Professional Documents

Culture Documents

Maceda Glass and Aluminum Supply Job Order Cost Sheet

Uploaded by

Warren Cabunyag0 ratings0% found this document useful (0 votes)

14 views8 pagesThe document summarizes the job order cost sheet for a fixed glass with awning windows order from Maceda Glass and Aluminum Supply. It details the direct material costs, direct labor costs, factory overhead applied, and calculates the total factory cost and gross profit. The order specification, dates, quantities, and costing details are provided.

Original Description:

jfutfutfuekjfhkjsehfkjsehfkjsheuyreywuirwuyeiuyrwieuyru

Original Title

Managerial Project

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the job order cost sheet for a fixed glass with awning windows order from Maceda Glass and Aluminum Supply. It details the direct material costs, direct labor costs, factory overhead applied, and calculates the total factory cost and gross profit. The order specification, dates, quantities, and costing details are provided.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views8 pagesMaceda Glass and Aluminum Supply Job Order Cost Sheet

Uploaded by

Warren CabunyagThe document summarizes the job order cost sheet for a fixed glass with awning windows order from Maceda Glass and Aluminum Supply. It details the direct material costs, direct labor costs, factory overhead applied, and calculates the total factory cost and gross profit. The order specification, dates, quantities, and costing details are provided.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

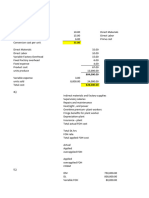

Maceda Glass and Aluminum Supply

Job Order Cost Sheet

Product: Fixed Glass with Awning Windows

Specification: 1.20m X 2.40m

Quantity: 1 set

Date Ordered: 10/28/17 Date of Delivery: 11/09/2017

Date Started: 11/02/17 Date Completed: 11/08/2017

Costing Details:

Direct Materials Cost Direct Labor Cost Factory Overhead Applied

Date Req. # Amount Date Amount Date Amount

Nov. 2 6,165.00 Nov. 2 700.00 Nov. 8 (60% of Direct

Labor Cost)

3 350.00 1,500.00

4 400.00

6 350.00

7 350.00

8 350.00

Total 6,165.00 2,500.00 1,500.00

Summary:

Direct Material Costs 6,165.00

Direct Labor Costs 2,500.00

Factory Overhead Applied 1,500.00

Total Factory Cost 10,165.00

Gross Profit (30%) 3,049.50

Job Cost (or Contact Price) 13,214.50

Dan and Altheas Bakery

Owner: Noel Pornobi

Dan and Altheas Bakery

Activity-Based Costing

Cost Driver and Activity Rate

Number of Units 12,960

Cost of Direct Materials 134,000

Labor Cost 24,000

Activity Relevant Cost Driver Activity Usage

Mixing Direct Labor Hours 150

Shaping and Cutting Direct Labor Hours 90

Machine set-up Number of setups 30

Baking Direct Labor Hours 40

Activity Activity Rate Activity Usage Activity Cost

Mixing 9.09 330 3,000.00

Shaping and Cutting 22.22 90 2,000.00

Machine set-up 300.00 30 9,000.00

Baking 75.00 40 3,000.00

TOTAL 17,000.00

Total Cost of the Order

Cost of Direct Materials 134,000.00

Labor Costs 24,000.00

Manufacturing Overhead 17,000.00

Total Cost 175,000.00

Maulawin Hardware

Owner: Edcel G. Velasco

Maulawin Hardware

Mixing Department

Process Cost Report: FIFO Method

For the month ended October 30

Beginning Inventory 2000

(units started last period)

Units started this period 7000

Units to be accounted for 9000

Current Equivalent units of Effort

Physical Unit Direct Materials % Incurred Conversion Cost % Incurred

Beginning Inventory 2000 --- 0% 400 20%

Units Started &

Completed this period 5000 5000 100% 5000 100%

Ending Inventory

(units started but not

completed this period) 2000 2000 100% 1000 50%

Units accounted for 9000 7000 6400

Total Costs

Beginning Inventory 17,858 = 14,751 + 3,107

Current Costs 56,917 = 51,667 + 5,250

Total Costs 74,775

Current Cost 51,667 + 5,250

Equivalent Units 7000 6400

Cost per equivalent unit 8.201 = 7.381 + 0.82

Cost of Goods Manufactured

And Transferred out:

From Beginning Inventory 17,858

Current Cost to Complete 328 = 0 + (400 x 0.82)

Units started and

Completed this period 41,005 = (5000 x 7.381) + (5000 x 0.82)

Cost of Goods Manufactured 59,191

Ending Inventory 15,582 (2000 x 7.381) + (1000 x 0.82)

Total Cost 74,773

Maulawin Hardware

Shaping Department

Process Cost Report: FIFO Method

For the month ended October 30

Beginning Inventory 2000

(units started last period)

Units started this period 7000

Units to be accounted for 9000

Current Equivalent units of Effort

Physical Unit Direct Materials % Incurred Conversion Cost % Incurred

Beginning Inventory 2000 --- 0% 600 30%

Units Started &

Completed this period 5000 --- 0% 5000 100%

Ending Inventory

(units started but not

completed this period) 2000 --- 0% 900 45%

Units accounted for 9000 6500

Total Costs

Beginning Inventory 3,107 = 3,107

Current Costs 5,250 = 5,250

Total Costs 8,357

Current Cost 5,250

Equivalent Units 6500

Cost per equivalent unit 0.81 = 0 + 0.81

Cost of Goods Manufactured

And Transferred out:

From Beginning Inventory 3,107

Current Cost to Complete 486 = 0 + (600 x 0.81)

Units started and

Completed this period 4,050 = 0 + (5000 x 0.81)

Cost of Goods Manufactured 7,643

Ending Inventory 729 0 + (900 x 0.81)

Total Cost 8,372

Cost per equivalent unit: 8.201 + 0.81 = 9.01

Southern Luzon State University

College of Engineering

Lucban, Quezon

Financial Costing

Submitted By:

Cabunyag, Warren

Isaguirre, Taniel

Plopino, Melissa

Velasco, Yvonne

BSIE - IVGK

Submitted To:

Engr. Stella Y. Dahilig

IEE01 Instructor

You might also like

- Cargo ManifestDocument16 pagesCargo ManifestnorwiNo ratings yet

- 05 Wilkerson Company Solution - StudentsDocument9 pages05 Wilkerson Company Solution - StudentsVinyabhooshan Bajpai PGP 2022-24 Batch100% (1)

- Wilkerson CompanyDocument2 pagesWilkerson CompanyAnkit VermaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Role of Freight Forwarder in The Execution of ExportDocument28 pagesRole of Freight Forwarder in The Execution of ExportMohd Fahad80% (10)

- How To Choose The Best Incoterm IN 2020: A Guide For Exporters and ImportersDocument29 pagesHow To Choose The Best Incoterm IN 2020: A Guide For Exporters and ImportersAlaa EhsanNo ratings yet

- Case Study WilkersonDocument2 pagesCase Study WilkersonHIMANSHU AGRAWALNo ratings yet

- FMC Weco and Chiksan Sour Gas Flowline CatalogDocument22 pagesFMC Weco and Chiksan Sour Gas Flowline CatalogJosé Neuquen100% (2)

- Cost AccountingDocument8 pagesCost AccountingHenny FaustaNo ratings yet

- Chief Mate (Unlimited)Document3 pagesChief Mate (Unlimited)Zia Ul Haq75% (4)

- Transportation Management TMDocument52 pagesTransportation Management TMAjaykhattar100% (18)

- Assignment 2 Ikea Case Study.Document4 pagesAssignment 2 Ikea Case Study.ddlj1989No ratings yet

- Process Costing Standard CostingDocument4 pagesProcess Costing Standard CostingNikki GarciaNo ratings yet

- EcdisDocument65 pagesEcdisIonut Gabriel100% (1)

- The Revenue CycleDocument3 pagesThe Revenue CycleConner BeckerNo ratings yet

- Draft Loi Wording - Discharge in RainDocument2 pagesDraft Loi Wording - Discharge in Rainviperov100% (4)

- Chapter 1-Test Material 3Document9 pagesChapter 1-Test Material 3Marcus MonocayNo ratings yet

- Chap 03Document10 pagesChap 03Farooq HaiderNo ratings yet

- Chapter 4-Test Material 4 1Document6 pagesChapter 4-Test Material 4 1Marcus MonocayNo ratings yet

- Ch2 - Cost Accounting - Horngren'sDocument16 pagesCh2 - Cost Accounting - Horngren'svipinkala1No ratings yet

- Code 4Document8 pagesCode 4Đỗ Hải MyNo ratings yet

- MARY GRACE PANGANIBAN - 045 Process and Activity-Based CostingDocument9 pagesMARY GRACE PANGANIBAN - 045 Process and Activity-Based CostingMary Grace PanganibanNo ratings yet

- Questions Fifo AverageDocument4 pagesQuestions Fifo AverageClaire BarbaNo ratings yet

- Quiz 1 and 2 AnswersDocument2 pagesQuiz 1 and 2 AnswersCeline Therese BuNo ratings yet

- Wilkerson Company - Class PracticeDocument5 pagesWilkerson Company - Class PracticeYAKSH DODIANo ratings yet

- Product Cost From TraditionalDocument5 pagesProduct Cost From TraditionalPrijulNo ratings yet

- Group 7 - Excel - Destin BrassDocument9 pagesGroup 7 - Excel - Destin BrassSaumya SahaNo ratings yet

- Chapter VII RevisedDocument21 pagesChapter VII RevisedJonabelle C. BiliganNo ratings yet

- Chapter 2-Test Material 2 1Document7 pagesChapter 2-Test Material 2 1Marcus MonocayNo ratings yet

- 16 Destinbrass - Solution-EnG YtcAIvEG2FDocument12 pages16 Destinbrass - Solution-EnG YtcAIvEG2Fshubhangi.jain582No ratings yet

- Raw Materials InventoryDocument4 pagesRaw Materials InventoryMikias DegwaleNo ratings yet

- Hoa Mai CompanyDocument5 pagesHoa Mai CompanyĐức HuyNo ratings yet

- Tugas AKBDocument8 pagesTugas AKBRizkiNo ratings yet

- Answers To 11 - 16 Assignment in ABC PDFDocument3 pagesAnswers To 11 - 16 Assignment in ABC PDFMubarrach MatabalaoNo ratings yet

- Chapter 3-Test Material 1Document6 pagesChapter 3-Test Material 1Marcus MonocayNo ratings yet

- Cost Accounting #2Document34 pagesCost Accounting #2Adil AnwarNo ratings yet

- Prelim Exam-Boticario D. (SBA)Document5 pagesPrelim Exam-Boticario D. (SBA)Dominic E. BoticarioNo ratings yet

- SalsabilaQ 041911333150 Tugasakbi Week5Document7 pagesSalsabilaQ 041911333150 Tugasakbi Week5salsa qotrunnadaNo ratings yet

- TugasABC - 13418039 - Vabila MagaretaDocument4 pagesTugasABC - 13418039 - Vabila MagaretaVabilaMagaretaNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingJashmin CosainNo ratings yet

- METU Industrial Engineering - Engineering Economy & Cost Analysis I Case StudyDocument6 pagesMETU Industrial Engineering - Engineering Economy & Cost Analysis I Case StudyOnur YılmazNo ratings yet

- COSTCO Section 1Document11 pagesCOSTCO Section 1Paula BautistaNo ratings yet

- HOA ĐỘT BIẾN COMPANYDocument7 pagesHOA ĐỘT BIẾN COMPANYĐức HuyNo ratings yet

- Practice Problems (Spoilage in Process Costing)Document3 pagesPractice Problems (Spoilage in Process Costing)lalalalaNo ratings yet

- Faithjames Servano - SA No. 4 - Chapter 3 Job Order CostingDocument1 pageFaithjames Servano - SA No. 4 - Chapter 3 Job Order CostingFaith James ServanoNo ratings yet

- 102,000.00 Prime Cost 102,000.00 147,000.00 Conversion Cost 147,000.00 197,000.00Document4 pages102,000.00 Prime Cost 102,000.00 147,000.00 Conversion Cost 147,000.00 197,000.00Darasin, Mhirasol B.No ratings yet

- Chapter 7Document8 pagesChapter 7Erlangga DharmawangsaNo ratings yet

- Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachDocument4 pagesActivity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachJay BrockNo ratings yet

- ClassicPenCompany 2023B2PGPMX012 KshitijDocument3 pagesClassicPenCompany 2023B2PGPMX012 KshitijSuraj KumarNo ratings yet

- QUIZZERDocument4 pagesQUIZZERchowchow123No ratings yet

- Documents - MX - Destin Brass Products Co 55f065486abf6 PDFDocument9 pagesDocuments - MX - Destin Brass Products Co 55f065486abf6 PDFNikhil WadhwaniNo ratings yet

- Practice Questions - SolDocument8 pagesPractice Questions - SolNicholas LeeNo ratings yet

- CCCAC Chapter 3Document10 pagesCCCAC Chapter 3rochelle lagmayNo ratings yet

- 5M - Angel Yahir Gauna LopezDocument19 pages5M - Angel Yahir Gauna LopezG4UNA 77No ratings yet

- C1C022025 FebbyanaAndra AkuntansiBiaya 3DDocument6 pagesC1C022025 FebbyanaAndra AkuntansiBiaya 3DdarlaaNo ratings yet

- Cost & Management Accounting - MGT402 Power Point Slides Lecture 24Document15 pagesCost & Management Accounting - MGT402 Power Point Slides Lecture 24Mr. JalilNo ratings yet

- Cost of Accounting (Pre-Test)Document4 pagesCost of Accounting (Pre-Test)Nicole MalinaoNo ratings yet

- Cost Accounting Quiz 2Document13 pagesCost Accounting Quiz 2Camille G.No ratings yet

- Baking DepartmentDocument6 pagesBaking DepartmentkmarisseeNo ratings yet

- LEC 2 Additions, Spoilage, Rework, and ScrapDocument37 pagesLEC 2 Additions, Spoilage, Rework, and ScrapKelvin CulajaráNo ratings yet

- Book 1Document12 pagesBook 1Vincent Luigil AlceraNo ratings yet

- Process Costing Excel ExampleDocument3 pagesProcess Costing Excel Examplehub sportxNo ratings yet

- Sba AssignmentDocument8 pagesSba AssignmentjuniordelossantospenasNo ratings yet

- Ceja Co Blending Production Cost Report May Equivalent Units Quantities Materials Physical Units Conversion CostDocument1 pageCeja Co Blending Production Cost Report May Equivalent Units Quantities Materials Physical Units Conversion CostJoshua SorensenNo ratings yet

- ACC60181H619 Managerial AccountingDocument9 pagesACC60181H619 Managerial AccountingaksNo ratings yet

- Fifo MethodDocument3 pagesFifo MethodCleah WaskinNo ratings yet

- Cost - Concepts and ClassificationsDocument23 pagesCost - Concepts and ClassificationsYehetNo ratings yet

- Jetter Engine Company Cost of Production Report Casting DepartmentDocument10 pagesJetter Engine Company Cost of Production Report Casting DepartmentRay MondNo ratings yet

- 105 - R Shachin Shibi - Assign1Document6 pages105 - R Shachin Shibi - Assign1Shachin ShibiNo ratings yet

- Cost of Accounting (Pre-Test)Document4 pagesCost of Accounting (Pre-Test)Nicole MalinaoNo ratings yet

- AkwjdhjkcbnbamnbejhfwjhegfwefwDocument5 pagesAkwjdhjkcbnbamnbejhfwjhegfwefwWarren CabunyagNo ratings yet

- KkkjfkjkjgituyDocument7 pagesKkkjfkjkjgituyWarren CabunyagNo ratings yet

- UouhouhhbvhfbhbvfDocument1 pageUouhouhhbvhfbhbvfWarren CabunyagNo ratings yet

- Basic State Values of Matter: Example 1.1Document27 pagesBasic State Values of Matter: Example 1.1Warren CabunyagNo ratings yet

- Formulation: Malunggay Miki Squash Miki Carrots MikiDocument1 pageFormulation: Malunggay Miki Squash Miki Carrots MikiWarren CabunyagNo ratings yet

- KlklkloioioioDocument12 pagesKlklkloioioioWarren CabunyagNo ratings yet

- HJHGKJHKJHKJHKJDocument1 pageHJHGKJHKJHKJHKJWarren CabunyagNo ratings yet

- VBVVNBVNBVNBDocument12 pagesVBVVNBVNBVNBWarren CabunyagNo ratings yet

- KhjhkjhkjhuuhugDocument1 pageKhjhkjhkjhuuhugWarren CabunyagNo ratings yet

- UtruygayaegfieDocument1 pageUtruygayaegfieWarren CabunyagNo ratings yet

- UyutyuerwreDocument12 pagesUyutyuerwreWarren CabunyagNo ratings yet

- GuwyeuywegweDocument6 pagesGuwyeuywegweWarren CabunyagNo ratings yet

- SRGRGRHHHJHJDocument1 pageSRGRGRHHHJHJWarren CabunyagNo ratings yet

- SRGRGRHHHJHJDocument1 pageSRGRGRHHHJHJWarren CabunyagNo ratings yet

- AwtsuDocument1 pageAwtsuWarren CabunyagNo ratings yet

- SRGRGRHHHJHJDocument1 pageSRGRGRHHHJHJWarren CabunyagNo ratings yet

- LKLKDocument1 pageLKLKWarren CabunyagNo ratings yet

- WarrrsgdDocument23 pagesWarrrsgdWarren CabunyagNo ratings yet

- Passwork UlitDocument1 pagePasswork UlitWarren CabunyagNo ratings yet

- AwtsuusDocument6 pagesAwtsuusWarren CabunyagNo ratings yet

- Wafs SgggaafsfsDocument1 pageWafs SgggaafsfsWarren CabunyagNo ratings yet

- Ulit Ulit NanamanDocument3 pagesUlit Ulit NanamanWarren CabunyagNo ratings yet

- Townsend Holubasch Chapter 4 Team Project-2 2Document2 pagesTownsend Holubasch Chapter 4 Team Project-2 2api-550043486No ratings yet

- SS-TF-SW-001A Service and Warranty PolicyDocument9 pagesSS-TF-SW-001A Service and Warranty PolicyChris McCloskeyNo ratings yet

- Bill of Lading: Date Customer Service 1-800-667-8556Document2 pagesBill of Lading: Date Customer Service 1-800-667-8556OM ENTERPRISENo ratings yet

- Emergency Contingency PlanDocument14 pagesEmergency Contingency PlanClarence PieterszNo ratings yet

- Arjun Trivedi: Core Competencies Profile SummaryDocument3 pagesArjun Trivedi: Core Competencies Profile SummaryArjun TrivediNo ratings yet

- Abs Academy Ilt Prospectus PDFDocument60 pagesAbs Academy Ilt Prospectus PDFIchsan SuryansyahNo ratings yet

- Supply Chain Notes - Transport and LogisticsDocument4 pagesSupply Chain Notes - Transport and LogisticsMirak AndrabiNo ratings yet

- PDF Sent To MaamDocument60 pagesPDF Sent To MaamPrateek VermaNo ratings yet

- GAFTA - 17 - General Short Form ContractDocument2 pagesGAFTA - 17 - General Short Form ContracttinhcoonlineNo ratings yet

- Fe191120a PDFDocument1 pageFe191120a PDFjose gregorio mata cabezaNo ratings yet

- Desmume Logistics CorporationDocument11 pagesDesmume Logistics CorporationJeffrey Adriano FerrerNo ratings yet

- Green ChilliDocument3 pagesGreen ChilliJai PrakashNo ratings yet

- PL 1018 203008 M05 003014 PDFDocument2 pagesPL 1018 203008 M05 003014 PDFAnonymous 1YmFJf7A7No ratings yet

- C V Sif Jean Marie Logistics Coordinator ChadDocument4 pagesC V Sif Jean Marie Logistics Coordinator ChadAnonymous TT3XLINo ratings yet

- Freight Broker Basics Online Course Module 3 Shippers and Trucking CompaniesDocument16 pagesFreight Broker Basics Online Course Module 3 Shippers and Trucking Companiesemmanuelhood642No ratings yet

- Freight Invoice Maersk LineDocument1 pageFreight Invoice Maersk LineAllen JohnsonNo ratings yet

- UBER AlternativesDocument1 pageUBER AlternativesCJ IbaleNo ratings yet

- Samsung EZON CI - PL (Arquitechtura)Document3 pagesSamsung EZON CI - PL (Arquitechtura)Jesus MoctezumaNo ratings yet

- Geography and International Inequalities: The Impact of New TechnologiesDocument35 pagesGeography and International Inequalities: The Impact of New TechnologiesPedro Jose Jimenez DiazNo ratings yet

- Gateway CXDocument1 pageGateway CXArif Tawil PrionoNo ratings yet