Professional Documents

Culture Documents

Ratio Analysis For Bankers - Farhadur Reza PDF

Uploaded by

Ahsan ZamanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis For Bankers - Farhadur Reza PDF

Uploaded by

Ahsan ZamanCopyright:

Available Formats

Ratio Analysis for Bankers

Ratio-analysis: Ratio-analysis means the process of computing, determining and presenting the relationship of related items

and groups of items of the financial statements. They provide in a summarized and concise form of fairly good idea about the

financial position of a unit. They are important tools for financial analysis.

1 Cost of Deposit (COD) = Interest on Deposit Total Deposit General Account is included (if any)

(Interest on Deposit + Total Operating

2 Cost of Fund (COF) = General Account is included (if any)

Expenses) Total Deposit

Yield or Yield on Interest on Loans & Advances Total

3 = General Account is included (if any)

Advances (YOA) Loans & Advances

Spread or Net Interest

4 = YOA-COD Difference between yield and cost

Spread (NIS)

Net Interest Margin

5 = Net Interest Income Loans & Advances NII=Interest Income Interest Expense

(NIM)

(Non Interest Expenses Non Interest

6 Burden Ratio = Negative result is better

Income) Total Assets

Advance to Deposit

7 = Total Loans & Advances Total Deposit Also known as Loan to Deposit ratio

Ratio (AD Ratio)

Classification Ratio (CL Total Classified Loans & Advances Total

8 = Rate of classified loans on specific loan portfolio

Ratio) Loans & Advances

Capital Adequacy Ratio

9 = RWA X 10% RWA= Risk Weighted Asset

(CAR)

EPS indicates the quantum of net profit of the year

Earnings Per Share Net Profit after Tax and Preference that would be ranking for dividend for each share of

10 =

(EPS) Dividend No. of Equity Shares the company being held by the equity share

holders.

Price Earnings Ratio PE Ratio indicates the number of times the Earning

11 = Market Price per Equity Share EPS

(P/E Ratio) Per Share is covered by its market price.

Indication of how equity investors regard the

12 Market/Book Ratio Common Equity Shares Outstanding

company

(Total Assets Total Liabilities) Share

13 NAV per share Measures income per Taka of Assets utilized

Outstanding

Return on Investment

14 = Net Profit after Tax Total Investment Measures income per Taka of Investment

(ROI)

Return on Assets

15 = Net Profit after Tax Total Assets Measures income per Taka of Assets utilized

(ROA)

Return on Equity Net Profit after Tax Total Equity or

16 = Measures income per Taka of capital Employed

(ROE) Tangible Net Worth

Cost to Income Ratio Measures the ratio of cost to income for a specific

17 = Total Cost Total Income

(C/I Ratio) period

Balance Sheet Ratio or Financial Ratio

Measures short term solvency, that is ability to meet

short term obligations. It is the relationship

18 Current Ratio = Current Assets Current Liabilities

between current assets and current liabilities of a

concern. The ideal current ratio is 1.33

It is the ratio between Quick Current Assets and

Current Assets Inventories Current Current Liabilities. It should be at least equal to 1.

19 Quick Ratio (Acid Test) =

Liabilities Measures of a firms ability to meet short

obligations without relying on the sale of inventory.

The ratio indicates the extent to which Tangible

Tangible Net Worth or Owners Equity Assets are financed by Owners fund. The ratio will

20 Proprietary Ratio

Total Tangible Assets be 100% when there is no borrowing for

purchasing of Assets.

Total Debt or Long Term Liabilities It is the relationship between Borrowers fund and

21 Debt Equity Ratio

Tangible Net Worth or Total Equity Owners capital

Measures the percentage of funds provided by

22 Total Debt Ratio Total Debt Total Assets

creditors

23 Gross Working Capital Current Assets Capital required to maintain current assets

Net Working Capital It is the difference of Current Assets and Current

24 = Current Assets - Current Liabilities

(NWC) Liabilities.

People with a substantial net worth are known as

25 Net Worth Total Assets Total Liabilities

high net worth individuals

Income Statement Ratio or Operating Ratio

A higher GP Ratio indicates efficiency in production

26 Gross Profit Ratio (Gross Profit Net Sales) X 100

of the unit

27 Operating Ratio (Operating Profit Net Sales) X 100 Higher the ratio indicates operational efficiency

28 Net Profit Ratio (Net Profit Net Sales) X 100 It measures overall profitability

29 Profit Margin Net Income Sales Indicate Profit per Taka Sales

The ratio indicates how fast inventory is sold.

Stock/Inventory

30 Sales Average Inventory Higher is good in that case from the view point of

Turnover Ratio

liquidity

It shows how much of a decline in earnings a

31 Interest Coverage Ratio EBIT Interest Expenses

company can absorb

Balance Sheet & Income Statement Ratio or Composite Ratio

Measures how effectively the firm uses its tangible

32 Asset Turnover Ratio Net Sales Tangible Assets

assets

Total Assets Turnover Measures how effectively the firm uses its overall

33 Net Sales Total Assets

Ratio assets

Fixed Asset Turnover Measures how effectively the firm uses its plant and

34 Net Sales Fixed Assets

Ratio equipment

Current Asset Measures how effectively the firm uses its Current

35 Net Sales Current Assets

Turnover Ratio Assets

36 Basic Earning Power EBIT Total Assets Shows the raw earning power of the firms assets

before the influence of taxes and leverage

Return on Equity Net Profit After Tax Tangible Net Worth

37 Measures income per Taka of capital employed

Capital (ROE) or Total Equity

Return on Assets

38 Net Profit After Tax Total Assets Measures the income per Taka assets utilized

(ROA)

EPS indicates the quantum of net profit of the year

Earnings Per Share Net Profit after Tax and Preference that would be ranking for dividend for each share of

39 =

(EPS) Dividend No. of Equity Shares the company being held by the equity share

holders.

Price Earnings Ratio PE Ratio indicates the number of times the Earning

40 = Market Price per Equity Share EPS

(P/E Ratio) Per Share is covered by its market price.

Debtors Turnover Total Credit Sales (Average Debtor + Indicates the times per year the debtors buy and

41

Ratio Average Bills) pay on average

Average Collection

42 365 Debtors Turnover Ratio The average day to pay by debtors

Period

Creditors Turnover

Indicates the times per year the creditors sales and

43 Ratio or Creditors ( Average Creditors Purchases) X 365

collect on average

Velocity Ratio

(Profit After Tax + Depreciation + Interest

Debt Service Coverage on Long Term Loans) (Interest on Long The ratio indicates the ability to meet liabilities by

44

Ratio (DSCR) Term Loans + Installments Payable on way of payments of installments of Term Loans

Long Term Loans)

Cost Volume Profit Analysis (CPV)

Sales Costs or The basic profit equation is

45 Profit

Sales (Variable Costs + Fixed Costs) P FC = Q X (SP - VC)

Contribution Margin Units Sold X (Net Sales Price Unit Can also be measured-

46

(CM) Variable Cost) Profit + Fixed Costs; or Sales Variable Costs

The point where revenue and expenses are equal

47 Break Even Point CM = FC

Time Value of Money

PV (1 + r) n -when compounding

yearly PV = Present Value, r = Rate of Interest

48 Future Value (FV)

PV (1 + r/m)mn -when compounding n = Time Period, m = compounding times

monthly or quarterly

FV / (1 +r/m )mn or

49 Present Value (PV) C1/ (1+ r)1 + C2/ (1+ r)2 + C3/ (1+ r)3 + Present value of the future after tax cash flows

-----

P = The number of years after the initial investment

at which the last negative value of cumulative cash

flow occurs

C = Initial Investment

50 Payback Period P + (C-K) / N

K = The value of cumulative cash flow at which the

last negative value of cumulative cash flow occurs

N = The cash flow at which last negative value of

cumulative cash flow occurs

Net Present Value C1/ (1+ r)1 + C2/ (1+ r)2 + C3/ (1+ r)3 + The Present value of the future after tax cash flows

51

(NPV) .. - Outlay minus the investment outlay.

C1/ (1+ r)1 + C2/ (1+ r)2 + C3/ (1+ r)3 +

.. Outlay = 0

The discount rate that makes the present value of

IRR is usually found via trial & error the future after tax cash flows equal that investment

Internal Rate of Return method using two discount rate outlay. It is the expected rate of return.

52

(IRR)

NPVb-NPVa An investment is considered acceptable if its IRR is

IRR = a+ ----------------- (b-a) greater than Cost of Capital.

NPVa

**a & b is the first & second discount rate

Compiled by: Farhadur Reza,

BBA (Finance & Banking), MBA (CU),

LL.B., CCA (BTEB), PGD (CS), DAIBB

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Money LionDocument4 pagesMoney LionhumleNo ratings yet

- Digital Banking For Federal Bank MCQDocument27 pagesDigital Banking For Federal Bank MCQsabs1234561080100% (5)

- 14 People Vs Puig and PorrasDocument2 pages14 People Vs Puig and PorrasPring SumNo ratings yet

- Summer Internship Project at ICICI BankDocument81 pagesSummer Internship Project at ICICI BankNeha Vora100% (3)

- Managerial Control FunctionsDocument27 pagesManagerial Control FunctionsKaustubh TiwaryNo ratings yet

- Managerial Control FunctionsDocument27 pagesManagerial Control FunctionsKaustubh TiwaryNo ratings yet

- Managerial Control FunctionsDocument27 pagesManagerial Control FunctionsKaustubh TiwaryNo ratings yet

- Phil Guaranty v. CIR DigestsDocument2 pagesPhil Guaranty v. CIR Digestspinkblush717100% (1)

- Daibb SmeDocument37 pagesDaibb SmeShafiul AzamNo ratings yet

- Difference Advantage Disadvantage and Uses of Cash Flow Statement & Funds Flow StatementDocument4 pagesDifference Advantage Disadvantage and Uses of Cash Flow Statement & Funds Flow StatementPrashanthi EdigaNo ratings yet

- Exercise On Capital Budgeting-BSLDocument19 pagesExercise On Capital Budgeting-BSLShafiul AzamNo ratings yet

- SME & Consumer Banking ReportDocument15 pagesSME & Consumer Banking ReportImran Al SabahNo ratings yet

- DAIBB SME SolutionsDocument29 pagesDAIBB SME SolutionsShafiul Azam100% (3)

- Jaibb Afs Nov 11Document5 pagesJaibb Afs Nov 11Rahman MoumitaNo ratings yet

- Jaibb Afs Nov 11Document5 pagesJaibb Afs Nov 11Rahman MoumitaNo ratings yet

- Organ. Behaviour Ch1Document30 pagesOrgan. Behaviour Ch1Sara A. Al TuwaijriNo ratings yet

- Organ. Behaviour Ch1Document30 pagesOrgan. Behaviour Ch1Sara A. Al TuwaijriNo ratings yet

- Application For Withdrawal of Fixed DepositDocument2 pagesApplication For Withdrawal of Fixed DepositShafiul AzamNo ratings yet

- UCPB v. MasaganaDocument5 pagesUCPB v. MasaganajrfbalamientoNo ratings yet

- Statement of AccountDocument1 pageStatement of AccountGopal AiranNo ratings yet

- Forbes Global 2000 List 2019 Someka V1Document25 pagesForbes Global 2000 List 2019 Someka V1SayyidRamiAlRifaiNo ratings yet

- CaseDocument3 pagesCaseAnawin FamadicoNo ratings yet

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document1 pageHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Hardik RavalNo ratings yet

- For Non Resident Indians: Account Opening FormDocument16 pagesFor Non Resident Indians: Account Opening Formshalabh2381No ratings yet

- Opportunities and Development in The Current Global Crisis: Ute Kochlowski-Kadjaia, Euler Hermes RussiaDocument33 pagesOpportunities and Development in The Current Global Crisis: Ute Kochlowski-Kadjaia, Euler Hermes RussiaSentthil KumarNo ratings yet

- Employees in BankDocument41 pagesEmployees in BankKasturiNo ratings yet

- SBM Bank Cash Deposit VoucherDocument1 pageSBM Bank Cash Deposit VoucherIrshaad Ally Ashrafi GolapkhanNo ratings yet

- EB Rainer wl11 IIS3 WM PDFDocument580 pagesEB Rainer wl11 IIS3 WM PDFran_chanNo ratings yet

- Shippers Letter of InstructionDocument2 pagesShippers Letter of InstructionWilliam LooNo ratings yet

- GK CAPSULE FOR SBI ASSOCIATE ASSISTANT EXAM 2015Document56 pagesGK CAPSULE FOR SBI ASSOCIATE ASSISTANT EXAM 2015Nilay VatsNo ratings yet

- CashBook (SEM2)Document4 pagesCashBook (SEM2)Xavier University- Economics SocietyNo ratings yet

- A Study ON "360 Performance Appraisal" Icici Prudential PVT LTDDocument13 pagesA Study ON "360 Performance Appraisal" Icici Prudential PVT LTDbagyaNo ratings yet

- Distributed Social Proof Insurance: Token SaleDocument51 pagesDistributed Social Proof Insurance: Token SaleAnte MaricNo ratings yet

- Información de Trading de Acciones - CysecDocument57 pagesInformación de Trading de Acciones - CysecMarcos CenturionNo ratings yet

- Central Bank Names of Different CountriesDocument6 pagesCentral Bank Names of Different CountrieskalasriNo ratings yet

- ASSET 2019 Mock Boards - AUDITDocument8 pagesASSET 2019 Mock Boards - AUDITKenneth Christian WilburNo ratings yet

- Ppe 2016Document40 pagesPpe 2016Benny Wee0% (1)

- R DJVFuh 3 Ri LB 7 Ep RDocument13 pagesR DJVFuh 3 Ri LB 7 Ep RKondayya JuttigaNo ratings yet

- Invoice 20190845103512 CBN45047100819Document1 pageInvoice 20190845103512 CBN45047100819yudhamomoichyNo ratings yet

- SCO-06 FeeSched Rev18Document1 pageSCO-06 FeeSched Rev18Marcelo VeronezNo ratings yet

- 1558035837508gtwf3RUDP4SoBRDQ PDFDocument1 page1558035837508gtwf3RUDP4SoBRDQ PDFEmba MadrasNo ratings yet

- IcotermsDocument3 pagesIcotermsMiguel Estrada DíazNo ratings yet

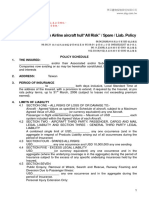

- Airline Aircraft Hull All Risk Spare Liab Policy BrochureDocument27 pagesAirline Aircraft Hull All Risk Spare Liab Policy BrochureZoran DimitrijevicNo ratings yet