Professional Documents

Culture Documents

Manufacturing Laundry Soap Project Profile

Uploaded by

Antony Joseph0 ratings0% found this document useful (0 votes)

16 views2 pagesThis document provides information about establishing a laundry soap manufacturing business. Key details include:

- Laundry soap manufacturing is a viable business opportunity due to increasing demand for cleaning products from population growth. Existing soap businesses have found success.

- Total project cost is estimated at Rs. 636,000 including capital expenditures of Rs. 340,000 and working capital of Rs. 296,000.

- Annual production capacity at 100% utilization is estimated at 55 tons of laundry soap with a total annual value of Rs. 1,186,600.

- Raw material costs are estimated at Rs. 750,000 along with other operating expenses totaling over Rs. 1 million annually at full capacity.

Original Description:

Laundry soap making

Original Title

Laund Ary Soap

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides information about establishing a laundry soap manufacturing business. Key details include:

- Laundry soap manufacturing is a viable business opportunity due to increasing demand for cleaning products from population growth. Existing soap businesses have found success.

- Total project cost is estimated at Rs. 636,000 including capital expenditures of Rs. 340,000 and working capital of Rs. 296,000.

- Annual production capacity at 100% utilization is estimated at 55 tons of laundry soap with a total annual value of Rs. 1,186,600.

- Raw material costs are estimated at Rs. 750,000 along with other operating expenses totaling over Rs. 1 million annually at full capacity.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesManufacturing Laundry Soap Project Profile

Uploaded by

Antony JosephThis document provides information about establishing a laundry soap manufacturing business. Key details include:

- Laundry soap manufacturing is a viable business opportunity due to increasing demand for cleaning products from population growth. Existing soap businesses have found success.

- Total project cost is estimated at Rs. 636,000 including capital expenditures of Rs. 340,000 and working capital of Rs. 296,000.

- Annual production capacity at 100% utilization is estimated at 55 tons of laundry soap with a total annual value of Rs. 1,186,600.

- Raw material costs are estimated at Rs. 750,000 along with other operating expenses totaling over Rs. 1 million annually at full capacity.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Sl. No.

Group / Name of Village Industries Code Page

C. Polymer and Chemical Based Industries PCBI

53. Laundry Soap PCBI-01 105

PCBI-01

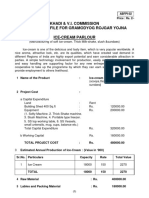

KHADI & VILLAGE INDUSTRIES COMMISSION

PROJECT PROFILE FOR GRAMODYOG ROZGAR YOJANA

MANUFACTURING OF LAUNDRY SOAP

With ever increasing population of the country, the demands of apparel/cloth also increasing

proportionately. For the better look the necessity for more and more laundry soap have increased

manifold in recent years. Many soap units have good success stories. The demand will never be negative. It

will be an ideal venture for an assured income.

1. Name of the Product : Laundry Soap

2. Project Cost :

(a) Capital Expenditure

Land : Own

Building Shed 1200 sq.ft. : Rs. 240000.00

Equipment : Rs. 100000.00

(Kadai, Moulds, Conical Pan, Slab cutter,

Cutting M/c, Stamping M/c. etc.)

Total Capital Expenditure : Rs. 340000.00

(b) Working Capital : Rs. 296000.00

TOTAL PROJECT COST : Rs. 636000.00

3 Estimated Annual Production of Laundry Soap : (Value in 000)

Sl. No. Particulars Capacity Rate Total Value

1. Laundry Soap 55.00 Tons 21.50 1186.60

TOTAL 55.00 21.50 1186.60

4. Raw Material : Rs. 750000.00

5. Labels and Packing Material : Rs. 30000.00

6. Wages (Skilled & Unskilled) : Rs. 200000.00

7. Salaries : Rs. 36000.00

8. Administrative Expenses : Rs. 25000.00

9. Overheads : Rs. 50000.00

10. Miscellaneous Expenses : Rs. 10000.00

11. Depreciation : Rs. 22000.00

12. Insurance : Rs. 3400.00

13. Interest (As per the PLR)

(a) Capital Expenditure Loan : Rs. 44200.00

(b) Working Capital Loan : Rs. 38480.00

Total Interest : Rs. 82680.00

14. Working Capital Requirement

Fixed Cost : Rs. 118600.00

Variable Cost : Rs. 1068480.00

Requirement of Working Capital per Cycle : Rs. 296770.00

15. Estimated Cost Analysis

Sl.No. Particulars Capacity Utilization (Rs. in 000)

100% 60% 70% 80%

1. Fixed Cost 118.60 71.16 83.02 94.88

2. Variable Cost 1068.00 640.80 747.60 854.40

3. Cost of Production 1186.60 711.96 830.62 949.28

4. Projected Sales 1350.00 810.00 114.38 130.72

5. Gross Surplus 163.40 98.04 114.38 130.72

6. Expected Net Surplus 141.00 76.00 92.00 109.00

Note:

1. All figures mentioned above are only indicative and may vary from place to place.

2. If the investment on Building is replaced by Rental Premises-

(a.) Total Cost of Project will be reduced.

(b) Profitability will be increased.

(c) Interest on Capital Expenditure will be reduced.

You might also like

- Laundarysoap PDFDocument2 pagesLaundarysoap PDFTanya KaushalNo ratings yet

- KVI-Hair Oil Manufacturing Project ProfileDocument2 pagesKVI-Hair Oil Manufacturing Project ProfileAntony JosephNo ratings yet

- Project Report VermicompostDocument2 pagesProject Report VermicompostShishir Kumar100% (2)

- Two Wheeler Repairing ShopDocument2 pagesTwo Wheeler Repairing Shopkrishna samNo ratings yet

- Khadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana Handmade Paper Conversion UnitDocument2 pagesKhadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana Handmade Paper Conversion UnitAKvermaNo ratings yet

- Masalasmall PDFDocument2 pagesMasalasmall PDFVIJAY PAREEKNo ratings yet

- Manufacturing Agarbatti Village IndustryDocument2 pagesManufacturing Agarbatti Village IndustryAntony JosephNo ratings yet

- Manufacturing Shampoo Project ProfileDocument2 pagesManufacturing Shampoo Project Profilevineetaggarwal50% (2)

- ATTACHAKKIDocument2 pagesATTACHAKKIgoutham.lokNo ratings yet

- Establishment of RestaurantDocument2 pagesEstablishment of RestaurantDeepak JinaNo ratings yet

- Khadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana PlumbingDocument2 pagesKhadi & Village Industries Commission Project Profile For Gramodyog Rozgar Yojana PlumbingMohammed Mohsin YedavalliNo ratings yet

- Ashish Vishvkarma Udaipur, Rajasthan, 313001Document2 pagesAshish Vishvkarma Udaipur, Rajasthan, 313001ashish vishwakarmaNo ratings yet

- Poha UnitDocument2 pagesPoha UnitBharat PatelNo ratings yet

- Project Profile On Exhaust FansDocument2 pagesProject Profile On Exhaust FansPhilip KotlerNo ratings yet

- Beverage Manufacturing Project ProfileDocument2 pagesBeverage Manufacturing Project ProfileUjjwal DwivediNo ratings yet

- Beverage Manufacturing SchemeDocument2 pagesBeverage Manufacturing SchemenathaanmaniNo ratings yet

- Beverage PDFDocument2 pagesBeverage PDFUjjwal DwivediNo ratings yet

- Beverage Manufacturing Project ProfileDocument2 pagesBeverage Manufacturing Project ProfileUjjwal DwivediNo ratings yet

- Khadi & V.I. Commission Project Profile For Gramodyog Rojgar Yojna Beverage Manufacturing SchemeDocument2 pagesKhadi & V.I. Commission Project Profile For Gramodyog Rojgar Yojna Beverage Manufacturing SchemeUjjwal DwivediNo ratings yet

- Bakery ProjectsDocument2 pagesBakery ProjectsfasmekbakerNo ratings yet

- Besan Manufacturing Unit PDFDocument2 pagesBesan Manufacturing Unit PDFDev MoryaNo ratings yet

- Model Project Profile On Plastic Bottle (Pcbi)Document2 pagesModel Project Profile On Plastic Bottle (Pcbi)sivanagendrarao beharabhargavaNo ratings yet

- Onionpaste PDFDocument2 pagesOnionpaste PDFPushpak DeshmukhNo ratings yet

- Honneyhouse PDFDocument2 pagesHonneyhouse PDFankit_kon_mnnitNo ratings yet

- Namkeenfarsan Manufacturing SchemeDocument2 pagesNamkeenfarsan Manufacturing Schemeanas malikNo ratings yet

- Khadi & Village Industries Commission Project Profile For Gramodyog Rojgar Yojana Papad ManufacturingDocument2 pagesKhadi & Village Industries Commission Project Profile For Gramodyog Rojgar Yojana Papad ManufacturingAMIT SRIVASTAVANo ratings yet

- Rs. 151000 Two Wheeler Repair Shop Project ProfileDocument2 pagesRs. 151000 Two Wheeler Repair Shop Project ProfileBhanwar SinghNo ratings yet

- Pulses Processing UnitDocument2 pagesPulses Processing UnitBurra Madhav100% (1)

- Project Profile On Aluminium FabricationDocument2 pagesProject Profile On Aluminium FabricationRNo ratings yet

- Broom MakingDocument2 pagesBroom MakingTom TomNo ratings yet

- Ice-Cream ParlourDocument2 pagesIce-Cream ParlourRupesh SharmaNo ratings yet

- Project Profile On Canvas ShoesDocument2 pagesProject Profile On Canvas ShoesPandey DivyNo ratings yet

- Project Profile On Coconut Oil and Oil Cake Manuafcuring PDFDocument2 pagesProject Profile On Coconut Oil and Oil Cake Manuafcuring PDFnathaanmaniNo ratings yet

- Oil Crusher/Expeller Project ProfileDocument2 pagesOil Crusher/Expeller Project ProfileMallikarjunReddyObbineniNo ratings yet

- Project Profile On Gingilee Oil and Oil Cake ManuafcuringDocument2 pagesProject Profile On Gingilee Oil and Oil Cake ManuafcuringnathaanmaniNo ratings yet

- KVIC Mumbai Profile Gingilee Oil Cake ManufacturingDocument2 pagesKVIC Mumbai Profile Gingilee Oil Cake ManufacturingnathaanmaniNo ratings yet

- Project Profile On Chemical Etching On WoodDocument2 pagesProject Profile On Chemical Etching On Woodquraishi831No ratings yet

- KVIC PMEGP Project Profile on Gem Cutting and PolishingDocument2 pagesKVIC PMEGP Project Profile on Gem Cutting and Polishingpramod kumar singh100% (1)

- Daliya Manufacturing Unit ProfileDocument2 pagesDaliya Manufacturing Unit ProfilepardeepNo ratings yet

- Stone Polishing Unit Project ProfileDocument2 pagesStone Polishing Unit Project ProfileKANNADIGA ANIL KERURKARNo ratings yet

- Steelfurniture PDFDocument2 pagesSteelfurniture PDFEknath karale100% (1)

- Onion Paste Manufacturing SchemeDocument2 pagesOnion Paste Manufacturing SchemePhilip KotlerNo ratings yet

- Project Profile On Groundnut Oil and Oil Cake Manuafcuring PDFDocument2 pagesProject Profile On Groundnut Oil and Oil Cake Manuafcuring PDFnathaanmani100% (2)

- Manufacturing of Detergent Powder & CakeDocument2 pagesManufacturing of Detergent Powder & Cakeramu_uppadaNo ratings yet

- Project Profile On Naphthalene BallsDocument2 pagesProject Profile On Naphthalene BallsOmkar KshirsagarNo ratings yet

- Ceramic Table Wares and Allied Items in Stoneware Earthenware Semi Vitreousware PDFDocument2 pagesCeramic Table Wares and Allied Items in Stoneware Earthenware Semi Vitreousware PDF124swadeshiNo ratings yet

- Ceramic Table Wares and Allied Items in Stoneware Earthenware Semi Vitreous WareDocument2 pagesCeramic Table Wares and Allied Items in Stoneware Earthenware Semi Vitreous WareVarun AgrawalNo ratings yet

- Project Profile On Mustard Oil and Oil Cake ManuafcuringDocument2 pagesProject Profile On Mustard Oil and Oil Cake Manuafcuringnathaanmani100% (1)

- Motor WindingDocument2 pagesMotor WindingQwertyNo ratings yet

- Kurkure Type SnacksDocument2 pagesKurkure Type SnacksVikas KumarNo ratings yet

- Project Profile On Kurkure Type Snacks PDFDocument2 pagesProject Profile On Kurkure Type Snacks PDFSundeep Yadav100% (3)

- Ice-Cream ParlourDocument2 pagesIce-Cream ParlourRaj sbnNo ratings yet

- ADDONCARDSFORCOMPUTERDocument2 pagesADDONCARDSFORCOMPUTERAR MOHANRAJNo ratings yet

- Beverage Manufacturing SchemeDocument3 pagesBeverage Manufacturing SchemeSameer KhanNo ratings yet

- KVIC PMEGP Project Profile on Solar CookerDocument2 pagesKVIC PMEGP Project Profile on Solar CookerVarun AkashNo ratings yet

- Project Profile On Wafer Biscuits Big TypeDocument2 pagesProject Profile On Wafer Biscuits Big Typeabhisheksingh bhumpmirNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Optimization and Business Improvement Studies in Upstream Oil and Gas IndustryFrom EverandOptimization and Business Improvement Studies in Upstream Oil and Gas IndustryNo ratings yet

- D365 Supply Chain MGMT Cert Learning PathDocument1 pageD365 Supply Chain MGMT Cert Learning PathAntony JosephNo ratings yet

- Nabard Poultry FarmingDocument9 pagesNabard Poultry Farmingtaurus_vadivelNo ratings yet

- NLM Guidelines Final Approved by ECDocument68 pagesNLM Guidelines Final Approved by ECAntony JosephNo ratings yet

- Financial ReportDocument1 pageFinancial ReportAntony JosephNo ratings yet

- 0604182934model - Indigenous Cow Farming EnglishDocument17 pages0604182934model - Indigenous Cow Farming EnglishAntony JosephNo ratings yet

- Adapting Bio Oc Technology For Use in Small Scale Ponds With Vertical SubstrateDocument6 pagesAdapting Bio Oc Technology For Use in Small Scale Ponds With Vertical SubstrateAntony JosephNo ratings yet

- Goat Farming Project Report Information - Goat FarmingDocument8 pagesGoat Farming Project Report Information - Goat FarmingAntony JosephNo ratings yet

- Insert SpectraLog data into archiveDocument1 pageInsert SpectraLog data into archiveAntony JosephNo ratings yet

- Goat Farming Project Report 500 20 GoatsDocument8 pagesGoat Farming Project Report 500 20 GoatsAntony Joseph100% (1)

- Online JobDocument1 pageOnline JobAntony JosephNo ratings yet

- PBXact KH Extention PDFDocument3 pagesPBXact KH Extention PDFAntony JosephNo ratings yet

- 0604183125model - Indigenous Poultry Farming EnglishDocument9 pages0604183125model - Indigenous Poultry Farming EnglishAntony JosephNo ratings yet

- Goat Farming Project Report - Investment, Expenses & ProfitDocument10 pagesGoat Farming Project Report - Investment, Expenses & ProfitAntony JosephNo ratings yet

- DownloadlyDocument1 pageDownloadlyAntony JosephNo ratings yet

- Refresh Parent Grid After Sub-Grid Save in UI For ASP - NET MVC Grid - Telerik ForumsDocument3 pagesRefresh Parent Grid After Sub-Grid Save in UI For ASP - NET MVC Grid - Telerik ForumsAntony JosephNo ratings yet

- Agriculture Borewell Permission and Subsidy in India - Agri FarmingDocument4 pagesAgriculture Borewell Permission and Subsidy in India - Agri FarmingAntony Joseph100% (1)

- Grass For CowsDocument1 pageGrass For CowsAntony JosephNo ratings yet

- Dairy Business PlanDocument17 pagesDairy Business Planvector dairy100% (4)

- Crossbred Dairy Farm ReportDocument2 pagesCrossbred Dairy Farm ReportAntony Joseph100% (1)

- Amaidhiyum Aarokiyamum (Monthly Magazine) - August Month 2017Document32 pagesAmaidhiyum Aarokiyamum (Monthly Magazine) - August Month 2017Antony JosephNo ratings yet

- Ragi Expert SystemDocument12 pagesRagi Expert SystemAntony JosephNo ratings yet

- Cattle Feed Manufacturing and Processing UnitDocument20 pagesCattle Feed Manufacturing and Processing UnitAntony Joseph100% (1)

- List of Farm Machine Manufactures in Tamil Nadu PDFDocument13 pagesList of Farm Machine Manufactures in Tamil Nadu PDFDivya Natarajan100% (2)

- SOAP PLANT Project Report CompleteDocument8 pagesSOAP PLANT Project Report CompleteER. INDERAMAR SINGH52% (25)

- Install Cu9 - Step by Step - Part 1Document22 pagesInstall Cu9 - Step by Step - Part 1Antony JosephNo ratings yet

- Crossbred Dairy Farm ReportDocument2 pagesCrossbred Dairy Farm ReportAntony Joseph100% (1)

- SOAP PLANT Project Report CompleteDocument8 pagesSOAP PLANT Project Report CompleteER. INDERAMAR SINGH52% (25)

- NSIF ReportDocument6 pagesNSIF ReportAntony JosephNo ratings yet

- Specific Objectives Chapter by Chapter Basics of AccountingDocument2 pagesSpecific Objectives Chapter by Chapter Basics of AccountingAntony JosephNo ratings yet

- Marketing Plan For Organic SoapDocument19 pagesMarketing Plan For Organic Soapkatakhijau270% (10)

- Characteristics of Underdevelopment and Approaches to Measuring Poverty in PakistanDocument54 pagesCharacteristics of Underdevelopment and Approaches to Measuring Poverty in PakistanHamid UsmanNo ratings yet

- Principles of Economics Asia Pacific 7th Edition Gans Test BankDocument26 pagesPrinciples of Economics Asia Pacific 7th Edition Gans Test Bankbeckhamkhanhrkjxsk100% (25)

- Quiz Gen Math AnnuitiesDocument1 pageQuiz Gen Math AnnuitiesJaymark B. UgayNo ratings yet

- Colander11e Ch24 FinalDocument28 pagesColander11e Ch24 Finalbosyapmalik31No ratings yet

- Economist and The European Democratic Deficit (O'Rourke 2015)Document6 pagesEconomist and The European Democratic Deficit (O'Rourke 2015)Latoya LewisNo ratings yet

- ECO 101 - Pr. of MicroeconomicsDocument3 pagesECO 101 - Pr. of MicroeconomicsAniqaNo ratings yet

- Linkers and ConnectorsDocument14 pagesLinkers and ConnectorsRicardo BarreraNo ratings yet

- Mrunal Explained - Headline Vs Core Inflation, WPI, CPI, IIPDocument19 pagesMrunal Explained - Headline Vs Core Inflation, WPI, CPI, IIPTarun MishraNo ratings yet

- Topic 2Document12 pagesTopic 2Jade Danielle Enmoceno FortezaNo ratings yet

- BMO Capital Markets - Treasury Locks, Caps and CollarsDocument3 pagesBMO Capital Markets - Treasury Locks, Caps and CollarsjgravisNo ratings yet

- Unit 7 Equity Financing (HH)Document35 pagesUnit 7 Equity Financing (HH)Nikhila SanapalaNo ratings yet

- Fundamentals of Engineering EconomyDocument14 pagesFundamentals of Engineering EconomyLin Xian XingNo ratings yet

- Bootstrapping Spot Curve ModelDocument6 pagesBootstrapping Spot Curve ModelKingsley AkinolaNo ratings yet

- Full Download Environmental Science Toward A Sustainable Future 12th Edition Wright Test BankDocument36 pagesFull Download Environmental Science Toward A Sustainable Future 12th Edition Wright Test Bankcantoblack9r5g100% (18)

- Research ProposalDocument13 pagesResearch ProposalMohaiminul IslamNo ratings yet

- Assignment:1: Marginal Cost Is The Difference (Or Change) in Cost of A Different Choice, The Increase inDocument3 pagesAssignment:1: Marginal Cost Is The Difference (Or Change) in Cost of A Different Choice, The Increase instudent wwNo ratings yet

- Market Power and Externalities: Understanding Monopolies, Monopsonies, and Market FailuresDocument19 pagesMarket Power and Externalities: Understanding Monopolies, Monopsonies, and Market FailuresLove Rabbyt100% (1)

- Economic Growth (Weil - 2E) Solutions (Ch.1&3&8)Document17 pagesEconomic Growth (Weil - 2E) Solutions (Ch.1&3&8)Hoo Suk HaNo ratings yet

- Goods and ServicesDocument47 pagesGoods and Servicesalluarjun heroNo ratings yet

- Tutorial 5: An Introduction To Asset Pricing ModelsDocument49 pagesTutorial 5: An Introduction To Asset Pricing ModelschziNo ratings yet

- AbstractDocument19 pagesAbstractDeru R IndikaNo ratings yet

- A.3s Scheme Used in Managing Epp ClassDocument35 pagesA.3s Scheme Used in Managing Epp Classpixie02100% (2)

- Determine Size of Sales ForceDocument15 pagesDetermine Size of Sales ForceShikha Jain100% (1)

- Leverage My PptsDocument34 pagesLeverage My PptsMadhuram SharmaNo ratings yet

- Vision IAS Guide to Indian EconomyDocument3 pagesVision IAS Guide to Indian EconomyannaNo ratings yet

- Consumer AnimosityDocument10 pagesConsumer AnimosityjayantverNo ratings yet

- Grand Strategy Matrix Quadrant AnalysisDocument3 pagesGrand Strategy Matrix Quadrant AnalysisRusselNo ratings yet

- Macroeconomics EC1001 Revision GuideDocument2 pagesMacroeconomics EC1001 Revision GuideErnest LiNo ratings yet

- Principles of Macroeconomics 8th Edition Mankiw Solutions ManualDocument25 pagesPrinciples of Macroeconomics 8th Edition Mankiw Solutions ManualTonyDonaldsonjmdye100% (29)

- The Production Possibilities FrontierDocument54 pagesThe Production Possibilities FrontierChristian AribasNo ratings yet