Professional Documents

Culture Documents

VRCHP 8

Uploaded by

Krushna MishraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VRCHP 8

Uploaded by

Krushna MishraCopyright:

Available Formats

CHAPTER VIII

ACCOUNTS AND RECORDS

67. Maintenance of accounts by a registered dealer. (1) Every dealer, who is

registered under the Act, or on whom a notice under sub-section (2) of section 33 has

been served to furnish return, shall, subject to sub-rules (4) and (5), maintain a true and

up-to-date accounts of goods

(i) purchased or received otherwise than by way of purchases, in the

purchase or input register;

(ii) sold or despatched outside the State otherwise than by way of sales by

him, in the sales or output register;

(iii) held in stock,

for the purpose of business.

(2) A dealer referred to in sub-rule (1) shall maintain accounts of waybills

issued and received, vouchers, bills, cash memos, tax/retail invoices and such other

documents, as may be required, in support of any entry in the purchase and sales register.

(3) Purchase and sales register referred to in sub-rule (2) shall be maintained

tax rate wise so that the totaling made at the end of each tax period will show the

purchases and sales under each tax rate and tax paid on such purchases and charged on

such sales during that tax period.

(4) A registered dealer engaged in the manufacturing or processing of goods

shall maintain true and up-to-date accounts of

(i) capital goods purchased;

(ii) inputs purchased;

(iii) inputs used in manufacturing and processing of goods for sale;

(iv) goods manufactured including manufacturing account;

(v) goods sold; and

(vi) stock account of inputs, consumables, packing materials, fuel, and

finished products and bye-products, if any.

(5) A registered dealer engaged in the execution of works contract shall

maintain a true and up-to-date account of-

(i) goods purchased for use in the execution of works contract;

(ii) goods utilized in the execution of works contract;

(iii)sale value of the goods at the time, such goods are appropriated to the

works contract;

(iv) stock account of goods

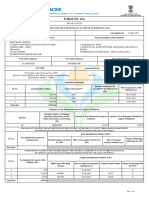

68. Contents of tax invoice and retail invoice. (1) The tax invoice issued

under sub-section (1) of section 62 shall contain the following particulars, namely:-

(a) the words Tax Invoice in bold letter at the top,

(b) the name, address and registration certificate number of the selling

registered dealer,

(c) the name, address and registration certificate number of the purchasing

registered dealer,

(d) in case, the sale is in course of export out of the territory of India, the

name, address, registration certificate number, if any, of the

purchasing dealer or foreign buyer and the type of statutory form, if

any, against which the sale has been made,

(e) an individual serialized number and the date on which the tax invoice

is issued,

(f) description, quantity, volume and value of goods sold and the amount

of tax charged thereon indicated separately,

(g) signature of the selling dealer or his manager or any other employee

or agent, duly authorized by him, and

(h) the name and address of the printer, if any, and first and last serial

number of tax invoices printed and supplied by him to the dealer.

(2) The retail invoice as referred to in sub-section (2) of section 62 shall

contain the following particulars, namely-

(a) the words Retail Invoice or Cash Memorandum or Bill in bold

letter at the top,

(b) the name, address and registration certificate number of the selling

registered dealer,

(c) the name and address of the purchaser, if available,

(d) an individual serialized number and the date on which the retail

invoice is issued,

(e) description, quantity, volume and the value of goods sold showing the

amount of tax charged separately,

(f) signature of the selling dealer or his manager or any other employee

or agent, duly authorized by him, and

(g) the name and address of the printer, if any, and the first and last serial

number of retail invoices printed and supplied to the dealer.

69. Records to be maintained by a registered dealer liable to pay tax under

clause (a) of section 9. Every registered dealer liable to pay tax under clause (a) of

section 9 shall, in addition to the accounts referred to in sub-rules (1), (2) and (3) of rule

67, maintain such accounts and documents as may be required to establish his claim for

filing revised return for any tax period, zero rate sales, claim of input tax credit, stock of

goods, cash balance, utilisation of waybills and statutory declaration forms issued under

the Central Sales Tax Act, 1956 and other claims and transactions relating or incidental to

the business of such dealer.

70. Accounts to be maintained by a registered dealer liable to pay turnover

tax under clause (b) of section 9. (1) The following particulars shall be maintained by

a dealer liable to pay turnover tax under clause (b) of section 9, namely : -

(a) the name and address of the person from whom goods are purchased

supported by invoice, bill or delivery note issued by the seller under

his signature;

(b) description of the goods;

(c) the quantity and value of goods so purchased under clause (a) above;

(d) the quantity and the value of goods sold, showing separately the sale

of goods exempt from tax;

(e) counterfoils of retail invoices issued, which are serially numbered for

each year.

71. Issue of Tax invoice and Retail invoice. (1) Where a registered dealer

effects sales to another registered dealer, the dealer making the sale shall issue a tax

invoice.

(2) Where a registered dealer effects sales to an unregistered dealer or a

registered dealer liable to pay turnover tax under clause (b) of section 9, he shall issue a

retail invoice.

(3) Where a registered dealer effects sales of goods, specified in Schedule C

of the Act to any dealer irrespective of whether he is registered or not under the Act, he

shall issue a retail invoice.

(4) Where a registered dealer liable to pay tax under clause (b) of section 9

effects sale of goods, the tax-exclusive price of which is rupees two hundred or above in

any single transaction, he shall issue a retail invoice against such sale, in accordance with

the provisions of sub-section (2) of section 62.

(5) Separate accounts shall be maintained in respect of sales in respect of

which tax invoices are issued and sales in respect of which retail invoices are issued.

(6) Where a registered dealer liable to pay turnover tax under clause (b) of

section 9 issues retail invoices in respect of sales and the sale price charged therein is

inclusive of tax, the tax amount due for payment shall be calculated by applying the tax

fraction to the tax-inclusive sale price.

(7) All tax invoices and retail invoices issued against sales made by a

registered dealer shall indicate the tax charged at each rate of tax separately.

(8) Tax invoice/retail invoice issued by a registered dealer shall be signed by

the dealer himself or his authorised representative.

(9) Where invoices as referred to in sub-rule (8) are generated electronically

they shall also be signed by the dealer himself or his authorised representative.

72. The language in which accounts are to be maintained. (1) Every

registered dealer liable to pay tax under clause (a) of section 9, who maintains accounts in

a language other than English shall adopt international numerals in the maintenance of

such accounts.

(2) Every registered dealer liable to pay tax under clause (b) of section 9 shall

keep and maintain account in any language specified in the Eighth Schedule to the

Constitution of India or in the English language.

73. Certificate to be furnished by the Accountant. Where the accounts of a

dealer are required to be audited under section 65, a certificate in the following form shall

be furnished along with the audited accounts (Trading account, Profit and loss account

and Balance sheet) for each year by the Accountant conducting such audit.

Form of Certificate

(See rule 73)

I/We have examined the trading account of _________________ (mention

name and address of the dealer with TIN) as at 31st March________________ and the

Profit and Loss account and Balance Sheet for the year ended on that date. The said

accounts are attached herewith.

2. I / We certify that the trading account, Profit and Loss account and the

Balance Sheet are in agreement with the books of account maintained at the principal

place of business at __________ and the branches at ______________.

3. I/We certify that the gross turnover and the taxable turnover returned by the

dealer, the input tax credit claimed and output tax shown as payable in the returns

furnished for the above mentioned year, are in agreement with the books of account

maintained in the principal place of business and the branches at ___________.

4. (a). I/We report the following observations/ comments/ discrepancies/

inconsistencies, if any:

(b) Subject to above -

(i) I/We have obtained all the information and explanations which to

the best of my/our knowledge and belief, were necessary for the

purpose of audit.

(ii) In my/our opinion, proper books of account have been maintained

at the principal place of business and branches of the dealer so far

as it appears from my/our examination of the books.

(iii)In my/our opinion and to the best of my/our information and

according to the explanations, that have been given to me/us, the

said accounts, read with notes thereon give a true and fair view :-

in case of trading account, the state of affairs of business of the

dealer as on 31st March _________,

in case of Profit and Loss account, the profit/loss or

surplus/deficit of the dealer for the year ended on that date, and

in case of the Balance Sheet, of the state of affairs of the dealer

for the year ended on that date.

______________________

Signed

Place____________________ Name_______________________

Date______________________ Address______________________

You might also like

- Deed of Absolute Sale Title TransferDocument6 pagesDeed of Absolute Sale Title TransferChika Tolentino100% (2)

- International Sale ContractDocument3 pagesInternational Sale ContractGlobal NegotiatorNo ratings yet

- Cash Flow Statement GuideDocument37 pagesCash Flow Statement GuideAshekin MahadiNo ratings yet

- Share Purchase AgreementDocument25 pagesShare Purchase AgreementpinoyabogadoNo ratings yet

- Sale and Purchase AgreementDocument7 pagesSale and Purchase AgreementNaval Gupta100% (2)

- Sample MOADocument8 pagesSample MOAAndre CruzNo ratings yet

- 3.03.2015.exclusive Distribution AgreementDocument7 pages3.03.2015.exclusive Distribution AgreementSchiop VioletaNo ratings yet

- #MEMO 1648 Store Sales AuditDocument5 pages#MEMO 1648 Store Sales AuditMAHESH DAVENo ratings yet

- FORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1Document26 pagesFORM - 704: Audit Report Under Section 61 of The Maharashtra Value Added Tax Act, 2002, Part - 1S Kumar SharmaNo ratings yet

- CST Form 1Document6 pagesCST Form 1Sarath Disha80% (5)

- Bir Ruling Da - (Tar-005) 459-08Document5 pagesBir Ruling Da - (Tar-005) 459-08NinaNo ratings yet

- About VatDocument3 pagesAbout VatAnubhav SahNo ratings yet

- Form Jvat 409Document2 pagesForm Jvat 409Suzanne BradyNo ratings yet

- FBR PakistanDocument12 pagesFBR PakistanKalimullah KhanNo ratings yet

- 28689ipcc ST Vol1 cp7 PDFDocument0 pages28689ipcc ST Vol1 cp7 PDFGautam PradhanNo ratings yet

- The Central Sales Tax (Andhra Pradesh) Rules, 1957Document12 pagesThe Central Sales Tax (Andhra Pradesh) Rules, 1957hjgfdxNo ratings yet

- Procedure To Be Followed For Delhi Value Added TaxDocument6 pagesProcedure To Be Followed For Delhi Value Added TaxChirag MalhotraNo ratings yet

- Tax 2 Sec 113Document2 pagesTax 2 Sec 113Aron LoboNo ratings yet

- Draft RR Registration EOPT - For Public ConsultationDocument18 pagesDraft RR Registration EOPT - For Public ConsultationGennelyn OdulioNo ratings yet

- Sales Tax Special Procedure (Withholding) Rules, PDFDocument6 pagesSales Tax Special Procedure (Withholding) Rules, PDFAli MinhasNo ratings yet

- Report Under Secion 80HHC (4), 80HHC (4a) of The Income-Tax Act, 1961Document2 pagesReport Under Secion 80HHC (4), 80HHC (4a) of The Income-Tax Act, 1961kinnari bhutaNo ratings yet

- RR 16-2005Document9 pagesRR 16-2005mblopez1No ratings yet

- Central Sales Tax - Tamil Nadu - Rules 1957Document13 pagesCentral Sales Tax - Tamil Nadu - Rules 1957omselvaNo ratings yet

- CST - RULES PondicherryDocument26 pagesCST - RULES PondicherrySR CapitalsNo ratings yet

- GST-Accounts and RecordsDocument4 pagesGST-Accounts and RecordsadvisoryNo ratings yet

- Sales Tax Special Withholding Rules 2010Document9 pagesSales Tax Special Withholding Rules 2010Shayan Ahmad QureshiNo ratings yet

- Draft Invoice RulesDocument6 pagesDraft Invoice RulesSandeep KaundinyaNo ratings yet

- Capital Gains Tax CTT ReviewDocument7 pagesCapital Gains Tax CTT ReviewRommel RoyceNo ratings yet

- PVAT Rules, 2007 With Gazette NotificationDocument54 pagesPVAT Rules, 2007 With Gazette NotificationsaaisunilNo ratings yet

- Form No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961Document2 pagesForm No. 3ba: Report Under Section 36 (1) (Xi) of The Income-Tax Act, 1961rajdeeppawarNo ratings yet

- Corporate Tax RulesDocument8 pagesCorporate Tax RulesSarika ThoratNo ratings yet

- CTA Case No. 24 (CTA Case No 6170)Document7 pagesCTA Case No. 24 (CTA Case No 6170)Jeffrey JosolNo ratings yet

- Arunachal Pradesh Goods Tax Rules 2005Document31 pagesArunachal Pradesh Goods Tax Rules 2005Luvjoy ChokerNo ratings yet

- Vietnam Circular 153 PDFDocument29 pagesVietnam Circular 153 PDFHang NguyenNo ratings yet

- Capital Gains TaxDocument10 pagesCapital Gains TaxVangie AntonioNo ratings yet

- 2007 Sro 660Document5 pages2007 Sro 660Haseeb JavidNo ratings yet

- Entry TaxDocument8 pagesEntry TaxSudhakar MitteNo ratings yet

- Form 704Document704 pagesForm 704Dhananjay KulkarniNo ratings yet

- Agmts - Sale of Shares Agreements (Short Precedent)Document11 pagesAgmts - Sale of Shares Agreements (Short Precedent)Kagimu Clapton ENo ratings yet

- Form-704 NewDocument251 pagesForm-704 NewHusaina NasikwalaNo ratings yet

- Comtax - Up.nic - in - cSTAct - CST UP Form-1 With AnnexureDocument4 pagesComtax - Up.nic - in - cSTAct - CST UP Form-1 With Annexuresaurabh261050% (2)

- Punjab VAT Act SummaryDocument12 pagesPunjab VAT Act SummarySuraj SinghNo ratings yet

- Bihar Value Added Tax Rules, 2005Document43 pagesBihar Value Added Tax Rules, 2005Saorabh KumarNo ratings yet

- Agreement For Sale of Freehold Property: Form No. 2Document3 pagesAgreement For Sale of Freehold Property: Form No. 2Sudeep SharmaNo ratings yet

- Form RT-II: Qua Rterly Statement Under Section 24 of The Bihar Value Added Tax Act, 2005Document7 pagesForm RT-II: Qua Rterly Statement Under Section 24 of The Bihar Value Added Tax Act, 2005abhaysrNo ratings yet

- Master Shop in Shop AgreementDocument12 pagesMaster Shop in Shop AgreementAbhishekNo ratings yet

- Contract Pentru Comenzi ExterneDocument3 pagesContract Pentru Comenzi ExterneDaniela BuicaNo ratings yet

- BB Gudline Forex Transaction Vol - 2Document145 pagesBB Gudline Forex Transaction Vol - 2M Kaderi Kibria0% (1)

- Jharkhand VAT Rules 2006Document53 pagesJharkhand VAT Rules 2006Krushna MishraNo ratings yet

- Sample Deed of Absolute SaleDocument4 pagesSample Deed of Absolute Saleverkie100% (2)

- Rmo 1981Document228 pagesRmo 1981Mary graceNo ratings yet

- 51 CI Entry RulesDocument17 pages51 CI Entry RulesreddyNo ratings yet

- Form No. 10ccaa: (Now Redundant) Audit Report Under Section 80HHBA of The Income-Tax Act, 1961Document1 pageForm No. 10ccaa: (Now Redundant) Audit Report Under Section 80HHBA of The Income-Tax Act, 1961busuuuNo ratings yet

- Contract To Sell With Extrajudicial Settlement Paid by BuyerDocument2 pagesContract To Sell With Extrajudicial Settlement Paid by BuyerLIZETTE REYES100% (1)

- WH Rules ST 1990Document8 pagesWH Rules ST 1990arslan0989No ratings yet

- Kepco v. CIRDocument2 pagesKepco v. CIRDhan SamsonNo ratings yet

- VAT Booklet for FY 2012-13 by Dhirubhai Shah & CoDocument20 pagesVAT Booklet for FY 2012-13 by Dhirubhai Shah & Coankur2706No ratings yet

- Form No. 3aaa (Now Redundant) Audit Report Under Section 32ABDocument4 pagesForm No. 3aaa (Now Redundant) Audit Report Under Section 32ABAnonymous 2evaoXKKdNo ratings yet

- Audit Report Form 88Document12 pagesAudit Report Form 88TarifNo ratings yet

- Belleza - San Roque Power Corp. vs. Cir G.R. No. 180345, Nov. 25, 2009Document4 pagesBelleza - San Roque Power Corp. vs. Cir G.R. No. 180345, Nov. 25, 2009Noel Christopher G. BellezaNo ratings yet

- Rawmaterials Inward ProcessDocument12 pagesRawmaterials Inward ProcessKrushna MishraNo ratings yet

- WIP Stages - Janakee Annex-4Document5 pagesWIP Stages - Janakee Annex-4Krushna MishraNo ratings yet

- Candle Manufacturing Unit Budget Sl. No. Items Amounts A. TrainingDocument3 pagesCandle Manufacturing Unit Budget Sl. No. Items Amounts A. TrainingKrushna MishraNo ratings yet

- Memorandum of AssociationDocument2 pagesMemorandum of AssociationKrushna MishraNo ratings yet

- Workplace Conduct Policy GuideDocument16 pagesWorkplace Conduct Policy GuideKrushna MishraNo ratings yet

- Chapter-X Liability To Produce Accounts and Supply InformationDocument18 pagesChapter-X Liability To Produce Accounts and Supply InformationKrushna MishraNo ratings yet

- Health, Safety and Environment Policy: RIIL Is Committed ToDocument3 pagesHealth, Safety and Environment Policy: RIIL Is Committed ToKrushna MishraNo ratings yet

- Sexual Harrassment PolicyDocument10 pagesSexual Harrassment PolicySANJAYSINH PARMARNo ratings yet

- Safety & Health Policy JanakeeDocument17 pagesSafety & Health Policy JanakeeKrushna MishraNo ratings yet

- Emergency Action PlanDocument18 pagesEmergency Action PlanSanil AlateNo ratings yet

- Astro DirectionDocument3 pagesAstro DirectionKrushna MishraNo ratings yet

- Vastu For StaircaseDocument7 pagesVastu For StaircaseKrushna MishraNo ratings yet

- Refund Procedures Under VAT RulesDocument5 pagesRefund Procedures Under VAT RulesKrushna MishraNo ratings yet

- Chapter-Ix Liabity in Special CasesDocument1 pageChapter-Ix Liabity in Special CasesKrushna MishraNo ratings yet

- Schedule B: List of Goods Subject To Value Added Tax On Turnover of Sales or PurchasesDocument29 pagesSchedule B: List of Goods Subject To Value Added Tax On Turnover of Sales or PurchasesKrushna MishraNo ratings yet

- Odisha Entry Tax Act Schedule: Part - IIIDocument1 pageOdisha Entry Tax Act Schedule: Part - IIIKrushna MishraNo ratings yet

- Exempted Goods ListDocument10 pagesExempted Goods ListKrushna MishraNo ratings yet

- Registration of Dealers, Cancellation and Amendment of Registration CertificateDocument8 pagesRegistration of Dealers, Cancellation and Amendment of Registration CertificateKrushna MishraNo ratings yet

- Oet Schedule I 07-10-13Document7 pagesOet Schedule I 07-10-13Krushna MishraNo ratings yet

- Jharkhand VAT Rules 2006Document53 pagesJharkhand VAT Rules 2006Krushna MishraNo ratings yet

- 7 Inspiring StoriesDocument7 pages7 Inspiring StoriesKrushna MishraNo ratings yet

- Vat ActDocument81 pagesVat ActKrushna MishraNo ratings yet

- Vastu For StaircaseDocument7 pagesVastu For StaircaseKrushna MishraNo ratings yet

- VAT Rules Chapter 1Document129 pagesVAT Rules Chapter 1Krushna MishraNo ratings yet

- Bedroom VastuDocument1 pageBedroom VastuKrushna MishraNo ratings yet

- Bhagabata Odiya 1Document58 pagesBhagabata Odiya 1Bimbit PattanaikNo ratings yet

- The Torchbearer - May 2013 - Vol 4 Issue 2 PDFDocument27 pagesThe Torchbearer - May 2013 - Vol 4 Issue 2 PDFKrushna MishraNo ratings yet

- GanaDocument15 pagesGanaKrushna Mishra100% (1)

- Planetary QualitiesDocument4 pagesPlanetary QualitiesKrushna MishraNo ratings yet

- Pricing of Holiday MarketDocument24 pagesPricing of Holiday MarketRabikumar HawaibamNo ratings yet

- Resume Ch.11 Consolidation TheoriesDocument3 pagesResume Ch.11 Consolidation TheoriesDwiki TegarNo ratings yet

- Pub B in B 2011 06 enDocument174 pagesPub B in B 2011 06 enfilipandNo ratings yet

- Business Cycle Unemployment and Inflation 2Document22 pagesBusiness Cycle Unemployment and Inflation 2GeloNo ratings yet

- General Questions: Pal SipDocument9 pagesGeneral Questions: Pal SipAura DewaNo ratings yet

- How To Release An IRS Wage Garnishment or Bank LevyDocument9 pagesHow To Release An IRS Wage Garnishment or Bank LevyKeith Duke JonesNo ratings yet

- Glencore 2018Document240 pagesGlencore 2018Eduardo AzorsaNo ratings yet

- TDS CertificateDocument2 pagesTDS Certificatetauqeer25No ratings yet

- Adv 1 - Dept 2010Document16 pagesAdv 1 - Dept 2010Aldrin100% (1)

- Indian Insurance SectorDocument18 pagesIndian Insurance SectorSaket KumarNo ratings yet

- Details of State Pension SchemesDocument30 pagesDetails of State Pension SchemesBoreda RahulNo ratings yet

- Ms - MuffDocument17 pagesMs - MuffDayuman LagasiNo ratings yet

- Advantages of Multinational CompaniesDocument20 pagesAdvantages of Multinational CompaniesPraveen Kumar PiarNo ratings yet

- Ebs-Strategy-R12.2 Roadmap PDFDocument156 pagesEbs-Strategy-R12.2 Roadmap PDFSrinivasa Rao AsuruNo ratings yet

- Clarkson QuestionsDocument5 pagesClarkson QuestionssharonulyssesNo ratings yet

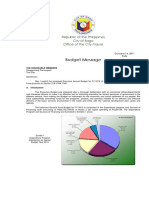

- Bago City 2012 Budget MessageDocument3 pagesBago City 2012 Budget MessageAl SimbajonNo ratings yet

- Cabcharge Research Report CAB ASXDocument4 pagesCabcharge Research Report CAB ASXzengooiNo ratings yet

- Ang & Bekaert - 2007 - RFS - Stock Return Predictability Is It ThereDocument58 pagesAng & Bekaert - 2007 - RFS - Stock Return Predictability Is It ThereẢo Tung ChảoNo ratings yet

- Lesson On Financial AnalysisDocument3 pagesLesson On Financial AnalysiscassieNo ratings yet

- Myob ElisDocument9 pagesMyob ElisDesak ElisNo ratings yet

- Joy Global Inc: FORM 10-QDocument44 pagesJoy Global Inc: FORM 10-QfiahstoneNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- A Guide To Investing in Closed-End Funds: Key PointsDocument4 pagesA Guide To Investing in Closed-End Funds: Key Pointsemirav2No ratings yet

- Product Modification Apple I4Document82 pagesProduct Modification Apple I4Gaurav Ssuvarna100% (2)

- M&A Intro by Prof. Rahul KavishwarDocument51 pagesM&A Intro by Prof. Rahul Kavishwarsalman parvezNo ratings yet

- Offer Letter HakkimDocument9 pagesOffer Letter Hakkimsenthil_kumaran_9100% (1)

- Nichita Elena Mirela Caig If en Simion Sorin GabrielDocument66 pagesNichita Elena Mirela Caig If en Simion Sorin GabrielrainristeaNo ratings yet

- Corporate Overview and Key Financial Highlights of Food Manufacturer Driving Growth Through InnovationDocument2 pagesCorporate Overview and Key Financial Highlights of Food Manufacturer Driving Growth Through InnovationBlueHexNo ratings yet

- The Measurement and Structure of The National Economy: Abel, Bernanke and Croushore (Chapter 2)Document21 pagesThe Measurement and Structure of The National Economy: Abel, Bernanke and Croushore (Chapter 2)Fahad TanveerNo ratings yet