Professional Documents

Culture Documents

Error Correction Sample Problems

Uploaded by

Katie Barnes0 ratings0% found this document useful (0 votes)

2K views42 pagesThe document describes several accounting errors discovered in the financial records of multiple companies for various years. It provides details on inventory misstatements, unrecorded expenses and income, improper classification and recording of transactions, and incorrect income amounts reported. The questions that follow ask the reader to determine the correct net or retained earnings amounts based on correcting the identified errors.

Original Description:

Practice the problems.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document describes several accounting errors discovered in the financial records of multiple companies for various years. It provides details on inventory misstatements, unrecorded expenses and income, improper classification and recording of transactions, and incorrect income amounts reported. The questions that follow ask the reader to determine the correct net or retained earnings amounts based on correcting the identified errors.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2K views42 pagesError Correction Sample Problems

Uploaded by

Katie BarnesThe document describes several accounting errors discovered in the financial records of multiple companies for various years. It provides details on inventory misstatements, unrecorded expenses and income, improper classification and recording of transactions, and incorrect income amounts reported. The questions that follow ask the reader to determine the correct net or retained earnings amounts based on correcting the identified errors.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 42

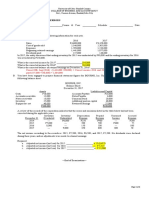

2.

0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #2

You are performing, for the first time, the audit for the year ended December 31,

2013 of Norman Corp. financial statements. The company reported the following

amounts of net income for the years ended December 31, 2011, 2012, and 2013:

2011

381,000

2012

450,000

2013

385,500

During your examination, you discovered the following errors:

You observed that there were errors in the physical count: December 31, 2012

inventories were understated by 42,000 and December 31, 2013 were overstated by

69,000.

On December 30, 2013 Norman recorded on account, merchandise in transit

which cost 45,000. The merchandise was shipped FOB Destination and had not arrived

by December 31. The merchandise was not included in the ending inventory.

Accrual sales at each year end were consistently omitted as follows:

2011

12, 000

2012

15,000

2013

10,500

Accrual of salaries were consistently omitted as follows:

.

December 31, 2011

30,000

December 31, 2012

42,000

On March 5, 2012, a 10%stock dividend was declared and distributed. The par

value of the shares amounted to 30,000 and market value was 39,000. The stock

dividend was recorded as follows:

Other expense 30,000

Ordinary shares 30,000

On July 1, 2012, Norman paid a 3-year rent. The 3-year premium of 18,000 was

paid on that date, and the entire premium was recorded as insurance expense.

On January 1, 2013, Norman retired bonds with a book value of 360,000 for

318,000. The gain was deferred and amortized over 10 years as a reduction of interest

expense on other outstanding bonds.

What is the correct net income in 2012?

498,000

534,000

528,000

477,000

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #3

When an accounting error is being corrected, the Company should the disclose

the following except:

The amount of the correction for each prior period presented.

That comparative information has been restated, or that the restatement for a

particular prior period has not been made because it would require undue cost.

The nature of the error

The effect of the restatement on each line item in the financial statements.

SOLUTION:

When an accounting error is being corrected, the reporting entity is to disclose

the following:

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #4

An examination of the accounting records of Ben Inc. for the year ended

December 31, 2013 indicates that several errors were made. The following errors were

discovered:

The footings and extensions showed that the inventory on December 31, 2012

was understated by 380,000

300,000 worth of inventories were received on January 2, 2014. Upon

investigation you discovered that these goods were shipped by the supplier on

December 30, 2013 FOB Shipping point. Further investigation revealed that liability on

item were recorded when the goods were shipped.

Salary accruals on December 31, were consistently omitted:

2010

190,000

2011

220,000

2012

200,000

2013

280,000

Unused supplies were consistently omitted at the end of each year

2010

150,000

2011

200,000

2012

230,000

2013

240,000

A 4-year fire insurance amounting to 300,000 was paid and fully expense on June

15, 2011. The insurance covers the fiscal year July 1 to June 30.

Interest receivable were not recorded on December 31 of the following years:

2011

40,000

2012

50,000

2013

60,000

On January 1, 2013 an equipment costing 800,000 was sold for 440,000. At the

end of the sale the equipment had accumulated depreciation of 480,000. The cash

received was recorded by the company as miscellaneous income.

You also discovered that on July 1, 2011, the company completed the

construction of the left wing of its factory building incurring a total cost of 1,400,000,

which it had charged to repairs expense. The said building has been used in operations

for 5 years as of july 1, 6,000,000 had a carrying value of 2,250,000 as of December 31,

2013.

The income statements of Ben Inc. indicate the following net income:

2011

3,000,000

2012

3,500,000

2013

4,000,000

What is the correct net income in 2011?

4,622,500

4,422,500

4,385,000

4,585,000

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #5

De Leon Inc. is a calendar year corporation. Its financial statements for the years

2012 and 2013 contained errors as follows.

2012

2013

Ending inventory

1,000 understated

3,000 overstated

Depreciation expense

800 understated

2,500 overstated

Assumed that no correcting entries were made at December 31, 2012 or

December 31, 2013 and that no additional errors occurred in 2013. Ignoring income

taxes, by how much will working capital at December 31, 2013 be overstated or

understated?

1,000 understated

3,000 overstated

500 overstated

1,700 understated

CCDAB

Question #1

An examination of the accounting records of Ben Inc. for the year ended

December 31, 2013 indicates that several errors were made. The following errors were

discovered:

The footings and extensions showed that the inventory on December 31, 2012

was understated by 380,000

300,000 worth of inventories were received on January 2, 2014. Upon

investigation you discovered that these goods were shipped by the supplier on

December 30, 2013 FOB Shipping point. Further investigation revealed that liability on

item were recorded when the goods were shipped.

Salary accruals on December 31, were consistently omitted:

2010

190,000

2011

220,000

2012

200,000

2013 2013

280,000

Unused supplies were consistently omitted at the end of each year

2010

150,000

2011

200,000

2012

230,000

2013

240,000

A 4-year fire insurance amounting to 300,000 was paid and fully expense on June

15, 2011. The insurance covers the fiscal year July 1 to June 30.

Interest receivable were not recorded on December 31 of the following years:

2011

40,000

2012

50,000

2013

60,000

On January 1, 2013 an equipment costing 800,000 was sold for 440,000. At the

end of the sale the equipment had accumulated depreciation of 480,000. The cash

received was recorded by the company as miscellaneous income.

You also discovered that on July 1, 2011, the company completed the

construction of the left wing of its factory building incurring a total cost of 1,400,000,

which it had charged to repairs expense. The said building has been used in operations

for 5 years as of july 1, 6,000,000 had a carrying value of 2,250,000 as of December 31,

2013.

The income statements of Ben Inc. indicate the following net income:

2011

3,000,000

2012

3,500,000

2013

4,000,000

What is the correct net income in 2011?

4,422,500

4,385,000

4,585,000

4,622,500

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #2

De Leon Inc. is a calendar year corporation. Its financial statements for the years

2012 and 2013 contained errors as follows.

2012

2013

Ending inventory

1,000 understated

3,000 overstated

Depreciation expense

Depreciation expense

800 understated

2,500 overstated

Assumed that no correcting entries were made at December 31, 2012. Ignoring

income taxes, by how much will retained earnings at December 31, 2013 be overstated

or understated?

2,700 understated

1,300 overstated

500 overstated

3,200 understated

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #3

You are auditing the financial statements of More Luck Co. the companys

accountant provided you with the following comparative statements of income and

accumulated profits for the years 2012 and 2013.

2013

2012

Sales

4,500,000

6,000,000

Cost of goods sold

(2,800,000)

(2,400,000)

Gross income

3,200,000

2,100,000

Operating expenses

(1,500,000)

(1,800,000)

Net profit

1,700,000

300,000

Accumulated profits, beg

1,150,000

1,000,000

Net profit

1,700,000

300,000

Dividends paid

(500,000)

(150,000)

Accumulated profits, end

2,350,000

1,150,000

Audit notes:

The ending inventory for 2012 was understated by 100,000.

The company decided to change its method of depreciation from the double-

declining balance method to the straight-line. The depreciable assets had a 10 year

useful life and is 50% depreciated as at the end of 2012. The salvage value of the said

assets was estimated to be 50,000. Expenses in the income statements included a

350,000 depreciation expense computed based on double-declining balance method.

balance method.

On August 31, 2012, the company started the construction of a building it plans to

use as a second factory. As of the current balance sheet, the construction is yet to be

finished. Total accumulated costs incurred on the construction and recorded in its

construction-in-progress account, amounted to 1,250,000, which included a 25,000

capitalized borrowing cost in 2012, since the company opted to apply the alternative

approach of accounting for finance cost in accordance with PAS 23. During the current

year, the company decided to change the method of accounting for borrowing cost to

follow the benchmark treatment. Actual borrowing cost in 2013 amounted to 75,000 it

charged to current operations.

What is the correct net income in 2012?

200,000

400,000

275,000

300,000

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #4

An examination of the accounting records of Ben Inc. for the year ended

December 31, 2013 indicates that several errors were made. The following errors were

discovered:

The footings and extensions showed that the inventory on December 31, 2012

was understated by 380,000

300,000 worth of inventories were received on January 2, 2014. Upon

investigation you discovered that these goods were shipped by the supplier on

December 30, 2013 FOB Shipping point. Further investigation revealed that liability on

item were recorded when the goods were shipped.

Salary accruals on December 31, were consistently omitted:

2010

190,000

2011

220,000

2012

200,000

2013

280,000

Unused supplies were consistently omitted at the end of each year

2010

150,000

2011

200,000

2012

230,000

2013

240,000

A 4-year fire insurance amounting to 300,000 was paid and fully expense on June

15, 2011. The insurance covers the fiscal year July 1 to June 30.

Interest receivable were not recorded on December 31 of the following years:

2011

40,000

2012

50,000

2013

60,000

On January 1, 2013 an equipment costing 800,000 was sold for 440,000. At the

end of the sale the equipment had accumulated depreciation of 480,000. The cash

received was recorded by the company as miscellaneous income.

You also discovered that on July 1, 2011, the company completed the

construction of the left wing of its factory building incurring a total cost of 1,400,000,

which it had charged to repairs expense. The said building has been used in operations

for 5 years as of july 1, 6,000,000 had a carrying value of 2,250,000 as of December 31,

2013. expense. The said building has been used in operations for 5 years as of july 1,

6,000,000 had a carrying value of 2,250,000 as of December 31, 2013.

The income statements of Ben Inc. indicate the following net income:

2011

3,000,000

2012

3,500,000

2013

4,000,000

What is the correct net income in 2013?

3,165,000

2,665,000

2,500,000

2,965,000

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #5

You are performing, for the first time, the audit for the year ended December 31,

2013 of Norman Corp. financial statements. The company reported the following

amounts of net income for the years ended December 31, 2011, 2012, and 2013:

2011

381,000

2012

450,000

2013

385,500

During your examination, you discovered the following errors:

You observed that there were errors in the physical count: December 31, 2012

inventories were understated by 42,000 and December 31, 2013 were overstated by

69,000.

On December 30, 2013 Norman recorded on account, merchandise in transit

which cost 45,000. The merchandise was shipped FOB Destination and had not arrived

by December 31. The merchandise was not included in the ending inventory.

Accrual sales at each year end were consistently omitted as follows:

2011

12, 000

2012

15,000

2013

10,500

Accrual of salaries were consistently omitted as follows:

.

December 31, 2011

30,000

December 31, 2012

42,000

On March 5, 2012, a 10%stock dividend was declared and distributed. The par

value of the shares amounted to 30,000 and market value was 39,000. The stock

dividend was recorded as follows:

Other expense 30,000

Ordinary shares 30,000

On July 1, 2012, Norman paid a 3-year rent. The 3-year premium of 18,000 was

paid on that date, and the entire premium was recorded as insurance expense. On

July 1, 2012, Norman paid a 3-year rent. The 3-year premium of 18,000 was paid on that

date, and the entire premium was recorded as insurance expense.

On January 1, 2013, Norman retired bonds with a book value of 360,000 for

318,000. The gain was deferred and amortized over 10 years as a reduction of interest

expense on other outstanding bonds.

What is the correct net income in 2012?

534,000

477,000

528,000

498,000

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #6

You are auditing the financial statements of More Luck Co. the companys

accountant provided you with the following comparative statements of income and

accumulated profits for the years 2012 and 2013.

2013

2012

Sales

4,500,000

6,000,000

Cost of goods sold

(2,800,000)

(2,400,000)

Gross income

3,200,000

2,100,000

Operating expenses

(1,500,000)

(1,800,000)

Net profit

1,700,000

300,000

Accumulated profits, beg

1,150,000

1,000,000

Net profit

1,700,000

300,000

Dividends paid

(500,000)

(150,000)

Accumulated profits, end

2,350,000

1,150,000

Audit notes:

The ending inventory for 2012 was understated by 100,000.

The company decided to change its method of depreciation from the double-

declining balance method to the straight-line. The depreciable assets had a 10 year

useful life and is 50% depreciated as at the end of 2012. The salvage value of the said

assets was estimated to be 50,000. Expenses in the income statements included a

350,000 depreciation expense computed based on double-declining balance method.

balance method.

On August 31, 2012, the company started the construction of a building it plans to

use as a second factory. As of the current balance sheet, the construction is yet to be

finished. Total accumulated costs incurred on the construction and recorded in its

construction-in-progress account, amounted to 1,250,000, which included a 25,000

capitalized borrowing cost in 2012, since the company opted to apply the alternative

approach of accounting for finance cost in accordance with PAS 23. During the current

year, the company decided to change the method of accounting for borrowing cost to

follow the benchmark treatment. Actual borrowing cost in 2013 amounted to 75,000 it

charged to current operations.

What is the correct net income in 2013?

1,685,000

1,610,000

1,715,000

1,675,000

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #7

Correcting the recognition, measurement and disclosure of amounts of financial

statement elements as if a prior period error had never occurred is known as:

retrospective restatement.

prior period application.

historical restatement.

retrospective application.

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #8

You are auditing the financial statements of More Luck Co. the companys

accountant provided you with the following comparative statements of income and

accumulated profits for the years 2012 and 2013.

2013

2012

Sales

4,500,000

6,000,000

Cost of goods sold

(2,800,000)

(2,400,000)

Gross income

3,200,000

2,100,000

Operating expenses

(1,500,000)

(1,800,000)

Net profit

1,700,000

300,000

Accumulated profits, beg

1,150,000

1,000,000

Net profit

1,700,000

300,000

Dividends paid

(500,000)

(150,000) (150,000)

Accumulated profits, end

2,350,000

1,150,000

Audit notes:

The ending inventory for 2012 was understated by 100,000.

The company decided to change its method of depreciation from the double-

declining balance method to the straight-line. The depreciable assets had a 10 year

useful life and is 50% depreciated as at the end of 2012. The salvage value of the said

assets was estimated to be 50,000. Expenses in the income statements included a

350,000 depreciation expense computed based on double-declining balance method.

On August 31, 2012, the company started the construction of a building it plans to

use as a second factory. As of the current balance sheet, the construction is yet to be

finished. Total accumulated costs incurred on the construction and recorded in its

construction-in-progress account, amounted to 1,250,000, which included a 25,000

capitalized borrowing cost in 2012, since the company opted to apply the alternative

approach of accounting for finance cost in accordance with PAS 23. During the current

year, the company decided to change the method of accounting for borrowing cost to

follow the benchmark treatment. Actual borrowing cost in 2013 amounted to 75,000 it

charged to current operations.

What is the adjusted accumulated profits at the end of 2013?

2,385,000

2,835,000

2,885,000

2,335,000

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #9

You are performing, for the first time, the audit for the year ended December 31,

2013 of Norman Corp. financial statements. The company reported the following

amounts of net income for the years ended December 31, 2011, 2012, and 2013:

2011

381,000

2012

450,000

2013

385,500

During your examination, you discovered the following errors:

You observed that there were errors in the physical count: December 31, 2012

inventories were understated by 42,000 and December 31, 2013 were overstated by

69,000.

On December 30, 2013 Norman recorded on account, merchandise in transit

which cost 45,000. The merchandise was shipped FOB Destination and had not arrived

by December 31. The merchandise was not included in the ending inventory.

Accrual sales at each year end were consistently omitted as follows:

2011

12, 000

2012

15,000

2013

10,500

Accrual of salaries were consistently omitted as follows:

.

December 31, 2011

30,000

December 31, 2012

42,000

On March 5, 2012, a 10%stock dividend was declared and distributed. The par

value of the shares amounted to 30,000 and market value was 39,000. The stock

dividend was recorded as follows: 450,000

2013

385,500

During your examination, you discovered the following errors:

You observed that there were errors in the physical count: December 31, 2012

inventories were understated by 42,000 and December 31, 2013 were overstated by

69,000.

On December 30, 2013 Norman recorded on account, merchandise in transit

which cost 45,000. The merchandise was shipped FOB Destination and had not arrived

by December 31. The merchandise was not included in the ending inventory.

Accrual sales at each year end were consistently omitted as follows:

2011

12, 000

2012

15,000

2013

10,500

Accrual of salaries were consistently omitted as follows:

.

December 31, 2011

30,000

December 31, 2012

42,000

On March 5, 2012, a 10%stock dividend was declared and distributed. The par

value of the shares amounted to 30,000 and market value was 39,000. The stock

dividend was recorded as follows:

Other expense 30,000

Ordinary shares 30,000

On July 1, 2012, Norman paid a 3-year rent. The 3-year premium of 18,000 was

paid on that date, and the entire premium was recorded as insurance expense.

On January 1, 2013, Norman retired bonds with a book value of 360,000 for

318,000. The gain was deferred and amortized over 10 years as a reduction of interest

expense on other outstanding bonds.

What is the correct net income in 2013?

418,800

313,200

388,800

393,000

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #13

An examination of the accounting records of Ben Inc. for the year ended

December 31, 2013 indicates that several errors were made. The following errors were

discovered:

The footings and extensions showed that the inventory on December 31, 2012

was understated by 380,000

300,000 worth of inventories were received on January 2, 2014. Upon

investigation you discovered that these goods were shipped by the supplier on

December 30, 2013 FOB Shipping point. Further investigation revealed that liability on

item were recorded when the goods were shipped.

Salary accruals on December 31, were consistently omitted:

2010

190,000

2011

220,000

2012

200,000 200,000

2013

280,000

Unused supplies were consistently omitted at the end of each year

2010

150,000

2011

200,000

2012

230,000

2013

240,000

A 4-year fire insurance amounting to 300,000 was paid and fully expense on June

15, 2011. The insurance covers the fiscal year July 1 to June 30.

Interest receivable were not recorded on December 31 of the following years:

2011

40,000

2012

50,000

2013

60,000

On January 1, 2013 an equipment costing 800,000 was sold for 440,000. At the

end of the sale the equipment had accumulated depreciation of 480,000. The cash

received was recorded by the company as miscellaneous income.

You also discovered that on July 1, 2011, the company completed the

construction of the left wing of its factory building incurring a total cost of 1,400,000,

which it had charged to repairs expense. The said building has been used in operations

for 5 years as of july 1, 6,000,000 had a carrying value of 2,250,000 as of December 31,

2013.

The income statements of Ben Inc. indicate the following net income:

2011

3,000,000

2012

3,500,000

2013

4,000,000

What is the effect of the errors to the 2013 working capital?

712,500 under

712,500 over

432,500 over

432,500 under

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #14

Which of the following statement is correct?

Materiality only depends only ever depends on the size of an item.

Extensive guidance is given in accounting standards on the concept of materiality.

The disclosure provisions of accounting standards do not need to be applied if the

resulting information is immaterial.

The disclosure provisions of accounting standards must always be applied even if

the resulting information is immaterial.

2.0 Financial Accounting and Reporting - Error Correction (Difficult) On March 5,

2012, a 10%stock dividend was declared and distributed. The par value of the shares

amounted to 30,000 and market value was 39,000. The stock dividend was recorded as

follows:

Other expense 30,000

Ordinary shares 30,000

On July 1, 2012, Norman paid a 3-year rent. The 3-year premium of 18,000 was

paid on that date, and the entire premium was recorded as insurance expense.

On January 1, 2013, Norman retired bonds with a book value of 360,000 for

318,000. The gain was deferred and amortized over 10 years as a reduction of interest

expense on other outstanding bonds.

What is the correct net income in 2011?

339,000

363,000

351,000

399,000

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #17

An examination of the accounting records of Ben Inc. for the year ended

December 31, 2013 indicates that several errors were made. The following errors were

discovered:

The footings and extensions showed that the inventory on December 31, 2012

was understated by 380,000

300,000 worth of inventories were received on January 2, 2014. Upon

investigation you discovered that these goods were shipped by the supplier on

December 30, 2013 FOB Shipping point. Further investigation revealed that liability on

item were recorded when the goods were shipped.

Salary accruals on December 31, were consistently omitted:

2010

190,000

2011

220,000

2012

200,000

2013

280,000

Unused supplies were consistently omitted at the end of each year

2010

150,000

2011

200,000

2012

230,000

2013

240,000

A 4-year fire insurance amounting to 300,000 was paid and fully expense on June

15, 2011. The insurance covers the fiscal year July 1 to June 30.

Interest receivable were not recorded on December 31 of the following years:

2011

40,000

2012

50,000

2013

60,000

On January 1, 2013 an equipment costing 800,000 was sold for 440,000. At the

end of the sale the equipment had accumulated depreciation of 480,000. The cash

received was recorded by theexpense. The said building has been used in operations for

5 years as of july 1, 6,000,000 had a carrying value of 2,250,000 as of December 31,

2013.

The income statements of Ben Inc. indicate the following net income:

2011

3,000,000

2012

3,500,000

2013

4,000,000

What is the effect of the errors to the 2013 retained earnings?

712,500 under

742,500 over

712,500 over

742,500 under

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #18

De Leon Inc. is a calendar year corporation. Its financial statements for the years

2012 and 2013 contained errors as follows.

2012

2013

Ending inventory

1,000 understated

3,000 overstated

Depreciation expense

800 understated

2,500 overstated

Assumed that no correcting entries were made at December 31, 2012. By how

much will 2012 income before income taxes be overstated or understated

500 overstated

3,200 understated

200 understated

2,700 understated

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #19

When it is impracticable to determine the effect of an error for all periods, the

entity

Restates comparative information retrospectively from the earliest date

practicable

Restates comparative information retrospectively up to the latest date practicable

Restates comparative information prospectively from the earliest date practicable

Restates comparative information prospectively up to the latest date practicable

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

Question #20

When an accounting error is being corrected, the Company should the disclose

the following except:

That comparative information has been restated, or that the restatement for a

particular prior period has not been made because it would require undue cost.

The amount of the correction for each prior period presented.

The effect of the restatement on each line item in the financial statements.

The nature of the error The nature of the error

SOLUTION:

When an accounting error is being corrected, the reporting entity is to disclose

the following:

2.0 Financial Accounting and Reporting - Error Correction (Difficult)

DBBDCBADCDCCDCABACAC

Question #1

Nando Co. purchased machinery that cost P810,000 on January 4, 2011. The

entire cost was recorded as an expense. The machinery has a nine-year life and a

P54,000 residual value. The error was discovered on December 20, 2013. Ignore income

tax considerations.

Nando's income statement for the year ended December 31, 2013, should show

the cumulative effect of this error in the amount of

0

558,000

726,000

642,000

SOLUTION:

CE = P0, correction of error

2.0 Financial Accounting and Reporting - Error Correction (Easy)

Question #2

Errors can occur for which of the following reasons?

Fraud

Mistakes in applying accounting policies

Misinterpretation of facts

All of the answers are errors.

2.0 Financial Accounting and Reporting - Error Correction (Easy)

Question #3

Gab Company purchased equipment that cost P750,000 on January 1, 2012. The

entire cost was recorded as an expense. The equipment had a nine-year life and a

P30,000 residual value. Gab uses the straight-line method to account for depreciation

expense. The error was discovered on December 10, 2014. Gab is subject to a 40 % tax

rate.

Gabs net income for the year ended December 31, 2012, was understated by

750,000

402,000

450,000

670,000

SOLUTION:

(P750,000 - [(P750,000 P30,000) 9]) (1 - .40) = P402,000.

2.0 Financial Accounting and Reporting - Error Correction (Easy)

Question #4

Which among the following errors could cause an understatement of owners'

equity and overstatement of liabilities?

Failure to record the earned portion of fees received in advance

Failure to record interest accrued on a note payable

Making the adjusting entry for depreciation expense twice

Failure to make the adjusting entry to record revenue which had been earned but

not yet billed to customers

2.0 Financial Accounting and Reporting - Error Correction (Easy) 2.0 Financial

Accounting and Reporting - Error Correction (Easy)

Question #5

Counterbalancing errors do not include

an understatement of purchases

errors that correct themselves in three years

an overstatement of unearned revenue

errors that correct themselves in two years

2.0 Financial Accounting and Reporting - Error Correction (Easy)

Question #6

If, at the end of a period, a company erroneously excluded some goods from its

ending inventory and also erroneously did not record the purchase of these goods in its

accounting records, these errors would cause

the ending inventory and retained earnings to be understated

no effect on net income, working capital, and retained earnings

cost of goods sold and net income to be understated

the ending inventory, cost of goods sold, and retained earnings to be understated

2.0 Financial Accounting and Reporting - Error Correction (Easy)

Question #7

Josh Company's December 31 year-end financial statements contained the

following errors:

Dec. 31, 2010

Dec. 31, 2011

Ending inventory

P7,500 understated

P11,000 overstated

Depreciation expense

2,000 understated

An insurance premium of P18,000 was prepaid in 2010 covering the years 2010,

2011, and 2012. The prepayment was recorded with a debit to insurance expense. In

addition, on December 31, 2011, fully depreciated machinery was sold for P9,500 cash,

but the sale was not recorded until 2012. There were no other errors during 2011 or

2012 and no corrections have been made for any of the errors. Ignore income tax

considerations.

What is the total net effect of the errors on Josh's 2011 net income?

Net income overstated by P13,000

Net income understated by P14,500

Net income overstated by P7,500

Net income overstated by P15,000

SOLUTION:

P7,500 (o) + P11,000 (o) + P6,000 (o) P9,500 (u) = P15,000 (o)

2.0 Financial Accounting and Reporting - Error Correction (Easy)

Question #8

Which of the following could result in overstatement of both current assets and

shareholders' equity?

Holiday pay expense for administrative employees is misclassified as factory

overhead

An understatement of accrued sales commission

Annual depreciation on manufacturing machinery is understated

Noncurrent note receivable principal is misclassified as current asset

2.0 Financial Accounting and Reporting - Error Correction (Easy)

Question #9

Josh Company's December 31 year-end financial statements contained the

following errors: Josh Company's December 31 year-end financial statements

contained the following errors:

Dec. 31, 2010

Dec. 31, 2011

Ending inventory

P7,500 understated

P11,000 overstated

Depreciation expense

2,000 understated

An insurance premium of P18,000 was prepaid in 2010 covering the years 2010,

2011, and 2012. The prepayment was recorded with a debit to insurance expense. In

addition, on December 31, 2011, fully depreciated machinery was sold for P9,500 cash,

but the sale was not recorded until 2012. There were no other errors during 2011 or

2012 and no corrections have been made for any of the errors. Ignore income tax

considerations.

What is the total net effect of the errors on Josh's 2011 net income?

Net income overstated by P15,000

Net income overstated by P7,500

Net income understated by P14,500

Net income overstated by P13,000

SOLUTION:

P7,500 (o) + P11,000 (o) + P6,000 (o) P9,500 (u) = P15,000 (o)

2.0 Financial Accounting and Reporting - Error Correction (Easy)

Question #10

Accrued salaries payable of P51,000 were not recorded at December 31, 2010.

Office supplies on hand of P24,000 at December 31, 2011 were erroneously treated as

expense instead of supplies inventory. Neither of these errors was discovered nor

corrected. The effect of these two errors would cause

2011 net income to be understated P75,000 and December 31, 2011 retained

earnings to be understated P24,000

2010 net income and December 31, 2010 retained earnings to be understated

P51,000 each

2011 net income and December 31, 2011 retained earnings to be understated

P24,000 each

2010 net income to be overstated P27,000 and 2011 net income to be

understated P24,000

SOLUTION:

2011 NI = P51,000 (u) + P24,000 (u) = P75,000 (u). 2011 RE = P24,000 (u) [The

2010 P51,000 (o) is offset by 2011 P51,000 (u)].

2.0 Financial Accounting and Reporting - Error Correction (Easy)

ADBABBDAAA

Question #1

The correction of a material error that occurred in a previous period must be

accounted for by:

a retrospective restatement in the first financial statements issued after the

discovery of the error.

a prospective adjustment to the financial statements.

an adjustment in future accounting periods.

disclosure in the notes to the financial statements.

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #2

Kristine, Inc. is a calendar-year corporation whose financial statements for 2012

and 2013 included errors as follows:

Year

Ending Inventory Ending Inventory

Depreciation Expense

2012

P162,000 overstated

P135,000 overstated

2013

54,000 understated

45,000 understated

Assume that purchases were recorded correctly and that no correcting entries

were made at December 31, 2012, or at December 31, 2013. Ignoring income taxes, by

how much should Kristine's retained earnings be retroactively adjusted at January 1,

2014?

P144,000 increase

P18,000 decrease

P36,000 increase

P9,000 increase

SOLUTION:

P54,000 (u) + P135,000 (u) P45,000 (o) = P144,000 (u)

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #3

Corrections of error are reported in

Retained earnings

Other comprehensive income

Other income or expense

Shareholders' equity

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #4

The following errors in the accounting records of Philip Company were discovered

on January 1, 2013:

2010

2011

2012

Ending inventory overstated

900,000

800,000

Depreciated understated

300,000

Accrued rent revenue not recorded

140,000

250,000

Accrued interest expense not recorded

20,000

What is the net effect of the errors on the January 1, 2013 retained earnings?

What is the net effect of the errors on the January 1, 2013 retained earnings?

730,000 over

820,000 over

570,000 over

1,120,000 over

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #5

On December 31, 2013, special insurance costs, incurred but unpaid, were not

recorded. If these insurance costs were related to work in process, what is the effect of

the omission on accrued liabilities and retained earnings in the December 31, 2013

balance sheet?

Accrued Liabilities (Understated); Retained Earnings (Overstated)

Accrued Liabilities (Understated); Retained Earnings (No effect)

Accrued Liabilities (No effect); Retained Earnings (No effect)

Accrued Liabilities (No effect); Retained Earnings (Overstated)

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #6

Prior period errors

Are corrected through accumulated profit or loss

Are corrected through current profit or loss

Do not cause misstatements in current period FS

Do not reverse themselves in the future in all circumstances

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #7

Prior period errors

Are corrected through current profit or loss

Do not cause misstatements in current period FS

Do not reverse themselves in the future in all circumstances

Are corrected through accumulated profit or loss

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #8

Which of the following is a correction of an error?

Increase in percentage for recording product warranty expense

Change in measurement basis

Revision in the total minerals to be extracted because it was overstated in the

previous year.

From direct writeoff to allowance method in recording bad debts

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #9

Nando Co. purchased machinery that cost P810,000 on January 4, 2011. The

entire cost was recorded as an expense. The machinery has a nine-year life and a

P54,000 residual value. The error was discovered on December 20, 2013. Ignore income

tax considerations.

Before the correction was made, and before the books were closed on December

31, 2013, retained earnings was understated by

558,000

810,000

642,000

726,000

SOLUTION: SOLUTION:

810,000 - ((810,000-54,000)/9)) x 2) = 642,000

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #10

Josh Company's December 31 year-end financial statements contained the

following errors:

Dec. 31, 2010

Dec. 31, 2011

Ending inventory

P7,500 understated

P11,000 overstated

Depreciation expense

2,000 understated

An insurance premium of P18,000 was prepaid in 2010 covering the years 2010,

2011, and 2012. The prepayment was recorded with a debit to insurance expense. In

addition, on December 31, 2011, fully depreciated machinery was sold for P9,500 cash,

but the sale was not recorded until 2012. There were no other errors during 2011 or

2012 and no corrections have been made for any of the errors. Ignore income tax

considerations.

What is the total net effect of the errors on the amount of Josh's working capital

at December 31, 2011?

Working capital overstated by P1,500

Working capital understated by P12,000

Working capital overstated by P5,000

Working capital understated by P4,500

SOLUTION:

P11,000 (o) - P6,000 (u) - P9,500 (u) = P4,500 (u)

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #11

In determining whether an item is material, consideration must be given to:

both its size and nature.

its size only.

none of the answers are correct

its nature only.

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #12

On December 31, 2013, special insurance costs, incurred but unpaid, were not

recorded. If these insurance costs were related to work in process, what is the effect of

the omission on accrued liabilities and retained earnings in the December 31, 2013

balance sheet?

Accrued Liabilities (No effect); Retained Earnings (No effect)

Accrued Liabilities (No effect); Retained Earnings (Overstated)

Accrued Liabilities (Understated); Retained Earnings (Overstated)

Accrued Liabilities (Understated); Retained Earnings (No effect)

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #13

Ronn Company's assets decreased by P4,000,000 and its liabilities also decreased

by P7,000,000 in the current year. Upon review of the accounting records, it was

determined that Ronn's available for sale securities increased by P200,000 and trading

securities decreased by P400,000 all due to changes in fair value. Also, Ronn received

equipment valued at P200,000 from a nonshareholder as donation with no restrictions

attached, and corrected a prior period error resulting from an overstatement of ending

inventory for P1,000,000. What is the net income for the current year?

4,000,000

3,800,000

4,200,000 Retained earnings understated by P4,500

SOLUTION:

P2,000 (o) + P11,000 (o) - P6,000 (u) - P9,500 (u) = P2,500 (u).

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #18

Gabriel Company's beginning inventory was understated by P260,000 and the

ending inventory was overstated by P520,000. What was the effect of the errors on the

cost of goods sold for the current year?

780,000 overstated

260,000 understated

780,000 understated

260,000 overstated

2.0 Financial Accounting and Reporting - Error Correction (Average)

Question #19

During the current year, an entity discovered that ending inventory of the prior

year was understated. How should the entity account for this understatement in the

comparative statement?

Adjust the beginning inventory.

Make no entry because the error will self-correct.

Restate the financial statements with corrected balances for all periods

presented.

Adjust the ending balance in the retained earnings account.

2.0 Financial Accounting and Reporting - Error Correction (Average)

AAADBADCCDADBAACCCC

You might also like

- RatioDocument13 pagesRatioKaren Joyce Sinsay50% (2)

- 1 Far Answer KeyDocument25 pages1 Far Answer KeyAngelie0% (1)

- Unmodified ReportDocument2 pagesUnmodified ReportErica CaliuagNo ratings yet

- Week 4 - Lesson 4 Cash and Cash EquivalentsDocument21 pagesWeek 4 - Lesson 4 Cash and Cash EquivalentsRose RaboNo ratings yet

- Illustration: Formation of Partnership Valuation of Capital A BDocument2 pagesIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoNo ratings yet

- Chapter 01 AnswerDocument19 pagesChapter 01 AnswershaneNo ratings yet

- Theory of Accounts - Valix - CinEquityDocument10 pagesTheory of Accounts - Valix - CinEquityMaryrose Gestoso0% (1)

- Audit of Cash & Cash Equivalents: Problem 1Document9 pagesAudit of Cash & Cash Equivalents: Problem 1John Lemuel RiveraNo ratings yet

- English Iii: University of Guayaquil Facultad Piloto de OdontologíaDocument4 pagesEnglish Iii: University of Guayaquil Facultad Piloto de OdontologíaDianitaVelezPincayNo ratings yet

- StudentDocument45 pagesStudentJoel Christian MascariñaNo ratings yet

- AuditingDocument9 pagesAuditingRenNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- CHAPTER 2 - The Unified Account Code StructureDocument87 pagesCHAPTER 2 - The Unified Account Code StructureJenny Jean Lelis100% (1)

- p2 Guerrero ch15Document30 pagesp2 Guerrero ch15Clarissa Teodoro100% (1)

- Cases (Cabrera)Document5 pagesCases (Cabrera)Queenie100% (1)

- Cordillera Career Development College problems and solutionsDocument10 pagesCordillera Career Development College problems and solutionsapatosNo ratings yet

- Acct. 162 - EPS, BVPS, DividendsDocument5 pagesAcct. 162 - EPS, BVPS, DividendsAngelli LamiqueNo ratings yet

- Shareholder's Equity Practice Set (Theories)Document42 pagesShareholder's Equity Practice Set (Theories)ME ValleserNo ratings yet

- RA 9298 Powerpoint PresentationDocument61 pagesRA 9298 Powerpoint PresentationPUNK BEARNo ratings yet

- Inventories Problem No. 1Document4 pagesInventories Problem No. 1Ren EyNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- Pledge - Mortgage - Chattel MortgageDocument23 pagesPledge - Mortgage - Chattel MortgageJohn Kayle BorjaNo ratings yet

- Test BankDocument136 pagesTest BankLouise100% (1)

- Auditing Reviewer 3Document3 pagesAuditing Reviewer 3Sheena ClataNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- Intermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020Document7 pagesIntermediate Accounting Iii - Final Examination 2 SEMESTER SY 2019-2020ohmyme sungjaeNo ratings yet

- Assignment 02 Correction of Errors Answer KeyDocument1 pageAssignment 02 Correction of Errors Answer KeyDan Andrei BongoNo ratings yet

- Classwork - Valuations 011621 PDFDocument2 pagesClasswork - Valuations 011621 PDFJasmine Acta0% (2)

- Acctg. QB 1-1Document8 pagesAcctg. QB 1-1Jinx Cyrus RodilloNo ratings yet

- Journal Entry For Correction of Errors and CounterbalancingDocument9 pagesJournal Entry For Correction of Errors and CounterbalancingsharbularsNo ratings yet

- FAR Reviewer - CPAR Test BankDocument31 pagesFAR Reviewer - CPAR Test BankemmanvillafuerteNo ratings yet

- PSA 700, 705, 706, 710, 720 ExercisesDocument11 pagesPSA 700, 705, 706, 710, 720 ExercisesRalph Francis BirungNo ratings yet

- Bustamante, Jilian Kate A. (Activity 3)Document4 pagesBustamante, Jilian Kate A. (Activity 3)Jilian Kate Alpapara BustamanteNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Working Trial Balance AdjustmentsDocument6 pagesWorking Trial Balance AdjustmentsJeane Mae BooNo ratings yet

- Calculating percentage taxes and VAT on various business transactionsDocument2 pagesCalculating percentage taxes and VAT on various business transactionsJenny Gomez Ibasco0% (2)

- Retrospectively in The First Set of Financial Statements Authorized For Issue AfterDocument7 pagesRetrospectively in The First Set of Financial Statements Authorized For Issue Aftermax pNo ratings yet

- 2009-09-06 125024 MmmmekaDocument24 pages2009-09-06 125024 MmmmekathenikkitrNo ratings yet

- Summative Assessment 2 ITDocument9 pagesSummative Assessment 2 ITJoana Trinidad100% (1)

- Accounting policies, estimates and errors quizDocument2 pagesAccounting policies, estimates and errors quizkim cheNo ratings yet

- P1 1Document12 pagesP1 1Donna Mae Hernandez0% (1)

- Philippine Auditing Standards GuideDocument8 pagesPhilippine Auditing Standards GuideI am JacobNo ratings yet

- Exercise Chapter 4Document3 pagesExercise Chapter 4Nela HasanNo ratings yet

- Summary Bonds Payable PDFDocument6 pagesSummary Bonds Payable PDFRovi PatinoNo ratings yet

- MGMT 134 CA KeyDocument4 pagesMGMT 134 CA KeyAnand KL100% (1)

- Assertion Based and Direct Reporting EngagementDocument4 pagesAssertion Based and Direct Reporting EngagementFanny MainNo ratings yet

- Error Correction MethodsDocument2 pagesError Correction MethodsValentina Tan DuNo ratings yet

- Final Exam Gbermic Multiple ChoiceDocument5 pagesFinal Exam Gbermic Multiple ChoiceMarie GarpiaNo ratings yet

- Chapter 14Document4 pagesChapter 14Jomer FernandezNo ratings yet

- Investor's Share in Associate Profits and Inventory TransactionsDocument7 pagesInvestor's Share in Associate Profits and Inventory Transactionsaryan nicoleNo ratings yet

- Nfjpia Region III Constitution & By-Laws - Final VersionDocument20 pagesNfjpia Region III Constitution & By-Laws - Final VersionAdrianneHarveNo ratings yet

- CPA Firm's Liability for Creditors' Losses Due to Reliance on Erroneous Financial StatementsDocument7 pagesCPA Firm's Liability for Creditors' Losses Due to Reliance on Erroneous Financial StatementsLeslie Mae Vargas ZafeNo ratings yet

- Review Question 3-1Document2 pagesReview Question 3-1Wilson Yao100% (3)

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyNo ratings yet

- HW On Book Value Per ShareDocument4 pagesHW On Book Value Per ShareCharles TuazonNo ratings yet

- Orca Share Media1532355060231Document18 pagesOrca Share Media1532355060231Let it beNo ratings yet

- Managerial AccountingMid Term Examination (1) - CONSULTADocument7 pagesManagerial AccountingMid Term Examination (1) - CONSULTAMay Ramos100% (1)

- AT05 Further Audit Procedures (Tests of Controls) PSA 520Document4 pagesAT05 Further Audit Procedures (Tests of Controls) PSA 520John Paul SiodacalNo ratings yet

- Financial Accounting-Basic-PQR, XYZ, MNO, ABCDocument4 pagesFinancial Accounting-Basic-PQR, XYZ, MNO, ABCHarishNo ratings yet

- AC557 W5 HW Questions/AnswersDocument5 pagesAC557 W5 HW Questions/AnswersDominickdad100% (3)

- Greek and Roman Arts: Bryan U. CariñoDocument20 pagesGreek and Roman Arts: Bryan U. CariñoKatie BarnesNo ratings yet

- Notes On Intangible Asets PDFDocument2 pagesNotes On Intangible Asets PDFKatie BarnesNo ratings yet

- Areas of Management Advisory Part IIDocument5 pagesAreas of Management Advisory Part IIKatie BarnesNo ratings yet

- Plant and Animal CellsDocument14 pagesPlant and Animal CellsKatie BarnesNo ratings yet

- Expenditure Cycle Risks and Internal ControlsDocument12 pagesExpenditure Cycle Risks and Internal ControlsKatie Barnes67% (6)

- TermsDocument6 pagesTermsKatie BarnesNo ratings yet

- Classification of Evolutionary RelationshipDocument24 pagesClassification of Evolutionary RelationshipKatie BarnesNo ratings yet

- Digital Divide Data LehrichDocument12 pagesDigital Divide Data LehrichAmitesh Sharma0% (1)

- Applied Auiting SeatworkDocument3 pagesApplied Auiting SeatworkKatie BarnesNo ratings yet

- BANWAGDocument2 pagesBANWAGKatie BarnesNo ratings yet

- Multiple Choice Questions ReviewDocument46 pagesMultiple Choice Questions ReviewJ Camille Mangundaya Lacsamana77% (30)

- Multiple Choice Questions ReviewDocument46 pagesMultiple Choice Questions ReviewJ Camille Mangundaya Lacsamana77% (30)

- Paragon of ExcellenceDocument2 pagesParagon of ExcellenceKatie BarnesNo ratings yet

- Effect of Persistence Prayer: Ĺukr 28.1p NDocument1 pageEffect of Persistence Prayer: Ĺukr 28.1p NKatie BarnesNo ratings yet

- Just For LaughsDocument1 pageJust For LaughsKatie BarnesNo ratings yet

- Components of A Research PaperDocument1 pageComponents of A Research PaperKatie BarnesNo ratings yet

- 5th Year Dominates JPIA Day CelebrationDocument3 pages5th Year Dominates JPIA Day CelebrationKatie BarnesNo ratings yet

- The Effects of Parental Influence On Their Children Career Choice PDFDocument64 pagesThe Effects of Parental Influence On Their Children Career Choice PDFKatie BarnesNo ratings yet

- 1public Goods PDFDocument13 pages1public Goods PDFKatie BarnesNo ratings yet

- Taking Criticism as a ComplimentDocument1 pageTaking Criticism as a ComplimentKatie BarnesNo ratings yet

- Balance SheetDocument3 pagesBalance SheetTukaram PawarNo ratings yet

- Finance Accelerator: Macro ResearchDocument4 pagesFinance Accelerator: Macro ResearchSEETHALNo ratings yet

- UCG7p2g3rF SBICAPsDocument31 pagesUCG7p2g3rF SBICAPsHarapriyaPandaNo ratings yet

- Bond Questions ExplainedDocument24 pagesBond Questions Explainedswati shuklaNo ratings yet

- A Capsule Summary of The Wave PrincipleDocument8 pagesA Capsule Summary of The Wave PrincipleomkarnadkarniNo ratings yet

- Business Brief ParagraphDocument3 pagesBusiness Brief ParagraphTrần ThơmNo ratings yet

- Corporate Financial PlanningDocument12 pagesCorporate Financial PlanningMuhaiminul IslamNo ratings yet

- Franchise Value - A Modern Approach To Security Analysis. (2004.ISBN0471647888)Document512 pagesFranchise Value - A Modern Approach To Security Analysis. (2004.ISBN0471647888)Favio C. Osorio PolarNo ratings yet

- PT Gajah Tunggal TBK GJTLDocument3 pagesPT Gajah Tunggal TBK GJTLDaniel Hanry SitompulNo ratings yet

- 4.1 LEMBAR KERJA-AkuntansiDocument33 pages4.1 LEMBAR KERJA-Akuntansiakuntansismkn5kabtangerangNo ratings yet

- 2019 FRM Prestudy Pe2Document174 pages2019 FRM Prestudy Pe2indymanNo ratings yet

- Clarkson Lumber Company (7.0)Document17 pagesClarkson Lumber Company (7.0)Hassan Mohiuddin100% (1)

- Financial AnalysisDocument8 pagesFinancial Analysisfelix robertNo ratings yet

- Bank ReconciliationDocument4 pagesBank Reconciliationrufamaegarcia07No ratings yet

- NZ Industry Financial DataDocument1,605 pagesNZ Industry Financial Datashashank kNo ratings yet

- Quantitative Reasoning TestDocument6 pagesQuantitative Reasoning TestHammad KhanNo ratings yet

- Extract Forex With Fundamental AnalysisDocument23 pagesExtract Forex With Fundamental Analysisfxindia1982% (11)

- DuffphelpsDocument1 pageDuffphelpsG ChaddiNo ratings yet

- Managerial EconomicsDocument7 pagesManagerial EconomicsJosua PagcaliwaganNo ratings yet

- Ega Hadi Prayitno Hudiono: Skills Personal Data EducationDocument23 pagesEga Hadi Prayitno Hudiono: Skills Personal Data EducationafriyadiNo ratings yet

- Sensitivity Analysis and Scenario Planning in Capital BudgetingDocument10 pagesSensitivity Analysis and Scenario Planning in Capital BudgetingAlexandre Cameron BorgesNo ratings yet

- Value Investing - Aswath DamodaranDocument43 pagesValue Investing - Aswath Damodaranapi-3821333100% (1)

- NPS 2021Document2 pagesNPS 2021Jagannath PradhanNo ratings yet

- Agri Market Chapter 4 - The SCP ModelDocument65 pagesAgri Market Chapter 4 - The SCP ModelbojaNo ratings yet

- Kajal BS Presentation 12Document15 pagesKajal BS Presentation 12Kajal JasejaNo ratings yet

- Unit 5: Cash Book: Learning OutcomesDocument20 pagesUnit 5: Cash Book: Learning OutcomesMonica NallathambiNo ratings yet

- Sara's OptionsDocument15 pagesSara's OptionsChirag Ahuja100% (3)

- Engineering Economy: Compound InterestDocument16 pagesEngineering Economy: Compound InterestLETADA NICOLE MAENo ratings yet

- Corporate finance project on Hindustan UnileverDocument20 pagesCorporate finance project on Hindustan UnileverAnkit Jaiswal0% (1)

- SPV1Document37 pagesSPV1ritu_gnimsNo ratings yet