Professional Documents

Culture Documents

Philippine HMO not liable for DST

Uploaded by

Lara YuloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Philippine HMO not liable for DST

Uploaded by

Lara YuloCopyright:

Available Formats

5. Philippine Health Care Providers, Inc. v.

Author: Camillas Group

Commissioner of Internal Revenue

600 SCRA 413 (2009)

Topic: Bill of Rights

Doctrines:

Legitimate enterprises enjoy the constitutional protection not to be taxed out of existence. Incurring

losses because of a tax imposition may be an acceptable consequence but killing the business of an

entity is another matter and should not be allowed. It is counter-productive and ultimately subversive

of the nations thrust towards a better economy which will ultimately benefit the majority of our

people

Facts:

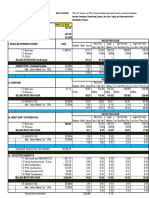

The petitioner, a prepaid health-care organization offering benefits to its members. The CIR found that

the organization had a deficiency in the payment of the DST under Section 185 of the 1997 Tax Code

which stipulated its implementation:

On all policies of insurance or bonds or obligations of the nature of indemnity for loss, damage, or

liability made or renewed by any person, association or company or corporation transacting the

business of accident, fidelity, employer's liability, plate, glass, steam boiler, burglar, elevator,

automatic sprinkler, or other branch of insurance (except life, marine, inland, and fire insurance)

The CIR sent a demand for the payment of deficiency taxes, including surcharges and interest, for

1996-1997 in the total amount of P224,702,641.18.

The petitioner protested to the CIR, but it didnt act on the appeal. Hence, the company had to go to the

CTA. The latter declared judgment against them and reduced the taxes.

It ordered them to pay 22 million pesos for deficiency VAT for 1997 and 31 million deficiency VAT for

1996.

CA denied the companys appeal and increased taxes to 55 and 68 million for 1996 to 1997.

Issues:

Whether or not the petitioner is liable to pay the DST on its health care agreement pursuant to Sec.185

of the National Internal Revenue Code of 1997?

No. It availed Tax Amnesty.

Held:

Petition granted. Petitioner is not contemplated to be included in or other branch insurance covered

by Section 185 of NIRC because it is a Health Maintenance Organization (HMO) and not an insurance

company. HMOs primary purpose is rendering service to its member by lowering prices and reducing

the cost rather than the risk of medical health. On the other hand, insurance businesses undertakes for

a consideration to indemnify its clients against loss, damage or liability arising from unknown or

contingent event. The term indemnify therein presuppose that a liability or claim has already been

incurred. In HMOs, there is no indemnity precisely because the member merely avails of medical

services to be paid or already paid in advance at a pre-agreed price under the agreements.

Moreover, HMOs play an important role in society as partners of the State in achieving its

constitutional mandate of providing citizens with affordable health services.

Also, the DST assessment of the petitioner for the years 1996 and 1997 became moot and

academic since it availed tax amnesty under RA 9480 on December 10, 2007. Thus, petitioner

is entitled to immunity from payment of taxes for taxable year 2005 and prior years.

THE POWER TO TAX IS NOT THE POWER TO

DESTROY

As a general rule, the power to tax is an incident of sovereignty and is unlimited in its range,

acknowledging in its very nature no limits, so that security against its abuse is to be found only in the

responsibility of the legislature, which imposes the tax on the constituency who is to pay it. So potent

indeed is the power that it was once opined that the power to tax involves the power to destroy

Petitioner claims that the assessed DST to date which amounts to P376 million is way beyond its net

worth of P259 million. Respondent never disputed these assertions. Given the realities on the ground,

imposing the DST on petitioner would be highly oppressive. It is not the purpose of the government to

throttle private business. On the contrary, the government ought to encourage private enterprise.

Petitioner, just like any concern organized for a lawful economic activity, has a right to maintain a

legitimate business.

Legitimate enterprises enjoy the constitutional protection not to be taxed out of existence. Incurring

losses because of a tax imposition may be an acceptable consequence but killing the business of an

entity is another matter and should not be allowed. It is counter-productive and ultimately subversive

of the nations thrust towards a better economy which will ultimately benefit the majority of our

people

You might also like

- Ivler V Judge San Pedro GR No 172716 11172010Document14 pagesIvler V Judge San Pedro GR No 172716 11172010Ubeng Juan Dela VegaNo ratings yet

- Philippine Health Care Providers, Inc. v. Commissioner of Internal RevenueDocument3 pagesPhilippine Health Care Providers, Inc. v. Commissioner of Internal RevenueJUAN REINO CABITACNo ratings yet

- 10 Zamora v. Heirs of Carmen IzquierdoDocument12 pages10 Zamora v. Heirs of Carmen IzquierdoJaypoll DiazNo ratings yet

- Request to Include Unaccrued Special Allowance DeniedDocument12 pagesRequest to Include Unaccrued Special Allowance Deniedsabrina gayoNo ratings yet

- Santos entitled to accounting as industrial partnerDocument3 pagesSantos entitled to accounting as industrial partnermichelle zatarainNo ratings yet

- Perla Compania de Seguros Vs RamoleteDocument2 pagesPerla Compania de Seguros Vs RamoleteMilcah MagpantayNo ratings yet

- Oro Enterprises, Inc. v. NLRC, GR 110861Document7 pagesOro Enterprises, Inc. v. NLRC, GR 110861Anonymous qRfOOBcYEJNo ratings yet

- Manila Memorial Vs Sec DSWDDocument4 pagesManila Memorial Vs Sec DSWDAngelGemp100% (1)

- Midterm Reviewer - Corporation LawDocument40 pagesMidterm Reviewer - Corporation LawLegalmindsNo ratings yet

- Sps. Cha v. CADocument1 pageSps. Cha v. CAJohn Mark RevillaNo ratings yet

- Case 4 PRC V de GuzmanDocument2 pagesCase 4 PRC V de GuzmanChuck NorrisNo ratings yet

- CIR - V - Algue, Inc., & CTA G.R. No. L-28896 February 17, 1988Document2 pagesCIR - V - Algue, Inc., & CTA G.R. No. L-28896 February 17, 1988piptipaybNo ratings yet

- COMELEC Rules on Party-List Nominee Substitution InvalidDocument3 pagesCOMELEC Rules on Party-List Nominee Substitution InvalidSunshine RubinNo ratings yet

- Civil Procedure Batch 2Document51 pagesCivil Procedure Batch 2Nicole Ziza100% (1)

- LITA ENTERPRISES v. Second Civil Cases DivisionDocument2 pagesLITA ENTERPRISES v. Second Civil Cases DivisionKent A. AlonzoNo ratings yet

- PNR vs. KanlaonDocument1 pagePNR vs. KanlaonXander 4thNo ratings yet

- G.R. Nos. 166299-300Document20 pagesG.R. Nos. 166299-300Henson MontalvoNo ratings yet

- Surety Liable Despite Absence of Written Principal ContractDocument2 pagesSurety Liable Despite Absence of Written Principal ContractJana Felice Paler GonzalezNo ratings yet

- Cuyugan vs. Santos, 34 Phil 100 (Case Digest)Document1 pageCuyugan vs. Santos, 34 Phil 100 (Case Digest)AycNo ratings yet

- Tatad Vs GarciaDocument2 pagesTatad Vs GarciaAngelie ManingasNo ratings yet

- Nufable v. NufableDocument14 pagesNufable v. NufableLeia VeracruzNo ratings yet

- SCA - Quo WarrantoDocument20 pagesSCA - Quo WarrantoPeter AllanNo ratings yet

- Smith Bell v. Sotelo, 44 Phil. 874Document3 pagesSmith Bell v. Sotelo, 44 Phil. 874catrina lobatonNo ratings yet

- Insurance Digest 1Document13 pagesInsurance Digest 1joenelNo ratings yet

- Pointers in Insurance Law PDFDocument5 pagesPointers in Insurance Law PDFMaria Diory RabajanteNo ratings yet

- Davao Light v. CADocument3 pagesDavao Light v. CAJolo RomanNo ratings yet

- Mejorada DoctrineDocument1 pageMejorada DoctrineWresen AnnNo ratings yet

- Time Inc v Reyes Libel CaseDocument1 pageTime Inc v Reyes Libel CaseMalcolm AdiongNo ratings yet

- Bayan Muna VS RomuloDocument2 pagesBayan Muna VS RomuloPawix 55No ratings yet

- Leon G. Maquera in His Own Behalf As Petitioner. Ramon Barrios For RespondentsDocument5 pagesLeon G. Maquera in His Own Behalf As Petitioner. Ramon Barrios For RespondentsMarjorie C. Sabijon-VillarinoNo ratings yet

- ALDECOA & CO. vs. WARNER BARNES & CO. 16 PHIL 423 - DigestDocument2 pagesALDECOA & CO. vs. WARNER BARNES & CO. 16 PHIL 423 - DigestMichelle LimNo ratings yet

- Transpo Cases and NotesDocument579 pagesTranspo Cases and NotesPaul Christopher PinedaNo ratings yet

- Maxima Realty Management Development Corp. v. Parkway Real Estate DevelopmentDocument2 pagesMaxima Realty Management Development Corp. v. Parkway Real Estate DevelopmentVian O.No ratings yet

- de Pedro Vs RomasanDocument8 pagesde Pedro Vs RomasanGladys BantilanNo ratings yet

- Reynoso v. Court of Appeals, G.R. No. 116124-25, November 22, 2000Document2 pagesReynoso v. Court of Appeals, G.R. No. 116124-25, November 22, 2000Metsuyo BariteNo ratings yet

- Pepsi Cola vs. Municipality of Tanauan, Leyte)Document1 pagePepsi Cola vs. Municipality of Tanauan, Leyte)Shall PMNo ratings yet

- Additional DigestDocument7 pagesAdditional DigestMel Manatad100% (1)

- Digested (TAX 1) - Phil Health Care Providers Vs CIRDocument2 pagesDigested (TAX 1) - Phil Health Care Providers Vs CIRChugsNo ratings yet

- No law impairing contractsDocument9 pagesNo law impairing contractsKleyr De Casa AlbeteNo ratings yet

- 1768 (Ang Pue & Co. vs. Sec. of Commerce and Industry, 5 SCRA 645 (1962) )Document4 pages1768 (Ang Pue & Co. vs. Sec. of Commerce and Industry, 5 SCRA 645 (1962) )Jillian BatacNo ratings yet

- The Insular Life v. Ebrado DigestDocument2 pagesThe Insular Life v. Ebrado DigestLiana AcubaNo ratings yet

- ConstiLaw Digested Cases - Exam 1 (Updated)Document57 pagesConstiLaw Digested Cases - Exam 1 (Updated)Charisse Domely Mendoza SuelloNo ratings yet

- 20 El Oriente, Fabrica de Tabacos, Inc., vs. Posadas 56 Phil. 147, September 21, 1931Document7 pages20 El Oriente, Fabrica de Tabacos, Inc., vs. Posadas 56 Phil. 147, September 21, 1931joyeduardoNo ratings yet

- CIR vs. Estate of Benigno TodaDocument9 pagesCIR vs. Estate of Benigno TodaJoshua CuentoNo ratings yet

- Plebiscite Required for Downgrading City StatusDocument3 pagesPlebiscite Required for Downgrading City Statusrgtan3No ratings yet

- CIR vs PAGCOR Ruling on Taxability of Employee Fringe BenefitsDocument2 pagesCIR vs PAGCOR Ruling on Taxability of Employee Fringe BenefitsendpointNo ratings yet

- British American Tobacco Tax Classification ChallengeDocument5 pagesBritish American Tobacco Tax Classification Challengergtan3No ratings yet

- Gachon Vs Devera, G.R. No. 116695Document11 pagesGachon Vs Devera, G.R. No. 116695Cyrus Pural EboñaNo ratings yet

- Conflicts Case Digest 9th SetDocument6 pagesConflicts Case Digest 9th SetJoedhel ApostolNo ratings yet

- ATP Case Digest Output (31-50)Document30 pagesATP Case Digest Output (31-50)Mik ZeidNo ratings yet

- Legal MaximDocument4 pagesLegal MaximVampire CatNo ratings yet

- Primelink V LazatinDocument1 pagePrimelink V LazatinEmer MartinNo ratings yet

- Yt BA 1: When Does The Property Become Clothed With Public Interest?Document92 pagesYt BA 1: When Does The Property Become Clothed With Public Interest?Nat HernandezNo ratings yet

- Gamboa V Teves G.R. No. 176579Document39 pagesGamboa V Teves G.R. No. 176579Gen GrajoNo ratings yet

- Philippine National Red Cross Autonomy UpheldDocument2 pagesPhilippine National Red Cross Autonomy UpheldJenell Cruz100% (1)

- 1786 - Moran, Jr. vs. Court of Appeals, L-59956, October 31, 1984 - DIGESTDocument2 pages1786 - Moran, Jr. vs. Court of Appeals, L-59956, October 31, 1984 - DIGESTI took her to my penthouse and i freaked itNo ratings yet

- CIR v. CLDCDocument7 pagesCIR v. CLDCFlorence UdaNo ratings yet

- Tax Deined - Philippine Health Care Vs CIR GR 167330Document2 pagesTax Deined - Philippine Health Care Vs CIR GR 167330Jem PagantianNo ratings yet

- 19 Philhealth V CirDocument5 pages19 Philhealth V CirKeangela LouiseNo ratings yet

- Case DigestsDocument158 pagesCase DigestsJustin Imadhay100% (4)

- PNB Liable for Losses from Fraudulent Check DepositsDocument2 pagesPNB Liable for Losses from Fraudulent Check DepositsLara YuloNo ratings yet

- PNB Liable for Losses from Unendorsed ChecksDocument2 pagesPNB Liable for Losses from Unendorsed ChecksLara YuloNo ratings yet

- Raynera v. Hiceta Et. Al., G.R. No. 120027 (April 21, 1999)Document2 pagesRaynera v. Hiceta Et. Al., G.R. No. 120027 (April 21, 1999)Lara YuloNo ratings yet

- AMLA case on extension of freeze orderDocument2 pagesAMLA case on extension of freeze orderLara Yulo100% (1)

- Barrido vs. Nonato G.R. 176492, October 20, 2014Document2 pagesBarrido vs. Nonato G.R. 176492, October 20, 2014Lara YuloNo ratings yet

- Children RightsDocument15 pagesChildren RightsrammstikNo ratings yet

- 12 Goan vs. Yatco - YULODocument2 pages12 Goan vs. Yatco - YULOLara YuloNo ratings yet

- Poe Vs ComelecDocument1 pagePoe Vs ComelecLara YuloNo ratings yet

- LOPEZ V FILIPINAS COMPAÑIA DE SEGUROSDocument1 pageLOPEZ V FILIPINAS COMPAÑIA DE SEGUROSLara YuloNo ratings yet

- Raynera v. Hiceta Et. Al., G.R. No. 120027 (April 21, 1999)Document1 pageRaynera v. Hiceta Et. Al., G.R. No. 120027 (April 21, 1999)Lara YuloNo ratings yet

- CRCDocument156 pagesCRCLara Yulo100% (1)

- Poe Vs ComelecDocument2 pagesPoe Vs ComelecLara YuloNo ratings yet

- 23 Oscar Villamaria, Jr. vs. Court of Appeals and Jerry v. Bustamante, Citing Jardin v. NLRC (Lao)Document2 pages23 Oscar Villamaria, Jr. vs. Court of Appeals and Jerry v. Bustamante, Citing Jardin v. NLRC (Lao)Lara YuloNo ratings yet

- 102 Compañia Maritima v. Insurance Company of North America, G.R. No. L-18965 (October 30, 1964)Document2 pages102 Compañia Maritima v. Insurance Company of North America, G.R. No. L-18965 (October 30, 1964)Ruby SantillanaNo ratings yet

- 12 Goan vs. Yatco - YULODocument2 pages12 Goan vs. Yatco - YULOLara YuloNo ratings yet

- de Zuzuarregui vs. Hon. Villarosa, Et. Al, G.R. 183788, April 5, 2010Document3 pagesde Zuzuarregui vs. Hon. Villarosa, Et. Al, G.R. 183788, April 5, 2010Lara Yulo100% (1)

- Resterio V PeopleDocument2 pagesResterio V PeopleLara YuloNo ratings yet

- 12 Sps Cha Vs CADocument2 pages12 Sps Cha Vs CALara YuloNo ratings yet

- Sps Cha Vs CADocument2 pagesSps Cha Vs CALara YuloNo ratings yet

- Validity of promissory notes despite claims of signing in blank and lack of considerationDocument1 pageValidity of promissory notes despite claims of signing in blank and lack of considerationLara YuloNo ratings yet

- Sps Cha Vs CADocument2 pagesSps Cha Vs CALara YuloNo ratings yet

- City of Manila vs. GarciaDocument1 pageCity of Manila vs. GarciaLara YuloNo ratings yet

- 07 Parel Vs PrudencioDocument1 page07 Parel Vs PrudencioLara YuloNo ratings yet

- Gillick V West Norfolk Health AuthorityDocument96 pagesGillick V West Norfolk Health AuthorityLara YuloNo ratings yet

- PNB Liable for Losses from Unendorsed ChecksDocument2 pagesPNB Liable for Losses from Unendorsed ChecksLara YuloNo ratings yet

- Alzua v. JohnsonDocument2 pagesAlzua v. JohnsonLara YuloNo ratings yet

- Taxation Law Review: Release of Rice Cargo and Vessel Upheld Due to Lack of Probable CauseDocument2 pagesTaxation Law Review: Release of Rice Cargo and Vessel Upheld Due to Lack of Probable CauseLara YuloNo ratings yet

- People vs. SerenasDocument2 pagesPeople vs. SerenasLara YuloNo ratings yet

- Poe Vs ComelecDocument2 pagesPoe Vs ComelecLara YuloNo ratings yet

- 55 Salas, Jr. vs. Aguila, G.R. 202370, September 23, 2013Document3 pages55 Salas, Jr. vs. Aguila, G.R. 202370, September 23, 2013Lara Yulo100% (1)

- Corporate Governance Assignment by JunaidDocument3 pagesCorporate Governance Assignment by JunaidTanzeel HassanNo ratings yet

- SFM PDFDocument260 pagesSFM PDFLaxmisha GowdaNo ratings yet

- Security agency cost report for NCRDocument25 pagesSecurity agency cost report for NCRRicardo DelacruzNo ratings yet

- Hill and Jones Chapter 4 SlidesDocument32 pagesHill and Jones Chapter 4 Slidesshameless101No ratings yet

- MTC Strategic Plan 2012 To 2016Document42 pagesMTC Strategic Plan 2012 To 2016Ash PillayNo ratings yet

- Policy On Prohibition of Child LaborDocument2 pagesPolicy On Prohibition of Child LaborkkyuvarajNo ratings yet

- Case Study 7.5 SPMDocument2 pagesCase Study 7.5 SPMgiscapindyNo ratings yet

- Straight Bill of LadingDocument2 pagesStraight Bill of LadingHafizUmarArshad100% (1)

- SKF Dom Prod Pricelist - Nov 2013 FinalDocument8 pagesSKF Dom Prod Pricelist - Nov 2013 FinalAnshul LoyaNo ratings yet

- ENY MRGN 016388 31012024 NSE DERV REM SignDocument1 pageENY MRGN 016388 31012024 NSE DERV REM Signycharansai0No ratings yet

- HACCP Assessment Audit ChecklistDocument6 pagesHACCP Assessment Audit ChecklistnataliatirtaNo ratings yet

- Prelim Quiz 2 Strategic ManagementDocument4 pagesPrelim Quiz 2 Strategic ManagementRoseNo ratings yet

- What Are Mutual Funds?Document8 pagesWhat Are Mutual Funds?ShilpiVaishkiyarNo ratings yet

- MAN Machine Material: Bottle Dented Too MuchDocument8 pagesMAN Machine Material: Bottle Dented Too Muchwaranya suttiwanNo ratings yet

- Case Study GuidelinesDocument4 pagesCase Study GuidelinesKhothi BhosNo ratings yet

- Marketing Management Chapter on Introducing New Market OfferingsDocument24 pagesMarketing Management Chapter on Introducing New Market OfferingslokioNo ratings yet

- FMV of Equity Shares As On 31st January 2018Document57 pagesFMV of Equity Shares As On 31st January 2018Manish Maheshwari100% (2)

- Basics of Accounting eBookDocument1,190 pagesBasics of Accounting eBookArun Balaji82% (11)

- My Dream Company: Why Join ITC Limited (Under 40 charsDocument9 pagesMy Dream Company: Why Join ITC Limited (Under 40 charsamandeep152No ratings yet

- Cheyne Capital ManagementDocument2 pagesCheyne Capital ManagementCheyne CapitalNo ratings yet

- Oxford Said MBA Brochure 2017 18 PDFDocument13 pagesOxford Said MBA Brochure 2017 18 PDFEducación ContinuaNo ratings yet

- VC Financing Guide: Stages & ProcessDocument19 pagesVC Financing Guide: Stages & ProcessVishnu NairNo ratings yet

- The Daimlerchrysler Merger - A Cultural Mismatch?Document10 pagesThe Daimlerchrysler Merger - A Cultural Mismatch?frankmdNo ratings yet

- Bot ContractDocument18 pagesBot ContractideyNo ratings yet

- 0452 s05 QP 2Document16 pages0452 s05 QP 2Nafisa AnwarAliNo ratings yet

- Union BankDocument7 pagesUnion BankChoice MyNo ratings yet

- Calculate Market Price and Amortization of Bonds Issued at a DiscountDocument5 pagesCalculate Market Price and Amortization of Bonds Issued at a DiscountKris Hazel RentonNo ratings yet

- Minors AgreementDocument12 pagesMinors AgreementDilip KumarNo ratings yet

- Scanner for CA Foundation covers key conceptsDocument34 pagesScanner for CA Foundation covers key conceptsMadhaan Aadhvick100% (2)

- Pioneering Portfolio ManagementDocument6 pagesPioneering Portfolio ManagementGeorge KyriakoulisNo ratings yet