Professional Documents

Culture Documents

Executive Summary

Uploaded by

Ruishabh RunwalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Executive Summary

Uploaded by

Ruishabh RunwalCopyright:

Available Formats

EXECUTIVE SUMMARY

Finance is life blood of business it is required from establishment of the

business to liquidity or winding up of business, so financial institutions played

a very important role on the operation of the business.

In the early days banking business was been confined to receive of

deposits and lending of money. But now a modern banker under take wide

variety of functions to assist their customers without op-rations the social and

economic progress would have been impossible.

This project report of “WSTABLISHMENT OF CO-OPERATIVE

SOCIETY & WORKING CAPITAL MANAGEMENT” at the Shri

Shiddeshwar Bank main Branch, t Bijapur.

My topic is “ESTABLISHMENT OF CO-OPERATIVE SOCIETY &

WORKING CAPITAL MANAGEMENT” which means that a process to

identify the financial performance of a firm by properly establishing the

relationship between the items of Balance sheet and Profit and Loss Account.

KARNATAKA UNIVERSITY DHARWAD

INTRODUCTION TO PROJECT

KARNATAKA UNIVERSITY DHARWAD

CHAPTER -I

Research Proposal:

1) Topic of the Study: -

“ESTABLISHMENT OF CO-OPERATIVE SOCIETY & WORKING

CAPITAL MANAGEMENT” of Shri Shiddeshwar Bank, at Bijapur main Branch.

2) Need for the Study:

The aim need for the organization study is to make the students

acquainted with the practical knowledge about the overall functioning of the

finance department in the organization.

It gives opportunity to study the human behavior and also makes one

ready to face different situation which normally would come across while

working in a company in different environment.

To understand the behavior, culture of an organization and to know

about the various policies of the organization and its performance and its

future strategies.

KARNATAKA UNIVERSITY DHARWAD

Introduction

Co-operative societies are one of the forms of business organization.

They are formed all over the world. It is voluntary association of person for

mutual benefit and its aim are accomplished of through self help and

collective efforts.

Co-operative organization is mutual help i.e. each for all and all

for each. Thus poor formers may form co-operative credit societies to get

cheap credit facilities and protect themselves against the exploitation of

money lenders. Small producer may form co-operative marketing societies

the exploitation of traders.

The idea behind a co-operative society is that an isolated and power

less man in association with others can lift himself as well others out of

weakness into strength co-operative ( i.e. work together) for working out

(i.e. solving) your economic problems is the theory of co-operation.

Working capital is life blood of business and nerve center for all business

activities. It is also regarded as the heart of business. If it becomes weak, the

business can hardly prosper and survive.

KARNATAKA UNIVERSITY DHARWAD

STATEMENT OF THE PROBLEM:

No project report begins either with problem or with an opportunity.

Each and every report has got its own objectives to be reached. The

statement of the problem in the given report is, analyzing the statements and

drawing some interpretation from the results. In the field of business world,

the finance has been renowned as the LIFEBLOOD of every business

concern. If this is the case, it should be properly utilized and managed so

that profits can be yielded to the highest extent. Once we analyze the

financial data, it reveals some interpretations to be drawn. No interpretations

can be drawn, if the analyst does not analyze the data. Analysis is an art that

can be practiced and learnt.

The report considers the different techniques of analysis and their

respective usefulness. There are so many techniques that can be used as a

base for us to understand that strong the banks are financially . Every analyst

naturally starts taking some preventive actions once he/she identifies some

deviations in the system. But this is not correct and hence we should be

analyzing the statement continuously. In the same way analysis of financial

statement is used as strategy to imply some decisions.

KARNATAKA UNIVERSITY DHARWAD

PURPOSE OF THE STUDY

The purpose of the study in the firm is to study financial performance

through 5 years Balance sheet.

The study has done on the basis of the followings:

1) Working capital statements

2) Balance sheet

KARNATAKA UNIVERSITY DHARWAD

OBJECTIVES OF THE STUDY:

The primary objective of the specialization study is to the

students to know the practical applicability of the theoretical concept into

business decision in the organization.

The other objectives of the study are as follows.

Details study of finance department.

To understand the aspect of the finance department.

To gain first-hand experience from the organization.

To integrate practical experience with theoretical concept.

To gain all-round view of financial management operation.

To understand the behavior and culture of an organization.

To analyze the present status and future strategies of the organization.

KARNATAKA UNIVERSITY DHARWAD

Proposed/Benefits from the Study:

To measure some financial trends and their relative impact on the results.

To give some instructions and recommendation that can be used as

strategies to take some finance related decisions.

It helps to study the financial performance of the Bank.

To understand the financial performance of the Shri Shiddeshwar Bank as

a whole.

It helps to understand the profit & Loss and its impact on the Bank.

KARNATAKA UNIVERSITY DHARWAD

Research Methodology:

Data collection methods

Primary data: The project report of this kind will really need first

hand information which will be collected by referring some bank

manuals and through internet. To make primary data more reliable,

discussions were also been made with respective departmental heads.

Secondary data: Some banking booklets of previous years have

been used as a reference for the study. Banking magazines and prospects

have also been used for the study. The following are the secondary

sources:

1) Annual Reports of the Bank for the past three years

2) Profit and Loss Appropriation Account

3) Balance Sheet.

KARNATAKA UNIVERSITY DHARWAD

SCOPE OF THE STUDY:

The scope of the study means the maximum extent of usefulness of

the study. The project report covers different financial aspects and its impact

on profitability. Different aspects, which have been covered under the

subject matter of the report, are:

Collection of the information as per the requirements of subject

matter.

Sequencing the information as per the use.

Analysis part of the information.

Predicting some financial results.

Interpreting the data and giving recommendations.

The subject matter of the report will definitely assist the banker that

how analysis should be done and compared and how to draw some

conclusions out of it.

KARNATAKA UNIVERSITY DHARWAD

Limitations of the study:

The limitations of the study are:

Time constraint

Information is partially based on secondary data and hence

authenticity of the study can be visualized and is measurable.

Level of accuracy of the results is restricted to the accuracy level of

the secondary data.

The generated information is not sufficient enough to draw the

conclusions.

The level of usefulness depends upon the kind of industry.

KARNATAKA UNIVERSITY DHARWAD

ORGANIZATION STUDY

KARNATAKA UNIVERSITY DHARWAD

ORGANIZATIONAL PROFILE:

SHRI SHEDDESHWAR CO-OPERATIVE BANK

Asset 105 lack crore

17 million customers and growing 10.36 million savings bank and 0.27 million

account customers

11 Branch

Other share holders 28%

2 Foreign exchange company

620 core banking solutions

35 Regional offices in India

7 day banking facility is introduced in 209 Branches

extended business hours introduced in 603 Branches

Tele banking facility introduced in 245 Branches

Syndicate bank all 2014 braches are computerized extending accurate and prompt

services

In 1995 syndicate bank was established Hi-Tech Agriculture Brands

E- banking has been launched the country as on 1919 June 2006.

Strong corporate Governance

Powerful Brand Equity at 588 Branches located in 234 centers across

KARNATAKA UNIVERSITY DHARWAD

Objectives of the SHRI SHEDDESHWAR Bank :

1. To extend banking facility in the country especially in rural areas, and

semi urban areas thereby encourage rural savings and mobilize those

savings for the economical development of the country.

2. To cater the credit needs of the rural areas.

3. To extend financial help for the establishment of ware Housing and

marketing securities in different part of the country.

4. To grant the financial facilities to the small-scale industries in the

country.

5. To provide remittance facilities to commercial banks and co-operative

banks.

KARNATAKA UNIVERSITY DHARWAD

OUR MISSION

The Mission articulated for each of the functional area of the Bank is

highlighted below:

Resources: To achieve global deposits of Rs. 76 thousand crore by March

2007 with emphasis on low cost resources by planned strategic initiatives

including branch expansion, aggressive marketing and active involvement of

each and every employee of the Bank.

Advances: To build a qualitative asset base of around Rs. 51 thousand

crore by March 2007 to augment the income portfolio of the Bank.

Business: To achieve global business of Rs. 127 thousand crore by March

2007 and attain Rs. 240 thousand crore by 2010.

Management of Assets: To focus on improving the quality of asset

portfolio by avoiding slippage of assets to NPA and to strive to upgrade the

existing non-performing assets to performing assets, bringing down gross

NPA level below 2% and Net NPA below 1%.

KARNATAKA UNIVERSITY DHARWAD

Risk Management: To continuously upgrade the Risk Management

systems & processes, imbibe risk management in business activities and

implement Basel II requirements for the benefit of all stakeholders.

Para Banking: To achieve insurance premium collection of nearly

Rs.180 crore with a commission income of Rs.20 crore, a credit card base of

1 lakh that brings in net earnings of a minimum of Rs.3.50 crore and a debit

card base of 15 lakh fetching a net revenue of Rs.25 crore.

Inspection: To migrate progressively from the present transaction

oriented inspection system to a risk based audit exercise enhancing the

effectiveness of risk management, control and governance processes.

KARNATAKA UNIVERSITY DHARWAD

THEORETICAL ASPECTS

ANALYSIS AND INTERPRETATION OF

FINANCIAL STATEMENTS

KARNATAKA UNIVERSITY DHARWAD

CHAPTER- III

THEORTICAL ASPECTS

ANALYSIS AND INTERPRETATION OF FINANCIAL

STATEMENTS

Introduction:

KARNATAKA UNIVERSITY DHARWAD

MEANING & DEFINITION OF WORKING

CAPITAL: -

Working capital in simple terms is the amount of funds, which a company, must have to

finance its day-to-day operation, it can be regarded as part/portion of capital, which is,

employed in short operation.

Every organization invests their funds in two terms of capital namely,

1. Fixed Capital.

2. Working Capital

The amount invested in the assets like Plant and Machinery, Building, Furniture etc,

blocked on permanent basis and is called Fixed Capital Organization not only requires

Fixed Capital, but also need of fund to meet day to day operations for short term purpose,

such funds is called Working Capital.

A Study of Working Capital is of major part of the external and internal analysis because

of its close relationship with the current day to day operation of business. Working

Capital consists broadly for that position/the assets of a business that are used at related

current operations and is represented by raw materials, stores, work in process and

finished goods merchandise, note/bill receivable.

KARNATAKA UNIVERSITY DHARWAD

Definition of Working Capital: -

Genestenberg: -

“ Working Capital means Current Assets of a company that are changed in the ordinary

course of business, from one to another, for ex, from cash to inventories, inventories to

receivable, receivable to cash”.

Gathman & Dug wall: -

“Working Capital as excess of current assets over current liabilities.”

Westen & Brigham: -

“ Working capital refers to a term investment in short term assets cash, short term

securities accounts receivables and inventories.”

J. Smith: -

“ The Sum of the current assets is the working capital of the business.”

“WORKING CAPITAL = CURRENT ASSETS – CURRENT LIABILITIES”.

KARNATAKA UNIVERSITY DHARWAD

COMPONENTS OF WORKING CAPITAL

There are two components of Working Capital

A. Current Assets

B. Current Liabilities

A. Current Assets

An asset is termed as current assets when it is acquired either for the

purpose of selling or disposing of after taking some required benefit through

the process of manufacturing of which constantly changes in form and

contributes to transactions take place with the operation of the business

although such assets does continue for long in the same form.

KARNATAKA UNIVERSITY DHARWAD

Components of Current Assets are as follows:

Cash & Bank Balance

Stock of Raw Material at cost- work in process and Finished Goods.

Advanced Recoverable in Cash or kind or kind or for value to be

received.

Security deposits with electricity board-telephone department balances

with customers.

Deposits under the company scheme.

Prepaid Expenses.

Miscellaneous Stores implements goods in transit.

Advanced payment of income takes credit certificates.

Excise duty and sales tax recoverable.

Outstanding debts for a period exceeding six months.

KARNATAKA UNIVERSITY DHARWAD

Current Liabilities:

Components of Current Liabilities are as follows:

Non-Refundable non-interest bearing advances against subscription to

shares.

Sundry Creditors for the goods and expenses.

Income tax deducted at sources from contractors.

Expenses Payable.

Amount due to promoter of company.

Unclaimed Dividend.

Security Deposits.

Dealers Deposits.

Liabilities for bills discounted.

KARNATAKA UNIVERSITY DHARWAD

CLASSIFICATION OF WORKING CAPITAL

KARNATAKA UNIVERSITY DHARWAD

A. On the basics of Concept

(a) Net Working Capital:

This is the difference between current assets and current liabilities.

Current Liabilities are those that are expected to mature within an

accounting year and include creditors, bills payable and outstanding

expenses.

Investment is current assets represent a very significant portion of the

total investment in assets. In case of public limited companies in India,

current assets constitute around 60% of the total capital employed.

Therefore the finance manager should attention to working capital

management.

KARNATAKA UNIVERSITY DHARWAD

Working Capital Management is no doubt significant for all firms, but

its significance is enhanced in cases of small firms. A small firm has more

investment in current assets than fixed assets and therefore current assets

should be efficiently managed.

The working capital needs increase as the firm grows. As sales grow,

the firm needs to invest more in debtors and inventories. The finance

manager should be aware of such needs and finance them quickly.

Current Assets can be finance through long-term and short-term

sources. The ratio of long-term to short-term source will depend on whether

the firm is aggressive of conservative. It the firm is aggressive then it will

finance a part of its permanent current assets with short-term funds. On the

other hand, a conservative firm will finance its permanent assets and also a

part of temporary current assets with long-term financing.

KARNATAKA UNIVERSITY DHARWAD

(b) Gross Working Capital

This refers to the firm’s investment in current assets. Current Assets are

the assets which can be converted into cash within a short period say, an

accounting year. Current assets include cash, debtors, and bill receivable,

short-term securities. etc.

A. On the basis of Time

a. Permanent Working Capital

Permanent Working Capital is permanently locked up in the

circulation of current assets. It covers the minimum amount requested for

maintaining the circulation of current assets.

i. Initial Working Capital

KARNATAKA UNIVERSITY DHARWAD

At its inception and during the formative period of its operations a

company must have enough cash fund to meet its obligations. The need for

initial working capital is for every company to consolidate its position.

ii. Regular Working Capital

It refers to the minimum amount of liquid capital required to keep up

the circulation of the capital from the cash inventories to account receivable

and from account receivables to back again cash. It consists of adequate

cash balance on hand and at bank, adequate stock of raw materials and

finished goods and amount of receivables.

b. Variable Working Capital

It refers to the past of the Working Capital that changes with the

volume of business; it may be divided into two classes.

i. Seasonal Working Capital

KARNATAKA UNIVERSITY DHARWAD

There is many line of business where the volumes of operations are

different and hence the amount of working capital varies with seasons. The

capital required to meet the seasonal needs of the enterprise knows as

Seasonal Working Capital.

ii. Special Working Capital

The capital required to meet any special operations such as

experiments with new products or new techniques of production and making

interior advertising campaign etc, is also know as Special Working Capital.

DETERMINANTS OF WORKING CAPITAL: -

KARNATAKA UNIVERSITY DHARWAD

A firm should plan its operations in such a way that it should

have neither too much not too of little working capital. The working capital

requirement is determined by a wide variety of factors. These factors,

however, affect different enterprise differently. They also vary from time to

time. In general, the following factors are involved in a proper assessment of

the quantum of working capital required.

The following are the some important determinants of working capital

1. General Nature of Business

The working capital requirements of an enterprise are basically

related to the conduct of business. Enterprise falls in to some broad

categories depending on the nature of their business. For instance, public

utilities have certain features which have a bearing on their working capital

needs. The two relevant features are,

1. The cash nature of business, that is, cash sale.

KARNATAKA UNIVERSITY DHARWAD

2. Sale of services rather than commodities.

In a view of these features, they do not maintain big inventories and

have, financial enterprise. The nature of their business is such that they

have to maintain a sufficient amount of cash, inventories, and book debts.

2. Production Cycle

Another factors which have a bearing on the quantum of working capital is

the production cycle. The term “Production or manufacturing cycle” refer to

the time involved in the man of finished goods. Funds have to be necessarily

tied up during the process of manufacture, necessitating enhanced working

capital. In other words, there is some time gap before raw material becomes finished

goods. To sustain such activities the need for working capital is obvious. The longer the

time span (i.e. Production Cycle), the larger will be the tied up fund and, therefore, the

larger is the working capital needed and vice-versa.

KARNATAKA UNIVERSITY DHARWAD

Research Problem: -

Research Problem is to maximize the company’s cash and bank balance

through the study of “Impact of Current Assets on Working Capital”.

Statement of the Problem: -

The study has been undertaken in the organization for the purpose to

know the company’s working capital management through the study of

“Impact of Current Assets on Working Capital”.

KARNATAKA UNIVERSITY DHARWAD

Declaration

I, Mr. NAVEED AHMAD .S.PATEL here by declare that this project

report is genuine & bonafied work prepared me and submitted to Karnataka

University Dharwad.

KARNATAKA UNIVERSITY DHARWAD

To the best of my knowledge and belief the matter presented on this

project report has not been submitted by any one to the Karnataka University

Dharwad.

The present work is original and conclusion drawn are based on data

collected by me. And I have tried to put all the possible efforts to make this

study a success.

Acknowledgment

I express my regards to the principal of the SIBA B.B.A Mr,

Sadanand Rudgi sir and his continuous interaction and encouragement

during entire span of project.

KARNATAKA UNIVERSITY DHARWAD

My sincere thanks are to our guide miss

JYOTI BIRADAR madam & HOD of SIBA B.B.A. who guided and

encouraged me to accomplish the task I also extend my heartiest thanks to

Mr C.I. MUDAKAMATH who gave me the co-operation during the time of

the project.

Lastly I would like thanks to all my friends who have directly

& indirectly supported me to complete this project.

DEFINITION & MEANING OF CO-OPERATIVE

SOCIETY

KARNATAKA UNIVERSITY DHARWAD

According to Indian co-operative societies which has its objective

the promotion of the interest of its members in accordance co-operative

principle.

H. calvert

Define co-operation as “a form of organization where in persons

voluntarily associate together as human beings on the basis of equality for

the promotion of the economic interest of themselves.

FEATURES OF CO-OPERATIVE SOCIETY

1) Voluntary association:- A co-operative society is totally based on

voluntary membership. Persons having a common interest can join together

to form as association.

KARNATAKA UNIVERSITY DHARWAD

2) Association of persons:- A co-operative society is as association

of persons & not of capital. Individuals join a co-operative as human beings

& not as capitalization.

3) Open membership:- Membership of a co-operative society is open

to all adults irrespective of caste, class, religion etc

4) service motive:- unlike other forms of business organization, the

primary objective of any co-operative society is to provide service to its

members and not for earning maximum profits. “service, not profit”.

5) Equity of distribution of profit:- In co-operative society

society, are not distributed as dividend among the members. A small portion

of profit, generally 9% of profits.10% of profit is used for the general

welfare of the locality in which the society is working.

KARNATAKA UNIVERSITY DHARWAD

6) Corporate status and state control: - A co-operative

society may be registered but most of the co-operative societies are

registered. A registered co-operative society enjoys certain privileges. Such

as exemption from the payment of income tax, stamp duty and registration.

Establishment of a co-operative society

In India, the formation and registration of co-operative societies is

governed by the provision of the Indian co-operative society Act of 1912 or

the state co-operative Act enforce in various state.

For the formation of a co-operative society there should at list ten

member who are bound together bound by a common bound ( i.e. belonging

KARNATAKA UNIVERSITY DHARWAD

to the same locality, class or occupation and having common and economic

need). These members are ( promoters) should submit an application for

registration to the register of co-operative societies of the state in which the

societies office is to be located.

The application for registration should state that

Name & address of organization.

Its function area.

Its name & objectives.

Liability & span of the members.

Objective of the capital use.

Rules & condition for the persons who want be members and other

liabilities.

KARNATAKA UNIVERSITY DHARWAD

Points to be considered while forming of co-

operative society

A) Apex is the union bank of the co-operative society.

B) Financial year of the bank start from April 1st of every year and end on

31st march.

C) An application of registration of co-operative society must contain all the

information as per the provision of Indian co-operative societies Act 1912 or

the state co-operative society enforce in various state.

D) Five copy of the rules and regulation of the co-operative society should

be attached with the application.

E) If all the application of the group are male then there number should be

les then ten.

F) All the applicant should be having more then 18 years age & all applicant

should not belonging to same family.

KARNATAKA UNIVERSITY DHARWAD

G) The person who are submitting the application must have a co-operative

group & represent all of them & he should be given all the rights of signing.

WHO CAN BE THE MEMBERS 0F CO-

OPERATIVE SOCIETY

The member should not be minor (not less than 18 years).

The member should not be of unsound mind.

He should not be engaged in any illegal activities forbidden by the

law.

Administration of co-operative societies

The management of co-operative societies is entrusted to

a committee known as “ Managing committee”. The members of the

managing committee are elected directly by the members of the co-operative

society at the “ Annual general meeting”.

KARNATAKA UNIVERSITY DHARWAD

Generally a co-operative society has the following office bearers.

President

Vice president

Secretary

Treasurer

The general body of the members lays down the broad objectives and

the polices of the society.

KARNATAKA UNIVERSITY DHARWAD

The managing committee determines the detailed programmers and

procedure of the society. It is accountable to the general body of the

members.

The office bearers are responsible for the conduct of the day-to-day

affairs of the society in accordance with the decision of the managing

committee.

Types of co-operative societies

1) Consumer co-operative societies

2) Producers co-operative societies

3) Marketing co-operative societies

KARNATAKA UNIVERSITY DHARWAD

4) Forming co-operative societies

5) Housing co-operative societies

6) Other co-operative societies

Advantages of co-operative society

1) The registration of co-operative society is simple, so a c-operative enjoys

the facility of easy formation.

2) The life of a co-operative society is not affected by the death, insolvency

etc of a member, so a co-operative society has continuity of existence.

3) A co-operative society helps to pool together the resource of weaker

sections of the society for constructive purpose.

4) It promotes the sprit of co-operation among the members.

5) It does not aim profit; it tried to render maximum service to its members.

KARNATAKA UNIVERSITY DHARWAD

About the Bank

HISTORY:

Shri Sheddeshwar c-operative Bank was started in the years

1912 April 22. in the years 1912 under the leadership of Late Vachana

pitamaha Rao Bahadur Dr. F.G Halakati ( B.A LLB) and in association of

Late Diwan Bahadur Shri S.G Deshmukh ( Almel ) under co-operative rules

for a small business, for the sake of poor and middle class people, with the

amount of Rs. 2500/- Share capital without any deposits started the business.

In the year 1932 with Rs 20,839 Share capital, Rs 16,821 reserved fund and

KARNATAKA UNIVERSITY DHARWAD

otherfunds, Rs 35,0661/- deposits and Rs 80,200 working capital Bank

started working with rules. Late after analyzing the financial position and

working procedure, Reserve bank of India in the year 1982 granted

permission. At present in the co-operative field sheddeshwar bank is one of

the biggest bank. In the end of the year 31/03/09 bank contains Rs. 7.07

crore share, Rs 9.91 crore deposit and Rs. 251 crore working capital.

Functions:-

It motivates limited, self service and co-operative feelings.

Through share, Deposits, Loans it reserve money and the reserved

fund are given in the form of loan without any burden on the people

and reserve more amount.

It reserve funds to the members of bank and the people dependent on

them.

It undertakes work in progress.

It provides security blocks.

It motives to start business, company and other business and to fulfill

this and to increase its profit it provides possible help.

KARNATAKA UNIVERSITY DHARWAD

It has necessary infrastructure.

Details of Bank register member

No & Date 4217. Date 22/04/1912

Date of business started 22/04/1912

The permission of DBOD, UBD, KA 322D Date 18/11/1982

reserve bank of India

sl, no and date

Offices Bijapur, Bagalkot, Belgaum, and Gulbarga

district. Head office and 11 branch

Details of members 1) ordinary member

2) co-members

Own buildings and plots Administration bank, main bank K.C market

branch, College campus branch. Jorapur

peth branch, paschapur peth branch, hudko

colony branch, Indi town branch & Ashram

road branch these are having building APMC

KARNATAKA UNIVERSITY DHARWAD

branch & Basav nagar are also

having buildings

Auditing 1) According to accounting calculation the

RBI, assigned Auditors & audits

according to rules

Auditing from reserve Bank Every year in the end of month march,

of India according to calculation RBI officers

Auditing observation Except DD facility everything is computerized

Details of finance:-

Share capital:-

In the last 5 years the amount of share capital and the number of members

and co-members will be as follows.

Years numbers Amount

31/03/2005 40937 7, 21, 97,275/-

31/03/2006 39801 6, 97, 76,975/-

31/03/2007 40060 7, 03, 34,000/-

31/03/2008 39787 7, 03, 73,950/-

31/03/2009 39116 7, 06, 90,325/-

KARNATAKA UNIVERSITY DHARWAD

2) Funds:-

From the last 5 years the reserve fund and other funds details are as

follows

Years Reserve other funds Total

31/03/2005 7, 75, 49,077.64 14,38,54,217.70 22,14,03,295.34

31/03/2006 8, 12, 71,904.84 23,84,55,912.37 31,97,27,817.21

31/03/2007 8, 64, 35,187.23 25,17,09,626.37 33,81,44,813.50

31/03/2008 9, 08, 08,788.00 30,30,60,176.37 39,38,68,964.37

31/03/2009 9, 90, 81,878.73 31,87,03,446.68 41,77,85,325.41

KARNATAKA UNIVERSITY DHARWAD

3) Working Capital:-

The Details of the working capital is as follows.

Years Amount

31/03/2005 236, 52, 77,214.91

31/03/2006 254, 55, 57,407.75

31/03/2007 216, 99, 81,701.48

31/03/2008 240, 81, 26,904.27

31/03/2009 250, 74, 37,705.73

KARNATAKA UNIVERSITY DHARWAD

4) Deposit:-

Bank accepts regular, saving, pigmy and fixed deposits the details

of the deposits in the last 5 years as following. In the end of the 31/03/2005

& 31/03/2006 deposits gets supposed. In the end of last 3 years i.e. 31/03/07,

31/03/08 & 31/03/09 there is an increase and deposits are secured.

Years Amount

31/03/2005 2,10,90,70,260.65

31/03/2006 2,24,22,65,504.69

31/03/2007 1,85,02,61,329.29

31/03/2008 1,99,66,76,887.43

31/03/2009 2,08,54,52,346.55

KARNATAKA UNIVERSITY DHARWAD

5) Out side Borrowings:-

From the last few years the situation of outside borrowing has

not raised. The reserve of bank are more.

6) Investments:-

According to banking Act 1949 secin the end of the year

31/03/09 Rs 6972.57 accordingly reserved invested investment in these Rs

3651.44 are government & confidential letters.

KARNATAKA UNIVERSITY DHARWAD

The inflation & deflation funds created by government

confidential letter. These funds contains Rs 30 lakhs

7) Borrowings:-

while providing loans more importance is given to profit. It

gives more importance to those forms which are necessary / important and

then grant loans. The details of the loans provided in last 5 years

years Amount

31/03/2005 1,56,47,99,350.00

31/03/2006 1,39,01,76,619.00

31/03/2007 1,25,23,36,852.95

31/03/2008 1,00,00,76,639.83

31/03/2009 93,05.37,955.52

KARNATAKA UNIVERSITY DHARWAD

8) over due debts:-

in the end of the year 31/03/09 over due debts amount to RS

3168.83 lakhs & the total debts will be 34.05% last year its percentage was

33.50 ( It is a irregular loan accounts )

Non performance assets:-

( Loan account treated as non performance account after 90

days of the date of over due )

in the last 5 years the non-performance assets are as follows

year N.P.A NPA & %

31/03/2005

31/03/2006

31/03/2007

31/03/2008

KARNATAKA UNIVERSITY DHARWAD

31/03/2009

P & L account / net loss:-

The details of the P & L account & net loss in the last 6 years

is as under.

Year P&L Net loss

31/03/2005 -463.41lakh 463.41lakh

31/03/2006 -821.93lakh 1285.34lakh

31/03/2007 27.80lakh 1257.54lakh

31/03/2008 155.34lakh 1102.20lakh

31/03/2009 60.22lakh 1102.17lakh

KARNATAKA UNIVERSITY DHARWAD

KARNATAKA UNIVERSITY DHARWAD

On the basis of possible loss in the property the

maximum number of capital ( CRAR) Capital Risk

Assets Rtio :-

KARNATAKA UNIVERSITY DHARWAD

According to the direction of reserve bank of India the C.R.A.R of

the bank should be maximum 9 from last 6 years the Ratio of the C.R.A.R

will be as follows

Year % age

31/03/2005 8.02

31/03/2006 4.47

31/03/2007 7.31

31/03/2008 10.69

31/03/2009 12.97

Auditing:-

KARNATAKA UNIVERSITY DHARWAD

There is a system of concurrent auditing as well as statutory auditing

by the charted accountant appointed by the state government.

Branching:

There are totally 11 main branches. In which one of the branch is in

indi town & the rest of 10 are situated in different areas of Bijapur. Main

branch of Bank are in K.C market, college campus, Jorapur peth, paschapur

peth, Hudco colony, and in Indi & Ashram Road, branches are having

security Blocks. In the Branch except Indi, other branches are gaining profit.

Computerized:-

To provide good service to the members of Bank, Depositors &

customers in main branch & other branches. And except D rest other work of

banks are done through computers.

KARNATAKA UNIVERSITY DHARWAD

KARNATAKA UNIVERSITY DHARWAD

KARNATAKA UNIVERSITY DHARWAD

KARNATAKA UNIVERSITY DHARWAD

KARNATAKA UNIVERSITY DHARWAD

KARNATAKA UNIVERSITY DHARWAD

You might also like

- Afar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFDocument11 pagesAfar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFJamaica David50% (2)

- Accounting Errors and EstimatesDocument10 pagesAccounting Errors and EstimatesXienaNo ratings yet

- Guide-To-Valuation-And-Depreciation (CPA, Australia)Document299 pagesGuide-To-Valuation-And-Depreciation (CPA, Australia)Jigesh MehtaNo ratings yet

- Loan Management System Project ReportDocument58 pagesLoan Management System Project ReportTamboli Iqbal75% (8)

- Mba-Iv-International Human Resource Management (14mbahr409) - Notes PDFDocument91 pagesMba-Iv-International Human Resource Management (14mbahr409) - Notes PDFAmit Khundia83% (6)

- MCQs For Accounting Principles and ProceduresDocument10 pagesMCQs For Accounting Principles and ProceduresAshfaq Afridi73% (11)

- Sahakari Khand Udyog Mandal LTDDocument43 pagesSahakari Khand Udyog Mandal LTDpatelrutulNo ratings yet

- Banking Sectors in BangladeshDocument69 pagesBanking Sectors in BangladeshTanvir Ahmed RanaNo ratings yet

- Indian Hotel Industry AnalysisDocument47 pagesIndian Hotel Industry Analysismphani072100% (8)

- Chapter 2 - Statement of Cash FlowsDocument23 pagesChapter 2 - Statement of Cash FlowsCholophrex SamilinNo ratings yet

- Moodys BankDocument191 pagesMoodys BankDeepak Kumar Mishra0% (1)

- Internship ReportDocument43 pagesInternship ReportAunto P PonnachanNo ratings yet

- In A Partial Fulfillment of Requirement For The Degree of Bachelor of Business Studies (B.B.S)Document6 pagesIn A Partial Fulfillment of Requirement For The Degree of Bachelor of Business Studies (B.B.S)Bishal ChaliseNo ratings yet

- FK 3039Document24 pagesFK 3039psy mediaNo ratings yet

- REPORTDocument27 pagesREPORTB safe nirman and suppliers pvt. ltd.No ratings yet

- Full Report Body Part FinalDocument113 pagesFull Report Body Part FinalSharifMahmudNo ratings yet

- Report of Umanga PaudyalDocument31 pagesReport of Umanga PaudyalbinuNo ratings yet

- Financial Position of Everest Bank Limited: A Research ProposalDocument8 pagesFinancial Position of Everest Bank Limited: A Research ProposalYutsarga Thiago ShresthaNo ratings yet

- Financial analysis of Everest BankDocument15 pagesFinancial analysis of Everest Bankutsav9maharjanNo ratings yet

- 7 SDocument8 pages7 SVijay Kulal88% (8)

- In A Partial Fulfillment of Requirement For The Degree ofDocument9 pagesIn A Partial Fulfillment of Requirement For The Degree ofBishal ChaliseNo ratings yet

- SusiDocument23 pagesSusiK MadhuNo ratings yet

- Organizational Study of The Perla Service Co-operative BankDocument37 pagesOrganizational Study of The Perla Service Co-operative BankFathima LibaNo ratings yet

- Uttara Bank Credit Risk PoliciesDocument80 pagesUttara Bank Credit Risk PoliciesKhalid FirozNo ratings yet

- Background of The StudyDocument5 pagesBackground of The StudygopalNo ratings yet

- Project ReportDocument122 pagesProject ReportSridhar ReddyNo ratings yet

- Fucking Proposal..docx 3Document8 pagesFucking Proposal..docx 3Bishal ChaliseNo ratings yet

- 5 Report BodyDocument64 pages5 Report BodyAsif Rajian Khan AponNo ratings yet

- Background of The StudyDocument11 pagesBackground of The StudyAnu SahNo ratings yet

- Internship Report: NCC Bank LTDDocument53 pagesInternship Report: NCC Bank LTDbikashNo ratings yet

- Komal's ProjectDocument52 pagesKomal's ProjectKomal JindalNo ratings yet

- Final ProposalDocument10 pagesFinal ProposalLasta MaharjanNo ratings yet

- ProposalDocument4 pagesProposalargonchaudhary21No ratings yet

- Dividend PolicyDocument9 pagesDividend PolicysasaNo ratings yet

- A Study On Loans and Advances For DCC Bank Main Branch Nayakaman BidarDocument62 pagesA Study On Loans and Advances For DCC Bank Main Branch Nayakaman BidarVijay PotdarNo ratings yet

- Finanancial Statement AnalysisDocument50 pagesFinanancial Statement AnalysisJafor100% (1)

- Financial Performance Analysis Proposal WritingDocument15 pagesFinancial Performance Analysis Proposal Writingramalemagar1225No ratings yet

- NCC Bank ReportDocument65 pagesNCC Bank Reportইফতি ইসলামNo ratings yet

- Organizational Study of Perla Service Co-operative BankDocument37 pagesOrganizational Study of Perla Service Co-operative BankFathima LibaNo ratings yet

- Internship Report On South East BankDocument52 pagesInternship Report On South East Bankm_iham100% (1)

- Body PartDocument109 pagesBody PartAjaj Mahmud MamunNo ratings yet

- Faizan KhanDocument59 pagesFaizan KhanTalha Iftekhar Khan SwatiNo ratings yet

- Saroj Intern ReportDocument47 pagesSaroj Intern ReportAwshib BhandariNo ratings yet

- Banking Industry OverviewDocument56 pagesBanking Industry OverviewMd Khaled NoorNo ratings yet

- Repoprt On Loans & Advances PDFDocument66 pagesRepoprt On Loans & Advances PDFTitas Manower50% (4)

- ProposalDocument5 pagesProposalbaghidai बाघिदाइNo ratings yet

- Abhi ProjctDocument59 pagesAbhi ProjctRaju ToleNo ratings yet

- A Project Report ON "A Comprehensive Study On Financial Analysis"Document75 pagesA Project Report ON "A Comprehensive Study On Financial Analysis"tanu2011No ratings yet

- Working Capital Management at IOB BankDocument63 pagesWorking Capital Management at IOB BankSadha Nanda PrabhuNo ratings yet

- Banking Products and Online Share Trading ConceptsDocument82 pagesBanking Products and Online Share Trading Conceptsniyati_parthNo ratings yet

- A Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Document109 pagesA Project Report ON "Customer Preference and Satisfaction Level For Credit Schemes Offered by The Varachha Co-Operative Bank"Ankit Malani100% (1)

- Analyzing Liquidity and Profitability of NIC Bank (NepalDocument26 pagesAnalyzing Liquidity and Profitability of NIC Bank (Nepalsaurav75% (8)

- Anshu Final SynopsisDocument12 pagesAnshu Final SynopsisbhaiyyavinitNo ratings yet

- Financial Performance Analysis of Public Sector Banks Using CAMEL ApproachDocument39 pagesFinancial Performance Analysis of Public Sector Banks Using CAMEL ApproachAditya ShankarNo ratings yet

- New ReportDocument66 pagesNew ReportঅচেনামানুষNo ratings yet

- Internship Project ReportDocument32 pagesInternship Project ReportPîyûsh KôltêNo ratings yet

- Project File On H.P State Cooperative BankDocument46 pagesProject File On H.P State Cooperative BankAshish ShandilNo ratings yet

- Bank Credit Appraisal ProcessDocument57 pagesBank Credit Appraisal ProcessMona KonarNo ratings yet

- Deposit Collection Strategies of Rastriya Banijya BankDocument5 pagesDeposit Collection Strategies of Rastriya Banijya BankRewanth Shah100% (1)

- Internship ReportDocument53 pagesInternship Reportm_ihamNo ratings yet

- The Impact of Financial Management Practices On The Performance of Kenyan BanksDocument38 pagesThe Impact of Financial Management Practices On The Performance of Kenyan BanksAmiani 'Amio' DavidNo ratings yet

- Revised)Document31 pagesRevised)Farhad SyedNo ratings yet

- SatpalDocument58 pagesSatpalSaurav KapilNo ratings yet

- Analysis of Customer Satisfaction in Banking Sector of Jammu Kashmir BankDocument88 pagesAnalysis of Customer Satisfaction in Banking Sector of Jammu Kashmir BankOwais ShiekhNo ratings yet

- Commercial BankDocument7 pagesCommercial Bankchandrashekhar.verma4025No ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Marketing of Consumer Financial Products: Insights From Service MarketingFrom EverandMarketing of Consumer Financial Products: Insights From Service MarketingNo ratings yet

- Small and Medium Enterprises’ Trend and Its Impact Towards Hrd: A Critical EvaluationFrom EverandSmall and Medium Enterprises’ Trend and Its Impact Towards Hrd: A Critical EvaluationNo ratings yet

- Legibility For Mudra LoanDocument7 pagesLegibility For Mudra LoanRRYACS BHOPALNo ratings yet

- GCRCEAF Final CAFES Report 1 PDFDocument26 pagesGCRCEAF Final CAFES Report 1 PDFSubhash GuptaNo ratings yet

- Bank’s Logo Loan ApplicationDocument4 pagesBank’s Logo Loan ApplicationMonika ShuklaNo ratings yet

- Marriage Decoration PresentationDocument55 pagesMarriage Decoration PresentationRuishabh RunwalNo ratings yet

- 1Document1 page1Ruishabh RunwalNo ratings yet

- Org TreeDocument1 pageOrg TreeRuishabh RunwalNo ratings yet

- Consumer Awareness Towards Nandini Milk & Milk Products at Bijapur-Bagalkot Co-Operative Milk ProducerDocument58 pagesConsumer Awareness Towards Nandini Milk & Milk Products at Bijapur-Bagalkot Co-Operative Milk ProducerRuishabh Runwal0% (1)

- Serial Number FilmmoraDocument1 pageSerial Number FilmmoraSmkpgri Sempu Bisa HebatNo ratings yet

- Project ReportDocument74 pagesProject ReportRuishabh RunwalNo ratings yet

- Organisational Study of Vijay AutomobilesDocument27 pagesOrganisational Study of Vijay AutomobilesRuishabh RunwalNo ratings yet

- Application Letter: Address of Permanent AddressDocument2 pagesApplication Letter: Address of Permanent AddressRuishabh RunwalNo ratings yet

- Factories Act objectives: Regulate conditions, health, safety, welfareDocument2 pagesFactories Act objectives: Regulate conditions, health, safety, welfareRuishabh RunwalNo ratings yet

- Investment Attributes and TypesDocument55 pagesInvestment Attributes and TypesPriya PriyaNo ratings yet

- Efm Solved QPDocument53 pagesEfm Solved QPRuishabh RunwalNo ratings yet

- Snehit Bank LTD Final PDFDocument69 pagesSnehit Bank LTD Final PDFRuishabh RunwalNo ratings yet

- Sample Employment Agreement TemplateDocument7 pagesSample Employment Agreement TemplatejexxicuhNo ratings yet

- 03 Literature ReviewDocument10 pages03 Literature ReviewRuishabh RunwalNo ratings yet

- Guidelines For 10 Week Project WorkDocument10 pagesGuidelines For 10 Week Project WorkRuishabh RunwalNo ratings yet

- 9b4e25c0-c245-4468-b5c1-b7935cb96af6Document118 pages9b4e25c0-c245-4468-b5c1-b7935cb96af6Priya PriyaNo ratings yet

- Solar PV Pumping System GuideDocument20 pagesSolar PV Pumping System GuideRuishabh RunwalNo ratings yet

- Afreen HR ProjectDocument83 pagesAfreen HR ProjectRuishabh RunwalNo ratings yet

- II Sem SyallbusDocument109 pagesII Sem SyallbusArvind MallikNo ratings yet

- One Role of The Purchasing Department Is To Procure All Necessary Materials.Document13 pagesOne Role of The Purchasing Department Is To Procure All Necessary Materials.Ruishabh RunwalNo ratings yet

- Kalpataru Industries PVT LTDDocument24 pagesKalpataru Industries PVT LTDRuishabh RunwalNo ratings yet

- Strategic ManagementDocument9 pagesStrategic ManagementRuishabh RunwalNo ratings yet

- Network MonitoringDocument68 pagesNetwork MonitoringRuishabh RunwalNo ratings yet

- Santosh ProjectDocument7 pagesSantosh ProjectRuishabh RunwalNo ratings yet

- Icici Bankhome Loan Project (Final)Document49 pagesIcici Bankhome Loan Project (Final)Ruishabh RunwalNo ratings yet

- Financial Accounting Company: Tata Consultancy Services LTDDocument13 pagesFinancial Accounting Company: Tata Consultancy Services LTDSanJana NahataNo ratings yet

- IP and PPEDocument3 pagesIP and PPEElaine Joyce GarciaNo ratings yet

- 12 Acs (S) - Set A 19.7.2021Document3 pages12 Acs (S) - Set A 19.7.2021Sakshi NagotkarNo ratings yet

- AKPI Argha Karya Prima Industry Tbk Company Report and Shareholder UpdateDocument3 pagesAKPI Argha Karya Prima Industry Tbk Company Report and Shareholder UpdateFaznikNo ratings yet

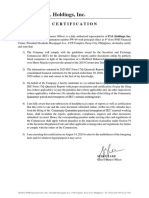

- PAL Holdings, Inc.: CertificationDocument53 pagesPAL Holdings, Inc.: CertificationJerryJoshuaDiaz100% (1)

- Income Statement: Company NameDocument9 pagesIncome Statement: Company NameAkshay SinghNo ratings yet

- Dog Boarding Business Plan ExampleDocument33 pagesDog Boarding Business Plan ExampleJoseph QuillNo ratings yet

- INTACCDocument4 pagesINTACCApple RoncalNo ratings yet

- BRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches VizDocument5 pagesBRANCHES OF ACCOUNTING: Accounting Has Three Main Forms of Branches Vizsohansharma75No ratings yet

- Business IncomeDocument53 pagesBusiness IncomeChandni AhujaNo ratings yet

- 5-2、关于重新转固的运维方案Treatment Plan for Asset Transfer Again - V1.3Document3 pages5-2、关于重新转固的运维方案Treatment Plan for Asset Transfer Again - V1.3Marijune LetargoNo ratings yet

- Bus Com 12Document3 pagesBus Com 12Chabelita MijaresNo ratings yet

- FAC4764 Study Pack 2Document41 pagesFAC4764 Study Pack 2Muvhusi NethonondaNo ratings yet

- Joshua & White Technologies Financial Statement AnalysisDocument2 pagesJoshua & White Technologies Financial Statement Analysisseth litchfield100% (1)

- Analysing Management Buyout Using Statement of Cash FlowsDocument9 pagesAnalysing Management Buyout Using Statement of Cash FlowsJaisyur Rahman SetyadharmaatmajaNo ratings yet

- Material 3 PDF FreeDocument6 pagesMaterial 3 PDF FreeIshi Erika OrtizNo ratings yet

- Separate Summary of Answers For Every ProblemDocument1 pageSeparate Summary of Answers For Every ProblemcpacpacpaNo ratings yet

- REVIEWER AACA (Midterm)Document15 pagesREVIEWER AACA (Midterm)cynthia karylle natividadNo ratings yet

- Corporate Finance Assignment SolutionsDocument6 pagesCorporate Finance Assignment SolutionsHaroon Z. ChoudhryNo ratings yet

- PS2 - Financial Analysis (Answers) VfinalDocument41 pagesPS2 - Financial Analysis (Answers) VfinalAdrian MontoyaNo ratings yet

- Topic 5Document29 pagesTopic 5Felicia TangNo ratings yet

- Jntuh Mba SyllabusDocument18 pagesJntuh Mba SyllabusDr Ramesh Kumar MiryalaNo ratings yet

- 2 Accounting Equestion and Double Entry UDDocument10 pages2 Accounting Equestion and Double Entry UDERICK MLINGWANo ratings yet

- CBSE Class 12 Accountancy Question Paper 2015 With SolutionsDocument50 pagesCBSE Class 12 Accountancy Question Paper 2015 With SolutionsRavi AgrawalNo ratings yet