Cortez For Private RespondentsDocument5 pagesJose C. Guico For Petitioner. Wilfredo Cortez For Private Respondentsmichelle m. templadoNo ratings yet

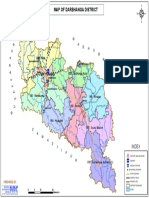

- DARBHANGA MapDocument1 pageDARBHANGA MapRISHIKESH ANANDNo ratings yet

- Family Dollar ReleaseDocument1 pageFamily Dollar ReleaseNewzjunkyNo ratings yet

- Internship Project BSLDocument58 pagesInternship Project BSLRajesh Kumar100% (1)

- Gold and InflationDocument25 pagesGold and InflationRaghu.GNo ratings yet

- P2P and O2CDocument59 pagesP2P and O2Cpurnachandra426No ratings yet

- Conservation Communities - Urban Land MagazineDocument3 pagesConservation Communities - Urban Land MagazineJohnnazaren MisaNo ratings yet

- 3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeDocument4 pages3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeLab Lee0% (1)

- New Economic Policy of IndiaDocument23 pagesNew Economic Policy of IndiaAbhishek Singh Rathor100% (1)