Professional Documents

Culture Documents

Layout

Uploaded by

Cid Benedict PabalanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Layout

Uploaded by

Cid Benedict PabalanCopyright:

Available Formats

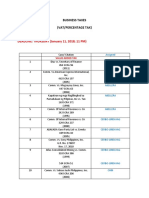

Times New Roman Size 14

1.5 Spacing

Margin:

Left 1.5 Top 1.2

Right 1 Bottom 1

TITLE BANK OF AMERICA, NT & SA v. CA, INTER-RESIN INDUSTRIAL CORPORATION, FRANCISCO

Bold, Center TRAJANO, JOHN DOE AND JANE DOE

G.R. No. 105395, December 10, 1993, VITUG, J.

A letter of credit is a financial device developed to facilitate commercial transactions.

DOCTRINE Banks play different roles in such transactions, each of which carries different rights and liabilities;

Full Block if a bank is an advising bank based on the provisions in the letter of credit, and other documents

Italicize presented as evidence, it incurs no liability under the letter of credit as its only role is to inform a

possible client of the existence of the letter of credit, nothing more.

BODY Facts:

Full Block

Bank of America entered into an Irrevocable Letter of Credit purportedly issued by Bank

of Ayudhya for the account of General Chemicals Ltd. to cover the sale of plastic ropes and

agricultural files, with Bank of America as the advising bank and Inter-Resin as the beneficiary.

Bank of America wrote Inter-Resin of the foregoing and transmitted the letter of credit. Inter-

Resin then sought to confirm the letter of credit, but Bank of America did not, as they explained

that there was no need for confirmation because the letter would not be transmitted if it were

not genuine.

Relying on this, Inter-Resin sought to avail of the letter of credit, using it to ship rope to

General Chemicals. Bank of America then issued checks in favor of Inter-Resin, after which it

informed Bank of Ayudhya of the availment of the letter of credit, seeking reimbursement in the

process. Bank of Ayudhya declared the letter of credit fraudulent, so Bank of America stopped the

processing of Inter-Resin's documents.

Issue:

Whether or not Bank of America incurred any liability to the beneficiary (Inter-Resin)

under the letter of credit.

Ruling:

NO. Bank of America merely acted as an advising bank. A letter of credit is a financial

device developed by merchants to facilitate commercial transactions. It was developed as an

attempt to satisfy the seemingly irreconcilable interests of a seller, who refuses to part with his

goods before he is paid, and a buyer, who wants to have control of the goods before paying.

To break the impasse, the buyer (here, General Chemicals) may be required to contract a

bank to issue a letter of credit in favor of the seller so that, by virtue of the letter, the issuing bank

(here, Bank of Ayudhya) can authorize the seller (here, Inter-Resin) to draw drafts and engage to

pay them upon presentment along with tender of documents required by the letter of credits

(such documents are those evidencing the shipment). Once the credit is established, the seller

ships the goods to the buyer and in the process the required shipping documents. To get paid, the

seller executes a draft and presents it together with the required documents to the issuing bank.

The issuing bank redeems the draft and pays cash to the seller if it finds that the documents

submitted by the seller conform with what the letter of credit requires. The bank then obtains

possession of the documents upon paying the seller. The transaction is completed when the

buyer reimburses the issuing bank and acquires the documents entitling him to the goods. Under

this arrangement, the seller gets paid only if he delivers the documents of title over the goods,

while the buyer acquires said documents and control over the goods only after reimbursing the

bank.

You might also like

- Davao City Chapter: Integrated Bar of The Philippines Revised Schedule of Minimum Attorney'S FeesDocument3 pagesDavao City Chapter: Integrated Bar of The Philippines Revised Schedule of Minimum Attorney'S FeesCid Benedict Pabalan100% (2)

- Mercantile 2016 PDFDocument67 pagesMercantile 2016 PDFCyd MatawaranNo ratings yet

- Davao City Chapter: Integrated Bar of The Philippines Revised Schedule of Minimum Attorney'S FeesDocument3 pagesDavao City Chapter: Integrated Bar of The Philippines Revised Schedule of Minimum Attorney'S FeesCid Benedict Pabalan100% (2)

- CE 4 2ndDocument2 pagesCE 4 2ndCid Benedict PabalanNo ratings yet

- Tarrifs and Customs CodeDocument75 pagesTarrifs and Customs CodeCid Benedict PabalanNo ratings yet

- Laperal CaseDocument7 pagesLaperal CaseYan PascualNo ratings yet

- Other FormsDocument13 pagesOther FormsCid Benedict PabalanNo ratings yet

- By Cid Benedict D. Pabalan: Torts First Exam Hot Tips From Atty. PanchoDocument1 pageBy Cid Benedict D. Pabalan: Torts First Exam Hot Tips From Atty. PanchoCid Benedict PabalanNo ratings yet

- What Do You Want To Do With Your Booking?: Hi Guest!Document5 pagesWhat Do You Want To Do With Your Booking?: Hi Guest!Cid Benedict PabalanNo ratings yet

- 5 CorpoDocument46 pages5 CorpointerscNo ratings yet

- Past Exam LaborDocument2 pagesPast Exam LaborCid Benedict PabalanNo ratings yet

- English Plus PrepositionDocument8 pagesEnglish Plus PrepositionCid Benedict PabalanNo ratings yet

- TortsDocument193 pagesTortsCid Benedict PabalanNo ratings yet

- NIL Case Outline DigestDocument44 pagesNIL Case Outline DigestCid Benedict PabalanNo ratings yet

- Donor's Tax Codal With Ra 10963 AmendmentDocument3 pagesDonor's Tax Codal With Ra 10963 AmendmentCid Benedict PabalanNo ratings yet

- Exercise: Subject and Verb Agreement ExerciseDocument4 pagesExercise: Subject and Verb Agreement ExerciseCid Benedict PabalanNo ratings yet

- Pre-Week Notes On Labor Law For 2014 Bar ExamsDocument134 pagesPre-Week Notes On Labor Law For 2014 Bar ExamsGinMa Teves100% (7)

- Exercise: Subject and Verb Agreement ExerciseDocument4 pagesExercise: Subject and Verb Agreement ExerciseCid Benedict PabalanNo ratings yet

- Laperal CaseDocument7 pagesLaperal CaseYan PascualNo ratings yet

- SEC Express System - Order ConfirmationDocument2 pagesSEC Express System - Order ConfirmationCid Benedict PabalanNo ratings yet

- Pabalan Tax 2 Digests Second SetDocument13 pagesPabalan Tax 2 Digests Second SetCid Benedict PabalanNo ratings yet

- Cid Benedict D. Pabalan: Professor: Atty. Louise Marie Brandares - EscobidoDocument1 pageCid Benedict D. Pabalan: Professor: Atty. Louise Marie Brandares - EscobidoCid Benedict PabalanNo ratings yet

- Tax 2 CompiledDocument106 pagesTax 2 CompiledCid Benedict PabalanNo ratings yet

- Corpo Sunday Class Outline First ExamDocument4 pagesCorpo Sunday Class Outline First ExamCid Benedict PabalanNo ratings yet

- Tax AssignmentDocument6 pagesTax AssignmentCid Benedict PabalanNo ratings yet

- Judicial Affidavit Of: Ruffa Campavilla-Gutierrez Ruffa Campavilla-GutierrezDocument5 pagesJudicial Affidavit Of: Ruffa Campavilla-Gutierrez Ruffa Campavilla-GutierrezCid Benedict PabalanNo ratings yet

- Philippine National Police Baganga Municipal Police Station: Physical InjuryDocument1 pagePhilippine National Police Baganga Municipal Police Station: Physical InjuryCid Benedict PabalanNo ratings yet

- Municipal Trial Court: Ella Campavilla, of AffectionDocument4 pagesMunicipal Trial Court: Ella Campavilla, of AffectionCid Benedict PabalanNo ratings yet

- Judicial Affidavit Of: Paulo Avelino Paulo AvelinoDocument4 pagesJudicial Affidavit Of: Paulo Avelino Paulo AvelinoCid Benedict PabalanNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bankers Code, Debt Millionaire, Wealthy CodeDocument91 pagesBankers Code, Debt Millionaire, Wealthy CodeJohn Turner100% (2)

- Finance 13e CH03 PPTDocument33 pagesFinance 13e CH03 PPTJOANNA LAMNo ratings yet

- 2021 02 Kantar Aldi US Five SlidesDocument8 pages2021 02 Kantar Aldi US Five SlidesEvenwatercanburnNo ratings yet

- ECON 315 Practice For FinalDocument9 pagesECON 315 Practice For Finaldimitra triantos0% (1)

- Minor Position in PFDocument4 pagesMinor Position in PFArun ShokeenNo ratings yet

- Automation 2021 Trends AnalysisDocument50 pagesAutomation 2021 Trends AnalysisJuan Manuel PardalNo ratings yet

- Case Study Pantaloon RetailDocument8 pagesCase Study Pantaloon RetailShruti AgrawalNo ratings yet

- CBM 121 FIRST ExamDocument5 pagesCBM 121 FIRST ExamJoelyn L. Javellana100% (1)

- Kernel FY2019 Annual Report PDFDocument128 pagesKernel FY2019 Annual Report PDFHaval A.MamarNo ratings yet

- 1st Assignment of P.MDocument41 pages1st Assignment of P.Masim_mbaNo ratings yet

- Test Bank For Systems Analysis and Design 11th Edition by TilleyDocument15 pagesTest Bank For Systems Analysis and Design 11th Edition by Tilleyreputedrapergjyn100% (42)

- Toni HabtamuDocument44 pagesToni HabtamuHaile Kebede100% (1)

- Distinction Between Partnership and CorporationDocument2 pagesDistinction Between Partnership and CorporationIan Ray PaglinawanNo ratings yet

- Concepts in Enterprise Resource Planning: Chapter One Business Functions and Business ProcessesDocument112 pagesConcepts in Enterprise Resource Planning: Chapter One Business Functions and Business ProcessesMohammed FahadNo ratings yet

- Personnel Planning and Recruiting: Human Resource ManagementDocument22 pagesPersonnel Planning and Recruiting: Human Resource ManagementMohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet

- MT1 Ch22Document4 pagesMT1 Ch22api-3725162No ratings yet

- OpmanDocument4 pagesOpmanNorodum NoradaNo ratings yet

- Laporan Mengenai Enterprise Arsitektur Pada Toyota AutomotiveDocument15 pagesLaporan Mengenai Enterprise Arsitektur Pada Toyota Automotivesatria prayogiNo ratings yet

- MOE Ed 29 N3 VADocument92 pagesMOE Ed 29 N3 VAJamal Alshawesh100% (1)

- STRATEGIC SUPPLY CHAIN MANAGEMENT PRINCIPLESDocument58 pagesSTRATEGIC SUPPLY CHAIN MANAGEMENT PRINCIPLESMadhupam BansalNo ratings yet

- Gujarat State Petroleum Corporation GSPCDocument3 pagesGujarat State Petroleum Corporation GSPCgagan3211No ratings yet

- Mortel V Kassco Case DigestDocument2 pagesMortel V Kassco Case DigestAbigail TolabingNo ratings yet

- Emergence of E Commerce A Brief HistoryDocument111 pagesEmergence of E Commerce A Brief HistoryPrashant Shinde100% (2)

- 2013 IadDocument141 pages2013 IadFakhree HarpinNo ratings yet

- Importance of Team BuildingDocument16 pagesImportance of Team BuildingKassandra KayNo ratings yet

- Setting Safety KPI's That WorkDocument37 pagesSetting Safety KPI's That WorkL NurhamidahNo ratings yet

- Cybersecurity and Data Protection Guideline-2022Document81 pagesCybersecurity and Data Protection Guideline-2022bullshit0976587No ratings yet

- Topic 8 PPT - 6 Per PageDocument4 pagesTopic 8 PPT - 6 Per PageHarnekh PuharNo ratings yet

- Allotment Retention of QuartersDocument35 pagesAllotment Retention of QuartersAnonymous xAKvws1Yu100% (2)

- Analysis of Common Business TransactionsDocument18 pagesAnalysis of Common Business TransactionsClarisse RosalNo ratings yet