Professional Documents

Culture Documents

Form 16 Part B 2016-17

Uploaded by

atulsharmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16 Part B 2016-17

Uploaded by

atulsharmaCopyright:

Available Formats

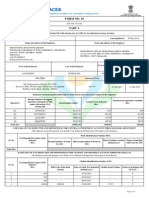

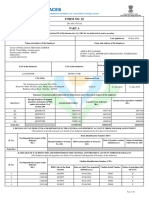

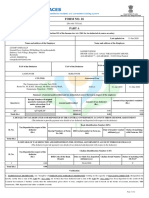

23185895 Pan No.

Financial Year 2016 - 2017 Sharma Atul Kumar

FORM 16 - PART B(Annexure)

Details of salary paid and any other income and tax deducted.

Particulars Rs. Rs. Rs.

1. Gross salary

a) salary as per provisions contained in sec.17(1)

132239.16

b) Value of perquisites under section 17(2)

( as per Form No.12BA wherever applicable )

0.00

c) Profits in lieu of salary under section 17(3)

( as per Form No.12BA wherever applicable ) 0.00

d) Total 132239.16

2. Less: Allowance to the extent exempt under section 10 8774.00

3. Balance(1-2) 123465.16

4. DEDUCTIONS:

(a) Entertainment allowance 0.00

(b) Tax on Employment 0.00

5. Aggregate of 4(a) and (b) 0.00

6. INCOME CHARGEABLE UNDER THE HEAD "SALARIES"(3-5) 123465.16

7. Add: Any other Income reported by the employee 0.00

8. GROSS TOTAL INCOME(6+7) 123465.16

9. DEDUCTIONS UNDER CHAPTER VI-A Gross Amount Deductible

Amount

A) sections 80C, 80CCC and 80CCD

a) section 80C

i) Employee Providend Fund 6786.00 6786.00 6786.00

(b) section 80CCC (c) section 80CCD(2) 0.00 0.00

B) other sections (for e.g. 80E, 80G, 80TTA etc.) under chapter VIA

10. Aggregate of deductible amounts under Chapter VI-A 6786.00

11. Total Income(8-10) 116680.00

12. Tax on total income

0.00

13. Rebate on Tax(U/S 87) 0.00

14. Balance Tax(12-13) 0.00

15. Surcharge @12%

0.00

16. Education Cess @3% 0.00

17. Tax payable (14+15+16) 0.00

18. Relief under sec 89(attach details) 0.00

19. Tax Payable (17-18) 0.00

20. Less: a) Tax deducted at source u/s 192(1) 0.00

b) Tax paid by the employer on behalf of the employee

u/s 192(1A) on perquisites u/s 17(2) 0.00

c) Tax Paid by employee outside the company 0.00 0.00

21. Tax payable/refundable(19-20) 0.00

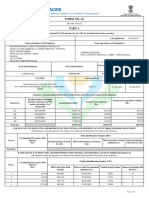

23185895 Pan No. Financial Year 2016 - 2017 Sharma Atul Kumar

Verification

I, MR. MEHERNOSH MEHTA ,son/daughter of MR. NARIMAN MEHTA working in the capacity of VP HR (Designation) do hereby certify that the

information given above is true, complete and correct and is based on the books of account, documents, TDS statements and other available records.

Place: MUMBAI

Date: 12.05.2017

Designation: VP HR (Signature of person responsible for deduction of tax)

Full Name: MR. MEHERNOSH MEHTA

Digitally signed by MEHERNOSH MEHTA

SerialNumber:2189734637188685761

Date: 2017.05.29 22:02:13 +05:30

Reason:I attest to the accuracy and integrity of this document

Annexure to Form No.16

Name: Sharma Atul Kumar Emp No.: 23185895

Particulars Amount(Rs.)

Emoluments paid

Basic Salary 56548.71

Conveyance 8774.19

House Rent Allowance 28274.36

Children Education Allowance 1096.77

Medical Allow/Reimb 6854.84

Other Allowances 30690.29

Perks

Gross emoluments 132239.16

Income from other sources

Total income from other sources 0.00

Exemptions u/s 10

Conveyance Exemption 8774.00

Total Exemption 8774.00

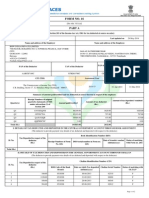

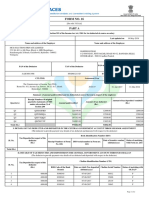

FORM No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisities, other fringe

benefits or amenities and profits in lieu of salary with value thereof

1) Name and address of employer :

MAHINDRA LOGISTICS LTD Mahindra Towers, Dr. G M Bhosle MargWorli, Mumbai 400018,

2) TAN: MUMM33771D

3) TDS Assesment Range of the employer :

DC/ACIT(TDS) Circle 2(2),K G Mittal Ayurvedic Hospital Bldg., - 400002

4) Name, designation and PAN of employee :

Mr/Ms: Sharma Atul Kumar, Desig.:Senior Executive - Operat, Emp #:23185895, PAN:

5) Is the employee a director or a person with substantial interest in No

the company (where the employer is a company) :

6) Income under the head "Salaries" of the employee : 123465.16

(other than from perquisites)

7) Financial year : 2016-2017

8) Valuation of Perquisites

S.No Nature of perquisite Value of perquisite Amount, if any recovered Amount of perquisite

(see rule 3) as per rules(Rs.) from the employee(Rs.) chargeable to tax(Rs.)

(1) (2) (3) (4) Col(3)-Col(4) (5)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other automotive 0.00 0.00 0.00

Sweeper , gardener , watchman or

3 0.00 0.00 0.00

personal attendant

4 Gas , electricity , water 0.00 0.00 0.00

5 Interest free or concessional loans 0.00 0.00 0.00

6 Holiday expenses 0.00 0.00 0.00

7 Free or concessional Travel 0.00 0.00 0.00

8 Free meals 0.00 0.00 0.00

9 Free Education

10 Gifts,vouchers etc. 0.00 0.00 0.00

11 Credit card expenses

12 Club expenses 0.00 0.00 0.00

13 Use of movable assets by employees 0.00 0.00 0.00

14 Transfer of assets to employees 0.00 0.00 0.00

15 Value of any other benefit

0.00 0.00 0.00

/amenity/service/privilege

16 Stock options ( non-qualified options )

17 Other benefits or amenities 0.00 0.00 0.00

18 Total value of perquisites 0.00 0.00 0.00

19 Total value of Profits in lieu of salary

as per 17 (3)

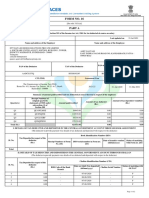

9. Details of tax, -

(a) Tax deducted from salary of the employee under section 192(1) 0.00

(b) Tax paid by employer on behalf of the employee under section 192(1A) 0.00

(c) Total tax paid 0.00

(d) Date of payment into Government treasury *

* Refer to part A of form 16 under Details of tax deducted and deposited into Central Government Account.

DECLARATION BY EMPLOYER

I, MR. MEHERNOSH MEHTA Son/daughter of MR. NARIMAN MEHTA working as VP HR do hereby declare on behalf of MAHINDRA

LOGISTICS LTD that the information given above is based on the books of account , documents and other relevant records or information

available with us and the details of value of each such perquisite are in accordance with section 17 and rules framed thereunder and that such

information is true and correct.

Digitally signed by MEHERNOSH MEHTA

SerialNumber:2189734637188685761

Date: 2017.05.29 22:02:13 +05:30

Reason:I attest to the accuracy and integrity of this document

Place: MUMBAI Signature of the person responsible for deduction of tax

Date: 12.05.2017 Name: MR. MEHERNOSH MEHTA

Designation: VP HR

You might also like

- Salary details and tax deductionsDocument3 pagesSalary details and tax deductionsBALANo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Form16 (2020-2021)Document2 pagesForm16 (2020-2021)Saras ShendeNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Form 16 ADocument5 pagesForm 16 Anisha_khanNo ratings yet

- Form16 2021Document8 pagesForm16 2021Mahammad HachanNo ratings yet

- Ahxxxxxxxq q4 2022-23Document2 pagesAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- Pay Slip March 2017Document4 pagesPay Slip March 2017Anonymous AsVoWD04c0% (1)

- Form 16 Salary CertificateDocument9 pagesForm 16 Salary CertificateHarish KumarNo ratings yet

- Form 16 Details for K PonnaDocument9 pagesForm 16 Details for K PonnaPonns KarnanNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Aofpc1472d 2020-21Document2 pagesAofpc1472d 2020-21uday digumarthiNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementSagar Kumar GuptaNo ratings yet

- Cipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureDocument2 pagesCipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureImtiyaz Alam SahilNo ratings yet

- YourForm16 2022Document8 pagesYourForm16 2022BHARATH MPNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Wipro Form 16 DetailsDocument8 pagesWipro Form 16 DetailssaisindhuNo ratings yet

- Form 16 TDS certificate for FY 2014-15Document2 pagesForm 16 TDS certificate for FY 2014-15RamyaMeenakshiNo ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- Form 16 TDS CertificateDocument9 pagesForm 16 TDS CertificateAmit GautamNo ratings yet

- 110773Document6 pages110773asheesh kumarNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- FORM 16 DETAILSDocument2 pagesFORM 16 DETAILSKushal MalhotraNo ratings yet

- A-Radha@dxc - Com F16Document9 pagesA-Radha@dxc - Com F16Radha PraveenNo ratings yet

- LNL Iklcqd /: Page 1 of 10Document10 pagesLNL Iklcqd /: Page 1 of 10Manoj ValeshaNo ratings yet

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- 2019 20 PDFDocument7 pages2019 20 PDFSanjeet SinghNo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- Annual Tax Statement Form 26ASDocument4 pagesAnnual Tax Statement Form 26ASMadhukar GuptaNo ratings yet

- Deve 60398Document7 pagesDeve 60398Devesh Pratap ChandNo ratings yet

- Anil 21-22Document2 pagesAnil 21-22chrisj 99No ratings yet

- RPT Pay SlipDocument1 pageRPT Pay SlipAllia sharmaNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- BGCC M01495Document2 pagesBGCC M01495RAJKUMAR CHATTERJEE. (RAJA.)No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Lavanya MittaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kapil KaroliyaNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruBINAYAK CHAKRABORTYNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Daman SharmaNo ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- TDS Certificate Form 16Document9 pagesTDS Certificate Form 16Aman AgrawalNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedSekhar DashNo ratings yet

- Form 16: Wipro LimitedDocument8 pagesForm 16: Wipro LimitedpadduNo ratings yet

- FORM 16 TDS CERTIFICATEDocument8 pagesFORM 16 TDS CERTIFICATESaleemNo ratings yet

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDocument5 pagesC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Black Farmers in America, 1865-2000 The Pursuit of in Dependant Farming and The Role of CooperativesDocument28 pagesBlack Farmers in America, 1865-2000 The Pursuit of in Dependant Farming and The Role of CooperativesBrian Scott Williams100% (1)

- 13 GARCIA v. VILLARDocument1 page13 GARCIA v. VILLARGSSNo ratings yet

- Actifio Copy Data ManagementDocument92 pagesActifio Copy Data ManagementmahalinNo ratings yet

- CIA Triangle Review QuestionsDocument11 pagesCIA Triangle Review QuestionsLisa Keaton100% (1)

- Ra 3720 - Safety and Purity of Foods, and CosmeticsDocument70 pagesRa 3720 - Safety and Purity of Foods, and CosmeticsShehana Tawasil MusahariNo ratings yet

- Introduction to Comparative Law MaterialsDocument5 pagesIntroduction to Comparative Law MaterialsnnnNo ratings yet

- Business Combination AccountingDocument3 pagesBusiness Combination AccountingBrian PuangNo ratings yet

- Jurnal Deddy RandaDocument11 pagesJurnal Deddy RandaMuh Aji Kurniawan RNo ratings yet

- City Limits Magazine, August/September 1991 IssueDocument24 pagesCity Limits Magazine, August/September 1991 IssueCity Limits (New York)No ratings yet

- Prof. EthicsDocument141 pagesProf. EthicsMohammed MuzamilNo ratings yet

- Jeff Gasaway Investigation Report From Plano ISD April 2010Document21 pagesJeff Gasaway Investigation Report From Plano ISD April 2010The Dallas Morning NewsNo ratings yet

- Supreme Court Power to Order Change of VenueDocument1 pageSupreme Court Power to Order Change of VenueKathleneGabrielAzasHaoNo ratings yet

- AACC and Proactive Outreach Manager Integration - 03.04 - October 2020Document59 pagesAACC and Proactive Outreach Manager Integration - 03.04 - October 2020Michael ANo ratings yet

- Human Rights and the Death Penalty in the USDocument4 pagesHuman Rights and the Death Penalty in the USGerAkylNo ratings yet

- Pre-Incorporation Founders Agreement Among The Undersigned Parties, Effective (Date Signed)Document13 pagesPre-Incorporation Founders Agreement Among The Undersigned Parties, Effective (Date Signed)mishra1mayankNo ratings yet

- Innovyze Software Maintenance Support AgreementDocument2 pagesInnovyze Software Maintenance Support Agreementshahrukhkhalid1359No ratings yet

- TIP Report 2015Document17 pagesTIP Report 2015SamNo ratings yet

- IAS 27: Consolidated andDocument31 pagesIAS 27: Consolidated andashiakas8273No ratings yet

- Duterte's 1st 100 Days: Drug War, Turning from US to ChinaDocument2 pagesDuterte's 1st 100 Days: Drug War, Turning from US to ChinaALISON RANIELLE MARCONo ratings yet

- International Aviation Safety Assessment Assessor’s ChecklistDocument23 pagesInternational Aviation Safety Assessment Assessor’s ChecklistViktor HuertaNo ratings yet

- PARAMUS ROAD BRIDGE DECK REPLACEMENT PROJECT SPECIFICATIONSDocument156 pagesPARAMUS ROAD BRIDGE DECK REPLACEMENT PROJECT SPECIFICATIONSMuhammad irfan javaidNo ratings yet

- FOI Disclosure Log 374 AnnexDocument1,204 pagesFOI Disclosure Log 374 AnnexSAMEERNo ratings yet

- Evidence Drop: Hawaii DOH Apparently Gave Obama Stig Waidelich's Birth Certificate Number - 3/27/2013Document62 pagesEvidence Drop: Hawaii DOH Apparently Gave Obama Stig Waidelich's Birth Certificate Number - 3/27/2013ObamaRelease YourRecords100% (3)

- Chapter 1 Accounting For Business Combinations SolmanDocument10 pagesChapter 1 Accounting For Business Combinations SolmanKhen FajardoNo ratings yet

- Feleccia vs. Lackawanna College PresentationDocument8 pagesFeleccia vs. Lackawanna College PresentationMadelon AllenNo ratings yet

- Mariam-uz-Zamani, Wife of Emperor Akbar and Mother of JahangirDocument6 pagesMariam-uz-Zamani, Wife of Emperor Akbar and Mother of JahangirMarinela UrsuNo ratings yet

- Darcy's LawDocument7 pagesDarcy's LawArt RmbdNo ratings yet

- Carbon Monoxide Safety GuideDocument2 pagesCarbon Monoxide Safety Guidewasim akramNo ratings yet

- Applications Forms 2 EL BDocument2 pagesApplications Forms 2 EL Bilerioluwa akin-adeleyeNo ratings yet

- National Emergency's Impact on Press FreedomDocument13 pagesNational Emergency's Impact on Press FreedomDisha BasnetNo ratings yet