Professional Documents

Culture Documents

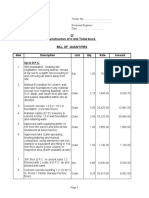

Project 1 FAR610 (2017)

Uploaded by

Siti Safika SapuraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project 1 FAR610 (2017)

Uploaded by

Siti Safika SapuraCopyright:

Available Formats

QUESTION 1

a) Explain, with reason, the appropriate method for Karratha Bhd to record the investment

in Namburg Bhd, Spring Bhd and Ashmore Bhd.

Since Namburg Bhd and Spring Bhd are subsidiaries of Karratha Bhd., the

appropriate method to account for these two companies is the acquisition method. All

assets and liabilities of these two companies should be combined with Karratha Bhd. as

a group in Consolidated Statement of Financial Statement. Ashmore Bhd is an associate

of Karratha Bhd. Karratha Nhd should account Ashmore Bhd using the equity method

that is the cost of investment plus share of post-acquisition reserves.

QUESTION 2

a) State the type of joint arrangements and explain the accounting treatments of each type

of the joint arrangements.

The MFRS 11 classifies joint arrangements into two types which are joint operations and

joint venture. A joint operation is a joint arrangement whereby the parties that have joint

control of the arrangements, for example joint operators. This type of joint operation

have rights to the assets, and obligations for the liabilities, relating to the arrangement. A

joint venture is a joint arrangement whereby the parties that have joint control of the

arrangement such as joint venture have rights to the net assets of the arrangement.

Firstly, the type of joint arrangement is joint operations or know as joint operator. This

joint arrangement shall recognise in relation to its interest in a joint operation which are:

a. Its assets, including its share of any assets held jointly.

b. Its liabilities, including its share of any liabilities incurred jointly.

c. Its revenue from the sale if its share of the output arising from the joint operation.

d. Its share of the revenue from the sale of the output by the joint operation and

e. Its expenses, including its share of any expenses incurred jointly.

For the other type of joint arrangement is a joint venturer. This type of arrangement shall

be recognise its interest in a joint venture as an investment and shall account for that

investment using the equity method in accordance with MFRS 128 Investment in

Associates and Joint Venture unless the entity is exempted from applying the equity

method as specified in that standard.

b) Explain the accounting treatment for intercompany sales of inventories with a joint venture if

some of the inventories from these sale transactions are still held by the buyer on reporting

date.

In these situation, unrealised profit or losses arise. Accordingly, consolidated adjustment

is required to eliminate the investors share of these unrealised profit and losses.

You might also like

- Deegan5e SM Ch34Document6 pagesDeegan5e SM Ch34Rachel TannerNo ratings yet

- 3 Joint Arrange. Ifrs 11Document6 pages3 Joint Arrange. Ifrs 11DM BuenconsejoNo ratings yet

- General de Jesus CollegeDocument16 pagesGeneral de Jesus CollegeErwin Labayog MedinaNo ratings yet

- As-27 (Financial Reporting of Interests in Joint Ventures)Document10 pagesAs-27 (Financial Reporting of Interests in Joint Ventures)api-3828505No ratings yet

- Other Consolidation Reporting Issues: © 2019 Mcgraw-Hill EducationDocument20 pagesOther Consolidation Reporting Issues: © 2019 Mcgraw-Hill EducationNeha SainiNo ratings yet

- Joint ArrangementsDocument22 pagesJoint ArrangementsJhoanNo ratings yet

- IAS 31 Interests in Joint Ventures: Technical SummaryDocument3 pagesIAS 31 Interests in Joint Ventures: Technical SummaryFoititika.netNo ratings yet

- ACC614 Lecture 3 Joint VentureDocument29 pagesACC614 Lecture 3 Joint VentureGEORGINA KINIKANo ratings yet

- Pfrs 11Document25 pagesPfrs 11rena chavezNo ratings yet

- Spectran Finals ForumDocument2 pagesSpectran Finals ForumCherryjane RuizNo ratings yet

- Joint Arrangements QuestionsDocument5 pagesJoint Arrangements QuestionsRichard LamagnaNo ratings yet

- 8925 Joint Arrangements Lecture NotesDocument18 pages8925 Joint Arrangements Lecture NotesBabyrose Pelobello GnayasgaNo ratings yet

- P2 Joint Arrangements - GuerreroDocument17 pagesP2 Joint Arrangements - GuerreroCelen OchocoNo ratings yet

- Learning Unit 12 - Joint ArrangementsDocument18 pagesLearning Unit 12 - Joint ArrangementsThulani NdlovuNo ratings yet

- Amalgamation NoteDocument4 pagesAmalgamation Notekscbwrsyd5No ratings yet

- Chapter One Joint ArrangementDocument28 pagesChapter One Joint Arrangementሔርሞን ይድነቃቸውNo ratings yet

- Adv Fa I CH 1Document30 pagesAdv Fa I CH 1Addi Såïñt GeorgeNo ratings yet

- Joint ArrangementsDocument88 pagesJoint ArrangementsJustine Kate Ferrer BascoNo ratings yet

- IAS31Document3 pagesIAS31Mohammad Faisal SaleemNo ratings yet

- Business Combination and ConsolidationDocument21 pagesBusiness Combination and ConsolidationRacez Gabon93% (14)

- Accounting For Special Transactions Mid - TermDocument12 pagesAccounting For Special Transactions Mid - TermJacqueline OrtegaNo ratings yet

- AC511Document3 pagesAC511Kimkim EdilloNo ratings yet

- Accounting For Joint Arrangements: Workshop Eleven, Week 11Document14 pagesAccounting For Joint Arrangements: Workshop Eleven, Week 11Krishna SinghaniaNo ratings yet

- Section 19 Business Combination and Goodwill 1Document17 pagesSection 19 Business Combination and Goodwill 1AdrianneNo ratings yet

- AFAR-13 (Joint Arrangements)Document6 pagesAFAR-13 (Joint Arrangements)MABI ESPENIDONo ratings yet

- Accounting Standard (As) 14 (Issued 1994) Accounting ForamalgamationsDocument9 pagesAccounting Standard (As) 14 (Issued 1994) Accounting ForamalgamationsasifanisNo ratings yet

- Accounting StandardsDocument23 pagesAccounting StandardsSreeja BalajiNo ratings yet

- Joint Arrangement With The AssignmentDocument28 pagesJoint Arrangement With The AssignmentIvan Bendiola0% (2)

- Adv 1Document26 pagesAdv 1liyneh mebrahituNo ratings yet

- Afar ToaDocument22 pagesAfar ToaVanessa Anne Acuña DavisNo ratings yet

- Accounting StandardsDocument30 pagesAccounting StandardssandychawatNo ratings yet

- Business Combination and ConsolidationDocument21 pagesBusiness Combination and ConsolidationCristel TannaganNo ratings yet

- Advanced AccDocument12 pagesAdvanced AccchikonhinetsaitrishNo ratings yet

- Chapter 1 Accounting For Joint ArrangementsDocument3 pagesChapter 1 Accounting For Joint ArrangementsPrinceNo ratings yet

- Amalgamation of CompaniesDocument8 pagesAmalgamation of CompaniesVikram NaniNo ratings yet

- Section 15Document23 pagesSection 15Abata BageyuNo ratings yet

- NotesDocument15 pagesNotesBeh Jia AiNo ratings yet

- Sri Lanka Accounting Standard-LKAS 31: Interests in Joint VenturesDocument17 pagesSri Lanka Accounting Standard-LKAS 31: Interests in Joint VenturesMaithri Vidana KariyakaranageNo ratings yet

- 14 Easy Way To Learn AmalgamationDocument3 pages14 Easy Way To Learn Amalgamationsudhy009100% (1)

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument46 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionKeith Anthony AmorNo ratings yet

- Chapter 3 Joint ArrangementsDocument4 pagesChapter 3 Joint ArrangementsKE XIN NGNo ratings yet

- ACCOUNTING-IMPLICATION Merger and AcquisitionDocument32 pagesACCOUNTING-IMPLICATION Merger and AcquisitionPrison PubgNo ratings yet

- AmalgamationDocument3 pagesAmalgamationKdlr RRNo ratings yet

- This Study Resource Was: Long Quiz No. 1Document7 pagesThis Study Resource Was: Long Quiz No. 1JS ItingNo ratings yet

- This Study Resource Was: Long Quiz No. 1Document7 pagesThis Study Resource Was: Long Quiz No. 1JS ItingNo ratings yet

- Vdocuments - MX - Chapter 5 578590693cc3a PDFDocument43 pagesVdocuments - MX - Chapter 5 578590693cc3a PDFAmrita TamangNo ratings yet

- Business Com Theories (Q1)Document10 pagesBusiness Com Theories (Q1)수지No ratings yet

- Ifrs 11: Joint Arrangements Joint Arrangement Joint ControlDocument4 pagesIfrs 11: Joint Arrangements Joint Arrangement Joint ControlMariette Alex Agbanlog100% (1)

- "Preface" "Hand Book"Document13 pages"Preface" "Hand Book"deepakgrajani_355197No ratings yet

- Article 44 of Circular 200-2014 Accounting Regime For BCCDocument12 pagesArticle 44 of Circular 200-2014 Accounting Regime For BCCLance WhiteNo ratings yet

- Joint ArrrangementsDocument5 pagesJoint ArrrangementsGIGI BODONo ratings yet

- Accounting For AmalgamationsDocument17 pagesAccounting For AmalgamationsJenish SanghaviNo ratings yet

- Purchase Method ConsolidationDocument4 pagesPurchase Method Consolidationsalehin1969No ratings yet

- Page 1 of 20 Chapter 6 - Accounting For PartnershipsDocument20 pagesPage 1 of 20 Chapter 6 - Accounting For PartnershipsELLAINE MA EBLACASNo ratings yet

- The Same As It Would Have Been If The Original Payment Had Been Debited Initially To An Expense AccountDocument37 pagesThe Same As It Would Have Been If The Original Payment Had Been Debited Initially To An Expense AccountNolyne Faith O. VendiolaNo ratings yet

- Lobrigas - Week3 Ia3Document39 pagesLobrigas - Week3 Ia3Hensel SevillaNo ratings yet

- 0901b8038042b661 PDFDocument8 pages0901b8038042b661 PDFWaqasAhmedNo ratings yet

- Chap 06 Ans Part 2Document18 pagesChap 06 Ans Part 2Janelle Joyce MuhiNo ratings yet

- Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Document28 pagesSelf-Instructional Manual (SIM) For Self-Directed Learning (SDL)Monique Dianne Dela VegaNo ratings yet

- Coca-Cola Summer Intern ReportDocument70 pagesCoca-Cola Summer Intern ReportSourabh NagpalNo ratings yet

- Atom Medical Usa Model 103 Infa Warmer I - 2 PDFDocument7 pagesAtom Medical Usa Model 103 Infa Warmer I - 2 PDFLuqman BhanuNo ratings yet

- Usha Unit 1 GuideDocument2 pagesUsha Unit 1 Guideapi-348847924No ratings yet

- Andrews C145385 Shareholders DebriefDocument9 pagesAndrews C145385 Shareholders DebriefmrdlbishtNo ratings yet

- Common Base AmplifierDocument6 pagesCommon Base AmplifierMuhammad SohailNo ratings yet

- 990-91356A ACRD300 CE-UL TechnicalSpecifications Part2Document25 pages990-91356A ACRD300 CE-UL TechnicalSpecifications Part2Marvin NerioNo ratings yet

- BS en 118-2013-11Document22 pagesBS en 118-2013-11Abey VettoorNo ratings yet

- M70-700 4th or 5th Axis Install ProcedureDocument5 pagesM70-700 4th or 5th Axis Install ProcedureNickNo ratings yet

- QuestionDocument7 pagesQuestionNgọc LuânNo ratings yet

- Summary - A Short Course On Swing TradingDocument2 pagesSummary - A Short Course On Swing TradingsumonNo ratings yet

- Marshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianDocument3 pagesMarshall Baillieu: Ian Marshall Baillieu (Born 6 June 1937) Is A Former AustralianValenVidelaNo ratings yet

- SVPWM PDFDocument5 pagesSVPWM PDFmauricetappaNo ratings yet

- PRELEC 1 Updates in Managerial Accounting Notes PDFDocument6 pagesPRELEC 1 Updates in Managerial Accounting Notes PDFRaichele FranciscoNo ratings yet

- People V Superior Court (Baez)Document19 pagesPeople V Superior Court (Baez)Kate ChatfieldNo ratings yet

- Ucbackup Faq - Commvault: GeneralDocument8 pagesUcbackup Faq - Commvault: GeneralhherNo ratings yet

- Teralight ProfileDocument12 pagesTeralight ProfileMohammed TariqNo ratings yet

- NCR Minimum WageDocument2 pagesNCR Minimum WageJohnBataraNo ratings yet

- Safety Inspection Checklist Project: Location: Inspector: DateDocument2 pagesSafety Inspection Checklist Project: Location: Inspector: Dateyono DaryonoNo ratings yet

- Emco - Unimat 3 - Unimat 4 LathesDocument23 pagesEmco - Unimat 3 - Unimat 4 LathesEnrique LueraNo ratings yet

- Inspection and Test Plan Piling: 1. Document ReviewDocument3 pagesInspection and Test Plan Piling: 1. Document ReviewZara BhaiNo ratings yet

- 1 s2.0 S0304389421026054 MainDocument24 pages1 s2.0 S0304389421026054 MainFarah TalibNo ratings yet

- Appleyard ResúmenDocument3 pagesAppleyard ResúmenTomás J DCNo ratings yet

- Invoice Acs # 18 TDH Dan Rof - Maret - 2021Document101 pagesInvoice Acs # 18 TDH Dan Rof - Maret - 2021Rafi RaziqNo ratings yet

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Document6 pagesType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasingheNo ratings yet

- Fire and Life Safety Assessment ReportDocument5 pagesFire and Life Safety Assessment ReportJune CostalesNo ratings yet

- CoP - 6.0 - Emergency Management RequirementsDocument25 pagesCoP - 6.0 - Emergency Management RequirementsAnonymous y1pIqcNo ratings yet

- MNO Manuale Centrifughe IngleseDocument52 pagesMNO Manuale Centrifughe IngleseChrist Rodney MAKANANo ratings yet

- PPL Exam Secrets Guide: Aviation Law & Operational ProceduresFrom EverandPPL Exam Secrets Guide: Aviation Law & Operational ProceduresRating: 4.5 out of 5 stars4.5/5 (3)

- Preclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1From EverandPreclinical Pathology Review 2023: For USMLE Step 1 and COMLEX-USA Level 1Rating: 5 out of 5 stars5/5 (1)

- Improve Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersFrom EverandImprove Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersRating: 4 out of 5 stars4/5 (14)

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersFrom EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersNo ratings yet

- Note Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusFrom EverandNote Taking Mastery: How to Supercharge Your Note Taking Skills & Study Like a GeniusRating: 3.5 out of 5 stars3.5/5 (10)

- NASM CPT Study Guide 2024-2025: Review Book with 360 Practice Questions and Answer Explanations for the Certified Personal Trainer ExamFrom EverandNASM CPT Study Guide 2024-2025: Review Book with 360 Practice Questions and Answer Explanations for the Certified Personal Trainer ExamNo ratings yet

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessFrom EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessRating: 4.5 out of 5 stars4.5/5 (17)

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASFrom EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASNo ratings yet

- Adult CCRN Exam Premium: For the Latest Exam Blueprint, Includes 3 Practice Tests, Comprehensive Review, and Online Study PrepFrom EverandAdult CCRN Exam Premium: For the Latest Exam Blueprint, Includes 3 Practice Tests, Comprehensive Review, and Online Study PrepNo ratings yet

- CUNY Proficiency Examination (CPE): Passbooks Study GuideFrom EverandCUNY Proficiency Examination (CPE): Passbooks Study GuideNo ratings yet

- 2024/2025 ASVAB For Dummies: Book + 7 Practice Tests + Flashcards + Videos OnlineFrom Everand2024/2025 ASVAB For Dummies: Book + 7 Practice Tests + Flashcards + Videos OnlineNo ratings yet

- USMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewFrom EverandUSMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewRating: 4.5 out of 5 stars4.5/5 (7)

- Norman Hall's Firefighter Exam Preparation BookFrom EverandNorman Hall's Firefighter Exam Preparation BookRating: 5 out of 5 stars5/5 (3)

- Check Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreFrom EverandCheck Your English Vocabulary for TOEFL: Essential words and phrases to help you maximise your TOEFL scoreRating: 5 out of 5 stars5/5 (1)

- Clinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2From EverandClinical Internal Medicine Review 2023: For USMLE Step 2 CK and COMLEX-USA Level 2No ratings yet

- The Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)From EverandThe Official U.S. Army Survival Guide: Updated Edition: FM 30-05.70 (FM 21-76)Rating: 4 out of 5 stars4/5 (1)

- Certified Professional Coder (CPC): Passbooks Study GuideFrom EverandCertified Professional Coder (CPC): Passbooks Study GuideRating: 5 out of 5 stars5/5 (1)

- Pilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CFrom EverandPilot's Handbook of Aeronautical Knowledge (2024): FAA-H-8083-25CNo ratings yet

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeFrom EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeRating: 3.5 out of 5 stars3.5/5 (3)

- College Level Anatomy and Physiology: Essential Knowledge for Healthcare Students, Professionals, and Caregivers Preparing for Nursing Exams, Board Certifications, and BeyondFrom EverandCollege Level Anatomy and Physiology: Essential Knowledge for Healthcare Students, Professionals, and Caregivers Preparing for Nursing Exams, Board Certifications, and BeyondNo ratings yet

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsFrom EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsRating: 4.5 out of 5 stars4.5/5 (77)

- Employment Law: a Quickstudy Digital Law ReferenceFrom EverandEmployment Law: a Quickstudy Digital Law ReferenceRating: 1 out of 5 stars1/5 (1)

- Summary of Sapiens: A Brief History of Humankind By Yuval Noah HarariFrom EverandSummary of Sapiens: A Brief History of Humankind By Yuval Noah HarariRating: 1 out of 5 stars1/5 (3)