Professional Documents

Culture Documents

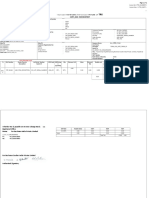

Japanese Depreciable Assets Tax Summary Report: No Data Found

Uploaded by

rpillzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Japanese Depreciable Assets Tax Summary Report: No Data Found

Uploaded by

rpillzCopyright:

Available Formats

<?call:Header?

>

<?template:Header?>

<?end template?>

if Data

Loop for G_TAX_AUTHORITY

H_TODAY_IMPERIAL_CODE Page 1 of 1

H_TODAY_IMPERIAL_YEAR Year H_IMPERIAL_CODE H_IMPERIAL_YEAR Year

H_TODAY_MONTH Month H_TODAY_DAY Date

Owner Code

NAME Honor Japanese Depreciable Assets Tax Summary Report TAX_REGISTRATION_NUMBER

3 Business Type

POSTAL_CODE BUSINESS_TYPE 7 Approval of the Short Year

(Total Capital SHORT

ALTERNATE_ADDRESS_LINE (0 Million Yen) Depreciation

(Alternate Amount)

ADDRESS_LINE

Address) 8 Notification of Increased

1 Address 4 Business BONUS

BIZ_YEAR Year Depreciation

Commencement

(Phone: PHONE_NUMBER) BUZ_MON Month NON_TA

Date 9 Non-Taxable Assets

X

Owner 5 Section and 10 Exception of Taxable

CONTACT_TITLE TAX

Name of the Standard

CONTACT_NAME

ALTERNATE_LEGAL_ENTITY_NAME contact who

(Alternate (Phone: 11 Special Depreciation or

LEGAL_ENTITY_NAME respond to this SPECIAL

Representative CONTACT_PHONE) Compressed Entry

ALTERNATE_CEO_NAME report

Name)

CEO_NAME TAX_ACCOUNTANT_NA 12 Depreciation Method for DEPRN_

2 Name

6 Name of Tax ME Tax Accounting M

Accountant (Phone:

13 Blue Return BLUE

TAX_ACCT_PHONE)

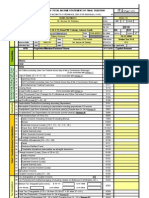

Cost 14 Location of (1) ASSET_ADDRESS1

Office or assets in (2) ASSET_ADDRESS2

Asset Type

Addition Before Prior Decrease in Prior Addition in Prior Year Total this municipality (3) ASSET_ADDRESS3

Year (A) Year (B) (C) ((A)-(B)+(C)) (D) Name of Lender:

TYPE_D 15 Leased Assets

LpTP 0 0 0 0ELp LESSOR_NAME

ESC (LEASED_ASSETS

LESSOR_ADDRESS

_FLAG)

7 Total 0 0 0 0 LESSOR_PHONE_NUMBER

Self-owned

Evaluated Net Book Taxable Standard 16 Ownership

Asset Type Decision Cost (F) Count Class of Location (OWNED_LOCATION_NUMBERS)

Value (E) Cost (G) Leasehold

Building

(LEASED_LOCATION_NUMBERS)

L 17 Remarks (addendum documents):

p

TYPE_DES

0 0 0 CELp REFERENCE_LINE1

C

T REFERENCE_LINE2

P REFERENCE_LINE3

REFERENCE_LINE4

REFERENCE_LINE5

7 Total 0 0 0 CT

REFERENCE_LINE6

Break Before

End-Loop for G_TAX_AUTHORITY

End if data

if No Data

No Data Found

End No Data

You might also like

- Miscellaneous Accrual Reconciliation Report: Cost ManagementDocument2 pagesMiscellaneous Accrual Reconciliation Report: Cost Managementmastanvali.shaik84359No ratings yet

- ACEN-SEC Form 23-B-JETFrancia (19 Aug 2022 A) SGD - CleanedDocument4 pagesACEN-SEC Form 23-B-JETFrancia (19 Aug 2022 A) SGD - CleanedPaolo EscalonaNo ratings yet

- Japanese Detail by Asset TypeDocument1 pageJapanese Detail by Asset TyperpillzNo ratings yet

- SECURITIES AND EXCHANGE COMMISSION FORM 23-BDocument4 pagesSECURITIES AND EXCHANGE COMMISSION FORM 23-BMartin Lewis KoaNo ratings yet

- SEC Form 23-B Vincent D. Lao (MD) As of 111819Document5 pagesSEC Form 23-B Vincent D. Lao (MD) As of 111819Frankie LauNo ratings yet

- Cover Sheet: Vitar I CH Co R Porat IonDocument5 pagesCover Sheet: Vitar I CH Co R Porat IoncraftersxNo ratings yet

- Attention:: Order Information Returns and Employer Returns OnlineDocument6 pagesAttention:: Order Information Returns and Employer Returns OnlineIRSNo ratings yet

- ISA Policy Payment Customer E R DiagramDocument1 pageISA Policy Payment Customer E R DiagramUzma RizviNo ratings yet

- Form C - Final - Shutdown - Oct 2020Document1 pageForm C - Final - Shutdown - Oct 2020jibin sebastianNo ratings yet

- SEC FilingsDocument8 pagesSEC FilingsManish MehraNo ratings yet

- SWCSTACRMIDocument2 pagesSWCSTACRMImastanvali.shaik84359No ratings yet

- 1099-r FREEDocument11 pages1099-r FREEItzFire2kNo ratings yet

- US Internal Revenue Service: f1120pc - 1998Document8 pagesUS Internal Revenue Service: f1120pc - 1998IRSNo ratings yet

- US Internal Revenue Service: f1065 - 1995Document4 pagesUS Internal Revenue Service: f1065 - 1995IRSNo ratings yet

- US Internal Revenue Service: F1120ric - 2001Document4 pagesUS Internal Revenue Service: F1120ric - 2001IRSNo ratings yet

- ALLDY - SEC Form 23-B - AllValue Holdings Corp.Document4 pagesALLDY - SEC Form 23-B - AllValue Holdings Corp.kjcnawkcna calkjwncaNo ratings yet

- 1099-r FREE PDFDocument11 pages1099-r FREE PDFVenkatSridharan0% (1)

- 2021 Financial LiteracyDocument54 pages2021 Financial LiteracyChi EdzaNo ratings yet

- XXSWSTACRMIDocument2 pagesXXSWSTACRMImastanvali.shaik84359No ratings yet

- Copy - Nos For Recipient: Bill From Beckman Coulter India Private LimitedDocument2 pagesCopy - Nos For Recipient: Bill From Beckman Coulter India Private LimitedrahulrsinghNo ratings yet

- ALLDY - SEC Form 23-B - Manuel B. Villar Jr.Document4 pagesALLDY - SEC Form 23-B - Manuel B. Villar Jr.kjcnawkcna calkjwncaNo ratings yet

- US Internal Revenue Service: F1099int - 1992Document4 pagesUS Internal Revenue Service: F1099int - 1992IRSNo ratings yet

- Fill OutDocument2 pagesFill OutSophia Nicole AykeNo ratings yet

- Registration of Business Names Act: Form BN 5Document3 pagesRegistration of Business Names Act: Form BN 5Jasmine JacksonNo ratings yet

- US Internal Revenue Service: f1066 - 1997Document4 pagesUS Internal Revenue Service: f1066 - 1997IRSNo ratings yet

- Mechelec Credit Application2Document3 pagesMechelec Credit Application2Nithin M NambiarNo ratings yet

- US Internal Revenue Service: f943 - 1991Document4 pagesUS Internal Revenue Service: f943 - 1991IRS100% (1)

- TLC AP REMIT RTF Fusion FDocument1 pageTLC AP REMIT RTF Fusion FAniket WaghavkarNo ratings yet

- Sample ExpenseDocument8 pagesSample ExpensesaravanakumarNo ratings yet

- Cover Sheet: COL Financial Group, IncDocument3 pagesCover Sheet: COL Financial Group, IncIrene SalvadorNo ratings yet

- US Internal Revenue Service: f1065 - 1997Document4 pagesUS Internal Revenue Service: f1065 - 1997IRSNo ratings yet

- US Internal Revenue Service: f1120 - 1996Document4 pagesUS Internal Revenue Service: f1120 - 1996IRSNo ratings yet

- Form CDocument1 pageForm Cjibin sebastianNo ratings yet

- US Internal Revenue Service: f1120pc - 1996Document8 pagesUS Internal Revenue Service: f1120pc - 1996IRSNo ratings yet

- " Part-II A: Return of Total Income/Statement of Final TaxationDocument7 pages" Part-II A: Return of Total Income/Statement of Final TaxationNomanAliNo ratings yet

- US Internal Revenue Service: F1099div - 1998Document5 pagesUS Internal Revenue Service: F1099div - 1998IRSNo ratings yet

- US Internal Revenue Service: f2438 - 2001Document3 pagesUS Internal Revenue Service: f2438 - 2001IRSNo ratings yet

- Billing: Billing - No Billing Date: Cut Off Date: Bill - Cust - Name Due Date /date DúDocument3 pagesBilling: Billing - No Billing Date: Cut Off Date: Bill - Cust - Name Due Date /date DúRedrouthu JayaprakashNo ratings yet

- Facility Application Form: DateDocument2 pagesFacility Application Form: DatesyeddilNo ratings yet

- Form 1100Document1 pageForm 1100Hï FrequencyNo ratings yet

- US Internal Revenue Service: f1120 - 1995Document4 pagesUS Internal Revenue Service: f1120 - 1995IRSNo ratings yet

- FORM 23-B: ONG Joseph John L. Dito Cme Holdings Corp. (Dito)Document4 pagesFORM 23-B: ONG Joseph John L. Dito Cme Holdings Corp. (Dito)Lyla Veronica SalgadoNo ratings yet

- Efirst Application FormDocument2 pagesEfirst Application FormRussell O'NeillNo ratings yet

- 2022.08.22 SEC 23-B Juan Arturo Iluminado C. de CastroDocument5 pages2022.08.22 SEC 23-B Juan Arturo Iluminado C. de CastrocraftersxNo ratings yet

- SEC Form 23-B - RCGBDocument5 pagesSEC Form 23-B - RCGBanne anneNo ratings yet

- US Internal Revenue Service: f1065 - 1996Document4 pagesUS Internal Revenue Service: f1065 - 1996IRSNo ratings yet

- UI19 Employers-DeclarationDocument1 pageUI19 Employers-DeclarationJohn Fass100% (2)

- Form - 19a - Fillable - 2023 - Atb Business Solutions Company LimitedDocument16 pagesForm - 19a - Fillable - 2023 - Atb Business Solutions Company LimitedallthatbuzzjaNo ratings yet

- US Internal Revenue Service: f1120pc - 1999Document8 pagesUS Internal Revenue Service: f1120pc - 1999IRSNo ratings yet

- U.S. Return of Income For Electing Large Partnerships: Taxable Income or Loss From Passive Loss Limitation ActivitiesDocument5 pagesU.S. Return of Income For Electing Large Partnerships: Taxable Income or Loss From Passive Loss Limitation ActivitiesIRSNo ratings yet

- LACLS_CL_MAJOR_BOOKDocument2 pagesLACLS_CL_MAJOR_BOOKandreaofNo ratings yet

- US Internal Revenue Service: f1099ptr - 2005Document6 pagesUS Internal Revenue Service: f1099ptr - 2005IRSNo ratings yet

- Model 2 Feb 05 V7.0 BlankDocument19 pagesModel 2 Feb 05 V7.0 BlanknicoweissNo ratings yet

- US Internal Revenue Service: F1120ric - 1996Document4 pagesUS Internal Revenue Service: F1120ric - 1996IRSNo ratings yet

- Federal Employment Income Tax DeclarationDocument1 pageFederal Employment Income Tax DeclarationMaddahayota CollegeNo ratings yet

- J 08 2014 Funds Transfer Authorization JCSUDocument2 pagesJ 08 2014 Funds Transfer Authorization JCSUGelli Anne AguimbagNo ratings yet

- US Internal Revenue Service: f1066 - 1991Document4 pagesUS Internal Revenue Service: f1066 - 1991IRSNo ratings yet

- Dito CME 23 B DAU (14 October 2022)Document4 pagesDito CME 23 B DAU (14 October 2022)Julius Mark TolitolNo ratings yet

- US Internal Revenue Service: f1120s - 1992Document4 pagesUS Internal Revenue Service: f1120s - 1992IRSNo ratings yet

- BI Publisher White PaperDocument88 pagesBI Publisher White PaperversatileNo ratings yet

- IB4B Statement Data Files GuideDocument28 pagesIB4B Statement Data Files GuiderpillzNo ratings yet

- Oracle Rest Web Service UsageDocument3 pagesOracle Rest Web Service UsagerpillzNo ratings yet

- Specializations Catalog - September 2019Document63 pagesSpecializations Catalog - September 2019rpillzNo ratings yet

- Oracle Rest Web Service UsageDocument25 pagesOracle Rest Web Service UsagediptikaulNo ratings yet

- Incorta - WP - Analytics and Reporting Solutions For Oracle EBSDocument7 pagesIncorta - WP - Analytics and Reporting Solutions For Oracle EBSrpillzNo ratings yet

- Signon Audit Responsibilities 080113Document5 pagesSignon Audit Responsibilities 080113rpillzNo ratings yet

- New Concurrent Manager For Shipping v4Document7 pagesNew Concurrent Manager For Shipping v4rpillzNo ratings yet

- Cloud Financials Overview Demo Script PartnerDocument76 pagesCloud Financials Overview Demo Script Partnerhgiang_st8889No ratings yet

- Oracle Fusion Applications Global Price List: Software Investment GuideDocument7 pagesOracle Fusion Applications Global Price List: Software Investment Guidelakshmi_13No ratings yet

- Tran Duc Ho ThuDocument55 pagesTran Duc Ho ThuedisontoNo ratings yet

- Cholesterol Meal Plan 011419 PDFDocument35 pagesCholesterol Meal Plan 011419 PDFrpillzNo ratings yet

- Pradeep Oracle Financials Functional R2R PDFDocument9 pagesPradeep Oracle Financials Functional R2R PDFrpillzNo ratings yet

- Cholesterol Meal Plan 011419 PDFDocument35 pagesCholesterol Meal Plan 011419 PDFrpillzNo ratings yet

- Oracle Landed Cost ManagementDocument38 pagesOracle Landed Cost Managementjimbo2267No ratings yet

- Additional remarks and declaration sectionDocument1 pageAdditional remarks and declaration sectionrpillzNo ratings yet

- Anand Final Sec LedgersDocument41 pagesAnand Final Sec LedgersMiguel FelicioNo ratings yet

- Insurance Accrual Accounting: Oliver ReichertDocument26 pagesInsurance Accrual Accounting: Oliver Reichertrpillz100% (2)

- Comm Card Best PracticeDocument62 pagesComm Card Best PracticerpillzNo ratings yet

- Oracle Landed Cost ManagementDocument38 pagesOracle Landed Cost Managementjimbo2267No ratings yet

- Oracle Quality Setup DocumentDocument15 pagesOracle Quality Setup Documentaartigautam100% (1)

- Pattanaik PPT PDFDocument41 pagesPattanaik PPT PDFrpillzNo ratings yet

- Chart of Account Circular 200 VIE ENGDocument12 pagesChart of Account Circular 200 VIE ENGrpillz0% (1)

- Outline v2Document11 pagesOutline v2rpillzNo ratings yet

- Insurance Accrual Accounting: Oliver ReichertDocument26 pagesInsurance Accrual Accounting: Oliver Reichertrpillz100% (2)

- Depreciation Methods White PaperDocument100 pagesDepreciation Methods White PaperramalingamsNo ratings yet

- Incorta - WP - Analytics and Reporting Solutions For Oracle EBSDocument7 pagesIncorta - WP - Analytics and Reporting Solutions For Oracle EBSrpillzNo ratings yet

- Scanner CAP II Income Tax VATDocument162 pagesScanner CAP II Income Tax VATEdtech NepalNo ratings yet

- Niddf PDFDocument1 pageNiddf PDFMuhammad MudassarNo ratings yet

- General journal entries for consulting businessDocument22 pagesGeneral journal entries for consulting businessPauline Bianca70% (10)

- Exercises IAS 8 SolutionDocument5 pagesExercises IAS 8 SolutionLê Xuân HồNo ratings yet

- Dextrin From Starch Project Report PDFDocument14 pagesDextrin From Starch Project Report PDFAnonymous vFwQuKrtSNo ratings yet

- Preparing An Income Statement, Statement of Retained Earnings, and Balance SheetDocument5 pagesPreparing An Income Statement, Statement of Retained Earnings, and Balance SheetJames MorrisonNo ratings yet

- Economic Value Added: Calculating EVADocument3 pagesEconomic Value Added: Calculating EVAsanjaycrNo ratings yet

- Quiz TAX2 FINALSDocument3 pagesQuiz TAX2 FINALSJoyce Anne MananquilNo ratings yet

- THPS-1 Spring 20110Document4 pagesTHPS-1 Spring 20110bugzlyfeNo ratings yet

- Singapore Illustrative Financial Statements 2016Document242 pagesSingapore Illustrative Financial Statements 2016Em CaparrosNo ratings yet

- Taxation TIAS 1591Document76 pagesTaxation TIAS 1591pablomartinezdiezNo ratings yet

- Ayeesha - Principles of Management AccountingDocument5 pagesAyeesha - Principles of Management AccountingMahesh KumarNo ratings yet

- Sap Fi Bootcamp Training Exercises For Day2Document80 pagesSap Fi Bootcamp Training Exercises For Day2bogasrinu0% (1)

- Behaviour of Interest RatesDocument45 pagesBehaviour of Interest Ratesniesa23No ratings yet

- P.R. Cements LTD Fixed Assets ManagementDocument71 pagesP.R. Cements LTD Fixed Assets ManagementPochender vajrojNo ratings yet

- ACC 250 Exam 1 Flashcards - QuizletDocument4 pagesACC 250 Exam 1 Flashcards - QuizletIslam SamirNo ratings yet

- Aa2 - Chapter 8 Suggested Answers: Exercise 8 - 1Document5 pagesAa2 - Chapter 8 Suggested Answers: Exercise 8 - 1Izzy BNo ratings yet

- Bookkeeping Basics MCQDocument65 pagesBookkeeping Basics MCQRana AwaisNo ratings yet

- Taxsmile Notes On Income TaxDocument46 pagesTaxsmile Notes On Income Taxaman16755747No ratings yet

- Kalbe Farma TBK 31 Des 2020Document173 pagesKalbe Farma TBK 31 Des 2020A. A Gede Wimanta Wari Bawantu32 DarmaNo ratings yet

- Basics of Demand and SupplyDocument29 pagesBasics of Demand and SupplyNuahs Magahat100% (2)

- An Introduction To The Chitsuroku Shobun: Part Two by Thomas SchalowDocument25 pagesAn Introduction To The Chitsuroku Shobun: Part Two by Thomas Schalowapi-260432934No ratings yet

- Ocbc Ar2016 Full Report English PDFDocument236 pagesOcbc Ar2016 Full Report English PDFMr TanNo ratings yet

- 2014 15 Tax Planning Guide - 29 01 15Document252 pages2014 15 Tax Planning Guide - 29 01 15DaneGilbertNo ratings yet

- China Banking Corporation investment loss classificationDocument7 pagesChina Banking Corporation investment loss classificationBernadette RacadioNo ratings yet

- Primavera PERT Master Risk Analysis ToolDocument22 pagesPrimavera PERT Master Risk Analysis ToolPallav Paban BaruahNo ratings yet

- Clarkson QuestionsDocument5 pagesClarkson QuestionssharonulyssesNo ratings yet

- Change in Demand and Supply Due To Factors Other Than PriceDocument4 pagesChange in Demand and Supply Due To Factors Other Than PriceRakesh YadavNo ratings yet

- The Nature and Scope of Cost & Management AccountingDocument17 pagesThe Nature and Scope of Cost & Management Accountingfreshkidjay100% (5)

- Manufacturing OperationsDocument13 pagesManufacturing OperationsAlyssa Camille CabelloNo ratings yet