Professional Documents

Culture Documents

Ratios

Uploaded by

myinfog8583Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratios

Uploaded by

myinfog8583Copyright:

Available Formats

Balance Sheet Ratio Analysis

Important Balance Sheet Ratios measure liquidity and solvency (a business's ability

to pay its bills as they come due) and leverage (the extent to which the business is

dependent on creditors' funding). They include the following ratios:

Liquidity Ratios:These ratios indicate the ease of turning assets into cash. They

include the Current Ratio, Quick Ratio, and Working Capital.

Current Ratios. The Current Ratio is one of the best known measures of financial

strength. It is figured as shown below:

Total Current Assets

Current Ratio = ____________________

Total Current Liabilities

The main question this ratio addresses is: "Does your business have enough current

assets to meet the payment schedule of its current debts with a margin of safety for

possible losses in current assets, such as inventory shrinkage or collectable

accounts?" A generally acceptable current ratio is 2 to 1. But whether or not a

specific ratio is satisfactory depends on the nature of the business and the

characteristics of its current assets and liabilities. The minimum acceptable current

ratio is obviously 1:1, but that relationship is usually playing it too close for comfort.

If you decide your business's current ratio is too low, you may be able to raise it by:

• Paying some debts.

• Increasing your current assets from loans or other borrowings with a maturity

of more than one year.

• Converting non-current assets into current assets.

• Increasing your current assets from new equity contributions.

• Putting profits back into the business.

Quick Ratios. The Quick Ratio is sometimes called the "acid-test" ratio and is one of

the best measures of liquidity. It is figured as shown below:

Cash + Government Securities + Receivables

Quick Ratio = _________________________________________

Total Current Liabilities

The Quick Ratio is a much more exacting measure than the Current Ratio. By

excluding inventories, it concentrates on the really liquid assets, with value that is

fairly certain. It helps answer the question: "If all sales revenues should disappear,

could my business meet its current obligations with the readily convertible `quick'

funds on hand?"

An acid-test of 1:1 is considered satisfactory unless the majority of your "quick

assets" are in accounts receivable, and the pattern of accounts receivable collection

lags behind the schedule for paying current liabilities.

Working Capital. Working Capital is more a measure of cash flow than a ratio. The

result of this calculation must be a positive number. It is calculated as shown below:

Working Capital = Total Current Assets - Total Current Liabilities

Bankers look at Net Working Capital over time to determine a company's ability to

weather financial crises. Loans are often tied to minimum working capital

requirements.

A general observation about these three Liquidity Ratios is that the higher they are

the better, especially if you are relying to any significant extent on creditor money to

finance assets.

Leverage Ratio:This Debt/Worth or Leverage Ratio indicates the extent to which

the business is reliant on debt financing (creditor money versus owner's equity):

Total Liabilities

Debt/Worth Ratio = _______________

Net Worth

Generally, the higher this ratio, the more risky a creditor will perceive its exposure in

your business, making it correspondingly harder to obtain credit.

Income Statement Ratio Analysis

Gross Margin Ratio:This ratio is the percentage of sales dollars left after

subtracting the cost of goods sold from net sales. It measures the percentage of

sales dollars remaining (after obtaining or manufacturing the goods sold) available to

pay the overhead expenses of the company.

Comparison of your business ratios to those of similar businesses will reveal the

relative strengths or weaknesses in your business. The Gross Margin Ratio is

calculated as follows:

Gross Profit

Gross Margin Ratio = _______________

Net Sales

(Gross Profit = Net Sales - Cost of Goods Sold)

Net Profit Margin Ratio:This ratio is the percentage of sales dollars left after

subtracting the Cost of Goods sold and all expenses, except income taxes. It

provides a good opportunity to compare your company's "return on sales" with the

performance of other companies in your industry. It is calculated before income tax

because tax rates and tax liabilities vary from company to company for a wide

variety of reasons, making comparisons after taxes much more difficult. The Net

Profit Margin Ratio is calculated as follows:

Net Profit Before Tax

Net Profit Margin Ratio = _____________________

Net Sales

Management Ratios:Other important ratios, often referred to as Management

Ratios, are also derived from Balance Sheet and Statement of Income information.

Inventory Turnover Ratio:This ratio reveals how well inventory is being managed.

It is important because the more times inventory can be turned in a given operating

cycle, the greater the profit. The Inventory Turnover Ratio is calculated as follows:

Net Sales

Inventory Turnover Ratio = ___________________________

Average Inventory at Cost

Accounts Receivable Turnover Ratio:This ratio indicates how well accounts

receivable are being collected. If receivables are not collected reasonably in

accordance with their terms, management should rethink its collection policy. If

receivables are excessively slow in being converted to cash, liquidity could be

severely impaired. The Accounts Receivable Turnover Ratio is calculated as follows:

Net Credit Sales/Year

__________________ = Daily Credit Sales

365 Days/Year

Accounts Receivable

Accounts Receivable Turnover (in days) = _________________________

Daily Credit Sales

Return on Assets Ratio:This measures how efficiently profits are being generated

from the assets employed in the business when compared with the ratios of firms in

a similar business. A low ratio in comparison with industry averages indicates an

inefficient use of business assets. The Return on Assets Ratio is calculated as follows:

Net Profit Before Tax

Return on Assets = ________________________

Total Assets

Return on Investment (ROI) Ratio.:The ROI is perhaps the most important ratio

of all. It is the percentage of return on funds invested in the business by its owners.

In short, this ratio tells the owner whether or not all the effort put into the business

has been worthwhile. If the ROI is less than the rate of return on an alternative, risk-

free investment such as a bank savings account, the owner may be wiser to sell the

company, put the money in such a savings instrument, and avoid the daily struggles

of small business management. The ROI is calculated as follows:

Net Profit before Tax

Return on Investment = ____________________

Net Worth

These Liquidity, Leverage, Profitability, and Management Ratios allow the business

owner to identify trends in a business and to compare its progress with the

performance of others through data published by various sources. The owner may

thus determine the business's relative strengths and weaknesses

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Oyo Rooms-Case StudyDocument13 pagesOyo Rooms-Case StudySHAMIK SHETTY50% (4)

- Brain Chip ReportDocument30 pagesBrain Chip Reportsrikanthkalemla100% (3)

- Neligence: Allows Standards of Acceptable Behavior To Be Set For SocietyDocument3 pagesNeligence: Allows Standards of Acceptable Behavior To Be Set For SocietyransomNo ratings yet

- (Template) Grade 6 Science InvestigationDocument6 pages(Template) Grade 6 Science InvestigationYounis AhmedNo ratings yet

- Tadesse JaletaDocument160 pagesTadesse JaletaAhmed GemedaNo ratings yet

- 110 TOP Survey Interview QuestionsDocument18 pages110 TOP Survey Interview QuestionsImmu100% (1)

- Faxphone l100 Faxl170 l150 I-Sensys Faxl170 l150 Canofax L250seriesDocument46 pagesFaxphone l100 Faxl170 l150 I-Sensys Faxl170 l150 Canofax L250seriesIon JardelNo ratings yet

- My PDSDocument16 pagesMy PDSRosielyn Fano CatubigNo ratings yet

- Summer Internship ReportDocument135 pagesSummer Internship Reportsonal chandra0% (1)

- Settlement of Piled Foundations Using Equivalent Raft ApproachDocument17 pagesSettlement of Piled Foundations Using Equivalent Raft ApproachSebastian DraghiciNo ratings yet

- Tutorial 3 Ans Tutorial 3 AnsDocument3 pagesTutorial 3 Ans Tutorial 3 AnsShoppers CartNo ratings yet

- MBA Third Semester Model Question Paper - 2009: Management and Organization Development-MU0002 (2 Credits)Document11 pagesMBA Third Semester Model Question Paper - 2009: Management and Organization Development-MU0002 (2 Credits)ManindersuriNo ratings yet

- MVD1000 Series Catalogue PDFDocument20 pagesMVD1000 Series Catalogue PDFEvandro PavesiNo ratings yet

- 1120 Assessment 1A - Self-Assessment and Life GoalDocument3 pages1120 Assessment 1A - Self-Assessment and Life GoalLia LeNo ratings yet

- Java Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingDocument2 pagesJava Interview Questions: Interfaces, Abstract Classes, Overloading, OverridingGopal JoshiNo ratings yet

- Labov-DIFUSÃO - Resolving The Neogrammarian ControversyDocument43 pagesLabov-DIFUSÃO - Resolving The Neogrammarian ControversyGermana RodriguesNo ratings yet

- Kids' Web 1 S&s PDFDocument1 pageKids' Web 1 S&s PDFkkpereiraNo ratings yet

- BICON Prysmian Cable Cleats Selection ChartDocument1 pageBICON Prysmian Cable Cleats Selection ChartMacobNo ratings yet

- Astrology - House SignificationDocument4 pagesAstrology - House SignificationsunilkumardubeyNo ratings yet

- Meta Trader 4Document2 pagesMeta Trader 4Alexis Chinchay AtaoNo ratings yet

- Important TemperatefruitsDocument33 pagesImportant TemperatefruitsjosephinNo ratings yet

- Jesus' Death on the Cross Explored Through Theological ModelsDocument13 pagesJesus' Death on the Cross Explored Through Theological ModelsKhristian Joshua G. JuradoNo ratings yet

- Final Key 2519Document2 pagesFinal Key 2519DanielchrsNo ratings yet

- Compro Russindo Group Tahun 2018 UpdateDocument44 pagesCompro Russindo Group Tahun 2018 UpdateElyza Farah FadhillahNo ratings yet

- Red Orchid - Best PracticesDocument80 pagesRed Orchid - Best PracticeslabiaernestoNo ratings yet

- As If/as Though/like: As If As Though Looks Sounds Feels As If As If As If As Though As Though Like LikeDocument23 pagesAs If/as Though/like: As If As Though Looks Sounds Feels As If As If As If As Though As Though Like Likemyint phyoNo ratings yet

- ModalsDocument13 pagesModalsJose CesistaNo ratings yet

- ms3 Seq 01 Expressing Interests With Adverbs of FrequencyDocument3 pagesms3 Seq 01 Expressing Interests With Adverbs of Frequencyg27rimaNo ratings yet

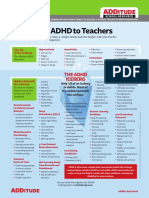

- Explaining ADHD To TeachersDocument1 pageExplaining ADHD To TeachersChris100% (2)

- Developing An Instructional Plan in ArtDocument12 pagesDeveloping An Instructional Plan in ArtEunice FernandezNo ratings yet